TDS Reconciliation Format in Excel

Select Vyapar to streamline TDS administration and obtain insightful knowledge on the financial health of your business. Furthermore, get a 7-day free trial to evaluate the advantages of the TDS reconciliation format in Excel and speed up your reconciliation procedure.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Excel TDS Reconciliation Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Download a Free Excel TDS Reconciliation Format

Download professional free Excel TDS Reconciliation formats, and make customization according to your requirements at zero cost.

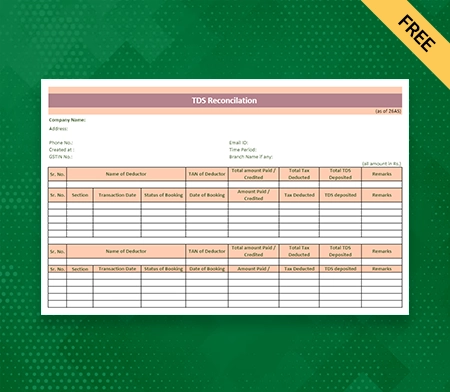

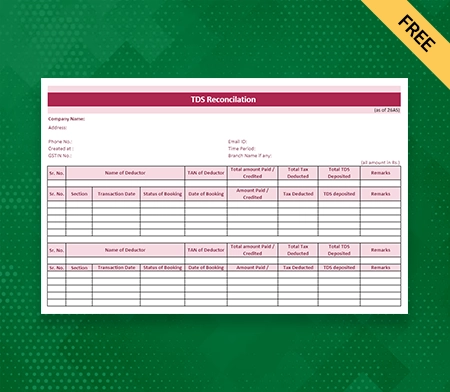

Excel TDS Reconciliation Format – 1

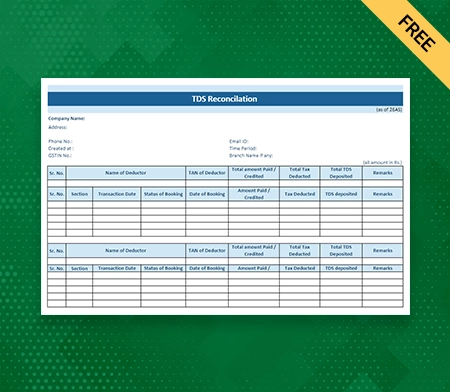

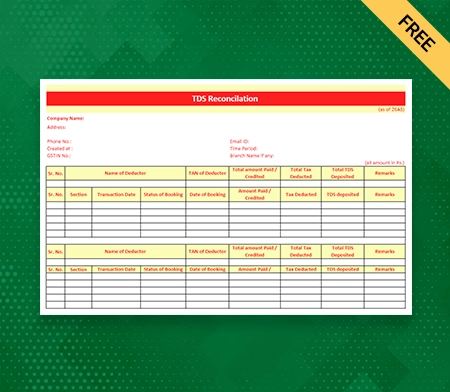

Excel TDS Reconciliation Format – 2

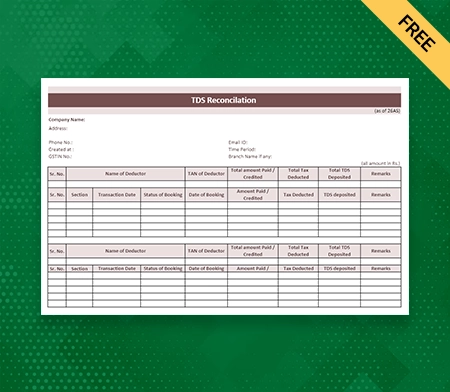

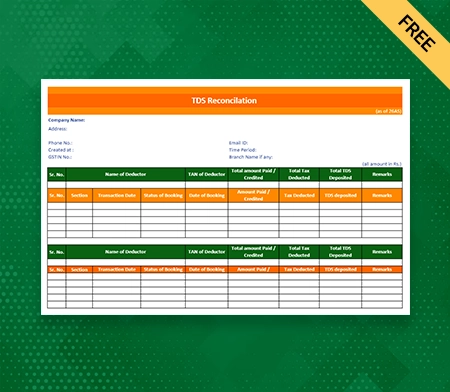

Excel TDS Reconciliation Format – 3

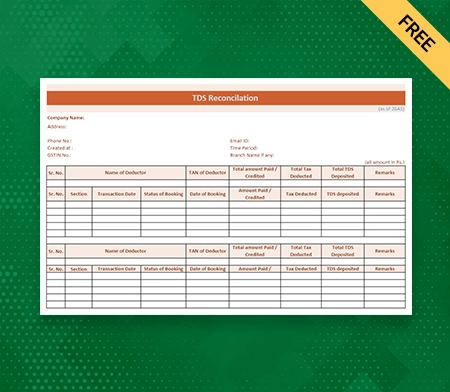

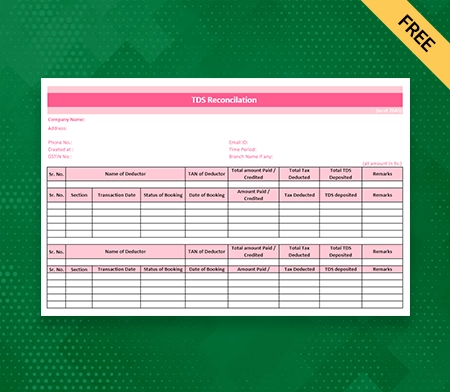

Excel TDS Reconciliation Format – 4

Excel TDS Reconciliation Format – 5

Excel TDS Reconciliation Format – 6

Excel TDS Reconciliation Format – 7

Excel TDS Reconciliation Format – 8

What is a TDS Reconciliation Format in Excel?

A structured template called a TDS (Tax Deducted at Source) reconciliation format in Excel was created to help businesses reconcile their TDS data effectively. It offers a uniform method for comparing and evaluating different TDS-related data, including TDS deductions, TDS deposits, TDS certificates obtained, and TDS certificates reclaimed.

Introducing Vyapar, an all-encompassing TDS management solution. A TDS reconciliation template in Excel is available from Vyapar. Customers may efficiently analyse TDS data from their business using this template.

You can create important reports from Vyapar directly from the software, including Purchase Reports, Profit & Loss Statements, and others. This format ensures accurate reporting and complies with tax laws, making finding discrepancies or mismatches in the TDS data easier.

Businesses can streamline their reconciliation process and get a complete picture of their TDS-related activities using an Excel TDS reconciliation Format. The format enables effective comparison and organisation of TDS data, assisting in systematically identifying errors or discrepancies.

The accuracy and effectiveness of the reconciliation process are further improved by Excel’s robust calculation and data manipulation features. Businesses can maintain compliance, minimise errors, and learn more about their TDS deductions and compliance using the TDS reconciliation format in Excel.

How To Prepare A TDS Reconciliation Format in Excel?

To ensure accurate data analysis and reconciliation, creating a TDS (Tax Deducted at Source) reconciliation format in Excel requires a systematic approach. You can efficiently create a TDS Reconciliation format in Excel by following these steps:

Step 1: Gather TDS Data

Gather all pertinent TDS data, such as TDS certificates that have been received, TDS that has been deducted from deductees, TDS deposits that have been made, and any other relevant data. Make sure the information is accurate and up to date.

Step 2: Creating An Excel Worksheet

Create the necessary column headers in a new Excel worksheet after opening the TDS data. Deductee name, TDS certificate number, TDS deducted, TDS deposited, and any other pertinent information specific to your business requirements are examples of common column headers.

Step 3: Enter The TDS Data

Fill in the Excel worksheet’s corresponding columns with the TDS data that you obtained in Step 1. To prevent any discrepancies during the reconciliation process, be meticulous in entering the data accurately.

Step 4: Apply Formulas And Functions

Use the formulas and functions in Excel to carry out the calculations and comparisons required for reconciliation. For instance, the total TDS deductions or deposits can be determined using the SUM formula, the TDS certificate numbers can be matched using the VLOOKUP function, and any discrepancies can be found using IF statements.

Step 5: Align Data

To ensure they match, compare the TDS deposits with the TDS deductions. Any discrepancies or inconsistencies should be noted and further investigated. Check to see if the TDS certificates you received line up with the ones you claimed or reported.

Step 6: Create A Reconciliation Report

Make an Excel TDS Reconciliation based on the data that has been reconciled. The total TDS deductions, deposits, and any discrepancies discovered during the reconciliation process can all be shown in the summary section. To make the data easier to read, visualise it using charts or graphs.

Step 7: Validate The Data

Cross-check the reconciled data with other pertinent sources, such as TDS certificates, bank statements, or Form 26AS, to confirm its accuracy and completeness. The TDS reconciliation’s dependability is ensured by this step.

Step 8: Examine And Complete

Review the TDS reconciliation in detail to ensure all comparisons and calculations are correct. If discrepancies are found, make any necessary adjustments or corrections. Finish the report once you are satisfied with its accuracy and submit it after any necessary additional analysis.

Step 9: Consistent Updates

Keeping the reconciliation report current is critical because TDS data evolves over time. To keep accurate records, frequently update the Excel worksheet with the most recent TDS data and repeat the reconciliation procedure.

Why Choose Vyapar Software For TDS Reconciliation Format In Excel?

The TDS (Tax Deducted at Source) reconciliation software from Vyapar stands out as a dependable and effective option for companies. Consider using Vyapar software for your TDS Reconciliation format in Excel for the following reasons:

1. User-Friendly Interface:

The Vyapar software has a user-friendly interface that makes the TDS reconciliation process easier to complete. Vyapar’s user-friendly design makes it simple to use regardless of whether you are a small business owner or a qualified accountant, enabling you to easily navigate the software and access the TDS Reconciliation format.

2. Pre-Designed TDS Reconciliation Template:

To save you valuable time and effort, Vyapar provides a pre-designed TDS reconciliation format in Excel. The columns, formulas, and functions necessary for TDS reconciliation are included in this ready-to-use template. By using this template, you can speed up the reconciliation process and concentrate on analysing the data instead of wasting time creating the format from scratch.

3. Accuracy And Error Detection:

The software developed by Vyapar is accurate. The Vyapar TDS Reconciliation format in Excel ensures accurate calculations, lowering the possibility of human error. You can easily find discrepancies or mismatches in the TDS data thanks to the pre-defined formulas and functions that are built into the template and perform calculations automatically. This error-detecting function improves the TDS reconciliation’s accuracy.

4. Comprehensive Reporting:

In addition to TDS reconciliation, Vyapar provides comprehensive reporting features. You can create purchase reports, profit and loss statements, and various other financial reports using the software. Making informed business decisions is made easier with the help of this comprehensive suite of reports, which offers insightful information about your company’s financial performance.

5. Integration And Data Management:

The Vyapar software allows seamless integration with other tools and systems, ensuring efficient data synchronisation and transfer. The software makes importing TDS data from various sources simple, enabling thorough TDS reconciliation. You can effectively organise and track TDS-related information using Vyapar’s data management features, ensuring accurate reporting and compliance.

6. 7-day Free Trial:

Vyapar provides a 7-day free trial that lets you examine all the features, including the format of the TDS Reconciliation. You can see firsthand how the Vyapar software streamlines the TDS reconciliation process and improves your overall financial management during this trial period. You can decide before buying the software with the help of this trial period.

In conclusion, the Vyapar software offers a user-friendly interface, a template for a TDS Reconciliation that is already designed, and robust reporting capabilities. It guarantees accuracy, makes reconciliation more manageable, and improves data management. You can reduce errors, gain valuable insights into your company’s financial performance, and save time with Vyapar. To streamline your TDS management and guarantee compliance with tax regulations, consider using Vyapar software for your TDS Reconciliation formats.

Create your first TDS Reconciliation with Vyapar App

How Many Types of TDS Reconciliation Formats are There?

Reconciliation of TDS (Tax Deducted at Source) is a critical step businesses must take to guarantee accurate tax compliance. Multiple TDS reconciliation formats have been developed to simplify the reconciliation process. These formats serve various functions and cater to various facets of TDS data. Let’s examine the formats for the most typical TDS reconciliation types:

1. Consolidated TDS Statement:

The format of the consolidated TDS statement offers a thorough overview of TDS transactions over a given period. It combines TDS deductions, deposits, and certificates from various parties or deductees. The overall TDS data can be reconciled using this format to ensure the total deductions and deposits match.

2. TDS Deductions And Deposits Reconciliation:

The main goal of this report format is to match up TDS deductions made by the deductor with TDS deposits made to the government. To ensure their accuracy, it compares the TDS amounts deducted from various deductees with the corresponding TDS deposits. It makes it easier to spot any differences or inconsistencies between the TDS amounts deducted and deposited.

3. Reconciliation Between TDS Certificates Received And Claimed:

Using this format is crucial for comparing TDS certificates that the deductor received from deductees to TDS certificates claimed when TDS returns were filed. It guarantees that all TDS certificates are legitimately claimed, avoiding discrepancies or overlooked claims.

4. Reconciliation Of TDS Certificates And Payments:

The main goal of this report format is to match up the TDS certificates given to the deductees with the actual payments made to them. It ensures that the deducted TDS amounts have been accounted for in the payments made and confirms the accuracy and timeliness of TDS certificate issuance.

5. TDS Returns And Deductee Data Reconciliation:

Using the TDS reconciliation format, the deductor compares the TDS information provided in the TDS returns it has filed with the corresponding deductee-wise data it has kept. To ensure accurate reporting, it assists in locating any differences between the filed returns and the actual data.

6. TDS And Form 26AS Conciliation:

Form 26AS is a crucial record that reflects TDS information according to the records of the Income Tax Department. The TDS data reported by the deductor and the TDS data found in the deductees’ Form 26AS are compared using this reconciliation format. It ensures accurate reporting and assists in locating any differences or discrepancies between the two sources.

These are a few examples of the TDS reconciliation formats that companies frequently use. The kind of transactions, the need for reporting, and the particular requirements of the business all influence the choice of format. Businesses must carefully select the TDS Reconciliation format in Excel that best meets their needs and enables them to reconcile their TDS data successfully. It will ensure accurate tax compliance and reporting.

How To Choose The Best Format For TDS Reconciliation?

For businesses to ensure accurate reporting, streamline the reconciliation process, and maintain compliance with tax regulations, selecting the best format for TDS (Tax Deducted at Source) reconciliation is essential. When choosing the best format, keep the following things in mind:

1. Business Prerequisites:

Analyse the complexity of your TDS transactions concerning your unique business needs. Decide whether you need a separate reconciliation for TDS deductions, deposits, certificates, or returns or a consolidated TDS statement format. Choosing a format that fits your needs for TDS reconciliation will be easier for you if you know your business requirements.

2. Reporting Frequency:

Take into account how frequently you must reconcile your TDS data. If you frequently reconcile accounts, using a format that enables effective and speedy analysis would be advantageous. On the other hand, a format that offers thorough insights into the data over longer periods may be more appropriate if your reconciliations occur less frequently.

3. Data Volume And Complexity:

Consider your TDS data’s volume and complexity. A format that offers comprehensive data organisation and calculation capabilities would be advantageous if you have a lot of deductees and transactions. Make sure the format you choose can handle the volume and complexity of your TDS data without sacrificing performance or accuracy.

4. Automation And Accuracy:

Take into account the format’s level of automation and accuracy. Look for pre-designed formats with integrated formulas and functions for automated calculations and error detection. During the reconciliation process, a format that minimises manual labour and lowers the possibility of mistakes will speed up the process and improve accuracy.

5. Flexibility And Customisation:

Consider how flexible and customisable the format is. Check to see if the format can be modified to fit your reporting needs and business requirements. You can customise it to your organisation’s preferences and efficiently capture all the necessary data points if the format is flexible.

6. User-Friendliness:

Take into account how simple and user-friendly the format is to use. To make it simple for users to navigate, enter data, and analyse the results, look for formats that offer a clear and intuitive user interface. The learning curve will be as short as possible, and reconciliation productivity will increase.

7. Integration And Compatibility:

Ensure that the format you choose is integrated with the software or systems you currently employ for TDS management. Think about formats that work well with your current tools, facilitating easy data transfer and collaboration. You’ll be able to take advantage of your current infrastructure and prevent workflow disruptions with compatibility and integration.

8. Expert Recommendations:

Look for advice from people with knowledge or experience in TDS reconciliation. They can suggest formats widely accepted and trusted in the industry and offer insights based on their experience. You can make the best decisions by selecting a professional format recommended by experts.

Businesses can choose the best format for TDS reconciliation that meets their unique requirements, improves efficiency, ensures accurate reporting, and supports compliance with tax regulations by taking these factors into account. The TDS reconciliation process can be streamlined and organisational financial integrity upheld by selecting the appropriate format.

Benefits Of Using The TDS Reconciliation Format in Excel

Structure And Organisation:

The TDS reconciliation format offers a structured layout that facilitates the efficient organisation and classification of TDS data. Businesses can enter and track pertinent data in a structured way using predefined columns and headers. This organised format makes navigating and analysing the TDS data simpler while ensuring that all pertinent data points are recorded.

Automatic Calculations:

Having built-in formulas and functions is one of the major benefits of using the pre-designed TDS reconciliation format in Excel. These formulas perform calculations and comparisons automatically, eliminating the need for manual computation. Businesses can save time and lower the chance of errors by using these automated calculations instead of manual ones.

Data Integrity:

Consistency in reporting procedures is encouraged by using a standard TDS reconciliation format. The predefined structure guarantees consistency in format across various time periods and data sets. This consistency facilitates accurate tracking of deductions, deposits, and certificates consistently and makes it simpler to compare and analyse TDS data over time.

Detecting Errors:

The TDS reconciliation format in Excel has predefined formulas and functions that aid in locating discrepancies or inconsistencies in the TDS data. Utilising these built-in error detection tools, companies can easily identify discrepancies and take the appropriate action to fix them. This automated error detection capability increases precision and guarantees accurate TDS reporting.

Time Savings:

Saving a lot of time by using a pre-made TDS reconciliation format. Businesses can save time and effort by pre-configuring the Excel worksheet and formulas. Businesses can allocate their time and resources more effectively by concentrating on data analysis and reconciliation when there is a ready-to-use format available.

Process Of Reconciliation Simplified:

By giving a clear framework for comparing TDS deductions, deposits, and certificates, the TDS Reconciliation format in Excel streamlines the reconciliation procedure. It simplifies the process of identifying discrepancies by outlining the columns and formulas needed for reconciliation. This simplification ensures compliance with tax laws, improves accuracy, and requires less manual labour.

Adaptability In Customisation:

The pre-designed format provides a standardised structure but can be altered to meet particular business needs. Businesses can choose to add extra columns or change the existing ones to record specific TDS-related data that is pertinent to their operations. By customising it, the TDS Reconciliation format is made to meet the unique requirements of the company.

Improved Data Analysis:

Through the use of visualisations like graphs and charts, the TDS reconciliation format in Excel enables more effective data analysis. It is simpler to spot trends, patterns, and anomalies in the TDS data thanks to these visual representations. Businesses can gain deeper insights into their TDS activities and take informed decisions and proactive actions by visualising the data.

Documentation And Record-Keeping:

TDS reconciliation activities are properly documented when the TDS reconciliation format in Excel is used. To keep accurate and well-organised TDS records, businesses can use the predefined format as a record-keeping tool. This documentation offers a transparent audit trail of the reconciliation process and is useful for compliance purposes.

Integrity And Compatibility:

Since Excel is widely used, sharing TDS reconciliations with the appropriate stakeholders is compatible and simple. A thorough reconciliation analysis is possible thanks to the TDS Reconciliation format’s seamless integration of TDS data from other sources into the Excel worksheet. This compatibility makes internal reporting and collaboration within the company more effective.

In conclusion, using the TDS reconciliation format in Excel has many advantages, such as structure and organisation, automatic calculations, consistency in data, error detection, time efficiency, a streamlined reconciliation process, customisation flexibility, improved data analysis, documentation, and record-keeping, as well as compatibility and integration. Employing this format aids organisations in streamlining their TDS reconciliation procedure, maintaining accuracy, and successfully adhering to tax regulations.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

Yes, the pre-designed TDS reconciliation format in Excel can be easily customised with the Vyapar software to suit your unique business needs. You can modify the existing columns, add new ones, and customise the format to collect particular TDS-related data pertinent to your business’s operations.

The Vyapar software does indeed support easy integration with other tools and systems. The software makes importing TDS data from various sources simple, enabling thorough TDS reconciliation. This integration guarantees seamless data transfer, synchronisation, and collaboration with your current infrastructure.

During the TDS reconciliation process, Vyapar software offers users complete support. Users can navigate the software more efficiently and produce accurate reports thanks to its user-friendly interface and pre-designed TDS reconciliation template in Excel. The customer service staff at Vyapar is also available to help users with any queries or problems they might have when utilising the program.

Yes, a 7-day free trial is available for Vyapar software. During the trial period, you can examine all the features, including the TDS Reconciliation format in Excel, during the trial period to see how Vyapar streamlines your TDS reconciliation procedure. Before committing, you can use this trial to experience the advantages of Vyapar software and determine whether it meets your business needs.