Cash Receipt Format In Word

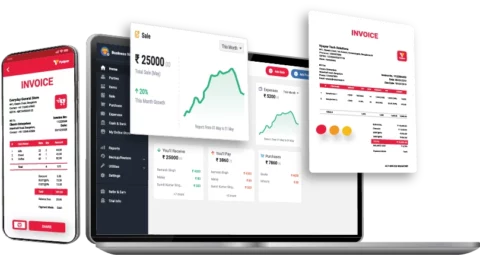

Download the Cash Receipt Format in Word for your client. Or use Vyapar App to track your payment history, and payment modes, manage inventory, and outstanding easily, and grow your business faster! Avail 7 days Free Trial Now!

Highlights of Cash Receipt Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Download The Cash Receipt Formats For Free

Download professional free material reconciliation templates, and make customization according to your requirements at zero cost.

Customize Invoice

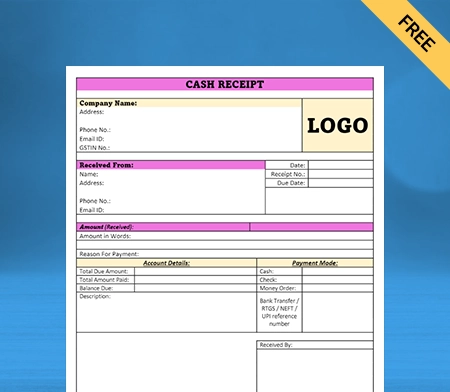

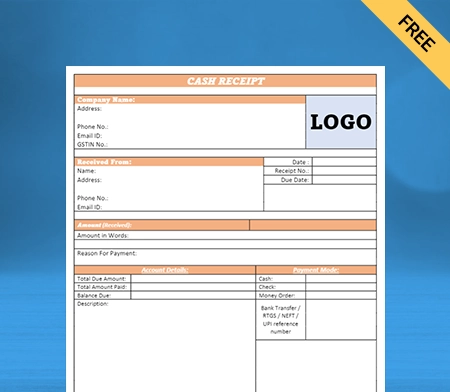

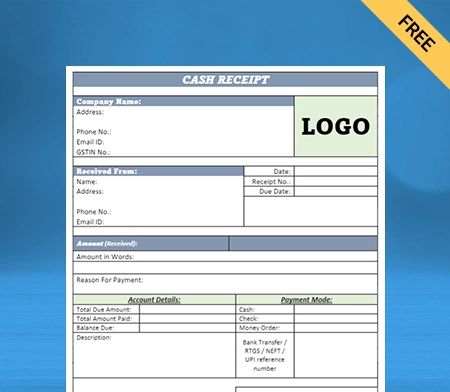

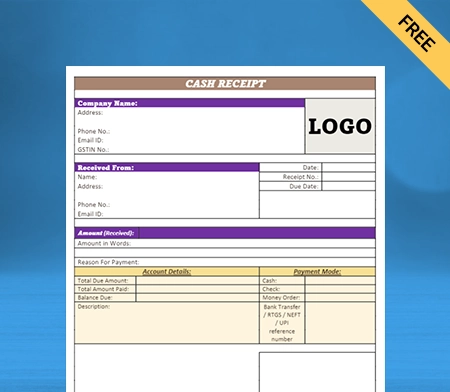

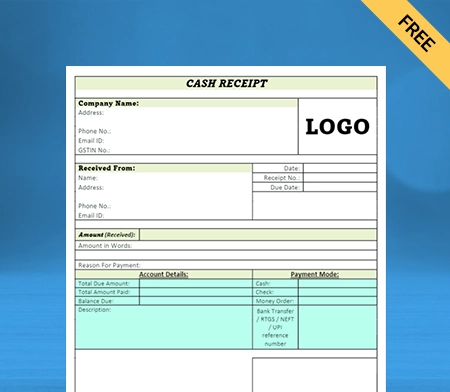

Type – 1

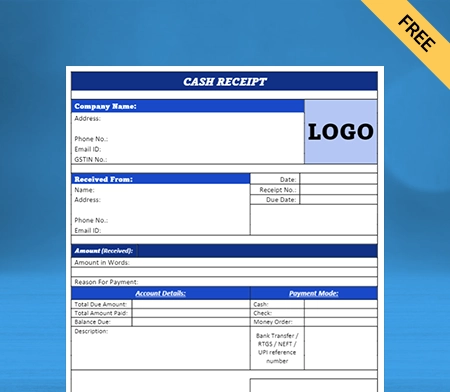

Type – 2

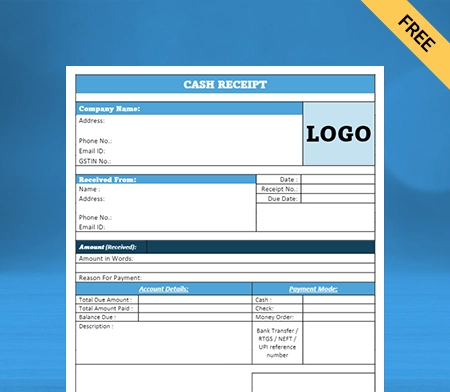

Type – 3

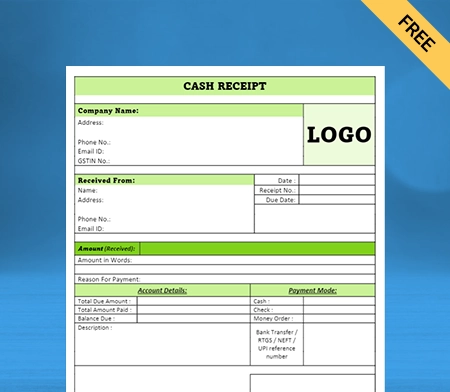

Type – 4

Type – 5

Type – 6

Type – 7

Type – 8

What is the Cash Receipt Format in Word?

Cash receipt format in Word is a format used to produce cash receipts. Having a predesigned and ready-to-use format saves you time. You can create cash receipts whenever you want within minutes using a professional cash receipt format in Word.

Additionally, for cash receipt vouchers, our user-friendly cash receipt voucher format in Word simplifies your financial transactions further.

The term that demands our attention when we talk about cash receipt format in Word is cash receipt. A cash receipt is a document that acts as proof of transactions between a business and its customer. This document is generally issued after the completion of sales.

While a cash receipt can be considered merely a document, it fulfills two major purposes:

- It acts as a medium to maintain business records. It allows vendors to track sales, record payment details, and maintain the right inventory levels.

- The receipt offers customers who are further hired by third parties to maintain accurate records. The receipt acts as a medium to track when cash is invested. It helps those employees maintain transparency with their clients.

Essential Components of a Cash Receipt Format in Word

A cash receipt format in Word can include multiple useful fields specific to your business needs. Having a brief idea of these components is vital for anyone planning to create one seamlessly.

Here are all the major components of a receipt format in word for cash you should know about:

Transaction or Invoice Number:

If your business is registered with GST, it’s essential to mention your invoice number in the receipt from a legal perspective. Therefore, we recommend you include a column on the top of your cash receipt format in word for the invoice number. Having this number in the cash receipt is good for you and your customers.

You can use the number to track your GST, sales, and other vital payment details. On the other hand, for customers, invoice numbers can promote convenience during tax filing or invoice management.

Date and Time of Issue:

Another obvious component of a cash receipt format in word is the date and time of the issue. These two details are to be present in the top section of your format. You can manually enter the date and time of the receipt issue when creating a cash sale receipt format.

Or, you can use accounting software such as Vyapar to create cash receipts. The date and time of the issue will automatically be adjusted in your final receipt once it’s printed or issued from your side.

Business Name and Address:

How can customers indefinitely differentiate between the multiple receipt formats they might be carrying? With the brand name. It’s not just important but necessary to have the name of your business either on the top or bottom of the format.

In addition to the business name, another key detail you cannot miss is the address. Try including your store’s address in your cash receipt format in Word. It will help customers to reach out to you without any inconvenience.

Price of Product/Service:

A cash receipt is incomplete without the price for the goods or services you have sold. That’s the whole point of issuing a cash receipt. Cash receipt format in Word can help you track your sales and aspects related to it.

Create a dedicated column where you will list all the services customers have bought from you. Next to those services, add or mention the respective prices. It will help you with tracking sales effortlessly. In addition, it will also help customers understand the cash they used for the purchase.

Subtotal Amount With/Without Tax:

Without the section for the total amount, your cash receipt format in word isn’t complete. Add a small column for the total amount at the bottom of your format or after the column for the list of services. In this section, you need to mention the total cash payment you received for the sales.

GST is an important part of this amount. Some businesses reflect the total sales amount with Goods or Services Tax included in it without highlighting it separately. You have to be transparent with the total sales amount. So, mention the GST or tax amount separately from the total amount.

Importance of Using Cash Receipts for a Small Business

Introducing the concept of issuing cash receipts is a huge deal for any business. Having a sense of surety that issuing cash receipts is important is a must. So here are some key points that reflect the importance of recent receipt:

Helps in the Auditing Process:

If you have a registered business, you will know that auditing the overall business is necessary. Auditing helps in identifying major issues in departments like accounting. Having a dedicated sales record promotes convenience during the auditing process.

Cash receipt is an integral part of sales records. It will help the auditor perform their job without inconvenience or extra effort. Therefore, issuing cash receipts is important if you want the auditing process to go smoothly.

Proof of Sale:

As mentioned above, a cash receipt is proof of sale. It’s a transaction record showing that customers have purchased from your business. Now, how is this information helpful for a business owner?

During legal scenarios where your customer is involved, and somehow your business is dragged into it, having a cash receipt record is like a shield. It will protect you against various sales-related allegations because you have proof that the sales happened.

Helps Maintain Accounts:

For a business, maintaining the accuracy of accounts is highly important. But because so many transactions are made in a day, keeping track of everything becomes tough.

The tougher and more complex the tracking process, the higher the chances of errors in accounts. The risk of errors can be eliminated with cash receipts. They can help you track sales and cash-related transactions effortlessly. With convenience in cash tracking comes accuracy in books of accounts and bookkeeping.

Inventory Management:

If your business deals in tangible products, you are in great need of efficient inventory management. The last thing you want from your customer is to leave your store empty-handed. Such scenarios only happen when you are out of stock. When you issue cash receipts, you get to track the sales in real time.

When you know how much stock is sold and the demand for which one is higher, it becomes easy for you to maintain stock availability. You can simply restock your inventories, reducing the chances of customers leaving empty-handed.

Saves Time During Account Audits:

Auditing helps businesses discover the potholes in various processes, which further are eliminated to promote growth. A dedicated record of all the cash sales helps them track and better overview the cash flow.

For convenience in understanding and tracking cash flow, issuing cash receipts is a great idea. Auditors can use those receipts to compare the current year’s books of your accounts to check the accuracy. To conclude, cash receipts are a great asset for auditing.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

Benefits of Offering Receipts Using Professional Cash Receipt Format in Word

There are so many benefits that come along with issuing cash receipts. To keep things straightforward, below we have mentioned some of the major benefits of cash receipts:

Provides Convenience During Tax Filing:

Cash receipts make tax filing less of an issue for you and your customers. During the tax filing process, accounts often need to be compared with sales. When it comes to sales, cash receipts are one of the mediums to evaluate yearly sales.

Moreover, a cash receipt also contains Goods or Services Tax details. It helps accountants avoid the risk of wrong tax filing, saving your business from serious legal consequences. Moreover, things can be managed better if you use small business accounting software such as the Vyapar app for cash receipts.

Underrated Marketing Medium:

Marketing plays an important role in the success of any business in any market. Funding your marketing needs might be affordable if you are just starting in the market, but not the same if you are struggling with cash flow.

But you need to keep an eye on your cash receipts and overall expenses to ensure you do not overspend. Cash receipts come as an economical approach to managing your important business transactions.

Further, having your branding on cash receipts is an underrated marketing medium that can help you promote your brand to anyone who lays eyes on the receipt. Turn your marketing efforts into the highest returns by using attractive designs of cash receipts in the Vyapar accounting app.

Online Cash Receipts Avoid BPA Contact:

Digitalisation has turned out to be a transformation for businesses across industries. By adopting technology, brands show customers that they contribute to nature. Issuing digital cash receipts is the best example here.

The ink used to print a hard copy of a cash receipt increases the risk of BPA contact. On the other hand, when you issue cash receipts using online accounting software like Vyapar, the risk of BPA contact is reduced to zero. Plus, you can also save time, which is the best part.

Improves Your Expense Management:

Cash receipts contain many payment details that can help a business in multiple ways. One such benefit of a cash receipt format in Word download is expense management. The cash receipts have information about the products you have sold.

Having this information helps businesses track the expenses in the backend. Knowing your overall sales expense is important to determine the profits your business earned. Moreover, it’s also important to calculate your brand’s financial condition.

Easy to Share With Customers:

The biggest advantage accounting software such as Vyapar brings with them is convenience. With Vyapar, you get a wide range of options to share cash receipts with customers.

Online sharing of cash receipts isn’t just environment-friendly but also saves time. As soon as the bill is ready, you can share it with the customer via WhatsApp or email address in just a few seconds. This option saves time and effort compared to manually creating a cash receipt.

How to Create a Cash Receipt Using the Vyapar Accounting App?

For beginners using the Vyapar app for the first time, shuffling their way to cash receipts could be tough. Here’s how you can create a cash receipt in Vyapar:

- Open the homepage of your Vyapar app.

- At the bottom of your screen, there’s an ADD SALE button.

- Tap on it and choose CASH from the header section.

- Now choose the invoice number and current date when the receipt is issued

- Enter the full name of the customer and their respective phone number

- Tap on ADD ITEM and enter the payment details of the products sold

- You will notice that the total amount is already mentioned

- Choose the payment medium as cash and click SAVE

- Now the PDF of your cash receipt will appear on your screen

- Tap on the share icon and share the receipt with the customer

The best part about using the Vyapar app for creating cash receipts is its variety of sharing options. You can share receipts with customers in their preferred medium using the app. It could be through Gmail or WhatsApp.

Besides online sharing options, businesses can print their cash receipts in hardcopy. All thanks to the compatibility of this amazing online accounting software with various printer models.

Benefits of Using Cash Receipt Format in Word By Vyapar

You can create unlimited cash receipts using the cash receipt format in Word free download offered by Vyapar. To justify it as a great choice, here are some wonderful benefits of using the Vyapar app:

Multiple Design Options:

Issuing cash receipts is the first step towards making your accounts accurate and reliable. To improve things, you can also use cash receipts to establish a good impression. Cash receipts are an underrated branding tool. Vyapar accounting solution offers a wide range of receipt designs.

You can create and design your cash receipts for an attractive appearance. No more black-and-white receipts. Vyapar will help you create eye-catching and designer cash receipts. With them, you can leave a long-lasting impression on your customers.

Straightforward Navigations:

For accounting software, it’s obvious to have an impression of a complex interface. Luckily, that’s not the case with the Vyapar accounting solution. The application is designed so that even a newbie to accounting can get it sorted in the first place.

For any accounting app, navigation is everything. Vyapar has kept its navigation straightforward. You don’t have to struggle to go into multiple pages to record your sales. Everything is present on the app, accessible in the most time-saving way.

Easy-to-Use Format:

When it comes to the cash receipt format in Word, most of them are super complex. It’s hard to enter the data in them and process them further. Things will become overwhelming if you plan to edit the format in Word.

The cash receipt format you will find on Vyapar comes with customization advantages. So even if you somehow make any mistake in your invoice, you can always edit it, as long as you don’t delete the record from your application.

Most-preferred Accounting Solution:

Vyapar is India’s best accounting solution, made so far. It’s used by more than 1 Crore businesses in the country, serving a wide range of industries. If so many brands have made this application their favorite choice, there might be a reason behind it.

Straightforward navigation, attractive receipt designs, customization facility, and so much more, all for FREE. Create a free account and get access to several accounting features to manage your business efficiently. Many brands prefer Vyapar for the seamless management of accounts prefer.

Save Receipts Directly into Your Device:

Most accounting software works with the cloud and saves all the data on their respective cloud servers. That’s not the case with the Vyapar app. The solution uses the storage of your smartphone devices, not any third-party cloud server. All your data will be with you, inside your device, safe and secure.

The last thing you need to worry about is data leakage, as Vyapar keeps your data safe. For additional data security, Vyapar also offers the facility of password. Having passWords protects your accounts from getting your account in the wrong hands.

Frequently Asked Questions (FAQs’)

Cash receipt format in Word is a predesigned format businesses can use to create cash receipts. You can get cash receipt format in Word in the Vyapar accounting app. Check it out!

Here are a few common examples of cash receipts in word:

* When you sell goods at the cash register, the sale receipt created when payment is collected is considered a cash receipt.

* When a taxi company produces receipts for any cash it collects through fares, it is considered a cash receipt.

You can create a cash receipt in Word by putting a number of headings present in a receipt in a Word dock. The manual way of creating cash receipts is time-consuming. You can access expert-designed and ready-to-use cash receipts in the Vyapar app. Visit their official website now!

Cash receipts are of two types. One is a capital receipt, and the other is a revenue receipt. A capital receipt is received during a special business activity, such as a capital contribution. On the other hand, revenue receipt is issued during a normal business activity such as rent received, discount received, etc.

Not every source you’ll find on the internet will offer you cash receipt format in word for free. Unlike those, Vyapar offers creatively designed cash receipts format for absolutely free. Create an account with Vyapar and access the cash receipt format for free now!

Yes, there is accounting software such as Vyapar that you can use to create cash receipts online. The application works on desktops as well as Android devices, so you have the choice of convenience. Download the app for a seamless accounting experience.