Nonprofit Accounting Software for NGOs

Making it easy for NGOs to track donations, grants, and expenses. Our accounting software is most trusted by not for profit organizations in India. Try it for free and streamline your operations.

1 Cr+

Audits Passed

99.9%

Data Accuracy

30+

Minutes Saved Daily

🔥 What Makes Vyapar Accounting Software Right for Your Nonprofits?

For an NGO, every rupee is a pledge. Vyapar enables you to fulfil that promise, building confidence and giving you the financial clarity to track every donation and proving your impact to people who support your cause.

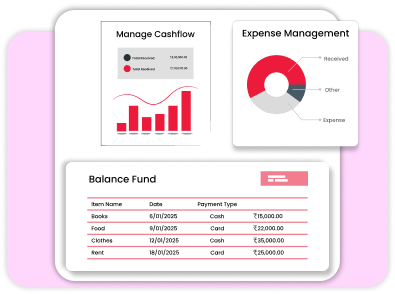

Simplified Fund Accounting

With our nonprofit software, demonstrate financial responsibility to donors, board members, and stakeholders by tracking funds and maintaining transparency and compliance.

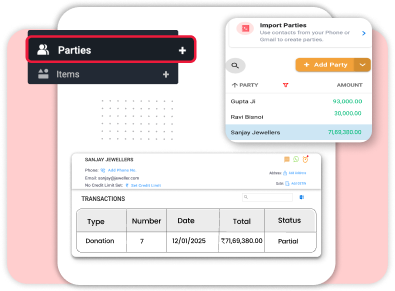

Manage Donor & Donation

We help to build strong and open relationships with donors by tracking donations from individuals or businesses, and auto acknowledge on WhatsApp.

Grant Tracking And Reporting

Our accounting app for NGOs highlights the grants impact by producing comprehensive reports. You can easily track grants, manage funds, and satisfy donor needs.

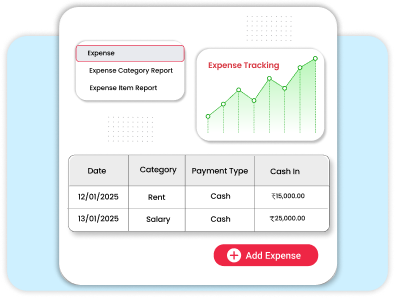

Easy Expense Management

Vyapar guarantees the financial stability of a nonprofit organization by recording the expenses helps to manage budgets and improve accountability to stakeholders and donors.

Fundraisers Are Loving the Vyapar App

Overall, this application is very useful for any business to keep their book of transactions easily and can generate any report at point of click.

Debraj (Chairman)

Source: sourceforge

Overall experience is good, no complaints from my side to Vyapar. It has great features and options to use, thankful to Vyapar for giving us a good app.

Akshay (Accountant)

Source: sourceforge

Ultimately application is very attractive and simple to have all transactions in one point of application, which is very helpful for business.

Geeth C (Secretary)

Source: sourceforge

Where Your NonProfit Mission Meets Our Innovation

Your passion for change deserves smarter tools. Our simple and advanced software simplifies your finances and connects you to achieve your organization’s mission.

Make Every Donation Count – Track and Organize

Take your NGO to the next level, which is built for both small and large Indian nonprofit organizations with true fund accounting features.

Discover Vyapar’s Not for Profit Accounting App Features for Easy Management

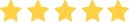

Compliance and Audit Support

Track Receivables and Payables

Provides Multiple Payment Options

Online/Offline Accounting

Inventory Management for Supplies

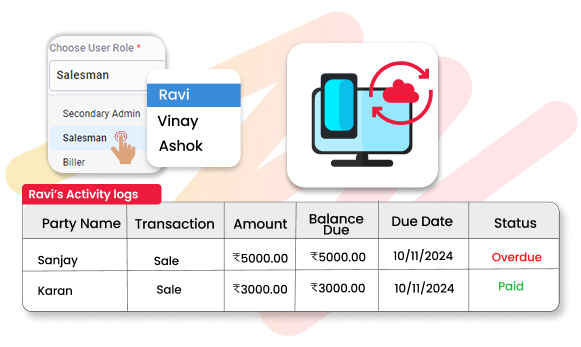

Multi-user and Multi-Device Access

Receipt Generation

Marketing Tools

Vyapar ensures compliance and simplifies the auditing process, allowing your nonprofit organization to focus on its mission.

- Regulatory Compliance: Built to meet specific accounting standards with accurate financial reporting.

- Streamlined Audits: Automate financial processes and maintain comprehensive documentation for effortless audits.

- Enhanced Credibility: Build trust with donors, board members, and regulatory authorities.

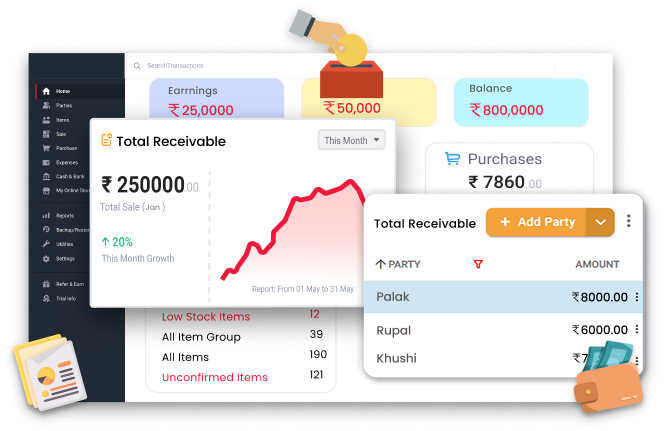

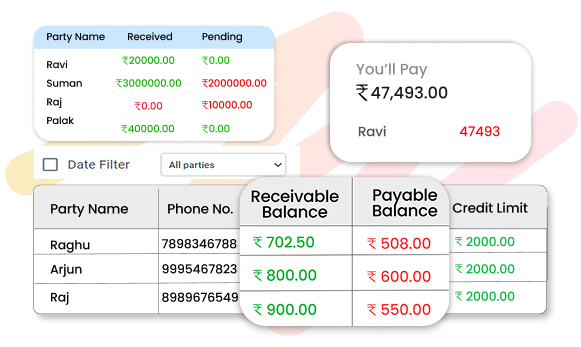

Our simple accounting software for nonprofits simplifies receivables and payables management, ensuring seamless cash flow tracking for NGOs.

- Professional Invoices & Bills: Create invoices and bills to track transactions securely.

- Effortless Cash Flow Monitoring: Manage accounts receivables and payables by party via a user-friendly dashboard.

- Payment Reminders: Send reminders via WhatsApp, SMS, or email to ensure timely payments.

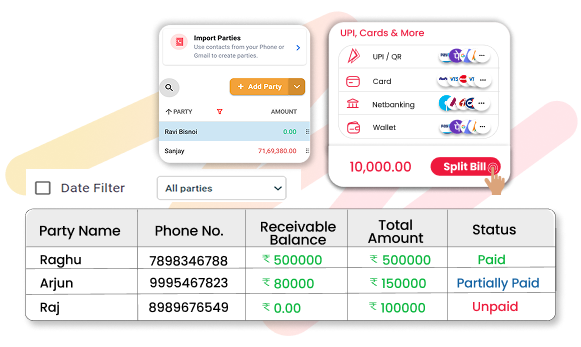

The software provides multiple payment options, ensuring convenience for your donors and steady cash flow for your NGO.

- Flexible Online Payments: Accept NEFT, RTGS, IMPS, UPI, QR codes, e-wallets, and credit/debit cards effortlessly.

- Convenient Offline Payments: Offer cash, cheque, and QR code payment options for donors without internet access.

- Donor-Friendly Transactions: Make it easy for donors to contribute using their preferred method

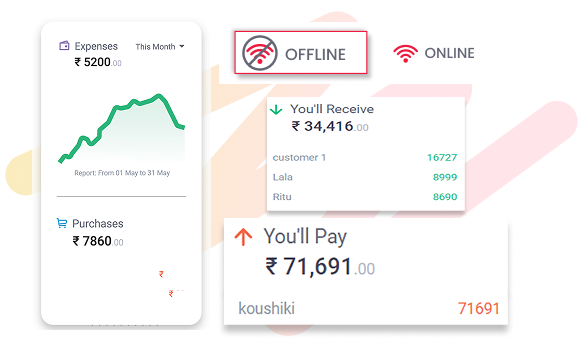

Vyapar is the ideal solution for NGOs seeking reliable accounting software that works both online and offline.

- Efficient Transaction Recording: Record and track transactions instantly, eliminating delays.

- Offline Functionality: Accept donor payments like cash and eWallets without an active internet connection on our offline accounting software.

- Perfect for Remote Areas: Designed to work seamlessly in rural and remote locations across India.

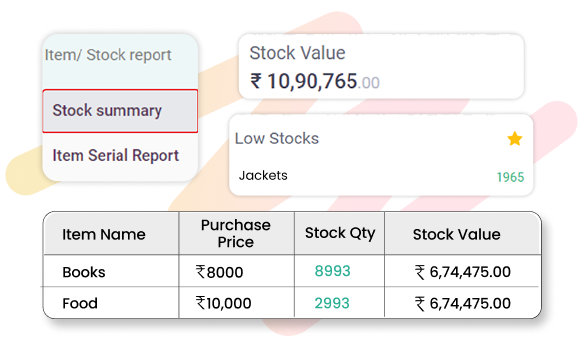

Offers real-time tracking, organized reporting, and easy categorization of in-kind donations, ensuring efficient utilization and improved accountability of your NGOs.

- Track In-Kind Donations: Manage supplies, food, or other donated items effortlessly with features like barcode scanning for quick entry and automated inventory updates for real-time tracking.

- Maintain Stock Levels: Monitor inventory with stock alerts to prevent shortages or overstocking with an integrated inventory tracking system.

- Ensure Proper Utilization: Allocate supplies effectively to meet organizational needs.

Vyapar’s cloud accounting software for nonprofits ensures seamless team collaboration and secure data management with its advanced Multi-User and multi-device access features.

- Role-Based Permissions: Assign specific roles and access levels to your team members for enhanced collaboration and data security.

- Mobile-Friendly Access: Manage your accounts effortlessly, anytime, anywhere, with our user-friendly mobile app.

- Enhanced Convenience: Enable your team to stay productive and aligned, even wherever they are.

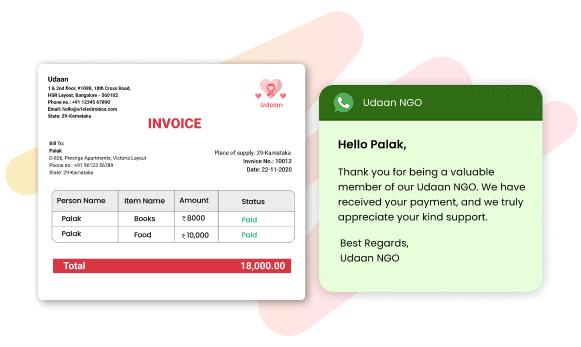

Vyapar, the best free accounting software for nonprofits, streamlines donor management and enhances engagement with its Donor Communication and Receipt Generation feature.

- Personalized Receipts: Generate donor-specific receipts quickly to ensure transparency and compliance with the invoicing system.

- Thank-You Letters: Strengthen relationships with donors by sending personalized appreciation letters effortlessly.

- Improved Accountability: Keep your donors informed and build trust with clear and accurate documentation.

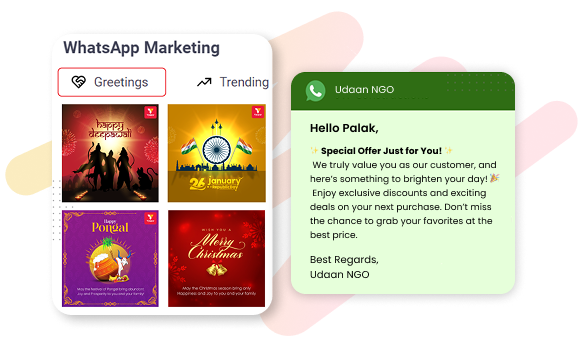

Our accounting app for nonprofits makes it easy to connect with supporters and keep them engaged through its Marketing Tool feature.

- Targeted Campaigns: Create and send personalized messages to donors, volunteers, or members, ensuring your communication feels genuine and relevant.

- Event & Fundraiser Promotions: Promote upcoming events or campaigns directly from the app, helping boost participation and awareness

- Relationship Building: Strengthen connections with your community by consistently sharing updates, impact stories, and achievements.

Flexible Pricing for Every Stage of Your Business

Start your nonprofit social service journey with the plan that fits your needs. Upgrade and downgrade anytime.

Free (Mobile)

₹0/month

Perfect for getting started

![]() Audit Trial

Audit Trial

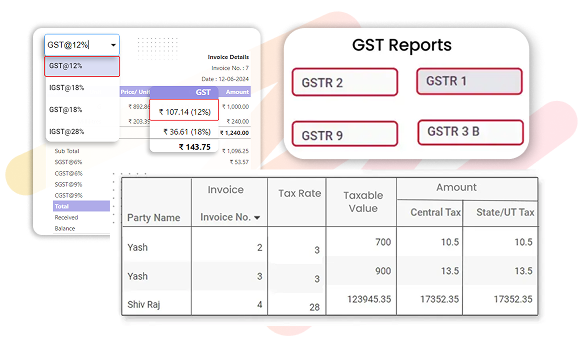

![]() GSTR Reports

GSTR Reports

![]() Expense Tracking

Expense Tracking

![]() 1 Firm/Organisation

1 Firm/Organisation

![]() Invoice & Bill Creation

Invoice & Bill Creation

Silver Plan

₹283/month

Billed annually + GST@18%

Great for small Stores

![]() Everything in Free plan

Everything in Free plan

![]() 3 Firm/Business

3 Firm/Business

![]() Multi Device Sync

Multi Device Sync

![]() Fixed Assets

Fixed Assets

![]() WhatsApp Integration

WhatsApp Integration

![]() Import Donors

Import Donors

![]() Share with CA

Share with CA

Most Popular

Gold Plan

₹308/month

Billed annually + GST@18%

Most popular for growing businesses

![]() Everything in Silver plan

Everything in Silver plan

![]() 5 Firm/Businesses

5 Firm/Businesses

![]() Service Reminders

Service Reminders

![]() Journal Entries

Journal Entries

![]() Chart of Accounts

Chart of Accounts

![]() Account Statement

Account Statement

![]() Accountant Access

Accountant Access

Platinum Plan

₹833/month

Billed annually + GST@18%

Popular for large businesses

![]() Everything in Gold plan

Everything in Gold plan

![]() Add Unlimited Businesses

Add Unlimited Businesses

![]() Complete Party Management

Complete Party Management

![]() Comprehensive Reports

Comprehensive Reports

![]() Marketing Tool Access

Marketing Tool Access

![]() Import/Export Data (Tally)

Import/Export Data (Tally)

![]() Priority Customer Support

Priority Customer Support

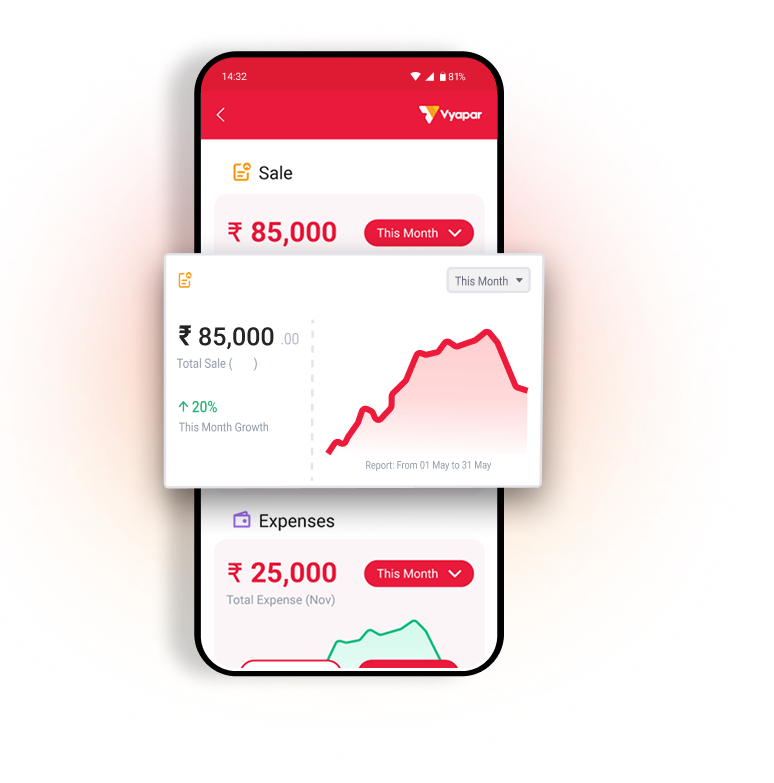

Run Your Organization from Your Phone

Track every donation, report & grants with a simple tap – right from your pocket.

Recommended by Leading Industry Experts

Ready to Transform Your Business Documentation?

Join thousands of nonprofits owners managing and impacting the society with Vyapar App

Frequently Asked Questions (FAQs)

What is Not-For-Profit Accounting Software?

Not-for-profit accounting software is a specialised financial tool made for non-profit organisations. It helps manage accounting for funds, keep track of donations, handle grants, and create reports to meet rules for non-profits. This software streamlines financial processes, makes it easier to handle donors, and ensures that stakeholders get accurate financial reports

How Can Accounting Software for Nonprofits Help Streamline Financial Processes For My Organisation?

The best accounting software for nonprofits streamlines financial operations by automating donation tracking, grant management, and fund accounting duties. It eliminates the requirement of manual data entry, saving time and reducing errors. The software generates comprehensive financial reports, making it simpler to comply with regulations and provide stakeholders with accurate financial data. It improves organisations’ overall financial administration, allowing them to focus more on their mission.

Can I Manage Multiple Funds And Grants Within The Software?

Using Vyapar NGO accounting software allows you to manage multiple funds and grants simultaneously. You can allocate and track transactions specific to each fund or grant for accurate financial reporting. You don’t have to pay additional fees to use our software as it offers a 7-day free trial to test its features and tools and see if it suits your not-for-profit organisation.

Can I Generate Financial Reports For Board Members And Other Stakeholders Easily?

Vyapar not for profit accounting software facilitates the production of financial reports for board members and other stakeholders. It provides pre-built and modifiable reports tailored to their specific requirements. This assures transparent and timely access to financial data, allowing stakeholders to make informed decisions and gain insight into the organisation’s financial health.

How Does Vyapar Handle Compliance With Non-Profit Regulations And Reporting Requirements?

Not-for-profit accounting software ensures compliance with non-profit regulations by incorporating reporting features unique to the sector. It contains features for filing IRS Form 990, monitoring restricted funds, 60 days balance sheet, and managing grants in accordance with applicable regulations. It ensures the organisation’s continued compliance with legal and financial standards, reducing the regulatory compliance burden for non-profits.

Is The Not-For-Profit Accounting Software Cloud-Based Or On-Premises?

Vyapar is a cloud-based accounting software solution for non-profit organisations. As a cloud-based platform, non-profit organisations can securely access their financial data from any Internet-connected location. It enables real-time collaboration among team members and provides the flexibility to manage finances efficiently while the software provider handles automatic data backups and system updates.

Can The Software is Suitable for All Type of Not-for-Profit Organisation Requirements?

Vyapar’s accounting software for nonprofits is compatible for all type of organisation uses. If you are running a healthcare foundations, educational, children welfare or any other NGO, our app suits and makes organization management easy.

Is There A Limit To The Number Of Users Who Can Access The Software?

Your organisation’s subscription plan will determine the number of users who can access Vyapar’s accounting software. Vyapar typically provides scalable solutions, allowing non-profit organisations to select plans based on their requirements and required user count. It ensures that the software suits small and large non-profit organisations with variable team sizes and access requirements.

How Can I Manage Accounting Operations For Free For My Not-For-Profit Organisation?

You can use the Vyapar accounting app for nonprofits to manage your organisation’s accounting operations seamlessly. It offers free trial for your organisation before finally committing to our not for profit accounting software. Vyapar is trusted by millions of businesses and organisations across India to perform their accounting operations effectively.

Show More