Excise Duty Invoice Format

Download the excise duty invoice format by Vyapar for free. Create invoices and manage the calculation of excise duties in one place using the Vyapar app. Grab your 7-day free trial today!

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Excise Duty Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional Excise Duty Invoice Formats

Download professional free excise duty invoice formats, and make customization according to your requirements at zero cost.

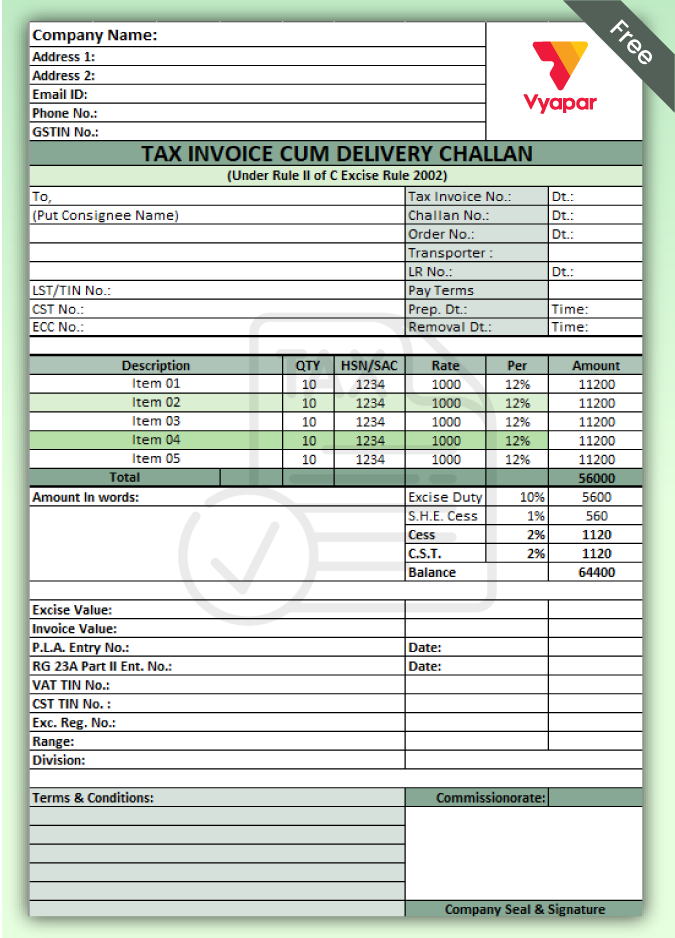

Excise Duty Invoice Format – 1

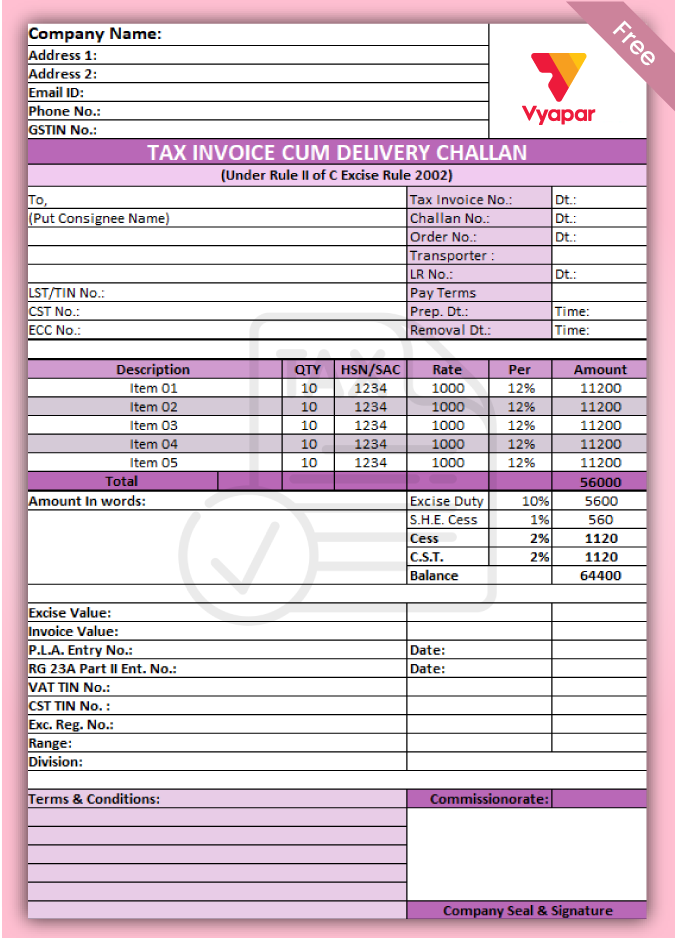

Excise Duty Invoice Format – 2

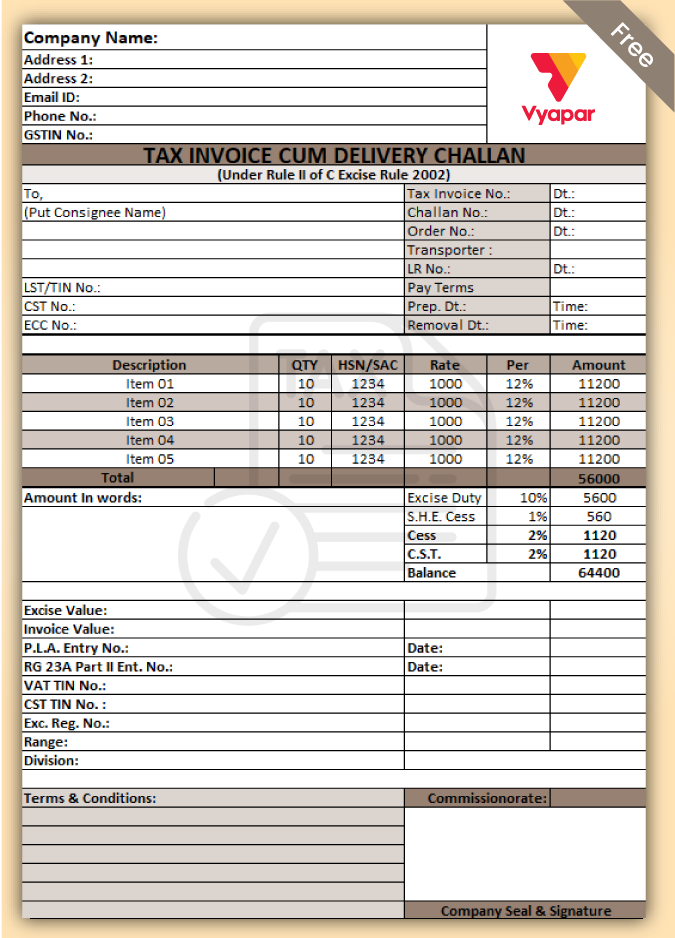

Excise Duty Invoice Format – 3

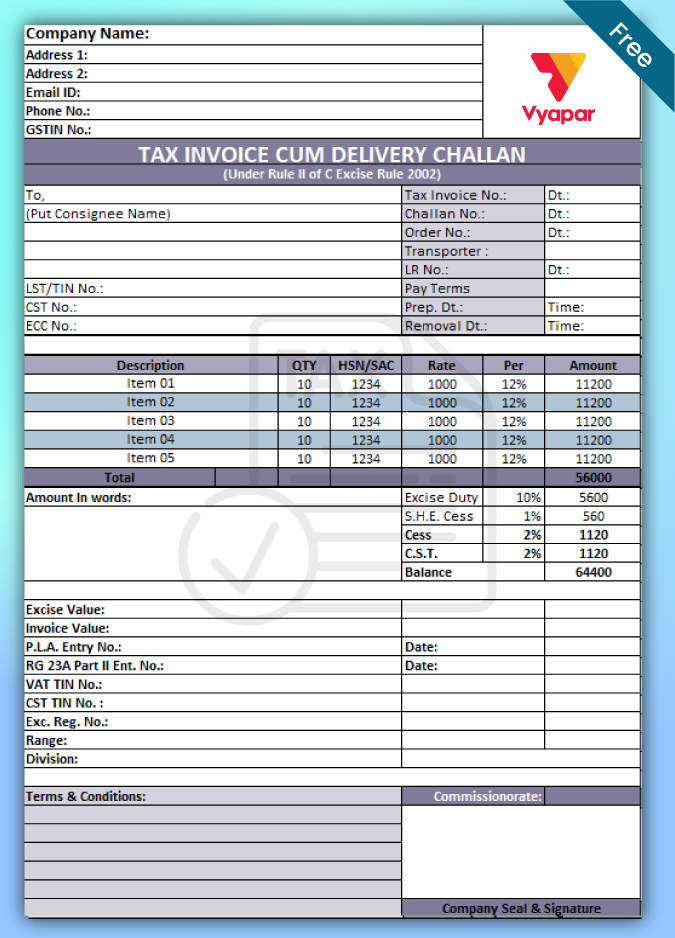

Excise Duty Invoice Format – 4

Generate Invoice Online

Advantages Of Imposing Excise Duty

Revenue Generation:

Excise duty serves as a significant source of revenue for the government. It contributes to public funds for various developmental activities and public services.

Selective Taxation:

It allows the government to tax specific goods or industries selectively. It enables targeted regulation and control over the production and consumption of certain items.

Encourages Compliance:

The imposition of excise tax encourages businesses to comply with regulatory standards. It contributes to the formal economy. Further, it reduces the scope of illicit or unregulated production.

Industry Regulation:

Excise duty provides a means to regulate industries that produce goods such as alcohol and tobacco that have potential social or health implications.

Incentivises Local Production:

The government can incentivise local production and protect domestic industries by taxing imported goods and exempting or imposing lower excise rates on domestically produced items.

Flexible Revenue Tool:

Governments can adjust excise rates based on economic conditions, inflation, or policy goals. Thus, it provides flexibility in revenue management.

Environmental Goals:

Excise policy can be used to promote environmentally friendly practices by imposing higher taxes on products with adverse environmental impacts. In this way, it encourages sustainable production.

Public Health Measures:

It can be employed to discourage the consumption of unhealthy goods. Measures for public health can be taken by imposing higher excise duties on products like sugary beverages or high-tar cigarettes.

Social Equity:

Excise policy can be structured to promote social equity by taxing luxury items at higher rates. It ensures that those with higher incomes contribute more to public funds.

Stabilises Prices:

By regulating the production and consumption of specific goods through excise duty, the government can contribute to price stability in the market, preventing excessive volatility.

What Are The Different Types Of Excise Duty?

Basic Excise Duty

Basic excise tax is levied on all excisable goods produced or manufactured in India except salt. It is assessed at the manufacturing or production stage. The basic excise duty is called CENVAT or Central Value Added Tax. It is imposed under section 3(1)(a) of the Central Excise Act 1944. The rate is prescribed in the first schedule of the Central Excise Tariff Act 1985.

Special Excise Duty

The special excise tax is levied under the second schedule to the Central Excise Tariff Act 1985. It is imposed on specific items such as pan masala or harmful goods. The purpose behind this is to discourage consumers from consuming such products.

Additional Excise Duty

The additional excise tax is levied under the third schedule to the Central Excise Tariff Act 1985. It is a shared tax between the central government and the state government. The additional tax is charged instead of sales tax on items like tobacco and certain petroleum products. Collecting this tax aims to curb the demand for such products.

Education Cess

Education cess on excise tax is an additional levy to fund education-related initiatives in India. It is calculated at 3% of the total excise taxes payable on goods. The funds collected through the education cess were used to support education programs.

What Are The Contents Of The Excise Duty Invoice Format?

The contents of an excise invoice format may differ based on the locality and industry. Usually, it includes the following items:

Header Information

The header of an excise duty invoice format includes the supplier and buyer’s name, address, and contact details. It also includes the excise invoice number and the date it is issued. It helps identify the parties involved in the transaction.

Product Details

In product details, a clear description of the goods supplied is included. The details of goods ideally include the number of units, specific measurements, unit price, and total price.

Taxes And Duties

After product details, the product’s excise tax is included, and any other applicable duties are added to the invoice format.

Total Amount

This section includes subtotal and total cost of goods, including all taxes and duties.

Payment Terms

Terms outline the agreed-upon terms and conditions for payment. It includes the due date for payment, any applicable discounts for advance payment, late payment penalties, and the accepted payment methods.

How Do You Pay Excise Tax Through Easiest?

Step 1:

Firstly, the assessee must access the NSDL-EASIEST portal and select the e-payment option. Now, enter the allotted 15-digit assessee code assigned by the jurisdictional commissioner and verify it.

Step 2:

After validation, the corresponding details like name, address, commissioner code, etc., available in Assessee Code Master will be displayed automatically. The excise duty will be automatically selected based on the Assessee Code.

Step 3:

Now, you must select the type of duty to be paid by clicking “Select Accounting Codes for Excise” or “Select Accounting Codes for Service Tax.” An assessee can select up to six accounting codes at once.

Step 4:

After data verification in the NSDL system, a drop-down menu listing the names of various banks that provide online payment facilities will appear. You can opt for any bank at your convenience.

Step 5:

Once the data is submitted, you will see a confirmation screen. You need to confirm the data entered, which will direct you to the net banking site of the selected bank.

Step 6:

The challan details will be transmitted to the bank with the location code of the assessee. The taxpayer needs to log in to the net banking site using their respective user ID and passwords.

Step 7:

Enter payment details and carry out the transaction. After successful payment, a challan containing payment details, Challan Identification Number, and bank name will be generated. The challan is proof that payment has been made.

Step 8:

The assessee can download the challan counterfoil at his discretion. It contains all the details included in the acknowledgement’s hard copy. You can see the payment status on the website with the help of the “challan status enquiry” option.

Difference Between Excise Duty And Customs Duty

1. Scope Of Application:

Excise is a tax levied on producing or manufacturing goods within the country. Custom duty is imposed on the import and export of goods. Custom duty regulates the movement of goods across international borders.

2. Taxable Event:

The excise tax is levied at the point of manufacturing or production. Customs duty is imposed when goods cross the national border, either on import or export.

3. Collection Point:

Excise duty is collected by the domestic government where the goods are produced. Custom duty is managed by the customs authorities of the importing or exporting country.

4. Nature Of Goods:

The excise tax is applied to goods produced domestically, i.e., in India. Custom duty applies to goods moving across international borders.

5. Purpose:

Excise policy aims to regulate and tax the production of specific goods within the country. Customs duty intends to control and generate revenue from moving goods in and out of the country.

6. Administration:

Indian tax authorities administer the excise policy. Customs authorities administer customs duty at international borders.

7. Rate Structure:

Excise policy is often based on the quantity or volume of goods produced. On the other hand, customs duty can be found on the value, quantity, or weight of imported or exported goods.

How to make an excise invoice using Vyapar?

- Open the Vyapar software on your device and log in to your account. Go to the “Invoices” section on the dashboard.

- Select the option to create a new invoice. Fill in the necessary details for the customer, including name, address, and contact information.

- Enter the details of the products or services that you are invoicing for. Include all the relevant information like quantity, rate, and other relevant information.

- Add additional charges or taxes, if applicable. Specify the excise amount and ensure it is calculated correctly.

- Double-check all the information on the invoice, including customer details, products/services, and the excise rate.

- Save the invoice or generate a PDF/printable version. Review the final invoice and choose to either print or email it to the customer.

Create your first GST quotation with our free Quotation Generator

Benefits Of Using Excise Duty Invoice Format By Vyapar:

1. Regulatory Compliance:

The excise duty invoice format includes specific fields for essential details. It ensures that all required information is captured accurately. The software integrates with tax codes and rates.

It automatically applies the correct excise tax rates based on the nature of the goods or services provided. Vyapar’s excise invoice format automates calculations based on predefined rules and rates.

It minimizes the risk of manual errors in tax calculations. Vyapar may provide real-time updates to ensure that businesses know about changes in excise rates or regulations. It helps companies to stay current and compliant.

2. Maintains Transparency:

The excise duty invoice format includes specific details about the excise tax imposed on goods. It provides a transparent breakdown of taxes applied. The invoice format by Vyapar includes fields for product details.

It helps identify goods subject to excise tax. Thus, transparency helps in verifying compliance with relevant regulations. Clearly outlining the excise components in the invoice enhances transaction clarity between the buyer and seller.

It fosters a transparent business environment. The excise invoice format includes a timestamp. It prevents discrepancies and offers a clear timeline of transactions.

3. Helps In Record Keeping:

Excise duty invoice formats require detailed information about the goods, such as quantity, value, and applicable duties. The comprehensive documentation helps in thorough record-keeping.

When you follow a standardised excise invoice format, it ensures compliance with legal requirements. The detailed records can serve as evidence during audits or inquiries. It contributes to a company’s adherence to regulatory standards.

The excise invoice format helps track financial transactions related to excise duties. It allows businesses to maintain accurate tax liabilities, payments, and credit records. All of it is crucial for financial reporting and analysis.

4. Automation Integration:

Automation relies on consistent data. The professional invoice format for excise tax by Vyapar ensures accurate recording of excise-related details. It reduces errors in the extraction process. The standardised format facilitates seamless integration with various automation tools and software.

Using automation helps streamline the processing of excise invoices by quickly extracting key details. It improves operational efficiency and reduces manual intervention. Automation provides real-time financial and regulatory compliance status insights.

Automated systems minimise the risk of human error in excise tax calculations and documentation. It ensures accurate and reliable records. Integration with automation allows businesses to leverage data analytics tools to understand it better.

5. Consistency:

Vyapar helps maintain a standardised format for excise invoices. It ensures that all necessary details are consistently presented. It streamlines the documentation process by providing a predefined template.

Consistent formatting minimises the chances of errors. It ensures accurate information in each excise invoice, which is crucial for financial and tax reporting. Using a uniform format across all invoices enhances the professional appearance of documents.

It contributes to a positive impression on clients, suppliers, and regulatory authorities. Over time, maintaining a consistent format can lead to cost savings by minimising errors. It reduces the need for corrective actions and improves overall operational efficiency.

6. Saves Time:

Vyapar offers ready-to-use excise duty invoice templates. It can help in saving time by eliminating the need to create invoices from scratch. You can make rapid data entries, minimising the time spent on manual input.

Vyapar enables the generation of multiple invoices simultaneously. It is a significant time-saving feature for businesses dealing with numerous transactions. The standardised format streamlines the approval process. It ensures that invoices are promptly reviewed and approved, expediting the workflow.

With Vyapar, you can access invoices quickly. It reduces the time spent searching for documents and facilitates quick retrieval for various purposes, including audits. Vyapar also allows users to copy and repeat previous invoices, preventing them from recreating similar invoices repeatedly.

Features of Vyapar that Make It The Best App For Excise Invoices:

1. Customisable Invoice Formats:

Vyapar’s customisable excise invoice format feature offers a range of flexible templates to suit various business needs. You can easily incorporate your company logo, colours, and other branding elements into the invoice formats. It gives a professional and personalised touch to your invoices.

The app provides options to customise fonts, styles, and sizes. It lets you maintain a consistent and branded appearance across all your excise invoices. Vyapar also allows users to create invoices in the language preferred by their clients or business partners.

You can easily configure tax rates, apply discounts, and adjust settings related to these elements directly within the invoice format. The customisable invoice format includes features for automatic sequential numbering. It ensures each invoice is uniquely identified and organised.

Vyapar allows users to preview the customised invoice before finalising it. It ensures that the formatting meets their expectations and requirements. The customisable invoice templates are designed to be responsive, adapting to different devices and screen sizes. It enhances accessibility for both users and recipients.

2. User-friendly interface:

Vyapar app guides users step-by-step through the excise invoice creation process. The app logically organises menus and options. It helps users, even those with limited accounting knowledge, to find the required tools effortlessly.

The interface provides a simple and efficient data entry system. It minimises the chances of input errors. Users can enter relevant details for excise duty seamlessly. Thus, it ensures accuracy in the invoice.

Vyapar has a drag-and-drop functionality for item details, making it convenient to add products to the invoice and effortlessly specify relevant excise information. The user-friendly interface includes prompts and alerts highlighting any missing or incorrect information related to excise tax.

By incorporating these user-friendly elements, Vyapar ensures that even users with limited accounting expertise can confidently create excise tax invoices. It reduces the learning curve and potential errors in the process.

3. Monitor Payments And Send Reminders:

Using the Vyapar app, you can set reminders for outstanding payments related to excise invoices. It improves your cash flow management. You can set recurring reminders for repetitive excise duty tasks to stay organised and avoid overlooking crucial steps.

The feature helps in organising and prioritising tasks. It contributes to overall operational efficiency and task management. The reminder feature supports a steady and reliable cash flow by ensuring that payments are made promptly.

Vyapar ensures you stay compliant with excise regulations by sending reminders for necessary documentation and filing requirements. You can receive automatic notifications on your device. It keeps you informed about upcoming excise invoice obligations.

The reminder feature allows you to set custom reminders for excise invoices. The system sends timely alerts based on due dates. It ensures you can meet deadlines for excise invoices.

4. Make Delivery Challan:

Vyapar facilitates the creation of delivery challans through easy-to-use templates. It reduces the time and effort required for manual document preparation. Users can customise excise delivery challans with specific details such as product descriptions, quantities, and other relevant information.

Vyapar automates the generation of delivery challans. It streamlines the process and saves time compared to manually creating each transaction. Users can track the status of delivery challans in real-time. It provides transparency and helps in efficient order fulfilment.

Delivery challans serve as essential documents in the order fulfilment process. It helps in organising and managing the logistics of product delivery. Sending a delivery challan and the goods improves communication between the seller and the buyer.

A well-documented delivery challan serves as a reference point in returns or discrepancies. It facilitates the resolution of issues related to the delivered products.

5. Barcode Scanning:

Vyapar’s barcode scanning feature enables quick and accurate data entry for products subject to excise tax. It reduces the chances of manual errors. Users can quickly identify and select products related to excise tax by scanning their barcodes.

Barcode scanning allows for efficient tracking of batches and serial numbers. The speed of barcode scanning accelerates the overall invoicing process. The software retrieves product details automatically from the barcode scan. It saves time and ensures accuracy in excise invoice creation.

Barcode scanning is an intuitive and user-friendly method of handling inventory tasks. Implementing barcode scanning enhances overall operational efficiency, reduces manual workload, and improves accuracy.

You can maintain a comprehensive product database with barcode information. It makes it easy to reference and include in excise duty invoices. Connect barcode-scanned products seamlessly with the app’s excise rate database, ensuring accurate calculations in your invoices.

6. Various Payment Methods:

Our Vyapar supports various payment methods. Users can make payments through credit/debit cards, cash, bank transfers, and digital wallets. Offering multiple payment options enhances the convenience for customers.

It allows them to choose their preferred method to pay the excise tax. It fosters positive experiences and repeat business. Moreover, Vyapar generates digital receipts for transactions. It provides a convenient and eco-friendly way to share proof of purchase with customers.

Vyapar can integrate with online payment gateways. It enables businesses to accept payments seamlessly through their websites or online platforms. Electronic payment methods facilitate quicker transactions. It reduces waiting times at the point of sale and improves overall efficiency.

It is a known fact that prompt payment processing leads to improved cash flow. It allows businesses to meet their financial obligations and invest in growth opportunities. It enables proactive management of accounts receivable and enhances financial visibility.

Frequently Asked Questions (FAQs’)

Excise is a type of indirect tax that is imposed on the manufacturing of certain goods. It is not paid directly to the authorities by the customers. Manufacturers and producers add the excise cost to the goods they sell. Thus, it is indirectly paid by the consumer with the price rise in the product.

An excise duty invoice includes essential details like supplier and buyer information, invoice number, date, product description, quantity, unit price, total amount, and applicable excise rate. It serves as a legal document for taxation purposes.

Excise duty is charged on the production or manufacturing of goods. Thus, producers or manufacturers are liable to pay excise tax to the government. As per the law, these three parties are responsible for paying excise:

The individual or entity engaged in manufacturing activities of goods.

The individual or entity that gets the goods manufactured by hiring labour.

The individual or entity that receives the goods manufactured by other parties.

Excise invoices must adhere to specific rules, which include accurate identification of goods, explicit mention of excise amount, proper supplier and buyer details, sequential numbering, and compliance with statutory requirements. Timely issuance, authenticity, and adequate record-keeping are crucial for a smooth supply chain process in excisable goods transactions.

In case you fail to pay excise tax on an excitable product, you are liable for the following punishments: If the duty chargeable on the product exceeds Rs 50 lakhs – Imprisonment for a term of up to 7 years or a fine, which may depend on circumstance or both.

Central Excise invoices are issued under Rule 11 of the Central Excise Rules, 2002 in India. This rule outlines the requirements and procedures for issuing invoices related to excisable goods.

The turnover limit for Central Excise duty exemption is specified under the “Small Scale Industries (SSI) Exemption Notification.” Small-scale manufacturers with a turnover below a certain threshold were exempt from excise tax. The turnover limit varies over time and is periodically revised.