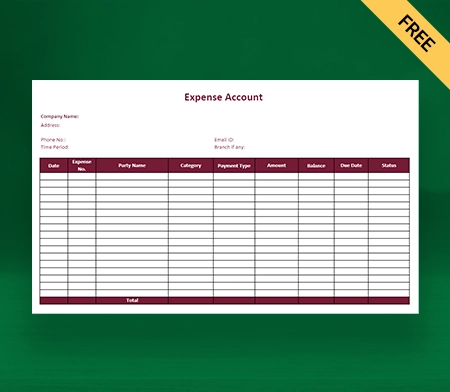

Expense Account Format

Use the customizable Expense Account Format by Vyapar to record your business expenses. It makes the entire process seamless and helps you manage your tasks easily. All account formats are available for free, so try them now!

Download Expense Account Format in Excel

What is an Expense Account?

Expense Accounts are temporary accounts that record the amount of money a company spends during a given accounting period. Expense Accounts are also known as contra-equity accounts as they have a debit balance. They are made for a set period, like a month, quarter, or year. New accounts are created for each new period.

Expense Accounts appear in the company income statement, which is the profit and loss account. The account increases when company funds are debited. The account decreases when funds are credited from another account into an Expense Account. These debit and credit entries aim to finish the bookkeeping period with a balanced account.

The purpose of an Expense Account Format is to provide a clear and consistent way of recording and reporting expenses, which helps to ensure accurate financial records and proper tax reporting. They are also used for budgeting, forecasting, and analysis. It allows businesses and individuals to make informed spending and financial management decisions.

Types of Expenses Accounts

The double-entry bookkeeping system has four main types of Expense Accounts. They are as follows:

Operating Expenses

Operating expenses are incurred to carry out daily business operations and create operating revenues. Operational expenses are directly connected to the business’s core activities. They are crucial because they can be used to evaluate a business’s cost and inventory management effectiveness.

It emphasizes the level of expenditures a business must make to produce revenue. Rent, salaries, wages, repairs, office supplies, utilities, cost of goods sold, etc., are linked to operating expenses.

Non-Operating Expenses:

Non-operating are the expenses that occur outside the primary activities of the business. They are indifferent to day-to-day activities. Non-operating expenses do not directly facilitate the core product or generate revenues or services during manufacturing, sale, or distribution.

Non-operating expenses are reported at the bottom of the company’s income statement after making deductions from the total operating profits. They mainly consist of restructuring, reorganizing, interest charges on debt, etc.

Fixed Expenses:

Fixed expenses do not fluctuate due to changes in production or sales volume. Although they may change over time, they are called period costs. Fixed expenses include depreciation, insurance, rent, loans, and other non-fluctuating expenses.

Fixed expenses are recurring in nature. They are mostly not related to the direct production of goods or services. If your fixed expenses are low, you tend to have more savings and profits.

Variable Expenses:

Variable expenses change with the output of production and sales of the business. Variable costs rise in response to rising production or sales and fall in response to falling output or sales.

Variable expenses help determine a product’s contribution margin, establishing a company’s break-even or target profit level. Raw materials, labour, utilities, commission fees, and distribution charges are a few examples of variable expenses.

Difference Between Expense Account and Income Account

- The main purpose of making an Expense Account is to track the costs incurred by a business or individual. On the contrary, the primary purpose of an income account is to track the revenue earned.

- Expense Accounts are debited when expenses are incurred, while income accounts are credited when revenue is earned. It means an Expense Account will have a debit balance, while an income account will have a credit balance.

- Examples of Expense Accounts include rent, salaries, and supplies, while income accounts include sales, fees, and interest earned.

- Expenses reduce the net income of a business, while revenue increases it. This means that when expenses are recorded in an Expense Account, they decrease the net income, while revenue recorded in an income account increases it.

- Expense accounts are normally listed on the income statement, whereas income accounts are listed on the income statement’s revenue section. The income statement shows the revenue and expenses for a specific period. It also displays the difference (net income or loss) at the bottom of the statement.

List of Expenses Incurred in Business

Rent Expense:

Rent is the expense of using a building or site for business purposes. They include stores, warehouses, offices, and factories. Rent forms a massive amount of total costs.

Interest Expense:

Interest is the cost of borrowing expressed as a percentage. Interest payments are the payments businesses pay to a lender or financial organization for lending money.

Utility Expense:

Utilities are the electricity, heating, natural gas, water, and sewage costs incurred during a predetermined period. Charges for the phone and internet are also included in this expenditure account. Utility expense consists of a mixed cost, as it comprises both a fixed cost component and a variable charge based on usage.

Marketing, Promotion, and Advertising:

The costs associated with promoting a company’s name, goods, and services include market research and advertising expenses. The cost of running adverts for a given period is an advertising expense incurred for the company.

Why Should You Maintain an Expense Account?

You can maintain your legality by separating your expenses. You can prevent combining deductible and non-deductible expenses by categorizing the quantities of your expenses.

Maintaining an Expense Account helps businesses to track their expenses accurately. It ensures that the financial statements of the business are accurate. It is essential for effective budgeting, financial planning, and tax purposes.

An Expense Account is essential for maintaining organization and assisting with budgeting. You can better determine ongoing and one-time costs by breaking down your company’s expenses. In this manner, you may forecast future costs when making your budget.

Businesses can get better control over their expenditure and stay within their budget by tracking their expenses. Utilizing an Expense Account helps individuals and organizations avoid overspending and identify areas where they can reduce expenses, providing valuable benefits for managing their finances.

You may readily compare your outgoing and incoming cash flow if you have an Expense Account. You may also track where all your money goes by breaking down your costs into separate accounts.

Maintaining an Expense Account simplifies the reimbursement process for employees who incur business-related expenses. It relieves employees from bearing the cost of business expenses personally.

Tips For Creating an Expense Account For Your Business

You can keep track of your spending and improve your financial decisions by setting up an expense account. Here are some pointers to assist you in setting up a suitable expense account:

Set Up Categories:

Start by organizing your expenses into categories such as rent/mortgage, groceries, transportation, utilities, entertainment, and other personal expenses. It will help you quickly identify where your money is going.

Track Every Expense:

Keep a record of every expense, no matter how small. You can use a book, spreadsheet, or an app to track your expenses.

Use Receipts:

Keep receipts for all your purchases, which will help you verify your expenses and avoid discrepancies.

Be Consistent:

Make sure to track your expenses and update your Expense Account regularly and consistently. Consistency will assist you in managing your money, and you will not spend over the limit.

Analyse Your Expenses:

You must take some time to review your Expense Account regularly and identify areas where you can cut back on spending. Analyzing your expenses can accelerate your financial progress and help you save money.

Benefits of Using Expense Account Format By Vyapar

1. You Can Maintain Consistency:

An Expense Account Format by Vyapar ensures that all employees report their expenses similarly, making it easier for managers to compare and analyze expenses across departments or individuals.

Maintaining consistency ensures that every expense report includes all essential information, reducing the likelihood of errors or omissions. Standardizing expenses in an Expense Account Format enhances clarity and facilitates easy comparison of different expenses.

Additionally, it ensures clear and uniform presentation of all expenses, helping to avoid confusion and inconsistencies. This helps in more accessible analysis and identification of patterns or trends.

2. Helps Keep Accurate Expense Records:

The Expense Account Format ensures accurate and consistent reporting of expenses, minimizing the risk of errors and discrepancies in financial statements. It is a structured way of presenting data related to costs.

It increases the accuracy of financial reporting, making it simpler for managers to allocate resources and set budgets. This structure captures all necessary information related to an expense consistently, including the date, amount, vendor, and purpose.

Including all relevant details helps prevent errors and ensures accurate account information. Using a standardized Expense Account Format also helps to identify each expense and the associated account. It is important when reconciling accounts or auditing expenses.

3. Enhances Efficiency:

Expense Account Formats by Vyapar save time and effort by providing a clear template for employees to use when reporting expenses. It reduces the time employees and managers spend creating and reviewing expense reports, freeing time for more critical tasks.

Vyapar Expense Account Formats have some automated features that save time and reduce the risk of errors. Automation can automatically categorize expenses and generate reports, saving employees the time and effort of tracking and reporting expenses manually.

An Expense Account Format can promote accountability by ensuring employees know what expenses are allowed and what are not. Clear guidelines help employees in adhering to spending limits and submit appropriate expenses, reducing the likelihood of overspending or inappropriate expenses.

4. Print or Save the Expense Format to Your Device:

You can maintain your Expense Account electronically and physically. After printing a digital copy of your GST form, you can manually fill it out, which only takes a few minutes.

The Expense Account Format is available for download by the user for later usage. The entire procedure is cost-free. The customization makes you seem more professional, raising your brand’s value.

The Expense Account Format can be modified to meet your requirements. Printing the customized format and manually entering the data are also options. The Expense Account Format is compatible with all common bill sizes and standard and thermal printers.

5. Personalise Your Expense Account Format:

A customized Expense Account Format can make a company look more professional and organized. It shows that the company pays attention to detail and takes its financial responsibilities seriously.

A consistent and customized Expense Account Format can help reinforce a company’s brand image. It shows that the company pays attention to every aspect of its operations and maintains a consistent image across all channels.

Customized Expense Account Formats can include a company’s logo, colours, and other brand elements, which can help reinforce brand recognition and awareness among employees, vendors, and other stakeholders.

6. Minimise Errors In Your Expense Account:

Expense Account Formats by Vyapar are designed to be clear and easy to read. It reduces the likelihood of errors caused by misunderstandings or misinterpretations.

Vyapar’s Expense Account Formats include built-in calculations, such as summing up expense categories or calculating totals. This reduces the risk of calculation errors when employees manually add up expenses.

Vyapar’s Expense Account Formats include clear instructions on how to fill out the form, including what information is required and where to enter it. It minimizes the chances of errors arising from employees’ lack of clarity regarding their responsibilities.

Features of the Vyapar App that Can Help You Manage Your Company Seamlessly

Vyapar app has many features that can help you in your daily business tasks. Here are some fantastic features:

Track Expenses:

To properly prepare your accounting and taxes, keeping track of and documenting all expenses made throughout the delivery of the goods is crucial. Vyapar makes it easier to generate precise reports and track expenditures.

Tracking expenses makes it possible to increase revenue and reduce costs. You can easily keep track of outstanding obligations using the free software. Also, it aids in their material tracking in the future.

With the assistance of our free billing software, budgeting is simple. Companies may immediately cut costs and save a significant amount of money. You may monitor GST and non-GST expenses using our free billing software.

Vyapar is a free mobile app for small and medium-sized businesses. As a result, they can handle the money spent and received. Also, maintaining tabs on your expenditures will make it easier to develop workable alternatives. Hence, business profitability will rise.

Manage Inventory Seamlessly:

Vyapar’s inventory management software helps boost performance. You may monitor your company’s sales using features of the Vyapar app, including business reports. It will make assessing how well you have handled your inventory easier.

By utilizing inventory tracking features, businesses maximize the utilization of their inventory space. Using the analysis, you can eliminate things that don’t sell very often and conserve room.

To track inventory effectively, businesses utilize essential information such as the batch number, expiration date, manufacturing date, slot number, and other relevant details. It helps to have the necessary stock available for sale when needed. It also aids in maintaining a record to make sure that no theft goes unreported.

You can view the current status of your inventory with the free billing software provided by Vyapar. Also, you can configure notifications to notify your suppliers of any new orders.

Keep Data Safe With Backups:

To ensure that all data is secure, you must create backups. You can set up an automatic data backup using Vyapar to protect the security of the data kept in the application.

Since data today serves as the foundation of all businesses, keeping that data secure is vital. You may safeguard your company’s security by setting up timely secure backups or creating automatic backups.

You can periodically build a local backup to help protect your data in a private location like a pen drive or hard drive for more security.

With the accounting features of Vyapar billing software, you can also analyze your sales data whenever necessary and develop a business plan after reviewing the business reports generated by the Vyapar app.

Manage Your Company’s Cash Flow:

With the billing and accounting software from Vyapar, businesses can keep track of invoices. It makes tracking and handling payments more effective.

You can maintain tabs on your current receivables and payables with Vyapar. Your company’s cash flow makes sure that you have enough cash on hand to carry on with your operations.

The dashboard can highlight and remind you to pay regular expenditures without skipping EMI installments. You might make decisions more quickly if you know cash flow.

It will guarantee effective operations and help in debt reduction. Accounting and billing are two essential responsibilities that rely on efficient cash flow management.

Generate Expense Reports:

Companies must make wise judgments if they want to continue expanding. You can create up to 40+ distinct business reports with Vyapar. The Vyapar accounting software can help create professional expense reports.

You can increase the operational efficiency of your business by exporting reports from Vyapar using the data acquired from invoices created with E-Way Bill Format.

The free tool facilitates the analysis of exact business and financial statements, among other things. Also, it is a quick and efficient way to assess profitability. You can generate expense reports, manufacture reports, sales reports, and other reports with the help of Vyapar.

Users can review and analyze the information immediately with our free GST invoicing and accounting Software. You can create graphical reports using the software to monitor sales and expenses.

Bank Account Management:

You can send or receive money via bank accounts and do bank-to-bank transfers for seamless cash flow management. Enterprises can use the Vyapar invoicing software for all their cash-ins and cash-outs, making it ideal.

Payments for both online and physical businesses may be added, managed, and tracked quickly. Whether your revenue comes from banks or e-wallets, you can quickly enter data into the free billing software.

Using free accounting software from Vyapar, you may manage cheque payments and manually alter the amount. The Vyapar App offers open checks, allowing users to deposit or withdraw money and instantly cancel them.

To use the bank accounts feature of Vyapar Accounting Software, a business bank account must be connected to it. Managing credit card, O.D., and liability accounts are accessible with the Vyapar app. It can be used to deposit money and make withdrawals from bank accounts.

Frequently Asked Questions (FAQs’)

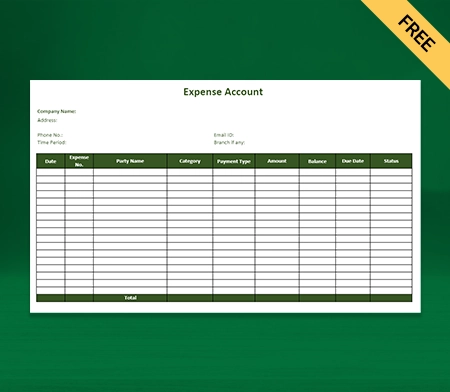

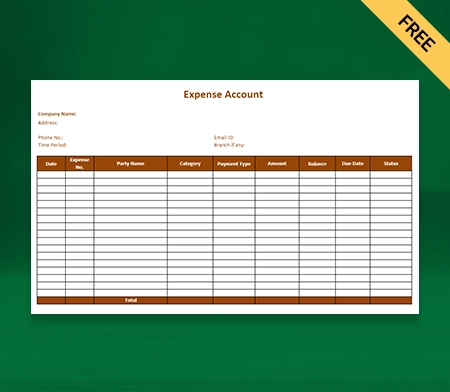

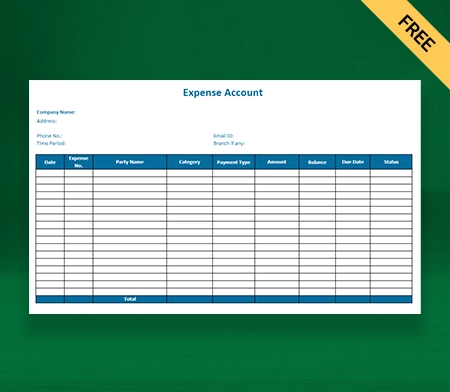

An Expense Account Format is a standardized structure used to track and report the expenses incurred by a business or an individual. The format includes specific categories for various expenses. Travel, office supplies, equipment, utilities, rent, etc., are some examples that are included in the expense account format.

Here’s an example of an Expense Account Format:

1. Date of expense

2. Description of expense

3. Amount of expense

4. Vendor or payee

5. Approval signature and date

A standardized format ensures that all employees report their expenses similarly, making it easier for managers to compare and analyze costs across departments or individuals.

An Expense Account Format will include columns for the expense date, a description of what was purchased or the reason for the expense, the expense amount, and the expense category. Some formats may include columns for the vendor or supplier, payment method, and associated tax or fees.

Yes. You can use Expense Account Formats by Vyapar for free. The templates are available online, and they are easily accessible.