Receipt And Payment Account Format

Download the Vyapar Receipt and Payment Account Format. Use it for summarising cash receipts and payments made by an organisation during a specific accounting period. Get a free 7-day trial right away!

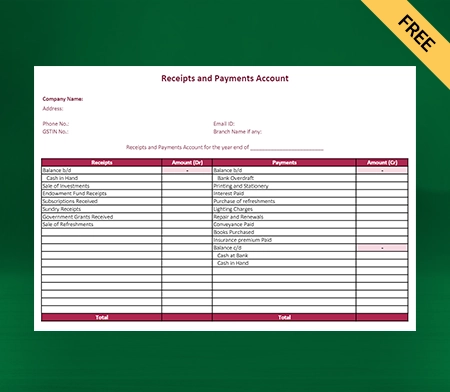

Download Receipt And Payment Account Format in Excel, Word, and PDF

What Is A Receipt And Payment Account?

The receipt and payment account is a statement summarising an organisation’s cash payments and receipts for a specific period. It records all cash transactions the organisation makes and gives an overview of cash flow activities. It is commonly used by non-profit organisations, clubs, societies, and other similar entities that primarily deal with cash transactions.

Capital or revenue payments and receipts are not recorded separately in the cash and payment account format. It records all cash and bank transactions which also includes capital or revenue. The receipt and payment account formation in Excel and PDF does not require non-cash transactions like depreciation.

The receipt and payment account is created at the end of each accounting period. A receipts and payments account aims to show the sources of cash inflows and the uses of cash outflows during particular accounting periods.

Cash receipts include membership fees, donations, grants, subscriptions, and other income received in cash. Cash payments include expenses, such as salaries, rent, utilities, office supplies, and other expenditures made in cash.

Importance Of Receipts And Payments Account

Cash And Bank Management:

The receipts and payments account helps organisations keep track of their cash inflows and outflows accurately. It provides a comprehensive record of all receipts and payments. Organisations can make sure that they have sufficient funds to meet their expenses.

Financial Reporting:

The receipts and payments account serves as a basis for financial reporting. It allows organisations to present a clear and concise summary of cash items. It provides an overview of cash receipts and payments. Non-profit organisations use this account to report their financial activities to stakeholders.

Budgeting And Planning:

The receipt and payment account helps businesses in financial planning and budgeting. Organisations can see trends, project future cash needs, and adjust their spending plans by monitoring cash inflows and outflows. It ensures that the financial resources allocated are handled efficiently.

Internal Control And Fraud Prevention:

By keeping a receipts and payments account, you can strengthen internal control. It lessens the chance of fraud and money theft. Organisations can quickly identify abnormalities by reconciling cash and bank transactions with the receipts and payments account format PDF.

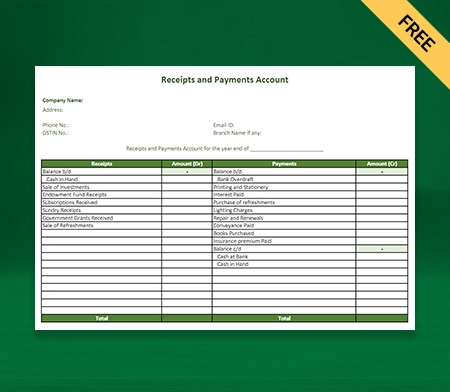

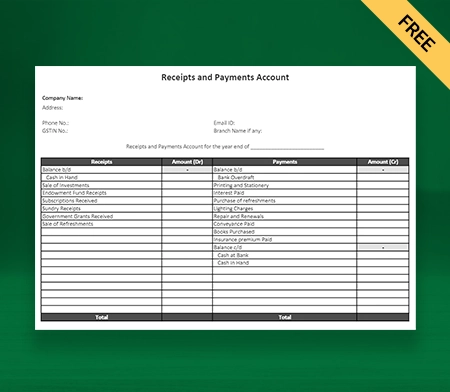

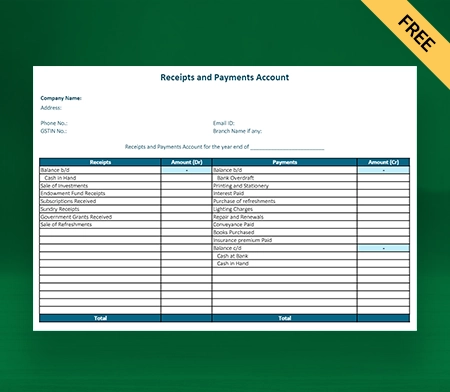

Contents To Include In Professional Receipt And Payment Account Formats

Receipts Section:

- Opening Balance:

The balance of cash at the beginning of the accounting period is the opening balance. The account starts with the cash and bank opening balance at the beginning of the accounting period. It represents the cash and bank balances carried forward from the previous period.

- Cash Receipts:

The closing balance is the total amount of cash received during the period from various sources. It includes membership fees, donations, grants, sales proceeds, etc. This section lists all the cash receipts during the accounting periods. Each source of cash inflow is mentioned separately, along with the corresponding amounts.

Payments Section:

- Payments:

Payments section records all the cash payments made during the accounting period. They include salaries, rent, utilities, office supplies, and repairs. Similar to cash receipts, each category of cash outflow is listed separately with the corresponding amounts.

- Closing Balance:

The balance of cash in hand at the end of the accounting period is the closing balance. It is calculated by subtracting the total payments from the total receipts. The account concludes with the cash and bank closing balance at the end of the accounting period.

Summary Section:

- Total Receipts:

The total amount of cash in hand received during the period (from the receipts section) is the total receipts.

- Total Payments:

The total amount of cash paid during the period (from the payments section) is the total payments.

- Surplus/Deficit:

Surplus or deficit depends on the difference between total receipts and total payments (total receipts minus total payments).

The receipt and payment account format PDF is a simplified cash-based accounting statement. It is often used to present the financial position of small organisations and monitor their cash inflows and outflows.

Main Features Of Receipt And Payment Account

The Receipt and Payment Account is prepared on a cash basis of accounting, which means that payments and receipts are recorded when cash is received or paid out rather than when income or expenses are incurred.

The account summarises all the cash and bank receipts during the accounting periods. This includes sources such as sales, donations, grants, subscriptions, and any other cash inflows.

Similarly, the account summarises all the cash and bank payments made during the accounting period. This includes expenses such as rent, salaries, utilities, purchases, loan repayments, and any other cash outflows.

The receipt and payment account formation in Excel shows the cash in hand and bank opening balance at the beginning of the accounting period and the closing balance at the end. These balances help reconcile the organisation’s cash position.

The account excludes non-revenue items such as capital receipts, payments, and adjustments for outstanding or prepaid expenses. These items are not considered in the receipts and payments account and are accounted for separately.

The Receipt and Payment Account provides a useful financial control and cash flow monitoring tool. It allows organisations to analyse their income and expenditure patterns and assess their liquidity position.

The Receipt and Payment Account is a supporting statement to an organisation’s Profit and Loss Account. The totals of receipts and payments from the receipts and payments account are incorporated into the income and expenditure account to determine the surplus or deficit for the period.

Advantages Of Preparing Receipt And Payment Account Format

The Receipt and Payment Account gives you a complete picture of your cash and bank transactions. It enables businesses to manage their cash flow better. It helps identify accounting periods of cash excess or deficit, allowing for improved financial planning and decision-making.

All receipts and payments are recorded and analysed in the receipts and payments account. It aids organisations in exercising financial control. Businesses can track income and cost patterns. They can detect any anomalies or discrepancies.

The Receipt and Payment Account helps to reconcile an organisation’s bank overdraft. To discover any mistakes or omissions in cash items and ensure correct cash position reporting, the opening and closing balances and the recorded receipts and payments are compared.

The Receipt and Payment Account supplements the Profit and Loss Account. It gives the totals of revenues and payments, which are then added to the Income and Expenditure Account to determine the period’s surplus or deficit. It enables the creation of accurate financial statements.

You can make wise financial decisions with the information compiled in the receipts and payments account. Organisations can assess their financial health by looking at their primary expenses and income streams. They can evaluate the success of their attempts to generate revenue and modify their financial plans.

The receipt and payment account allows arranging your finances and creates effective budgets. It provides information about the organisation’s cash receipts and payments. It helps in figuring out whether proposed projects or efforts are financially viable. Organisations can allocate funds to particular operations and set appropriate earning and spending goals.

Benefits Of Using Receipt And Payment Account Formats By Vyapar

Saves Time And Efforts:

Accounting Software Vyapar’s automated calculations feature eliminates the need for manual calculations. The software automatically computes totals, subtotals, and balances based on the entered receipt and payment account data. Thus, it saves time and minimises the chances of errors.

You can quickly input transaction details, such as dates, descriptions, and amounts. The streamlined data entry process eliminates the need for manual writing and calculating. It helps in substantial time savings for users.

You can create templates for commonly recurring receipts and payments. It enables them to replicate transactions that occur regularly. By using templates, businesses save time as they no longer have to enter the same information repeatedly.

Provides Quick Access:

The receipt and payment account formation PDF from Vyapar provides businesses with quick access to their financial documents. The software has an easy-to-use interface that allows users to search for transactions based on various criteria.

You can select your documents by using dates, amounts, or descriptions. Businesses can use the search option to identify and obtain the financial documents they need rapidly. It eliminates the need to sort through a large number of entries manually.

Furthermore, Vyapar provides advanced filtering tools to speed up document retrieval. Filters can be used to narrow down search results depending on certain criteria.

Create Format In PDF And Excel:

You can save your receipt and payment account format in Excel and PDF using Vyapar. Businesses can easily organise and categorise their financial records by saving receipts and payment accounts in digital formats, such as PDF and Excel.

Electronic filing systems can sort documents into folders, tagged with relevant keywords, and label them with appropriate metadata. This enables quick and effortless retrieval of specific accounts whenever required.

Storing receipts and payment accounts in digital formats eliminates the need for physical storage space. It reduces clutter in the office and minimises the risk of misplacement or damage.

Simple To Use For Anyone:

Cash transaction management is an important part of financial management. With its user-friendly design, Vyapar’s receipt and payment account template simplifies the procedure. You don’t have to perform calculations manually.

The template has a simple and user-friendly interface. The template has key fields such as date, description, and amount, making it simple for users to enter transaction details precisely and effectively.

Furthermore, Vyapar’s receipt and payment account design allows you to use predefined transaction types. These categories make categorising cash items such as sales, costs, and miscellaneous items easy.

Helps With Effective Financial Analysis:

The receipts and payments account format enables firms to track and assess their cash inflows and outflows. Businesses can learn about the timing and volume of cash flows by studying recorded transactions.

Vyapar’s receipt and payment account formation PDF helps store precise information about cash receipts and payments. Businesses can assess their income and cost trends by categorising transactions and providing reports based on transaction kinds.

Vyapar enables organisations to generate customisable reports depending on the receipt and payment account format Excel. These reports summarise cash items, provide cash flow figures, or provide insights into certain parts of financial analysis.

Enables Efficient Record Keeping:

Vyapar’s receipts and payments account format is essential for organisations in allowing efficient record-keeping. You can do receipt and payment account formation in Excel using the Vyapar app, which provides a systematic framework for recording currency transactions.

The receipt and payment account format PDF includes fields like date, description, payment mechanism, and amount to ensure that all relevant information is regularly captured. Structured data entry reduces the possibility of missing or incomplete data, facilitating accurate record-keeping.

Vyapar keeps the records up to date in real-time. This real-time update gives firms an accurate picture of their cash transactions and debit and credit balances. It allows for rapid decision-making and precise data for financial analysis and reporting.

Helpful Features Of Receipt And Payment Account Format By Vyapar

Customisable Templates

Vyapar receipt and payment account format PDF offers a wide range of pre-designed receipt and payment account templates that serve as a starting point for creating your financial reports. You can tailor the template’s appearance, layout, and content to align with your organisation’s branding requirements.

Vyapar’s receipt and payment account formation PDF includes predefined sections for credit and debit balances, receipts, payments, and net cash flow. You can rearrange these sections or add additional ones as needed.

You can customise the font style, size, colour, and formatting options to match your organisation’s preferred style. You can also choose from different layout options, such as table-based or free-flowing formats, based on your presentation preferences.

Vyapar offers a selection of colour themes and schemes to apply to the template. It lets you personalise the visual appearance of the receipt and payment account according to your organisation.

Bank Reconciliation

Vyapar’s bank reconciliation feature is an effective tool that promotes consistency and accuracy in financial records. Your bank statements can be directly imported into the software via Vyapar. These statements detail every transaction that your bank completed.

The transactions from your bank overdraft statement that you imported can be compared to those recorded in your receipt and payment account. Any transactions that match are found and highlighted by the software. It makes their reconciliation simple.

Billing Software Vyapar offers solutions to help you reconcile differences between the recorded transactions and the entries on the bank statement. You can examine the variations, look into potential faults, and amend them.

Additionally, you can generate bank reconciliation reports describing the transactions that were matched and those that weren’t, as well as any differences discovered. These reports offer a transparent overview of the reconciliation procedure.

Data Security

Data security is of utmost importance when it comes to financial records. Vyapar uses encryption techniques to protect your financial data. It ensures that the software encrypts your receipt and payment account information and other sensitive data during transmission and storage.

Encryption helps prevent unauthorised access and ensures that only authorised individuals can view and access the data. Vyapar allows you to set user access controls and permissions. You can assign different roles and permissions to individuals within your organisation.

Our free Inventory Management software securely stores your financial data in the cloud. Cloud storage offers data redundancy, regular backups, and disaster recovery measures. These measures help protect your receipt and payment account data from damage.

You can create regular copies of your financial data. You can securely store these backups on external devices or in the cloud. In the event of data loss or system failure, you can restore your receipt and payment account data from these backups.

Customer Management

The customer management feature provides a centralised database for storing customer details. It improves customer relationship management and enables seamless communication.

The software can automatically fill in customer information in the receipt and payment account format Excel. You can save the customer’s name, billing address, and contact details. This reduces the possibility of manual errors in the account format and saves time.

You can track client transactions connected to the receipts and payments accounts using Vyapar. You can record customers’ payments, track pending payments, and view transaction history.

You may learn more about consumer preferences, purchasing trends, and payment behaviour. By using this information, you may offer individualised and effective customer service that strengthens client connections and loyalty.

Payment Reminders

You can set up automated reminders to notify customers about pending payments. You can customise the reminder frequency and the number of days before or after the due date to send the reminders. This helps ensure that customers are aware of their payment obligations.

Vyapar allows you to personalise payment reminders with specific details such as the customer’s name, outstanding amount, and due date. You can send reminders through email, SMS, or other communication channels.

With Invoicing Software Vyapar, you can schedule payment reminders to be sent automatically based on predefined rules. This eliminates the need for manual intervention and ensures that the system consistently sends reminders at the specified times.

Vyapar allows you to track the status of payment reminders. Easily you can identify whether you have sent a payment reminder, whether someone has viewed it, or if the payment has been made. This helps you keep track of customer responses and take appropriate follow-up actions if necessary.

Track Expenses

Vyapar enables you to record and track your business expenses easily. You can enter detailed information about each expense, including the date, vendor name, amount, and payment method. It ensures that you accurately record all costs associated with receipt and payment accounts.

Vyapar allows you to organise expenses in a structured manner. Proper categorisation provides a clear breakdown of expenses. It makes it easier to analyse spending patterns and identify areas for cost optimisation.

Vyapar generates comprehensive expense reports based on the recorded data. These reports provide a detailed overview of the expenses incurred during a specific period, categorised by expense type and vendor.

The expense tracking feature in Vyapar receipt and payment account format PDF allows you to monitor and analyse expense trends over time. You can identify patterns and fluctuations in spending. It enables you to make informed budgeting, cost control, and financial planning decisions.

Frequently Asked Questions (FAQs’)

The receipt and payment account is a summary of cash and bank transactions conducted by an organisation during a specific accounting period. It provides a consolidated view of all receipts and payments. It allows for a clear understanding of the organisation’s cash flow.

The format of a receipt and payment account format Excel consists of two main sections: the receipt side of the account and the payment side.

Receipts Side: It is the left-hand side, also known as the debit side.

Opening balance of cash and bank

Cash received from various sources

Bank receipts

Any other sources of cash inflow

Payments Side: It is the right-hand side, also known as the credit side.

Payments for various expenses

Payments made through the bank

Any other cash outflows

At the end of each side, you will calculate the totals, and the excess of receipts over payments or payments over receipts will be carried over as the closing balance.

Date of the transaction

Particulars or descriptions of the transaction (e.g., source of receipt, purpose of payment)

The amount received or paid

Mode of the transaction (cash or bank)

Opening balance

Closing balance

Yes. A receipts and payments account is prepared for a specific period, usually a year. It summarises the cash inflows and outflows during that particular period.

The primary purpose of preparing a receipt and payment account is to summarise cash and bank transactions for a specific period. It helps organisations track their cash inflows and outflows.