Common Size Balance Sheet Format in Excel, PDF

Vyapar creates common-size balance sheets with one click. Save time & understand your business performance better.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Download Free Common Size Balance Sheet Format

Download the Free Common Size Balance Sheet Format in Excel, PDF, and make customization according to your requirements at zero cost.

Customize Invoices

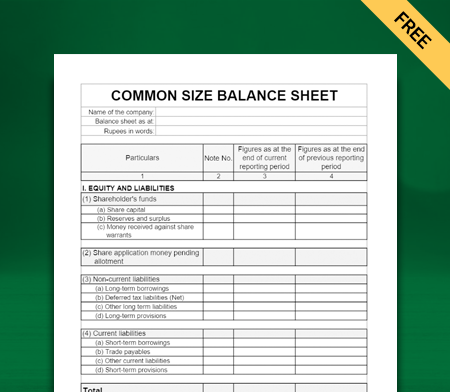

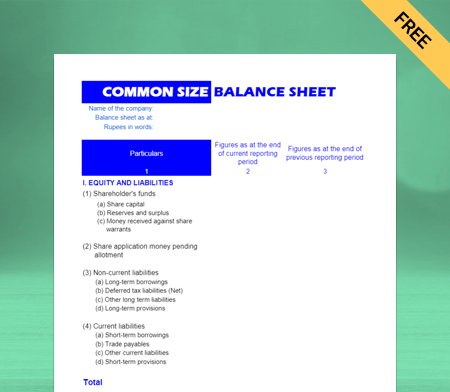

Common Size Balance Sheet Format Type I

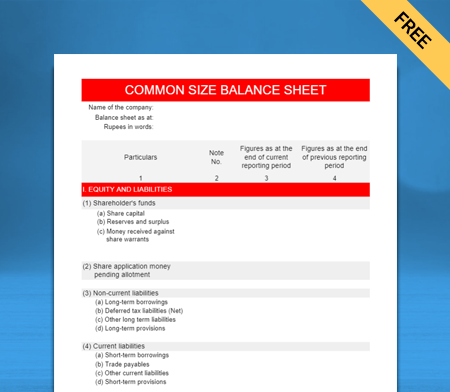

Common Size Balance Sheet Format Type II

Common Size Balance Sheet Format Type III

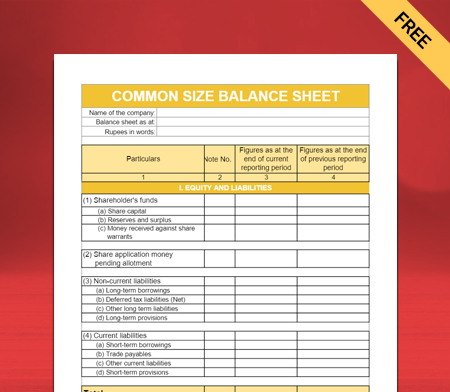

Common Size Balance Sheet Format Type IV

Generate Invoice Online

Highlights of Balance Sheet Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What is a Common-Size Balance Sheet?

A common-size balance sheet is a financial statement that expresses each line item as a percentage of total assets. Common-size balance sheet format allows easy comparison of different companies’ financial health and performance, as it standardizes the presentation of balance sheet data.

What is Included in the Common Size Balance Sheet Format?

The “common size balance sheet” format includes various financial elements such as assets, liabilities, and equity, presented as a percentage of total assets. Its presentation enables a comparison of the proportionate composition of each category within the balance sheet. Both parties must match (Assets = Liabilities + Equity) to show an accurate and fair picture.

Benefits of Common Size Balance Sheet Format by Vyapar:

Assess Working Capital:

The balance sheet generator app helps generate balance sheets and determine whether the business has sufficient working capital (difference between current assets and current liabilities) to carry on its operations or not. A Vyapar balance sheet in common size can help you recognise if your business is doing good or running at a loss by taking more loans than you can repay.

Borrow Capital for your Business:

Lenders and financial institutions rely on your company’s balance to know your credit history, financial health, debt-repayment track record, etc. It also keeps investors informed about where their funds are deployed and when they can expect the return. So, a common size balance sheet maker app can help secure loans for your business.

Keep Interested Parties Well Informed:

A balance sheet allows interested parties to make informed financial decisions by giving them an idea of the company’s financial position. It reports your financial status to interested lenders, investors, and stakeholders. A common-size balance sheet can guide your internal management decisions as well and helps you learn about your financial health.

Potential for Future Operations:

Based on non-current assets and current assets, Vyapar’s common size balance sheet can help you determine how sustainable your business is. For example, your company owns the equipment, utilities, office space, etc. If their overall value is higher than that of current assets, your business is capable of persisting future functions.

Decide on the Possibility of Dividends:

When the company is making tremendous returns and has a high rate of profit, dividends are issued. Whether your business can afford to give dividends is a matter that can be identified using the balance sheet: The more your retained earnings, the more your shareholder’s dividends.

Create your first invoice with our free Invoice Generator

Why is a Balance Sheet Important For Your Business?

Balance sheets are essential for different reasons. They reflect essential financial records that are used in the course of business transactions. Executives, investors, analysts, and regulators use it to understand the current financial health of the business. A balance sheet allows a user to get a view of the assets and liabilities of the company and shows whether the company has a positive net worth, enough cash, and assets to cover its obligations.

Determines Financial Health and Creditworthiness:

A balance sheet lists your company’s assets and liabilities concisely. Current and long-term investments reflect your ability to generate cash and sustain business operations, while short and long-term debts prioritise your business’s financial obligations. It would be best to have more assets on your balance sheet than long-term liabilities, implying a positive net worth. Nevertheless, a balance sheet can also show you when your debt levels are not sustainable. It determines the financial health and creditworthiness of your business. You can avoid severe financial problems if you use common-size balance sheet formats for your business.

Record Assets and Liabilities:

Your balance sheet effectively shows your ability to collect payments and repay debts if updated from time to time. It shows business loan lenders that you have a track record of managing assets and liabilities responsibly. If you apply for a small business loan, having a balance sheet will prove to lenders that you can repay your debts timely. Using Vyapar’s common size balance sheet formats, you can seamlessly record all assets and liabilities and manage your business cash flow. The user can know a precise financial position by analyzing and scrutinizing the assets and liabilities at a particular date.

It Helps Make Informed Decisions:

Balance sheets can guide management decisions, and you can use them to report your business’s financial status to lenders, investors, and other stakeholders. The common size balance sheet formats make it easier to keep track of what you own, that is, your total asset. So it can influence business decisions by showing whether you can afford new investment by placing the context in the bigger picture. Keeping track of your business finances can help you identify potential issues timely. You can avoid those problems by creating a sound business plan and using financial statements to guide business decisions.

Show Business’s Financial Status to Outsiders:

Your balance sheet allows people to understand the economic condition of your business quickly. If you are applying for a loan, your financial statement can help lenders verify that you will likely repay your debts on time. Potential investors often read out balance sheets prepared in common size to analyse your business funding requirements and when to expect the return from the investment. Your financial statement allows people outside of your company to quickly understand its financial health. If the business owner has a strong credit history or if the company has a proven track record of repaying timely debts.

Helps in Tax Preparation:

It is essential for tax planning and preparation to keep accurate business records. The Internal Revenue Service (IRS) recommends that small business owners maintain organised and up-to-date financial records to prepare valid tax returns. If your financial statements are in order, your accountant will be able to prepare your returns accurately and ensure that you are not paying more taxes than you should. Additionally, in an IRS audit, you will be required to present a complete set of financial records for inspection, including financial statements and receipts. Using the common size balance sheet maker app by Vyapar can help make all of these tasks simpler.

Provide Helpful Ratios:

Ratios are often used in examining how a small business is performing in terms of Productivity, Liquidity, Profitability, and Solvency. These financial ratios are beneficial when assessing how sustainable the business will be in a long time. A company’s balance sheet accounts can determine them. Your balance sheet is a snapshot that displays your company’s overall capital structure. It can also indicate how long it takes to sell inventory and the length of your accounts payable and accounts receivable process. This information can help you identify trends and see how your company’s finances and operations are compared to competitors.

Other Features of the Vyapar Common Size Balance Sheet Generator

Vyapar delivers you much more than a simple accounting balance sheet format. You can add assets and liabilities for a business outlook and customise it to enter other valuable attributes like cash flow, working capital, income-generating assets, accounts receivables, and further inventory details. It allows you to track equity regularly, and all the available balance sheet templates come with pre-set formulas for determining accurate results.

Business Management:

If you keep track of your financial records, you can identify any issues beforehand and avoid future problems. It also helps your organisation to stay flexible and adopt change with time. A consistent balance sheet format in common size ensures that your business is not suffering from a lack of cash flow. Small businesses often neglect the importance of budgeting which causes significant issues.

Reports Real value:

The common-size balance sheet formats can help businesses showcase their net worth, the difference between total assets and liabilities. It is the share you own from the enterprise after subtracting all liabilities. Your net worth can be significant for potential investors interested in securing a stake in your company.

Determine Risk and Return Capacity:

By monitoring your current and long-term assets through the Vyapar app, you grasp your ability to generate cash flow and sustain business operations. You can keep liabilities in check and grow more assets. On the other hand, short and long-term liabilities help you prioritise your most urgent financial obligations. It would be better for your business if your assets exceeded your liabilities.

Bill Wise Payments:

A balance sheet can help you decide if you need to borrow additional capital from another source or not. With the help of a common-size balance sheet maker app, you can stay updated on whether your debt levels are sustainable. The other app features will help you track payment status for individual invoices, and you can also make contra entries. Hence, it helps you dodge long-term financial concerns by taking action well ahead.

Frequently Asked Questions (FAQs’)

The balance sheet is available in the Reports section of the Mobile and Desktop apps of Vyapar. You can use any common size balance sheet format for your business.

You can use the “Close Financial Year” option to close books. Read the step-by-step method to close your books in the blog section.

Not yet! We might implement this feature, but currently, you can download the data and use it for your business requirements manually.

Vyapar is a business accounting application to manage your business digitally. You can use it for any small and micro-scale business, and all kinds of retail, wholesale, and distributorship businesses can use Vyapar App to manage their businesses hassle-free.

Yes! You can export all-party reports from the reports section and then go to the new companies utility & download the sample file & make sure your party details are fed based on the sample file, select the new file, and restore it.

A common size balance sheet presents each item as a percentage of total assets, liabilities, or equity. This format simplifies comparisons and trend analysis, providing a standardized view for easier interpretation and analysis of a business’s financial position over time.

A common size balance sheet is used for standardization, trend analysis, comparative analysis, decision-making, and effective communication with investors and stakeholders.

A common size balance sheet shows items as percentages within one period, aiding comparisons within that period. In contrast, a comparative balance sheet compares items across different periods to track changes over time.

The common size balance sheet sum is the total percentage of assets, liabilities, or equity, each expressed as a portion of the total balance sheet value.

In a common size balance sheet, 100% represents the total value of the category being analyzed, such as total assets, total liabilities, or total equity.