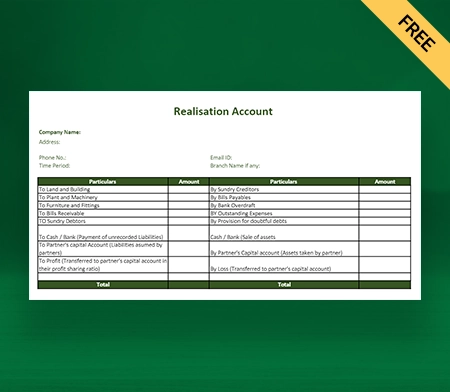

Realisation Account Format

Perform dissolution of your firm accurately and transparently with a realisation account format. Vyapar offers an expert-designed, customisable and easy-to-use format that you can use to create a realisation account. Download the app and avail 7-day free trial now!

Download Realisation Account Format in Excel

What is a Realisation Account Format?

A realisation account format is a financial statement that records the sale or closure of a business or the withdrawal of a partner/proprietor. It breaks down the assets and liabilities sold/transferred to a partner during the process. A realisation account is prepared when a company is getting dissolved.

A realisation account format has two sections: the temporary account (debit side) and the partner’s capital account (credit side). The temporary account records asset sales/transfer and liability settlement. Conversely, the partner account is used for recording individual capital investments/withdrawals.

At the end of the dissolution process, the realisation account is closed by transferring the balance to the partner’s capital accounts. The capital accounts are closed, and the remaining balance is distributed based on profit-sharing ratios or predetermined agreements. It is done to ensure good faith in the time of dissolution.

During a firm’s dissolution, it’s essential to have a realisation account format handly. This format ensures fairness and transparency during the dissolution of a business entity. It does that by providing a clear picture of each partner’s financial transactions and final outcome.

For auditors who are given the responsibility of dissolving a firm, the first thing they do is create a realisation account. So things will be done smoothly when you have a format ready. To access this format for free, download the Vyapar accounting app now.

Importance Of Realisation Account Format For Dissolving Businesses

During a company’s dissolution, a realisation account is created. Having a realisation account format is important to create this account most easily. Here are critical reasons why it’s a highly important business format:

Provides Overview Of Financial Position During Dissolution

The realisation account format is a tool businesses use during the dissolution process to get a clear overview of their financial situation. It shows the assets, liabilities, and capital of the company. This information helps stakeholders such as partners, shareholders, and creditors understand the business’s financial health.

Having an idea about a company’s finances helps make important decisions about the dissolution. The format displays all the financial information related to the business. This includes details such as the value of assets that will be sold or distributed among partners.

In addition, it also gives an overview of bank account, debt, expense, and profit or loss on realisation. This way, stakeholders can evaluate the overall financial status of the business in the shortest period of time. Division of assets and debts is done in the right and timely manner with this format.

Determines Settlement Of Outstanding Debts

The realisation account format is important because it helps businesses settle outstanding debts. When a business is ending, it usually owes money to different creditors. The format helps figure out how much is owed in an organised way.

Creditors can use the realisation account to see their claims and how much they might get from the sold assets. It makes sure all creditors are treated fairly. The realisation account also helps the business pay back debts in order of importance.

For example, old and large debt is given priority over smaller ones. For example, debt from banks or large sums is taken as debt. Such borrowers are first paid off before others are offered the funds. This approach helps make sure all obligations are met systematically.

Identifies And Values Assets And Liabilities Accurately

When dissolving a business, it’s important to accurately identify and assess all of its assets and liabilities. The realisation account format is a reliable way to do this. It involves systematically listing and evaluating all the assets owned by the business.

In the format, we include fictitious assets like property and inventory and intangible items like patents or trademarks. In addition, the format considers all liabilities, such as outstanding loans and expenses. By accurately valuing both assets and liabilities, it ensures the distribution of assets is done fairly among partners.

Moreover, this format also promotes proper allocation of any surplus or deficit arising from the settlement process. It ensures that all partners or shareholders receive their fair share based on the accurate valuation. So, using this format can help you maintain transparency and fairness throughout the dissolution process.

Determines Settlement Of Outstanding Debts

The realisation account format is important when a business is closing down. It’s because it helps determine how to pay off any debts the business still owes. This format keeps track of all the business’s financial transactions and debts in an organised way.

Organised financial information makes it easier to see how much money is owed and to whom. By looking at the format, the business can decide how to use the available money to pay off the debts fairly and transparently.

It is done so that each creditor gets the money they are owed so that the overall owing capacity of shareholders decreases. This way, The realisation account format helps prevent any confusion or disagreements while paying debts off.

Resolves Disputes Among Partners/Shareholders

During the dissolution of a business, conflicts may arise towards the distribution of assets and payment of obligations. In such cases, the realisation account format can be used as an objective reference point for resolving disputes. The format is a clear and detailed report of the business’s financial situation.

It offers a detailed understanding of the values of assets, liabilities, and capital. By referring to this format, the partners can accurately assess their respective interests and contributions to the business.

If shareholders cannot agree, the realisation account can be used as a trustworthy source of information. It will help facilitate discussions and negotiations towards a fair and mutually acceptable resolution.

Determines Tax Implications Of Dissolution

When a business is dissolved, there are important tax consequences to consider. The realisation account format is crucial in addressing and calculating these tax implications. It helps the business determine its taxable income or loss quickly.

Factors like asset realization and liabilities settlement determine the determination. The format allows businesses to accurately record all financial transactions related to the dissolution, which is necessary to meet tax obligations.

The format of realisation accounts also helps allocate tax liabilities among partners or shareholders according to their interests and contributions. Using a professional realisation account format helps your business can follow tax regulations and avoid potential issues or penalties related to taxation.

Benefits Of Using A Realisation Account Format

The realisation account format comes with various benefits for a dissolving firm. Some of the major benefits of having this format are as follows:

Facilitates Strategic Planning

The realisation account format is important for businesses because it helps with strategic planning. It clearly shows the company’s assets, liabilities, and capital. It is important during significant events like dissolution. Having this information allows management to make informed decisions and create strategies.

With the format for realisation accounts, businesses can assess their resources and what assets they can use. It helps them understand their financial position and strengths and weaknesses. They can then use this information to allocate resources, prioritise investments, and create strategies that match their financial capabilities and goals.

The format for realisation accounts also helps businesses identify risks and challenges associated with dissolution. It shows the company’s financial obligations and liabilities, which helps them identify problem areas. It helps businesses plan and allocate resources effectively, increasing the chances of a successful dissolution process.

Supports Informed Decision-Making

A realisation account is a financial tool that helps businesses make informed decisions. It provides a complete record of a company’s assets, liabilities, and capital, all in one place. This helps decision-makers have a better understanding of the business’s financial position.

By looking at the realisation account, management can see how they may impact the business’s financial position. For example, they can decide whether to sell assets, pay off debts, or invest in specific projects. This information enables decision-makers to weigh the benefits, risks, and financial implications of different choices to make more effective decisions.

Using the realisation account format also helps businesses analyse scenarios and forecast outcomes. They can anticipate potential outcomes by projecting the financial results of different strategies or choices. You can make the right decisions based on a more comprehensive understanding of the potential consequences.

Streamlines Auditing And Tax Compliance

A realisation account is a useful tool that simplifies auditing and ensures compliance with tax regulations. It provides a structured framework for presenting accurate and transparent financial information. Information that is essential for auditors and tax authorities to carry out their duties effectively.

Businesses can create a clear and organised record of their financial transactions using the format. It includes the realisation of assets and settlement of liabilities systematically to promote easy understanding by auditors. In addition, the realisation account format simplifies tax compliance for businesses.

It helps them accurately report their financial transactions and comply with tax obligations arising from the dissolution process. This approach minimises the risk of errors or omissions in tax reporting, reducing the possibility of penalties. Overall, the format for realisation accounts streamlines the auditing process and simplifies tax compliance using a format.

Simplifies Financial Statement Preparation

Using the realisation account format makes it easier for businesses to create financial statements. It includes statements like the income statement, balance sheet, and cash flow statement. These statements are important for showing how well a company is doing financially.

The format keeps a structured record of a company’s financial transactions, like selling assets and paying debts. It saves time and effort because all the data is in one place instead of scattered. The format also organises financial information clearly and systematically.

Preparing financial statements makes it easier to prepare accurate financial statements quickly. That way, businesses can meet their reporting requirements. In addition, you can give trustworthy financial information to investors, lenders, and regulators.

Provides Historical Record For Analysis

The realisation Account format is a useful tool that records financial data related to the closure of a business or significant financial events. It provides a record that businesses can analyze retrospectively, giving them valuable insights into their financial performance. By examining this record, management can identify strengths, weaknesses, and areas for improvement.

They can evaluate the effectiveness of past strategies, decisions, and financial management practices. Businesses can use the historical data in the format for benchmarking and comparative analysis. It helps them compare their financial performance during the dissolution process.

We make the comparison to understand what we did right in the past and what we did wrong. Having an idea about that helps the inventors make informed decisions in other businesses they have invested in. So for a better understanding of historical records, get a format for realisation accounts.

Supports Compliance With Accounting Standards

Businesses must follow accounting standards to ensure transparency and consistency in financial reporting. The realisation account format is a good way to achieve this compliance and aligns with accounting regulations.

By using this format, businesses can record and report financial transactions in a structured manner. The transactions follow accounting principles and guidelines. This framework promotes consistency in financial reporting across different periods and entities.

A focused framework makes it easier to compare financial statements of the current year with the previous year. Using the format for realisation accounts also enhances the credibility of financial information. Credibility is important for stakeholders such as investors and regulatory bodies who rely on standardised reporting to make decisions.

Why Use Vyapar For Realisation Account Format?

Accounting Software Vyapar is India’s best and most trusted accounting partner. With the solution, you can access the realisation account format for free. Other than the free account format, here are some reasons to choose this accounting solution:

Generation Of Accurate Financial Statements

Vyapar is an easy-to-use platform that helps businesses generate precise financial statements. It allows you to record and classify financial transactions, ensuring that you don’t miss out on any important details.

The billing software then uses this information to automatically generate accurate income statements, balance sheets, and cash and bank statements. We create the statements clearly and organize them, reducing the risk of human error.With Vyapar, you can make informed decisions based on reliable financial information.

Accurate financial statements provide a comprehensive overview of your company’s financial position. It includes details like revenues, expenses, assets, and liabilities. Further, it allows stakeholders, such as investors, lenders, and partners, to understand your business’s financial health and evaluate its performance.

Secure Data Storage And Backup Features

At Vyapar, we understand that keeping business data secure is essential. That’s why we offer secure data storage and backup features. These protect your realisation account information from unauthorised access and potential data breaches.

This way, you can maintain the confidentiality and integrity of your financial data. We also provide robust backup features that automatically copy your data at regular intervals. These backups act as a safety net, protecting against data loss caused by hardware failure, system crashes, or other unforeseen circumstances.

Vyapar’s secure data storage and backup features allow you to quickly and easily restore your realisation account information in case of data loss or corruption, ensuring the protection and recoverability of your financial information.

Robust Reporting And Analysis Capabilities

Vyapar is a software that can help businesses during the dissolution process. It offers useful reporting and analysis capabilities that can help you better understand the financial position of your business. The reporting features allow businesses to analyse key financial indicators derived from the realisation account data.

Reports can include revenue trends, expense breakdowns, asset realisation status, and liability settlements. Businesses gain insights into their financial performance through visually representing this information. Moreover, Vyapar’s analysis capabilities help businesses perform detailed assessments and comparisons.

They can evaluate different scenarios and assess the impact of various financial decisions on the overall outcome of the dissolution process. It empowers businesses to optimise resource allocation and identify areas of improvement. In addition, it also helps devise strategies for maximising financial gains during the dissolution phase.

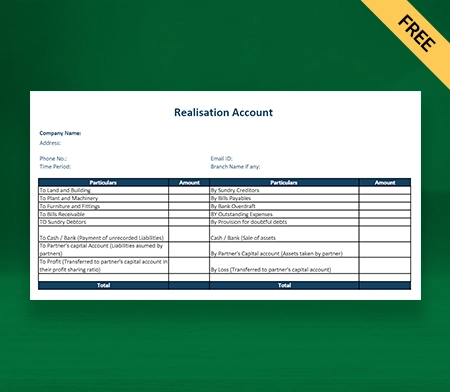

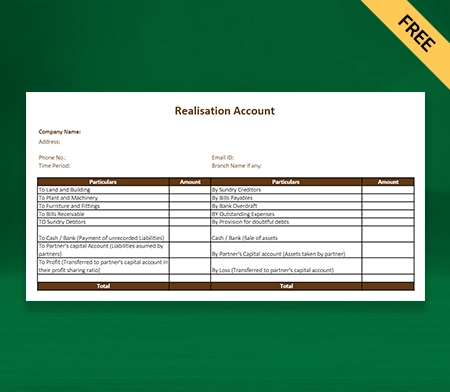

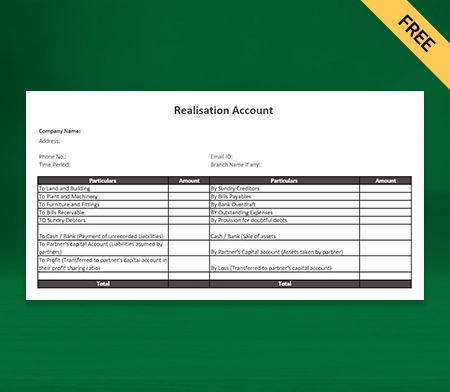

Customisable Realisation Account Format Templates

Vyapar offers customizable account templates for the realisation account format. With the customisation feature, businesses can modify the format to suit their reporting needs. We understand that each business is different and therefore allow flexibility to make changes in format.

Moreover, the feature also helps you create a format that aligns with the industry standards. Financial reporting becomes more efficient when the format aligns with internal processes. Customisable templates help businesses streamline recording and tracking financial transactions during the dissolution process.

The templates ensure that the business captures, classifies, and presents all relevant information in a familiar and meaningful manner. It facilitates easier data entry, improves accuracy, and enhances the consistency of realisation account records.

Comprehensive Tracking Of Financial Transactions

Vyapar is a software that helps businesses keep track of their financial transactions during realisation. It involves recording the realization of assets, the settlement of debts, and other relevant financial activities that occur during the dissolution process.

With Vyapar, businesses can easily monitor the flow of funds and keep track of debt settlements and asset disposal or transfer. The software categorises and classifies these transactions, making it easy to analyse and interpret financial data.

A comprehensive financial transaction record is important for businesses during the dissolution phase. It ensures transparency and auditability with an accurate balance sheet, helping create a reliable historical record. Auditors use the historical record for business analysis, tax compliance, and future decision-making.

Automatic Calculation Of Profit Or Loss

Vyapar can save businesses time and effort by automating the calculation of profit or loss. With Vyapar, businesses can input their financial transactions, and the software will automatically calculate the outcomes of the dissolution process.

Using Inventory management software Vyapar eliminates the need for manual calculations and reduces the risk of errors in the process. The software calculates profit or loss based on recorded transactions. It includes details such as provisions for depreciation, asset realisations, liability settlements, and other financial activities.

This feature not only saves time but also ensures accurate financial results. It gives businesses a clear understanding of their financial performance during the dissolution process. Understanding the performance enables them to evaluate the financial impact and make informed decisions based on the figures.

Frequently Asked Questions (FAQs’)

A realisation account format is a pre-designed template you can use to easily create a realisation account. The realisation account is important during the dissolution of a firm.

You can access the realisation account format for free using the Vyapar app. Vyapar is India’s best and most preferred accounting software. Download now and enjoy using the format for free.

The best tool you can find on the internet today for the realisation account format is Vyapar. Vyapar is an easy-to-use accounting software that comes with a customisable format.