Export Invoice Format

Vyapar App is a free-to-use invoice maker for small business owners. Even though it does not allow you to create export invoices, it can help you manage everything with the latest updated tax regulations.

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Export Invoice Format Vs Vyapar App

Features

Export Invoice Format

GST Calculation

Invoice Customization

Multi-Device Access

Real-Time Inventory Sync

Auto Backup

Tax Invoice Generation

Multiple Payment Modes

Free Support and Assistance

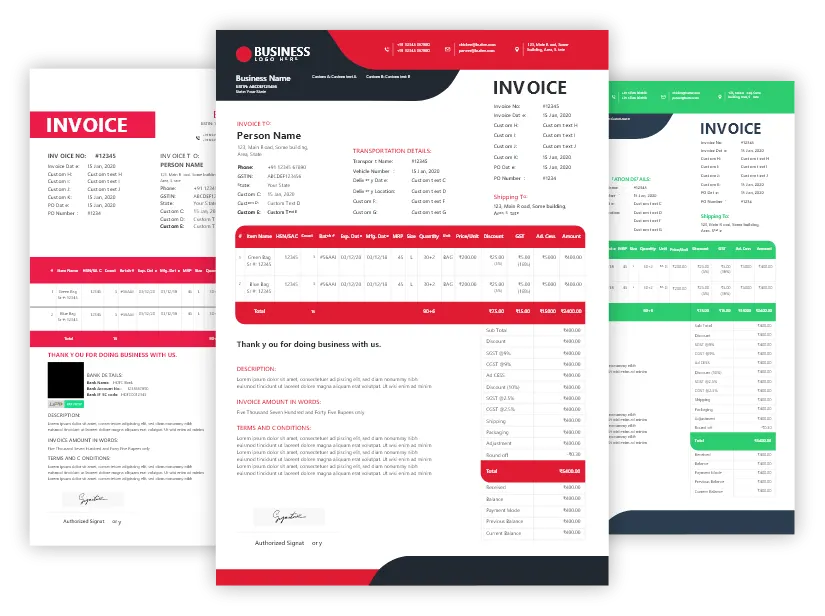

Free Professional Export Invoice Templates

Download professional free export invoice templates, and make customization according to your requirements at zero cost.

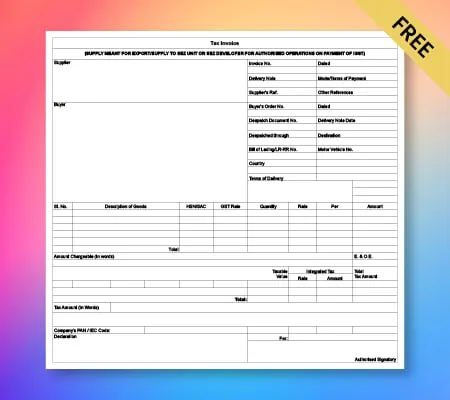

Export Invoice Format – 01

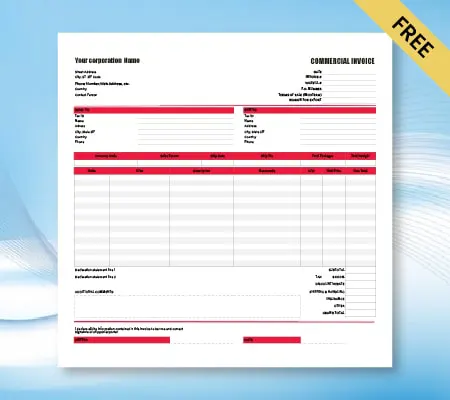

Export Invoice Format – 02

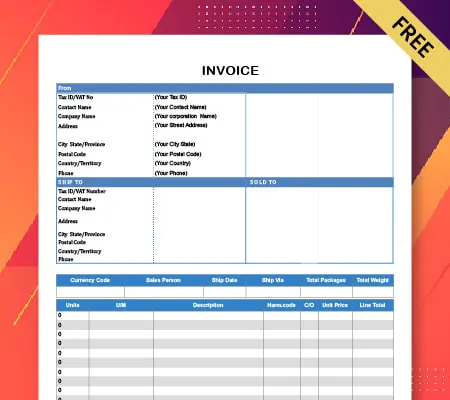

Export Invoice Format – 03

Generate Invoice Online

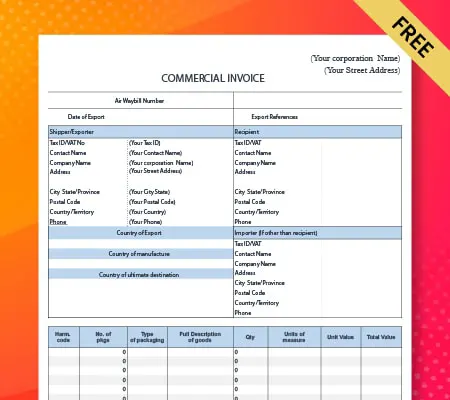

Export Invoice Format – 04

What is the GST Export Invoice Format?

The GST export invoice format is an editable document that a seller or the shipping company can use to issue commercial invoices to exporters. The sellers will use it to report their sales or purchase of goods and services to the exporters.

Use of the GST export invoice format is mandatory for exports above Rs 20 lakhs. The sellers can issue the GST export invoices to customers and then manage their accounting requirements using the Vyapar app through a shipping company registered under goods and services tax (GST).

How to Create an Export GST Invoice Format in India?

Export invoice format is a GST government prescribed format for the export of goods and services. You can prepare the export invoice using the formats available in software such as MS Excel, Adobe, Open Office, and any other export invoicing software, etc. Currently, the Vyapar app is not cannot help create export invoices. The first draft of the format provides a way to identify sellers and buyers covered under the law and indicate the value of the transaction(in INR).

Using Export Invoice Format is Great, But It Has Limitations. How Export Invoice Software Vyapar Makes This Better?

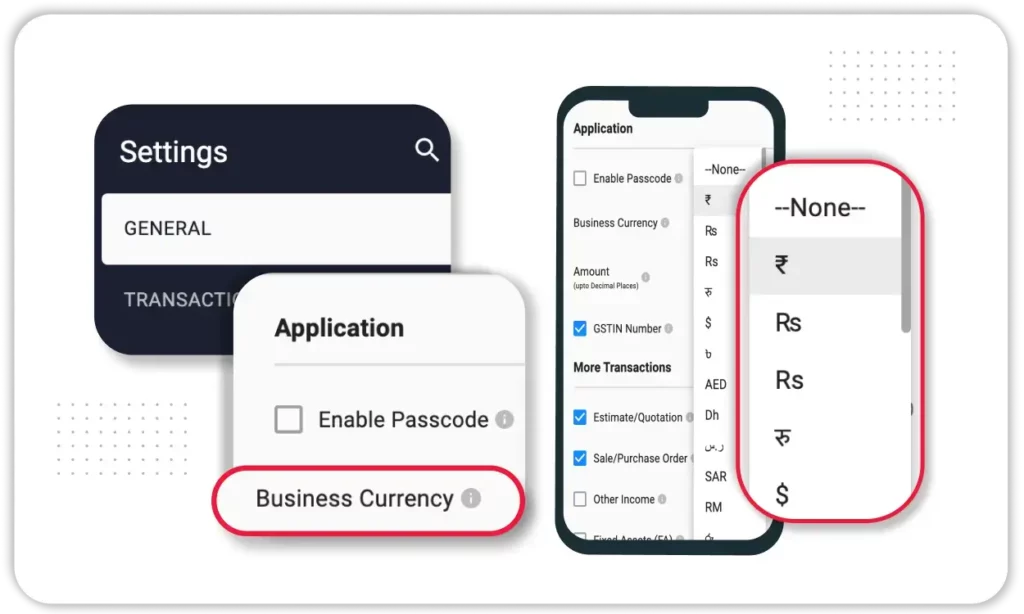

Export Invoice Format with Native-Currency Support

Vyapar offers export invoice formats with native currency, perfect for businesses seeking robust export invoice software to handle international sales smoothly. It simplifies documentation while meeting cross-border compliance needs.

- Professional Templates: Generate compliant and branded invoices for global buyers in their preferred currency.

- HSN Code & Tax Support: Vyapar allows you to manually add or choose the correct HSN Code and applicable tax rates while creating export invoices. This ensures your documents meet compliance standards without applying fields automatically — giving you full control.

- Native-Currency Support for Invoices: Create invoices in your customer’s preferred currency while tracking profits and taxes in INR for seamless international billing and compliance.

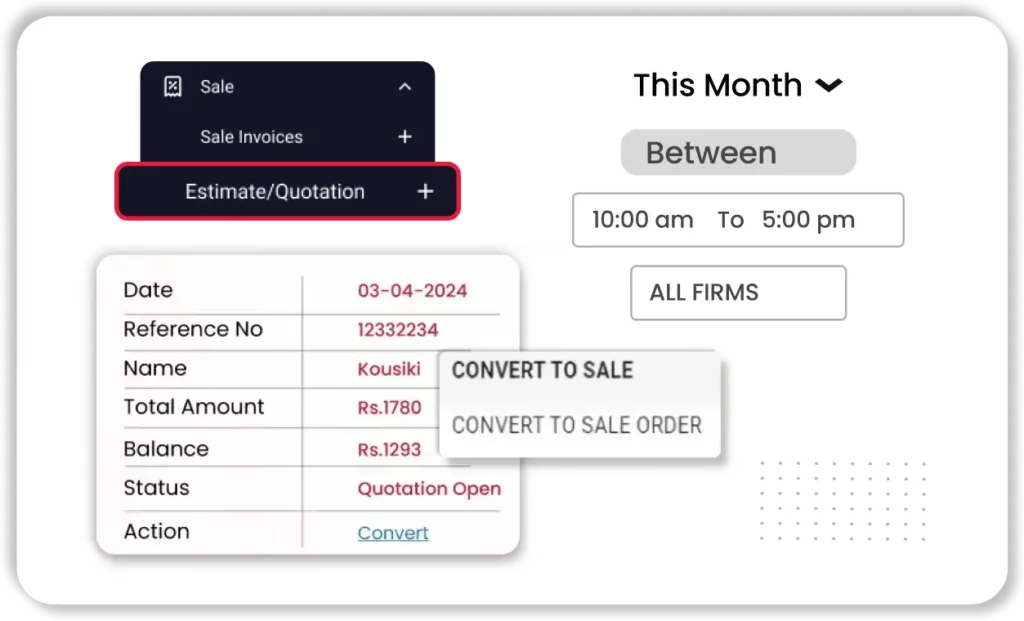

Quotation and Estimate Management

Vyapar is also a great export invoicing software for managing international quotations and pricing negotiations professionally.

- Instant Quote Generator: Just enter item details, prices, and terms to create and send quotations within seconds — no spreadsheet required.

- Convert to Invoice: When a client accepts your quotation, turn it into a GST invoice in one click without retyping the data.

- Track Quote Status: Monitor which quotes are accepted, declined, or pending, so you can follow up or adjust accordingly.

Inventory Management for Export Products

Vyapar includes robust export invoicing software with inventory features that are essential for managing global stock across locations, warehouses, or ports.

- Real-Time Stock Tracking: Instantly know what’s available, reserved, or dispatched. You can avoid over-committing to customers and ensure timely deliveries globally.

- Batch & Expiry Tracking: For products with expiration dates or serial batches, manage them efficiently. FIFO (First In, First Out) ensures older stock gets shipped first.

- Multi-Warehouse View: Manage inventory across godowns, ports, bonded warehouses, or distribution zones — all from one dashboard.

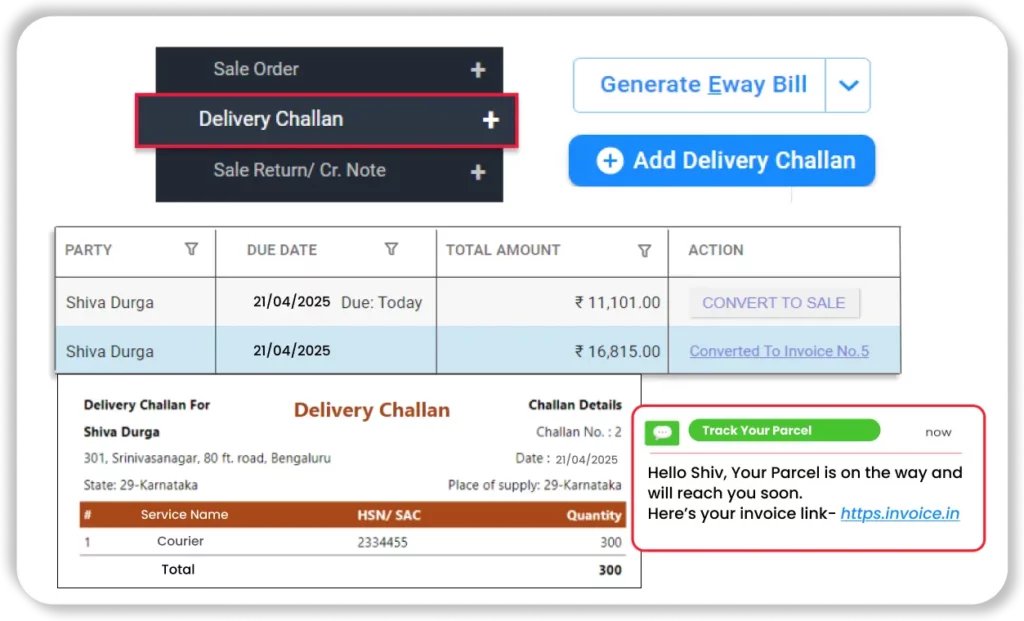

Packing List and Delivery Note Generation

If you’re looking for smart export billing software, Vyapar lets you generate standard packing lists and delivery notes that streamline your shipping documentation.

- Standardized Templates: Professional-looking documents with item-wise details like quantity, weight, and dimensions, as per global shipping standards.

- Avoid Shipment Errors: Use system-generated notes to verify every item before loading, ensuring nothing is missed or duplicated.

- Custom Field Support: Add container numbers, HS codes, consignee details, or special handling instructions as per export rules.

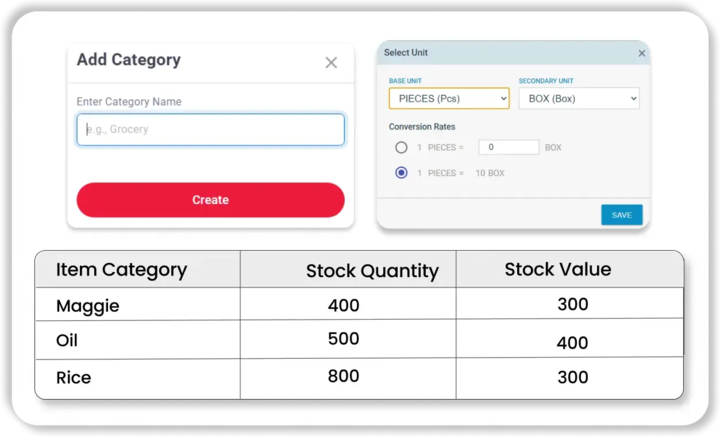

Multiple Units of Measurement

Vyapar is an export invoice software India businesses trust to handle multiple measurement units for global trade — from kg to tons, boxes to pallets.

- Dual Unit Mapping: Stock items in kg or pieces, and bill in boxes or pallets — Vyapar calculates everything accurately for you.

- Unit Conversion Logic: Whether you’re selling 1 box = 100 units or 1 ton = 1,000 kg, the system converts units correctly during sales and purchases.

- No Manual Errors: Prevent costly mistakes in stock counting or billing by letting Vyapar handle the math.

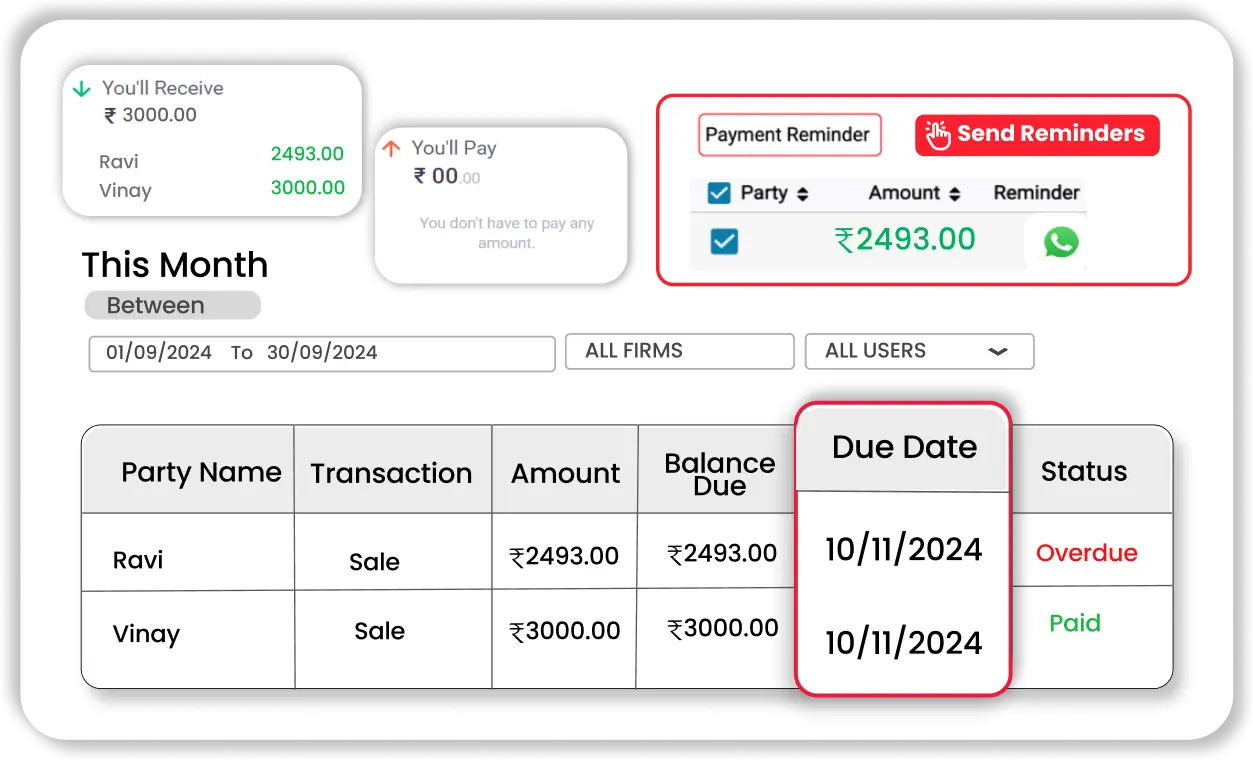

Payment Tracking

More than just an export invoice software free download, Vyapar offers full-fledged payment tracking to help you stay on top of receivables from overseas clients.

- Payment Reminders: Automate alerts for pending dues to reduce payment delays without sounding pushy.

- Outstanding Reports: Instantly generate a list of unpaid invoices, so you can follow up quickly and keep cash flow steady.

- Customer Payment History: View full transaction details for each client — invoices, payments made, and any overdue amounts — all in one place.

Barcode and SKU Management

Vyapar makes logistics seamless with features you’d expect in top export billing software, like barcode scanning and SKU tracking.

- Quick Product Scanning: Use barcodes to add items to invoices or packing lists instantly, reducing manual entry time.

- Automated Stock Updates: Every scan updates your inventory in real-time, helping you track stock movement across locations.

- Multi-SKU Handling: Assign and track unique SKUs for every product variant — size, color, type — across domestic and export markets.

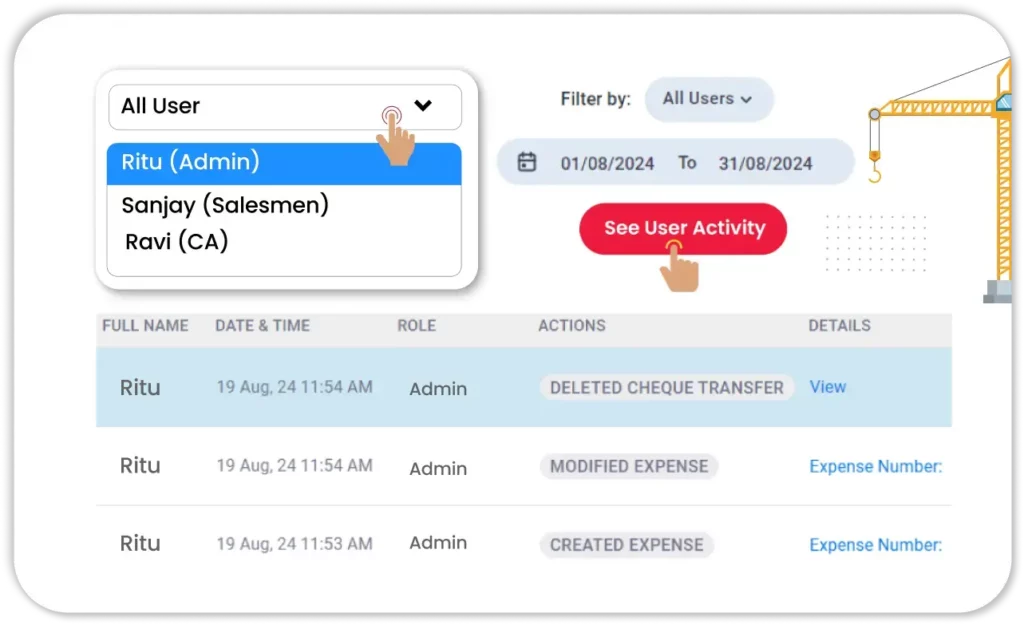

Multi-User Access with Role-Based Permissions

Vyapar’s export invoice software offers safe and collaborative multi-user access, perfect for growing teams managing exports together.

- User Access Rights: Define who can view, edit, or create data — such as only allowing accountants to view financial reports and salespersons to create invoices.

- Audit Logs: Keep track of every user action — what was changed, who did it, and when — for improved transparency and accountability.

- Real-Time Collaboration: Let sales, dispatch, and accounts teams work simultaneously without overlapping or making errors.

E-Way Bill & E-Invoice Integration

Vyapar helps you stay compliant with India’s regulations by integrating e-Invoicing and e-Way Bill tools into its powerful export invoicing software India edition.

- 1-Click GST Compliant Documents: Generate e-way bills and e-invoices directly from Vyapar with a single click during invoice creation.

- Error-Free Filing: Vyapar automatically pulls data from your invoice to fill in GST-required fields, reducing human errors.

- Government Portal Sync: Upload directly to the GST portal, saving time and ensuring fast compliance.

Mobile App Access for On-the-Go Operations

Manage your export business from anywhere using Vyapar’s mobile app — your all-in-one export invoice software on the move. Whether you’re traveling for meetings or managing operations remotely, Vyapar gives you full control at your fingertips.

- 24×7 Access: Create GST invoices, send estimates, and monitor stock even while traveling — all from your smartphone.

- Instant Alerts: Get push notifications for payment receipts, stock-out situations, or delivery dispatches so you never miss a beat.

- Offline Mode: Even if you’re in a no-network zone (like a factory or rural warehouse), you can work offline and sync data once you’re back online.

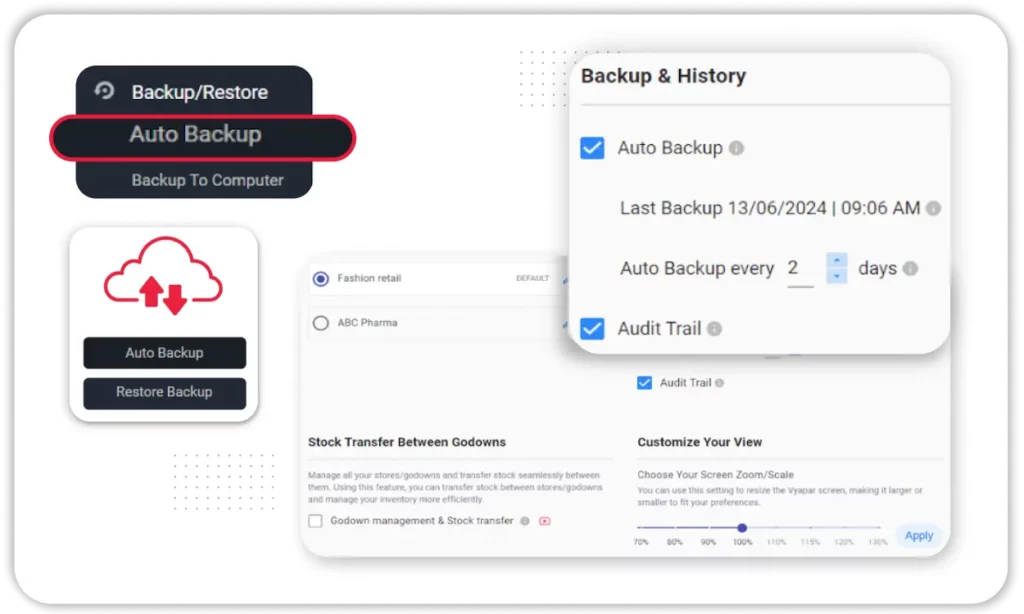

Data Backup and Security

Vyapar isn’t just trusted as a powerful export billing software, it also ensures your sensitive data is protected, backed up, and recoverable at all times.

- Automatic Cloud Backup: All your billing, inventory, and transaction data is backed up to the cloud regularly, so you don’t lose anything important.

- Data Encryption: Vyapar uses encryption to keep your financial records secure from hacking, theft, or unauthorized access.

- Restore Anytime: If your device crashes or data is accidentally deleted, restore everything with just a few clicks — quickly and stress-free.

OCR Scanning

Vyapar’s OCR Scanning feature helps you instantly capture and digitize printed or handwritten information using your mobile camera—making data entry faster and error-free.

- Quick Data Capture: Scan bills, prescriptions, or product labels to auto-fill details like names, prices, or dates without manual typing.

- Error Reduction: Minimize typos and entry mistakes by letting OCR extract text directly from physical documents.

- Seamless Integration: Use OCR within billing, inventory, or customer records to update information in real time with just a scan.

Create your first Export Invoice with our free Invoice Generator

Why Do Small Businesses Require a GST-Compliant Export Invoice Format?

A well-prepared GST Invoice is critical for all businesses. It simplifies the process of doing business and makes it efficient.

Save Time by Tracking All Your Exports in One Place

Vyapar is a free business management app that helps individuals track their exports and keep all their data in one place. Wherever you are in the world, data has a significant impact on your business – and Vyapar lets you track all of it together.

Accurate and Timely Invoices for Export

The export invoicing process can add a significant amount of time to the process, and thus it is advisable to use invoice software that can help you process invoices in India. Vyapar invoice maker app is the perfect choice for quick invoicing. Invoices are the fastest and easiest way to offer professional invoices to your clients. However, you have to use templates to provide accurate export invoices as they are not available in the Vyapar app.

Useful for Small Businesses When Exporting

Vyapar app is a billing and accounting application that is used by small businesses all across India. An export invoice is a statement that shows the value of goods exported and the duties and taxes levied on them. It is an invoice for the export of goods is an essential document in any import-export transaction. An export invoice generator comes with built-in features for a small business to export to its preferred destination.

Features Of Vyapar Invoice Format

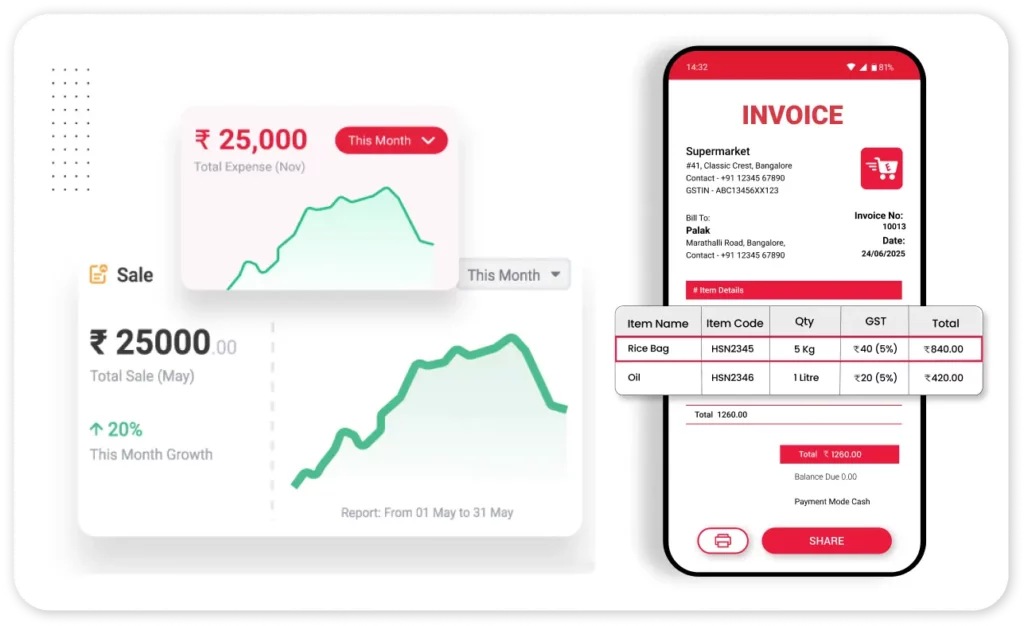

Multiple Payment Systems

Vyapar is a cost-effective way to create invoices for your products and collect payments. You can enable offline and online payments, including UPI, NEFT, debit, credit, cash, and cheque. The company provides cost-effective, fast, and reliable invoicing services in India.

Dashboard

The dashboard is an integrated suite of applications that provides a single source of information to view the status and progress of your business activities. It gives you the ability to understand what’s happening in every area of your business, and it helps you make better decisions faster.

Operate Online/Offline

Vyapar’s invoice format is a GST billing accounting software for invoicing within India. Vyapar app cannot create export invoices, but it can help operate your business accounting effectively. It works entirely offline on a single device, and no connectivity is required while using this accounting software. Our invoice generator is straightforward to use, user-friendly & flexible. You can access your data from anywhere using any device (computer/laptop/mobile) with an internet connection.

GST Reports

GST reports are the official documents that you can use for tax purposes. These reports will be filed monthly with the government. The format of these reports is laid out in detail in the Goods and Services Tax Act 2017. Vyapar helps you take care of tax filing in India.

Business Management From Mobile/desktop

Vyapar is online accounting software for small and medium businesses. You can manage your entire accounting from a single window on your PC or laptop. And also, you can access all the records and data via a mobile app, which is available on Android and iOS. Using Vyapar, you can manage your business from a single device or multiple devices by accessing data across the devices.

Compatible for All Businesses Types

Vyapar app is the best app for tracking data & bills, inventory & accounting for any small/medium business in India. Even though it cannot create export invoices, Its simple, secure, and easy to use interface makes it a leading player in the retail invoicing industry in India. Vyapar app will help you with all your business requirements right from invoicing, managing, payments, and tax filing.

Tax and Discounts

Our invoicing app is a complete solution to manage your business and financial requirements, including the latest tax rates and discounts on your products. It provides you with an easy way to manage your accounts and file for taxes with GST reports created using sale/purchase transaction invoices. You can add outside transactions in the app to manage finances effectively.

Customisable Invoice

A customisable invoice is an essential document for any small/medium business. It has to be in a professional tone and should have all the information about products/services being provided by the company. Vyapar invoice format provides you with a platform to create any number of invoice templates and customise it according to your requirements. You can use ready-made invoice templates to facilitate quick billing for your business within India.

Create Various Transactions

You can save all transactions within the Vyapar app easily. You need not have any accounting knowledge to create transactions in Vyapar. It’s a simple interface and is easily accessible on mobile phones and tablets. The app allows you to create an invoice within seconds, saved or emailed it as a PDF file. You can also view your history of invoices, along with their status and payment details.

Frequently Asked Questions (FAQs’)

You can use any export invoice template online or an export invoicing app to find our app’s best quality export invoice generator. The Vyapar app cannot generate invoices for exports and imports digitally. The users are allowed to choose the type of transaction, whether it be export or import, and have the option to set taxes. Users can also upload their logo, add line items for payment, and create custom fields that will help export data in excel sheets with all the necessary calculations automatically done by Vyapar App.

Creating an export invoice requires complete functionality and compatibility with multiple currencies. Vyapar app does not have all the features needed to generate export invoices. However, you can use the app for your business accountancy requirements.

Export invoicing is a process that records your company’s transactions with export buyers. It also keeps track of the price and volume in exchanges of goods or services for a particular shipment with an export buyer. Export invoices are used for border procedures, customs clearance, and to protect customer interests.

There are three types of invoices that you can export. There are three types of invoices available for exporting but are unavailable in the Vyapar app: Transaction, Inventory Transfer/Sync, and Inspection Sheet (surveying).

A good export invoice is necessary for the seller to avoid paying taxes or duties on a shipment, ultimately making exporting easier. Vyapar app cannot help create export invoices, but it can help you connect new members with an export invoice format to make it easy on yourself. It can contain some or all of the following sections as per country-specific requirements:

1. Seller Identification

2. Shipment identification and the type of commodity/goods being sold

3. The weight or quantity in number (if applicable)

4. Prices and currency including tax and duty charges before shipping both in the origin country’s currency as well as the destination country’s currency (following World Customs Organization guidelines)

5. Tax obligations (if any) specific to the destination country for this product (adhering to product-specific regulations)

6. Shipping terms and packaging information

7. Customs Export Declaration Number

To create an e-invoice for export using Vyapar:

1. Open Vyapar and select an export invoice template.

2. Enter invoice details like business info, customer details, products/services, prices, and taxes.

3. Customize the format with your logo, fonts, and colors.

4. Add export specifics such as order number, shipping terms, and destination details.

5. Ensure GST compliance for exports.

6. Save the e-invoice and send it via email or download as PDF.

Vyapar simplifies this process with customizable templates, tax automation, and GST compliance features.

An export invoice is similar to a regular invoice but includes additional details specific to international trade, such as export order number, shipping terms, destination details, tax treatment for exports, currency, and compliance with international trade regulations.

Yes, an invoice is required for exports. It serves as a legal document that outlines the details of the exported goods or services, including the quantity, price, terms of sale, shipping information, and payment terms. The export invoice is essential for customs clearance, verifying the value of the goods or services, determining applicable taxes or duties, and ensuring compliance with export regulations. Additionally, it is used for accounting purposes, record-keeping, and facilitating international trade transactions.

The purpose of an export invoice is to provide detailed information about exported goods/services for legal compliance, smooth payment transactions, record-keeping, verification of goods, and customs clearance.

Special Purpose Invoice Formats: