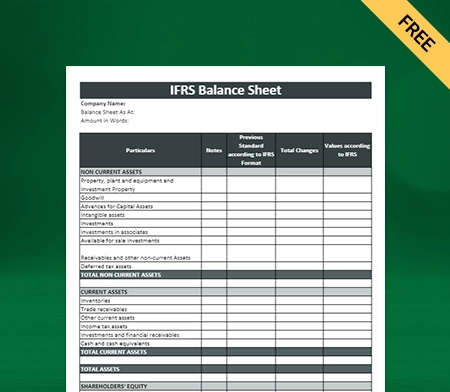

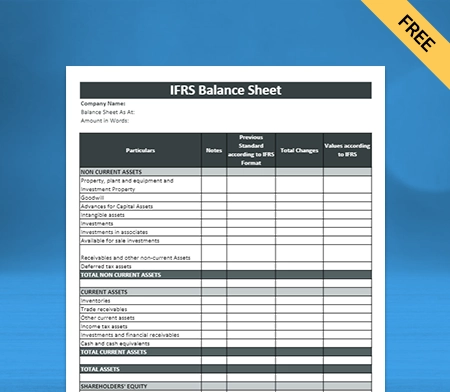

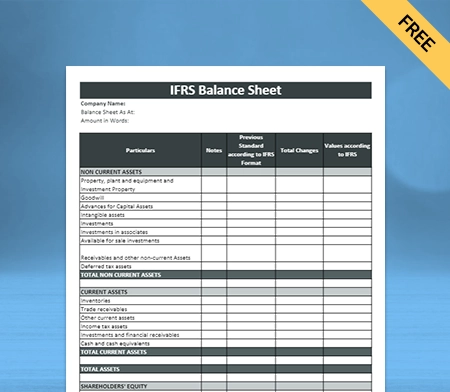

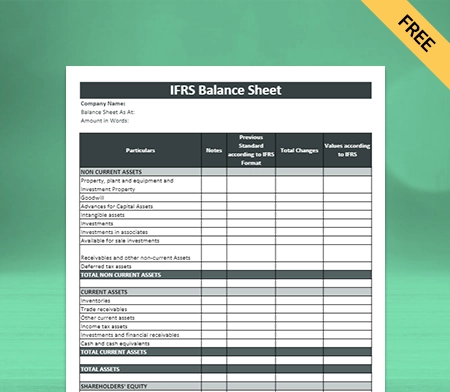

IFRS Balance Sheet Format in Excel, Pdf

Eliminate errors & ensure IFRS balance sheet compliance with Vyapar! Automate calculations, simplify formatting & gain valuable insights.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

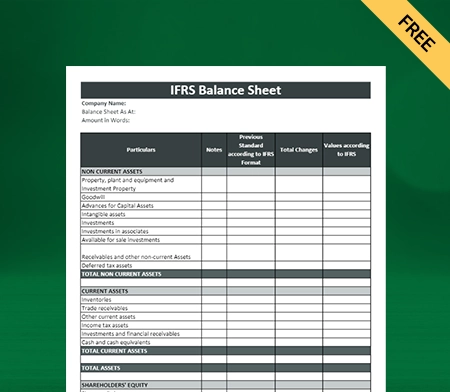

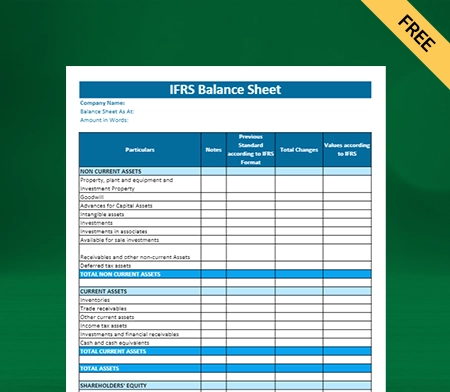

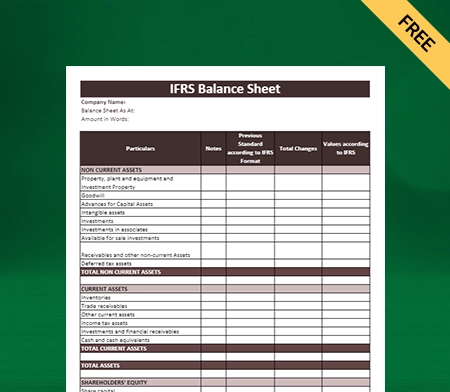

Download IFRS Balance Sheet Format in Excel

Download IFRS Balance Sheet Format in PDF

Download IFRS Balance Sheet Format in Word

Download IFRS Balance Sheet Format in Google Docs

Download IFRS Balance Sheet Format in Google Sheets

What is the IFRS Balance Sheet?

The balance sheet comes under IAS 1 “Presentation Of Financial Statements” of IFRS and is called a “Statement of Financial Position.” IFRS (International Financial Reporting Standards) are accounting standards issued by the IFRS Foundation and the accounting standards board IASB.

International accounting standards board (IASB) members are responsible for developing and publishing IFRS Accounting Standards. These reporting standards aim to describe a company’s complete set of IFRS financial statements template excel more clearly so that they can be compared across international boundaries.

The IFRS balance sheet can provide greater transparency, accuracy, and international recognition while simplifying financial reporting and reducing regulatory burden for companies that operate in multiple countries.

Contents of the IFRS Balance Sheet:

Assets:

The asset section includes all the resources that the company owns or controls, which have the potential to generate future economic benefits. Current and non-current assets are two types of assets.

- Current Assets

Assets that are expected to be converted into cash or used within one year are called current assets. Current assets include cash and cash equivalents, inventory, accounts receivable, and prepaid expenses. Current assets are short-term assets that a corporation expects to sell, consume, utilize, or exhaust within one year through business operations. They are also known as current accounts and are necessary for the operation of a business.

The current ratio, computed by dividing existing assets by current liabilities, reveals a company’s liquidity. It shows the company’s ability to meet short-term obligations. Similarly, the quick ratio assesses a company’s ability to promptly use its near cash assets to extinguish its current obligations.

- Non-Current Assets

Non-Current Assets are tangible assets or property that a company cannot immediately convert into cash. They are also known as Fixed assets and are expected to be held for over a year. Examples include property, plant and equipment, intangible assets, and long-term investments.

Fixed assets are investments that show stakeholders that the organization has growth potential. The two types of non-current assets are freehold and leasehold. Freehold assets are purchased with legal ownership and usage rights, whereas leasehold assets are used without legal rights for a specific period.

Liabilities:

This section includes all the obligations the company owes to other parties, which require future economic outflows. Liabilities are either current or non-current.

- Current Liabilities

Current liabilities are the obligations that are expected to be settled within one year. Current liabilities comprise accounts payable, short-term loans, and accrued expenses. They are usually paid in cash within its operational cycle. Since current obligations have the same annual maturity as current assets, they can be settled during the same fiscal year.

Dividends payable, accounts payable, short-term obligations and income taxes are all included in current liabilities. The ability of the corporation to pay down short-term debts is determined in part by the current liabilities to current assets ratio. Investors become immediately interested in a company because it demonstrates its managerial skills.

- Non-Current Liabilities

Obligations not expected to be settled within one year are long-term liabilities. Examples include long-term loans, bonds, and deferred tax liabilities. They indicate a company’s long-term financial obligations that have a maturity of more than a year. They do not need to be settled immediately.

The time it takes for a business to convert inventory into cash is the standard operation period. Bond payables, deferred tax liabilities, loans secured by equipment or real estate, and other long-term mortgages are a few examples of non-current liabilities. The long-term liabilities help run the firm and provide a better understanding of the company’s existing liquidity.

Equity:

The company’s value after all liabilities are deducted from assets is known as shareholder’s equity, also known as net worth. Equity represents the funds that have been contributed by the company’s shareholders and retained earnings.

“Owner’s equity = Assets – Liabilities” is the fundamental equation. It demonstrates how much the business owner has committed to the organization through financial investments or retention of long-term earnings.

Advantages Of Using IFRS Balance Sheet:

The International Financial Reporting Standards (IFRS) balance sheet offers several advantages, including:

Improved Transparency and Comparability: Assets, liabilities, and equity are all included in a company’s IFRS balance sheet. Investors can easily analyze and compare the financial performance of various organizations.

Greater Accuracy and Relevance: IFRS balance sheet requires companies to use fair value accounting, which can lead to more accurate and relevant financial information. You can obtain a more accurate picture of a company’s statement of financial position by using fair value accounting, which takes into account changes in the value of assets and liabilities over time.

International Recognition: IFRS is a globally recognized accounting standard, making it easier for companies to access international capital markets and do business with other companies worldwide.

Simplification and Standardisation: IFRS balance sheet can simplify financial reporting for companies that operate in multiple countries by providing a single set of accounting standards that they can use in all their operations.

Reduced Regulatory Burden: IFRS balance sheet can reduce the regulatory burden on companies by eliminating the need for multiple sets of financial statements to comply with different accounting standards in different countries.

Difference Between IFRS Balance Sheet and Gaap Balance Sheet:

The balance sheet format under International Financial Reporting Standards (IFRS) is similar to Generally Accepted Accounting Principles (GAAP). However, there are some differences in the format and presentation of the balance sheet under IFRS compared to GAAP. Here are some of the key differences:

Under GAAP, balance sheets typically present assets, liabilities, and equity. Under IFRS, balance sheets present assets, followed by liabilities and equity.

IFRS generally requires more detailed classifications of assets than GAAP. For example, IFRS requires companies to separate property, plant, and equipment into different categories, whereas GAAP allows companies to group these assets.

IFRS and GAAP have different rules for the valuation of assets. For example, under IFRS, companies can choose to value property, plant, and equipment using either the cost or revaluation models. Assets are listed at their historical cost under the cost model and at their fair value under the revaluation approach. GAAP generally requires companies to use the property, plant, and equipment cost model.

IFRS and GAAP have different rules for the treatment of intangible assets. For example, companies can either amortize goodwill or test it for impairment annually under IFRS. Under GAAP, goodwill is amortized over a period not exceeding ten years.

IFRS and GAAP have different rules for presenting deferred tax assets and liabilities. Under IFRS, these items are generally presented as non-current assets or liabilities. In contrast, under GAAP, they can be presented as either current or non-current assets or liabilities, depending on their nature.

Benefits Of Using IFRS Balance Sheet Format By Vyapar:

The Vyapar IFRS balance sheet format reduces the likelihood of errors and mistakes. Here are some of the benefits of using the balance sheet format as per ifrs by Vyapar:

1. Clarity and Simplicity:

The IFRS balance sheet format in excel, pdf is a clear and simple way to present financial information. It is organized into three main sections, assets, liabilities, and equity which are easy to understand and interpret.

A well-designed format can make it easier for readers to understand a company’s financial position by clearly summarising its assets, liabilities, and equity. Using a consistent format can also make comparing balance sheets between different companies easier over time.

Vyapar’s IFRS balance sheet format can help improve the clarity and usefulness of financial information, making it easier for stakeholders to make informed decisions.

2. Overview Of Financial Position:

The IFRS balance sheet provides a brief overview of the assets, liabilities, and equity of a company at a certain point in time. Investors, creditors, and other stakeholders can use this information to assess the financial health of a company.

By comparing IFRS balance sheets with similar formats, businesses can easily track their financial performance and see how their assets, liabilities, and equity have changed.

This helps businesses identify strengths and weaknesses and make informed decisions about their financial strategies. A balance sheet is a useful tool for decision-making.

3. Enhances Work Efficiency:

An IFRS balance sheet format ensures the information is presented consistently, making it easier to understand and analyze. This can help quickly retrieve relevant information, saving time and increasing work efficiency.

The balance sheet format as per ifrs enables easy comparison of financial information between different periods and companies. It simplifies identifying trends, tracks changes, and analyses a company’s financial performance, ultimately increasing work efficiency.

An IFRS balance sheet format facilitates clear communication of financial information to stakeholders. It ensures everyone is on the same page, reducing confusion and the need for additional explanations or clarifications, ultimately increasing work efficiency.

4. Maintains Accuracy Of Financial Statements

Using a standardized balance sheet format reduces the possibility of errors or omissions. Presenting the financial information in a specific format makes it easier to identify discrepancies and rectify them quickly, saving time and increasing efficiency.

The IFRS balance sheet format classifies assets, liabilities, and equity into different categories based on their characteristics. This ensures that each item is appropriately categorized and reported, reducing the likelihood of errors or omissions.

You need to calculate each item accurately in the format, including total assets and liabilities, net income, and equity. This ensures that the financial information presented is mathematically correct, reducing the risk of errors or inconsistencies.

5. Customise Your IFRS Balance Sheet Format

A customized IFRS balance sheet format in excel, pdf can incorporate a company’s branding elements, such as logos, colour schemes, and typography, into the design. It can create a cohesive visual identity that reinforces the company’s brand image and makes the financial information more engaging and memorable.

Vyapar’s balance sheet format as per ifrs can highlight the company’s financial and performance metrics. It can create a more focused and meaningful picture of the company’s financial health and reinforce its brand image as a high-performing and successful organization.

You can tailor a customized IFRS balance sheet format to specific stakeholders, such as investors, customers, or employees. It can create a more personalized and relevant experience for each group, reinforcing the company’s customer-centric, investor-friendly, or employee-focused brand image.

6. Helps In Record-Keeping

The IFRS balance sheet format provides a historical record of a company’s financial position over time. By comparing balance sheets from different periods, companies can track changes in their statement of financial position, identify trends, and plan for the future.

Vyapar’s IFRS balance sheet structure helps maintain accurate balance sheets with additional disclosures. Companies can demonstrate compliance with these standards and regulations, reducing the risk of penalties and legal issues.

The format provides a clear and concise summary of a company’s financial position, making it easier to hold individuals and departments accountable for financial performance. By regularly reviewing balance sheets, companies can identify areas for improvement and take corrective action as needed.

Features of the Vyapar Accounting and Billing Software:

Create Reports in Minutes:

Business reports are an essential source of data. They bring everyone up to date on current and completed events. The Vyapar app allows you to create 40+ business reports. Vyapar invoicing management software offers a variety of format options.

You may rapidly assess the operation of your company by tracking sales, purchases, cash on hand, stock value, expenses, open checks, and loan amounts on your dashboard.

You can generate sales reports, production reports, financial records, and other reports. The app lets you get this information from any location through live status tracking. You can locate all of the important information about your company in one location.

Report analysis can provide an accurate and balanced picture of your company. It has the potential to enhance the operational efficiency of your company. It also boosts the productivity of your staff.

Bank Account Management Made Simple:

You can send and receive money using bank accounts and conduct bank-to-bank transfers for simple cash flow management. Vyapar invoicing software is the best since it can be used for all cash-ins and cash-outs.

A business account must be linked to the Vyapar Accounting Software to use the bank accounts feature. You can deposit and withdraw money from bank accounts using it. The Vyapar app makes managing liability, O.D., and credit card accounts easier.

You can quickly introduce, manage, and track payments for online and offline businesses. Whether your revenue comes from banks or e-wallets, you can quickly enter data into the free Inventory Management Software.

You can manually modify the number of cheque payments using Vyapar’s free accounting software. Open checks are available on the Vyapar App, allowing users to deposit or withdraw funds and cancel them immediately.

Data Security:

Data security has become essential because it is the foundation of all modern businesses. You may protect your company’s security by creating automatic backups.

Accounting and invoicing software processes data and protects its security through three factors. They are password protection, data encryption, and continuous backup.

The Vyapar accounting app allows you to back up the data in your Google Drive by enabling Auto Backup. The software ensures the protection of user privacy, preventing anyone, including Vyapar, from accessing the user’s data.

It would be beneficial if you created backups to ensure that all data is safe. You can also generate a local backup to protect your data in a private location, such as a pen drive or hard disc. It increases the security of your data.

Manage Your Company’s Cash Flows:

Businesses can use Vyapar’s accounting and billing software to keep track of their invoices. It allows for more efficient payment processing and tracking.

With Vyapar, you can keep track of your current payables and receivables. Your company’s cash flow ensures you have enough cash to keep operations running.

It will ensure effective operations while also assisting in debt reduction. Several corporate tasks, including billing and accounting, rely on good cash flows.

The dashboard can show you how easy it is to pay recurrent costs without missing EMI installments. Cash flow statistics may assist you in making more timely judgments.

Keep Track Of Expenses:

Keeping track of and recording all expenses incurred throughout the delivery of items is critical for properly preparing your accounting and taxes. Vyapar simplifies the generation of exact reports and the tracking of expenditures.

Tracking expenses allows you to improve revenue while decreasing costs. Using the free program, you can quickly keep track of overdue responsibilities. It also helps them track their materials in the future.

Budgeting is simple with the help of our free software. Businesses can quickly cut costs and save a significant amount of money. Using our free billing software, you can keep track of GST and non-GST spending.

Vyapar is a free small and medium-sized business smartphone app. As a result, they can manage the money they spend and get. Keeping track of your expenses will also make it easy to develop viable alternatives. As a result, corporate profitability will increase.

Inventory Management Made Simple:

Vyapar’s inventory management software aids in performance enhancement. You may track your company’s sales using the Vyapar app’s capabilities, such as business reports. It will make determining how successfully you managed your inventory easier.

By utilizing inventory tracking features, businesses can maximize the utilization of their inventory space. Using the analysis, you can delete items that don’t sell frequently and save space.

Tracking uses the batch number, expiration date, manufacturing date, slot number, and other information. Having the necessary stock on hand for sale when needed is beneficial. It also helps to keep a record to ensure no theft goes unreported.

Vyapar’s free billing software allows you to view the current status of your inventory. You can also set up notifications to notify your suppliers of new orders.

Frequently Asked Questions (FAQs’)

The balance sheet format under ifrs is a standard way to report a company’s financial position according to international reporting standards. It has three main components: Assets, Liabilities, and Equity.

The balance sheet format under IFRS starts with non-current assets, followed by current assets, owners’ equity, non-current liabilities, and current liabilities.

IFRS allows for greater flexibility in classifying assets and liabilities compared to GAAP. For example, under IFRS, financial assets and liabilities can be classified as current or non-current based on the entity’s intentions and ability to hold or settle them.

The balance sheet’s international financial reporting standards (IFRS) name is Statement of Financial Position.

Yes, IFRS (International Financial Reporting Standards) requires a balance sheet. Companies use the income statement as a key financial statement in IFRS reporting to consolidate financial information. It provides a snapshot of the assets, liabilities, and equity of a corporation as of a particular date in its statement of financial status.

The IFRS balance sheet format categorizes assets into current and non-current assets and liabilities into current and non-current liabilities.

Yes, IFRS (International Financial Reporting Standards) includes guidelines for preparing a balance sheet. The IFRS balance sheet format provides a standardized way for companies to present their financial position, ensuring consistency and comparability across different entities following IFRS guidelines.

Under IFRS, a balance sheet categorizes assets into current and non-current assets, and liabilities into current and non-current liabilities and equity.

The five elements of IFRS are Assets, Liabilities, Equity, Income, and Expenses.

GAAP is primarily used in the U.S., while IFRS is used globally. GAAP is rule-based, whereas IFRS is principles-based.

IFRS 4 allows insurers to use existing national standards and offers flexibility in reporting insurance contracts on the balance sheet, leading to diverse practices.

Related Posts:

1. Cooperative Society Balance Sheet Format

2. Cooperative Society Balance Sheet Format in Excel

3. Trial Balance Sheet Format

4. Business Financial Software For Macbook