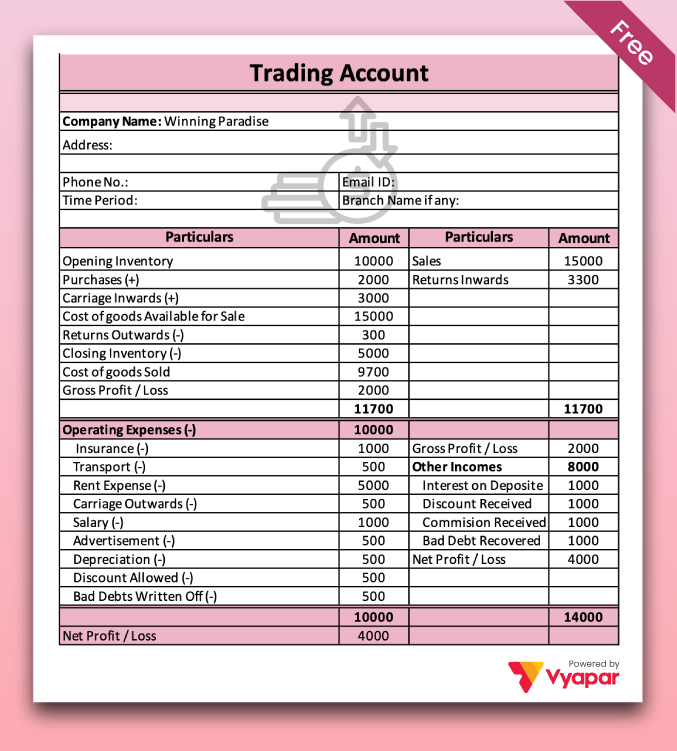

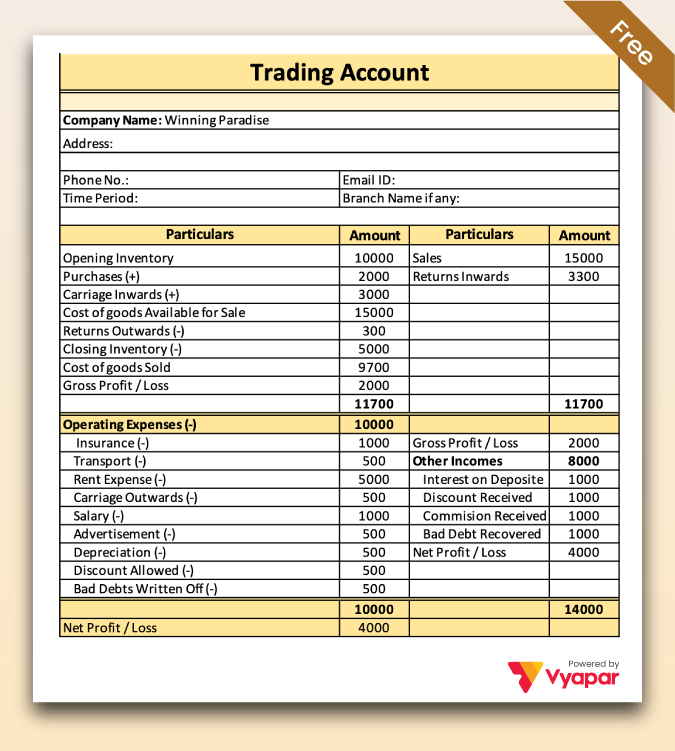

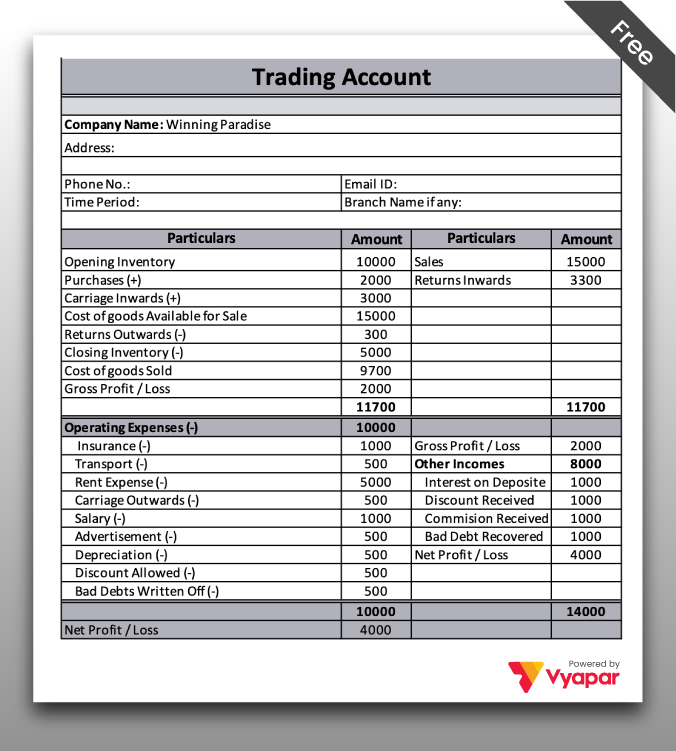

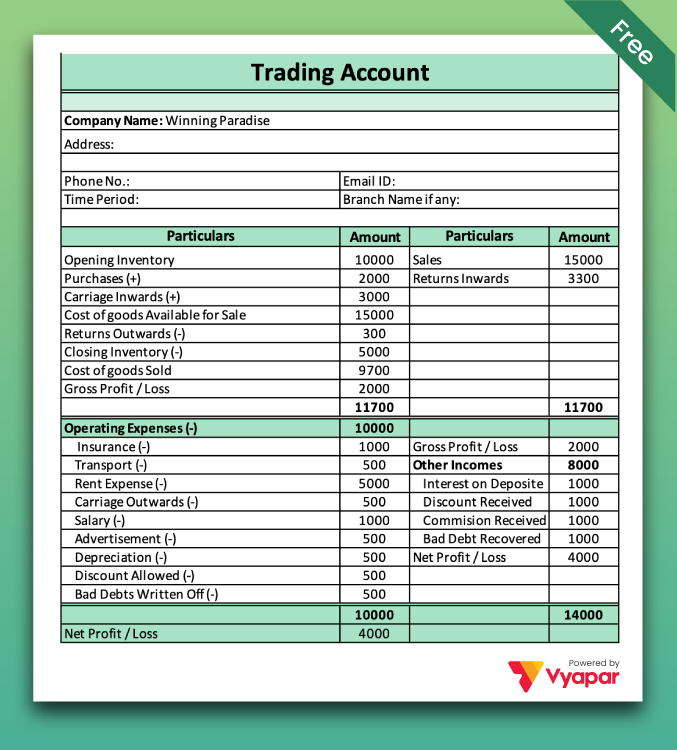

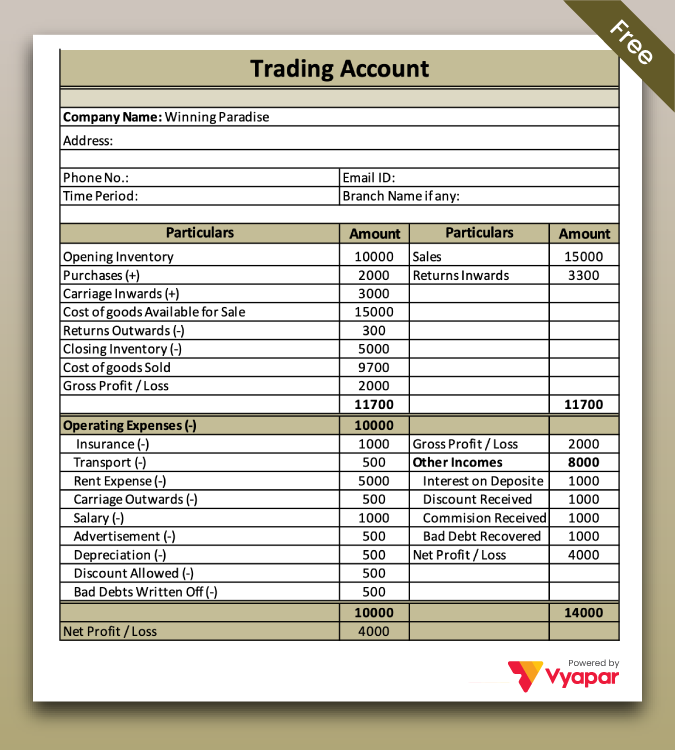

Trading Account Format

Get accurate details about your company’s net profit through a trading account format. The format contains detailed descriptions of profits, losses, and other essential financial items. Access expert-designed trade accounting format for free. Download now!

Download Free Trading Account Formats in Excel, Word, and PDF

What is a Trading Account Format?

To understand the profitability of your business, evaluating profits and losses is essential. It can be done through a professional trading account. A professional format for a trading account is prepared by accountants. It reflects the gross profit of an organisation for a financial year or specific period. A trading account proforma is an integral part of the accounting process.

With a trading account, you can have a broader look at – total purchases, total sales and direct expenses related to sales and purchases. There is also a mention of closing stock and opening stock for the year the statement is prepared. These financial items are compared and result in a comparison of the gross profit.

In accounting, when we say trading account, the visual figure that comes to our minds is a format or statement. As the name says, a trade account format is a pre-designed format of a trading account. It contains two sections, credit and debit, which will be filled with the required elements. Using a professional format for a trading account is the first step towards accurate gross profit calculation.

There are two ways to create a professional account format. The first is to manually create one. In manual creation, you must create a ṭrading account proforma in a spreadsheet yourself. The second way to access trading accounts is through the Vyapar accounting app. We suggest you choose the second approach of creating a format for a trading account.

Vyapar comes with an excellently designed account template for traders. You will find all the necessary columns already present in the format. We are not saying it’s not ideal to manually create a format for trade accounts. But why choose manual operation when you can create a more efficient format with an advanced accounting tool?

What Are The Contents Of A Trading Account Format?

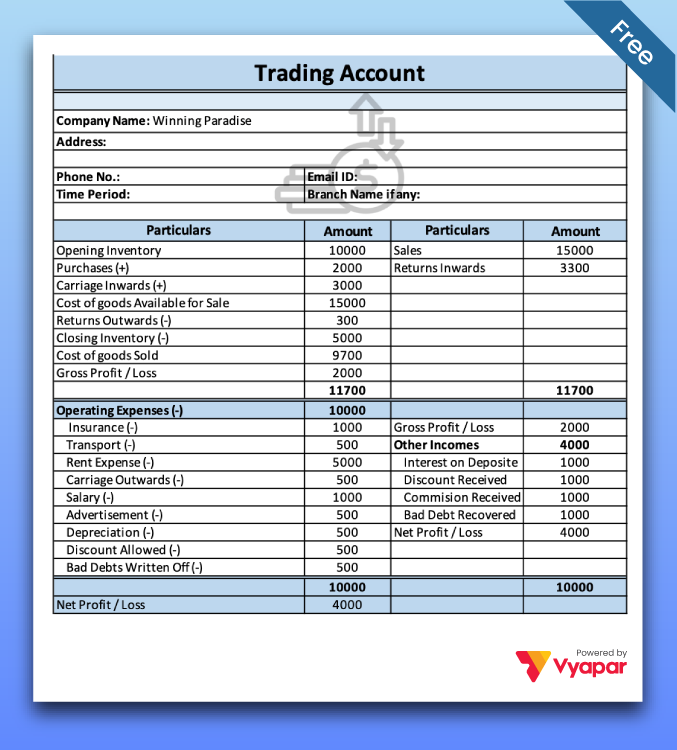

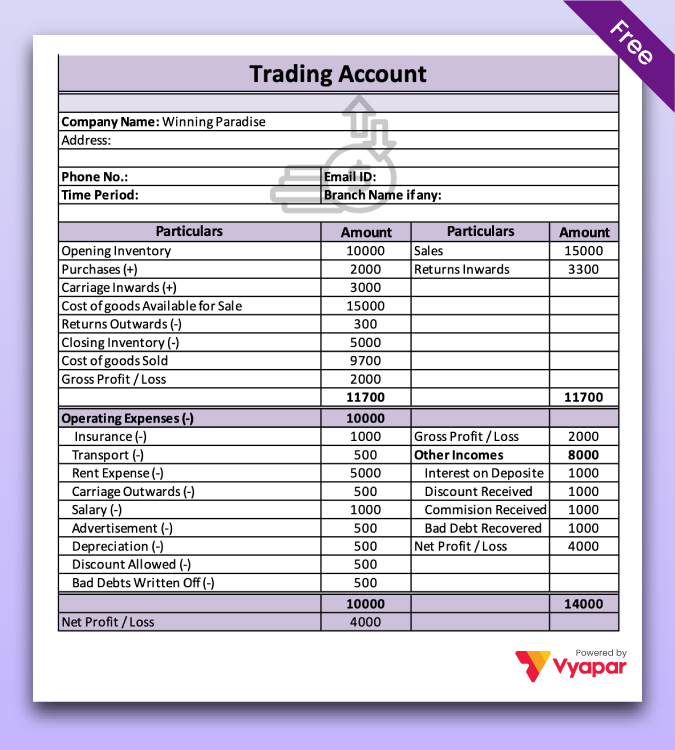

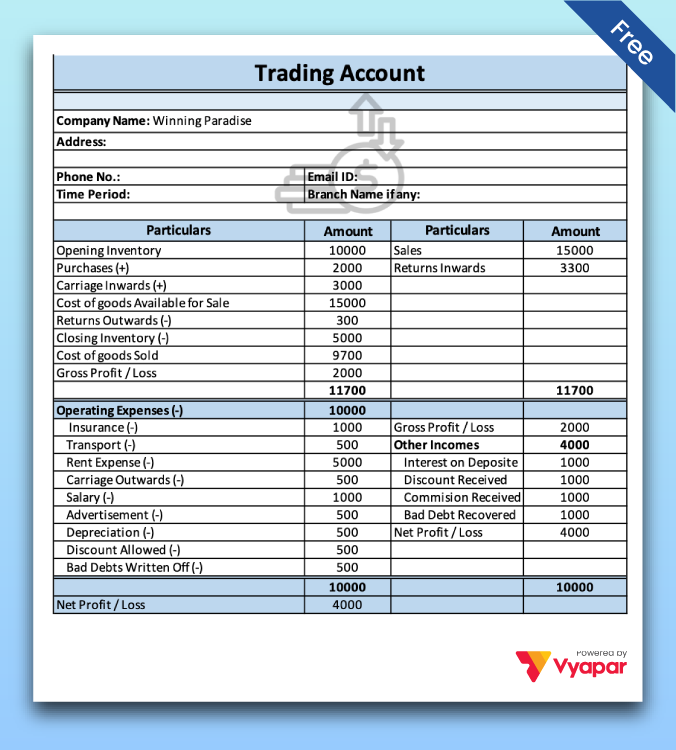

A format for a trading account is used for calculating a company’s gross profit. Multiple elements are required to calculate gross profit. Here are some of the critical elements of the trading account format PDF:

Opening Balance The opening balance refers to the value of equity and liabilities and is assessed at the beginning of a financial period. The amount opening balance comprises balances of multiple accounts. For example, cash account, accounts receivable, the value of stock in hand, etc. The opening balance is brought forward from last year’s closing balance.

Purchases: Purchases are an essential component of a trading account. It includes the total value of materials that are being purchased by a business for operating activities. The purchases are made from the cost of raw materials, inventory and finished goods purchased from manufacturers and suppliers.

Sales: The sales figure reflects the total value of services and products your business sells during an accounting period. To calculate gross profit, sales are equally important as purchases. Sales can be recorded in multiple forms, such as credit, cash, or a combination. Tracking sales helps assess your company’s revenue-generating capabilities.

Direct Expenses: Direct expenses are the costs directly connected with the production of your products or services. These expenses ensure the production process is smoothly done by fulfilling numerous production requirements. Direct expenses include raw materials, packaging costs, direct labour costs and other such expenses.

Indirect Expenses: As the name says, indirect expenses are indirectly relevant to your business process. Also known as overhead expenses, these costs aren’t directly linked to the production of your products. These expenses support the overall functioning of your business. For example, salaries, advertising expenses, insurance premiums, etc.

Closing Stock: Closing stops means the total amount or value of inventory or goods left unsold at the end of a financial year. So, in simple words, closing stock refers to products that are yet to be sold but are part of the inventory. It is important to include the closing stock figure in the account format for accurately calculating gross profit or loss.

Gross Profit/Loss: Gross profit or loss is calculated by subtracting the total product cost from sales revenue. The cost of goods sold is calculated through opening stocks, direct expenses and purchases. Gross profit means when there’s an excess of sales revenue over the cost of goods sold. Gross loss, on the other hand, is just the opposite of it.

Carriage Inwards/Outwards: Carriage refers to the cost that is incurred during the transportation of materials and goods into your business. Carriage inwards is the cost associated with the inward movement of materials. Carriage outwards, on the other hand, represents the cost of delivering the final product to customers. The inward and outward carriage is considered part of inventory production cost.

Importance Of Using Trading Account Format For Businesses

Trade account formats are a crucial element of accounting for every business, regardless of industry. However, businesses that are new to this format might experience a dilemma towards its usage. If you are confused about using it, here are key points that reflect its importance in a business.

Provides A Clear Overview Of Sales And Expenses

For every business, it’s important to clearly understand sales and expenses. But with so many transactions happening daily, tracking sales could become tough. That’s when a trading account format comes into play.

It offers a detailed overview of sales and expenses incurred during a financial year. In most cases, the need to evaluate sales and expenses comes into play during the tax filing process. So when the need arises, you can simply create a trade account format.

Using the format, you can understand sales in detail. It will help you file the right amount of tax. Moreover, you can also use it to prepare a budget for future expenses.

Assists In Analysing The Cost Of Goods Sold

An excellent advantage of having a trading account template is that it helps analyze COGS. COGS stands for the cost of goods sold. It refers to the costs associated with the product that your brand deals in.

The cost can be a combination of all the expenses such as raw material purchase, transportation, machinery cost, etc. The trading account format helps analyze these costs. By allowing accurate calculation of COGS, the trading account template helps businesses with inventory management.

In addition, it also helps with controlling the operating costs related to production. Moreover, the trade account format also facilitates the differentiation of operating and direct expenses.

Enables Comparison Of Financial Performance Over Time

Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years.

Using your financial data concisely, you can track and compare your – sales, profitability, and expenses across years, months, and quarters. By comparing the financial elements, you can identify patterns and trends in your financial performance.

For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. Simply put, if you want to compare your financial performance over time, the trading account format is what you need.

Helps Calculate Gross Profit Or Loss Accurately

Trading account format plays an important role in accurately calculating your company’s gross profit or loss. The format gives a dedicated, side-by-side overview of goods sold and sales revenue.

Accurate calculation of gross profit or gross loss, unable businesses to understand their financial performance in a better way. It makes it time efficient for you to determine gross profit or loss since every detail is present in one format.

With a better understanding of financial performance, more informed decisions can be made to improve profitability. In addition, it will be much easier to identify growth opportunities.

Helps In Determining Pricing Strategies

A trading account format offers exclusive insights into your company’s sales revenue and cost of goods sold. Both of these financial elements are necessary to calculate the gross profit.

Businesses can use this format to evaluate the effectiveness and impact of different pricing strategies on gross profit. You can access how promotional offers, discounts, or pricing changes affect your profitability.

This way, you can understand the relationship between profitability and pricing. The relationship analysis can be used for making informed decisions toward the optimal pricing of products and services.

Aids In Identifying Areas For Cost Reduction

The trading account template is an effective and powerful tool for identifying areas where cost reduction is possible. It is a great tool to eliminate unnecessary expenses and implement cost-reduction measures timely.

By analyzing the trading account and categorizing expenses, you can pinpoint particular expense categories that significantly contribute to the cost structure. You can analyze the reasons and create detailed reports.

This analysis will help you determine where you can concentrate your cost-reduction efforts. Simply put, the trading account format acts as a roadmap toward cost reduction. It helps businesses make informed decisions to optimize cost structure.

Benefits Of Using A Trading Account Format For Your Business

Provides A Clear Overview of Sales And Expenses

For every business, it’s important to clearly understand sales and expenses. But with so many transactions happening daily, tracking sales could become tough. That’s when a format for a trading account comes into play.

It offers a detailed overview of sales and expenses incurred during a financial year. In most cases, the need to evaluate sales and expenses comes into play during the tax filing process. So when the need arises, you can simply create the best format for a trading account.

Using the format, you can understand sales in detail. It will help you file the right amount of tax. Moreover, you can also use it to prepare a budget for future expenses.

Assists In Analysing The Cost of Goods Sold

An excellent advantage of having a professional account template is that it helps analyse COGS. COGS stands for the cost of goods sold. It refers to the costs associated with the product that your brand deals in.

The cost can be a combination of all the expenses such as raw material purchase, transportation, machinery cost, etc. The trading account format PDF helps analyse these costs. By allowing accurate calculation of COGS, the account template helps businesses with inventory management.

In addition, it also helps with controlling the operating costs related to production. Moreover, the trade account format also facilitates the differentiation of operating and direct expenses.

Enables Comparison of Financial Performance Over Time

Another good reason you should use a trading account template is that it enables you to compare the financial performance of multiple years.

Using your financial data concisely, you can track and compare your – sales, profitability and expenses across years, months and quarters. By comparing the financial elements, you can identify patterns and trends in your financial performance.

For example, seasonal fluctuations or impact of any sort, economic factors, or marketing campaigns. Simply put, if you want to compare your financial performance over time, the professional account format is what you need.

Helps Calculate Gross Profit or Loss Accurately

The free format for a trading account plays an important role in accurately calculating your company’s gross profit or loss. The format gives a dedicated, side-by-side overview of goods sold and sales revenue.

Accurate calculation of gross profit or gross loss, unable businesses to understand their financial performance in a better way. It makes it time-efficient for you to determine gross profit or loss since every detail is present in one format.

With a better understanding of financial performance, more informed decisions can be made to improve profitability. In addition, it will be much easier to identify growth opportunities.

Helps In Determining Pricing Strategies

A trade account format offers exclusive insights into your company’s sales revenue and cost of goods sold. Both of these financial elements are necessary to calculate the gross profit.

Businesses can use this format to evaluate the effectiveness and impact of different pricing strategies on gross profit. You can access how promotional offers, discounts, or pricing changes affect profitability.

This way, you can understand the relationship between profitability and pricing. The relationship analysis can be used for making informed decisions toward the optimal pricing of products and services.

Aids In Identifying Areas For Cost Reduction

The trading account format PDF is an effective and powerful tool for identifying areas where cost reduction is possible. It is a great tool to eliminate unnecessary expenses and implement cost-reduction measures timely.

By analysing the account and categorising expenses, you can pinpoint particular expense categories that significantly contribute to the cost structure. You can analyse the reasons and create detailed reports.

This analysis will help you determine where you can concentrate your cost-reduction efforts. Simply put, the trade format of trading accounts acts as a roadmap toward cost reduction. It helps businesses make informed decisions to optimise cost structure.

Why Choose Vyapar For a Trading Account?

Vyapar is India’s best accounting software for creating trade account formats. First of all, it’s the best, that’s one reason for using it. If that isn’t enough for you, here are more reasons for using the Vyapar trading account format:

User-Friendly Interface And Easy Navigation

Unlike most accounting apps, Vyapar has the best user interface in terms of visual appeal and user-friendliness. Vyapar offers an exclusive user-friendly interface that makes it easier for you to access the trade account format. It is designed with new users’ demand for easy-to-use apps in mind.

Moreover, there is a list of features that you can enjoy within the app. Despite offering an exclusive range of features, its navigation is super easy. It will hardly take a minute to navigate to the trade account format. The UI is designed to promote convenience and efficiency throughout the accounting process.

Advanced invoicing And Billing Capabilities

Vyapar offers the best trading account templates. You can find it on the Internet. But that is not the only best thing it offers. In addition to a user-friendly trading account PDF format, Vyapar offers advanced invoicing features. Invoicing is one of the most important and time-consuming processes for business.

Vyapar comes out to be an excellent tool that streamlines the invoicing process. This tool has excellent billing capabilities that make it easier to create and manage bills. When combined, advanced invoicing and dealing capabilities help us streamline the most complex part of accounting.

Comprehensive Features For Accurate Financial Tracking

Another good reason you should use Vyapar is that it offers financial tracking features. Every business needs to have proper tracking and monitoring tools. But to buy them separately could be a deal of loss. Luckily, Vyapar is a deal of profit. You get a wide range of comprehensive features all inside one dedicated platform.

These features, like financial monitoring, cash flow tracking, etc., will allow you to monitor your finances in real time. Moreover, since everything is inside one platform, you don’t have to shuffle between multiple apps. You can simply fulfil a variety of accounting needs through one Vyapar app.

Expense Tracking And Reporting

Expense tracking is one of the best features of the Vyapar accounting app. The trading account format you get in the app gives you a detailed overview of your expenses. During the income tax filing process, you can use it to understand your expenses better. However, the expense tracking feature can be helpful if you want to understand your expenses on any other day of the year.

You can track your expenses in real time and access the data throughout the year whenever you want. In addition to creating a trade account format, you can also create expense reports. The reports will be based on insights into real-time expense tracking and the data collected so far.

Customisable Trading Account Templates

The biggest and most common problem experienced by business owners is the permanency of templates. It makes no sense If you can’t customise your trading account templates. Thankfully, Vyapar has noticed this issue and has come up with an excellent solution. Vyapar offers expert-designed professional account format templates that are easy to use.

And the best part is that you can customise them however you want. The templates are highly customisable and come with various colour and design options. Therefore, if you don’t like the default template theme, you always have the option to change it to a better one.

Automatic Calculation Of Profits, Losses, And Taxes

Automation is one of the key features that you will notice in the Vyapar accounting app. With this tool, you won’t have to worry about manually calculating anything. The software offers automatic calculation of profit losses and taxes. It saves you a lot of time, which you can use for any other task that deserves more importance.

Moreover, since the calculation is automated, the chances of human errors are reduced. This way, the whole accounting process becomes accurate and error-free. Moreover, if your records are accurate, you won’t find issues calculating balance sheets or statements like trade account format.

Frequently Asked Questions

A trading account is a statement that contains financial elements like sales, revenue, closing stock, etc. To better understand trade accounts, scroll up to the first topic above.

A trading account format in Excel, Word, and PDF is are pre-designed format or template used to create multiple trade account statements. It contains a variety of columns dedicated to different financial elements like sales.

The trade account format is a totally different statement compared to a profit and loss account statement. In a trading account, we compare not just profit and losses but also expenses and sales. In a profit and loss account, however, transactions related to profit and losses are shown.

Yes, Vyapar is a free accounting app. You can access the trading account format for absolutely free. Do not underestimate Vyapar’s capabilities, despite it being a free tool.

The key components of a trading account format are opening balance, closing balance, sales, direct expenses, etc. To have a detailed look at these components, scroll back to the top.