Account Format-Tailored for Your Business

Download the Professional account format by Vyapar for your business. With Vyapar, you can manage all your accounting needs in one app. Get a free 7-day trial now!

Download Free Account Format in Excel, Word and PDF

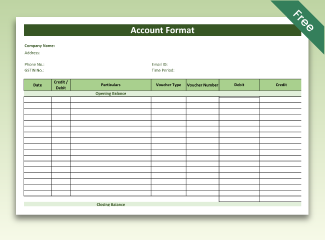

Template – 1

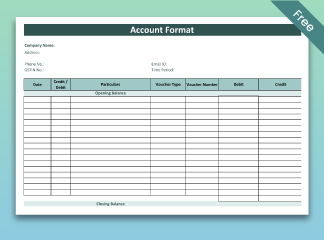

Template – 2

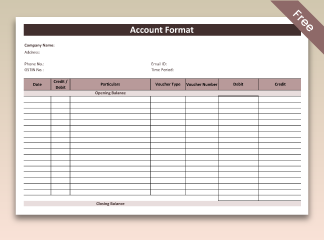

Template – 3

Different Types of Account Formats

There are primarily three types of account formats:

T-Account Format:

The T-account format is a simple and widely used format to represent accounts in financial accounting. Its name is derived from its visual representation, which resembles the letter “T.” In this format, the account title is written at the top of the T, with the left side representing the debit side and the right side representing the account’s credit side. Transactions and their corresponding amounts are recorded on the appropriate side of the T-account to reflect increases or decreases in the trial balances.

Chart Of Accounts Format:

All of an organization’s accounts are organized in a systematic manner using the chart of accounts format. It functions as a structure for gathering and categorizing financial transactions. Each account in this structure is given a special account number and classified as assets, liabilities, equity, revenue, and expenses. The chart of accounts offers a common framework that makes it easier to record, present, and analyze financial data.

Online Account Format:

Many accounts are now offered in an electronic version that can be accessed through websites or mobile applications. Online account designs change depending on the provider or platform, but they frequently offer a user-friendly interface to see and manage account information. These forms could include debit balance and credit balance, transaction histories, dashboards, and interactive investment management tools.

Balance Sheet:

The balance sheet presents the financial position of a business at a specific point in time. Its table of contents consists of three main sections: asset account, liabilities, and equity. The account format of a balance sheet lists individual accounts under each section, providing details of the debit and credit entries.

Profit And Loss Account (Income Statement):

The profit or loss statement summarises the revenues, expenses, gains, and losses incurred by a business over a specific period. It showcases the financial performance and profitability of the business. The income statement’s account format lists revenue and expense accounts and calculates the net profit or loss.

Cash Flow Statement:

The cash flow statement tracks the inflows and outflows of cash in a business over a specific period. It helps analyze the sources and uses of cash, including operating, investing, and financing activities. The account format of a cash flow statement typically includes sections for cash flows from operating, investing, and financing activities.

How To Use Account Formats?

Here are some essential uses of account formats in business:

- Account formats offer a uniform method of presenting financial data in different reports. Statements of equity, cash flow statements, income statements, and balance sheets are all part of it.

- It makes it easy for stakeholders to comprehend the company’s financial performance, position, and cash flows.

- Account formats help bookkeepers and accountants accurately record financial transactions. They list the necessary fields, such as account names, account numbers, descriptions, debit/credit columns, and monetary values.

- Businesses can compare data across multiple periods, divisions, or projects. It helps recognize patterns, measure profitability, review cost structures, and make sound financial decisions.

Why Choosing the Right Account Format is Important?

1. Consistency And Standardisation:

Account formats provide a uniform structure for organizing and presenting financial information. Businesses can guarantee that transactions are recorded consistently across many accounts using a consistent format. Because of this consistency, financial data may be more easily understood, compared, and analyzed within the company and by external stakeholders like investors, lenders, and auditors.

2. Accurate Recording:

The correct documentation of financial transactions is made easier by account formats. Debits and credits have specified places to go, ensuring that every transaction is appropriately classified and posted to the correct account. Maintaining accurate financial records, creating financial statements, and meeting regulatory requirements depend on this precision.

3. Classification And Analysis:

Account formats make it possible to categorize and assemble related transactions and accounts. Businesses can analyze and assess their financial situation, performance, and cash flow by classifying accounts into asset, liability, equity, revenue, and expense categories. Making informed judgments based on the study of financial data is made easier by using account formats that provide financial ratios, reveal trends, and identify patterns.

4. Efficient Auditing And Financial Analysis:

Account formats that are well-organized make auditing easier. The accounts are simple to travel through, allowing auditors to follow transactions and check the quality and completeness of financial information. Account formats also facilitate effective financial analysis, allowing auditors, financial analysts, or management to assess performance, pinpoint areas for improvement, and base strategic decisions on the financial data presented in a uniform format.

5. Communication And Transparency:

Account formats improve financial reporting’s openness and communication. They offer a consistent vocabulary for expressing financial data, allowing stakeholders to communicate effectively. Account formats make it easier for users to comprehend and evaluate a firm’s financial performance and position by presenting financial information clearly and concisely.

Benefits of Using Account Formats By Vyapar

Easy Organisation:

Vyapar Inventory Management App provides a structured and organized format for managing your accounts. It offers a comprehensive chart of accounts with predefined categories. It makes it easier to classify and track different types of transactions.

You can maintain consistency and accuracy in the financial recording. Vyapar offers a user-friendly interface that simplifies organizing and managing financial data. It provides a familiar layout with clearly defined sections for different accounting tasks.

The software allows users to set up their trading accounts according to their business needs. You can create and manage multiple ledgers, including sales, purchases, expenses, and cash/bank accounts.

Simplified Bookkeeping:

Vyapar streamlines bookkeeping by automating a number of processes. You can easily create invoices, keep track of spending, monitor payments, and manage inventory. Vyapar’s account formats make sure that financial data is recorded appropriately.

It saves time and cuts down on the possibility of errors. The Vyapar account format offers a user-friendly interface and powerful tools that automate several operations in order to simplify the bookkeeping process. Vyapar makes double entry easier by letting users simply record financial transactions.

For accurate bookkeeping, transactions must be categorized. It enables users to classify revenue and expenses into the relevant categories and subcategories. It improves how financial data is organized and analyzed. It makes it simpler to monitor and report on many business-related issues.

Customized Account Formats:

Vyapar enables users to create and manage multiple ledgers based on their business structure. Whether it’s sales, purchases, expenses, cash accounts, or specific project accounts, you can customize the account formats to align with the structure of your business.

It ensures that the financial data is organized in a way that reflects the operational flow and hierarchy of your business. Vyapar allows users to define relevant account categories and subcategories for income and expenses.

You can create custom categories specific to your business, such as product lines, cost centers, departments, or geographical regions. Billing Software Vyapar allows users to assign unique account codes to different accounts. These account codes can be customized based on your preference or industry standards.

GST Compliance:

Vyapar automates the calculation of GST amounts for sales and purchases. It applies the correct tax rates based on the HSN codes and the type of supply. Automation reduces the chances of errors in tax calculation. It ensures accurate GST compliance and eliminates the need for manual calculations.

Vyapar allows businesses to track GST payments and input tax credits. It helps in organizing and monitoring the payment status of GST liabilities. This feature ensures that businesses are aware of their tax payment obligations and can manage their cash flows accordingly.

Vyapar provides GSTIN validation to verify the authenticity of GSTIN numbers of suppliers and customers. This validation feature helps in ensuring that businesses are dealing with registered GST taxpayers, promoting compliance and reducing the risk of fraudulent transactions.

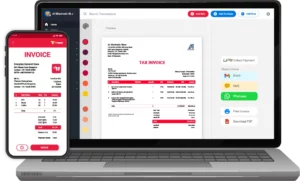

Accessibility And Mobility:

Vyapar is a cloud-based accounting software. It means you can access your account data from anywhere using a computer or mobile device. The mobility allows you to manage your accounts on the go. You can create invoices at customer locations and stay updated with real-time financial information.

Vyapar offers cloud-based storage for financial data. It allows users to securely store and access their account formats from any device with an internet connection. This eliminates the limitations of physical storage and enables users to retrieve their financial data conveniently, regardless of their location.

Vyapar offers a mobile app that allows users to access and manage their account formats on the go. The mobile app provides a user-friendly interface optimized for smaller screens. It makes it convenient for users to handle their accounting tasks while travelling or away from their office.

Data Security:

Your financial information’s security is guaranteed by Vyapar. To protect sensitive information, it uses secure data storage techniques and industry-standard encryption algorithms. Routine backups and data recovery options further improve the security of your account data.

Strong encryption methods are used by Vyapar to safeguard data both in transit and at rest. It guarantees that financial information is secure from unwanted access and encrypted. An additional layer of security is added through encryption. It makes it very difficult for attackers to comprehend the data.

Features for data backup and restoration are available in Vyapar. Users can use it to regularly back up their financial data. As a result, important data is protected from unintentional deletion, system failure, and other unforeseen events.

Helpful Features of Vyapar Accounting Software For Any Business

Cash Flow Management:

Cash flow management is a crucial aspect of financial management for businesses. Vyapar allows you to generate cash flow statements. It provides a detailed breakdown of the cash inflows and outflows within your business over a specific period.

Cash flow statements help you understand the sources and uses of cash. You can identify cash flow trends and assess your business’s ability to meet financial obligations. Vyapar’s invoicing features enable you to create professional invoices and track the status of payments.

Vyapar supports bank reconciliation. It allows you to match your recorded transactions with your bank statements. This feature helps you identify any discrepancies between your records and actual bank transactions. It ensures that your cash flow data is accurate and up to date.

Vyapar Invoicing Software may provide tools or reports that assist in projecting future cash flow based on historical data and expected inflows and outflows. These projections can help you anticipate cash shortages or surpluses. It enables you to make informed financial decisions and take necessary actions in advance.

Multiple Payment Modes:

Vyapar recognizes the importance of providing flexibility and convenience in payment options. Vyapar offers support for multiple payment modes. These payment modes are integrated into the software. It enables businesses to accept payments seamlessly and efficiently.

Vyapar account formats seamlessly integrate with popular online payment gateways. It allows businesses to accept online payments, like UPI, directly from customers. This includes support for major payment providers in India, such as Paytm, PhonePe, Google Pay, and more.

Customers can make payments using their preferred payment method, whether it’s debit and credit cards, net banking, or digital wallets. Vyapar supports UPI payments, enabling businesses to generate UPI payment links or QR codes that customers can use to make payments directly from their UPI-enabled banking apps.

Vyapar facilitates bank transfers, allowing businesses to accept payments through direct bank transfers or NEFT. While digital payments are on the rise, cash transactions still play a significant role in certain businesses. Vyapar allows you to record cash payments received from customers, providing a comprehensive record of all payment modes used.

Get Real-Time Insights:

Vyapar’s account formats provide real-time insights into your business finances. You can view comprehensive reports such as profit or loss statements, balance sheets, cash flow statements, and tax reports. These reports help you analyze your business’s financial health, identify trends, and make informed decisions.

Vyapar allows you to set up and manage a chart of accounts, which is a list of all the accounts used in your business. It includes categories such as assets, liabilities, equity, income, and expenses. The billing software maintains a general ledger that records all financial transactions and provides a detailed overview of your accounts.

Vyapar offers a dashboard that provides a snapshot of your business’s financial health. It includes key metrics, such as sales, expenses, and cash flow. It allows you to monitor your business’s performance at a glance. The software enables you to create and send professional invoices to your customers.

You can track the status of your invoices, including whether they have been sent, viewed, or paid. If you sell products, Vyapar offers inventory management features that help you track your stock levels, manage purchase orders, and generate reports on stock movement and valuation.

Manage Receivables And Payables:

Vyapar offers comprehensive tools and features to assist businesses in managing their receivables and payables effectively. These features are designed to streamline the invoicing process, track outstanding payments, and ensure timely payments to suppliers and vendors.

Vyapar account formats enable businesses to create and customize professional invoices with ease. You can generate invoices for products or services rendered, specifying payment terms, due dates, and accepted payment methods. It facilitates prompt and accurate invoicing. It reduces the risk of payment delays.

Vyapar helps you keep track of outstanding invoices and monitor the status of customer payments. You can view a summary of receivables, including invoice amounts, due dates, and payment statuses. It allows you to identify overdue payments and send reminders or initiate follow-ups.

Vyapar provides features that allow you to schedule payments to suppliers and vendors. By maintaining a clear overview of payables and scheduling payments in advance, you can ensure timely payments and avoid late payment penalties.

Offline And Online Access:

Vyapar provides businesses with the flexibility of accessing their account data both offline and online. It allows users to manage their finances anytime, anywhere. It ensures that you can continue to work even without an internet connection.

While working offline, Vyapar account formats make it possible to store your data locally on your device. Once you regain an internet connection, the software syncs your offline changes with the cloud, ensuring that your data is up to date across all devices and accessible online.

Online access offers several advantages. It enables you to collaborate with team members or accountants remotely and access your data from multiple devices. You can access the accounting app on smartphones, tablets, or computers. Furthermore, online access securely stores your data in the cloud, safeguarding it against local device failures or data loss.

Vyapar ensures seamless syncing between offline and online modes. When you work offline, the software synchronizes your changes with the cloud once an internet connection is available. Likewise, the system synchronizes any online modifications to your offline device. It ensures that your data remains consistent across all instances.

Track All Expenses:

Vyapar offers a comprehensive expense tracking feature that allows businesses to efficiently manage and monitor their expenses. The expense tracking feature in Vyapar helps you keep a record of your business expenditures. You can categorize them and gain valuable insights into your spending patterns.

Vyapar account formats enable you to easily record and track your business expenses. You can enter details such as the expense amount, date, description, and payment method. By accurately recording your expenses, you can maintain a clear and organized record of your financial transactions.

The software may provide a receipt management feature that allows you to attach digital copies or images of expense receipts to your expense records. This helps in maintaining proper documentation and simplifies expense verification during audits or when reconciling with bank statements.

Vyapar integrates expense tracking with other modules, such as invoicing and bank reconciliation, ensuring a seamless flow of data. This integration accurately reflects expenses recorded in the system in your financial statements and reports.

Account Format For Your Businesses

* Depreciation Account Format

* Manufacturing Account Format

* Ledger Format in Tally

* Fund Flow Statement Format

* Receipt And Payment Account Format

* Product Costing Format

* Expense Account Format

* Debtors Account Format

* Total Creditors Account Format

* Journal Account Format

* Profit And Loss Account Format

* Cost Accounting Format

* Trading Account Format

* Bills Payable Account Format

* Contract Account Format

* Profit And Loss Adjustment Account Format

* Deficiency Account Format

* Revaluation Account Format

* Joint Venture Account Format

* Realisation Account Format

* Royalty Account Format

* Final Account Format

* Capital Account Format

Frequently Asked Questions (FAQs’)

Account formats refer to the standardised structure or layout used to organise financial information within the company’s accounting system. These formats play a crucial role in recording, summarising, and reporting financial transactions, ensuring consistency and accuracy in financial statements.

Yes. Vyapar allows customisation in all account formats. You can add subcategories or modify existing categories to align with your specific business needs. This flexibility enables you to tailor the account format to accurately reflect your business’s financial structure and reporting requirements date

Our Vyapar account formats enable calculating GST amounts, balancing transactions, and generating GST reports. It also provides GST-compliant invoice templates. The account types in Vyapar ease the tax filing process. It ensures that your company’s financial records and reports comply with GST compliance rules.

Yes. Vyapar allows you to generate various financial reports to gain insights into your business’s financial health. You can generate reports such as profit or loss statements, balance sheets, cash flow statements, and tax reports. These reports provide a comprehensive view of your business’s financial performance.

Yes. Vyapar offers a mobile app that allows you to access your account data on your smartphone or tablet. This mobile accessibility enables you to manage your accounts on the go, create invoices while visiting customers, and stay updated with real-time financial information wherever you are.