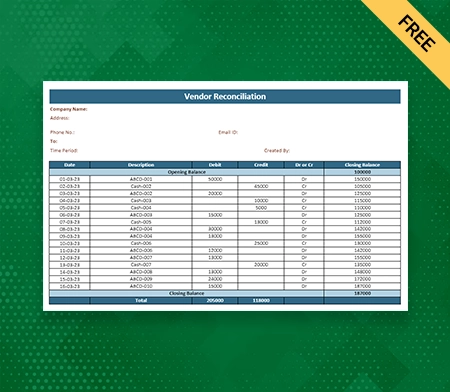

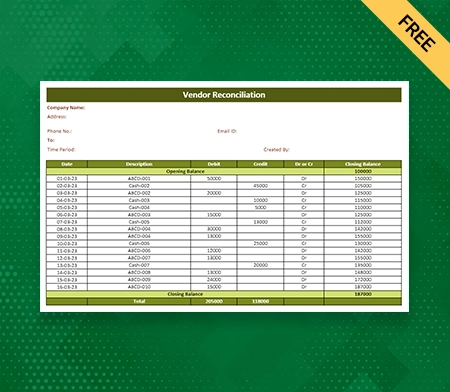

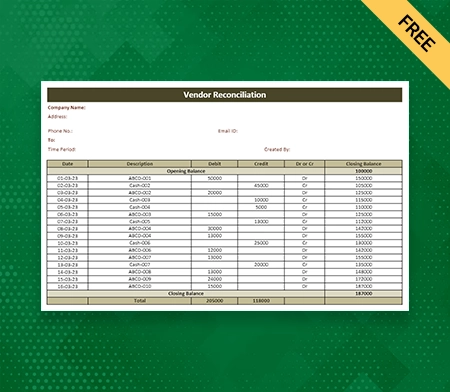

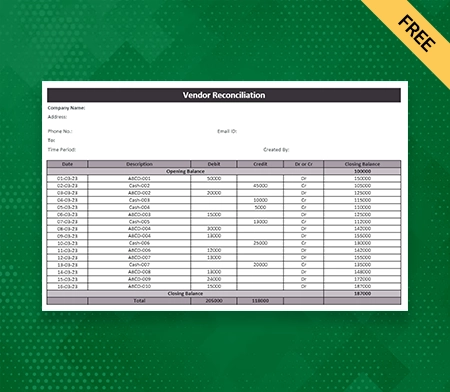

Vendor Reconciliation Format in Excel

Are you searching for a free vendor reconciliation format in Excel software for your small or big business? Vyapar is the solution for managing all your reconciliation templates, billing needs, supplier statements, inventory, invoices, etc.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

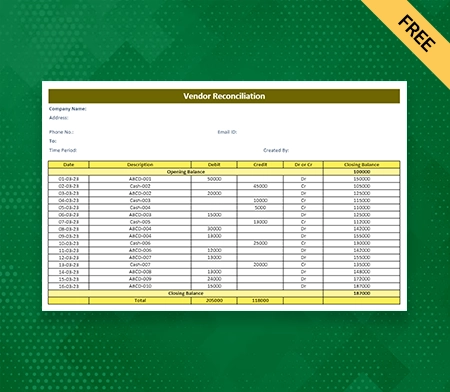

Download Vendor Reconciliation Format in Excel

What is Vendor Reconciliation Format In Excel?

The Vendor’s reconciliation account is to confirm that the balances owed to vendors via any firm or organisation match the Vendor’s records. This work could be done by comparing the firm’s accounts payable forms to the Vendor’s statements and invoices.

In a way, vendor reconciliation format in Excel has become important as it helps the organisation to be sure about the payment that they are making. It takes care of managing the overpaid and underpaid transactions.

Vendor reconciliation format also helps rectify the mistakes in the organisation’s accounts payable records. Vendor reconciliation does not need to be performed by accounting staff, but an outside firm could also perform it.

What is The Vendor Reconciliation Process?

This vendor reconciliation format in the Excel process is generally performed every month. It could be done more frequently if significant changes in the firms’ accounts payable balances exist.

1. The process begins when the organisation receives an invoice from their vendors.

2. In the next step, if the organisation finds any discrepancies, it directly contacts the Vendor to resolve the issue.

3. Once this process of vendor reconciliation is over, the next step to pay off the invoices takes place. This process can be done by using any software or manually. While performing it manually, organisations must take care of all vendor invoices and payments within a ledger.

4. Vender reconciliation process could be an extra step, but by performing this, any firm can ensure that they are not overpaying for any goods or services. Here comes the role of accounting softwares by which you can directly set up this system that automatically tracks vendor invoices and payments.

By using softwares, you can save a lot of time and effort over vendor reconciliation.

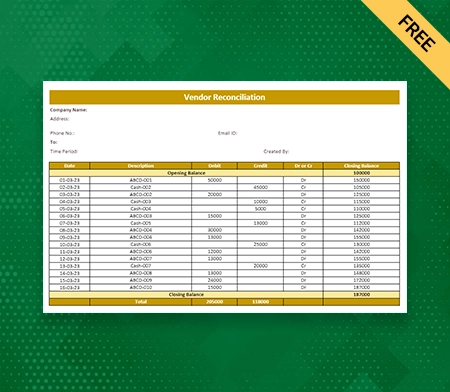

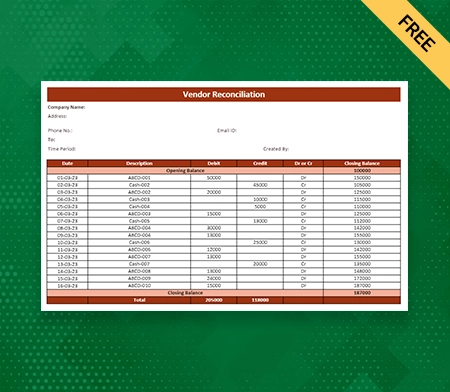

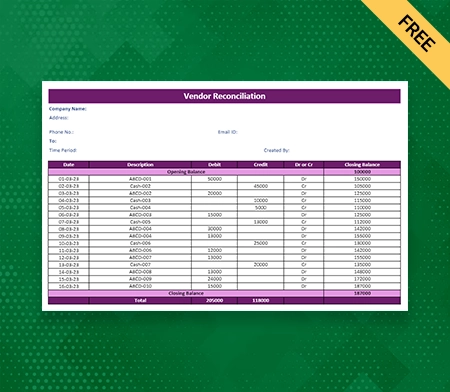

Components Of A Vendor Reconciliation Format In Excel

On the Vendor reconciliation format in Excel, you can specify the following fields:

Reconciliation Account:

As we read above, the reconciliation account refers to the accounting process ensuring the amount being paid matches the amount shown on the invoice and the vendors’ sheet by a particular period. This could be performed monthly, quarterly or even during the accounting period. Generally, the organisation performs this every month to get stress free about inaccurate transactions.

Vendors’ Account:

Vendors’ account refers to the account maintained by the Vendor to briefly note down the purchases they make during a particular time. It is a financial account used to manage the transactions and payments between businesses and its supplier.

Account Number:

It is the unique number of the Vendor’s account, which is entirely different from the account no. that exists overall. This is intentionally used to specify the account number from the vendors’ account numbers in their statements.

Statement Date:

The statement date or billing date refers to the date and time the statement is generated monthly/quarterly/yearly. Any transaction that has taken place on the card outside of the billing date has to reflect on the next billing statement.

Opening Balance:

The balance at the beginning of any accounting period is the opening account. You can also call it the amount “brought forward” from the previous period. It could also be applied to your bank account or financial records.

For example: If you open a brand new account at your bank with 5,00,000 lakh rupees. If you create a quickbooks account and set the starting date for the same day, 5,00,000 lakh rupees would be your opening balance. You can willingly begin your opening day on any chosen day.

Opening Balance Date:

The opening balance date is to be clear about the opening balance date of the vendor statement. It is mentioned to use the date before the opening date. If the start date is 1st May, you should use 30th April as the opening date balance.

Closing Balance:

Closing balance = Net cash flow+ opening balance

The closing balance is the amount of money any particular business has left at the end of the reporting period. This usually happens at the end of the fiscal year or every month, depending upon the organisation’s choice.

The closing balance remains in your account after all the sales are made, payment is made, bills are paid off all incurred expenses during a particular time. Depending upon the organisation’s organisation, this time could be on a day-to-day basis, monthly, quarterly, or yearly basis.

Due Date:

In its literal sense, the due date refers to the Vendor’s statement that has specified a due date on which any payment will be made.

References And Notes:

References are used to specify the references that are being given on the Vendor’s statement. Further, notes refer to the notes stated by the Vendor’s statement.

Benefits Of Vendor Reconciliation Accounts For A Business

A vendor reconciliation account manages the balances that any organisation owes to vendors by matching their invoices and accounts. This work is done by checking the firm’s accounts payable forms to the Vendor’s statements and invoices.

In a way, the reconciliation format in Excel by Vyapar has become important as it helps the organisation to be sure about the payment that they are making. The Vyapar app manages cash flow with seamless tracking of the overpaid and underpaid transactions.

Here are some important benefits of vendor reconciliation accounts:

1. It helps in having smoothness in the financial records, as businesses can ensure that their financial records are accurate and there is no error in the transaction. This process is essential for both internal and external reporting purposes.

2. A reconciliation account helps determine accuracy by matching the amount charged by the supplier, inventory, or services received by the company to the invoices and vendors’ accounts. It helps businesses to identify the mistakes and disturbances in their vendor invoices, preventing over and underpayments by the company.

3. The due date is also introduced under the reconciliation account to make timely payments. In any business, it is important to maintain timely payment by which the relationship between the Vendor and the supplier stays strong. Thus a vendor reconciliation account helps maintain this relationship by enabling the organisation to make timely payments.

4. Where timely payments can improve the company’s cash flow and goodwill, it can also save the organisation from being protected from the overpayments they could have made to the vendors unknowingly. This 100% ensures that any unwanted or irrelative transaction is not made during the processing of the month or the fiscal year.

5. Vendor reconciliation format has become highly essential for firms because it provides various benefits such as the improved structure of payment being done to the Vendor, maintenance of good vendor relationships, saving money and improving the cash flow.

In conclusion, any organisation must follow a vendor reconciliation account every month to reduce the chances of payment errors and enhance the smoothness and accuracy of payments. Not only this, It could help the organisation to build good relations with the vendors by making the payment on the due date.

Now you must be clear about the benefits of a vendor reconciliation account. Let’s further explore the other essential learnings of it through this blog.

Challenges Of Vendor Reconciliation For A Business

With every new task comes new challenges; let’s study the challenges you might face while maintaining your vendor reconciliation account. The challenges of vendor reconciliation include the following:

- Ensuring that all the invoices are received duly and are accounted for.

- Correctly putting together the purchase order and receiving reports.

- Any error that is being faced is resolved correctly.

- Invoices are being paid timely with the help of the due date to avoid any discrepancies.

- Maintaining records for important purposes such as auditing and others.

What is the Process Of Vendor Reconciliation?

We have gone through the basics of vendor reconciliation that any organisation should follow to have error-free transactions and stay protected from the overflow of money. We have easily broken down the steps you can follow to get the most effective vendor reconciliation done without errors. Follow these steps to get closer to the accuracy of vendor reconciliation:

Step 1: Prefer One Single Statement Template For Suppliers Statement:

It happens that you might have vendor documents in different formats, which might take longer to go through each and every statement. Prefer to combine all your Vendor’s statements into a single document which could be a pdf or a sheet, or any other form of document that you feel comfortable studying and going through the reconciliation.

This step will allow you to get uniformity and also a properly organised form of documentation for your organisation’s documents.

Step 2: Check The Row Item Correctly:

It is advised not to just go through the rows without paying much attention, as you can skip some serious errors you might regret later. Well, reconciliation is important to be done with full focus to not let any mismatch happen. Select the document and carefully go through the row one after another.

Step 3: Check The Vendor’s Statements:

The Vendor’s statement is the most crucial part to go through. It carries the payment entries of selected vendors. Please go through the lines that are being written on the Vendor’s statement and check it properly. Once you match the line properly, remove it and move to the other step.

Step 4: Allocate The Discounts And Credit Notes Properly:

This verification is said to be done at the beginning of the reconciliation, but to be on the safer side, check whether you have missed any discounts or offers.

Including credit notes for verification could also be beneficial because, without it, you would not be able to figure out why payment is in the vendor statements but in the debit section of your statement.

Step 5: Mark The Mismatched Entries And Clear Them With The Vendors:

There could be various reasons behind the deviation of entries; here are a few reasons:

- When the payment is revised late but it was paid pretty earlier. The problem with such payment entries is that the earlier paid entry might be in both records or in one of them but with the difference in the time phase.

- We all know that mistakes are the part of life that humans do. And here comes the role of omissions that could be done mainly because of human errors.

- Improperly aligned entries could be a result of missing documents by both parties.

- Some online invoicing could also delete the row or items the Vendor already paid for. If you don’t reconcile for the same at the correct time, you might end up paying it again because of noticing the difference in the amount owed.

- Don’t be afraid if you cannot match the vendor statement entry with a credit note or an invoice. In this case, if you are using any invoicing software, you can check invoices stalled for any reason.

- You can also prefer to check the GRIR(Goods Receipt Invoice Receipt) record to see if the receipt is regarding the goods/services that are received but not invoices. Also, check whether you can identify the PO number in the statement.

Verify this against your valid purchases and investigate further.

Why Use Vyapar App For Managing Vendor Reconciliation Formation In Excel?

The efforts you put in to pull out the reconciliation are worth it. But the benefits are splendid when you use the Vyapar app for reconciliation. Some crucial benefits of carrying out vendor reconciliation by the Vyapar app are as follows:

Faster Invoice Processing:

Be it a large-scale business or a small-scale business, when you have so many invoices to check up on, it takes a lot of time. Thus Vyapar helps in checking end-to-end invoices automation in such a way that the work gets quickly done.

This application saves you time, and you can use this time to focus on other important things. This software is built to provide accuracy and save you time, so you need not worry about discrepancies.

Easily Track Invoices:

Vyapar collects and updates the accounting system as soon as any new entry arrives. You can also choose to go paperless and keep all your accounting details updated on the application without being concerned about storage.

Thus this helps in keeping full track of the invoices of your account, and you do not skip or miss any important information that is required for you and your organisation. Apart from this, it also helps in maintaining healthy relations between the organisation and the Vendor with the help of timely payments.

Transparent And Detailed Work:

Suppose you are looking for software that could not only take care of your accounting needs but could provide you with each and every detail behind the accounting process. Vyapar is here to make your accounting convenient.

Vyapar helps to provide you with all the detailed work, whether it is for vendors’ reconciliation, invoices, balance sheets or any other documentation. Over one crore people have used it and found it convenient enough to rely upon.

Automatic Data Backup:

Vyapar helps in keeping all the data that your organisation has updated on its app. This means that you do not have to look for any papers or documents after having this app. You can simply find out all the documents in your account of Vyapar.

Vyapar is a 100% secure app to store your data accurately. Our free app helps you to save your data by creating local, external, or online google drive.

GST Invoicing and accounting software could easily recover the data quickly. Additionally, Vyapar in India comes with hassle-free automatic backup, so you dont lose anything.

Frequently Asked Questions (FAQs’)

The process of reconciliation helps in checking and matching the amount that the suppliers and vendors bill your organisation versus how much you actually owe to them.

The vendor reconciliation process helps in protecting your company from overpaying or underpaying your vendors or suppliers. It helps the organisation to maintain healthy relations with its Vendors and suppliers.

This may lead to over or underpaying the vendors. Basically, when you do not maintain any vendor reconciliation account, then there are chances that you skip any important payment, or you might make any payment twice.

Reconciliation can help you to recheck your payment that is yet to be done by going through the Vendor’s statement and the invoices.

A reconciliation account is a G/L account in which postings are made with an automatic feature whenever any business transaction is entered on a sub-ledger account.

The four major types of reconciliation are listed below:

1. Bank reconciliation:

Bank reconciliation is defined as the conclusion of banking and business accounts that reconcile a company’s bank account with its financial record.

This statement contains the record of all the deposits, withdrawals and other financial activities with the bank during a period of time.

2. Vendor reconciliation:

The reconciliation account refers to the accounting process that will ensure the amount being paid matches the amount shown on the invoice and the vendors’ sheet by a particular period. This could be performed monthly, quarterly or even during the accounting period. Generally, the organisation performs this every month to get stress free about inaccurate transactions.

3. Customer reconciliation:

The process keeps an eye on the details of the accounts receivable ledger. It helps record all related invoices and payments individually with the receivables control account in the general ledger.

4. Business-specific reconciliation:

By comparing the internal records at the start and end of the fiscal year, you can do business specification reconciliation. You’re looking to see if the goods sold or services provided match your internal records. Each business need will dictate the specifics of this reconciliation.

Related Posts: