E-Way Bill Format

Vyapar billing software is your one-stop solution for generating E-Way Bill Formats. You may generate customized bills with our all-in-one automated solution. A free 7-day trial is available right now, so try now!

How to Generate an E-Way Bill Using Vyapar?

Here’s how you can generate an E-Way Bill using the Vyapar desktop application:

- Open the Vyapar desktop application.

- On the left side, there’s a setting option. Click on it.

- Select “Taxes & GST” in the setting and enable the E-Way Bill number.

- After clicking “enable E-Way Bill number,” you will see an option of “Generate E-Way Bill no.” Click on it.

- Create a new sales invoice. At the bottom right side, you will see a “Generate E-Way Bill button.” Click on that. A pop-up window will be opened in which you need to enter your GST login id and password.

Note: Step 5 is required only for the 1st Time Users - After logging in, a screen called ‘generate E-Way Bill’ will be opened.

- Fill in all the required details in the form and click the generate button.

- You can view, save, and download the E-Way Bill using the Vyapar E-Way Bill generator.

- If any situation requires you to cancel the E-Way Bill, you can do so within 24 hours of generating such a bill.

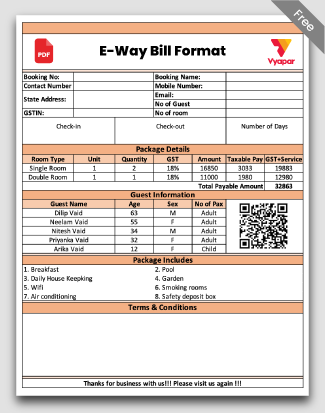

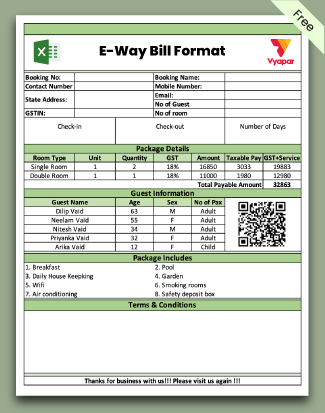

Download E-Way Bill Format For Free

Download professional free e-way bill templates, and make customization according to your requirements at zero cost.

What is an E-Way Bill?

E-Way Bill, or electronic way bill, is a document generated on the GST bill portal for moving goods worth more than Rs 50,000.

The E-Way Bill mechanism ensures that goods being transported comply with GST laws. It helps in tracking the movement of goods and prevents tax evasion.

It has two divisions. The invoice and recipient information is in Part A. Transporter specifics, including departure information and vehicle numbers, are included in Part B.

An electronic way bill is produced for:

- Supply of goods

- Non-supply transactions include export/import, returns of items, job work, line sales, sales based on approval, semi-knocked-down supplies, supplies of goods for shows or fairs, and supplies for individual use.

Contents of an E-Way Bill

An E-Way Bill follows a standardized format. It must include the following:

- E-Way Bill no

- E-Way Bill date

- Generated by

- Validity

Further, there are two divisions in E-Way Bill Format.

Part A:

- GSTIN of recipient

- Place of delivery (PIN Code)

- Invoice or challan number and date

- Value of goods

- HSN code

- Transport document number

- Reasons for transport of goods

Part B:

- Mode of transportation

- Vehicle Number

- Place of dispatch

- Other transportation details

The person causing the movement of goods exceeding Rs.50,000/- must fill out part A, while the person transporting the goods must fill out part B.

What Documents are Necessary to Create an E-Way Bill?

- The delivery challan, bill of supply, or invoice.

- The transporter should have their transporter ID on them when travelling by vehicle.

- The transporter should have their transporter ID, the transport document number, and the transportation date while transporting goods by rail, air, or ship.

- The E-Way Bill number or a copy of the E-Way Bill (EBN).

- The transporter might carry the EBN physically on paper or mapped to a radio frequency identification device (RFID).

Purpose of Generating E-Way Bill

The E-Way Bill is a document required to be generated by the person responsible for the movement of goods in India, and it is used for the following purposes:

1. Movement of Goods:

The E-Way Bill serves as a document that validates the movement of goods from one place to another. It enables the tax authorities to track the movement of goods and ensure they are transported with proper documentation.

2. Compliance With Tax Laws:

The E-Way Bill is mandatory under India’s Goods and Services Tax (GST) regime for moving goods worth more than Rs. 50,000. It ensures compliance with tax laws and helps to prevent tax evasion.

3. Hassle-Free Transportation:

The E-Way Bill enables the seamless movement of goods from one state or union territory to another, as it serves as a single document for the entire journey.

Using E-Way Bills eliminates the need for multiple documents at different checkpoints, thereby reducing the time and effort required for transportation.

4. Efficient Logistics Management:

The E-Way Bill helps in the efficient management of logistics operations by providing real-time information on the movement of goods. It helps to optimize the supply chain and reduce the time and cost of transportation.

In summary, the E-Way Bill is an essential document that helps to ensure compliance with tax laws, facilitates hassle-free transportation, and enables efficient logistics management.

Validity of E-Way Bills

The distance determines an E-Way Bill’s validity travelled by the goods. The E-Way Bill will be valid for one day from the relevant date for distances under 100 kilometres.

The validity of E-Way Bills will increase by one day from the pertinent date for every 100 Kilometres after that. The term “relevant date” refers to the date the E-Way Bill was generated.

The validity period is measured starting from the moment the E-Way Bill was generated, with each day equaling twenty-four hours.

The validity of E-Way Bills can not be extended. However, in specific categories of goods, the Commissioner may extend the validity period only by issuing a notification.

Also, suppose extraordinary circumstances prevent the items from being delivered within the E-Way Bill’s validity period. In that case, the transporter may generate another E-Way Bill by changing the information in Part B of FORM GST EWB-01.

How to Generate E-Way Bills on the E-Way Bill Portal?

The GST E-Way Bill portal facilitates the generation of E-Way Bills. You must be registered as a transporter for GST to utilise the platform.

Step 1:

- Go to https://ewaybill.nic.in/.

- Access the E-Way Bill generation page.

- Enter your login information to access the platform.

Step 2:

Select “Create New” from the E-Way Bill-Main menu page to produce a new E-Way Bill.

Step 3:

A new EWB bill generation form will appear. Similar to creating a GST invoice, fill out the necessary information. If you are the supplier, choose outward; if you are the recipient, choose inward. Where applicable, include the GSTIN and the supplier and recipient’s information.

Further information is added to the blank fields in the form when a registered GSTIN is submitted in the designated field. Please double-check the information before moving on to the next stage.

Step 4:

Enter Goods Description. Information to be filled out in the second half of the page is as follows:

- The product name and description

- It is necessary to input the product’s HSN code. To get the HSN code, check the website.

- Product quantity and unit.

- The cost of the goods and the tax rate

- Rates of CGST or IGST are applicable. For intra-state transportation, SGST/CGST would apply, whereas IGST would apply for interstate transport.

- The approximate distance of the transport of goods and the transporter’s name and ID. This will establish whether the E-Way Bill is valid.

The transporter must have a radio-frequency identification (RFID) tag installed in his vehicle. The information from the E-Way Bill created for the products being transported by the vehicles is uploaded into the RFID system.

Step 5:

Create an E-Way Bill. The “SUBMIT” button must be clicked when all the required information has been entered to produce the EWB. The E-Way Bill with the E-Way Bill number and the QR Code, including all the information in digital form, will be shown on the billing portal.

The printed copy of the invoice bill of supply should be given to the transporter, who will keep it with them the entire journey till they deliver it to the consignee.

The E-Way Bill allows updating the details once it has been created. As long as the existing E-Way Bill is not due on its validity date, the transporter, consignment, and consignor details can be updated.

Who Should Generate an E-Way Bill?

If the value of the goods is above Rs 50,000:

- Every registered person generates an E-Way Bill if the goods are transported through their own hired means. Registered person includes consignor, consignee, recipient, or transporter.

- If an unregistered person supplies to the registered person, the recipient must follow the compliances as the supplier is not registered.

- If both the consignor and the consignee fail to generate an E-Way Bill while giving the transporter the goods for road transportation, the transporter should generate it.

An E-Way Bill must be generated irrespective of the value of the consignment, even if the value is less than 50000 in the following cases:

- When an interstate transaction involves a principal providing the commodities to an employee.

- When a vendor exempted from GST registration transfers handcrafted goods inter-state.

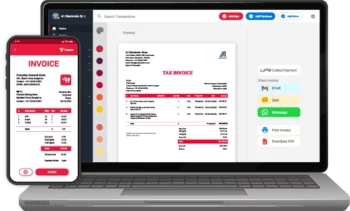

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Benefits of Using an E-Way Bill Format For Any Business

E-Way Bill Format makes the entire E-Way Bill generation process seamless for customers. You can create your E-Way Bill using the free templates and send copies to your customers digitally.

There are many benefits of using E-Way Bill Formats provided by the Vyapar app. Some of them are listed below:

1. Send Professional E-Way Bill Formats:

You can customise a professional bill for your unique business needs using our free E-Way Bill Formats. The formats are effortless to use. You just need to select the template that suits your business needs and enter the essential information.

You can create an E-Way Bill in different colours, change its themes and font, and use your business logo. Updating the details of your business details on the E-Way Bill Format is easy.

The format comes with many benefits. If you use the data collected using the format in the Vyapar app, it can automatically update your transactions. You can save the format, view the E-Way Bill after creating it, and download it for further use.

2. Create an E-Way Bill in Any Format:

The E-Way Bill Formats are available in Word, PDF, and Excel Formats. The seller can quickly make customised E-Way Bills according to the goods transported.

Sellers can easily modify the E-Way format to satisfy the needs of particular business firms. You can include the name and logo of your business and even add more rows and columns. Format’s font and colour scheme are editable.

With our free E-Way Bill Formats, you can create high-quality E-Way Bills within a few minutes. Because the designs are customisable, altering and creating E-Way Bill Formats for your company that seem professional is simple.

3. Use the E-Way Bill Format For Free:

You can download and use the E-Way Bill Format by Vyapar for free, without any cost. You don’t need to invest in designing and printing your E-Way Bill Formats, which saves money.

A seller can edit the E-Way Bill Format according to their needs and download it for future use. The entire process is entirely free. The customisation makes you appear professional and enhances your brand value.

You can also print the custom format to make manual entries. The Formats are compatible with both regular and thermal printers in any standard bill size.

4. Reduce Human Error Significantly:

Entering every single detail manually in E-Way Bills increases the risk of inaccuracy. It is wise to choose an E-Way Bill Format that can help you reduce repetitive data entry and help you prevent mistakes.

Automation makes the process more efficient and helps eliminate human mistakes. You can focus on essential things that need your attention by following a professional format.

It is easy to use E-Way Bill Formats provided by Vyapar. It helps reduce the requirements to hire personnel to design E-Way Bill Template for your business.

5. Enhances Your Brand’s Goodwill:

Offering professional E-Way Bill Formats during transactions improves the brand’s reputation. You can be completely transparent about the deal as all the data is in the E-Way Bill Format, which inspires even more trust.

The E-Way Bill Format helps in the growth of your professional brand. A skillfully crafted E-Way Bill Template can help you stand out from the crowd and project a professional image for your company.

You can use our company’s logo, style, font, and brand colours in your invoice to perfectly represent your brand’s identity. It will help you set better brand retention among your customers, making them more likely to come back to your store.

6. Maintain Consistency While Saving Time:

Using our free E-Way Bill Formats, you can create E-Way Bills that meet the needs of your business. It takes a while to do it manually, which is time-consuming and prone to mistakes. By the use of formats provided by the Vyapar app, you may prevent this issue.

You can modify the E-Way Bill Format to save your company’s information. The customised format can be saved and used professionally whenever required to save time.

This method can save you from starting over each time you need a bill. By providing matching E-Way Bills to your clients, you can maintain consistency. You become more productive since you have more time to do other essential tasks.

Create your first e-way bill with our free Invoice Generator

Features of the Vyapar App that Can Make E-Way Billing Easy For a Business

Our E-Way Bill generator app has multiple benefits, making it a perfect fit for any business. Here are some features of our app that make your daily accounting and management process easy:

Record and Track Expenses:

It is essential to track and document all costs incurred while transporting the goods for accounting and tax filing purposes. Tracking the money spent and creating an accurate report are made easier by Vyapar accounting software.

The free billing software is a helpful resource for budgeting. Businesses needing to generate E-Way Bills may swiftly optimise their spending to produce considerable savings. Our free GST billing software lets you track both GST and non-GST expenses.

The billing solutions from Vyapar also give you several benefits. It promotes cost-cutting and sales growth. The free Bill Format Maker software lets you quickly record unpaid debts. It also helps with future tracking of them.

Small and medium enterprises can use our free mobile app. That helps them with money management. Also, keeping track of spending will help create more effective strategies. That will increase corporate profitability.

Data Protection For Your Company:

You can regularly build local or online Google Drive backups because the Vyapar app is entirely confidential. You also have constant access to your business’s financial information via various devices.

The data for your company won’t be accessible to other team members or outside parties, guaranteeing its long-term security. Using the “auto-backup” feature of the bill/invoice generator app, you can continue where you left off.

As an additional layer of security, the software uses encryption technology to restrict access to the data to the owner alone. User login information won’t be saved or shared by Vyapar for later use.

The Vyapar free accounting app makes managing a business easier. You may analyse the daily activities of your business in real-time using the app’s extensive dashboard.

Multiple Business Reports:

Making wise decisions is necessary for businesses to maintain a steady growth trajectory. Utilise our free easy billing software to generate 40+ business reports for your needs.

Professional balance sheets are included with the Vyapar small business accounting software. The ease with which you can export the reports in Excel or PDF while using Vyapar improves your company’s operational effectiveness.

With the help of our free Accounting & GST Invoicing Software, users may access and analyse the data right away. With the software, you may make graphical reports to keep track of sales and spending.

This free application examines precise financial information, business facts, etc. It is also a simple and effective way to analyse the company’s profit. You can make reports, including GSTR 1 format, GSTR 3B, and GST-related reports.

Maintain Inventory Levels:

The Vyapar app enables you to manage your inventory correctly by tracking your sales. Within the programme, Vyapar keeps a record of company data. It makes it simple for business owners to create a profitable plan.

With the inventory management solutions from Vyapar, you can utilise your storage space to the fullest. The sales of your firm can be tracked using business reports. You’ll better understand how well you handled your inventory management.

Using Vyapar’s free billing software, you may see the current state of your inventory. Notifications can be set up to inform your suppliers of any new orders.

Also, you can check the location of your orders at any time using the delivery challan. Our E-Way Bill Format lets you easily fulfil all rules and obligations. It helps to provide better customer service.

Make GST Invoices and Send Them Online:

With efficient GST billing tools, Vyapar billing software assists you in creating a professional brand identity. Invoices can be made using the Vyapar accounting and billing programme. It enables you to abide by Indian Goods and Service Tax law.

The Vyapar app can be used offline as well as online. So, an SME can more easily adhere to the best accounting procedures by using the app. It streamlines the bookkeeping procedure for companies.

Use our simple invoicing programme to adhere to GST regulations. Vyapar offers a selection of practical billing solutions. In a few simple steps, you can make invoices for your clients. Also, you can print, email, or share them via WhatsApp with your clients.

Vyapar enables you to produce invoices quickly. The best part is that it is a simple process and won’t require hours of demanding training. You may choose from more than ten GST invoices and billing templates in the programme to create professional and distinctive bills.

Send Payment Reminders to Recover Dues:

The accounting and billing software from Vyapar aids in keeping track of any unpaid invoices in the company dashboard. You can send reminders for payment to your clients using the app’s reminder feature.

Using WhatsApp and email will assist in reminding them of the entire amount due and the due date. Reminders are sent to customers to ensure they remember to pay. This allows you to maintain cash flow in your company and prevent unneeded delays.

The best billing software from Vyapar includes a variety of payment methods to aid in prompt payment from your clients. Cash, credit cards, debit cards, e-wallets, NEFT, RTGS, UPI, QR codes, and other payment methods are among them.

Customers can pay conveniently using various cash and online payment methods. It guarantees that your consumers can pay using the most convenient way.

Download E-Way Bill Format For Free in Word

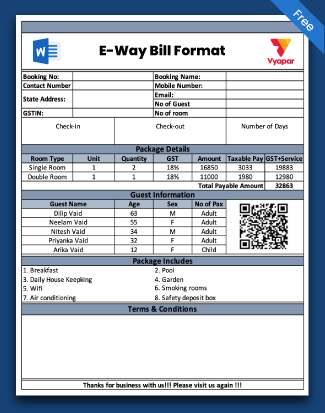

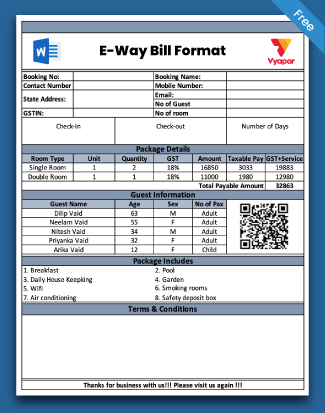

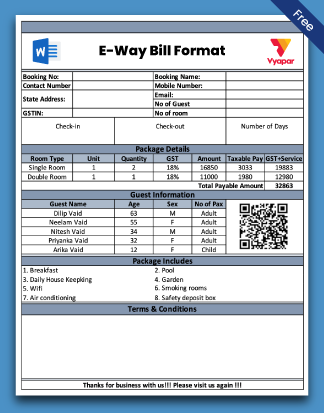

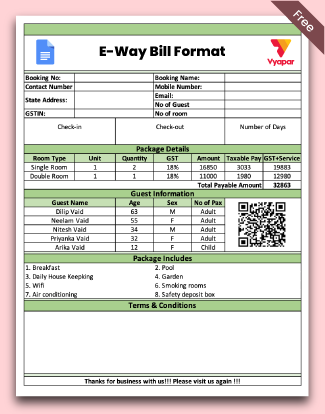

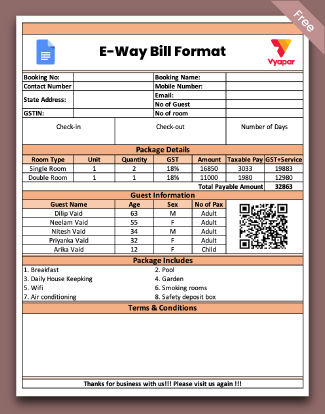

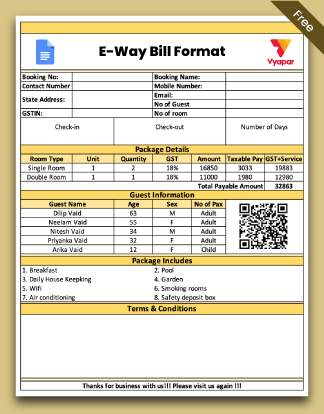

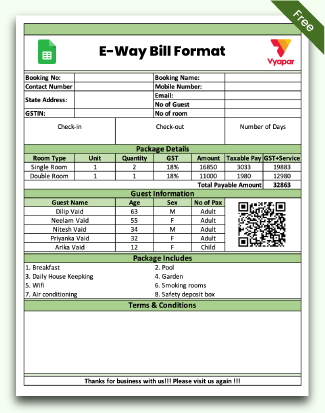

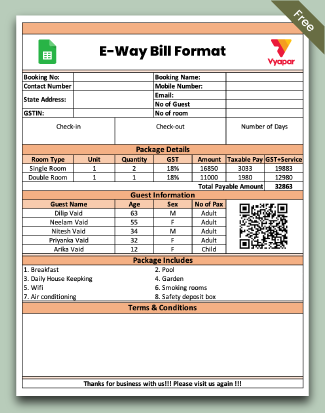

E-Way Bill Format – 1

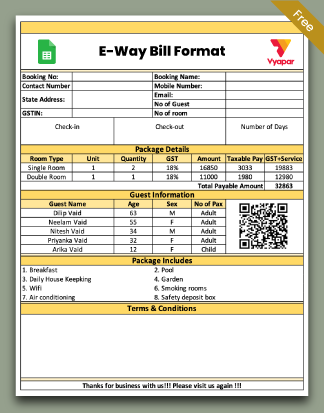

E-Way Bill Format – 2

E-Way Bill Format – 3

Download E-Way Bill Format For Free in Docs

E-Way Bill Format – 1

E-Way Bill Format – 2

E-Way Bill Format – 3

Download E-Way Bill Format For Free in Sheet

E-Way Bill Format – 1

E-Way Bill Format – 2

E-Way Bill Format – 3

Frequently Asked Questions (FAQs’)

An E-Way Bill is an electronic bill required to facilitate the movement of goods worth more than Rs 50,000 within India.

The format of an E-Way Bill consists of two divisions. Part A includes the invoice bill of supply and recipient details. Part B includes transporter information like departure details and vehicle numbers.

You can create an E-Way Bill Format online through the GSTN portal or use Vyapar’s E-Way Bill Formats to create E-Way bills.

The information required to generate an E-Way Bill Format includes the following:

* Unique E-Way Bill number

* Date and time of bill

* Name, address, and GSTIN of the person generating the bill

* Place of delivery

* HSN code

* Quality and quantity of goods

* Total amount and tax applicable

The validity of an E-Way Bill depends on the distance of transportation. The E-Way Bill is valid for one day for distances up to 100 km. The validity will increase by one day from the relevant date for every 100 km after that. The E-Way Bill is valid for 7 days for distances over 3000 km.

The person who generated an E-Way Bill can cancel if the goods are not transported or transported but not as per the details mentioned in an E-Way Bill. An E-Way Bill can only be cancelled within 24 hours of its generation.