GST Reconciliation Format in Excel

Vyapar is India’s best and easiest solution for accounting. Get yourself the premium plan, and you are all set to access this gst reconciliation format in excel and take care of your company’s accounting effortlessly. Start your 7-day free trial today!

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Table of contents

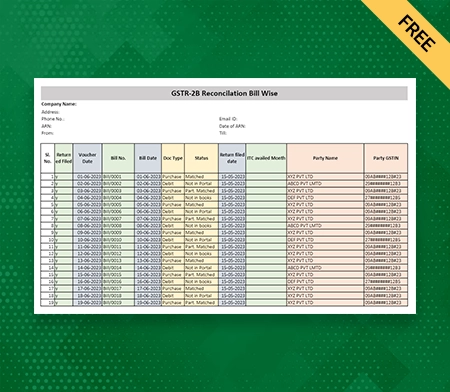

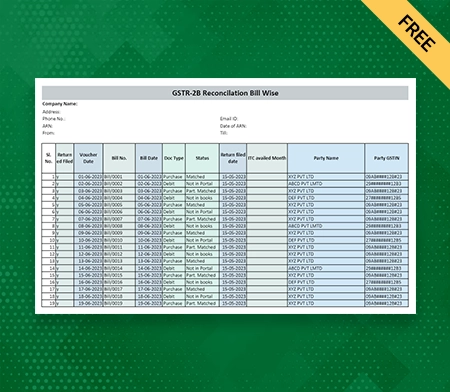

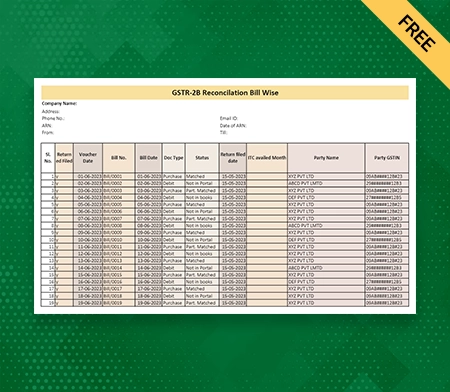

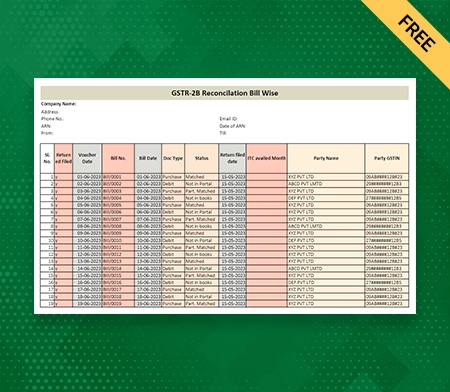

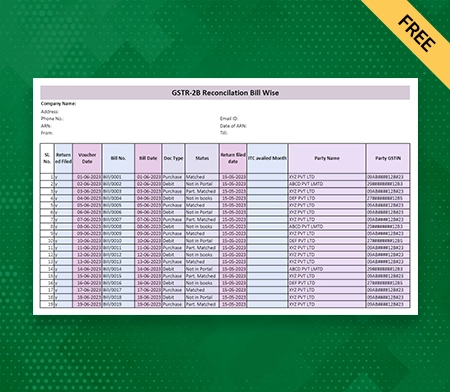

Download GST Reconciliation Format in Excel

What is a GST Reconciliation Format In Excel?

GST is a form of indirect tax that gets levied on goods and services. GST reconciliation, on the other hand, is a process of comparing GST returns with total sales and purchases. The comparison is done to ensure that you file the right amount of GST returns.

There are certain laws regarding GST in India that, if it gets violated, the GST payee will suffer consequences. There are multiple ways to access the GST reconciliation format. One of the ways is through Excel.

A GST reconciliation format in Excel is a spreadsheet used for comparing GST details with that of your company’s sales/purchase details. Some of the key elements of a typical GST reconciliation format in Excel contains:

- Columns for taxable amount, invoice amount, invoice number and date.

- A dedicated section to record all the purchases and sales of a company.

- A section to enter the decided GST return forms, such as GSTR-1 and GSTR-3B. Including of GSTR-1 and GSTR-3B in the reconciliation excel format ensures a comprehensive alignment with the specific return forms, allowing for a detailed comparison of the reported data with the actual financial transactions.

- Specific formulas for comparing the financial transactions and GSTRs with the GST details.

- A summary section contains the GST reconciliation conclusion and the GST credit breakdown.

Simply put, a GST reconciliation format in Excel is a well-structured spreadsheet to streamline the GST filing process. The format ensures that a company follows all the required GST rules set by the government.

In addition, it also helps you make your GST filing process Accurate and time efficient. Instead of creating a GST reconciliation format from scratch in Excel, you can get the same through the Vyapar app. To access the expert-designed GST reconciliation format in Excel, download the Vyapar app now!

Importance Of Using A GST Reconciliation Format In Excel

For a business to avoid GST penalties, filing GST on time and having a proper GST record is important. GST reconciliation format in Excel is an important financial tool to help you streamline accounting in compliance with GST. Here’s why it’s an important tool for you:

1: Streamlining GST Reconciliation

GST reconciliation is a process of matching a company’s accounts with the GST return filed. The major objective of the comparison is to ensure that the data sent to tax authorities through the GST file is right. However, the process of reconciling your accounts with the GST file is pretty effort-consuming.

It is why businesses use financial instruments like a professional GST reconciliation format. A GST reconciliation format in Excel allows you to bring accuracy to the GST filing process. Using the best GST reconciliation format, businesses can easily organise financial data such as sales records, purchase records, etc.

With the improved organisation of data comes easy identification. With this format, it becomes easy to identify any specific transaction, no matter how old. Overall, this improved Data organisation and accessibility help to streamline your overall GST reconciliation process.

2: Ensuring Accuracy In Tax Filings

Every company aims at better credibility and yet avoids breaking any GST laws. Submitting an accurate GST file is an important factor that helps you maintain your market credibility. In addition, filing the wrong GST can have certain bizarre consequences, which every business aims to avoid.

With the GST reconciliation format in Excel, companies can achieve accuracy and precision in tax submissions. The format does that by allowing automatic calculations and seamless data transfer. When manual labour is eliminated from the GST calculation process, the risk of any human-made errors is also reduced.

Further, the automated data transfer that the Vyapar app offers eliminates any potential errors that generally arise during manual data transfer. Besides, since Excel is known for promoting Data organisation, identifying inaccuracies also becomes easy. Their mistakes are identified easily, and implementing the solution becomes no big deal.

3: Detecting Discrepancies And Errors

Even a small mistake in your GST filing could make you face a bizarre legal consequence. But luckily, you can avoid that by using a GST reconciliation format in Excel. It is an excellent tool that You can use to not just identify but pinpoint the specific area of error.

As mentioned above, we compare multiple data in GST reconciliation to identify accuracy in GST filing. The good thing is that when you perform reconciliation using a GST reconciliation format in Excel, the comparison becomes easier than before. You can conveniently perform a line-by-line comparison between your company’s sales/purchase record and GST.

The improved Data organisation in Excel helps with easy GST reconciliation. With accurate GST conciliation, you can further identify dispensaries even more easily. It’s like a chain of tasks that this format brings convenience into.

4: Facilitating Compliance With GST Laws

Complying with GST laws is another important element to ensure that your business does not face any legal complications. Any legal complications that come up to you as a result of any non-compliance have a direct effect on your business operations. The GST reconciliation format in Excel is an amazing financial tool that you can use to maintain GST compliance.

First, this format gives you an in-depth overview of all the details and Data relevant to your GST filing. With such an overview, it becomes effortless for the accountants to review and validate your GST information. Since Excel promotes data organisation, accountants will face no inconvenience in cross-checking the transactions relevant to GST.

Further, the GST reconciliation format in Excel allows you to include or update financial details in real time. Therefore, even if you discover any potential mistake in the financial data, you don’t have to worry about how you will audit your data. Making changes in this format is a really simple and effortless task.

5: Efficient Handling Of Large Data Sets

The GST reconciliation could be a headache if you are a business that deals in a large volume of transactions daily. Fortunately, having a GST reconciliation format in Excel can greatly help you. Using this format, you can handle large data sets efficiently and in a time-saving manner.

The GST reconciliation format in Excel offers the facility to import data from multiple sources in a seamless manner. You can further consolidate all the data into one spreadsheet, eliminating the need for managing multiple files. In addition, the format offers features such as searching, filtering and sorting.

These features promote efficiency in the GST reconciliation process. With these features, you can easily locate any transaction, no matter how old. Overall, efficiently handling large data sets promotes convenience, efficiency and accuracy in the GST reconciliation process.

6: Minimising Tax Penalties And Auditing Risks

If you file wrong or incorrect GST returns, you will have to face serious consequences, like tax penalties. And in some cases, the consequence can go as severe as jail time. Using a GST reconciliation format in Excel, businesses can reduce such risks by complying with the GST laws.

The GST reconciliation format in Excel helps prevent tax penalties by bringing accuracy into the tax reporting. As said above, This format offers an organised structure and in-built validation rules for financial data management. Both these features help reduce the risk of errors in calculations and data entry.

Fewer errors mean more accuracy in the financial data, and therefore, the chances of your business overpaying for underpaying taxes get reduced. Both these things are the major causes of GST penalties, and this format helps reduce their chances of happening. Thus, if you want to reduce auditing risk and minimise text penalties, get yourself this format now.

Advantages Of Working With A GST Reconciliation Format In Excel

Make the GST filing process more efficient using the GST reconciliation format in Excel. The format offers a variety of features, which reduces unnecessary hassle in the filing process. Some of the key benefits of this format are as follows:

Easy Data Organization And Management

If you want to organise your GST-related financial data without hassle, a GST reconciliation format in Excel is what you need. Excel is known for its excellent capability to categorise data into separate rows and columns. It promotes data organisation, making it convenient for businesses to input financial information in a well-structured manner.

Moreover, another excellent feature of Excel is its data filtering and sorting capabilities. They allow businesses to arrange their data according to certain sorting criteria. Both these features make it easy for businesses to manage data and further analyse it in the easiest manner. The hassle of gathering and managing data for GST calculation is removed.

Further, when an accountant is performing GST reconciliation, they need financial data to be easily accessible. With GST reconciliation format in Excel, data accessibility is top-notch and convenient. You will have everything you would need for the reconciliation process in just one place. Therefore, you don’t have to shuffle through multiple files and accounts.

Quick Identification Of Discrepancies

The GST reconciliation format in Excel helps businesses improve the speed of identifying dispensaries. During the reconciliation process, the major objective is to figure out the accuracy of the GST filed by comparing it with the company’s financial record. Since Excel is known for its advanced data comparison capabilities, error identification becomes easy.

Furthermore, it’s super easy to import the GST data into this Excel format. The company’s financial data, as well as the GST return data, are placed side-by-side so that the comparison can be done in the least effort-consuming manner. Since all the required data is present in one place and that too side by side, any dispensary can be spotted instantly.

In addition, Excel offers a feature called conditional formatting, which will help you automatically highlight any potential errors. For example, businesses can easily filter data using this feature to view transactions for any tax period or category. Ultimately, this format makes sure that the accounts have everything they need to perform GST reconciliation without any inconvenience.

Seamless Integration With Accounting Software

The GST reconciliation format in Excel easily integrates with various accounting programs. The easy integration helps with data transfer and reconciliation, making the process easier. Moreover, you can also use various accounting apps to export your data into this format without any inconvenience.

With this format, businesses can automatically import data relevant to GST filing into their preferred accounting software, eliminating the need for manual entries. Since both the import and export between the GST reconciliation format in Excel and accounting apps are automatic, the chances of data errors are reduced to zero.

Also, automatic data transfer helps save time and human effort. Besides this, the seamless integration of the accounting app into this format saves a lot of hassle that accountants encounter during the data transfer from one source to another. Thus, this format is perfect if you are looking for a tool that saves you a lot of time and effort during GST reconciliation.

Improved Accuracy In GST Returns

With the GST reconciliation format in Excel, businesses can improve the accuracy of the GST filing and data relevant to it. Excel offers excellent in-built features and formulas that you can use to achieve precise tax calculations. Moreover, both these features also help with accurate data entry, one of the biggest hassles for accountants.

Besides, this Excel format also allows you to create your own formulas. For example, you can create automation formulas for input credits or tax calculations based on sales and purchase transactions. Automatic calculation is a huge advantage for your business as it helps you achieve accuracy in tax calculation.

In addition, it also helps prevent calculation mistakes that could lead to an inaccurate GST calculation. Inaccurate GST calculation can end up you facing serious legal complications. Luckily, you have this format to help you with accurate GST calculations, eliminating any potential risk of legal penalties caused due to inaccuracy in GST filing.

Time-Saving Reconciliation Process

Another great advantage of having a GST reconciliation format in Excel is the time efficiency that this format brings into the GST reconciliation process. Excel offers data management features that help you easily handle your financial data. Convenience and data management promote the overall well-being of the reconciliation process.

Moreover, locating any specific transaction or data element in this format is very easy. It’s a feature that comes in handy during times when you are handling high volumes of transactions. You can also automate repetitive calculations by applying formulas into multiple cells in this Excel format. It’s another fantastic technique that will save you some time.

Time is one of the biggest assets for any business, especially regarding the accounting aspect. Using our professional GST reconciliation format, the saved time and effort can be used in any other important business area. So what are you waiting for now? Get yourself this format and streamline GST reconciliation fast.

Increased Transparency In Tax Filings

Transparency in filing taxes is crucial for businesses to ensure that they maintain necessary compliance with the GST laws. You can ensure that through a GST reconciliation format in Excel. The data collected using the professional format help you file the right amount of GST.

Moreover, another underrated advantage of using a GST reconciliation format in Excel is that it helps with data review. Tax auditors and accounts can systematically review the GST data since everything is inside one spreadsheet. Further, if you want to trace any specific transaction detail, that can also be done easily using the Vyapar app.

In addition, using the Vyapar accounting app for the GST reconciliation format in Excel can achieve an extra advantage. The app offers the facility to create detailed reports on various aspects of accounting, including GST reports. For example, if you don’t have any organised record of something, you can simply import the data into the app, and the statement will be ready.

Why Use Vyapar App For GST Reconciliation Format in Excel?

Vyapar is India’s most trusted accounting software. You can use this solution to access the GST reconciliation format in Excel for free. The tool is a favourite choice of countless brands. And here’s why you should also invest in it:

User-Friendly Interface:

Vyapar accounting software is known for its user-friendly interface. It is this feature that makes this tool a nice choice for accessing the GST reconciliation format. The tool offers a pre-designed GST reconciliation in Excel for free. In addition, with this format, combined with the in-built accounting feature of the tool, managing GST becomes merely a tough task.

When you open the app, the first thing that you will be greeted by is an organised and clean dashboard. The dashboard will present you with a variety of options or features, all designed to make accounting easier and simpler. Since the Vyapar app is visually appealing and offers an uncluttered layout, users can remain more focused on the task.

The last thing they will feel is overwhelming, as everything is easily accessible. Moreover, instead of using an Excel format to perform reconciliation, you can use this tool. Well, it’s not like you cannot use Excel; you, of course, can. But Vyapar is a more time-saving and less effort-consuming alternative to performing GST reconciliation.

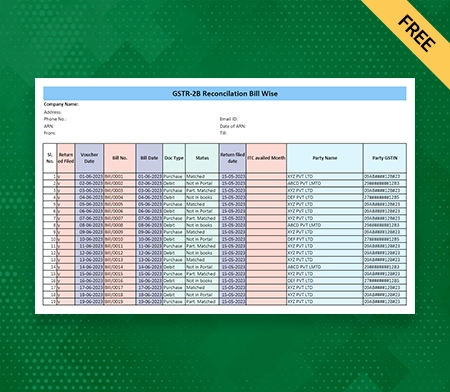

Pre-Designed GST Reconciliation Format:

An excellent feature that Vyapar offers is a ready-to-use GST reconciliation format. Now you can always create this format from scratch using Excel, but why waste so much effort? Simply create an account on the Vyapar app and access this format for free. The best part is that the format is expertly designed, so it’s the best among the ones in the market.

Furthermore, Vyapar comes with excellent customisation facilities. Unlike other formats that are hard to customise, you can easily customise the GST reconciliation format Vyapar offers. The format is highly flexible, and you can add or remove anything you want in merely seconds. The easy customisation further promotes convenience in GST reconciliation.

An underrated feature of the GST reconciliation in Excel that Vyapar offers is that it’s versatile. It means that the format works well for any business, doesn’t matter which industry it serves or deals in. So you can simply use this format to perform reconciliation without worrying about non-compliance with any GST law.

Seamless Import And Export Of Data:

Vyapar is a popular choice for businesses because of its efficient capability to import and export data. The ease of import and export of financial data brings efficiency to the overall workflow. Besides, you can integrate the GST reconciliation format in Excel with the app and transfer data in a seamless manner.

The tool eliminated the need for manual data entry to transfer data from one place to another. Moreover, once the data is imported, Vyapar automatically maps it down in the corresponding sections of the reconciliation format. With such intelligent data mapping, the risk of mismatching data gets reduced.

Not just data transfer, but Vyapar also promotes record creation and maintenance efficiency. You can use this solution to create a GST reconciliation record that you can use in future for audits and referencing. Lastly, this tool also supports data synchronisation in real-time. Therefore, as the data in the software updates, the data in your format updates simultaneously.

Real-Time Data Synchronisation:

As mentioned above, Vyapar offers real-time data synchronisation. It is this feature that sets it apart from other tools that deal with manual GST reconciliation techniques. When you integrate this software with your accounts, Vyapar automatically will create a seamless connection. The connection is what will help with data synchronisation in the least effort-consuming way.

One of the reasons why data synchronisation is an important element of the GST reconciliation process is because of its auto updates. In simple words, when you update any data element in the app, the same will be made in your GST format automatically. You will not have to manually make the changes in the other data source, saving you a lot of time.

Another advantage of data synchronisation is that it gives a real-time view of the GST details. You will not have to worry about the data’s authenticity as it keeps updating in real-time. Since the data remains accurate all the time, you can make accurate calculations about GST filing. When the GST calculation is accurate, the risk of legal penalties gets reduced.

Frequently Asked Questions (FAQs’)

A GST reconciliation format in Excel is basically a format that helps businesses reconcile their GST accounts with sales and purchase records. It’s a format that helps organise the GST-relevant data systematically.

Yes, the GST reconciliation format in Excel is free to access. However, only a few software offer it for free. One such excellent accounting software is Vyapar, which you can use to access this format for free.

A GST reconciliation is important for a business as it helps determine whether or not the right amount of GST is paid.

Yes. You can use the Vyapar app to access the customisable GST reconciliation format in Excel. You should use Vyapar because the format it offers is free and highly customisable.

Related Posts: