Receipt Book Format

Use accounting software to create your processional-looking receipt book format. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all receipt formats for free.

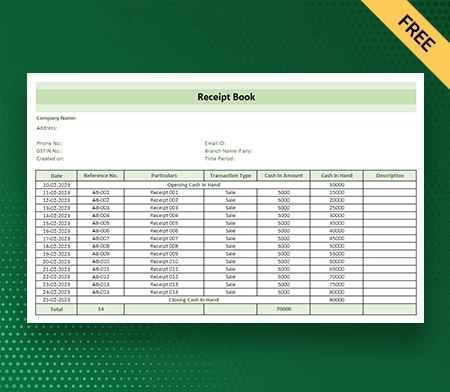

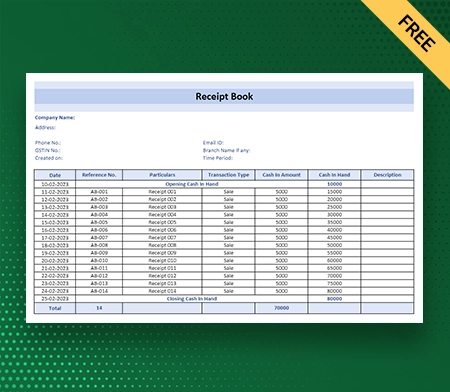

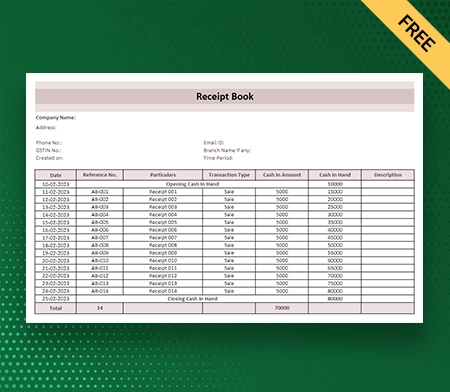

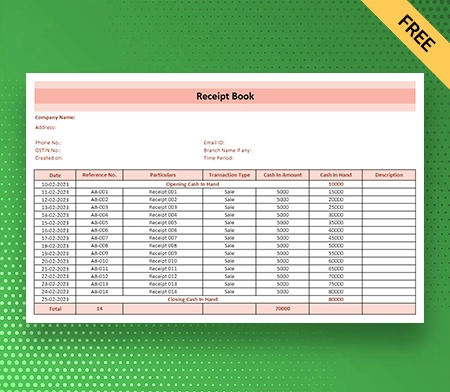

Download Receipt Book Format in Excel

Download Receipt Book Format in PDF

Download Receipt Book Format in Word

Download Receipt Book Format in Google Docs

Download Receipt Book Format in Google Sheets

What is the Receipt Book Format?

A receipt book format is used to record financial transactions and notify customers by giving them receipts. It usually accommodates details like the date of the transaction, receiver name, a detailed list of the goods or services paid for, the amount, the price, and the total amount paid.

The receipt book format ensures everything is the same and gives important information for keeping records and doing accounts. Businesses, organizations, and people often use receipt books to keep track of deals and show that money has been paid.

Types Of Receipt Book Format

Here are the following types of receipt books:

1: Carbon Copy Receipt Books

Traditional carbon copy receipt books are made of paper and can make two or three copies of a receipt when it is written in. They are made of several layers of paper, with the original receipt on the top layer and carbon copies on the other levels.

While you write on the top layer and press down, the carbon paper moves the writing to the copies underneath. It allows businesses to keep track of sales and gives customers a copy of the receipt for their records.

2: Electronic Receipt Books

An electronic receipt book is a digital version of a standard receipt book earlier made of paper. It is done by using programmes or billing software that allows businesses to create and send receipts electronically. Electronic receipts are made, saved, and sent digitally instead of printed on paper. They can be saved in a digital database or sent by email or text.

Electronic receipt books are easy to use, save time, and use less or no paper. They often have features like automatic numbering, customizable receipt book templates, and integration with accounting systems, making it easier for businesses to handle and track their transactions electronically.

3: Customised Receipt Book

The term customized receipt book refers to a receipt book tailored to a company or organization’s particular requirements and branding. It enables businesses to customize their receipt book format by adding their logo, company name, contact information, and other pertinent information. Receipt books can be designed with specific fields or sections to record additional information required for the distinct transactions of a business.

They offer a professional and unified appearance, reinforce brand identity, and can be utilized as a marketing tool by including promotional messages or special offers. Customized receipt diaries help businesses maintain a consistent and professional image while documenting their transactions.

Benefits Of Using Book Receipt Format

Here are the following benefits that come with using the book receipt format:

1: Accurate Record-Keeping

Receipt books provide a regular and organized method of recording financial transactions, ensuring accurate documentation of purchases, sales, and payments. By offering pre-defined details and formats, they help businesses to preserve consistency and accuracy in capturing crucial elements such as date, recipient information, itemized descriptions, quantities, prices, and total amounts.

This method reduces errors, promotes effective record-keeping, and simplifies financial reconciliation. Receipt books help firms keep dependable and accurate records of their financial activities by streamlining the process of capturing and tracking transactions.

2: Proof Of Purchase

The receipts book format is used as tangible proof of payment. They are important proof of purchase that allows customers to use their rights for returns, swaps, or claims about warranties. They include details like the date, items bought, prices, and way of payment. If there is any legal disagreement, it can also be beneficial.

This written proof makes the return and swap process go more smoothly and helps warranty claims because it shows that the customer bought the product or service from the business. Receipts give customers peace of mind and safety when they buy goods or services.

3: Legal Protection

When there is a legal disagreement or an audit, the receipt can be used as a clear transaction record. When there is a dispute or a legal problem, both the business and the customer can use the receipt as valuable proof to back up their claims. They set the terms, details, and agreed-upon price of the trade.

It helps settle disagreements and gives an unbiased account of the deal. Receipts protect both parties in a business transaction by ensuring transparency and accountability. They can be essential in legal processes or financial audits to prove the transaction was real and accurate.

4: Helps in Financial Management

Receipt books format are crucial for businesses because they help them to keep track of their income and spending. It also makes it easier to reconcile accounts, make financial statements, and manage budgets well. Receipt books help keep correct books by keeping track of all financial transactions, including both money coming in and money going out.

It allows businesses to monitor their finances, look for patterns, and make good choices based on accurate data. Receipt books make it easier to keep track of money, plan, and budget better, and ensure that the business is financially stable and successful.

5: Helps With Tax Compliance

Receipt book formats are essential for businesses when filing taxes correctly. Tax filings serve as essential documentation that enables businesses to claim deductions and substantiate expenses. Receipts serve as proof of expenses incurred and validate the legitimacy of asserted deductions, ensuring compliance with tax regulations.

With receipts, businesses may be able to justify their expenses and run the risk of having deductions disallowed or being audited. By keeping accurate receipts, businesses can confidently and accurately report their income and expenses, bolstering the accuracy and reliability of their tax returns.

6: Better Customer Service

Providing customers with receipts demonstrates professionalism and contributes to superior customer service by promoting transactional transparency and accountability. Receipts are physical evidence of a completed transaction, giving clients a record of their purchase. This transparency reassures customers and inspires confidence in the company.

In addition, receipt books provide customers with a convenient reference for tracking expenses, reconciling accounts, and making returns and exchanges. By providing receipts, businesses demonstrate their dedication to customer satisfaction, enhance their credibility, and cultivate positive client relationships.

7: Enhanced Cash Flow Management

Receipt book formats are essential for keeping track of cash flow because they properly record payments received. They keep a record of all payments that come in, so businesses can keep track of and handle their income streams well.

By writing down payments in receipt books regularly, businesses can track when and how much money they get. It helps them understand their cash flows and keep accurate financial records. Businesses can keep track of their cash flow and general financial stability with the help of receipt books.

8: Better Inventory Management

The Receipt Book Format is a valuable source of data regarding the sold products or services, allowing businesses to track inventory levels, monitor sales trends, and plan restocking. By analyzing receipt details such as item descriptions, quantities, and prices, businesses can determine which products are in demand and establish sales patterns.

This information assists in optimizing inventory management by ensuring adequate stock levels to meet customer demand while minimizing excess inventory. Receipts allow businesses to make data-driven decisions regarding inventory acquisition, pricing strategies, and product assortment, resulting in more efficient operations and increased profitability.

Steps To Prepare Professional-Looking Receipt Book Format

Here are the following steps you should follow to create a professional-looking receipt book format:

Step 1: Determine The Required Information

It would be best to determine what information must be printed on each receipt book format. Include your company’s name and logo, a contact number and email address, the transaction date, a detailed account of the services rendered, the total price, taxes, the method of payment accepted, and any other applicable terms and disclaimers.

Step 2: Design The Layout

Use software like Vyapar for a clear and well-organized format for your receipt book. Make a template for a receipt with uniform spacing, font size, and style that is easy to read. A format that is easy to read and looks professional makes it easier for customers to understand and remember transaction information. Make sure to find a good mix between a design that looks good and one that makes it easy to see important details.

Step 3: Incorporate Branding Elements

While creating the professional receipt book format, you should include details like the business’s name, image, and contact information on the receipt to reinforce your brand and make it easier for customers to find you. Put these logos near the top or bottom of the ticket where they will be seen. This makes it easy for people to connect the receipt with your business and get in touch with you if they need to. Putting the same logo on all your papers gives your business a professional look and helps people remember your brand.

Step 4: Add Sequential Receipt Number

Assigning specific receipt numbers to each receipt in consecutive order helps record-keeping and transaction tracking. The receipt number should be prominently displayed on the receipt, preferably near the top or in the header area. This makes it simple to refer to and retrieve specific transactions as needed. Sequential numbering improves speed and accuracy in financial tracking and analysis by simplifying the organization and ensuring a systematic approach to managing receipts.

Step 5: Include Payment Details

While finalizing your receipt book format, you should remember to include the payment details, such as whether you are paid by credit card, cheque, or online payment. You should also include the cost associated with the transaction and applicable taxes.

Step 6: Review And Print

Before finalizing, double-check your receipt book format to ensure all relevant information is included and everything is correct, as it might not be good for your business image. Make any necessary changes. Finally, to give the receipt book a professional appearance, print it on high-quality paper.

Feature Of Vyapar App That Helps Manage Your Cash

Flow And Receipts

1: Manage Your Business Cash Flow Seamlessly

Vyapar’s free accounting software assists businesses in managing their cash flow more efficiently. It is done to keep accounts on the right track. If you buy this accounting program, it will be simple and easy to keep track of your business’s cash flow and help prevent it from going wrong. This software has everything you need to handle online and offline transfers.

It has benefits like being able to track bank withdrawals and deposits on the Vyapar business dashboard. It can help a business to save money by automating repetitive tasks and adding all the information about costs, payments, purchases, and other things. With Vyapar billing software, it’s easy to keep track of cash.

The daybook that comes with this solution is a bonus for businesses. With this free program, you don’t have to enter data manually. Using our accounting tool gives you a better way to keep track of the money in your account. You can add and manage multiple bank accounts for efficient transactions.

2: Track Your Inventory On A Smartphone

No one wants to overstock and understock products and services in their inventory. You can use our free tools and features to keep track of your inventory, which can assist your business platform to manage your inventory more efficiently. By looking at the sales records, you can plan for trends and what you want to buy next right before supplies run out.

With the free accounting software from Vyapar, you will have everything you need to manage your inventory well. When you get new goods, your employee can use our software to update and keep track of the list. Also, you can decide the size of each store’s stock by carefully looking at each store’s sales record.

Our accounting software lets you detect shoplifting as your store’s inventory is reduced as items are sold. Using our inventory system, periodic reviews can help detect inventory discrepancies. You can consult your security cameras as soon as you realise that some things are missing.

3: Cash And Bank Management

Vyapar is an all-in-one solution for effective cash and bank management. With inventory management software Vyapar, you can effortlessly manage cash-to-bank and bank-to-cash transfers, allowing for the rapid transfer of funds between your cash register and bank accounts. The platform also simplifies inter-account transactions by facilitating bank-to-bank amount transfers.

In addition, Vyapar facilitates the modification of cash and bank balances, facilitating the accurate monitoring and reconciliation of your financial records. Vyapar simplifies the recording and tracking of cheque transactions, thereby streamlining cheque management. Within the system, you can manage deposits and withdrawals and check the clearing status efficiently.

In addition, the platform facilitates loan account administration by providing tools for recording loan information, monitoring payments, and generating loan statements for streamlined financial tracking. Vyapar provides businesses with robust cash and bank administration capabilities, a user-friendly interface, and a variety of features that optimize financial operations.

4: Data Safety And Security

The Vyapar accounting software prioritizes safety and security to safeguard sensitive data. It provides several essential security features to protect your data. The software offers an automatic backup function that transfers your data to Google Drive, thereby minimizing the risk of data loss.

In addition, you can perform manual transfers to Google Drive, local drives, or even email, providing an additional layer of data protection. Vyapar permits transaction-level passcodes for editing and deleting transactions, ensuring that only authorized users can make adjustments.

Vyapar software provides a passcode to access the software, preventing unauthorized access to your financial information. With Vyapar, you can have confidence that your data is securely stored and safeguarded, allowing you to focus on your business without worry.

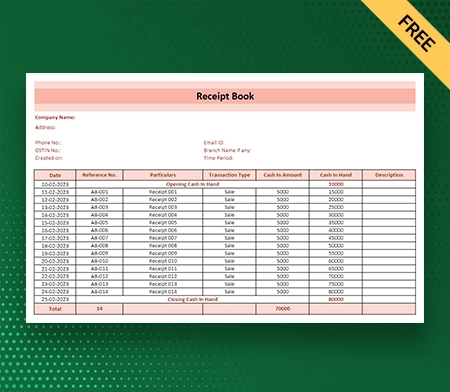

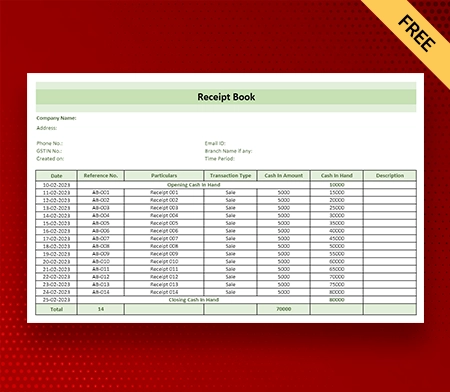

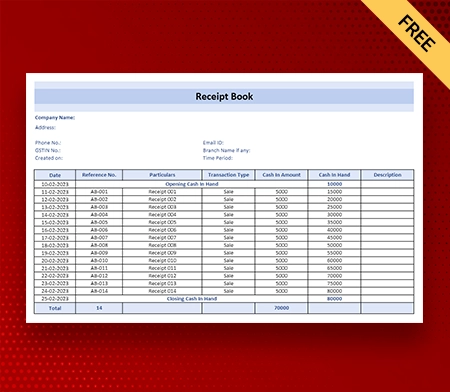

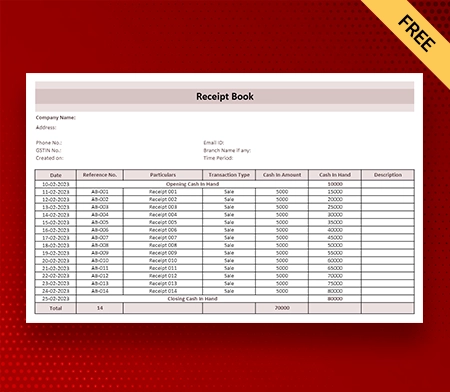

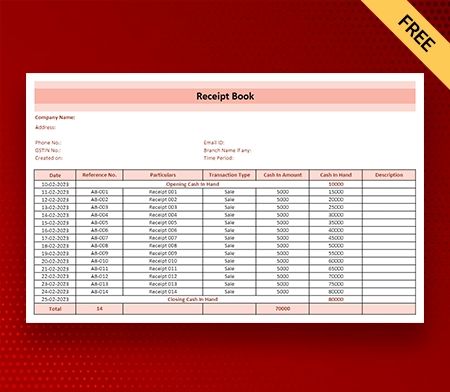

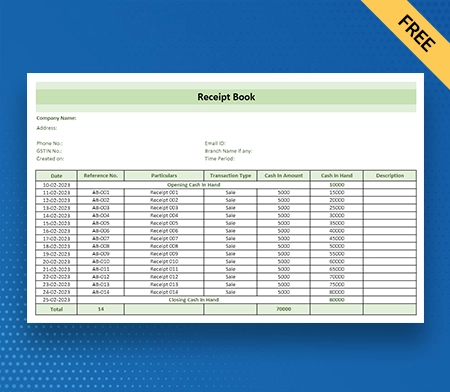

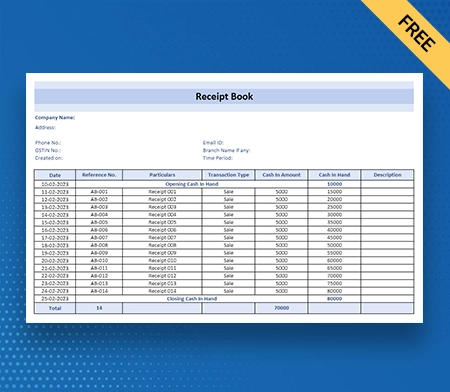

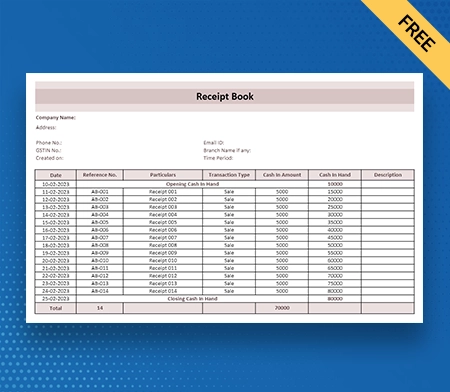

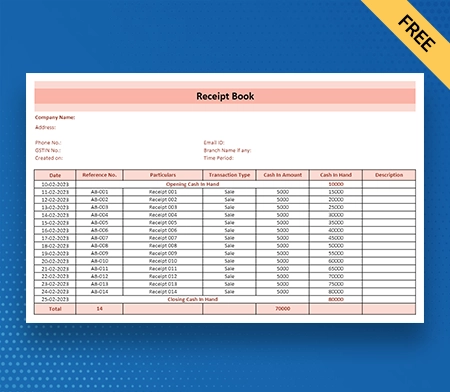

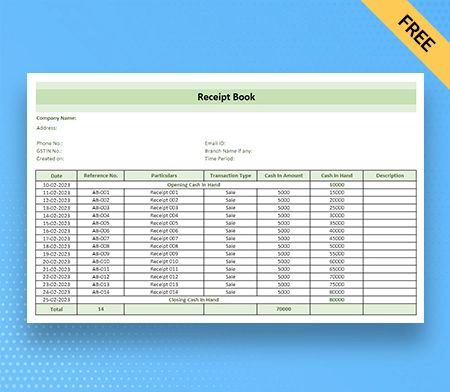

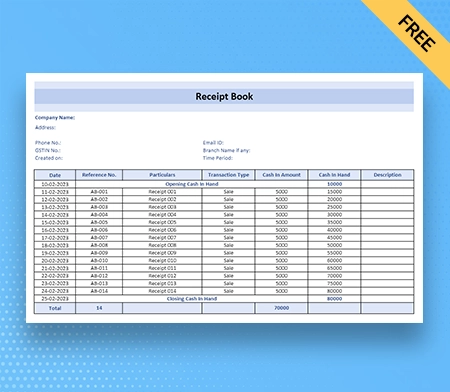

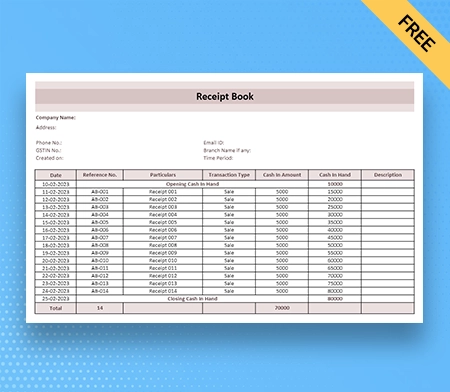

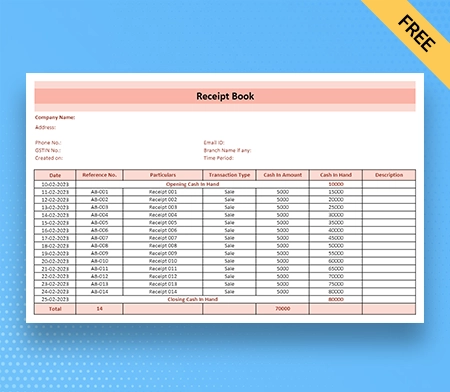

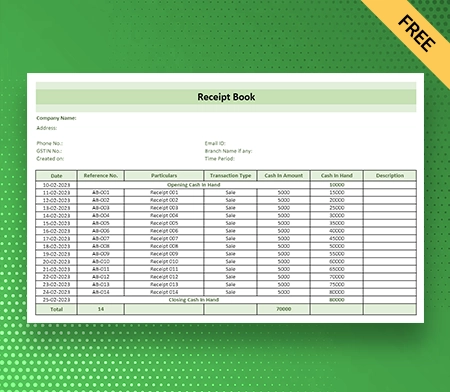

5: Choose Various Themes For Receipt Book

Maintaining and sharing professional receipt books with your clients can enhance your brand’s identity. Vyapar accounting App includes two thermal printer invoices and receipt book templates. In addition, there are twelve invoice templates for standard printers.

This accounting software can rapidly enhance your receipt book format appearance. Utilizing available personalization options is effortless. You can prepare the receipt book for your client with precision. Generated business invoices are more likely to impress a prospect. You can prepare your receipt book in different formats such as docs, PDF, Word, and Excel.

This accounting app is an optimal choice for your accounting inventory. Choose the most appropriate receipt book format for your business needs. Most companies utilize our free accounting software to present a professional image. It is an ideal method for constructing a favorable brand image.

6: Tax And Discounts

Using the sophisticated functionality of the Vyapar software, you can monitor the status of each bill’s payment. Vyapar aids in establishing invoice due dates, ensuring that your business maintains a healthy and steady cash flow and saves money by automating tasks. It offers alternative tax and discount options based on the item or transaction. The contract can also be entered into our sophisticated accounting software.

The Vyapar software permits the addition or modification of tax groups and rates. Our accounting software allows you to manage discounts effectively. It will enable you to accept/make partial and complete payments based on the requirements of your business. Our accounting software permits the administration of loans and payments.

It features an intuitive user interface and automates repetitive business processes in your organization. Vyapar provides over 40+ reports to its consumers. Our accounting instrument enables you to perform various tasks without incurring additional fees.

Frequently Asked Questions (FAQs’)

The receipt book format is a structured layout for recording and issuing receipts. Specific fields include date, consumer information, item description, quantity, cost, and total amount. The format ensures uniformity and clarity in the documentation of financial transactions and functions as proof of payment for businesses and customers.

The receipt book format is essential because it facilitates the accurate recording of financial transactions. It provides a standard format for documenting transactions and payments, ensuring uniformity and clarity. The format enables businesses to maintain organised records, facilitates the tracking of transactions, and provides consumers with reliable proof of purchase. Moreover, it facilitates financial analysis, reconciliation, and tax compliance.

Electronic receipts, also known as e-receipts, can replace conventional receipt book formats. With digital payment methods and point-of-sale systems, companies can generate and send electronic receipts via email or text. E-receipts offer customer convenience, reduce paper consumption, and facilitate record-keeping through digital platforms or software.

You can use Vyapar software to customise your receipt book format for free. Vyapar software comes for free to Android users. You can customise your receipt book with different colours and formats on Vyapar per your business preference. You can also use our software on your Windows or Macbook devices after paying a small subscription fee.