Self Invoice Format under GST in Excel, Pdf

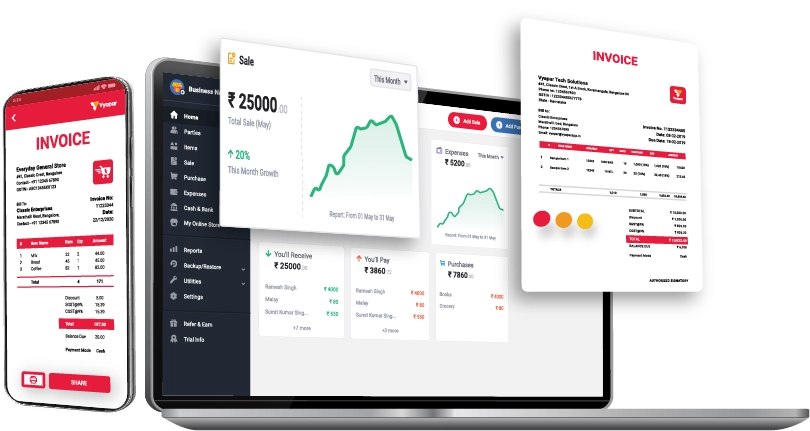

Vyapar free invoicing software is easy to use and eliminates the need for multiple applications. You can manage your business professionally with Vyapar and simplify self-invoice format creation using accessible formats.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Free Professional Self Invoice Format Under GST

Download professional free self invoice format under in Excel, PDF Gst, and make customization according to your requirements at zero cost.

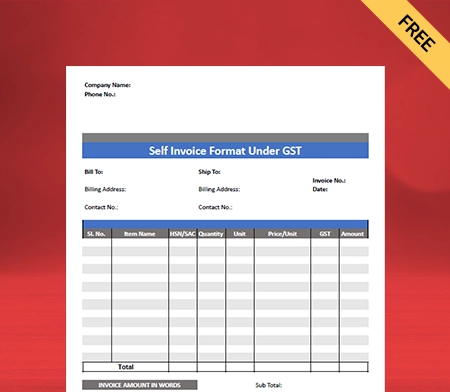

Self Invoice Format Under GST – 1

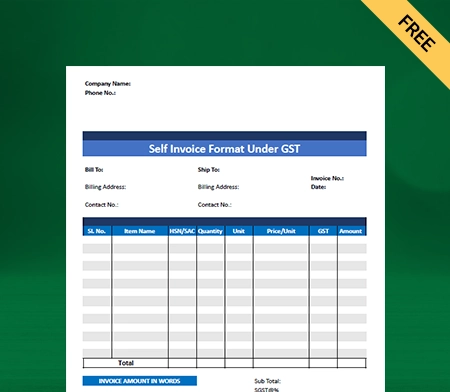

Self Invoice Format Under GST – 2

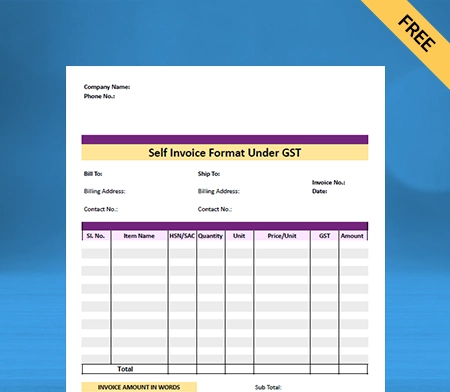

Self Invoice Format Under GST- 3

Generate Invoice Online

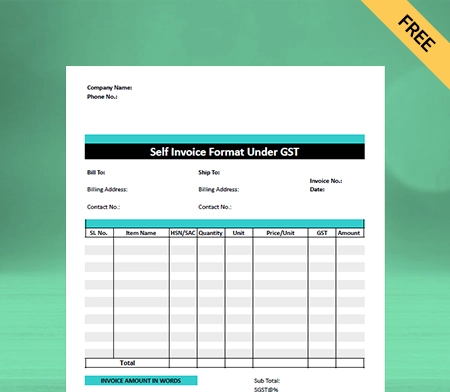

Self Invoice Format Under GST – 4

Highlights of Self Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is a Self Invoice Format?

A customer prepares a self-invoice format where the supplier is unregistered. A supplier usually pays the tax on supply, but under the reverse charge mechanism, the chargeability gets reversed. The recipient of the goods and services becomes liable to pay the tax.

The reverse charge mechanism only applies to specific kinds of business entities. The purpose of shifting GST payments to recipients is to increase tax levies on various unorganized sectors. It also aims to exempt specific supplier classes and tax the import of services since the supplier is located abroad.

Rules under Section 9(4) of CGST Act

Where a non-registered supplier supplies taxable goods or services or both to a registered person, the central tax shall be paid by the recipient on a reverse charge basis. The Act’s provisions shall apply as if the recipient were the person liable for paying the tax for the supply of those goods or services or both.

All registered buyers of goods and services from non-registered sellers must pay taxes on a reverse charge basis. Further, as per section 31(f) of the CGST Act, “A registered person shall issue an invoice in respect of goods or services or both received by him from the supplier who is not registered.”

Thus, all the registered persons, i.e., the buyers, shall issue invoices when paying taxes on a reverse charge mechanism. Since the customers will provide invoices to themselves, it is called self-invoicing.

Rule 46 of the CGST Rules states that all registered persons whose supply exceeds Rs 5000 daily from all suppliers must issue a consolidated invoice each month. Therefore, such stores will be tax-free if the total price does not exceed Rupees 5000.

Self-Billing Invoices Under GST

When issuing a self-invoice under goods and services tax, a customer and supplier have additional responsibilities to ensure that all the requirements are met. The buyer can issue self invoice under gst the following circumstances:

- When making the supply, the supplier cannot estimate its value.

- Under GST or any other supplier authorized by the Director-General, the supplier and the client are registered.

- The issuance of a self-billing invoice must be agreed upon in writing between the supplier and the client.

Contents of Self Invoice Format Under GST

- State the words ‘Self-billed invoice’ at a visible place on the invoice.

- Date and 16-digit alphanumeric serial number of the invoice.

- Recipient’s name, address, and GSTIN number.

- Description of goods or services.

- HSC code for goods and SAC code for services.

- The total amount that the supplier will receive.

- Tax charged as per the provisions.

- Location of supplier and state, interstate, or area code, if applicable.

Create your first invoice with our free invoice Generator

Advantages of Self-Billing Invoice

The self-invoice benefits both the supplier and the customer, some of its advantages are as follows:

- Increases Efficiency: A customer prepares a self-billing invoice, reducing the supplier’s work and compliance burden and improving efficiency.

- Quick Payments: When the customer makes the invoice, they also clear the payment. Thus, the supplier gets the payments faster.

- Increases Accountability: The customer is accountable for making the invoices under RCM. So they manage it efficiently and speed up the transactional process.

- Smooth work: When a customer issues an invoice, he incorporates all the necessary details for the supplier’s reference and convenience. Thus, all the work will go smoothly.

Necessary Documents to Make Self-Invoices Under RCM for Record-Keeping

You must produce the documents listed below to maintain accurate records of the self-invoices you create.

1) Copies of each self-invoice you or your business has ever sent to a supplier.

2) All suppliers’ names, phone numbers, addresses, and GSTINs who have consented to join the self-invoice system with you.

Even when you choose to hire a third party to handle your self-invoicing, you are still responsible for keeping the records. If the required documents are not preserved, the issued invoices won’t meet the requirements of VAT invoices, so you can’t get any input VAT back. Remember that You must provide your agreement and invoices to HMRC if they request them.

The Time Limit for Issuing Self-Invoice and Discharge of Tax Liability

The earliest of three dates is the time limit for issuing self-invoices and discharging tax liabilities. You either issue it on the date of receipt of goods or the date of payment.

You can also issue it 30 days after the invoice date for goods and 60 days after the service date, respectively if the payment is not received or delivery is pending.

It is assumed that the date of entry in the recipient’s books of accounts is the time of supply if it is impossible to identify the time.

How can you reduce errors in self-billing invoices?

- Customers and suppliers should maintain effective communication and transparency.

- You must verify the information on the self-billing invoice.

- Ensure that proper GST tax rates are mentioned in the invoice.

- Cross-check the requirements for issuing a self-billing invoice.

- Keep all documents ready for inspection during the audit trail.

Why Vyapar App Is a Better Alternative to Self Invoice Format Under GST

Efficient Dashboard

The dashboard of Vyapar serves as a single source that displays your business activity status and progress in one place. The dashboard for Vyapar is simple and user-friendly.

You can analyze your business activities and enabling you to understand every aspect of your business in a better way. Thus, you can make effective decisions faster.

You can add business data by selecting the left-hand corner of the application. You may also print such particulars on the personalized invoice format with the appropriate settings.

Business Reports

Owners of businesses must make wise selections. Managing the funds for everyday operations, analyzing reports, and reviewing business activity at once might be difficult. Vyapar is the answer to each of these issues.

You can build 40+ different reports using Vyapar. You can produce reports like balance sheets, expense or revenue reports, and GST reports. You can preserve the company’s cash flow and prevent disruptions to the workflow.

You can examine the reports and assess the company’s standing. Doing so may determine which product is in demand and stock up on it. Using the Ledger balance sheet format can make income tax filing simple.

Make Personalized Bills

You can quickly make invoices with Vyapar. You may customize your bills using the software to help you project a professional image. You can save time using the program to automatically fill out repetitive debit entries.

Make your self-billing invoices distinctive. The invoice may include your name, address, phone number, payment options, customized themes, and business logo.

Using this technology, you can reach out to your consumers however you like. You will respond quickly and give your consumers a better experience.

Lifetime Free Basic Usage

Using our accessible self-invoice format, you can easily create customized invoices. Additionally, you may track inventory goods and control your dashboard.

We have maintained our business accounting tool’s most essential features available without charge. Android mobile users have lifetime access to the free services. Free access is part of our effort to bring millions of small business owners into the digital economy.

You may join up to use the accounting app for free and download the app for free from the Play Store. However, a company can use a subscription to access the premium features and desktop programs.

All Businesses Can Use It

Every small or medium-sized business in India can use the Vyapar app. You can track data, invoices, and inventory using this app and even manage your books of accounts.

You can use the Vyapar app to help with your business needs, including tax preparation, managing payments, and invoicing. You may control all accounting aspects from a single window on your PC or laptop.

A mobile app accessible on Android and iOS allows you to view all the records and data. With Vyapar, you may access data from various sources and manage your business from one or more devices.

Eliminate Human Error

A mistake during self-invoicing can result in a significant loss. Therefore, it is crucial to pick the appropriate program to prevent errors. Your business can process data much more quickly using Vyapar.

Automation streamlines the procedure and gets rid of human mistakes. You can save a lot of time and focus on other tasks. The user interface for the Vyapar ledger balance sheet formats is straightforward.

Data can be exported and imported from other compatible programs. It also sends reminders to collect payments and refund debts, which helps prevent further disagreements.

Valuable Features of the Vyapar App:

Send Estimates & Quotations

Create useful quotations and accurate estimates using our free self-invoicing software. You can also make accurate GST invoice formats using the in-built features of the app. Your invoices and quotes look more professional as they are error-free.

The app lets you print the quotes and send the documents to customers through WhatsApp, email, or SMS. Making invoices using Vyapar’s free templates is easy as the app automates most processes.

You can make invoices within a few minutes using Vyapar. Businesses can save time and manage their operations with increased productivity. Additionally, you can track invoices seamlessly by setting up a due date.

The billing app can help impress your customers and encourage them to return. One of the best investments you can make for your business is to select our best self-invoice GST billing software.

Record Expenses

Businesses need to record all expenses. With the help of Vyapar, it becomes easy to generate reports and track all the money spent. You can issue tax invoices and quickly file taxes using those reports.

You can examine the income figures rapidly and evaluate your business. You don’t need to recruit additional staff to handle the program because anyone on your team can do it.

The company can reduce spending by employing GST software to record the expenses, which helps reduce costs. Both GST and non-GST expenses are recorded using our free GST billing software.

Vyapar billing solutions have several advantages over other companies. It helps in cost-cutting and increases sales. Additionally, keeping track of expenses will help develop better tactics, and business profitability will arise from it.

GST Invoicing / Billing

Using the Vyapar App, you can generate GST invoices for your clients and customize them per your requirements. The recipient can quickly create a self-invoice and share it with the supplier with the help of the app’s excellent features.

Your business will benefit greatly from using our free GST billing software because it will enable you to automate your billing needs. It works well in helping small and medium-sized businesses save on accounting time.

The barcode scanner and shortcut keys can help you do repetitive chores more quickly during the billing process. One of the main features of the Vyapar app is “bill-wise payment,” which makes it simple to connect payments to sales invoices.

The app can generate and manage several parties together, which makes it simpler to keep track of all the invoice due dates and to look up previous bills at any moment. Any firm may immediately identify any outstanding payments thanks to the Vyapar app.

Data Safety and Security

Vyapar’s self-invoice format is 100% safe. You can create local or online Google Drive backups, so you don’t have to worry about losing your data. Moreover, you can access that data 24×7 using multiple devices.

The app has an encryption system for extra security so only owners can access the data. Any third party or even our team cannot avail of your business records.

Vyapar will not store or share users’ authentication data for further use. Hence, there is no need to worry about your data safety. Vyapar has an “auto-backup” feature that will let you continue your work from where you left off.

You get an automatic backup every day when you use the auto-backup mode. You can create data backups based on your needs and help ensure the security of your data.

Financial Management

You may effortlessly run your business with the help of the Vyapar GST billing app. Vyapar’s comprehensive dashboard allows you to monitor and analyze your business operations in real-time.

The user-friendly layout of the Vyapar app might help you increase the efficiency of your company. With the help of this software, you may manage inventory, costs, and bookkeeping.

The easy and accessible format makes it easier to keep track of all company transactions. The software does away with the requirement to manually create a bill for each sold mobile device.

The Vyapar app lets you personalize your company’s features and additional information. The software also assists in tracking the stock that is available and placing your next order according to your needs.

Scanner Compatibility

Since customers prepare self-invoices Vyapar barcode billing software can help speed up the process. Vyapar’s features reduce the time and effort required in the billing process.

You can use the software to retrieve the product information from a barcode scanner on your PC. The system eliminates the need to enter minute details about each item, such as its name, quantity, and price.

There is a chance for mistakes during the manual billing procedure, and you can omit to include something or add the same thing twice. You can minimize those mistakes by using Vyapar’s barcode feature.

You may access your business dashboard from any location by downloading the Android app. You can set up a business dashboard on your Windows PC with a barcode scanner attached. It will help you produce invoices rapidly.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

A buyer needs to self-invoice when purchasing goods or services from an unregistered supplier, which falls under reverse charge.

You need to furnish a self-invoice in the GSTR-1 return in Table 13. Further, the document required to claim an input tax credit of the tax paid under reverse charge is a self-invoice.

You can write a self-invoice under gst format Excel, PDF or Word. You can also download any template from Vyapar, make the necessary changes, and have your self-invoice. Ensure that you mention ‘Self-billed invoice’ on the invoice.

ITC is available to the recipient under a reverse charge if such goods or services are used for business purposes.

The individual who paid tax under RCM in a particular month may claim it as ITC the month after.

To create a self-invoice under GST (Goods and Services Tax), follow these steps:

1. Generate a standard invoice with all required details.

2. Include a note stating it’s a self-invoice.

3. Calculate taxes (CGST, SGST/UTGST, IGST) based on rates.

4. Issue the invoice to yourself.

5. Keep a copy for records and compliance.

If you encounter any difficulties while creating a self-invoice under GST or have specific questions related to GST compliance, you can connect with Vyapar for guidance and support. Our team can assist you in understanding the GST invoicing requirements and ensure that your self-invoice complies with the relevant regulations.

Not issuing a self-invoice under GST can result in penalties, including monetary fines, interest charges, and potential legal action. It’s crucial to comply with GST invoicing requirements to avoid penalties and ensure regulatory compliance.

If you have concerns or questions about GST compliance and self-invoicing, consulting with tax professionals or experts at Vyapar can provide clarity and guidance.

The time limit for issuing a self-invoice under GST is typically within 30 days from the date of supply of goods or services to yourself for business purposes. Compliance with this time limit is important to avoid penalties and ensure GST compliance.