Under GST, transporters should carry an E Way Bill when moving goods whose value exceeds Rs. 50,000 from one place to another. GST E way bill needs to be generated on the E Way Bill Portal

# Steps to Generate E-Way Bill

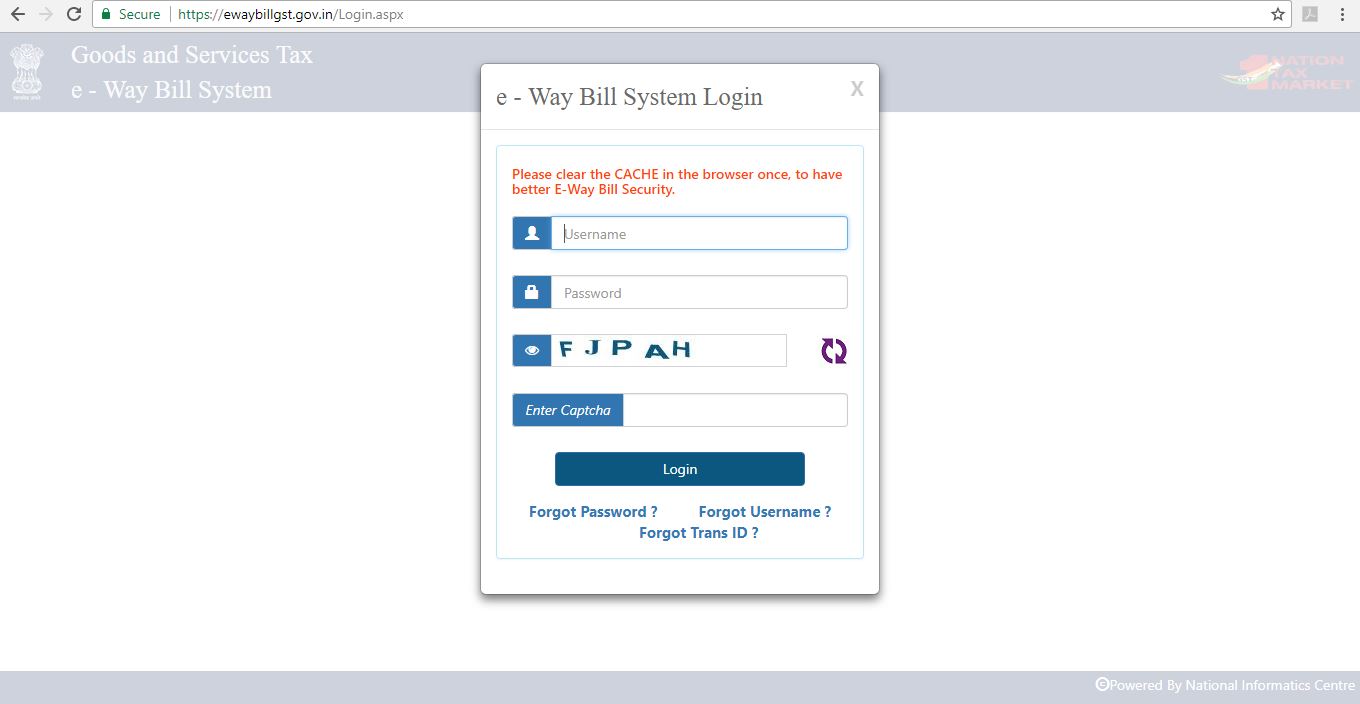

Step 1: Login to E-Way Bill Portal at https://ewaybill.nic.in/ with your login details.

Note: To generate E way Bill, it is mandatory to have GST Registration and transporter registration.

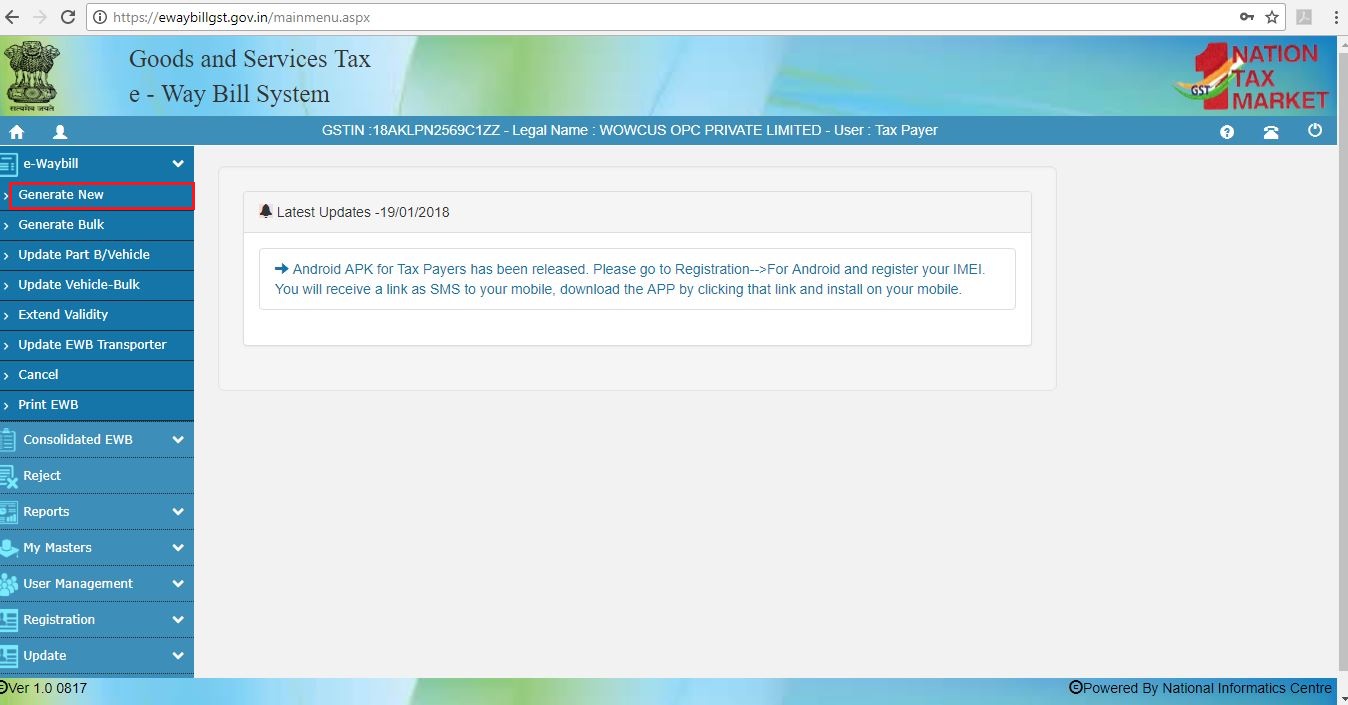

Step 2: Pick the “Generate New” option from the left menu.

Step 3: Fill in the details

If you’re a supplier, select “Outward” as the transaction type.

If you’re the receiver, select “Inward” and enter details of the supplier and recipient along with GSTIN, wherever applicable. Some of the fields will be auto-populated when GSTIN is provided.

STEP 4: Enter Goods Description

- Product Name and Description must be completed just as you do in your tax invoice.

- HSN Code for the Product must be entered. Click here to find HSN code.

- Click here and learn more about: What is HSN code? How does HSN Code Work in Vyapar?

- Enter the IGST or CGST Rates applicable. IGST would be applicable for inter-state transport and SGST / CGST for intra-state transport.

- The approximate distance of transport. This would determine the validity of the eway bill.

Step 5: Click on Submit

Click on the “SUBMIT” button to generate your E way bill. Now, the eWay bill will appear which contains the E way bill number and the QR Code that contains all the details. Print the copy of the bill and provide it to the transporter who will carry it throughout the trip till it is being handed over to the receiver.

# What is an E-way bill? When and who should generate it.

What is an E way bill?

Under GST, transporters should carry an eWay Bill when moving goods whose value exceeds Rs. 50,000 from one place to another. GST E way bill needs to be generated on the eWay Bill Portal.

* E way bill is used to monitor the movement of goods to/ from a state in order to check tax evasion.

Exemptions:

You may not require E-waybill in the following cases:

- If the value of the goods being shipped is < Rs. 50,000.

- When the goods being shipped are exempt from GST.

Who should Generate an eWay Bill?

✔ Registered Person – A Registered person should to generate and carry eWay bill if the value of goods is more than Rs 50,000.

✔ Unregistered Persons – When the supply is made by an unregistered person to a registered person, the receiver will have to generate an E-way bill.

✔ Transporter – Transporters carrying goods by road, air, rail, etc. also need to generate e-Way Bill if the supplier has not generated an e-Way Bill.

When to generate an E-way bill?

An e-way bill must be generated before the goods are shipped. An e-way bill should be generated even if the value of goods being shipped is lesser than Rs.50,000 in 2 cases:

- When the goods are supplied by a principal to a job working in an inter-state transaction.

- During an interstate transfer of handicraft goods by a supplier who has been exempted from GST registration.

# Not Filed GSTR Returns? You Can’t Generate E-Way Bills!

Yes, you will not be allowed to generate e-way bill if you haven’t filed your GSTR returns for the past 2 months on time. By this, you will not be allowed to transport goods from one state to another. Therefore, if you did not file your previous returns, complete them before 21st June 2019.

This is applicable for

- Supplier

- Receiver

- Transporter

- An e-commerce operator

- Courier agencies

Also,

- Taxpayers registered under composition scheme who do not file their return for 6 months will not be allowed to generate e-way bills.

- However, if you have a valid reason for not filing GSTR returns, you will be allowed to generate E-way.

# How to Generate EWay Bill Through Vyapar? All About Eway Bill

GST E-Way Bill needs to be generated on the GST E-Way Bill Portal, but now you can Generate E-way Bill from your Vyapar Billing Software in a single click just after you make the invoice and you can share the invoice with the E way Bill no. with your transporter. If you are registered Under GST, You should carry an E-Way Bill when moving goods from one place to another whose value exceeds Rs. 50,000.

# Who Should Make an E Way Bill?

- Registered Person – E-way Bill must be generated to or from a registered person, If the Value of moving goods is more than Rs. 50,000

- Unregistered Persons – Unregistered persons are also required to generate an E-Way Bill. If a supply is made to a registered person.

- Transporter – If the supplier has not generated an E-Way Bill, Transporters carrying goods by road, air, rail, also need to Create an E-Way Bill.

# Documents Required To Create E Way Bill

- Tax Invoice -Invoice / Bill of supply/challan related to consignment

- Your registered mobile number

- Pin Code

- Product details of products to be transported properly along with the HSN code

- Recipient details – Details of the receiver of the goods

- Transporter details –

If transport by Road – Transporter ID or Vehicle number

If transport by rail, air, or ship – Transporter ID, Transport document number, and date on the document

# How To Enable Generate EWay Bill Option And Where To Get It?

1.) Go to “Settings” in the left menu

2.) Click on “Taxes & GST” setting > “Enable E-Way Bill number”

(Allows you to add E-way Bill number in your transaction)

3.) Enable “Generate EWay Bill no.”

(Allows you to create E-way Bill directly from the app in a single click just after you make the Sale invoice)

Have Vyapar Software?

Download now

# How to Create GSP Username & Password in simple steps

E-way Bill GSP Username/Password is different from the E-way bill portal Username & Password. Watch this video “How to Create GSP username & password” to create a GSP username & password from the E-way Bill portal.

# How to Generate EWay Bill in Vyapar Billing Software?

1.) Create a sale invoice > Click on “Generate E-Way Bill”

2.) Enter Your GSTN no. GSP username & password to login > Click on “Login” button

3.) On the Generate E-Way Bill screen fill all the required details > Select mode of transport > Enter vehicle details (Either vehicle no. or transporter id) > Enter the distance in Kilometers (It must be under 4000 km) > once the details completed click on “Generate” button

4.) E-Way Bill is generated. E-Way Bill no. will be auto-filled > If you want to view and Download the E-way Bill Click on “View E-way Bill” (It will be open in PDF format. You can take a print out and share with the transporter)

5.) If you made any mistakes or for any other reason you can also cancel the generated E-Way Bill before saving the invoice. To Cancel the E-Way Bill Click on the “Cancel” option

6.) “Select Reason” to cancel the Bill from drop-down menu

7.) You can also add the remark for cancellation of E-Way Bill > Click on “Cancel E-way Bill” button

8.) The E Way Bill is canceled. Now you can create a new Eway Bill if required.

Please comment on the comment box below about your views on this new feature. Your feedback means a lot to us. We will be back soon with more updates on our next blog.

Stay updated about the Latest News on Vyaparapp

Download the BEST GST Compliant Mobile Billing App

Happy Vyaparing!!!