GST Export Invoice Format

Vyapar’s GST export invoice format is not only easy to use but also comes with a range of powerful features to streamline your invoicing and accounting processes.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of GST Export Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Free Professional GST Export Invoice Templates

Download professional free GST export invoice templates, and make customization according to your requirements at zero cost.

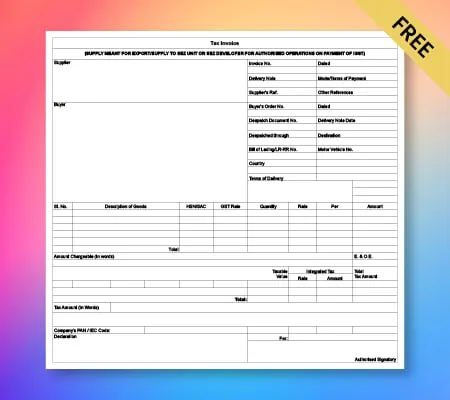

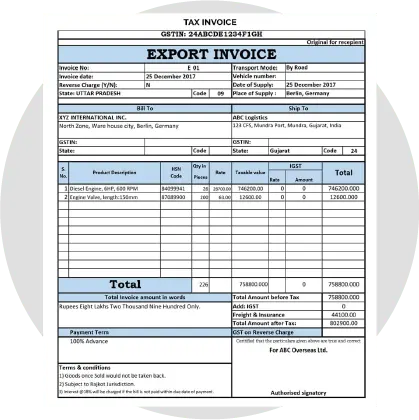

GST Export Invoice Format – 01

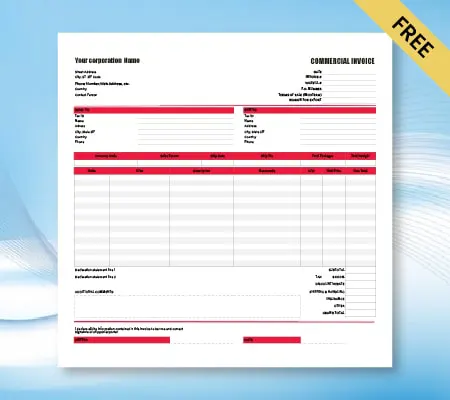

GST Export Invoice Format – 02

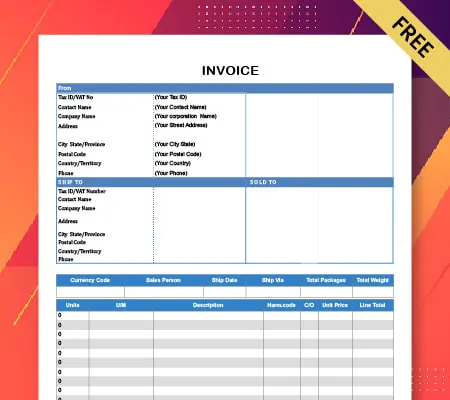

GST Export Invoice Format – 03

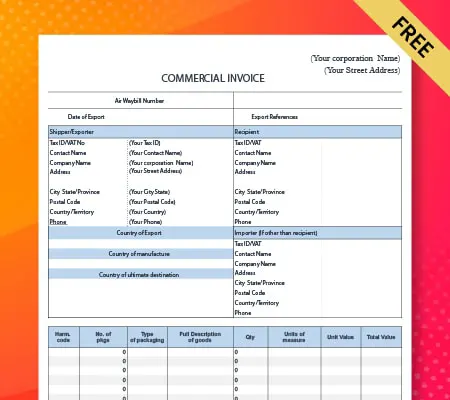

GST Export Invoice Format – 04

Generate Invoice Online

GST Export Invoice Format: The Complete Guide

The Indian Goods and Services Tax Act was implemented on 1 July 2017, replacing all indirect taxes levied on goods and services at the national level. Vyapar is the best GST billing software in India. It’s designed to help businesses comply with all aspects of the Indian Goods and Services Tax Act, 2017. With Vyapar, you can manage your business more efficiently and keep track of GST billing data.

GST is an acronym for Goods and Services Tax, a tax you pay when buying or selling goods and services. The GST rate in India is currently at 18% on most items. Get the most reliable and trusted GST export invoice format online from Vyapar. We are a leading GST billing software provider in India. Our easy-to-use software helps you to get your export invoices done faster, easier, and error-free. Each section of the invoice has a unique purpose and thus, businesses must understand what the use of these sections is.

Export Invoice Format Under GST

Vyapar export invoice format is a set of instructions for exporting goods. The instructions are about how to import goods in that particular country. Vyapar GST export invoice format includes the necessary information that is needed for the customs and other taxes.

Sometimes there are specific notes for each kind of goods exported from that particular country. Examples of this include electronics, mineral oil, etc. In general, the invoice is issued by an exporter. When you are to export goods, you must prepare and issue a bill of lading. The export bill is issued and sent to the importer by the exporter with this export invoice.

What is A GST Export Invoice Format?

A GST Export Invoice Format is a document that accompanies goods when they are exported from one country to another. The GST Export Invoice Format must meet the requirements of the country of destination, and the formats available on our website help you take care of it. Export tenders and invoices must be in English or the country’s official language to which you are exporting. GST Export Invoice Format is an essential document for every exporter and importer who has goods for export or import.

There are some rules and laws related to GST Export Invoice Format. Every country has different policies for the import and export of goods. For example, suppose you are exporting day-old chicks from India to the United Kingdom. In that case, the GST Export Invoice Format must be English and may not contain any symbols, special characters, or logos of your company. The primary purpose of the GST export invoice format is that the payment must be made with a legal original invoice.

Create your first invoice with our free Invoice Generator

How To Create a GST Export Invoice Format?

There are a few steps and requirements to create a GST Export Invoice Format, such as checking the customs information or documents for an export order. You need to get the total quantity of goods, description of the product, value in Indian rupees, and foreign currency. After that, give finishing details such as item number, assortment Code, price per unit, and other necessary information required by your client or customer.

- When you enter the details of the worth of exported goods for your customers or clients, check them one by one. If any mistakes are found in those details, then correct them immediately with necessary corrections.

- After adding all your details, recheck them one by one. If any mistakes are found in those details, then correct them immediately with necessary corrections.

- Enter all the details mentioned in this document, such as order number, date of selling product, value in Indian rupees, and foreign currency.

- Create a new document as per the above requirements and name it. It will be your GST Export Invoice Format.

Why Do Small Businesses Require GST Export Invoice Format?

A GST Export Invoice Format for small businesses helps them maintain a record of their business transactions, thus ensuring that time-consuming audits do not cripple their business. A GST Export Invoice Format for small businesses also helps them file taxes on time. It is the responsibility of any business organization to keep proper records or documents containing essential information such as the name and registration number of the firm, names of partners, addresses, PAN number (if applicable), date of incorporation or registration, and date on which cancellation of registration applies.

A GST export invoice format provides an overview of all transactions made by a small business related to exports.

A GST export invoice format will help you track your expenses for tax purposes.

A GST export coupon code is provided with each sale made on an international transaction to ensure the correct tax has been paid.

Features of Vyapar GST Export Invoice Formats

Vyapar comes with a wide variety of features to assist businesses in simplifying their everyday operations. Our GST export invoice templates facilitate seamless transactions by removing manual procedures significantly.

Generate Export Invoices

Create GST export invoices using Vyapar to make your brand stand out among competitors. In a few minutes, you can create invoices for your clients. An invoice template is the simplest way to control the look and feed of your invoicing process. Vyapar allows you to create invoices from anywhere and send them to your customers.

Customisable GST Formats

Customise your invoice to give it a unique look and separate your business from the crowd. You can choose from multiple GST Export Invoice Format and customise them to meet your business requirements. You may also include your standard remarks, signature, and company logo in the GST export invoice created by Vyapar.

Track Orders

Monitor every sale/purchase order by using our GST export invoice maker app. Vyapar makes it easy to create a large number of invoices in a short time frame. It is very beneficial for managing multiple orders and it significantly improves the overall customer satisfaction.

Free Billing and Accounting

Using Vyapar GST invoicing app, you can create invoices, manage business activities, track storage space, and perform many other tasks for free. You can bill as many customers with the basic version for free using our Android app.

Track Expenses

GST export invoice formats are designed to help your company create export invoices seamlessly for your customers. It offers you the best way to keep track of your business expenses every time you make a payment. GST invoices made for exports save the time and effort required in managing the finances of your business.

Net Payables and Receivables

Our GST Export Invoice Format maker helps you track your business dashboard from anywhere. Free GST export invoices make it simple to keep track of your business finances.

Frequently Asked Questions (FAQs’)

In GST, the service tax is paid in import. So the company imports goods and pays taxes on them to the government. But if a person wants to export goods, he doesn’t need to pay taxes for it. The company will show an export invoice and input VAT (Value Added Tax) wherever he exports his product so that there won’t be any trouble with duty offices at the destination point.

There are many different software programs designed solely for creating export invoices, and a number of them are available online. The most common format is a spreadsheet with columns that include the invoice number, the date it was issued, and the quantity ordered and exported by country (which would be another column).

Yes. GST is applicable on all export goods shipments from any Indian state. It’s central taxation legislation and so applies to break-ups in any country. Vyapar app helps you add the GST to the invoice whenever you create an export invoice.

An GST invoice is automatically generated when an order is placed online and it will include GST information as set up in the system.

An export invoice is an invoice for your products that you’re going to send out of the country. An export invoice must have a legal description of the product being exported and in what form it exists.

Vyapar aids in raising GST invoices for exports with international trade templates, automating tax calculations, currency conversions, and creating professional export invoices. It also manages export orders, tracks shipments, and ensures GST compliance for export transactions

Exports are zero-rated under GST, meaning GST is charged at 0%. This allows exporters to claim refunds on input tax credits, promoting competitiveness in international markets.

The HSN code is a must-have on export invoices, being an international standard for classifying goods. It’s crucial for customs clearance, aiding in clear product identification, duty/tax determination, and regulatory compliance.

Vyapar streamlines GST export invoicing with customizable templates tailored for exports. It automates tax calculations, currency conversions, and ensures GST compliance, simplifying invoice creation, order management, shipment tracking, and record-keeping.

Special Purpose Invoice Formats: