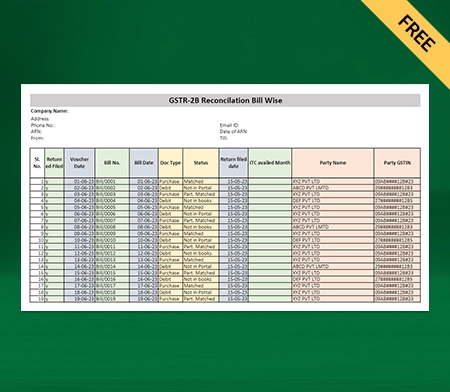

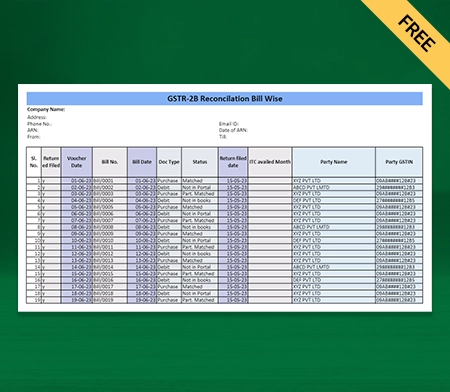

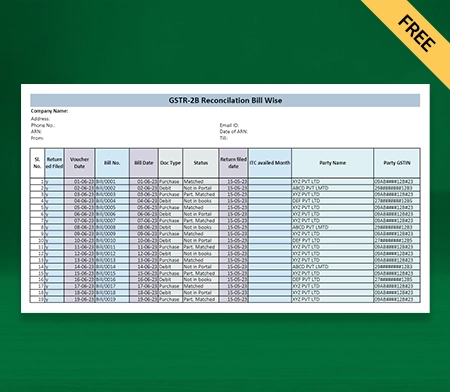

GST Reconciliation Format

Use the customizable GST Reconciliation Format by Vyapar to rectify the mismatches in your GST returns. All the reconciliation formats are entirely free and simple to use. Try them now!

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

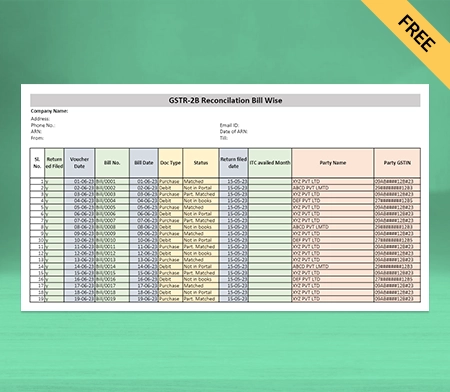

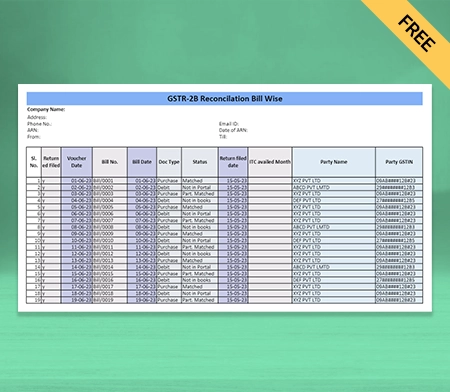

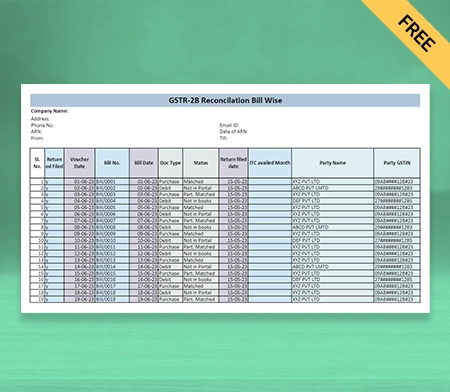

Download GST Reconciliation Format

What is the GST Reconciliation Format?

Reconciliation, in general, means comparing two sets of data to determine discrepancies. Once the discrepancies are identified, they can be rectified by either the supplier or the recipient.

GST Reconciliation compares the tax details declared in a taxpayer’s GST returns with the tax details as per the books of accounts maintained by the taxpayer. It ensures the tax liability is accurately calculated and paid to the government.

All registered taxpayers with turnover above five crore rupees in a particular financial year must file GSTR 9C. It is an annual audit form with a reconciliation statement. It compares the annual returns filed for F.Y. in GSTR-9 and figures shown in the audited financial statements of the taxpayer.

It will include gross and taxable turnover as reported in the books, reconciled to the corresponding sums from all the GST returns for the financial year. Any discrepancies found during this reconciliation process and their causes will be published here.

Contents of GST Reconciliation Format:

The GST Reconciliation Format includes the following details:

- GSTIN of the taxpayer

- GSTIN of the supplier/customer

- The tax period for which reconciliation is being done

- Details of outward supplies (sales) as per taxpayer’s GST returns

- Details of inward supplies (purchases) as per supplier/customer’s GST returns

- Details of any amendments or corrections made by the taxpayer or supplier/customer

- Details of any differences or discrepancies between the taxpayer’s and supplier/customer’s data

- Reconciliation statement summarising the differences and their resolution

Why is GST Reconciliation Necessary?

A GST-registered business is required to file periodic GST returns. The reconciliation process ensures that the returns filed are accurate and match the corresponding entries in their books of accounts.

Reconciliation helps identify errors or discrepancies in the GST returns or accounting records. It helps ensure that the GST liability or refund amount declared in the GST returns is accurate and that the business is paying what is required.

Reconciliation helps speed up the accounting process by pointing out discrepancies. Finding errors in accounting records can increase their correctness and lessen the risk of mistakes in subsequent GST filings.

Reconciliation lessens the possibility that the tax authorities may impose penalties, fines, or take legal action. Businesses can save potentially costly penalties and fines by ensuring the GST requirements are followed.

Reconciliation offers valuable information about the company’s sales and purchase data that may be utilised to analyse performance, spot trends, and come to wise business decisions.

Various Types of GST Reconciliation

Here are some types of GST Reconciliation that you should consider before filing your GST return:

Inward Supplies and GSTr-2a Reconciliation:

Inward supply means the goods purchased by a registered taxpayer from a supplier. A registered taxpayer is required to report the details of the purchase in their GST returns. It determines the amount of GST payable by the taxpayer.

GSTR-2A is an auto-populated form containing the details of all the inward supplies a registered taxpayer receives. The information in GSTR-2A is generated from the GSTR-1 returns filed by the suppliers.

Reconciliation of GSTR-2A matches the details of inward supplies as per GSTR-2A with the actual purchases made by the taxpayer. It enables you to ensure that Input Tax Credit is claimed on invoices where the vendor has stated their GST due, but the buyer in their returns has yet to claim the credit.

GSTr-3b and GSTr-2a Reconciliation:

GSTR-3B is a monthly return form registered taxpayers must file under GST. It is a summary of all the transactions that have taken place during a particular month. GSTR-2A is a purchase-related tax return containing details of all the inward supplies a registered taxpayer receives.

The details of inward supplies mentioned in GSTR-2A are compared with those of outward supplies mentioned in GSTR-3B. If there are any differences, the taxpayer should immediately rectify them and adjust the GSTR-3B return.

The reconciliation of GSTR-3B and GSTR-2A helps ensure that all the inward supplies received during a particular period have been correctly reported in the GST returns. It helps taxpayers avoid penalties or interest charges the GST authorities may levy for non-compliance.

GSTr-3b and GSTr-1 Reconciliation:

The GSTR-3B is a monthly return form that GST-registered taxpayers must submit. It is an overview of all the transactions during a specific month. GSTR-1 is a detailed return that contains all the details of outward supplies made by a taxpayer.

The GSTR-3B summary return and the GSTR-1 return contain different amounts of sales information. In the reconciliation process, every invoice is included and recorded once in either return. It guarantees that a taxpayer will accurately calculate the output tax due on sales made within a period.

The details of outward supplies in the form GSTR-1 are compared with those in the form GSTR-3B. If there is any mistake, it is rectified and adjusted in the GSTR-3B return. The revised GSTR-3B return is then filed with the GST portal.

Benefits of GST Reconciliation

GST Reconciliation compares the purchases and sales data reported in a business’s GST returns with those of their suppliers and customers. The benefits of GST Reconciliation are as follows:

1. Identify Discrepancies: GST Reconciliation helps businesses identify discrepancies between their GST returns and those of their suppliers and customers. It ensures that errors are rectified promptly, preventing legal or financial implications.

2. Accurate Input Tax Credit: GST Reconciliation ensures businesses claim the correct Input Tax Credit (ITC) on their purchases. The reconciliation forms help reduce the business’s tax liability and increase profitability.

3. Compliance With GST Laws: GST Reconciliation ensures that businesses comply with the GST laws and regulations. You can avoid any legal and financial penalties for non-compliance.

4. Avoidance of Unnecessary Tax Payments: GST Reconciliation helps businesses avoid unnecessary taxes. Businesses can reduce their tax liability and save on taxes by ensuring that the Input Tax Credit claimed by the registered person is accurate.

5. Improved Cash Flow: GST Reconciliation helps businesses improve their cash flow by claiming the correct Input Tax Credit and paying the correct amount of tax. It helps avoid unnecessary tax payments, improving the business’s cash flow.

6. Better Decision Making: GST Reconciliation provides businesses with accurate data on their purchases and sales. This data can be used to make better pricing, inventory management, and cash flow management decisions.

In summary, GST Reconciliation provides businesses with accurate data on purchases and sales, helps them claim the correct Input Tax Credit, ensures compliance with GST laws, and improves their cash flow.

Benefits of Using GST Reconciliation Format:

Here are some benefits of using automated GST Reconciliation Formats:

1) Helps Save Time:

Using a customized GST Reconciliation Format will save time for your company. You don’t need to create a form from scratch every time. The ready-made GST Reconciliation tool can fill in the reconciliation details.

It takes a while to complete manually, is time-consuming, and is prone to error. Use the formats provided by the Vyapar app to get around this issue. Using this method, you can avoid beginning over each time you require a bill.

You can edit the GST Reconciliation Format to save the information about your company. The customized format can be saved and used as needed to save time.

2) Maintain Consistency:

Using the same GST Reconciliation Format every time helps you maintain Consistency. Using this method, you can avoid starting over each time you need a Bill.

Users can fill out the form in less time and use the extra time to focus on other essential tasks. Additionally, since you use the same format every day, you know which fields belong where.

You can maintain the accuracy of GST Reconciliation forms without errors using online formats. It also helps increase the productivity of your team.

3) Customisable Format:

Offering professional GST Reconciliation Format and estimates enhances the brand’s reputation. To foster confidence, you might make all relevant information regarding the deal available.

Building a credible brand for yourself is made easier with a professional GST Reconciliation Format. A custom form that has been expertly created can help you stand out from the crowd and project a professional seller image.

Your invoice can incorporate your company’s logo, style, font, and brand colours to express your firm’s identity effectively. Making use of the GST Reconciliation Format gives you a polished appearance.

4) Easy to Use Format:

Small businesses can readily use the GST Reconciliation Format without complicated accounting methods. You can make GST Reconciliation forms by downloading a free copy of the format in different modes.

Choose the template that best fits your company’s needs and fill it out with the necessary data. It’s simple to update the information about your company in the GST Reconciliation Format.

With the help of our free GST Reconciliation Formats, you can easily create a unique, expert form to meet your business’s demands. After creating the GST Reconciliation, you can view, download, and save its format.

5) Print Or Save On Your Device:

You can send your GST Reconciliation Format electronically instead of through physical means. You can manually fill in the details of your GST form after printing a digital copy, which only takes a few minutes. Or, you can enter them before printing.

The user can download the GST Reconciliation Format for future use. Everything about the process is free. You appear more professional thanks to the customization, which increases your brand’s worth.

You can customize the GST Reconciliation Format to suit your needs. Also, you can also print the custom format and manually enter the data. The GST Reconciliation Format works with standard and thermal printers and any typical bill size.

6) Minimise Errors:

Errors may arise when manually entering every detail into the GST Reconciliation form. We recommend choosing a GST Reconciliation Format to prevent errors and save time by minimizing repetitive data entry.

Automation increases process effectiveness and reduces human error. By following a formal structure, you may focus on the crucial concerns that demand your attention.

It is easy to use the GST Reconciliation Format that Vyapar provides. You can download GST Reconciliation Formats online using this software. You don’t need to hire extra staff to design the format.

Valuable Features of the Vyapar App For Managing Your Business:

The online format generator has several benefits. You can also take advantage of its outstanding features if you download the Vyapar app for accounting and billing purposes, such as:

Make GST Invoices Online:

The Vyapar billing software helps develop a trustworthy brand identity by offering efficient GST billing choices. You can adhere to the regulations of the Indian Goods and Service Tax.

Use our simple invoicing software to adhere to GST regulations. You can make GST invoices for clients in a few simple steps. You can send them to your clients via print, email, or WhatsApp.

Using Vyapar, you may quickly produce bills. It’s a straightforward procedure that won’t need extensive, hard training. You can choose from more than 10+ GST invoice formats and billing/invoice templates in the application to create professional and distinctive bills.

Both online and offline usage of the Vyapar app is possible. An SME can more easily follow the best accounting procedures with the help of the software. For enterprises, it streamlines the bookkeeping procedure.

Track and Manage Orders:

Having tracking capabilities makes it much easier to fulfill orders quickly. Establishing a due date simplifies managing orders effectively and ensures that inventory items are available.

Vyapar simplifies the process of creating orders for sales or purchases. Use our GST invoicing software to cut labour expenses and time. Users can save time by automating the transformation of orders into sale/purchase invoices.

Tracking helps avoid unnecessary losses. Use the time you would have spent tracking to complete other routine tasks. You can track when payments are due using the app and add a tax invoice to your order.

Easily you can track open, closed, and late orders using our free billing software. You may improve the order types for your purchases and sales using our GST Reconciliation billing solution.

Get Helpful Reports:

If companies want to keep growing, they must make sensible decisions. Using Vyapar, you can generate up to 40+ different business reports. Expert balance sheets are included with the Vyapar accounting software.

With the information gathered from invoices produced with the E-Way Bill Format in Excel, you can improve your company’s operational effectiveness by exporting reports from Vyapar.

The free GST Reconciliation tool helps analyze precise financial information, business data, etc. Also, it is a rapid and effective method of determining profitability. Reports in the GSTR 1 format, GSTR 3B format, and GST-related reports can all be made.

With our free GST Invoicing and accounting Software, users may immediately examine and analyze the data. The software lets you make graphical reports to track sales and expenses.

Manage the Cash Flow of Your Business:

Businesses may keep track of invoices using Vyapar’s billing and accounting software. It facilitates efficient payment handling and tracking.

You can keep an eye on your current payables and receivables with Vyapar. Your company’s cash flow guarantees that you have adequate cash on hand to maintain operations.

The dashboard can demonstrate how simple it is for you to pay recurring expenses without skipping EMI payments. Cash flow information might help you make decisions more swiftly.

It will ensure efficient operations while also helping to reduce debt. Several corporate functions, including billing and accounting, depend on effectively managing cash flows.

Manage Bank Accounts:

You can quickly add, manage, and track online and offline business payments. You may quickly enter data into the free billing software, regardless of whether your revenue comes from banks or e-wallets.

You can send or receive money via bank accounts and conduct bank-to-bank transfers for seamless cash flow management. With all the cash-ins and cash-outs using the Vyapar invoicing software, it is perfect for enterprises.

To use the bank accounts feature, you need to link Vyapar Accounting Software to a business bank account. Using the Vyapar app, managing credit cards, O.D., and loan accounts is simple. You can use it to deposit or withdraw money from bank accounts.

You may handle cheque payments and manually change the amount using free accounting software from Vyapar. Open checks are available on the Vyapar App, allowing users to deposit or withdraw funds and immediately close them.

Data Protection For Your Company:

You can regularly store all data in local or online Google Drive backups created with Vyapar. Also, you constantly have access to financial information about your business via various gadgets.

Your business’s data won’t be accessible to other team members or parties, ensuring its long-term security. The “auto-backup” feature of the bill generation app allows you to continue where you left off.

The billing and accounting app Vyapar simplifies business management. The app’s comprehensive dashboard enables you to analyze the daily activities of your business instantly.

As an additional layer of security, the software uses encryption technology to restrict access to the data to the owner alone. User login information won’t be saved or shared by Vyapar for later use.

How to do GST Reconciliation?

The GST Reconciliation process involves comparing the information from your books of accounts and GST returns. The steps you can take to perform a GST Reconciliation are as follows:

Collect and Verify the Data:

Collect the relevant data related to your sales and purchases. Verify that the data in your GST returns are accurate and that the GSTIN, invoice number, date, value, and other details match.

Identify the Discrepancies:

The next step is to compare the data in your GST returns with the data in your books of accounts. Identify any difference or mismatch in your records.

Review and Rectify:

After identifying the mistake, the next step is to review the mismatches. Rectify the differences by updating your books of accounts or GST returns. For example, if you have missed out on reporting a sale in your GST returns, you can rectify it by filing a revised return.

File Your Returns:

File your GST returns with accurate data when you’ve reconciled the data. Save copies of all the paperwork to reconcile the GST, including the invoices, debit notes, credit notes, and GST returns.

It is essential to perform GST Reconciliation regularly to ensure that your GST returns are accurate and to avoid any penalties or interest charges for incorrect filings.

Frequently Asked Questions (FAQs’)

The GST (Goods and Services Tax) reconciliation format is a document businesses use to reconcile the GST returns filed with the corresponding entries in their books of accounts.

GST Reconciliation is essential for businesses to ensure compliance with GST regulations, improve accuracy, and manage risks effectively.

A typical GST Reconciliation Format generally includes the following required information:

1. GST registration details

2. GST returns details

3. Sales and purchases data

4. Adjustments

5. Reconciliation calculations

6. Reasons for differences

7. Supporting documents

Yes, businesses or organizations can customize the GST Reconciliation Format to meet their specific needs. Please note that you should customize the GST Reconciliation Format in compliance with the relevant GST regulations and guidelines.

To perform GST reconciliation:

* Collect GST returns and invoices.

* Compare data for discrepancies.

* Identify and rectify errors.

* Reconcile Input Tax Credit (ITC).

* File corrections if needed.

* Document the reconciliation process.

Yes, GST reconciliation is mandatory for businesses under the GST regime in India to ensure accuracy and compliance.

In GST, there are two main types of reconciliation:

GSTR-2A vs. Purchase Register Reconciliation: Compares GSTR-2A with the purchase register to verify input tax credit (ITC) claims.

GSTR-3B vs. GSTR-1 Reconciliation: Compares data in GSTR-3B with GSTR-1 to ensure consistency in reporting sales and purchases.

The last date for GST reconciliation varies based on the specific reconciliations required and the taxpayer’s filing frequency. It’s important to stay updated with GST compliance deadlines to avoid penalties.

Related Posts:

1. Composition Dealer Invoice Format