Proforma Invoice Template

Proforma invoice is the best way to keep records by writing estimates that can serve as a final agreement between any buyer and seller.

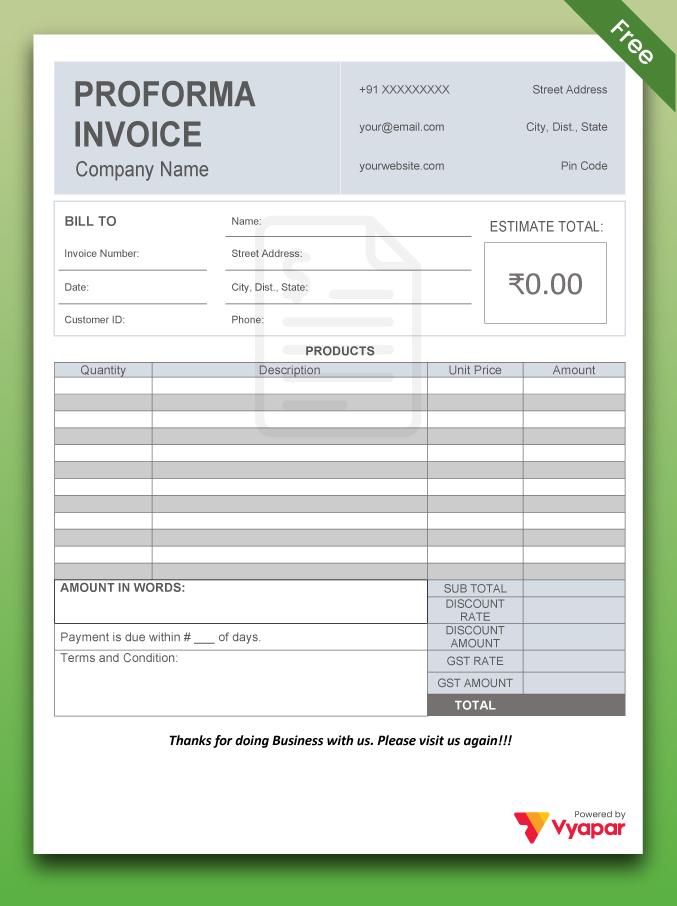

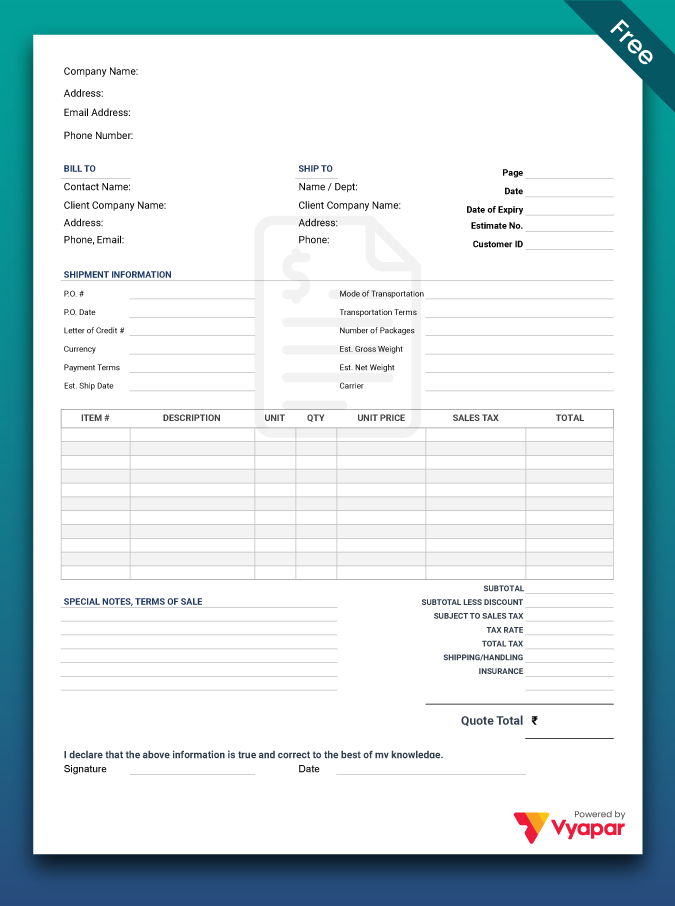

Download a Free Proforma Invoice Template

Download professional free proforma invoice template, and make customization according to your requirements at zero cost.

Sample Proforma Invoice Format

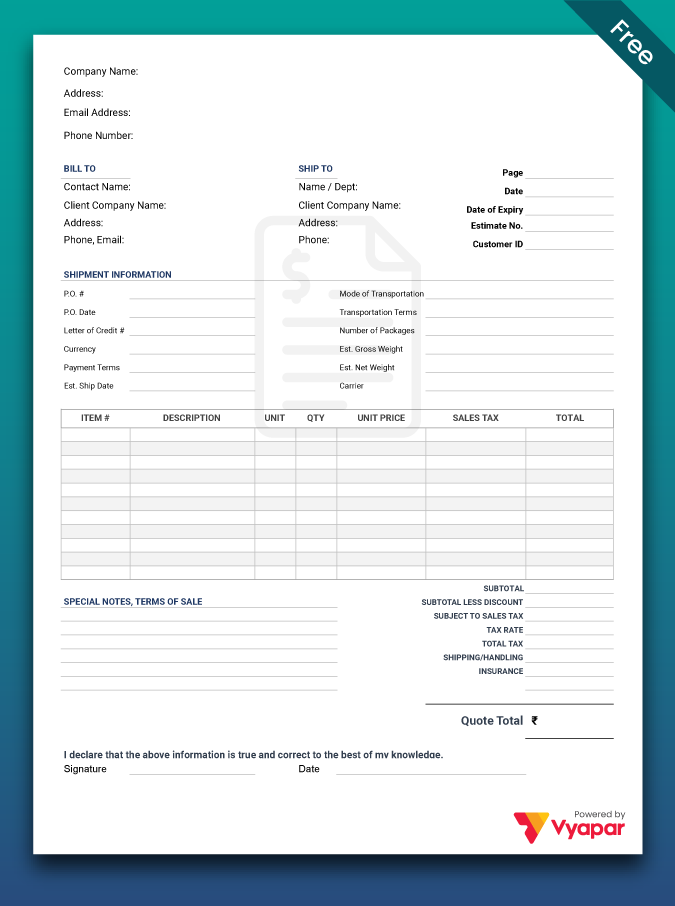

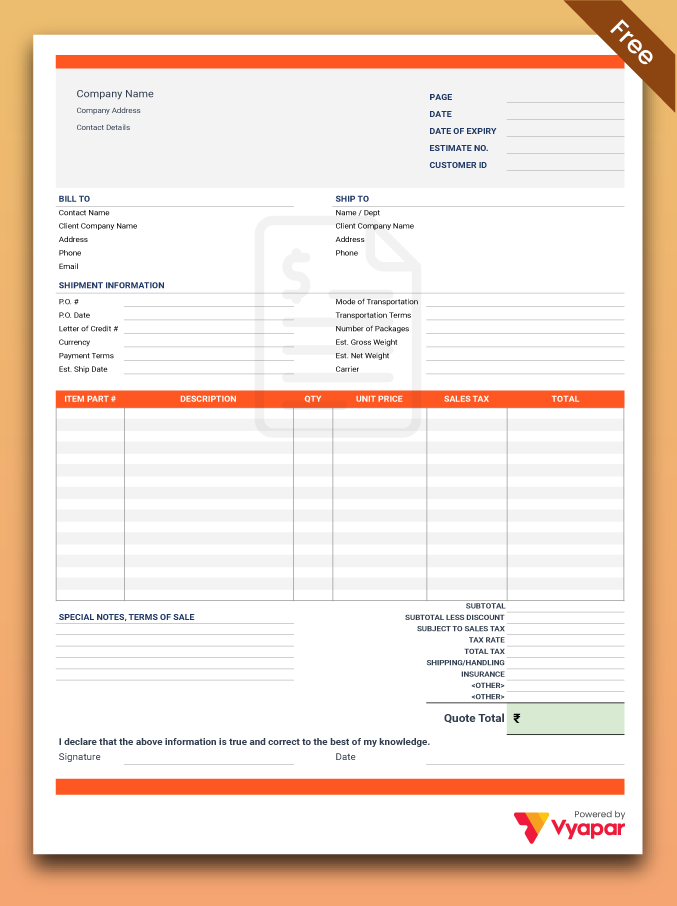

Simple Proforma Invoice Format

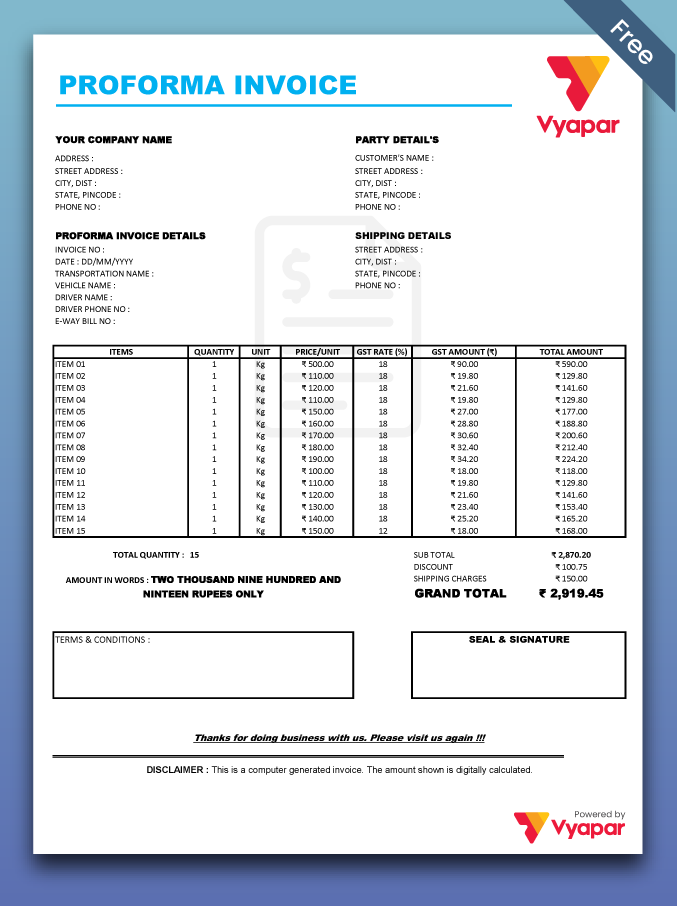

Gst Proforma Invoice Format

Generate Invoice Online

Create a Logo

Highlights of Proforma Invoice Templates

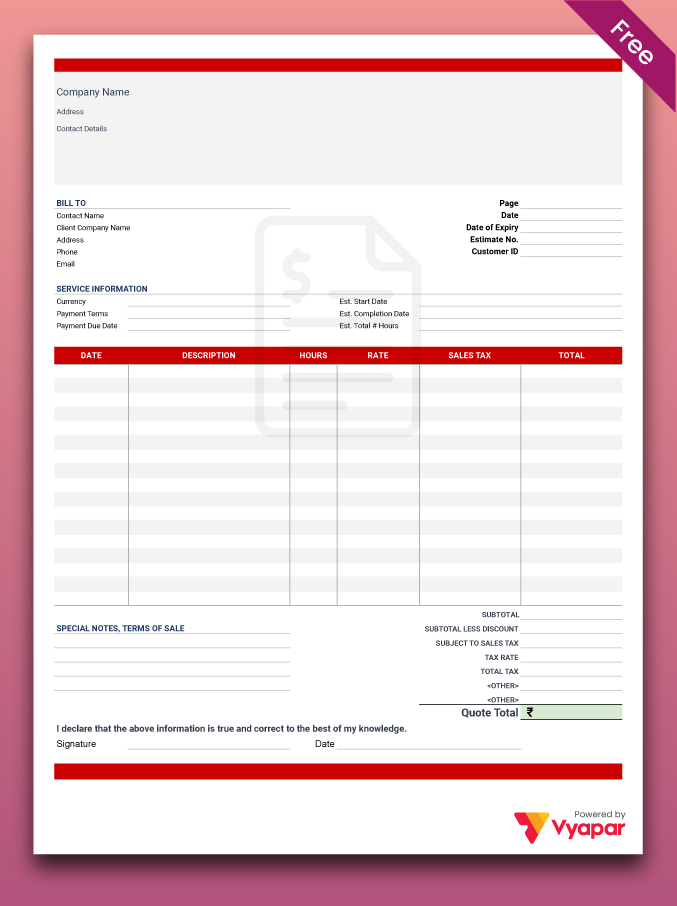

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Proforma Invoice?

A proforma invoice is essentially a draft invoice. It helps the buyer get an estimated cost for the purchase, and it helps the vendor ensure that the buyer gets a rough idea about the sale price. It helps avoid conflicts in future payments.

Like invoice templates, businesses can use a proforma invoice when there is no fixed price to the cost of service the buyer needs. It can help manage the books for buyers and sellers in a long term project.

Where can you use a Proforma Invoice?

A Proforma invoice works as an agreement between a vendor and a customer to ensure a price range for a product or service. There are many businesses where proforma invoice works well. Some of these are listed below.

Freelancing

Freelancers often use proforma invoices to provide a quote or an estimate to their clients. It helps clients manage their budgets and keep a study workflow for the freelancer.

Consulting

Consultants provide detailed information on the work they will perform each month to their clients. Using a proforma invoice, they give an estimate in advance as per the consultation requirements.

Contracting

Contractors create a proforma invoice with an estimated time, material, labour, and other costs required to complete the project. Once the work gets completed, the proforma invoice is converted into a GST invoice for bookkeeping purposes.

Get a free Proforma Invoice Template

As a business owner, you have to do a lot to keep your clients happy. Creating manual invoices can kill your time. You can this time to provide better products and services. Using Vyapar, you can create a professional proforma invoice that can help you ensure that you and your clients are on the same page before an official invoice is sent.

Create your first GST quotation with our free Quotation Generator

Best Proforma Invoices for Small Businesses

Onboarding new clients require negotiation, finalisation of terms, and other minute details of the products and services offered. As a small business owner, you have to ensure that the client approves all associated costs.

A proforma invoice lets your client have a record of the terms of the sale along with the associated cost. It helps them plan their purchase according to the budget. It helps ensure that the client knows what they can expect from you.

Here are a few reasons why you should opt for a Vyapar proforma invoice for your business before sending an actual GST invoice

- It mentions the quantity, delivery date, and other essential details about the order.

- Clearly outline the scope of services provided by you.

- It helps your clients get an estimated cost for the goods or services they want to purchase.

- It helps in managing the stock/inventory items efficiently. So, you can place preorders for the items well before exhausting them.

- Inform your client about the payment due date and let them know about your accepted payment methods.

Features of Vyapar that Make It The Best App For Proforma Invoices

Client Management

Save your client information in one place and easily create a proforma invoice every month for them.

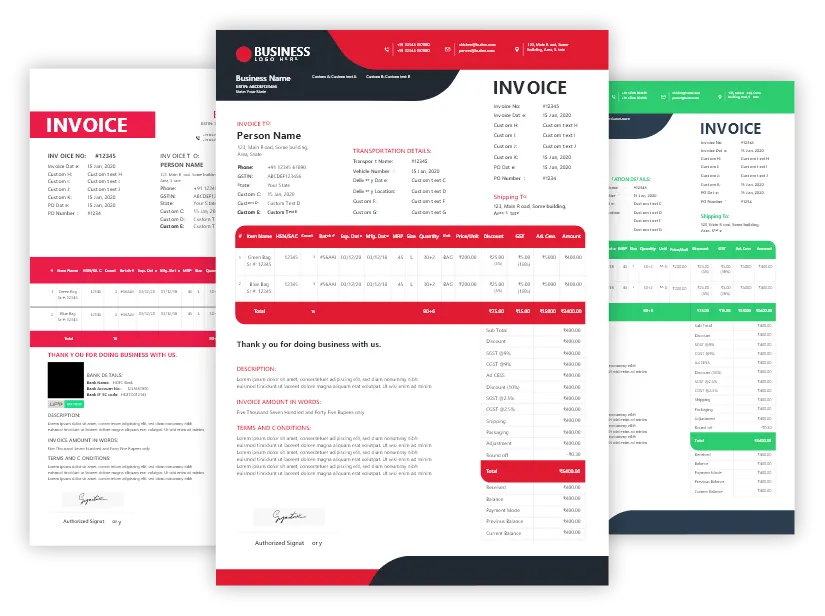

Customisable Templates

Create customisable templates that help you include all your business requirements to create a professional proforma invoice. You can add a logo and your business details to the invoice too.

GST Compliant Invoices

Easily convert proforma invoices to final GST invoice to help manage your taxes efficiently. It can reduce your efforts of manual bookkeeping.

Instant Reports

Create all essential reports using the Vyapar proforma invoice generator. All reports made using Vyapar can help you make informed decisions for your business to drive better sales. It can help you reduce costs by improving the efficiency of your business.

Easy Management

Using the Vyapar app, you can manage all your invoices in one place. It can help you track down unpaid invoices and send reminders to your clients. Using it can help you track all active orders to ensure they get delivered on time.

Frequently Asked Questions (FAQs’)

Yes. Using Vyapar, you can generate a regular tax invoice from your proforma invoice.

Yes. You can choose from a wide range of performer invoice templates available on our website.

Yes. You can use the Vyapar app to manage customer details and track your proforma invoice. It can help you autofill information if you use the app.

Yes. Vyapar keeps your data encrypted. Only you can access the data. You can create a backup of your data in Google Drive for local storage using the Vyapar app.

Yes. You can create as many proforma invoices as you need using the Vyapar proforma invoice generator online.

Yes. Vyapar proforma invoice templates are fully customisable, and you can add a logo, change the font, and customise the invoice as per your requirement.

A proforma invoice format estimates the cost of goods or services before they are shipped or ordered. It includes the buyer and seller’s name, address, and contact details.

A proforma invoice has an itemised list of all items and their costs and the estimated subtotal, taxes, and total due. It’s not an ‘official’ invoice, and its figures are subject to change before an agreement is achieved.

To create a proforma template, you can use a proforma invoice template by Vyapar and follow these steps:

1. Enter your company and buyer’s contact details.

2. List the products/services with estimated prices.

3. Preview and share/download the proforma invoice.

The person or business supplying the goods or services prepares the proforma invoice. It could be a business owner or freelancer.

After discussing the order and agreeing on details, they prepare the proforma invoice to share with their customers. Once a deal gets finalised, the proforma invoice can be used as the final invoice for the sale.