RCM Invoice Format

Use our RCM invoice formats to create reverse charge invoices, send them online, and manage your business effortlessly. Download the Vyapar App and get a 7-day free trial now!

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Free Professional RCM Invoice Formats

Download professional free RCM invoice formats, and make customization according to your requirements at zero cost.

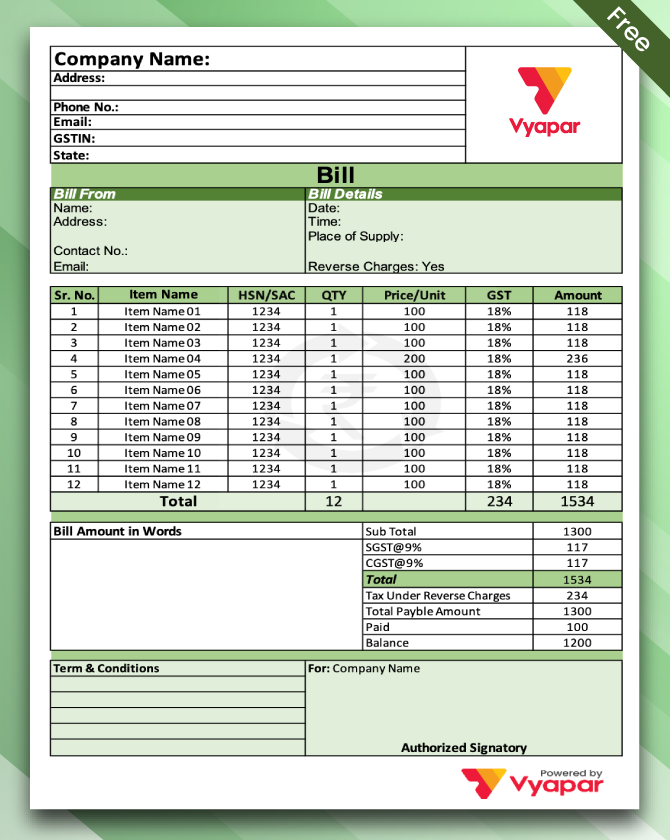

RCM Invoice Format – 1

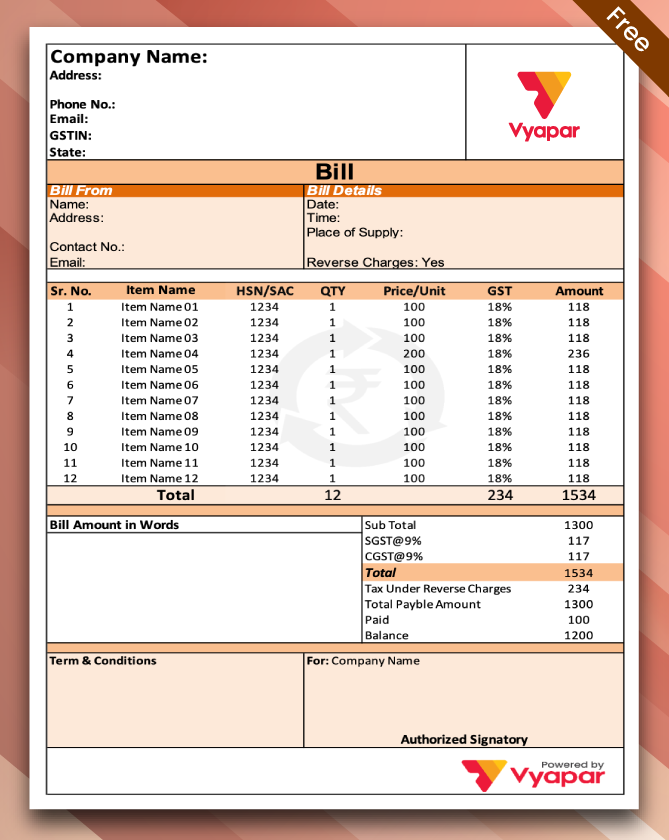

RCM Invoice Format – 2

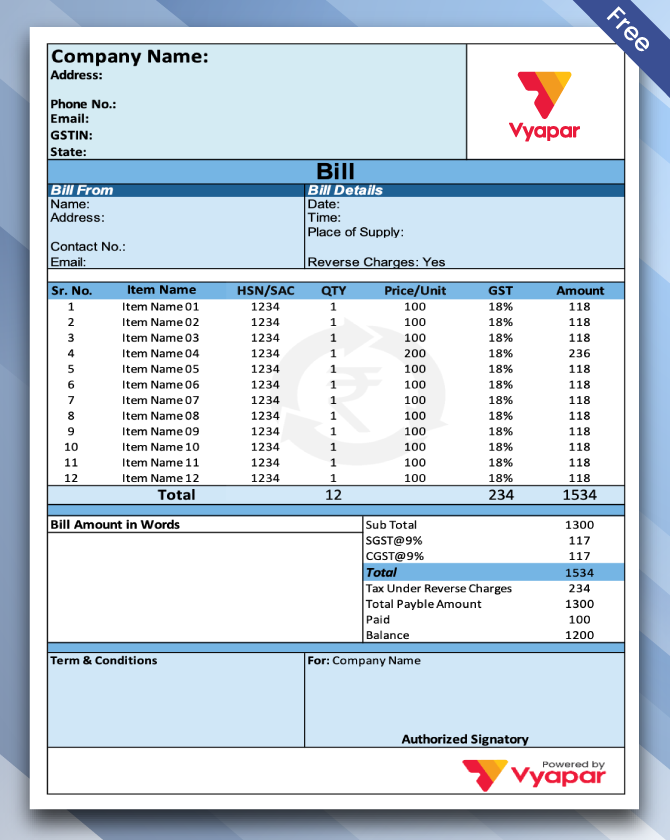

RCM Invoice Format – 3

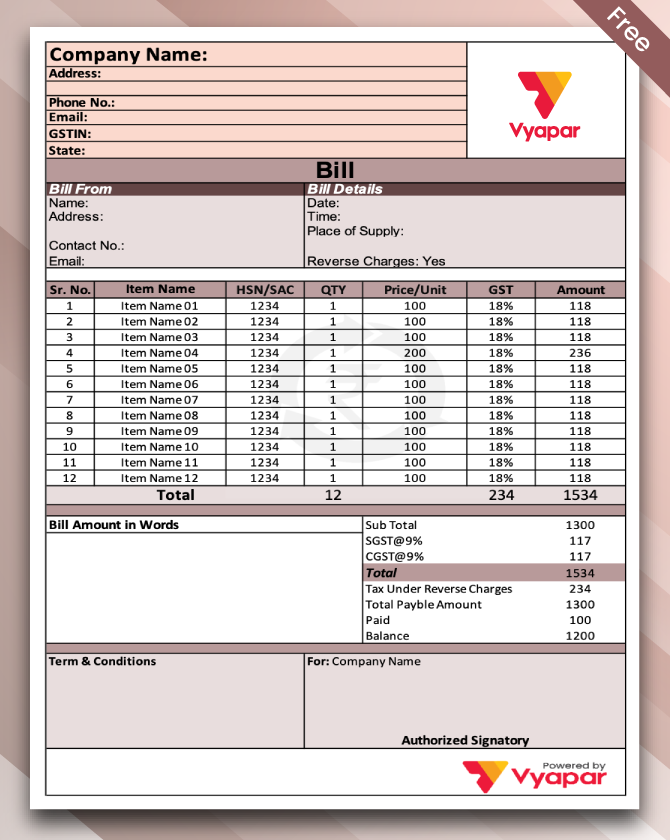

RCM Invoice Format – 4

Generate Invoice Online

Highlights of RCM Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Benefits Of Using RCM Invoice Formats Provided By Vyapar

Helps In Compliance:

The GST-compliant invoices facilitate accurate tax reporting for transactions subject to reverse charge, where the recipient is liable to pay GST instead of the supplier.

Vyapar’s RCM invoice formats ensure compliance with the relevant tax regulations, helping businesses avoid penalties and legal issues.

With our RCM invoice formats, you can ensure that necessary details, such as supplier and recipient information, GSTIN, HSN codes, and taxable amounts, are correctly documented.

Accuracy And Efficiency:

The invoice formats for RCM are designed to capture and calculate reverse charge taxes accurately, reducing the chances of errors in tax reporting.

Our RCM invoice format clearly indicates which items are eligible for RCM. By providing a standardised structure, Vyapar’s RCM invoice format facilitates precise documentation.

By automating the calculation and recording of reverse charge taxes, Vyapar’s RCM invoice formats save businesses time and effort, allowing them to focus on core operations.

Customisation:

Vyapar’s RCM invoice formats can be customised to meet the specific needs of different businesses, ensuring flexibility and adaptability.

With Vyapar, users can personalise their RCM invoices by adding company logos, custom fields, unique fonts, and colours. The flexibility enables businesses to align their invoices with their brand identity.

Moreover, Vyapar offers users the ability to include GST details, item-wise tax breakup, and other relevant information, making it easier to generate accurate and professional-looking invoices.

Vyapar App Simplifies Business Management With RCM Invoicing

We understand managing multiple tasks while trying to provide excellent customer service in your locksmith business can be difficult. But we have got the solution.

The App eases customer service and streamlines functional processes. This leads to offering improved efficiency.

Invoice Management

The Vyapar app enables users to generate invoices with unique identifiers, allowing for easy identification and tracking. These identifiers, such as invoice date, due date, and payment status, empower businesses to stay organized in managing their receivables.

The invoice tracking feature in the Vyapar app facilitates real-time updates on invoice status, ensuring that users are promptly notified of any changes. Whether an invoice is pending, overdue, or paid, users can quickly access this information, enabling timely follow-ups and actions to be taken.

Online Store Portal

The online store in Vyapar invoicing software allows the buyer to create and customize an online portal with the Vyapar app and showcase their services to their clients. This feature helps the buyer to reach more clients, receive and fulfill orders online, accept online payments, and send invoices and receipts via SMS, WhatsApp, or email.

Vyapar app enables the buyer to customize their online store with their own domain name, logo, banner, theme, and service categories. The buyer can also add service descriptions, images, charges, and GST rates to their online portal. The online portal feature not only enhances the buyer’s online presence but also improves their service quality and customer satisfaction.

Data Synchronisation

With data sync feature in Vyapar’s RCM Invoicing software allows the buyer to sync their data between their online portal and their offline portal using the Vyapar app. This feature helps the buyer view and update their services, invoices, and expenses from both their online and offline portals.

The RCM invoicing app ensures that the buyer’s data is consistent and accurate across both portals. The data synchronization feature not only saves the buyer’s time and effort but also prevents any data loss or discrepancy.

Invoice History

The invoice history available in the invoicing app by Vyapar allows the buyer to view and manage all the invoices generated under the reverse charge mechanism. This feature helps the buyer to keep track of the payments made, the input tax credit claimed, and the tax liability under reverse charge.

The dedicated invoice management app enables the buyer to filter, sort, and search the invoices by date, status, amount, or supplier. The buyer can also edit, delete, or print the invoices as per their requirement. The invoice history feature not only organizes the buyer’s invoices but also helps them comply with the GST laws and avoid any penalties or notices.

GST Reports

The GST Reports created using RCM Invoicing tools allow the buyer to generate and download various GST reports related to the reverse charge mechanism. This feature helps the buyer to file their GST returns accurately and timely.

Vyapar app provides the buyer with reports such as GSTR-3B, GSTR-2A, GSTR-1, and GSTR-4, which show the details of the supplies received, the tax paid, the input tax credit availed, and the tax liability under reverse charge. The GST reports feature not only simplifies the buyer’s GST filing process but also helps them reconcile their data and claim the correct input tax credit.

Backup and Restore

Using the Vyapar app, you can make it easier to back up and restore the data securely. This feature helps the buyer to protect their data from any loss or damage due to any unforeseen circumstances.

The free invoicing tool for RCM invoicing enables the buyer to back up their data to any secondary storage device or Google Drive. The buyer can restore their data from any of these sources in case of any data loss. The backup and restore feature not only safeguards the buyer’s data but also ensures that they have access to their data anytime and anywhere.

What is the Reverse Charge Mechanism?

In the GST regime, the supplier of goods or services is usually liable to pay GST. However, in the reverse charge mechanism, the recipient of goods or services becomes liable to pay the tax. The mechanism of reverse charge GST applies to imports and notified supplies.

The purpose of RCM is to increase compliance by unorganized sectors while exempting certain classes of suppliers of goods/services and import of services.

When is the Reverse Charge Mechanism Applicable?

A] Supply Of Goods And Services Notified By CBIC:

Section 9(3) of the CGST Act states that on the recommendation of the Council, the government may specify categories of supply of goods or services or both by notification. The indirect tax on such specified categories shall be applicable on a reverse charge basis by the recipient.

B] Supply Of Goods And Services From An Unregistered Person To A Registered Person:

As per Section 9(4) of CGST Act, 2017 and 5(4) of IGST Act, 2017, if an unregistered person supplies goods or services or both to the registered person, the recipient, i.e., the registered person, shall be liable to pay tax on reverse charge basis. However, this provision has been rescinded as of 29.01.2019.

C] Supply Of Services Through E-commerce Operators:

The e-commerce sector has been growing tremendously in the business world. The supply of goods or services or both over an electronic or digital network is called electronic commerce, including digital products. An E-commerce operator is a person who owns, operates, or manages a digital or electronic facility or platform for electronic commerce. Examples include Amazon, Flipkart, UrbanClap, etc.

According to Section 9(5) of the CGST Act, the e-commerce operator shall be liable to pay tax on intra-state supplies of services that the government specifies. Suppose the electronic commerce operator does not have a physical presence in the taxable territory. In that case, any person representing such an e-commerce operator for any purpose in the taxable territory shall be liable to pay tax.

Suppose an electronic commerce operator does not have a physical presence or representative in the taxable territory; such electronic commerce operator shall appoint a person in the taxable territory to pay tax, and such person shall be liable to pay tax.

How To Make The RCM Invoice Format?

Every RCM invoice format must have all the necessary details about a transaction. Here is a checklist that is included in an invoice for reverse charge:

1. Invoice Header:

At the top of the invoice, you need to include the supplier’s name, address and contact details. You must also include the supplier’s GSTIN if they have one.

2. Invoice Number And Date:

Assign a unique invoice serial number to the RCM invoice so that it is easily identifiable. You should also mention the date of the transaction on the invoice.

3. Customer Details:

An RCM invoice format should include the recipient’s details. Include the recipient’s name, address, and GSTIN if applicable.

4. Description Of Goods Or Services:

Provide a detailed description of the goods or services supplied. Including the details of goods and services clarifies why the reverse charge is being applied and avoids confusion.

5. Quantity And Price:

Specify the quantity, unit price, and total price for each item sold or service provided. Calculate the taxable amount by multiplying the quantity with the unit price for each item.

6. GST Details:

Mention the HSC or SAC code in the invoice. Indicate the applicable tax rates and the amount of GST charged. Moreover, it would help if you clearly mentioned that the recipient will pay the GST under the reverse charge mechanism.

7. Total Amount:

Sum up the taxable amount and GST to calculate the total invoice amount.

8. Payment Terms:

Specify the payment terms and due date, if applicable. Include any other relevant terms and conditions, such as delivery terms or warranties.

9. Signature:

An authorised person should sign the invoice. You can save a copy of the invoice for your records and send it to the customer via email or any other mode.

Top Features Tailored For RCM Invoicing

Reverse charge Mechanism:

With RCM, the recipient of the goods or services is liable to pay GST instead of the supplier. This is applicable for specific supplies as per tax laws. This mechanism shifts the responsibility of tax collection from the supplier to the recipient and helps curb tax evasion and expand the tax base.

Payment Voucher:

The recipient has to issue a payment voucher or a self-invoice to the supplier while making the payment for the supplies, on which a reverse charge is applicable. The payment voucher contains the details of the supplier, the recipient, the amount paid, and the tax payable by the recipient. The voucher is evidence of payment and tax liability under the reverse charge.

Specific Details:

The invoice has to include specific details such as the name, address, and GSTIN of the supplier and the recipient, the description of goods or services, the HSN or SAC code, the taxable value and rate of tax, and the amount of tax payable by the recipient. These details are essential for ensuring compliance with GST laws and facilitating the smooth processing of invoices.

Step-By-Step Guide To RCM Invoice Generation With Vyapar App

Using the Vyapar app for RCM invoice generation is very easy and convenient. You can create and manage your invoices in just four simple steps:

Step 1: Add Your Services

Enter the service details manually or import them from Excel or CSV files. You can also use voice input to add them. Further, assign each service to a category and a GST rate. Lastly, set the service charge, the tax rate, the discount, and the quantity for each service.

Step 2: Create Your Invoices

Select the services from your list or search them by name and add new services on the fly. Edit the charge, tax, or discount of the services before generating the invoice. You can apply taxes and charges or round off your invoice. Choose a theme for your invoice that supports the reverse charge mechanism and customise it with your logo, signature, terms and conditions, and other details.

Step 3: Print Or Share Your Invoices

You can print your invoices using any printer that is compatible with your device. Further, you can share your invoices with your clients or vendors via SMS, WhatsApp, email, or other apps. Save your invoices in PDF format and view them in your invoice history.

Step 4: Collect Payments

Collect payments from your clients online or offline through various modes such as cash, cheque, UPI, QR, debit card, credit card, NEFT, RTGS, IMPS, net banking, and e-wallet. Send payment links or reminders to your clients via SMS, WhatsApp, or email. Track the payment status and the outstanding balance of each client and send them alerts or notifications when they exceed their credit limit or miss their due date.

Create your first Invoices with our free Invoice Generator

How To Manage Your RCM Invoices Online With Vyapar App?

With the Vyapar app, you can manage your RCM invoices not only offline but also online. You can create and customise your online portal with the Vyapar app and showcase your services to your clients. Here are some of the benefits and features of having an online portal with Vyapar app:

- Reach More Clients: Increase your client base and revenue by reaching out to more clients online. You can attract new clients by offering discounts, coupons, or free consultations on your online portal.

- Receive And Fulfil Orders Online: Receive and manage orders from your clients online and track their status and delivery. Further, you can accept online payments and send invoices and receipts to your clients via SMS, WhatsApp, or email.

- Customise Your Online Portal: Customise your online portal with your own domain name, logo, banner, theme, and service categories. Make sure to add service descriptions, images, charges, and GST rates to your online portal.

- Sync Your Data With Your Offline Portal: Sync your data between your online portal and your offline portal using the Vyapar app. View and update your services, invoices, and expenses from both your online and offline portals.

Get Client Feedback And Ratings: Get feedback and ratings from your clients on your online portal and improve your service and quality. You can respond to client queries and complaints online and build trust and loyalty.

Some Helpful Features Of Vyapar RCM Invoice Formats That Make Your Work Easy

Reverse Charge Tax Calculation:

The Reverse Charge Tax Calculation feature in Vyapar’s RCM Invoice format simplifies the process of handling taxes for transactions where the liability to pay tax shifts from the seller to the buyer.

In such cases, the buyer is responsible for paying the tax directly to the government instead of the seller collecting and remitting it. Vyapar’s RCM format automatically calculates reverse charge taxes based on applicable rates and transaction details.

The calculation of reverse charge taxes, ensuring accuracy and compliance with tax regulations. It includes fields to specify the type of transaction subject to reverse charge, such as goods or services covered under the scheme.

The tax calculation feature not only streamlines invoicing processes but also helps businesses maintain compliance with tax laws, minimising the risk of errors and penalties associated with incorrect tax calculations.

Self-Invoicing:

Self-invoicing using RCM Invoice format enables the buyer to generate an invoice on behalf of the supplier when the supplier is unregistered under GST or does not issue an invoice.

This feature helps the buyer to claim the input tax credit on purchases made from unregistered suppliers or suppliers who do not issue invoices.

Vyapar’s RCM format allows the buyer to create a self-invoice format under GST with all the necessary details, such as the supplier’s name, address, GSTIN (if any), the description of goods or services, the taxable value and rate of tax, and the amount of tax payable by the buyer.

The self-invoicing feature not only simplifies the invoicing process but also ensures that the buyer has a valid document to support the tax liability under reverse charge and the input tax credit claim.

User-Friendly Interface:

Vyapar’s RCM invoice format has a user-friendly interface, making it easy for businesses to navigate and utilise its features efficiently. The interface is designed with intuitive elements, ensuring that users can quickly grasp the invoicing process without extensive training or prior experience.

One of the key features of the format is the clear and organised layout, which presents essential information in a structured manner, reducing clutter and confusion for users. Another notable feature contributing to Vyapar’s user-friendly interface is its customizable invoice templates.

Users can tailor the invoice format to suit their branding preferences and specific business requirements, adding logos, custom fields, and colours to create a professional and personalised look.

Vyapar prioritises simplicity in its design, minimising unnecessary complexities and focusing on essential functionalities. The interface guides users through the invoicing process step by step, eliminating guesswork and potential errors.

Cloud-Based Access:

Vyapar’s RCM invoice format enables users to access their invoices anytime, anywhere with an internet connection. The online access allows business owners and their teams to manage invoicing tasks remotely, even when away from their office or primary workstations.

Whether on a business trip, attending meetings, or simply working from home, users can conveniently log in to their Vyapar account and access their RCM invoices effortlessly.

Team members can simultaneously view, edit, and update RCM invoices, fostering seamless communication and coordination within the organization. The collaborative approach enhances productivity and reduces delays in invoicing processes.

The cloud-based access feature of Vyapar’s RCM invoice format enhances data security and reliability. With data stored securely on remote servers, businesses can mitigate the risks associated with data loss or system failures.

Difference Between Forward Charge Mechanism And Reverse Charge Mechanism:

RCM (Reverse Charge Mechanism) and FCM (Forward Charge Mechanism) are two methods used to collect and pay Goods and Services Tax in India. Here are the key differences between the two:

Liability to Pay Tax:

- Under RCM, the liability to pay tax is shifted from the supplier to the recipient of goods or services.

- In FCM, the supplier is liable to pay tax on the supply of goods or services.

Applicability:

- RCM applies when certain specified goods or services are purchased from an unregistered dealer or for specific services notified by the government.

- FCM applies to regular supplies made by registered taxpayers.

Payment of Tax:

- The recipient of goods or services pays the tax directly to the government instead of the supplier under RCM.

- The supplier collects tax from the recipient and pays it to the government under FCM.

Input Tax Credit (ITC):

- Recipients can claim an input tax credit (ITC) for the tax paid under RCM under certain conditions.

- Suppliers can claim ITC under FCM for the tax paid on inputs and services used in the course of business.

Registration Requirement:

- Recipients need to register under GST if they are liable to pay tax under RCM.

- Suppliers must register under GST if their turnover exceeds the threshold limit under FCM.

Compliance Burden:

- RCM increases the compliance burden on recipients as they need to calculate and pay taxes under RCM.

- In FCM, the compliance burden primarily lies with the supplier, as they are responsible for collecting and remitting tax.

Frequently Asked Questions (FAQs’)

You can make an RCM invoice using the RCM invoice format provided by Vyapar. Our formats are easy to use for self-invoicing.

The full form of the RCM invoice is the Reverse Charge Mechanism Invoice.

Yes. If you are eligible for e-invoicing, it is applicable for RCM transactions. You can use Vyapar software available for Android mobiles, Windows PCs and Macbooks to create a seamless e-invoicing experience for your customers.

Yes, RCM (Reverse Charge Mechanism) is payable in GST (Goods and Services Tax).

You can report RCM transactions in GST returns with the help of the Vyapar app. Vyapar app automatically calculates reverse charge taxes and generates GST reports for you. You can also sync your data with your online portal using the Vyapar app. To report RCM transactions in GSTR-1, you need to select the option of “Supply attracting reverse charge” under Table 4B of B2B invoices.