Reconciliation Statement Format

Keeping an account of all transactions for your business can be a hassle sometimes. With the Vyapar reconciliation statement format, you can do that easily. Also, enjoy the various benefits that come along with this handy application. Avail of the offer now only by downloading the Vyapar accounting app.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download Free Reconciliation Statement Format

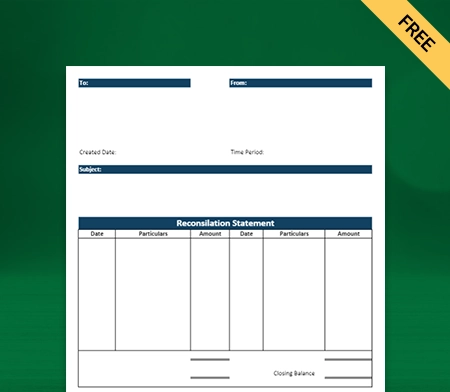

Reconciliation Format

What is a Reconciliation Statement Format?

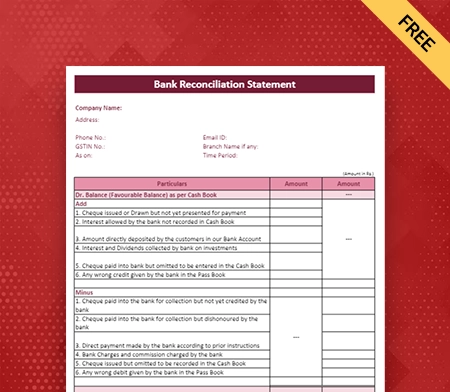

A reconciliation statement is a critical financial document that helps businesses ensure the accuracy and integrity of their bank account transactions. It compares the balances of the business’s accounting records, such as the cash book and the corresponding bank statements. By reconciling these two sets of records, businesses can identify discrepancies and take appropriate action to rectify them.

This format is a standardized layout or structure businesses follow to present their bank reconciliation statement. It provides a consistent and organized way to document the reconciliation process, making it easier to understand and analyze financial information.

The reconciliation statement format typically includes the following sections:

- Table of Contents: This section provides an overview of the contents of the reconciliation statement, allowing readers to navigate through the document easily.

- Balance as per Bank Statement: Here, businesses list the closing balance per the bank statement for the period being reconciled.

- Balance as per Book: This section displays the closing balance per the business’s accounting records, such as the cash book.

- Outstanding Checks: Outstanding checks refer to checks that have been issued by the business but have yet to be presented to the bank for payment. This section lists the details of these outstanding checks.

- Cheques Deposited but Not Cleared: Sometimes, businesses deposit checks into their bank accounts, but the funds are not immediately cleared. This section records the details of the deposited but not yet cleared checks.

- Bank Charges: Bank charges are fees levied by the bank for various services provided. This section includes the details of bank charges incurred during the reconciliation period.

- Other Adjustments: This section allows businesses to include any additional adjustments or transactions that must be accounted for in the reconciliation statement.

- Adjusted Bank Balance: After considering all the necessary adjustments, this section presents the adjusted bank balance.

- Adjusted Book Balance: The adjusted book balance is calculated by considering the adjustments made to the cash book balance.

- Reconciliation: The reconciliation section brings together the adjusted bank balance and adjusted book balance, highlighting any discrepancies and explaining the differences.

Mastering the art of bank account reconciliation is crucial for businesses to maintain accurate financial records and make informed financial decisions. By following a reconciliation statement format, businesses can streamline the reconciliation process and ensure the integrity of their bank account transactions.

Choosing the right bank reconciliation accounting software to generate auto statements, such as Vyapar, further enhances the efficiency and accuracy of the reconciliation process. Vyapar’s user-friendly interface, customization options, and powerful features make it an excellent choice for businesses of all sizes.

How Does A Reconciliation Statement Format Work?

A reconciliation statement format systematically compares the bank’s and business’s accounting records. It allows businesses to identify and resolve discrepancies, ensuring that financial information is reliable.

To begin the reconciliation process, businesses gather the necessary information, such as bank statements, cash books, and supporting documentation for outstanding checks or deposits. They then follow the reconciliation statement format, inputting the relevant details into each section.

Next, businesses compare the closing balance per the bank statement with the balance per their accounting records. If the two balances match, the records are accurate and have no discrepancies. However, further investigation is required if there is a difference between the two balances.

The reconciliation statement format helps businesses identify the reasons behind any discrepancies. For example, outstanding checks and deposits that have not yet cleared may explain differences between the bank statement and the book balance. Bank charges or other adjustments may also contribute to the differences.

Businesses can take appropriate action to rectify these discrepancies by systematically documenting and analysing them. It may involve contacting the bank to resolve outstanding checks or deposits, adjusting the accounting records to reflect the correct balances, or investigating potential errors or fraud.

Uses Of A Reconciliation Statement Format

The reconciliation statement format serves several important purposes for businesses. Firstly, it helps identify errors and discrepancies in the accounting records. By comparing the cash book and the bank statement, any discrepancies, such as outstanding checks or bank charges, can be identified and rectified promptly.

Secondly, the reconciliation statement template helps businesses monitor their cash flow. It provides a clear overview of all cash transactions, allowing them to track income and expenses accurately. This information is crucial for making informed financial decisions and forecasting future financial needs.

Lastly, the reconciliation statement format ensures compliance with accounting standards and regulations. It provides a standardised way of presenting financial information, making it easier for auditors and regulatory bodies to review and verify the accuracy of the company’s financial records.

Reconciliation Statement Format Template

Businesses can utilise a reconciliation statement template to ensure consistency and accuracy in preparing reconciliation statements. This template provides a pre-defined structure that includes all the sections and headings required for a comprehensive reconciliation statement.

A reconciliation statement format template typically consists of the following sections:

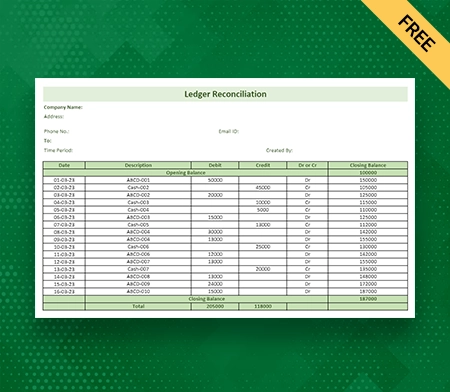

- Opening Balance: This section includes the balance as per the bank statement and the balance as per the cash book at the beginning of the reconciliation period.

- Transactions Recorded in the Cash Book: This section lists all the transactions recorded in the cash book during the reconciliation period. It includes details such as each transaction’s date, description, and amount.

- Transactions Reflected in the Bank Statement: This section lists all the transactions reflected in the bank statement during the reconciliation period. It includes details such as each transaction’s date, description, and amount.

- Adjustments and Discrepancies: This section accounts for any adjustments or discrepancies between the cash book and the bank statement. It may include outstanding checks, bank charges, or other factors affecting the reconciled balance.

- Closing Balance: This section reflects the reconciled balance, which is the adjusted balance after considering all the transactions and adjustments made during the reconciliation process.

By using a reconciliation statement template, businesses can save time and effort in preparing their reconciliation statements while ensuring accuracy and consistency.

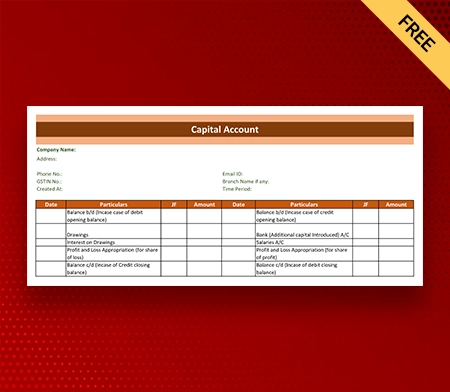

Reconciliation Statement Format In Cost Accounting

The reconciliation statement format in cost accounting is crucial in tracking and analysing costs related to manufacturing processes. It helps businesses reconcile the differences between the costs recorded in the cost accounting system and the costs reflected in the financial statements.

The reconciliation statement template for cost accounting typically includes the following sections:

- Standard Costs: This section includes the standard costs associated with each product or manufacturing process. These costs serve as the benchmark against which actual costs are compared.

- Actual Costs: This section lists the costs incurred during manufacturing. It includes details such as direct materials, direct labour, and overhead costs.

- Variance Analysis: This section analyses the differences between standard and actual costs. It identifies and explains the reasons behind any variances, such as material price or labour efficiency variances.

- Reconciliation of Costs: This section reconciles the differences between the costs recorded in the cost accounting system and those reflected in the financial statements. It ensures that the financial statements accurately represent the costs incurred during manufacturing.

The reconciliation statement template in cost accounting enables businesses to identify discrepancies, analyse variances, and make informed decisions to improve cost efficiency and profitability.

Reconciliation Statement Format For Construction

In the construction industry, a reconciliation statement format is crucial for managing project finances effectively. It helps reconcile the costs incurred during construction with client payments and ensures accurate and transparent financial reporting.

The reconciliation statement template for construction typically includes the following sections:

- Project Costs: This section lists all the costs incurred during construction. It includes labour, materials, equipment, subcontractor fees, and overhead costs.

- Progress Payments: This section reflects the payments received from clients or project sponsors at various stages of the construction project. It ensures that the payments received align with the progress of the project.

- Retentions: This section accounts for any retentions or holdbacks on payments. Retentions are typically a percentage of the total payment withheld until the project is completed satisfactorily.

- Reconciliation of Costs and Payments: This section reconciles the costs incurred with the payments received. It ensures that the financial records accurately reflect the actual costs and payments associated with the construction project.

The reconciliation statement format for construction enables businesses to monitor project profitability, track costs, and ensure timely client payments.

Reconciliation Statement Format For Business

In general business operations, the reconciliation statement format is essential for maintaining financial records and ensuring the integrity of financial transactions. It helps reconcile the transactions recorded in the cash book with the transactions processed by the bank, providing a clear overview of the company’s financial position.

The reconciliation statement template for business typically includes the following sections:

- Opening Balance: This section includes the balance as per the bank statement and the balance as per the cash book at the beginning of the reconciliation period.

- Transactions Recorded in the Cash Book: This section lists all the transactions recorded in the cash book during the reconciliation period. It includes details such as each transaction’s date, description, and amount.

- Transactions Reflected in the Bank Statement: This section lists all the transactions reflected in the bank statement during the reconciliation period. It includes details such as each transaction’s date, description, and amount.

- Adjustments and Discrepancies: This section accounts for any adjustments or discrepancies between the cash book and the bank statement. It may include outstanding checks, bank charges, or other factors affecting the reconciled balance.

- Closing Balance: This section reflects the reconciled balance, which is the adjusted balance after considering all the transactions and adjustments made during the reconciliation process.

The reconciliation statement template for business ensures that financial records are accurate, discrepancies are identified and rectified promptly, and banking transactions are properly documented and accounted for.

Benefits Of Using The Reconciliation Statement Format For Your Business

Using a reconciliation statement format offers several benefits for businesses, including:

- Accuracy: The standardised format ensures businesses follow a consistent and structured approach to reconciling their bank accounts. It reduces the risk of errors or omissions and improves the accuracy of financial information.

- Efficiency: The format provides a clear and organised framework for documenting the reconciliation process. It saves time and effort by guiding businesses through the necessary steps and ensuring that all relevant information is included.

- Transparency: The reconciliation statement format enhances transparency by clearly presenting the reconciliation process and the reasons behind any discrepancies. It allows stakeholders, such as investors or auditors, to easily understand and verify financial information.

- Compliance: Following a reconciliation statement format helps businesses comply with accounting standards and regulatory requirements. It ensures that the reconciliation statement is prepared to meet industry standards and best practices.

- Decision-making: Accurate and up-to-date financial information is crucial for effective decision-making. By using the reconciliation statement format, businesses can confidently rely on the integrity of their bank account records when making important financial decisions.

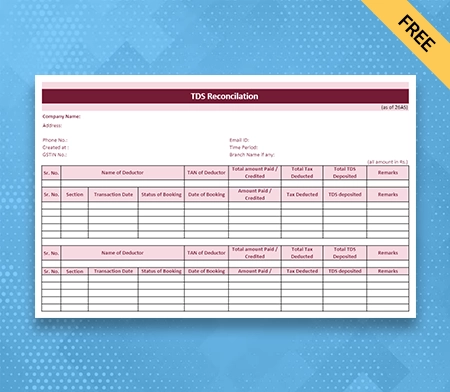

Steps To Choose The Best Reconciliation Statement Format Software

Choosing the right reconciliation statement format software is crucial for businesses to streamline their reconciliation process and ensure accuracy. Here are some steps to help you choose the best billing software for your business:

- Identify your needs: Assess your business’s reconciliation statement software requirements. Consider factors such as the size of your business, the volume of banking transactions, and any unique features or integrations you may need.

- Research available options: Conduct thorough research to identify the available reconciliation statement software in the market. Consider factors such as user reviews, reputation, features, ease of use, and compatibility with your existing business.

- Evaluate features: Create a list of essential features you require in the software, such as automated data import, bank statement matching, customisation options, reporting capabilities, and user permissions. Evaluate each software option based on these criteria.

- Consider scalability: Ensure the reconciliation statement format software can accommodate your business’s future growth and increasing transaction volumes. Scalability is essential to avoid outgrowing the software and switching to a different system in the future.

- Trial and compare: Take advantage of free trials or demos the software providers offer. Test the software’s functionality and usability, and compare multiple options to determine which best meets your business’s needs.

- Seek recommendations: Reach out to other business owners or financial professionals to gather their recommendations and insights on reconciliation statement format software. Their experiences and feedback can provide valuable guidance in making your decision.

Remember, choosing the right reconciliation statement software is an investment in your business’s financial management and accuracy. Take the time to thoroughly evaluate your options and select a solution that best aligns with your business’s needs and goals.

Reconciliation Statement Format By Vyapar

Vyapar offers a comprehensive and user-friendly solution for businesses of all sizes to streamline their bank account reconciliation process. With Vyapar’s reconciliation statement format, businesses can:

- Import bank statements and automatically match them with their accounting records, reducing manual data entry and potential errors.

- Easily customize the reconciliation statement format to meet their specific needs and preferences.

- Generate detailed reports and analyses to gain valuable insights into their financial information.

- Benefit from an intuitive, user-friendly interface that makes the reconciliation process efficient and straightforward.

Vyapar’s reconciliation statement template simplifies and enhances the bank reconciliation process, allowing businesses to focus on their core operations and make informed financial decisions.

Make the most of the reconciliation statement format by Vyapar and simplify your bank account reconciliation process today!

Benefits Of Using Reconciliation Statement Software By Vyapar

Using Vyapar’s reconciliation statement software offers several advantages for businesses:

- Simplicity: Vyapar’s small business acounting software is designed with user-friendliness in mind. It provides a simple and intuitive interface, making it easy for businesses to navigate and use the reconciliation statement format effectively.

- Accuracy: By automating the reconciliation process and minimizing manual data entry, Vyapar’s software reduces the risk of errors and ensures accurate financial information.

- Efficiency: Vyapar’s software streamlines the reconciliation process, saving businesses time and effort. It automates repetitive tasks, such as matching bank statements with accounting records, allowing businesses to focus on more critical activities.

- Insights: The detailed reports and analysis generated by Vyapar’s software provide valuable insights into the business’s financial health. This information helps businesses make informed decisions and identify areas for improvement.

- Customization: Vyapar’s software allows businesses to customise the reconciliation statement template to meet their specific requirements. This flexibility ensures businesses can adapt the software to their unique processes and preferences.

By using Vyapar’s reconciliation statement software, businesses can streamline their bank account reconciliation process, ensure accuracy, and gain valuable insights into their financial information.

Features That Make Vyapar App Best For Small Business Owners

In addition to its powerful reconciliation statement format software, Vyapar offers several other features to help businesses manage their financial operations effectively. These features include:

- Invoicing: Vyapar provides a comprehensive invoicing solution that allows businesses to create professional invoices, track payments, and manage client details seamlessly.

- Expense Tracking: With Vyapar’s expense tracking feature, businesses can easily record and categorise their expenses, ensuring accurate financial records and easier tax compliance.

- Inventory Management: Vyapar’s inventory management software feature enables businesses to track their stock levels, monitor sales, and generate inventory reports, ensuring efficient inventory control.

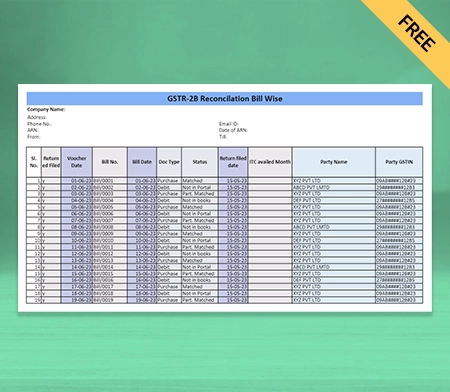

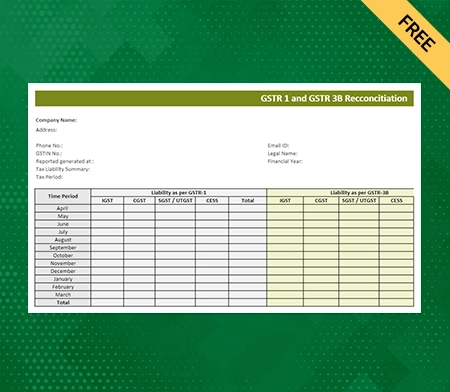

- GST Compliance: Vyapar supports businesses in complying with Goods and Services Tax (GST) regulations. It simplifies GST calculations, generates GST-compliant invoices, and provides reports for GST filing.

- Financial Reports: Vyapar offers various financial reports, including profit and loss statements, GST reports, sales reports, cash flow statements, and balance sheets. These reports provide businesses with a detailed overview of their financial performance.

By utilising these additional features, businesses can streamline their overall financial management and gain better control over their operations.

Frequently Asked Questions (FAQs’)

A Reconciliation Statement is a financial statement that compares two sets of records to ensure they are in agreement. It helps identify any discrepancies between the two records.

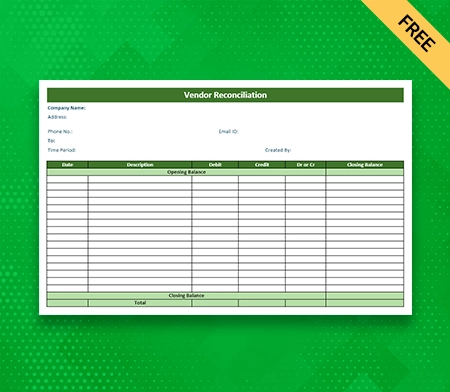

The two types of Reconciliation Statements are Bank Reconciliation Statement and Vendor Reconciliation Statement.

A Vendor Reconciliation Statement is a statement that reconciles the accounts payable balance in the company’s accounting records with the balance owed to vendors.

The components of a Reconciliation Statement include the opening balance, reconciling items, adjusted balance, and closing balance.

Reconciling items are the items that cause the difference between the two records. These items may include outstanding checks, deposits in transit, bank fees, and interest.

A Reconciliation Statement is important because it helps ensure the accuracy of the financial records. It helps identify any errors or fraudulent activities and ensures that the company’s financial statements are reliable.

A Reconciliation Statement should be prepared at least once a month for bank statements and any other sets of records that require regular reconciliation. However, the frequency of preparation may depend on the size and complexity of the organization.

The reconciliation statement format includes:

* Title: “Reconciliation Statement.”

* Purpose: Clarify discrepancies or reconcile balances.

* Reference Period: Specify the timeframe covered.

* Accounts/Items: List the accounts/items being reconciled.

* Beginning Balances: Initial balances at the start of the period.

* Additions: Credits increasing balances.

* Deductions: Debits decreasing balances.

* Adjusted Balances: Calculate adjusted balances.

* Explanation: Briefly explain additions, deductions, and adjustments.

* Final Balances: Reconciled balances after adjustments.

* Signatures: Include authorized signatures for validation.

When writing a reconciliation statement, Vyapar’s features can automate data imports, highlight discrepancies, and provide clear insights into reconciled balances. This ensures efficient and accurate financial reporting.

Adjusted Bank Statement Balance = Opening Balance + Deposits in Transit – Outstanding Checks +/- Bank Errors

This formula reconciles the bank statement balance by considering deposits in transit, outstanding checks, and bank errors.

To record reconciliation:

* Open a reconciliation journal.

* Enter opening balances.

* Add reconciliation adjustments.

* Calculate adjusted balances.

* Verify accuracy.

* Close the reconciliation journal.

* Document the reconciliation for future reference.

Related Posts: