Salary Voucher Format

Download the salary voucher format by Vyapar for free. Manage the salaries of all employees in one place and issue professional salary vouchers to your employees within minutes. Grab your 7-day free trial today!

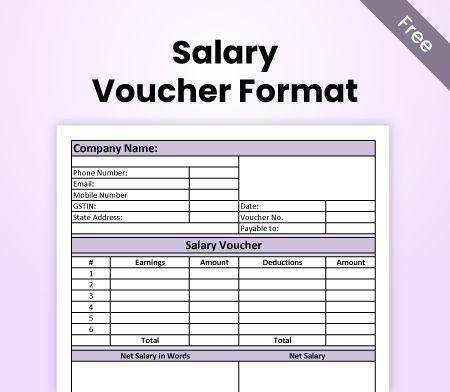

Highlights of Salary Voucher Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Salary Voucher Format

Download professional free solar quotation formats, and make customization according to your requirements at zero cost.

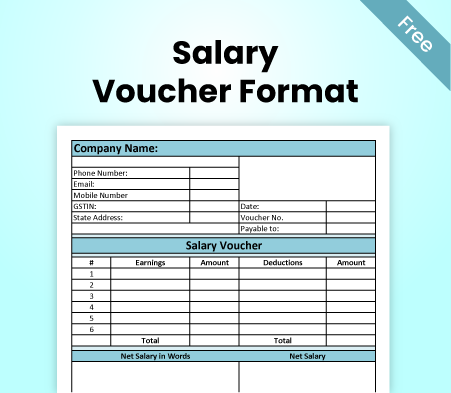

Type – 1

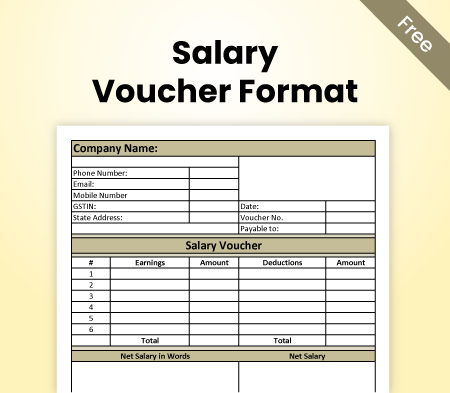

Type – 2

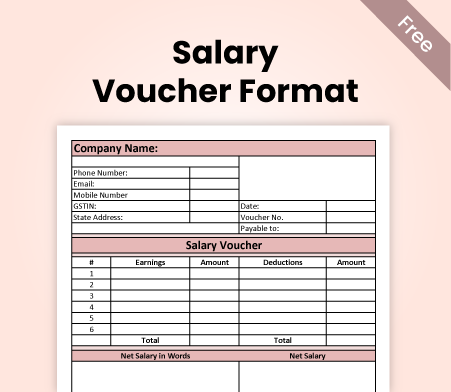

Type – 3

Type – 4

Professional Logo Maker

What is a Salary Voucher?

A salary voucher is a document that shows the details of an employee’s monthly salary. An employer issues it and serves as a record of salary payment. You can use the best salary management tools by the Vyapar app to track all payments to your employees in one place.

Any professional salary voucher includes information like the employee’s name, designation, salary amount, deductions, and net amount. Using a salary voucher format can make the entire task effortless as it ensures that everything required in the voucher is included in it.

What To Include In A Salary Voucher Format?

Employee Information

The employee information section of a salary voucher includes details about the employee. It consists of the employee’s name, employee ID, designation of the employee or job title, and department within the company in which the employee works. The information here helps identify and specify the employee to whom the salary voucher belongs.

Salary Details

In the salary details section of a salary voucher format, you will find information about the various components that make up an employee’s salary. It includes the basic salary, allowances such as housing or transportation, overtime pay, and any bonuses or incentives. It provides a breakdown of how the employee’s salary is calculated.

Deductions

Deductions refer to the amounts that are subtracted from an employee’s gross salary to arrive at the net pay. The common deductions that are deducted from the salary voucher are income tax, health insurance premiums, retirement fund contributions, and loan repayments. In most cases, deductions are agreed upon between the employer and the employee.

Net Salary

The net salary column of a salary voucher format includes the final amount. It is the amount that the employee receives after all the deductions have been subtracted from the gross salary. It represents the actual amount that the employee gets. The net salary is what the employee can expect to receive in their bank account or as a physical payment.

Pay Period

The pay period column in a salary voucher format indicates the duration for which the salary is being calculated. It specifies the period during which the employee has worked and for which they are being paid. The common pay periods include monthly, bi-weekly, or weekly. The pay period provides clarity on the time frame for which the salary is being processed.

Employer Information

The details about the employer or the company issuing the salary voucher are written in the employer information section of a salary voucher format. It mainly includes the name of the company, its address, contact information, and possibly the company’s logo or branding. This section contains necessary information about the employer for any further communication or reference.

Payment Method

The information regarding how the employee will receive their salary is included in the payment method section. Payment methods can be direct deposit to a bank account, physical check, or electronic transfer. It may also include additional information like the bank account number or payment reference. The payment method section ensures that the employee knows how their salary will be disbursed.

Date Of Payment

The date of payment is the date when the salary is transferred to the employee by the employer. The employees can keep track of when they can expect to receive their salary.

Signature

The salary vouchers are issued after the employer signs them, and in most cases, there is a space for the employee’s signature as well. The employee’s signature acknowledges that they agree with the details stated in the voucher. The employee’s signature indicates that the payment has been made in accordance with the employment agreement.

Allowances In The Salary Voucher Format

Allowance is the additional payments or benefits given to employees on top of their basic salary. Some common allowances in the salary voucher format include:

1. Dearness Allowance (DA):

Dearness allowance is an allowance provided to employees, mostly government employees and pensioners. It is given to help them cope with the rising cost of living. As the effect of inflation at different locations, the calculation of dearness allowance also varies from employee to employee based on their place of work.

There are mainly two types of dearness allowance in India. Fixed dearness allowance is a component of an employee’s basic salary that remains constant. It does not change along with the changes in the inflation rate. It is usually provided to employees who work in industries where the cost of living remains stable or does not vary significantly.

Variable dearness allowance is a percentage of the basic salary of the employee. It is revised periodically depending on the inflation rate. It can be further calculated based on the consumer price index or industrial average. Variable dearness allowance helps ensure that employees receive fair compensation.

2. House Rent Allowance (HRA):

Employers give house rent allowances to their employees who reside in rented accommodation. It helps cover a part of the cost of renting a house or apartment. It can only be claimed by employees who do not have company-provided accommodation. House rent allowance is a percentage of the employee’s basic salary.

It can vary depending on factors like the city of residence and the employee’s salary level. The purpose of HRA is to provide financial assistance to the company’s employees for their housing needs. The employees need to show proof of rental expenses, such as rent receipts, to determine the eligibility and amount of HRA.

Employees can claim HRA exemption of the amount that is the lowest of the following:

- Actual house rent allowance received

- 50% of basic salary, including dearness allowance for those living in Delhi, Kolkata, Mumbai or Chennai

- 40% of basic salary including dearness allowance for those living in any other city

3. Leave Travel Allowance (LTA):

LTA is provided to employees to cover the cost of travel when they take leave for a vacation or after retirement or termination. It can be used for domestic travel within India. Leave travel allowance can be claimed only by individuals for travel costs incurred on themselves as well as on their family.

The term family includes spouse, children, and dependent family members. The employee must have travelled in India in order to be eligible to claim exemption. The exemption is only available for up to two kids.

The exemption limit can be actual expenses or economy class fare, whichever is lower if the employee is travelling by air. The exemption amount would be lower than the actual expenses or first class AC rail fare in case of travel by railway mode.

4. Education Allowance:

Education allowance for children is a benefit provided by employers, mostly the government, to their employees. It helps them in meeting their education costs and reduces their financial burden. Children’s education allowance covers the cost of schooling and hostel expenditure.

A salaried person can claim an exemption up to Rs 100 per month for education allowance up to a maximum number of 2 children. The exemption for hostel expenditure allowance is Rs 300 per month for up to a maximum number of 2 children.

The exemption can be claimed by parents only. Education allowance is important as it supports the pursuit of further education of children.

Create your first voucher Format with Vyapar App

Deductions In The Salary Voucher Format

Deductions refer to the amounts that are subtracted from an employee’s salary in the salary voucher format. These deductions include items such as:

1. Income Tax:

The income tax amount is deducted from the employee’s salary as per the applicable income tax laws and regulations. The deduction is calculated based on the individual’s taxable income, tax slabs, and other relevant factors.

Employers deduct the applicable income tax amount and remit it to the government on behalf of the employee. The income tax deduction is an important component that ensures compliance with tax regulations. It facilitates the accurate payment of taxes by employees.

2. Provident Fund (PF):

Provident fund deduction in a salary voucher refers to the contribution deducted from an employee’s salary for their provident fund account. A provident fund is a mandatory contribution deducted from the employee’s salary. It goes towards their retirement savings.

The provident fund is a savings scheme that provides financial security and retirement benefits to employees. Both the employer and employee make contributions to the provident fund. The deducted amount from the employee’s salary is a percentage of their basic salary.

3. Professional Tax:

Professional tax is deducted from a salary voucher. It is the amount deducted from an employee’s salary as a contribution towards the state government’s professional tax. Professional tax is a tax levied by state governments in India on income earned by individuals engaged in professions, trades, and employment.

Employers are responsible for deducting professional tax from the salaries of their employees who fall within the taxable bracket and remitting it to the state government. The professional tax deduction is reflected in the salary voucher to ensure compliance with the respective state’s tax regulations.

4. Loan Repayments:

If an employee has taken any loans from the employer, the monthly instalments towards loan repayment may be deducted from their salary. This deduction is agreed upon in advance through a loan agreement outlining the terms and conditions of the loan, including the repayment schedule.

The deducted amount is used to repay the principal amount borrowed along with any applicable interest. The purpose of reflecting loan repayments in the salary voucher is to provide transparency to employees about the deductions made from their salary.

Importance Of Salary Voucher Format

Serves As Legal Proof

A salary voucher is legal proof of income and employment of an employee. It contains all the essential details related to employee compensation.

Easy Availing Of Loan

Lenders usually require proof of borrower’s income. It helps them assess the repayment capacity of the borrower. A salary voucher provides a breakdown of an individual’s earnings, which helps in the easy availment of loans.

Basis For Income Tax Payment

A salary voucher includes an employee’s basic salary, dearness allowance, other allowances, bonuses, and earnings. All this information is from the basis of income tax.

Helps In Salary Negotiation

Employees can Compare their salary with industry standards with the help of a salary voucher. It provides transparency and highlights relevant components of an employee’s salary.

Benefits Of Using Salary Voucher Format By Vyapar

Automated Payroll Processing

The salary voucher format is a structured template for capturing companies’ essential information related to employees’ salaries. It ensures consistency in recording salary details for all the individuals. Consistency is vital for efficiency.

The salary voucher format by Vyapar specifies fields for various components of an employee’s salary. It makes it easier for employers to input data and process it accurately. The format also provides automated calculations.

In some companies, salary is linked with attendance or the total hours of an employee. In such cases, the salary voucher format facilitates integration with time and attendance systems. It ensures that accurate working hours are considered in payroll calculation.

Tax Compliance

The proper breakdown of various components of an employee’s salary helps in accurately declaring income to tax authorities. The salary voucher format allows for a clear identification of taxable and non-taxable components of the salary.

The salary voucher format outlines deductions and allowances. The voucher also includes information on tax withholdings, such as TDS. It helps determine the net taxable income of the individual.

Employees can use the salary voucher as proof of income when filing their annual Returns. The salary voucher format contributes to maintaining an audit trail. It documents changes in updates to salary-related information of the employee.

Customisation

Vyapar salary voucher format allows users to customise the appearance and layout of their salary voucher. It enables companies to personalise the format according to their business needs.

Employers can add the logo of their business, the name of the business, the employee’s name, and other details. It provides a professional look to the salary voucher. The ability to add or remove a modified field allows businesses to include specific and relevant information.

Vyapar offers a preview feature that allows users to see how the customised salary voucher format would appear. It allows businesses to include relevant fields.

Maintains Transparency

A salary voucher format contributes significantly to maintaining transparency between employers and employees. The voucher highlights various allowances and perks. It gives employees a transparent view of additional benefits beyond the basic salary.

In the event of salary-related disputes or discrepancies, the salary voucher serves as a crucial document for reference. Employees can use it to address concerns and seek resolution.

A well-designed salary voucher format enhances transparency by clearly communicating the various elements. The transparency builds trust and fosters a positive employer-employee relationship.

Record Keeping

A salary voucher format plays a crucial role in record-keeping within an organisation. The salary voucher includes essential employee details. It helps identify and associate the compensation details with specific employees.

The voucher clearly outlines the net pay received by the employee after deductions. This information is vital for both the employee and the employer. It serves as a record of the actual amount disbursed to the employee.

The salary voucher format helps in complying with legal and regulatory requirements related to salary disbursements. Businesses must keep organised records to demonstrate adherence to employment laws and tax regulations.

Enables Communication

The format allows employees to easily understand their total earnings and the various deductions made from their salary. The clarity helps in avoiding misunderstandings. It enables effective communication about the financial aspects of employment.

If the salary includes performance-related bonuses or incentives, the voucher format communicates how these components are calculated. This transparency promotes discussions on performance expectations and rewards.

In case there are any changes in an employee’s compensation, such as salary increments or adjustments, the updated information is communicated through the salary voucher. It ensures that employees are informed about changes in their financial terms.

Features That Make Salary Management Effortless For Small Businesses

Employee Management

Vyapar salary voucher format streamlines the salary voucher creation process. It saves time and reduces manual errors compared to traditional paper-based methods. The format being digital minimises the risk of errors in calculations or data entry.

It ensures accurate and error-free salary information. Employees can easily access their salary vouchers online, anytime and anywhere. Thus, our voucher provides convenience and transparency.

Employers can reduce the cost associated with printing and storing physical salary slips. Vyapar’s salary voucher format is completely online, which enables employers to go paperless. You can send the salary voucher directly to your employees through PDF.

Track Salary Payables

Vyapar salary voucher serves as a documented record of each employee’s salary details for a specific period. It includes essential information such as the employee’s name, designation, and the components of the salary.

The salary voucher captures all the earnings an employee is entitled to. It ensures that there is a comprehensive record of the compensation owed for a given period. If there are any arrears of salary advances, the voucher format can document these.

The voucher includes a due date for salary payment, facilitating timely and organised disbursement of salaries. It helps in avoiding delays and ensures compliance with payment schedules.

Bank Integration

Vyapar allows users to connect their bank accounts within the application. The connection is established securely to ensure the confidentiality and integrity of financial data. Users need to authorise Vyapar to access their bank accounts.

The authorisation process is a one-time step. It involves providing necessary permissions for the app to retrieve relevant financial information. Once the bank integration is set up, Vyapar can sync with the connected bank accounts to fetch transaction data.

Bank integration enables real-time updates on financial transactions. Users can view the latest information about income, expenses, and account balances directly within the Vyapar app. The integration allows for the automatic tracking of costs.

Reports And Analytics

Vyapar enables users to generate various financial reports, including profit and loss statements, balance sheets, and cash flow statements. These reports provide a comprehensive overview of the financial status of the business.

Vyapar allows for the generation of expense reports. It helps in the analysis of spending patterns, identifies cost-saving opportunities, and ensures better financial control. Businesses can also prepare tax-related reports to assist in tax compliance.

Vyapar can provide reports on stock levels, sales velocity, and inventory turnover. It can assist in efficient inventory management. Users can generate reports related to payments, including overdue payments, pending invoices, and cash flow statements, aiding in better financial planning.

Expense Tracking

Users can easily record all business expenses within Vyapar, including purchases, bills, and other expenditures. Vyapar allows users to categorise all expenses into different types.

You can attach receipts or supporting documents to expense entries. Vyapar is designed to be GST-compliant. It helps businesses manage and track expenses in accordance with Goods and Services Tax regulations.

The app provides features to generate detailed expense reports. These reports offer insights into spending patterns, helping businesses make informed financial decisions. Vyapar allows users to set up recurring expenses.

Data Security

Vyapar uses encryption protocols to secure data during transmission between the user’s device and Vyapar servers. It helps protect sensitive information from unauthorised access.

User authentication processes are implemented to ensure that only authorised individuals can access the Vyapar account. Regular data backups are an essential part of data security.

Vyapar likely implements backup procedures to prevent data loss due to unforeseen events like server failures or data corruption. Vyapar has privacy policies that outline how user data is collected, stored, and processed.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A salary voucher is a document provided by an employer to an employee. It details the salary payment for a specific period. It includes information like earnings, deductions, and net pay.

Yes, salary vouchers can be used for income verification as they document detailed information about an employee’s earnings, deductions, and net pay.

A salary voucher is generally issued by an employer every month. It includes a fixed payment as a basic salary, and the final amount can vary based on hours worked by the employee.

You can make salary slips using the free salary voucher format by the Vyapar app. It will help you save the time required to create a salary voucher from scratch. Further, you can use Vyapar’s salary voucher format to create salary slips for your entire staff and manage it all in one place.

A salary slip provides individual earnings and deduction details to employees. A salary voucher is a comprehensive document issued by employers summarising payroll details for a specific period.

Yes, you can request a duplicate salary voucher from your employer if needed. Employers often retain payroll records and can provide duplicates for documentation or verification purposes.