Petty Cash Voucher Format

Handling small day-to-day expenses can be time-consuming. Discover the top petty cash voucher formats for free using the Vyapar App. Keep track of essential expenses. Simplifying petty cash management maximises control over total finances.

Download a Petty Cash Voucher Format For Free

Download professional, free Petty Cash Voucher templates and make customization according to your requirements at zero cost.

Customize Invoice

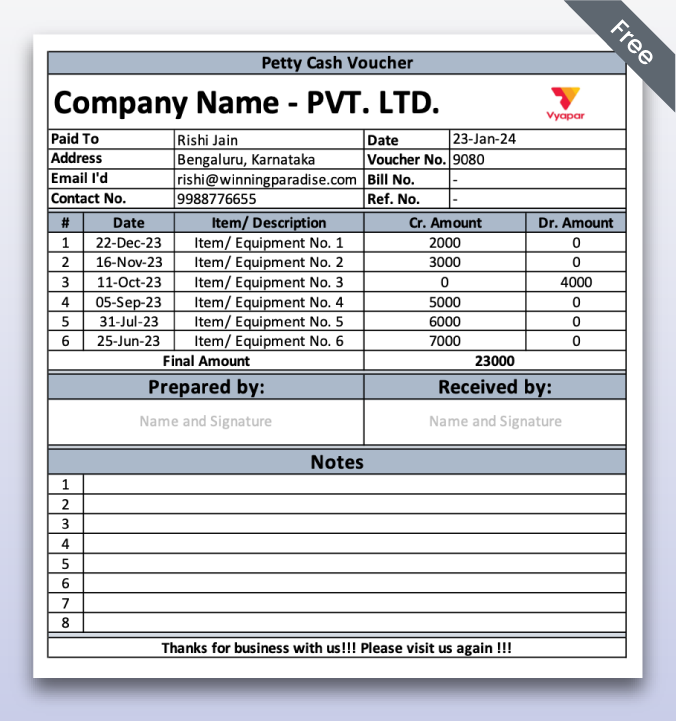

Type – 1

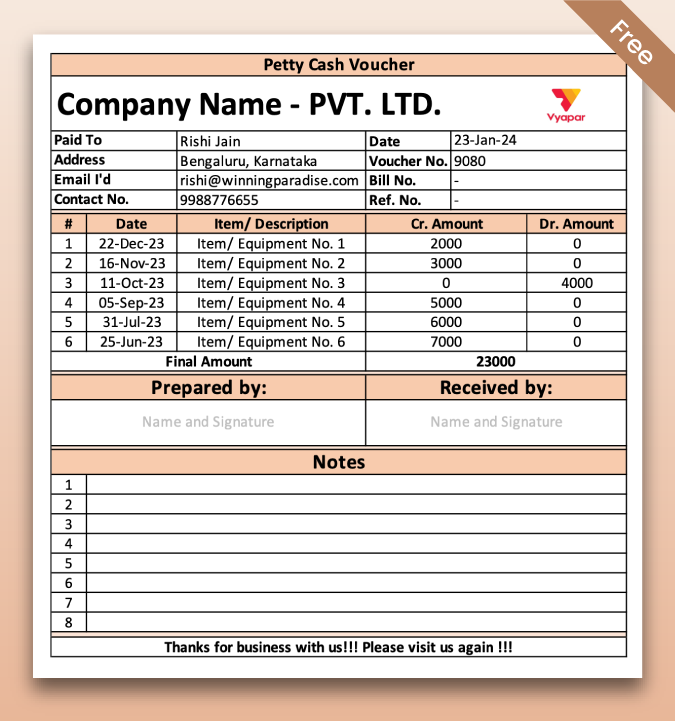

Type – 2

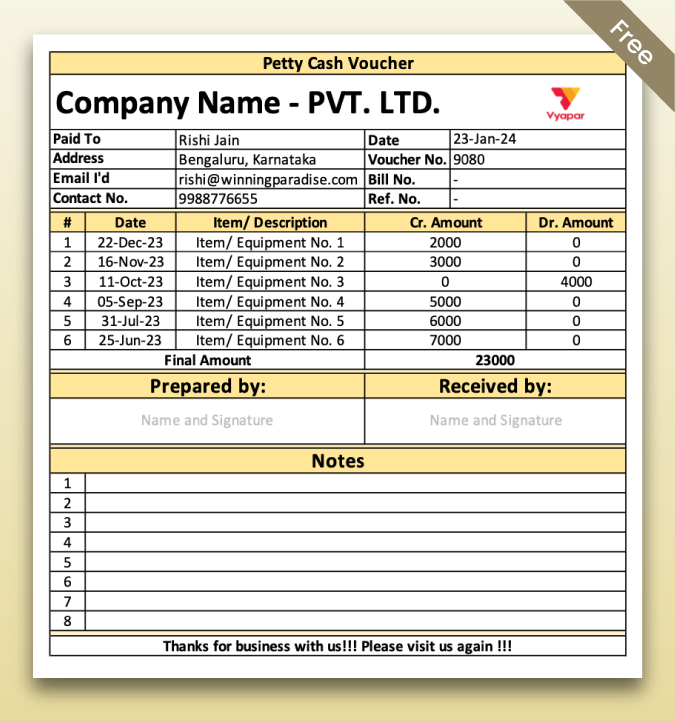

Type – 3

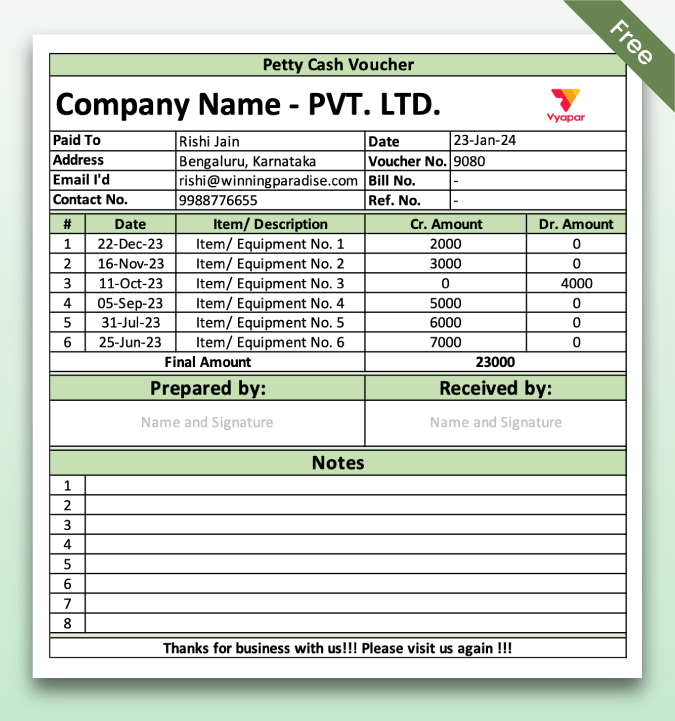

Type – 4

Highlights of Petty Cash Voucher Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Main Objectives And Benefits of Using Petty Cash Voucher Format

Effective Cash Management

A business cannot depend on check or credit card payments for day-to-day expenses. That’s where petty cash and petty cash management come in.

There are small expenses that occur every day. However, it is necessary to keep track of them. It helps optimize the cash flow. Using automated billing software can help with effective cash management.

One of the advantages of using the cash voucher format is it ensures that there’s enough liquidity to cover operational needs. It aids in maximising the investment potential.

Expense Tracking

Having a petty cash voucher format is necessary for effective expense tracking in businesses. Petty cash vouchers provide a systematic way to record and document each small expenditure.

It simplifies the record-keeping of small expenses. When the data is fed and the limit is set, it helps regulate the expenses. Businesses can analyze whether their petty cash is being used efficiently. This enables adjustments if needed.

Check out the customised petty cash voucher formats from the Vyapar App. It simplifies the recording of small expenses and ensures financial accuracy.

Financial Planning

Business owners understand the importance of making data-driven decisions. Financial planning is crucial for every business.

Analysing the tracked expenses over time enables businesses to make informed decisions. It helps identify patterns, areas of overspending, and opportunities for cost-saving. The Vyapar App offers detailed petty cash formats that can be easily customised.

The petty cash vouchers provide complete data for the businesses. This can help the firms make strategic decisions aligned with their financial goals.

The Importance of The Vyapar App for A Petty Cash Voucher Format

Effective management of petty cash involves handling small amounts of cash for daily operational expenses. It is crucial in the realm of business finance.

The Vyapar App offers a complete, user-friendly solution to streamline this process. It empowers businesses with an efficient system for managing petty cash, ensuring smooth operations and enhanced financial control.

These expenses usually include:

- Office Supplies

- Refreshments

- Transportation

- Office snacks

- Printing and Xeroxing

- Other minor maintenance costs

These are small expenses that occur every day. However, it is necessary to keep track of them. At the end of the month, they can add up to a really good amount. So, there needs to be a proper system to keep the records.

Businesses usually face the following problems with petty cash management:

- Lack of information

- Inadequate documentation

- No Tracking/record-keeping

- Difficulty in Auditing

- Lost Receipts

By providing a customized approach to managing petty cash, the Vyapar App enables businesses to streamline their processes. This resolves discrepancies and develops a transparent financial environment.

The Vyapar App offers tailored features for businesses to manage petty cash effectively. This promotes financial transparency.

Elements of Petty Cash Voucher Format

1. Date:

- You cannot record this month’s transaction next month. Maintain the date of the expenditure. It provides a sequential record of the transactions.

- It helps identify patterns or trends of spending. It eases the expense record in the long run.

2. Payee:

- The payee field maintains the name or details of the person or vendor.

- These are the ones who received the cash payment. It ensures a clear record of who received the funds. It also mentions the purpose of receiving the funds.

3. Explanation

- Expect an explanation of the expense. It should be clear and brief. This helps understand the purpose of the spending.

- Considering recording relevant details like the item purchased can be helpful. Also, state the reason for the spending.

4. Amount

- The amount is the most important aspect. It is vital to mention the exact amount. This leads to accuracy in financial records.

- Avoid rounding off or estimating the amounts. This develops precision in expense recording.

5. Account Code

- Labeling and allocation of overheads are possible now. This ensures recording expenses in the correct cost centres.

- If needed, in the general ledger accounts. This makes it easier to analyze spending patterns. It also assists in preparing financial statements.

6. Approver’s Signature

- The approver’s signature field serves as proof of approval for the expenditure. It provides liability.

- This ensures that the designated individual approves the expenses. It can even be a department preventing unofficial practices.

7. Receipt Attachment

- Attaching the original receipt or invoice to the petty cash voucher form is crucial. It is part of proper documentation and evidence of the transaction made, which eases verification and auditing.

Tips for Maximizing Control Over Total Amounts

The petty cash voucher form is an amazing tool for managing petty cash. However, maximizing control over total amounts requires taking additional measures.

It’s simple; read on to learn more about it, and check these 5 tips:

Spending Limitations

- Set a spending limit for each expense category. This prevents excessive spending.

- Develop a clear step-by-step guide for employees. Share in the guide the expenses. Compensate the expenses from petty cash. And what requires additional approval or payment through other means.

Device A Dual Approval Process

- Device a dual approval process for important expenses. Have a specific process for petty cash fund reduction too.

- Thoroughly review expenses to ensure they are well-managed. Moreover, authorized by multiple individuals. This reduces the risk of unofficial expenses.

Device a Dual Approval Process

Regularly conduct surprise audits. This is to verify the accuracy of petty cash transactions. Just select a few completed voucher forms and receipts. Cross-check them.

Check the actual cash balance. This will reduce fake activities and ensure compliance.

Train Employees

Provide proper training and control to employees. This is for the ones responsible for petty cash transactions. Educate them on the importance of accurate record-keeping and proper completion of voucher forms.

Regular training sessions will help maintain consistency in petty cash management.

Use Technology

Explore software or digital solutions like the Vyapar App. It offers advanced features for petty cash management. It automates processes and provides real-time reporting.

It also offers additional security measures. Take advantage of these tips to improve control over total amounts.

This minimizes the risks associated with petty cash management.

Why Choose The Vyapar App for Petty Cash Management?

Finances are a really important part of any business. Maintain all small or big expenditures. This fosters sustainable growth.

The Vyapar app offers a fully integrated invoicing software to simplify the finances. We have added advanced features to simplify all the finance processes. We have got your back. From generating reports to improving the overall performance.

1. Expense Supervision Solution:

The Vyapar App’s expense supervision solutions allow you to automate the entire petty cash management process.

Some of the features that can help are:

- Specific digital voucher forms

- Expense Classification

- Approval Process

- Integration with other software.

This provides real-time visibility into expenses. And ensures easy report generation. And analyze spending patterns.

2. Mobile App Availability:

The Vyapar App is a dedicated mobile app designed for petty cash management. This offers an effective way to analyze expenses on the go.

It includes features like receipt scanning and expense tracking. Moreover, we offer integration with cloud storage for easy access to data. And that too from any device.

This reduces the need for paper forms and simplifies the repayment process.

3. Cloud-Based Solutions:

The Vyapar App’s Cloud-based solution offers the benefit of data access from anywhere. And anyone can check it anytime. It allows for collaboration among team members and centralized record-keeping.

It also offers the secure storage of digital documents. And the best part is, data backup and recovery options are also available. This ensures the safety of your financial records.

4. Accounting Software Integration:

Are you already using accounting software for your business? The Vyapar App offers an easy connection with your existing system.

This removes the need for manual data entry. This leads to consistency between the petty cash records. Moreover, sets a proper connection with the general ledger.

5. Custom-Built Solutions:

Businesses may require custom-built solutions. This meets the specifics of petty cash management needs.

The Vyapar App helps create a tailor-made solution that aligns with your unique requirements. Book a free demo with our accounting experts today.

Features And Benefits Of the Vyapar App For the Business Owners

Record Multiple Transactions

The ability to document individual transactions is a crucial feature. The Vyapar App allows users to record each petty cash expense separately.

This functionality ensures that businesses have a detailed and organised account of every financial outlay This promotes accurate tracking and transparency in petty cash management.

It could be a small office supply purchase or a miscellaneous expense, the capability to create distinct transactions guarantees precision.

This feature is invaluable for businesses seeking to enhance accountability. This streamlines the financial management process.

Individual Bill Payments

The Vyapar app offers a convenient individual bill-payment feature. This allows users to effortlessly link specific bills or expenses to each payment.

This streamlined process greatly facilitates tracking and managing petty cash expenditures. This ensures meticulous records of transactions.

Businesses can improve transparency and accuracy in their financial management. This leads to more efficient and effective business operations.

Cash and Bank Control:

Efficient cash management is made easy with the Cash and Bank Management feature in the Vyapar app. This is especially useful for managing petty cash transactions.

This powerful platform allows users to effortlessly record, monitor, and reconcile. Moreover, ensures a smooth process for petty cash management whether it’s tracking expenses or maintaining an up-to-date overview of available funds.

We have got you covered with the Vyapar app’s Cash and Bank Management feature. It caters to the unique requirements of businesses involved in daily cash operations.

Diverse Payment Options

The Vyapar App offers the Multiple Payment-type feature. It helps users experience unmatched flexibility when it comes to managing petty cash.

This advanced functionality caters to the diverse nature of payment methods involved in petty cash transactions. The Vyapar app helps record cash payments, checks, or digital transactions.

This flexibility proves highly advantageous for businesses handling petty cash. It offers a complete solution meeting the specific requirements of various payments. And it is possible to do it within the app.

Billing and Printing:

The Vyapar App can generate automated bills for any business. The features of billing and printing are really important for any business. Petty cash transactions are usually small amounts.

However, it is necessary to create a petty cash voucher form to record the transactions. These records help with overall financial planning.

The printing feature allows you to easily create and print the bills whenever required. This eases the reviewing and reporting of the transactions.

Data Reporting and Analysis

The Vyapar app empowers businesses with its powerful data reporting and analysis capabilities. This makes it an all-inclusive solution for efficient petty cash management.

Featuring user-friendly tools, businesses can effortlessly generate detailed reports. Analysing the patterns in the business is important.

The Vyapar App provides valuable insights that aid in informed decision-making. It simplifies data reporting and analysis and improves the overall efficiency of petty cash management, helping businesses establish precise control over financial transactions.

Vendor Relationship Management

The Vyapar app provides the features of customer/vendor management. Businesses can effortlessly handle petty cash transactions associated with customers and vendors.

This feature systematically organises all relevant data involving customers or vendors. Users can track and categorise petty cash expenses related to specific customers or vendors. This ensures efficient record-keeping.

The streamlined process simplifies the management of financial interactions. It also provides a comprehensive overview of petty cash activities.

Previous Transaction Data

Vyapar App’s transaction history feature provides a detailed and easily accessible log of all petty cash transactions. This allows users to effectively track and review each small expense.

This functionality promotes transparency and facilitates expenditure monitoring. Ultimately contributing to precise financial record-keeping.

5 Steps for Using a Petty Cash Voucher Form Successfully

Set Aside Petty Cash Fund

Calculate how much money to allocate to the petty cash fund. And how do you do that? It is the amount based on the average monthly expenses. And other means cannot conveniently pay for it.

Understand the necessity of securely storing the petty cash fund. It should only be accessible to authorized personnel.

Handled by Individual

Make a specific individual in charge of managing the petty cash fund. The individual should be accountable for issuing and reloading the cash. And also, for maintaining the petty cash voucher forms.

Record Expenses on The Voucher Form

As and when the expenses occur, the individual responsible should take the task at hand. The record-keeping of the expenditure is a responsible work.

Follow the process religiously. Enter all the necessary details, such as original receipts and approvals.

Review and Resolve

Regularly review the petty cash voucher forms. Record the receipts to ensure accuracy and completeness. Sort out the expenses recorded on the forms.

Maintain Proper Documentation

File all petty cash voucher forms and receipts in an organized manner. Keep them securely stored for future reference. Auditing or tax purposes may require it.

Frequently Asked Questions (FAQs’)

In Vyapar App, crafting a petty cash voucher is easy. It involves entering key details such as the date and expenditure amount. Moreover, the purpose of the expense.

For security purposes, obtaining the necessary approval signature. This user-friendly format ensures efficient recording. And tracking of petty cash transactions.

Vyapar App includes a ‘Petty Cash’ account, reflecting standard business practices. This account holds a small sum for minor expenses. Such as courier services, refreshments, and stationeries.

Utilize petty cash vouchers to spend these small expenses. It also helps maintain accurate financial records.

The Vyapar App seamlessly integrates with a petty cash log. This allows users to track and manage petty cash expenses over time.

This solid system ensures transparency and efficiency. It helps with monitoring and recording petty cash transactions.

It is easy to request a petty cash quote using the Vyapar App. The users need to provide details such as the date and amount.

Additionally, the purpose of the expense. For security purposes, the individual authorises the expenditure. This information is vital for accurate record-keeping. This ensures the maintenance of a systematic approach to petty cash management.

In the Vyapar App, a quotation for petty cash services is a structured document. This presents details of petty cash transactions. It enables businesses to communicate effectively.

This showcases professionalism. It also helps maintain a clear record of petty cash expenditures. The quotation feature in the Vyapar App helps businesses convey their value proposition. Moreover, it eases better contract management.