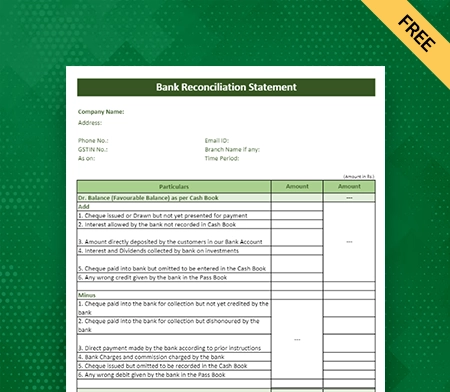

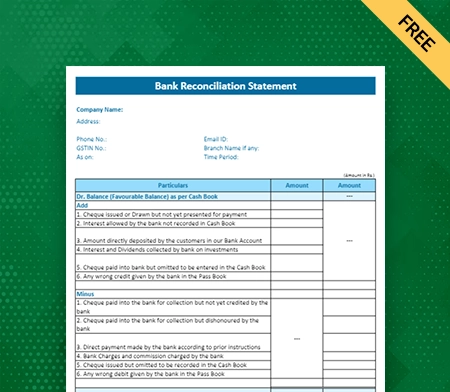

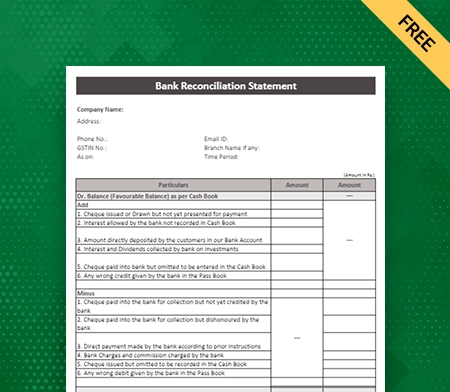

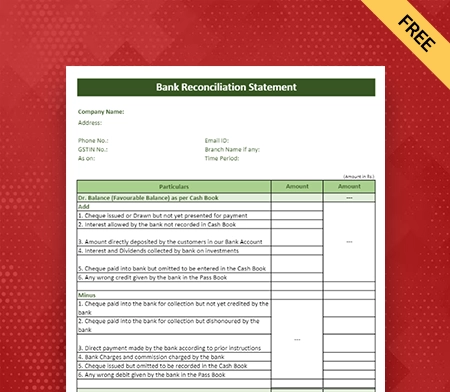

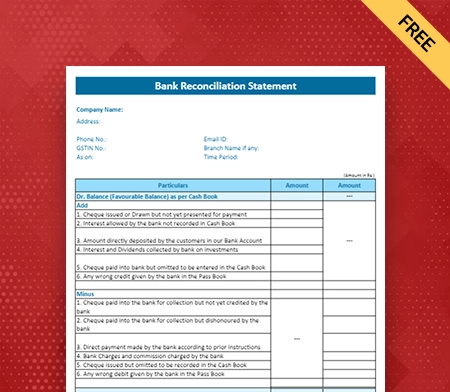

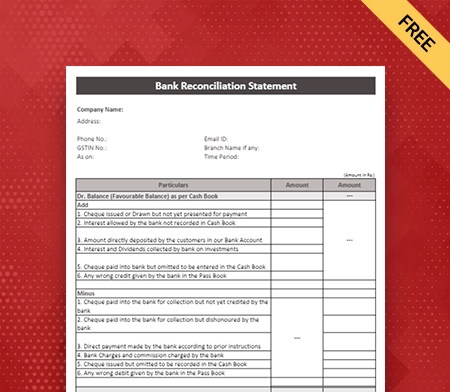

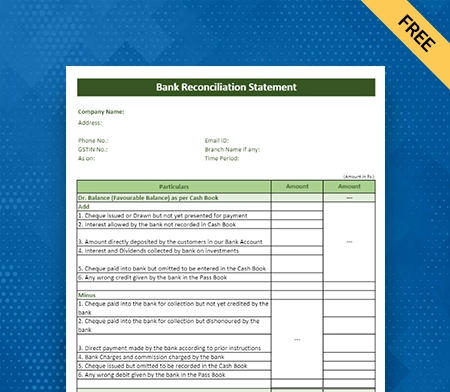

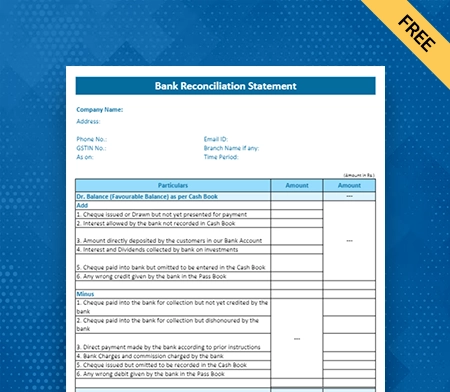

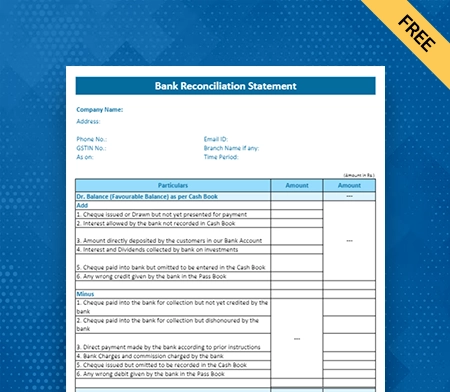

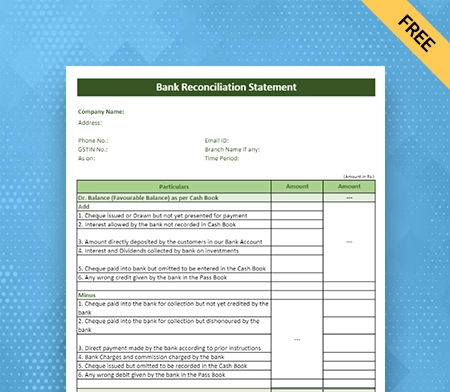

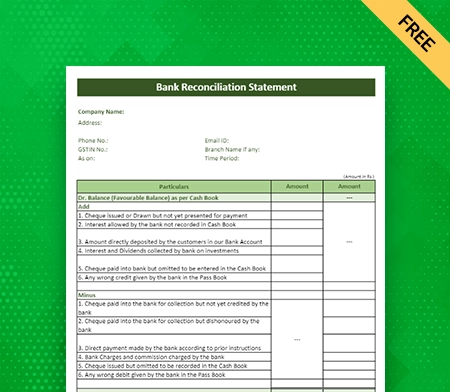

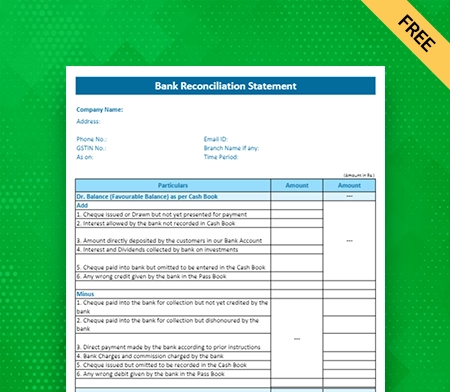

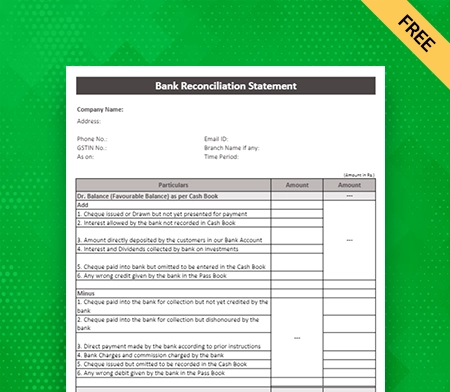

Bank Reconciliation Statement Account Format

Creating a bank reconciliation statement format could become effortless with a pre-designed format. Get the Vyapar premium plan and enjoy a top-notch and effortless accounting experience. Start with a 7-day free trial today!

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download Bank Reconciliation Statement Format

What is a Bank Reconciliation Statement Format?

A bank reconciliation statement is a financial document that helps businesses compare their financial records with bank statements. It ensures that the bank account’s balance matches the individual’s or business’s records. By preparing this statement, unwanted bank charges, discrepancies and errors can be identified and corrected.

Using Free Invoicing software Vyapar, you can use the bank reconciliation statement format for absolutely free. You can create as lengthy and detailed bank reconciliation statements as possible with the format. On the other hand, the bank reconciliation statement format is the format used to create this document.

The format provides a structured way to organize financial information and transactions for reconciliation. The bank reconciliation statement format consists of multiple sections. For example, there are sections such as – opening balance, bank transactions, individual or business transactions, discrepancies, adjusted balance, and remarks.

The opening balance section shows the initial balance from the previous statement. The bank transactions section lists all activities that occurred in the bank account. Businesses use a bank reconciliation statement format that helps tally the financial transactions with bank statements.

The format allows systematic comparison and reconciliation of the bank account balance with business records. The comparison is made in order to detect errors like missing transactions or double entries, if any. Regular reconciliation ensures accuracy, identifies fraudulent activity, and provides control over finances.

It also supports financial audits and gives an overview of the individual or business’s financial health. Therefore if you want to prepare a bank reconciliation statement using a format is the best way. Download Vyapar and access the bank reconciliation statement format for free.

Importance Of Bank Reconciliation Statement Format For Businesses

The Bank reconciliation statement format is an important tool for businesses to track their transactions. Every business in today’s competitive marketplace is using this format. Here are some key points that reflect this format’s importance:

1: Ensures Accuracy Of Financial Records

A bank reconciliation statement format is a financial tool to ensure accuracy in a company’s financial records. It involves comparing the bank statement with the internal records to identify and address any discrepancies or differences. This process is essential for ensuring all transactions are properly recorded and accounted for.

Regularly reconciling the accounting record instills confidence in the accuracy of a business’s financial data. This confidence is crucial for making informed decisions and preparing accurate financial statements. By regularly reviewing and reconciling their bank account, businesses can have a clear and reliable picture of their financial health.

2: Detects Errors And Discrepancies

A bank reconciliation statement format offers a crucial advantage in detecting errors and discrepancies between a company’s and the bank’s records. This format helps uncover various situations where transactions are missing, whether it’s an unrecorded deposit or an oversight by the bank in processing a transaction.

Identifying these errors allows businesses to promptly address them, ensuring the accuracy of their financial records. By rectifying such discrepancies, companies can be confident that their financial position is accurately represented.

3: Identifies Fraudulent Activities

A Bank reconciliation format is a useful tool for detecting fraud in a company’s financial transactions. It involves comparing the bank statement with the internal records to spot unauthorized or suspicious activities. This can include things like forged checks, unauthorized withdrawals, or fraudulent electronic transfers.

By catching these activities early, businesses can take action right away. For example, reporting fraud to the bank, improving internal controls, and investigating further to prevent future incidents. Bank reconciliation is an important part of fraud prevention, as it helps businesses protect their money and maintain stakeholder trust.

4: Improves Internal Controls

Implementing a bank reconciliation statement format helps enhance internal controls in a business. This format compares bank statements with internal records to ensure accurate financial transactions. Regular reconciliations help identify weaknesses in control systems and strengthen them through measures like segregation of duties and regular reviews.

Effective internal controls protect company assets, improve efficiency, and build stakeholder confidence in financial information. Reconciliation also helps detect and prevent errors or fraudulent activities. It promotes transparency and accountability by identifying discrepancies promptly.

5: Provides A Clear Picture Of The Cash Position

A bank reconciliation statement format is essential for businesses to accurately track their cash position. By reconciling bank accounts, businesses can determine their actual available cash book balance. This information is crucial for effective cash flow management, enabling informed decision-making about payments, investments, and expenses.

The reconciled cash position provides valuable insights into liquidity. In addition, it also helps in assessing financial health, meeting short-term obligations, and planning for future growth or contingencies. With an accurate understanding of their cash position, businesses can optimize cash flow, mitigate shortages, and make confident financial decisions.

6: Helps In Identifying Outstanding Checks/Deposits

A bank reconciliation statement format helps businesses identify outstanding checks and deposits that the bank hasn’t processed yet. By comparing issued checks and recorded deposits with bank statements, businesses can find outstanding transactions that banks haven’t cleared. It is important to avoid double payments, prevent overdrafts, and keep accurate financial records.

It also helps businesses track and address any discrepancies or delays in processing. Doing this allows you to make sure all transactions are accounted for on time. By reconciling and resolving outstanding items, businesses can maintain accurate cash balances. In addition, they can prevent any differences between their records and the bank’s records.

Advantages Of Bank Reconciliation Statement Format For Companies

With a bank reconciliation statement, your business will benefit a lot from improved financial management. If you want to track your money right, this format is what you need. Here are some more advantages of using this format:

1: Promotes Timely Reconciliation Of Bank Statements:

The bank reconciliation statement format is important for companies to reconcile their bank statements on time. Reconciling bank statements means comparing the company’s records with the bank’s records to find any differences. The bank reconciliation statement format helps companies compare their records with the transactions on the bank statements.

Doing this helps them find any missing transactions, errors, or timing differences between the two sets of records. By reconciling bank statements quickly, companies can deal with any differences as soon as possible. With this, you can ensure that the company’s financial records show the correct amount of cash and avoid problems like having too much or too little cash.

Reconciling bank statements on time helps find and solve errors or fraud early. If there are any unauthorized transactions or fraudulent activities, the company can find them through the bank reconciliation process. Further, required actions can be taken on time to fix the problem to avoid losses.

2: Supports Decision-Making Processes:

The bank reconciliation statement format is a valuable tool that supports decision-making in companies. Companies gain a clear and accurate view of their cash position by regularly reconciling bank statements. A real-time update of the cash flow position is crucial for making well-informed financial decisions.

Further, having up-to-date information about the company’s cash balance allows management to assess its financial capabilities. By understanding the available cash resources, companies can make decisions about – whether to proceed with these initiatives or explore alternative financing options.

The bank reconciliation statement format also helps companies monitor their financial performance. In addition, it also helps evaluate the effectiveness of their financial strategies. By comparing actual cash balances with projected or expected amounts, companies can assess the accuracy of their financial forecasts.

3: Promotes Timely Reconciliation Of Bank Statements:

The bank reconciliation statement format is important for companies to reconcile their bank statements on time. Reconciling bank statements means comparing the company’s records with the bank’s records to find any differences. With the bank reconciliation statement format, companies can match their records with the bank statement transactions.

It helps them find any missing transactions, errors, or timing differences between the two sets of records. By reconciling bank statements promptly, companies can address any differences early on. Doing this ensures that the financial records accurately show the company’s cash position, avoiding issues like incorrect cash balances.

Timely reconciliation also helps detect and resolve errors or fraud quickly. If there are any unauthorized transactions or fraudulent activities, they can be found through the bank reconciliation process. Timely identification of errors allows the company to take the necessary steps to fix the situation.

4: Facilitates Auditing And Financial Reporting:

The bank reconciliation statement format is crucial for companies in their auditing and financial reporting processes. Accurate financial records are important for auditors to evaluate the company’s financial health and compliance with regulations. The bank reconciliation statement BRS provides a detailed record of all banking transactions.

For example, transactions such as deposits, withdrawals, and other activities related to the company’s bank accounts. The format gives auditors a comprehensive view of the company’s financial activities, ensuring transparency and accountability. During the audit, auditors compare the transactions in the bank reconciliation statement with the company’s general ledger.

In addition to helping prepare bank reconciliation statements, the format also helps companies create precise financial statements. For example, statements it helps create are balance sheets, cash flow statements, and income statements. By making sure that the recorded cash balances match the banks’ records, companies can confidently present their financial position to stakeholders.

5: Enhances Financial Transparency And Accountability:

The format of the bank reconciliation statement is important for improving transparency and accountability in companies. It helps companies ensure that the company’s cash balance matches the balance shown in their bank accounts. And this way, the format promotes transparency in financial reporting.

When companies reconcile their bank balance, they can identify any differences or mistakes between – their own cash records and the bank balance record. Mistakes include transactions that were not recorded in the bank statement and errors made by the bank. By quickly addressing these mistakes, companies can keep their financial records accurate.

Accurate financial records give stakeholders a clear picture of their financial situation. Having this transparency helps build trust and confidence among investors. Improved financial transparency also helps with internal controls within companies. In addition, it also helps prevent financial mismanagement or misconduct.

6: Helps Identify Cash Flow Issues:

The bank reconciliation statement format helps companies identify cash flow issues. It allows companies to compare their cash records with bank statements to find differences. These differences could indicate potential cash flow challenges. For example, if the bank reconciliation shows many outstanding checks that haven’t been cashed, it suggests the company’s cash outflows may be higher than recorded.

Using this information, companies can investigate further and improve cash flow management. They can contact the payees to ensure the checks are processed or review their payment policies. Similarly, let’s suppose the bank reconciliation finds deposits in transit that haven’t been credited to the company’s account.

It indicates that the recorded cash inflows may be lower than the actual amounts. Companies can follow up with the bank to speed up the processing of these deposits and improve their cash position. Further, the format also identifies cash flow issues, so you can take proactive measures to address them on time.

7: Supports Accurate Financial Forecasting:

Accurate financial forecasting is essential for companies to make strategic decisions and plan for growth. The bank reconciliation statement format plays a vital role in this process. It provides reliable data for forecasting cash positions.

Through bank reconciliation, companies compare balances of cash with their recorded bank balances. It ensures that all transactions, such as deposits and withdrawals, are accurately recorded in the financial records. Further, this format also gives clarity on cash positions.

With an accurate understanding of their cash position, companies can make more effective forecasts of future cash flows. They can anticipate the timing and amounts of expected inflows and outflows. Doing this helps them prepare for any potential shortages or surpluses that might come in the future unexpectedly.

Why Choose Vyapar For Bank Reconciliation Statement Format?

Vyapar is India’s best accounting software for bank reconciliation integrated with advanced tools like bank reconciliation statement format. The format this software offers is expertly designed and comes with free accessibility. If that’s not enough, here’s more on why Vyapar is an ideal choice for this format:

User-Friendly And Intuitive Interface:

Vyapar is committed to providing a great user experience with its easy-to-use and intuitive interface. The billing software has been designed to be user-friendly and can be easily navigated, even by those who may not have a strong accounting background.

The interface is organised and visually appealing, which makes it quick and easy to find the tools and features needed for managing bank reconciliation statements. The menus and options in Vyapar are clearly labelled and logically arranged.

The simplicity of navigation makes it easy for you to perform tasks such as importing bank statements. Besides, the user-friendly nature of Vyapar means that businesses can start using the software immediately. There’s no need for extensive training or expertise.

Customisable Bank Reconciliation Statement Templates:

Another great advantage of using Vyapar is that it offers customisable bank reconciliation statement templates. The templates can be adjusted according to the specific requirements of businesses. Users can easily modify the format, layout, and design of the templates to suit their needs.

They can add or remove sections, adjust bank column headers, and even incorporate their company’s branding elements. The customisation feature ensures that the bank reconciliation statements generated through Vyapar are accurate. In addition to that, it should be visually consistent with the business’s unique identity.

It is especially advantageous for businesses that need consistent formatting across different financial documents. Or, if you want to present your statements in a way that resonates with their stakeholders, customisation features are advantageous for you.

Integration With Multiple Bank Accounts:

Vyapar makes it easy for businesses to integrate multiple bank accounts seamlessly. The integration enables users to bring together their financial data from different sources into a single platform. As a result, the reconciliation process becomes much simpler.

The simplicity is achieved because there’s no need to switch between different systems. In addition, you don’t have to manually input data from various bank statements. Since both these tasks are eliminated, Vyapar offers convenience towards bank reconciliation.

Moreover, with Vyapar, users can effortlessly connect their bank accounts and import statements. Furthermore, you can automatically reconcile transactions, regardless of how many accounts are involved. The automation feature saves time and reduces the potential for errors when dealing with multiple bank accounts.

Time-Saving And Streamlined Reconciliation Workflow:

Vyapar streamlines the bank reconciliation workflow, providing significant time savings for businesses. The software automates several key process aspects, such as automatic calculations. When creating a reconciliation statement using Vyapar’s format, it automatically makes the required calculations with the corresponding entries.

With this, the need for manual reconciliation gets eliminated. Moreover, with the reconciliation statement created using Vyapar, identifying discrepancies or unaccounted transactions is easy. When you compare the format with your bank statements, you can easily review and resolve any transnational issues.

By automating these traditionally time-consuming tasks, Vyapar speeds up the reconciliation process. Further, this allows businesses to allocate their resources to other crucial aspects of their operations. Thus, if you need a time-saving accounting solution, go with Vyapar.

Dedicated Customer Support And Assistance:

Vyapar understands the importance of customer satisfaction. Thus, we offer dedicated support and assistance throughout the bank reconciliation process. The software provides multiple support channels, including email, phone, and live chat.

Therefore, users can reach out for help whenever they face challenges or have questions about the reconciliation statement format. The customer support team at Vyapar consists of knowledgeable professionals who are experts in the software’s functionalities.

They are ready to provide prompt and accurate solutions to any user queries. With their guidance and assistance, businesses can fully utilize Vyapar’s features. Moreover, it helps resolve any issues and make the most of the software for their bank reconciliation needs.

Cost-Effective Solution For Businesses:

Choosing Vyapar for bank reconciliation statement format is a cost-effective solution for businesses. By automating and streamlining the reconciliation process, Vyapar eliminates the need for manual data entry. Automation helps in reducing the risk of errors.

Using Inventory Management Software Vyapar saves time, allowing employees to focus on activities that generate revenue. The software’s accuracy in reconciling transactions also minimises the risk of financial discrepancies, penalties, or fines resulting from errors in the bank reconciliation process.

In addition, Vyapar’s pricing structure is cost-effective and accessible to businesses of all sizes. It provides a scalable solution that aligns with organisations’ budgetary constraints. By choosing Vyapar, businesses can streamline their bank reconciliation processes while maximising cost efficiency and minimising operational risks.

Frequently Asked Questions (FAQs’)

Bank reconciliation is essential for businesses because it ensures the accuracy and integrity of their financial records. It helps identify discrepancies between the bank’s and the business’s accounting records, such as the cash book. By reconciling these records, businesses can identify errors, fraud, or other issues and take appropriate action to rectify them.

We recommend preparing a bank reconciliation statement every month. Doing so ensures that you identify and resolve any discrepancies or errors promptly. Regular bank reconciliations also help businesses maintain accurate and up-to-date financial records.

To match the bank records with your books of accounts, start by comparing the closing balance per the bank statement with the balance per your accounting records. Identify any outstanding checks or deposits that have not yet cleared.

Please consider any bank charges or other adjustments that you need to account for. By systematically analysing these factors, you can reconcile the bank’s records with your books of accounts.

Yes. You can prepare a bank reconciliation statement manually. However, manual preparation can be time-consuming and prone to errors. Using reconciliation statement format software like Vyapar can significantly simplify the process and enhance accuracy.

When using reconciliation statement software, choosing a reputable and secure software provider is crucial. Look for software that employs encryption protocols and follows industry best practices for data security. Additionally, ensure that the software allows you to set user permissions and restrict access to sensitive financial information.

A bank reconciliation statement typically includes the following information:

– Bank statement details opening and closing balances, statement date, and period covered.

– Adjusted book balance: The balance in your accounting records after making necessary adjustments.

– Reconciling items: A list of outstanding items, such as uncleared checks or deposits in transit.

– Final reconciled balance: The adjusted book balance plus or minus the reconciling items, resulting in the final reconciled balance that matches the bank statement.

Note: The specific format and contents of a bank reconciliation statement may vary depending on the organisation’s requirements and the accounting software used.

The bank reconciliation statement format typically includes:

1. Opening balance as per the bank statement.

2. Additions (e.g., deposits in transit).

3. Deductions (e.g., outstanding checks).

4. Adjusted bank statement balance.

5. Book balance as per company records.

6. Additions/Deductions to reconcile book balance.

7. Adjusted book balance.

8. Reconciliation statement explaining adjustments.

When reconciling a bank statement, Vyapar can simplify the process by automating bank statement imports, matching transactions, and identifying discrepancies accurately.

Compare deposits and withdrawals.

1. Adjust for outstanding transactions.

2. Update the bank statement.

3. Compare balances.

4. Identify differences.

5. Investigate discrepancies.

6. Resolve and make adjustments.

Related Posts: