Revaluation Account Format

Use accounting software to prepare your Revaluation account format. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all account formats for free.

Download Revaluation Account Format in Excel

What is The Revaluation Account Format?

The revaluation account format is used as a financial statement used for determining the net profit or loss on the revaluation of assets and liabilities, including unrecorded items. It is made when a new partner is admitted or when a partner dies or retires.

The revaluation profit or loss is transmitted to all partners’ capital accounts, including deceased or retiring partners, under their previous profit-sharing ratio (PSR).

Instance Of Revaluation Account Format

Here are the following scenarios when companies prepare revaluation accounts:

- Changes In Market Conditions: If the market value of a company’s assets has changed significantly since they were first put on the balance sheet, the company may decide to make a revaluation account to show the new values.

- Changes In The Legal Or Regulatory Environment: The company can construct this account when laws or regulations change the value of a company’s assets or liabilities.

- Merger Or Acquisition: When a company integrates with or acquires another, it may need to revalue the acquired company’s assets and liabilities to reflect their fair market value.

- Changes In The Company’s Financial Position: A revaluation account might be established if its financial condition has changed after it was first reflected on its balance sheet.

- Significant Events: If something big happens, a revaluation account could be made to show the new prices. Such as a natural disaster or any huge government announcement on the 31st of March at the end of the financial year that may have a big impact on the company’s assets or bills from the beginning of the new financial year on the 1st of April.

Types Of Revaluation Account Format

Here are the following types of revaluation account formats:

1: Revaluation Of Fixed Assets

It is intended to record adjustments made to fixed assets such as land, buildings, machinery, and equipment, among other things.

The goal of the revaluation is to reflect their current price or market value rather than their past cost. It can easily cover the appreciation and depreciation of a company’s fixed assets over a period of time.

2: Revaluation Of Investments

It is used to revalue the company’s investments. It is typically seen when a corporation has long-term interests in securities or shares of other companies. The main goal of this document is to adjust investment values to their fair market value.

3: Revaluation Of Inventory

Adjustments made to the value of inventory items can be recorded by using this account. It may be required when the difference between the inventory cost and the market price is bigger. It may result in either overstocking or understocking into the inventory.

4: Revaluation Of Financial Instruments

The revaluation account for financial instruments is used where the changes to the market value especially for assets like bonds, debentures, derivatives, and other financial instruments are tracked.

As the market value of these instruments changes, the revaluation account makes the appropriate changes to ensure that the financial statements reflect their current fair value. This helps give a more true picture of the organization’s finances and performance.

5: Revaluation Of Foreign Currency Balances

When businesses use multiple currencies, it is common that they may need to revalue their foreign currencies from time to time as revaluation offers changes in exchange rates that directly impacts the value of foreign currency assets in the company.

This account keeps track of the changes that need to be made to reflect the fair value of these balances at the moment. This ensures that the financial records accurately show how changes in exchange rates affect the company’s finances.

Purpose Of Creating A Revaluation Account

Here are the following purposes for creating the revaluation account format:

1: Adjusting Asset And Liability Values

The revaluation account format facilitates the adjustment of asset and liability values to reflect their accurate, fair market values. By recording the revaluation of companies’ profits and losses, the financial statements accurately reflect the true value of these assets. This aids in maintaining transparency, ensuring compliance with accounting standards, and providing decision-makers with reliable information.

In addition, it facilitates accurate performance evaluation, facilitates tax compliance, and serves as the basis for effective future planning based on current asset and liability values.

2: Maintaining Transparency

The revaluation account format is crucial in promoting transparency by documenting the adjustments made to the financial statements clearly and exhaustively. Providing a comprehensive record of revaluation gains and losses enables stakeholders to comprehend and monitor the changes in the values of assets and liabilities.

Maintaining transparency builds customer trust inside the business and helps businesses in preparing well-detailed financial reporting statements. It helps businesses and stakeholders to make better-informed decisions based on the data given by your business. It also provides strategic clarity to the company for the provision of doubtful debts.

3: Complying With Accounting Standards

The revaluation account format assists businesses to comply with the accounting standards requiring recognizing changes in asset and liability values. By accurately documenting and reflecting these changes, the revaluation account ensures that businesses comply with the requirements specified in the relevant accounting standards.

This compliance helps companies maintain the integrity of their financial reporting, improves comparability between organizations, and ensures industry-wide consistency in recognizing and reporting changes in asset and liability values.

4: Facilitating Decision-Making

The revaluation account format is crucial in providing accurate information to stakeholders and facilitating informed decision-making regarding asset management, investments, and financial strategies. By reflecting on the adjusted value of assets and liabilities, stakeholders can make better assumptions about the company’s current market value.

This data facilitates the evaluation of investment opportunities, the assessment of the organization’s financial health, and the formulation of effective asset management and financial strategies that correspond with the company’s overall objectives and market conditions for better reconstitution of partnership firms.

5: Supporting Taxation Requirements

The revaluation account format is critical for tax purposes, especially for calculating taxable profit or loss on revalued assets or liabilities. The revaluation account offers a clear basis for computing taxable amounts by precisely documenting the modifications made to asset and liabilities values.

This data supports businesses in adhering to tax legislation and appropriately reporting taxable earnings and losses to tax authorities. The revaluation account format guarantees that the tax liabilities connected with revalued assets and liabilities are appropriately accounted for, making tax compliance easier and reducing possible difficulties with tax authorities.

6: Facilitating Future Planning

By giving the adjusted values of assets and liabilities of a partner’s capital account, the revaluation account format is an excellent way to plan for future finances. These adjusted values show how much the company’s resources and responsibilities are worth on the market. This lets the company make intelligent decisions about investments and strategic moves.

By using revalued assets and liabilities, organizations can get an accurate picture of their financial situation, find potential growth or risk areas, and make good financial plans that align with their goals and the market. This makes it easier for businesses to make intelligent decisions in the long term.

7: Ensuring Accuracy Of Financial Statements

Reflecting the true side of the valuation of accounts, assets, and liabilities is crucial in accurately representing a company’s financial position. The revaluation account ensures that the financial statements accurately reflect the company’s assets and liabilities by revising the values to their fair market values.

This accurate representation enhances the financial position’s transparency and credibility, allowing stakeholders to comprehend the company’s financial health more and make decisions based on the actual values of assets and liabilities.

8: Evaluating Performance

Tracking the appreciation or depreciation of assets and liabilities over time is an essential aspect of the revaluation account format for assessing the performance of assets and liabilities over time. The account provides a comprehensive record of changes in the valuations of assets and liabilities by recording the revaluation of profits and losses.

It enables a comparative analysis of their performance, allowing stakeholders to evaluate trends in value changes, identify areas of growth or decline, and make informed decisions regarding asset management, portfolio optimization, and risk mitigation strategies based on the historical performance of these assets and liabilities.

Features That Make Vyapar Best Choice For Your Business

1: Business/Accounting Software

Vyapar accounting software allows you to manage a single company or a chain of companies easily. You can also create a well-detailed and professional-looking revaluation account format on Vyapar. It’s simple to run a business without being registered. Vyapar accounting software lets you view your business’s data across different devices.

Vyapar is cutting-edge software that equips small businesses with all the necessary tools to manage their balance sheet. It offers an easy-to-use interface and offers 7-day free trial before finally committing it to software. Vyapar is available without a subscription charge for your Android device.

Vyapar can be used for GST and non-GST purchases and transactions. You may automate accounting processes like billing, invoicing, and report generation for your courier businesses with the help of this program. A business screen is included to provide a broader perspective on operations. Using Vyapar, you can be miles ahead of your competitors who need to pay attention to these upgrades.

2: Track Your Real-Time Business Status

Vyapar’s business dashboard makes the entire management process of revaluation accounts seamless. It allows its users to check the business cash flow, inventory status, open orders, and payment updates and perform many other operations in a single place only. You can easily track your company’s assets and liabilities over a specific period of time.

With free accounting software tools, you can manage your business credit and debit side using your mobile phone. Using Vyapar free inventory management software on your Android device is free and completely secure. By using our advanced accounting software, preparing your balance sheet will become quite simple and efficient. All data gets stored while you prepare your bills, invoices, balance sheet, etc.

With our business dashboard, the entire business management process becomes more accurate as it becomes less prone to manual errors. Vyapar readily avails you of the latest business updates like sales in your stores. The accounting app helps analyze your overall business operations.

3: Automatic Data Backup

Users highly appreciate the Vyapar accounting software for its advanced safety measures and tools. Using billing software Vyapar you can create local, external, or Google drive backups of your financial data which allows the data recovery quite simple and easier.

Vyapar’s “auto-backup” feature simplifies backups and ensures the safety of your financial data. When you enable the auto-backup mode in the Vyapar app, the app creates a daily backup automatically. The app has an encryption system that ensures the data is only accessible to the owner. By using the Vyapar invoicing software, you can create customized data backups and help ensure the security of your data.

You can download Vyapar from the play store, and after creating an account on Vyapar, you can take advantage of its advanced features Seamlessly. One crore small and medium business owners trust Vyapar to keep their businesses going. You can also use Vyapar on your Windows devices and can use its advanced tools and features after paying a small subscription fee.

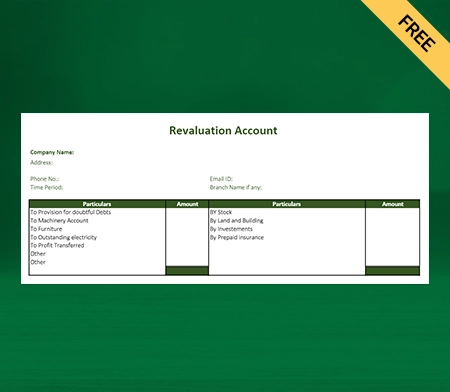

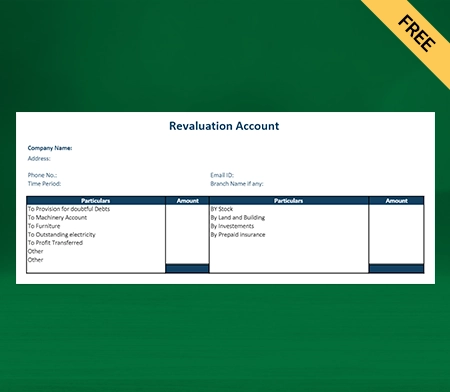

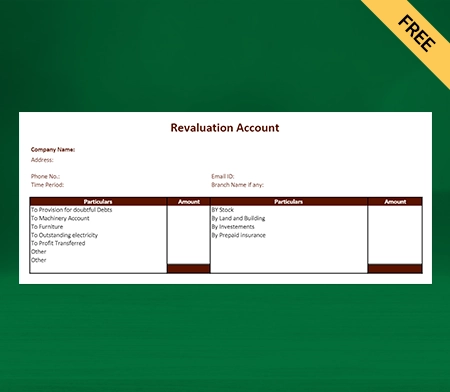

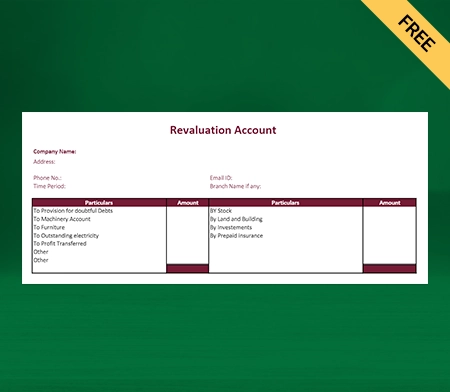

4: Choose Professional Themes For Your Revaluation Account

Keeping professional-looking revaluation accounts and giving them to your stakeholders and clients can enhance your brand’s identity. There are two statement designs for thermal printers in the Vyapar accounting software. Also, it has twelve invoice themes available for standard printers. This accounting software lets you quickly make your balance sheet look professional.

You can make the bills for your business look nice. Making business bills can help a client be more impressed. The best choice for your financial inventory is the accounting app. Pick the best theme for your balance sheet in Vyapar. Most companies use our accounting software because it helps them look more professional. Using professional themes is suitable for building a reputation for your business among your clients.

You can create your balance sheet in different formats per your business requirement. Easily you can create your revaluation account format in docs, excel, PDF and Word format. You can create and send it to your colleagues and clients through online platforms such as WhatsApp, chat and email. It already has all the essential details required in your revaluation account format.

5: Manage Your Business Cash Flow

Vyapar’s accounting software facilitates management automation by significantly reducing manual errors in your balance sheet. Investing in this accounting software will allow you to monitor your company’s cash flow easily. Its integrated accounting software facilitates the administration of monetary dealings because you can keep tabs on your deposits and withdrawals from the bank.

When it comes to maintaining an accurate financial record in real time to create the assets and liabilities in your balance sheet, there is no better alternative for Vyapar. Keeping a running tally of money spent, received, and spent on. This GST accounting software makes handling money much more straightforward.

Businesses can profit even more from accounting solutions’ daybook features. Use this accounting software to avoid having manual errors in your balance sheet. It’s a more convenient alternative for keeping track of money. You can make prompt decisions with the cash flow information at hand, without any interruption to the workflow. Additionally, it aids in staying out of a financial rut caused by poor planning.

6: Online/Offline Accounting Software

If you are performing your business from remote areas where you face frequent internet and network disruption, Vyapar can be a useful tool. Using our accounting tool, you can complete your business opportunity from anywhere across India. When you go online, the system will automate your data.

You can also perform your transaction process by using our accounting software. Vyapar allows its users to provide their clients with various online and offline payment options. Online payment options include the IMPS, NEFT, UPI, net banking, debit, and credit side. You can also perform bank-to-bank transfers on our free accounting tool. If you face internet disruption, you may provide offline payment options such as QR, cash and cheque to your clients.

Using Vyapar offline accounting software, you can create your balance sheet to reconstitute a partnership firm and analyse your memorandum revaluation account seamlessly. The online and offline features of the Vyapar are beneficial for businesses operating from rural areas where connectivity and network issues often appear. Using Vyapar to perform their day-to-day operations can be the one-time solution to mitigate your network and internet issues.

Frequently Asked Questions (FAQs’)

A revaluation account format is a financial statement presentation that documents changes to the asset or liability. It consists of each asset’s opening balance, revaluation adjustments, and closing balance. The format provides a concise summary of the changes in value caused by factors such as fair value adjustments, currency fluctuations, and market conditions.

The revaluation account format emphasises the recording of adjustments made to reflect changes in the values of assets or liabilities. A revaluation account format captures updates based on fair value, market conditions, and currency fluctuations. In contrast, other financial accounts may predominantly deal with historical costs or book values. It presents these modifications and their effect on the financial statements in a distinct format.

Changes in the value of assets like land, buildings, machinery, equipment, investments, intangible assets, and financial instruments are reflected in a revaluation account by recording adjustments like fair value adjustments, currency translation adjustments, impairment adjustments, and reversals of previous revaluation adjustments.

The revaluation account format’s purpose is to accurately reflect changes in the values of assets and liabilities over time. It contributes to a more accurate depiction of the current value of these assets by incorporating factors such as fair value, market conditions, currency fluctuations, and impairments. The format allows for improved decision-making, transparency, and compliance with accounting standards.

The organization’s specific needs and the nature of the assets or liabilities being revalued determine the frequency of updating or reviewing a revaluation account. Generally, it is advisable to periodically revise the revaluation account, such as on an annual basis or whenever significant changes in asset or liability values occur. Regular evaluations ensure the accuracy and relevance of recorded adjustments.

The revaluation account format influences financial statements by reflecting the adjustments made to the asset or liability values. These modifications may affect a variety of financial statement elements. For instance, re-evaluation of increases or decreases in asset values affects the balance sheet and equity. Moreover, changes in fair values may affect the income statement through the revaluation of gains or losses, thereby influencing the reported profit or losses.

Yes, a company can profit or lose based on a revaluation account format. When the revaluation increases, the company records it as profit; when it decreases, it considers it as a loss. The company writes down these gains or losses in its financial statements. They affect the company’s equity and could affect its profitability and financial standing.