Customizable Cash Voucher Format

Take advantage of the cash voucher format now and increase your business’s sales. In addition to simplifying billing and accounting processes, Vyapar accelerates business growth. Sign up now for a 7-day free trial!

Download the Free Cash Voucher Format

Download professional, free cash voucher templates and customise them according to your requirements at zero cost.

What is a Voucher?

A voucher serves as an official record at the start of any business transaction, whether it involves buying, selling, paying, or receiving. It’s like the paper trail that verifies where the money is coming from within a company.

Sometimes referred to as “memos,” these vouchers can be managed through both digital and traditional methods, depending on what works best for a particular business.

In every company, there’s a team responsible for managing what they owe to suppliers and creditors, called the accounts payable department.

Using Vyapar’s free inventory management software to format vouchers can simplify this process. These vouchers act as proof for starting the paperwork needed to settle debts and payments.

The accounts payable department is critical for a company’s internal finances. They ensure that payments are authorized and made correctly, according to agreements made beforehand.

When a voucher is issued, it’s like giving the green light to pay an invoice. It confirms that the invoice has been checked and approved for payment. This authorization is then recorded on the company’s balance sheet.

What are the Different Types of Vouchers?

We have clearly come to an understanding of the importance of vouchers for different companies in the market. But to differentiate between the different types of vouchers, we need to take note of the source documents for the same.

In manual accounting, the vouchers are specified according to the transactions. This helps in making journal entries for the same. This way, specific vouchers are created for specific transactions, which are formalized with the sign of the accountant on them.

Here are the most frequently used types of vouchers:

Cash vouchers: This is the most common form of a voucher which is created for all forms of cash transactions. It has two subtypes which are as follows:

Debit vouchers: The debit voucher is also known as the payment voucher. The main function of this voucher is to showcase the transactions where there is an outward movement of funds from the company.

The main goal of creating this voucher is to record different transactions, cash or bank, which have been for a payment to another organization.

Credit vouchers: The credit voucher is also known as the receipt voucher. This voucher is prepared when a company is receiving money. This money can come from various sources such as:

- From consumers as sales revenue.

- From shareholders against their equity capital in the company.

- Through the sale of fixed assets.

- Through interest earned from various other sources.

- From debtors

- And other sources.

The credit voucher or the receipt voucher can also be differentiated by its two types. One is a cash receipt voucher, and the other is a bank receipt voucher.

Non-cash voucher: There are various names given to the non-cash voucher. Some of them are:

- Transfer voucher

- Journal voucher

Any form of receipts from transactions that do not involve a bank or cash receipts are recorded through this type of voucher. Usually, this type of voucher deals with transactions that involve credit sales, transfer of any form of property, credit purchases, and other forms of transactions that do not involve the bank or any cash transfers.

The various cases which are recorded under this type of voucher are:

- Sale of goods or purchase of goods on credit.

- Sale of fixed assets or purchase on credit.

- Returned goods concerning sales or purchases on credit.

- Bad debts in written form

- Any other form of non-cash transactions.

Sales Voucher: Any form of transaction that involves sales of goods and services is recorded under the sales Voucher. Sales voucher records all transactions involving cash and credit sales that take place in a company.

The process starts when the company’s debtor account is debited; meanwhile, the sales account gets credited. This voucher then acts as proof and, in many cases, as hard evidence that the sales of goods and services have taken place in a company.

Purchase voucher: Any transaction revolving around the purchase of goods and services is passed under the criteria of a sales voucher. This type of voucher is created just for the specific purpose of sales that have taken place through cash, bank, or credit in a company.

The purchase is initiated when the supplier for the goods or services is credited. Various documents support the purchase order, such as the purchase order, supplier slip, and other relevant documents. Purchase orders can be easily generated through the purchase order generator tool by Vyapar.

Supporting voucher: All the company transactions that have occurred in the past are recorded through the supporting voucher. This serves as written documented proof of a company’s past transactions.

Many other documents act as supplementary documents for the supporting voucher, such as the expense bill, fuel bills, and more.

What is the Importance of Cash Vouchers?

Cash vouchers are handy documents designed to facilitate invoice payments efficiently. They play a crucial role in managing expenses, ensuring timely payments, and even availing discounts when applicable.

These vouchers provide a clear record of cash transactions, indicating the date, amount, and purpose of the transaction. A signature confirms the validity of the transaction, making it a straightforward yet effective tool for all types of businesses.

Cash vouchers serve a variety of purposes, from tracking cash inflows from customers, employees, or other businesses to facilitating payments to vendors. They are versatile, equally suitable for personal or business use, whether it’s settling invoices, paying for goods and services, or handling loan payments and savings deposits.

In some cases, cash vouchers may take the form of small, one-time currency units available for purchase in stores or online. Alternatively, they can be easily generated using computer programs for free, ensuring they’re readily available whenever needed.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Major Benefits of Using a Cash Voucher

A cash voucher needs to be designed in a professional manner as it is a one-stop solution for companies that look forward to dealing with an organized cash system.

As a system of record, it helps keep a sharp eye on daily transactions while checking the inflows and outflows of cash in the company.

A cash voucher can also be attached with various other documents containing sales and purchase transaction details. At a specific time, they can be consolidated to get details about the exact amount that is present in an account or a petty cash register.

Some major benefits of a cash voucher include the following:

- Cash vouchers offer a specific amount of money as a flexible gift option when uncertain about the recipient’s preferences.

- They aid in budgeting by providing a predetermined spending limit and tracking mechanism.

- Cash vouchers can serve as an alternative form of payment, especially when traditional methods aren’t feasible.

- They contribute to saving on expenses like groceries, car registration, and emissions testing.

- Effective marketing tools, cash vouchers catch consumers’ attention and drive sales by offering enticing discounts or promotions.

- They attract new customers who are incentivized to spend more to redeem vouchers, thereby boosting sales.

- Cash vouchers provide a convenient payment option for individuals lacking cash or other payment methods.

- They are durable and long-lasting compared to other voucher types.

- Suitable for gifting, cash vouchers help build stronger client relationships.

- Cash vouchers aid in marketing efforts by attracting more customers through promotional offers.

- They assist businesses in managing expenses, particularly marketing costs, allowing for greater investment in product development.

- Cash vouchers can help generate more leads and requests for further action (RFAs).

- Creating cash vouchers provides marketing and sales teams with practical strategies to enhance market presence and increase productivity.

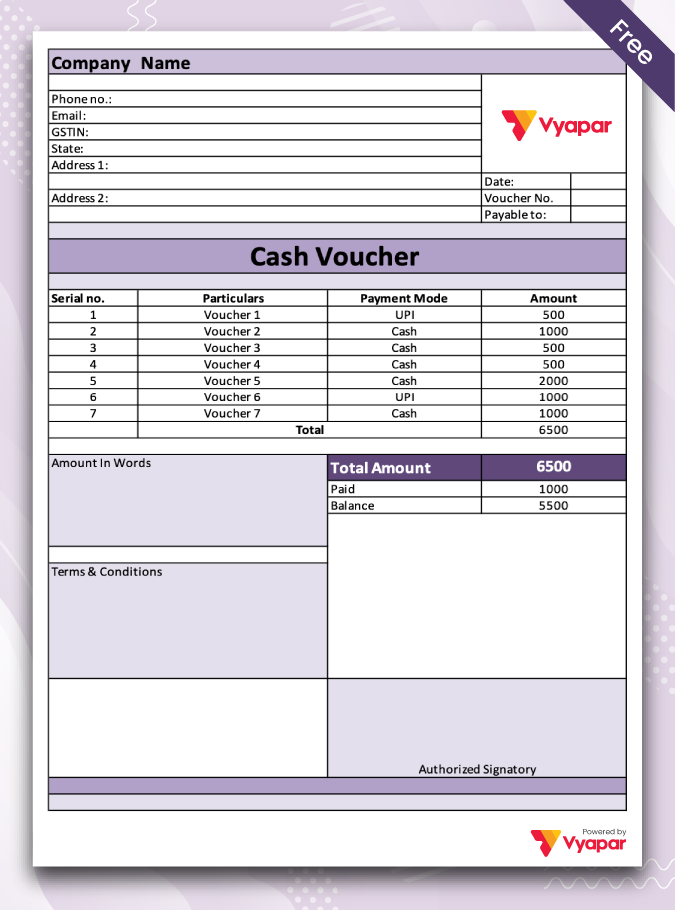

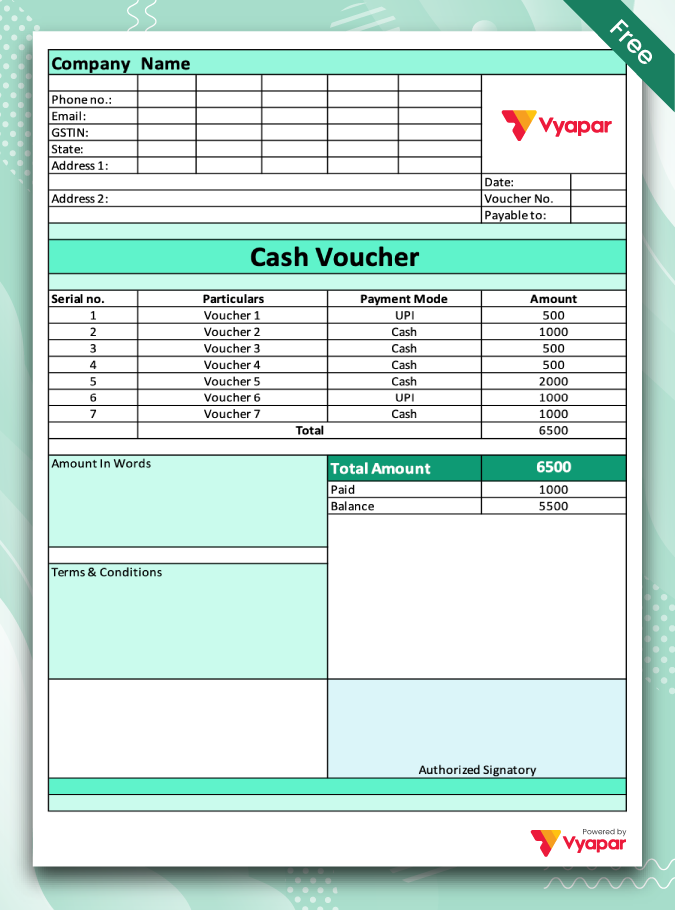

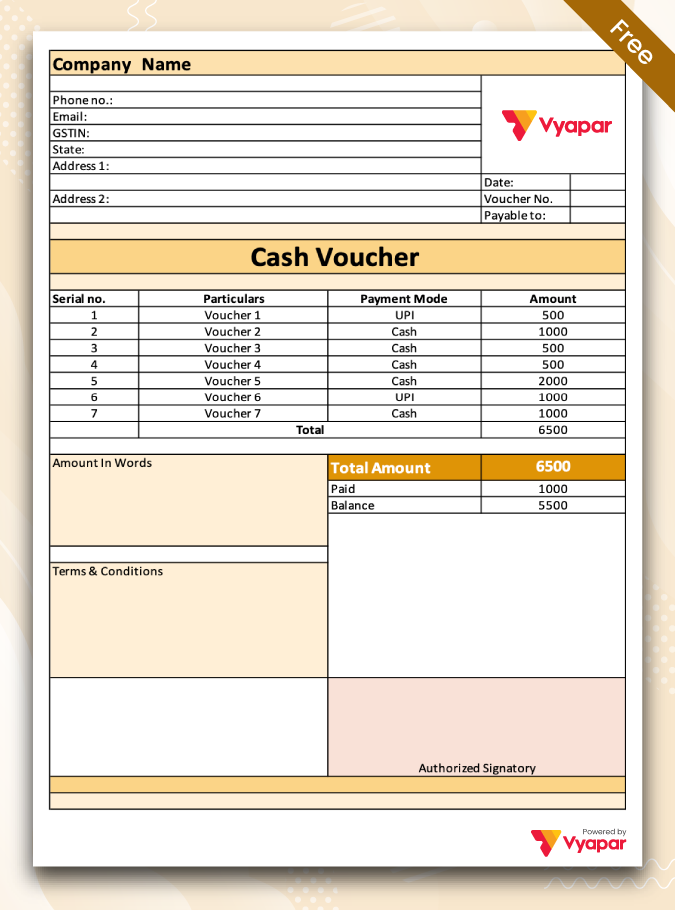

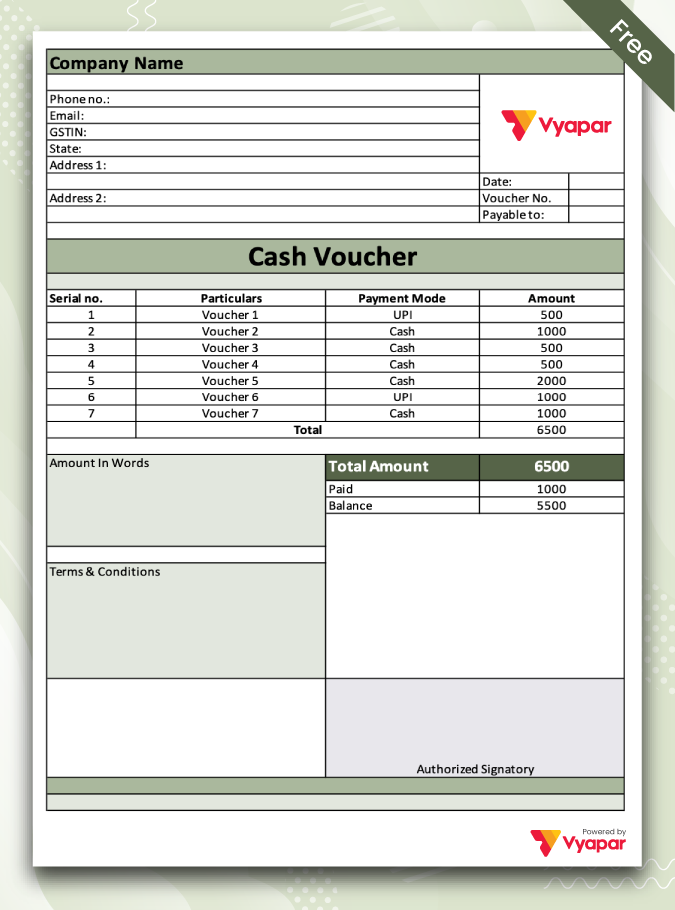

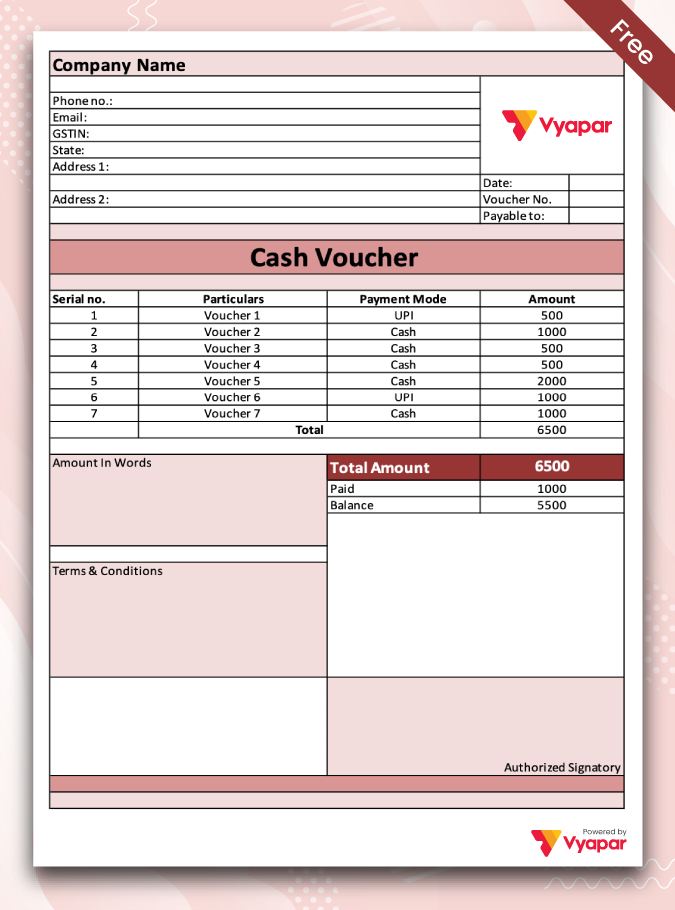

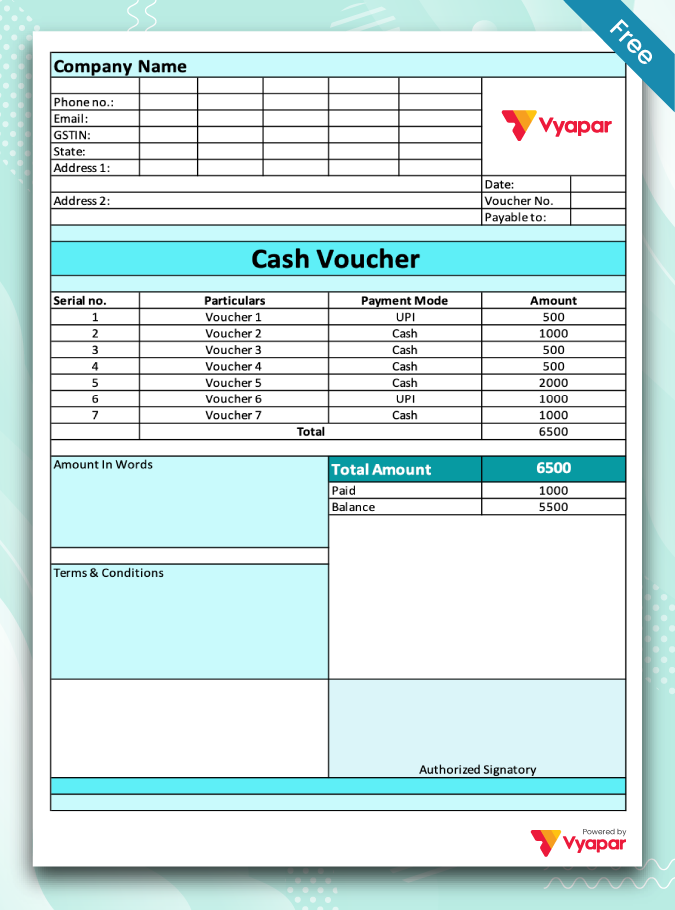

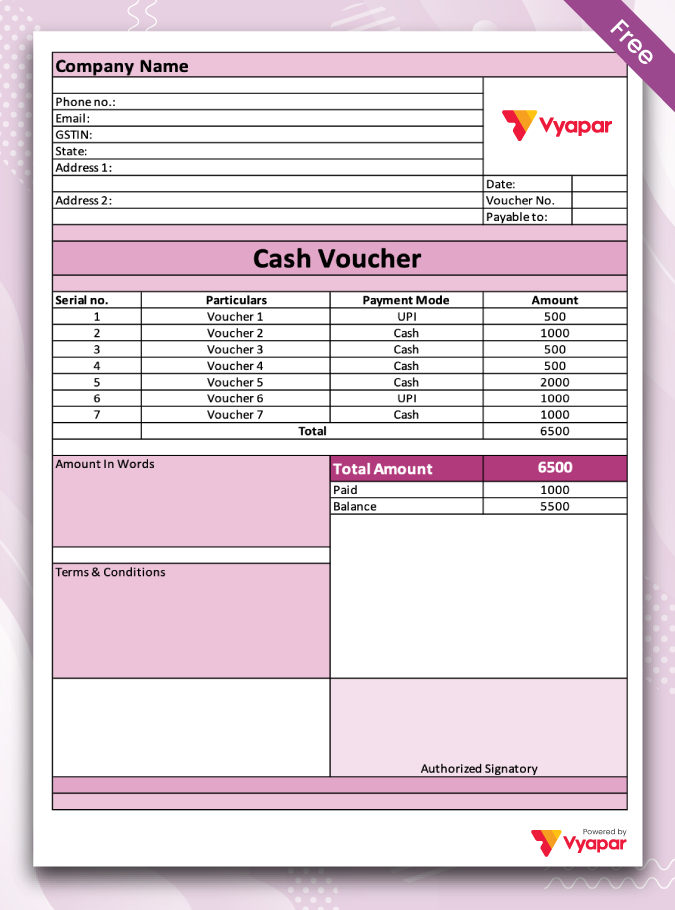

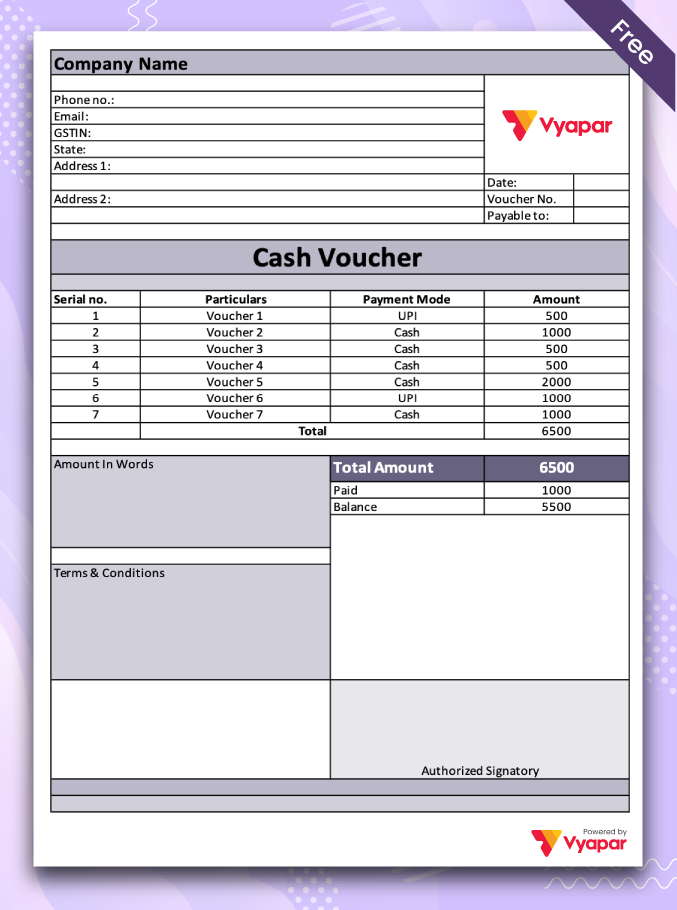

Essentials Elements of a Cash Voucher Format

Various details need to be included in creating a cash voucher in a professional format. Below is the general format or the details that need to be included in a simple or general cash voucher format.

- Company Details: Include the company name, official logo, address, and contact numbers.

- Proper Heading: Clearly state that it’s a Cash Voucher and specify whether it’s a debit or credit voucher.

- Date Field: Provide space for the date when the payment is issued.

- Amount: Mention the issued amount in both words and figures for clarity.

- Mode of Payment: Specify whether the payment is made in cash or through a bank cheque. Include bank details if necessary.

- Recipient Details: Include details of the person or organization receiving the payment.

- Payee Details: Provide information about the person authorizing the payment, typically from the company’s accounts department.

- Transaction Details: Describe the nature of the transaction for which the voucher is issued.

- Approval of Designated Authority: Ensure the signature of the authorized personnel from the accounts department to validate the voucher.

- Approval of Cashier: Acknowledge that the cashier handles the amount mentioned in the voucher according to the transaction.

- Receiver’s Signature: Allow the recipient to sign as an acknowledgement of receiving the payment.

By including these details, a cash voucher can serve as a reliable document for recording financial transactions accurately.

Frequently Asked Questions (FAQs’)

The general cash voucher format is as follows:

* The heading contains the details, such as the type of cash voucher that has been created.

* The first thing that needs to be included in the cash voucher is the proper details of the company, including their address and their contact details. This helps in the proper identification of the company.

* Then the fields of date, mode of payment, and amount payable need to be filled.

* Now, the details of the payee need to be filled, which include their contact details.

* The details of the transaction also need to be included in the document along with the proper approval of the authority, which is a crucial part of the process.

* In the end, the receiver’s signature and the approval of the cashier are needed to complete the document.

A cash voucher and a cash-purpose voucher are the same. It is a document that proves that cash was received or paid. It typically includes the date, amount, purpose, and signature of the person authorizing the transaction.

A cash-purpose voucher is a simple document that businesses of all sizes can use. The voucher can be used to track the receipt of cash from customers, employees, or other businesses.

A cash voucher Template is a ready-to-use document wherein the owner has to fill in the details required by the document to make it complete. These templates can be edited and shared, which becomes a boon in business.

With the help of the available cash voucher templates across all formats and minimal use of tools, one can easily create, share, edit, and print or download their cash voucher without any problem. These templates are available in various formats, such as Word, Excel, and PDF.

You can follow the prescribed cash voucher format to write a general cash voucher, or you can choose to use the accounting software Vyapar, which allows you to enjoy its template features. You can easily use these templates to write your cash voucher and share them with others in no time.

The Vyapar application is built to save time and cost for companies that are used to fulfil various activities. Using the Vyapar billing app makes it seamless for a business to create cash vouchers for customers.

There are two types of cash vouchers:

* Debit vouchers: A debit voucher is a document used in double-entry bookkeeping. It is a voucher representing a debit transaction.

Debit vouchers are used to record transactions in the purchase ledger of a business. (The purchase ledger is a sub-ledger that records the value of the business’s purchases.)

* Credit vouchers

Credit vouchers are a service that allows you to transfer credit from one account to another. The credit voucher is the generic name of a payment instrument that bears the features of a banknote and a cheque. This type of voucher is issued by an issuer (company or state).

It is used as a means of payment and has the same value as a certain amount of money. A credit voucher has the advantage over a banknote or a cheque in that it can be issued in a certain amount only. The issuer determines the value of the credit voucher and its validity.

A cash voucher can be used in tally as a document containing all the details of a financial transaction that needs to be later recorded in the book of account.

To create a cash voucher:

* Include business details like name, address, and contact information.

* Add recipient details and purpose of the cash voucher.

* Specify the amount in numbers and words.

* Mention any terms or conditions related to the cash voucher.

* Sign and date the voucher for validity.

* Maintain a copy for your records.

An example of a cash voucher is a document that states: “ABC Store Cash Voucher. Received from John Doe $50 (Fifty Dollars) for goods purchased on April 1, 2024. This voucher is valid for one month. Signed: [Your Name].”

Yes, a cash voucher can serve as a receipt for a cash transaction, providing proof of payment or receipt of funds.

A voucher is a broader term that can refer to various types of documents or coupons used for different purposes, such as discounts, payments, or promotions. On the other hand, a cash voucher specifically refers to a document used to record and authorize cash transactions, such as payments or receipts.

The advantages of cash vouchers include:

1. Record Keeping: Helps in maintaining accurate records of cash transactions.

2. Accountability: Ensures accountability as each transaction is documented.

3. Security: Reduces the risk of cash mishandling or theft.

4. Proof of Payment: Serves as a receipt for both parties involved in the transaction.

5. Control: Enables businesses to track and control cash flow effectively.