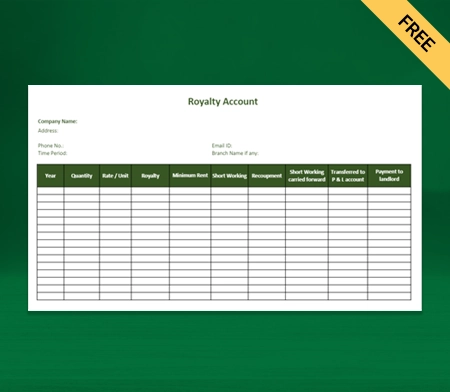

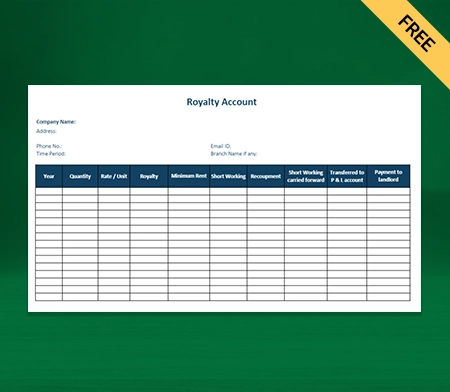

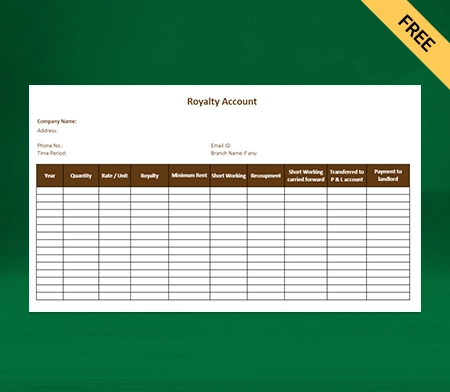

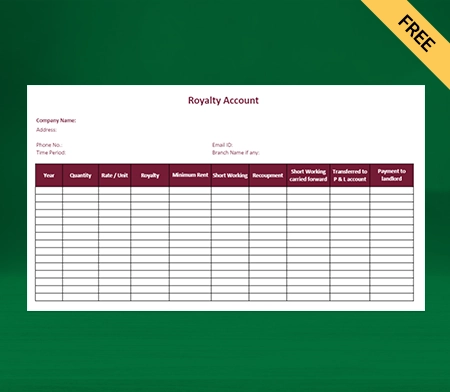

Royalty Account Format

Vyapar is the solution for managing all your copyrights, patent royalties, mining royalties, etc. The accounting app Vyapar aims to help make your daily routine more focused on your core business. Use the custom pre-designed royalty account format now. Try out the free trial for 7 days!

Download Royalty Account Format in Excel

What is Royalty Accounting?

Royalty is a payment a user must make while using someone’s asset. For instance, If your firm cannot buy a particular machinery and prefers to take it on rent, then you have to pay some rent for it. This rent and maintenance are known as royalty.

The royalty account format helps calculate the periodic payment that the user has to make for using the asset to its owner. In simpler words, the owner/author of any asset, such as a mine, building, or machinery, may allow other parties to use their assets and pay them money (royalty) for it. Therefore, this payment made by the user to the owner is known as a royalty.

Parties Added In Royalty Account Format

Lessor:

The easiest synonym to define lessor is the landlord. Yes, a lessor is a person who owns an asset and provides the asset to a third person/party for using the rights to use his assets. If we talk about simple examples, then the owner of the mine, the author of a book, the painter who owns the particular art piece and other owners of particular assets are known as lessors.

Lessee:

Lessee is the third party (parties in royalties accounting) or the person who takes the asset on rent and makes all the payments of royalty for it. Simple examples are book publishers, miners, builders and so on.

Different Types Of Royalties In Royalty Account Format

Some common types of royalties in royalty account format are listed below:

Copyrights:

Copyright is the assignable legal right given to the author or owner of the asset, like a book, painting, music, mine etc., to get a royalty from the publisher. Thus, the owners get the royalty from the publishers based on the sales.

Patent Royalty:

The agreement is made to patent or fix the royalty to be paid according to the number of produced items.

Mining Royalty:

Mining royalty refers to the user or lessee paying the owner or lessee based on production. Thus, in this case of copyright, the publisher is entitled to pay a royalty to the owner.

For instance, if someone is publishing a particular book by author ABC, then the publisher has to pay a royalty based on the number of items sold by the publisher. Whereas, in the case of mining, the royalty is received by the mine owner based on the number of items produced by the user.

Important Terms Used In Royalty Accounting

Royalty is received by business/asset owners who sell their assets or creation to a third party. Royalty could be known as rent (if we look for its closest synonym. But in this, terms and conditions vary depending upon different assets.

Though the person using the asset is liable to pay consideration to the owner for using their asset, it could be in any case whether someone is acquiring it in the form of property for rent, publishing a biography or novel and many more.

Thus various important terms should be used in Royalty accounting format. Here we have discussed a few of them:

1. Minimum Rent To Be Paid:

We know that the lessor enters into a contract or an agreement with the lessee for payment that is supposed to be done to the lessee. This royalty (pay) depends entirely on the quantity of goods or quantum of goods sold. The royalty account format makes it easier to understand the minimum due.

No doubt, we have all learned during the depression period (such as COVID-19) that any firm can face little or null production. In such cases, the quantity of goods produced could be lower than a firm’s actual production. The lessor would receive low or sometimes no royalty, directly impacting the lessor’s royalty income.

In simpler words, It does matter whether you produce goods because, as a lessor, you would not be at a loss if you receive no royalty from the lessee, who is not using the asset but still has it. The only way to get away from this situation is for the lessee to pay a minimum amount of royalty to the lessor (some amount is to be paid to the lessor), no matter what product the lessee uses or produces.

To get rid of such a situation, the lessor requires a particular amount of payment to be paid by the lessee, irrespective of the number of goods produced or sold by the lessee. This guaranteed security of minimum rent to be paid by the lessee is e known as minimum rent. Minimum rent must be discussed while agreeing with the lessee to keep the terms and conditions clear.

This particular term is added to the contract as “interest of the landlord,” which assures that the minimum rent is to be paid even in the condition of low sales or high sales. Therefore, the lessee pays minimum rent or the actual royalty amount, no matter what the condition is.

It is also known as fixed rent or dead rent because the minimum rent amount is fixed. This would depend highly on the terms and conditions discussed before.

For instance:

- The production of a firm is 3,000 tons.

- The royalty that the lessee pays is Rs 90 per ton.

- The fixed rent/minimum rent in the agreement is Rs 4 lakhs.

So as per production, the actual royalty to be paid is Rs 2,70,000 lakhs. Since we know that the actual royalty is less than the fixed rent, the lessee pays royalty or the minimum rent of 4 lakhs to the lessor.

2. Redeemable Dead Rent or Short Working:

Short working or Redeemable dead rent refers to a condition where the minimum rent exceeds the actual royalty. In simpler words, short working is the difference between minimum rent and actual royalty. The royalty account format help capture that seamlessly to avoid confusion.

For example: In the agreement, the lessee is supposed to pay Rs 5 lakhs as the minimum rent, whereas the lessee otherwise has to pay Rs 100 for every ton of production. Now let’s suppose that the lessee has produced 4,000 tons, and the royalty that comes out is 4000(actual production) * 100 (royalty cost per ton) = Rs 4,00,000 Lakhs.

In this situation, you can wonder that the actual royalty to be paid is Rs 4,00,000 lakhs according to the production, which is less than the minimum rent of Rs 5,00,000 lakhs. This difference between the actual royalty to be paid and the minimum rent decided in the agreement is known as short working.

3. Excess Working:

Excess working is a condition where the minimum rent is lower than the actual rent. Using the royalty account format, you can make the calculations automated, helping you save time and effort.

For instance, the minimum rent should be Rs 5,00,000 lakhs and Rs 100 per ton in the normal production phase. Let’s consider that the firm produced 8,000 tons in a periodic phase. Let’s calculate its royalty cost:

8,000 (total production) * 100 (royalty cost) = Rs 8,00,000 Lakhs

Excess Working: 8 Lakhs – 5 lakhs = 3 lakhs

This amount that exceeds the minimum rent is known as the excess amount.

4. Recoupment Of Short Workings:

“Recoupment of short working” gives us the idea that something compensates for the short workings. Now that we know what short working is and the process of excess royalty, it’s easier for us to understand the recoupment of short working.

Generally, the agreement of royalty account format held between the lessor and the lessee provides provision. The provision provides to carry ahead the short workings to adjust the same.

Thus, Short workings are being adjusted against the excess royalty amount during these years. Adjusting the short working capital is called the recoupment of short workings. Therefore, a particular period is fixed in the agreement, according to which the number of years is fixed between the lessor and the lessee, during which the short workings could be recovered or recouped.

In simpler words, the clause of recoupment in royalty account format provides the right to the comfort to the lessee to overcome excess payment made by him to the lessor for complying against the minimum rent of previous years. In various cases where lessees cannot recover the short workings within the fixed period, the short working is then debited to the P&L Account for when the recoupment lapses.

For instance: If in the agreement of the royalty account period, it is written that the lessee can take a year to pay back the short workings within two years, then it is the comfort and responsibility to recoup the short workings within this time phase. If the lessee can not pay, this short work will be added to the debit section of the P&L Account.

Fixed Right

Fixed right refers to the condition in which the lessee can recover short working from the lessor within a fixed period that begins with the asset’s lease date.

For instance: If the fixed right mentions that the lessee can recover short working from the lessor within a particular period. That period starts from the date of the lease. If the lessee fails to process this, the recoupment lapses or ends.

Fluctuating Right

In fluctuating rights, the lessee has the liberty to recover the short workings for any period during the upcoming time period. For example, A firm with shortcomings in 2020 could comfortably recover it in the upcoming year of 2023 or ahead.

Benefits Of Choosing The Vyapar App For Creating Royalty Account Formats

We have received over one crore+ happy customers with a high rating of 4.7 out of 5. We came up with the idea of Vyapar to make it accessible and easy for multiple users on their devices. Here we have mentioned multiple benefits of using free billing software Vyapar:

Provides Quotations and Estimates:

Using the royalty account format of Vyapar, you can easily create useful documents such as quotations, journal entries, estimates and accurate royalty bills. You can easily send the information via WhatsApp, email, SMS, or printing.

Vyapar has a standard look with professional features that provide instant estimates and quotes. This app ensures that your professional account format is error-free. With this, you can also seamlessly add a due date for paying or receiving a royalty.

To simplify this process, you can prefer the Vyapar app, which can be done in a few clicks. Vyapar helps you to save time and money by hiring a different accountant to handle all this.

Receivables and Payables Royalties:

This professional app helps to keep all the transaction details that must be noted in the cash flow of the account seamless. This provides a better way to keep your accounts safe and maintained properly.

Free GST invoicing adds up to track party-wise royalty receivables and payables. Using the royalty account format, you can easily track the money or royalty that you have to pay the lessor and receive as a lessee.

You can also keep a note of people who still need to pay the royalty. You can also send reminders for them and yourself via WhatsApp, SMS, and email. Furthermore, it helps you to keep an overall track of your accounts.

Advanced Invoicing And Billing Capabilities:

You can undoubtedly enjoy the best royalty account format with the Vyapar app. Our royalty accounting app offers advanced invoicing and accounting solutions. Accounting and invoicing take a lot of time for a firm, but Vyapar free invoicing software has made it easier for its users.

Over one crore people found Vyapar the most convenient and trustworthy platform to perform and keep their accounting safe. Vyapar has unique billing capabilities in which you can also set themes and reminders for payment.

Fully Customisable Professional Themes:

Vyapar royalty account format provides various themes for your professional invoices with your clients, which could improve your brand’s identity. Vyapar consists of twelve invoicing and accounting themes for regular printers, whereas two are for thermal printers.

With the help of this billing software, you can improve the look of your printouts by using attractive customized options that can be used seamlessly. You can easily create the invoice for your clients with just a click which would make your client feel more professional and neat.

User-Friendly Interface And Easy Navigation:

Inventory Software Vyapar is the best user-friendly having the best visual appeal and easy-to-use features. Vyapar offers easy access to the royalty account format, which is highly user-friendly. It is exclusively designed so that it can be made easier for people who do not even know how to use it.

Keeping it all aside, there are many features that you can use within this app. The royalty accounting app provides easy usage with attractive features. You can get all this within this app only by making invoices or generating bills, or filing GST. It will take just a click to get your royalty account format checked.

Comprehensive Features For Accurate Royalty Tracking:

One of the reasons behind people using Vyapar is its tracking features. Every business needs to keep an eye on each and every activity of their business, and here comes the role of 24/7 tracking availability by the Vyapar app.

Vyapar helps the lessor to keep track of its royalty that is to be received by the lessee within the due date. The same goes for the lessee; he/she can keep track of when they are supposed to pay the minimum rent or royalty to the lessor.

Lifetime Free Primary Usage:

Vyapar royalty account format helps manage the billing and accounting software with which you can easily create custom royalty invoices. Not only this, but you can conveniently manage your dashboard and track inventory items.

We assure you of the best quality service. It leads over one crore businesses in India and allows users to enjoy its accounting app for free. And whenever the business owner feels they can subscribe and enjoy the premium features.

Seamless Business Management:

Vyapar royalty account format helps you to manage your everyday business operations seamlessly with completely customizable formats. Further, using the Vyapar app, you can access other features like cost accounting, GST billing, and quotations also help build your business.

With an updated world, this app lets you easily share your data with your client. Yes, by this, you can share your data on WhatsApp or email without using your laptop, which ultimately saves you time and effort in managing data. We ensure that this app provides professionalism and transparency to meet their trust.

Automatic Backup Of Data:

Royalty accounting software helps to secure 100% of data and can easily be stored. This app provides proper data security by online google drive or by creating local backups.

You can easily use royalty accounting software and other accounting software to secure your data accurately. The data is saved with added security, and the Vyapar app is advanced free accounting and invoicing software. The Vyapar accounting app in India brings hassle-free backup and accounting software with auto-backup features.

Vyapar royalty billing software in India has a hassle-free backup system with the “auto-backup” feature. With automatic backup on the Vyapar app, you can rely on the best accounting app to secure all your data with backups, so you would not lose anything.

Easy Printing Facility:

Whether you need your billing to be done in bill format or Excel format, this free billing software helps you to find the best compatible way with which thermal and regular can be done within a few minutes.

Vyapar software for royalty, invoicing, accounting, and GST billing helps you print your invoices and bills easily. Now you have various options to choose size and sheet (such as A4 & A5, thermal paper 2 & 3, and other customized paper options.

All you need to do is connect your regular or thermal printer via Bluetooth or plug-in to start the process of printing. You can use the Vyapar app to create and send royalty bills and invoices to your customers. It also helps to send payment reminders to the lessor and the lessee. All this could be done by printout or digital mode.

Frequently Asked Questions (FAQs’)

Various people need to learn what royalty is in accounting. It basically refers to the payment or rent paid to the owner of an asset like property, machinery, and so on. Royalty account format helps any individual who is not actually the asset’s owner, like property, mine, machinery, etc., to use it in exchange for a royalty.

There are various important and common types of royalties, such as patent royalties, book royalties, performance royalties, franchise royalties, and mineral royalties. Royalty account format can help track and manage royalty effortlessly.

1. Book royalties: Publishers pay this royalty to the owner depending upon the sales quantity. Generally, for every book sold, the owner will get an agreed amount for it.

2. Performance royalties: The fees paid to the music owner when the music is being performed.

3. Patent royalties: Owners fix the amount and condition of the product. On this condition of the owner, if a third party wants to use the same product with the same condition by signing it down on a licensing agreement.

Royalty is a payment that a user is obligated to make while using someone’s asset. It is most commonly used for using a brand name or using airing rights of digital content. For example, If your firm cannot buy a particular machinery and prefers to take it on rent, then you have to pay some rent for it. This rent and maintenance are known as royalty in such cases.

The main advantages of Royalty accounts are:

It helps ascertain the actual cost of production because the royalties paid on production are a direct expense. Royalty accounts help in knowing the tax amount to be deducted before the lessee pays the royalty.

Royalties based on output should be debited to Manufacturing or Production Account. In contrast, royalties based on sales are treated as selling expenses and should be debited to a Trading Account or Profit and Loss Account. Royalty account format can make it easier to manage royalty.

The person making payments or paying rent to the owner is referred to as the lessee, while that person who is the owner of the asset is known as the lessor. Remember that royalty is an expense of a business paid out. It is transferred to a profit or loss account. You can use professional royalty account formats to make transactions effortless and reduce manual calculation errors.