Business Financial Software For MacBook

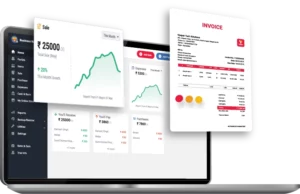

Vyapar is a comprehensive business financial software for Macbook solution for small and medium-sized businesses to manage their financial operations efficiently. This software works well with the Mac operating system. Try the free trial now!

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

What is Business Finance?

The management of financial resources to accomplish a business’s financial goals is known as business finance. It entails organising, obtaining, and using financial resources to maximise earnings and reduce risks. The primary objective of business finance is to make sure a company has the resources it needs to run profitably, expand, and do so in the long run.

Businesses can manage their accounts more efficiently using the business financial software for MacBooks. It can handle financial transactions and carry out a variety of tasks. You can create reports, control cash flow, and keep tabs on your financial performance with the help of business finance software for a MacBook.

The administration of money and financial resources within a corporate organisation is often referred to as business finance. It refers to the methods and techniques that are utilised to gather, allocate, and manage financial resources to meet the firm’s goals and objectives.

What is Included in Business Financial Activities?

Any financial decisions or actions taken by a business or organisation to manage its finances, produce revenue, and preserve financial stability are referred to as business financial activities. The following are some instances of corporate financial activities:

Financial Planning: Financial planning involves forecasting future financial needs and developing strategies to meet those needs.

Budgeting: Budgeting means preparing and managing the company’s budget, including setting revenue and expense goals and tracking actual performance against those goals.

Investment Management: This involves managing the company’s investments to achieve a balance between risk and return.

Cash Management: Cash management means managing the company’s cash flow. It helps ensure there is enough cash available to meet the company’s obligations and to invest in growth opportunities.

Financial Analysis: Analysing financial statements and other financial data to evaluate the company’s financial performance and make recommendations for improvement is called financial analysis.

Risk Management: Managing risks includes identifying and managing financial risks, such as credit risk, market risk, and operational risk.

Capital Structure Management: This involves managing the company’s debt and equity capital structure to optimise its cost of capital.

Purpose of Using Small Business Accounting Software For Mac:

1. Improved Accuracy:

Business financial software for Macbooks helps to improve the accuracy of financial calculations. It reduces the likelihood of errors that can result from manual data entry. It can automate many routine financial accounting tasks, such as balancing accounts, tracking expenses, and generating reports.

2. Time-Saving:

The automation of financial accounting tasks can save a lot of time for business owners. The time saved can be better spent on more critical accounting tasks. You can use it to analyze financial data and make strategic decisions.

3. Increased Efficiency:

Small business accounting software for Mac can streamline financial workflows. It makes the whole process more efficient and helps in cost savings. It increases productivity, and you can manage your finances efficiently.

4. Better Decision-Making:

With accurate financial data, business owners and managers can make better-informed decisions. Businesses can identify areas for development and make strategic decisions to maximize their financial performance using the precise information and analytics provided by financial software.

5. Improved Security:

The security of financial data can be enhanced by business financial software for a MacBook. It can offer many layers of protection, such as encryption and password protection. The danger of financial theft and other security breaches can be decreased as a result.

Overall, small businesses and startups can use business financial software for MacBooks to optimise their financial management processes.

Features of a Business Financial Software For MacBook

There are many different business financial software options available for Mac users, each with its own unique set of accounting features. However, some standard features to look for in business financial software for iOS apps include:

Invoicing and Billing:

The billing software should be able to create invoices and billing statements for customers, track payments, and generate reports on accounts receivable.

Expense Tracking:

The software should allow expense tracking and automatically categorise them by type (e.g., office supplies, travel, utilities) for easy reporting and analysis.

Budgeting:

The software should allow you to create and track budgets for your business, with the ability to compare actual expenses against budgeted amounts.

Financial Reporting:

The programme should be capable of producing financial reports such as balance sheets, profit and loss statements, and cash flow statements.

Bank Account Reconciliation:

The software should be able to reconcile your bank accounts, automatically matching transactions in the software with those in your bank account to ensure accuracy.

Tax Management:

The software should help you manage your tax obligations, such as tracking tax payments and generating reports for tax purposes.

Multi-Currency Support:

The software should be able to manage currency conversions if your company does business with clients or suppliers who use other currencies. It should be able to convert them for reporting purposes automatically.

Mobile Access:

The software should have a mobile app or be accessible via the web so that you can access your financial data from anywhere.

Integration With Other Tools:

The software should integrate with other devices you use, such as your bank, payment processors, or CRM software.

These are just a few of the many accounting and financial features to look for in business financial software for a MacBook. It’s essential to evaluate your specific business needs and choose software that meets those needs.

Types of Business Financial Software For MacBook

There are many different types of business financial software, like Vyapar business financial software, Wave accounting, and Zoho books. Every business financial software has its own accounting features and capabilities. Some of the most common types of business financial software are:

Accounting Software:

Accounts are tracked on computers using accounting software for Mac, which also logs transactions and account balances. Accounting software is used by businesses of all sizes. It helps in the management of financial transactions for firms. This kind of software can assist in financial reporting, budgeting, and tax preparation.

Invoicing And Billing Software:

Invoicing and billing software helps businesses create and manage invoices. You can track payments and generate reports on billing activity. It allows companies to create and send invoices to customers. With invoice and billing software, businesses can streamline their billing process and reduce errors.

Expense Management Software:

An expense management software helps organisations in automating the process of monitoring and controlling business expenses. Businesses can track and manage expenses, pay back their debts, and produce reports for accounting and tax needs. An expense management software also allows employees to submit the costs incurred by them for work purposes.

Budgeting Software:

Budgeting software helps businesses create, manage, monitor, and change their budget. It allows Mac users to set financial goals, allocate funds to different categories, and monitor spending against those goals. By automating the budgeting process, users can save time and reduce the risk of errors. It ensures that companies and stakeholders always have a clear picture of their financial situation.

Financial Reporting Software:

Financial reporting software helps businesses generate financial reports. They include profit and loss statements, balance sheets, and cash flow statements. Financial reporting software can help companies manage their financial data more effectively. It reduces the risk of errors. By automating the financial reporting process, Mac users can save time. It ensures that they have accurate and timely financial information.

Tax Preparation Software:

Tax preparation software helps businesses prepare and file their taxes accurately and efficiently. It automates the process of completing tax forms and advises taxpayers on deductions, credits, and other tax-related issues. It reduces the risk of errors and potential penalties. By automating the tax preparation process, Mac users can save time and reduce the stress of tax season.

Point of Sale (Pos) Software:

Point of Sale software is referred to as POS software. This computer system is used by businesses to manage their sales effectively. POS software offers inventory management, sales monitoring, customer management, and reporting. A POS system’s main job is to process sales transactions efficiently.

Payment Processing Software:

Payment processing software is a type of financial software designed to help businesses accept and process payments from their customers. Payment processing software is used by businesses that sell products or services online or in person and need a way to accept payments securely and efficiently.

Our Vyapar business financial software for MacBook is an all-in-one software. Small and medium enterprises can use Vyapar financial software to manage their finances.

How to Use Vyapar Business Financial Software For Your Business?

Our business financial software is available for Mac users. Here are the steps to get started with Vyapar on a MacBook:

1. Download and Install:

Download the Vyapar accounting application directly from the website and install it on your MacBook.

2. Create an Account:

After installing the programme on your MacBook, you must register with Vyapar. You must mention your name, email id, and password to sign up.

3. Set up your Business Profile:

You must now create your company profile by entering your company’s name, address, and other information.

4. Add Customers:

You can add your customers to the accounting application by providing their details. You can also import customer and vendor data from a spreadsheet.

5. Record Transactions:

You can record all your business transactions in Vyapar, including invoices, bills, expenses, and payments. You can create new transactions by clicking on the ‘+’ button in the software.

6. Generate Reports:

Vyapar provides a range of reports to help you track your financial performance, including profit and loss statements, balance sheets, and cash flow statements. By selecting the ‘Reports’ tab in the accounting application, you can create these reports.

7. Customisation:

Vyapar allows you to customise the app to suit your business needs. You can customise invoices, estimates, and other documents with your own logo, colours, and fonts.

8. Backup and Sync:

Vyapar provides cloud backup and sync accounting features. It enables risk-free access to your data from wherever.

In summary, Vyapar is an easy-to-use business financial software that can help you manage your finances more efficiently on a MacBook.

Advantages of Using Our Business Financial Software For MacBook

Simplifies Accounting:

Vyapar business financial software for MacBook automates most of the accounting process. It helps in invoicing, expense tracking, inventory management, and tax calculation. The automation saves time and minimises errors.

Mac users can easily perform accounting tasks with the help of Financial Software for MacBook. The software helps you keep your transactions organised. You can maintain receipts and invoices in the accounting application.

The software also has a reminder feature that can remind you when the payment is pending. You can send reminders to your customers as well. It can help you get paid on time. Additionally, you don’t need any extra training structure to use this software.

Creates a Professional Brand Identity:

Vyapar provides numerous professional invoice templates that you can use to create invoices. The software has predefined formats that give a consistent look. The consistency of the invoices makes customers more familiar with your brand.

The software also allows you to create customised invoices. You can add branding elements like your company’s logo, your business’s name, and other such things to your invoices. It makes you look more professional and helps establish your brand identity.

The software features in sure that all your invoices and bills are consistent in terms of design and branding. It also helps you track your business’s financial performance. Small and medium sizes are more efficient.

Make GST Invoices:

Vyapar is a GST-compliant billing tool that streamlines the creation and management of GST-compliant bills for businesses. Businesses may easily create GST-compliant invoices with our MacBook software.

The software automatically calculates the GST based on the item’s rate and tax slab. Mac users can enter HSN/SAC codes, which the GST law requires. As a result, businesses may more easily make sure that their invoices adhere to GST laws.

Business owners can add custom fields, change the font, and add their logo to personalise their invoices. It aids companies in producing bills that seem professional and represent their brand.

Making Purchase/Sales Orders:

Users of the Vyapar business financial software for MacBook can create sales and purchase order formats. It could facilitate the management of sales and inventory. Businesses may track their inventory levels and keep an eye on sales by using our software.

You can maintain a record of customer order information, including the products ordered, their quantity, and the date of delivery. Mac users can place orders for products from vendors using purchase orders, indicating the products, quantities, and delivery dates.

You may keep thorough records of your purchases and sales. It assists companies in determining whether to place product reorders, which goods are doing well, and how to streamline their inventory management procedures.

Open An Online Store:

You can set up your online shop with Vyapar’s assistance. If you run an online store, your sales will increase. Using the Vyapar online store to grow your business will help you draw in more local clients.

You can use the free online shop features of Vyapar to help you grow your business online. Customers can place online orders through the URL you give and pick up their orders at your physical store.

The package can be prepared before your consumers arrive at the store. Thus, by employing the online shop feature, checkout queue wait times can be reduced.

Cash Flow Control:

You can follow the status of your invoices and set payment reminders with the Vyapar POS software download for MacBook. Sending reminders to clients who still need to pay will urge them to do so. It guarantees on-time payment, which enhances cash flow.

With the use of the Vyapar POS MacBook software, Mac users may correctly track their spending as well. By keeping track of your spending, you may successfully manage your company’s cash flow and prevent overpaying.

Businesses can also sync their bank statements with their accounting records using Vyapar. It assists in locating any inconsistencies and guarantees that cash flow is precise.

Valuable Features of Business Financial Software For MacBook

Monitor Inventory:

Inventory tracking is a function of the Mac retail inventory programme, Vyapar. Real-time inventory tracking is made possible for enterprises. It is simple to keep an eye on stock levels and avoid stockouts.

The inventory dashboard offered by the software shows the current stock levels of each item. It contains information like the item name, SKU, unit price, and quantity available.

Our business financial software for MacBook will help you make the best use of your storage space. Inventory management accounting features make it simple to locate unsold goods. By deleting items that are not consistently sold, you can make use of space.

Businesses can also set up low-stock notifications with Vyapar business financial software for MacBook. When inventory levels fall below a given threshold, the alerts can send out messages. This allows businesses to keep track of inventory levels and avoid stockouts.

Bank Administration:

Our business financial software, MacBook, has a bank management function. It assists firms in managing banking activities and reconciling accounts. You may add and manage several bank accounts from a single dashboard with Vyapar.

You may reconcile your bank accounts by comparing your bank transactions with the related Vyapar transactions. You can quickly track transactions, monitor your account balance, and transfer dollars between accounts.

Our MacBook software interfaces with popular Indian payment methods. When you receive a payment through a payment gateway, Vyapar automatically reconciles it with the related bank transaction.

The reports provide a detailed breakdown of your banking activity. You can see all of your bank transactions and withdrawals and track your expenses. Retailers can maintain track of their money and make informed business decisions.

Create Reports:

Vyapar MacBook business financial software comes with a variety of reporting options. It can assist you in keeping track of your inventory. You can also track sales and earnings. You can produce sales reports that detail your sales performance in detail.

You can see how many goods you’ve sold and which ones are performing well. You may also track and compare sales patterns over time.

Vyapar inventory reports provide a detailed picture of your current inventory levels. You can inspect your inventory and see which products are running low. You can also set up low-stock alerts to notify you when supplies are running low.

Profit and loss statements provide an accurate view of your company’s financial situation. You can see the amount of money you generate from sales. You can also calculate your inventory expenses and profits.

Print Invoices:

Our business financial software for MacBook is the perfect option if you prefer your invoice to be printed in a certain format. Both laser printers and thermal printers are compatible with Vyapar. It enables you to obtain the printout you need quickly.

Printing invoices and bills is quick and simple using Vyapar’s free accounting software for Mac. Printing options include standard paper sizes like A4 and A5, thermal paper sizes like 2″ and 3″, and custom paper sizes.

To start printing invoices, pair our software through Bluetooth or plug it in with your standard/thermal printer. You can make and send unpaid bills to your clients using our software. You can use digital tools like email, SMS, or WhatsApp in place of printing.

To create an invoice with complete customisation, generate invoice forms, and then print them for your clients, choose from a variety of Excel, Word, or PDF files. The process is easy and practical. The invoice can be printed using both regular and thermal printers and given to clients.

Customised Quotes and Bills:

You may make customised quotes and invoices on a MacBook using our best software. Users can produce and distribute documents at any time and from any location using our software for MacBooks.

Vyapar’s invoicing software provides quick estimates and quotations in addition to a professional appearance. They can be sent immediately via email, SMS, WhatsApp, or printing.

It removes inaccuracies in estimates and quotations. The billing software gives you a polished appearance. You can manage your business more efficiently and save time.

With the help of the billing and invoice software Vyapar, you may turn your estimates into invoices on your MacBook. With a few clicks, you can acquire instant bills.

Multiple Payment Options:

If a customer is unable to pay using their selected method, they may cancel their order. By providing a variety of payment choices, you make it simple for your consumers to pay in the manner that is most convenient for them.

More clients will complete their purchases if you provide them with various payment options, which could result in more significant sales for your firm. You will be able to service a broader range of customers.

You can produce invoices with numerous payment choices using the Vyapar invoicing features. You can offer options such as UPI, QR, NEFT, IMPS, e-wallet, and credit cards.

Providing different payment alternatives helps boost trust in your company. Offering numerous payment methods can assist in boosting client happiness, increasing revenue, and broadening the reach of your organisation.

Frequently Asked Questions (FAQ’s)

Business financial software is a tool that helps businesses manage their finances. They assist in invoicing, expense tracking, budgeting, financial reporting, and tax management. Business financial software for MacBook can help you streamline financial workflows, reduce errors, save time, and make better-informed decisions.

Businesses use financial software to streamline their financial operations, reduce manual processes, save time, and improve accuracy. It also helps them make informed decisions based on real-time financial data.

There are different types of financial software. For example:

1. Financial management software

2. Accounting software for Mac

3. Invoicing software

4. Payroll software

5. Budgeting software

When choosing business financial software for a MacBook, you should consider your business needs and budget. Look for software that offers:

1. The features you need

2. Good user reviews

3. Provides excellent customer support

4. Compatible with your MacBook and iOS software

The Vyapar business financial software for MacBook is a secure system that offers multiple layers of protection. It uses encryption and password protection. You should keep your software updated with the latest security patches and avoid sharing sensitive information.