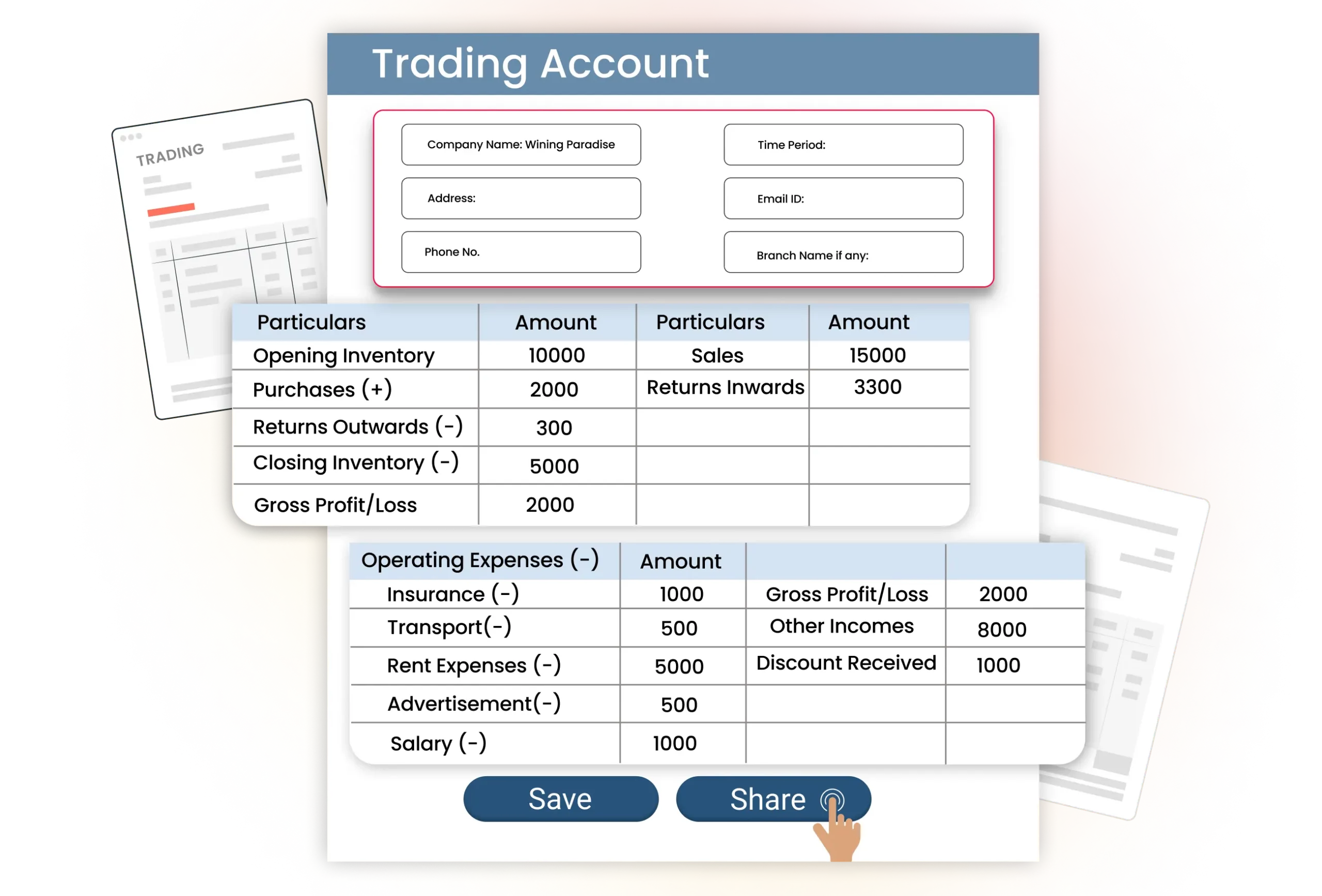

Trading Account Format

Get a ready-to-use trading account format in Excel, Word, or PDF. Understand your business’s gross profit, sales, and expenses with ease. Built for Indian businesses.

Trading Account Format vs Vyapar App

Trading Account Format

Billing Software

Price

Free

Free

200+ Professional Themes

Quick Billing

Unlimited Invoices

Auto Calculation

Error-Free Transactions

Data Backup

UPI Payments

Payment Reminders

Business Status Reports

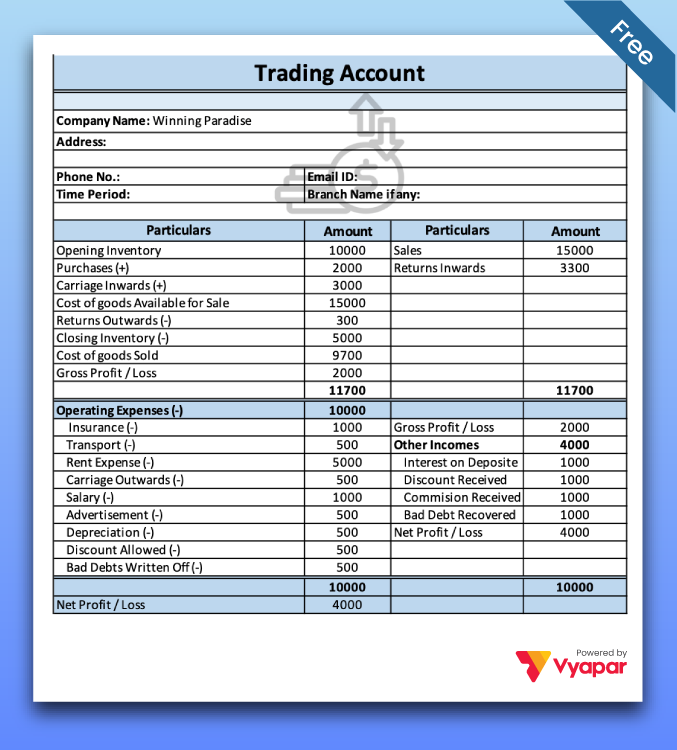

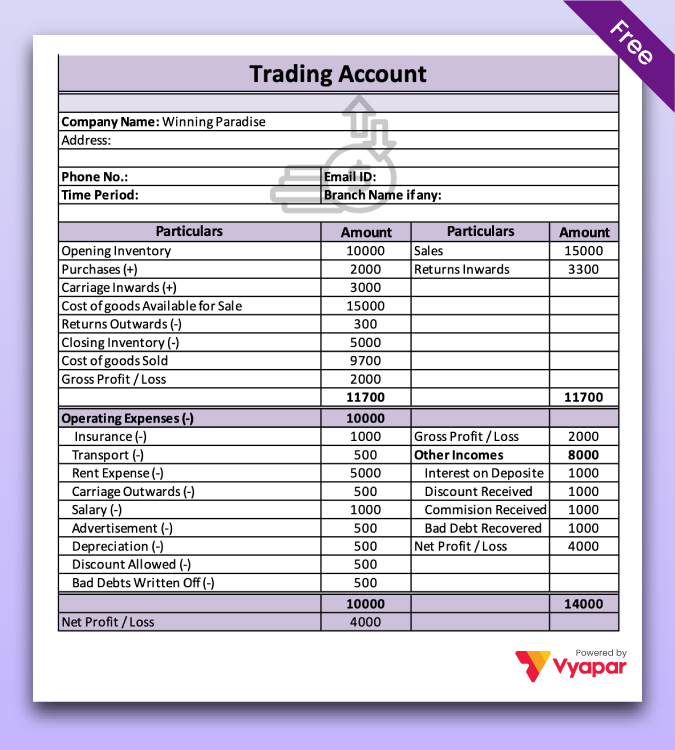

Download Free Trading Account Formats in Excel, Word, and PDF

Download professional free GST tax invoice templates, and make customization according to your requirements at zero cost.

Get 100+ Premium Themes to Customize. Try Vyapar for FREE!

What is a Trading Account Format?

If you want to understand how much profit your business is really making, a trading account format is your starting point.

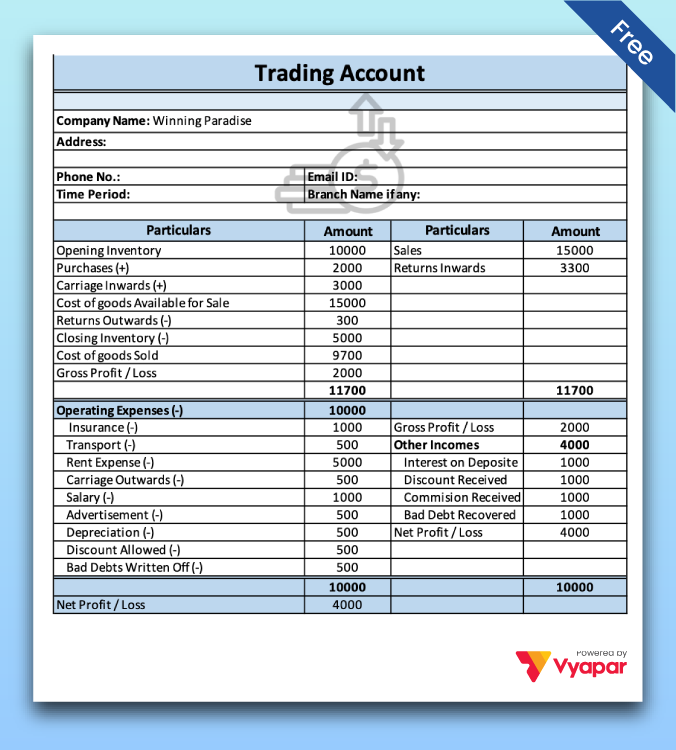

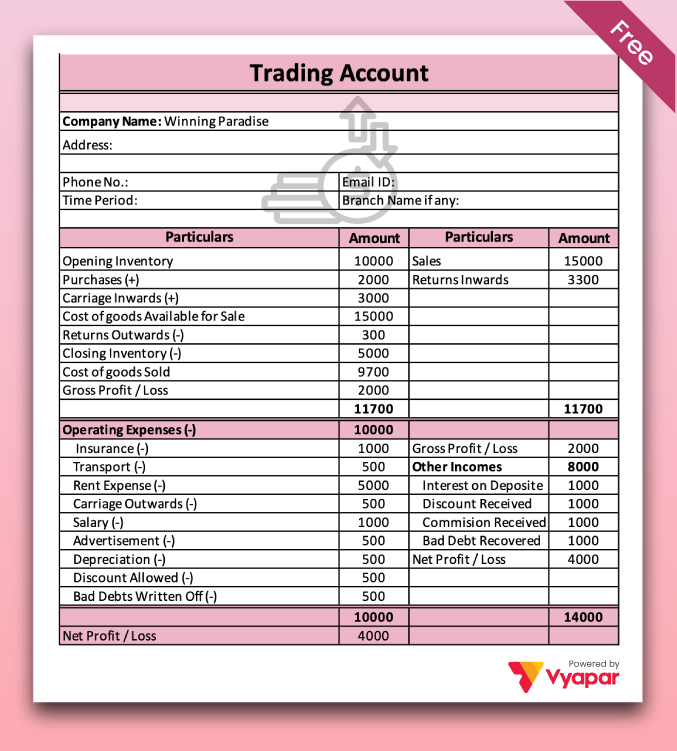

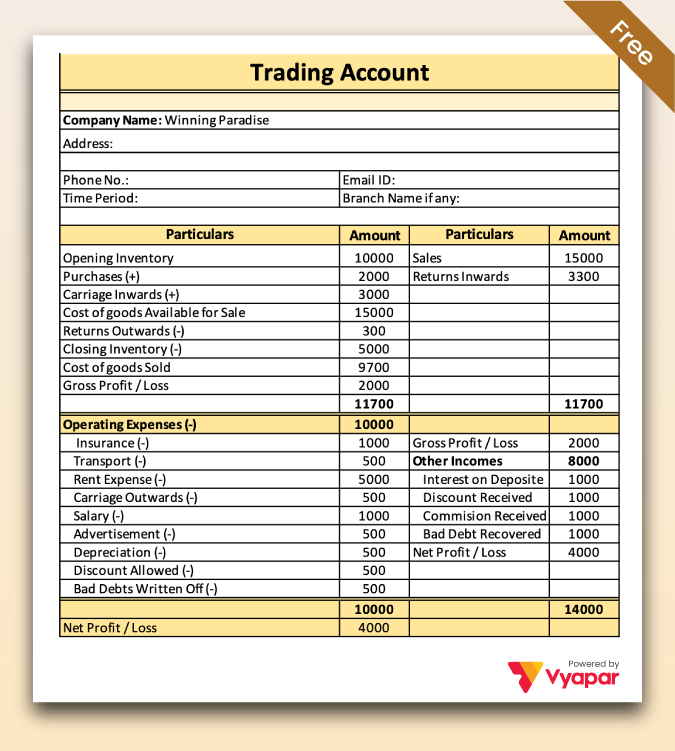

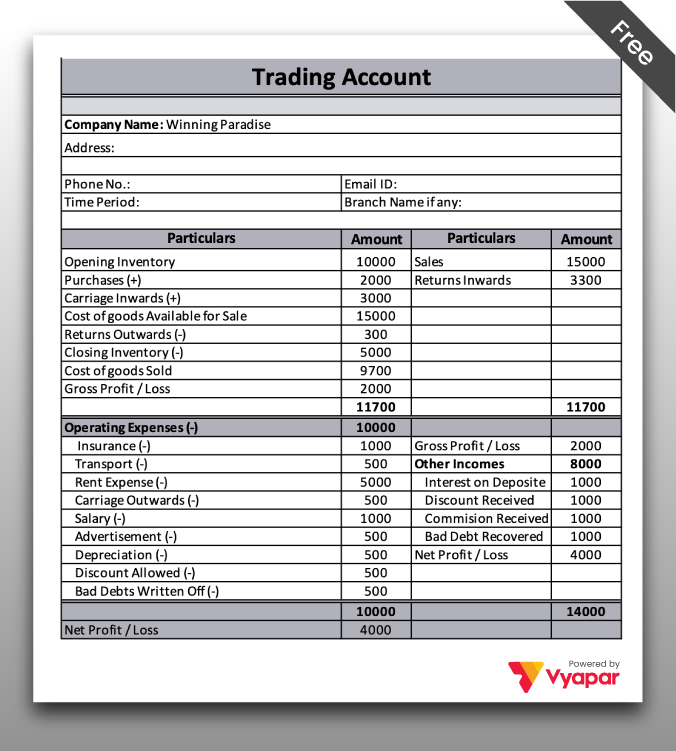

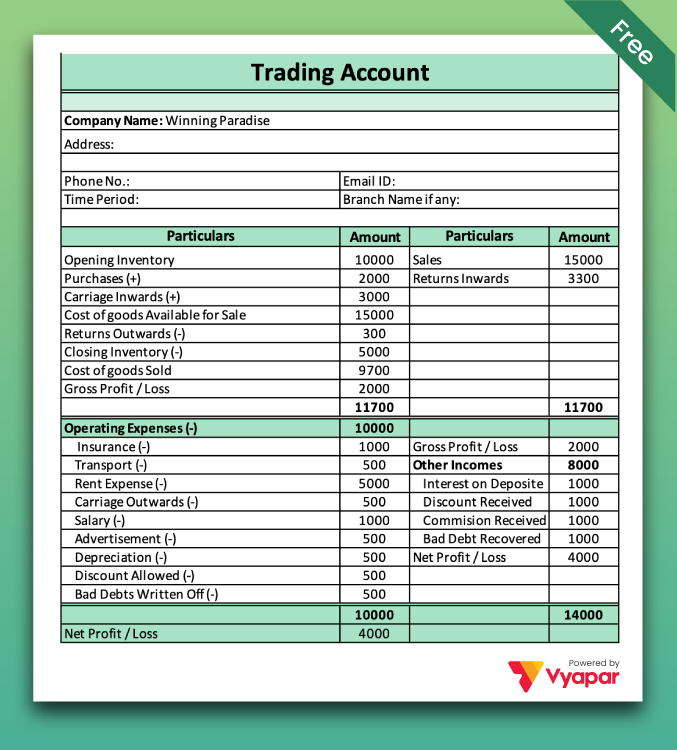

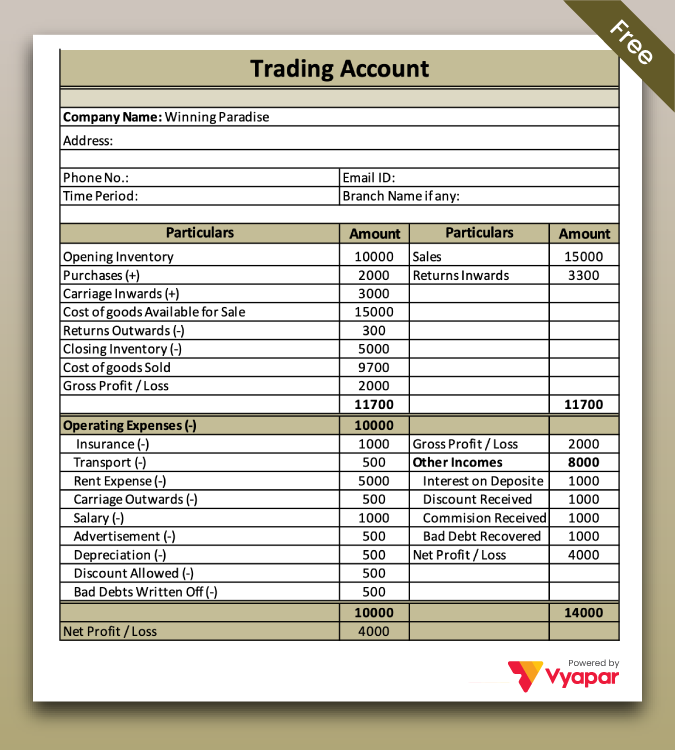

It’s a financial statement that shows your gross profit for a specific period—usually a financial year. It compares your total sales, total purchases, direct expenses, and stock levels (opening and closing), helping you evaluate how efficiently your business operates.

A trading account format typically includes two sides—debit and credit—where you record all the relevant financial entries. This structured layout gives you a clear picture of your business performance.

Now, there are two ways to create this format:

- Manually in Excel or Word (which takes time and precision), or

- Automatically using an app like Vyapar – where everything’s pre-designed and easy to use.

Vyapar offers a ready-made trading account format with all the essential columns built in. No need to start from scratch. Whether you’re a trader, manufacturer, or wholesaler, using Vyapar helps you save time, reduce errors, and focus on growing your business—not just maintaining books.

So, instead of building one manually, why not let Vyapar do the heavy lifting?

Importance of Using Trading Account Format for Businesses

1. Clear View of Sales and Expenses

Understand daily, monthly, and yearly transactions in one place. The format helps simplify tax filing and future budgeting.

2. Accurate COGS Analysis

Analyze raw material, transportation, and manufacturing costs to calculate the true cost of goods sold and improve inventory control.

3. Compare Financial Performance

Easily track and compare sales, profits, and expenses across months or years to spot trends, patterns, or seasonal changes.

4. Gross Profit/Loss Calculation

Get a side-by-side view of income and expenses to calculate gross profit or loss quickly and make confident business decisions.

5. Refines Pricing Strategy

Use insights from the format to evaluate the effect of offers, discounts, and pricing changes on profitability and set better rates.

6. Identifies Cost-Cutting Areas

Break down expenses to see where your business is overspending, so you can reduce unnecessary costs and improve margins.

What Are the Contents of a Trading Account Format?

Opening Balance

Means: Value of available stock and assets at the beginning of a financial period.

Includes: Cash, inventory, receivables — brought forward from the previous year.

Purchases

What it means: Total value of goods purchased for business operations.

Includes: Raw materials, inventory, or finished goods bought from suppliers.

Sales

What it means: Revenue generated from products or services sold.

Includes: Cash sales, credit sales, or a mix of both.

Direct Expenses

What it means: Costs directly involved in producing goods or services.

Includes: Raw materials, packaging, direct labor, freight inwards.

Indirect Expenses

What it means: Operating expenses not directly tied to production.

Includes: Rent, salaries, admin expenses, advertising.

Closing Stock

What it means: Value of unsold inventory at the end of the period.

Why it matters: It impacts gross profit calculation.

Benefits of Using a Trading Account Format for Your Business

A standardized GST invoice format not only keeps your business compliant but also adds efficiency and professionalism to your billing process. Here’s how:

Clear Overview of Sales and Expenses

A trading account format helps you keep track of your sales and expenses in one place. It offers a structured way to monitor all transactions over the financial year. This makes it easier to calculate taxes correctly and prepare future budgets with confidence.

Better Analysis of Cost of Goods Sold

By using a trading account format, businesses can accurately calculate their cost of goods sold. It helps break down expenses like raw material costs, transport, labour, and manufacturing. This not only improves inventory control but also helps in separating direct and indirect expenses.

Compare Financial Performance

With proper formatting, it’s easier to compare your business’s performance across months, quarters, or years. You can spot trends, understand seasonal patterns, and evaluate the impact of marketing campaigns or economic changes on your profits.

Gross Profit or Loss Calculation

Trading account formats provide a side-by-side view of all revenue and direct expenses. This makes gross profit or loss calculations quick and accurate. Having these numbers handy helps you make smart, informed decisions to grow your business. reporting.

Improve Pricing Strategy

By analyzing sales and costs together, you can better understand how pricing affects profitability. You’ll be able to evaluate discounts, promotions, and pricing models to fine-tune your strategies for maximum margins.

Opportunities for Cost Reduction

A detailed trading account helps uncover areas where your business might be overspending. By categorizing and analyzing expenses, you can take timely actions to reduce waste, cut unnecessary costs, and increase overall efficiency.

Why Choose Vyapar for Your Trading Account Format?

Vyapar is more than just accounting software — it’s a complete business tool designed for Indian traders, retailers, manufacturers, and service providers. Here’s why it’s the smart choice for managing your trading account format:

User-Friendly Interface

Vyapar is built for ease. Whether you’re a beginner or experienced user, the clean design and intuitive layout make it easy to navigate. You can access the trading account format within seconds — no technical expertise needed.

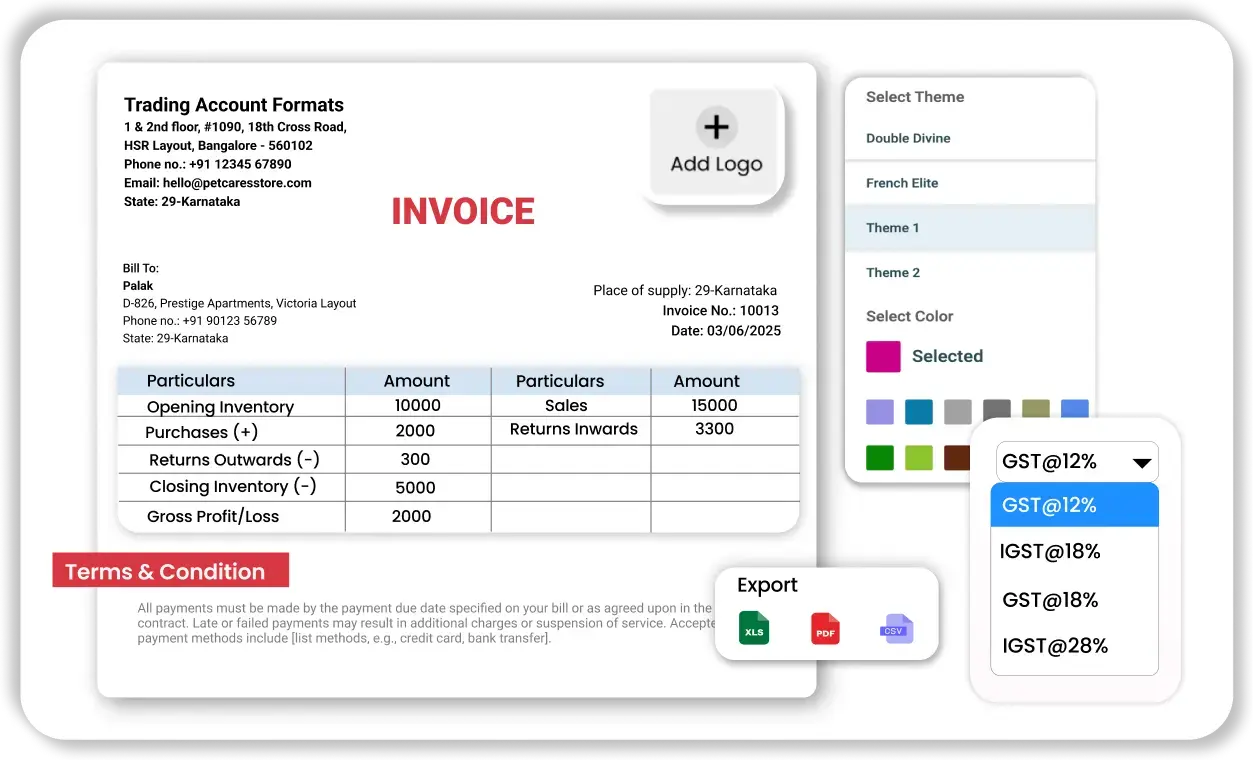

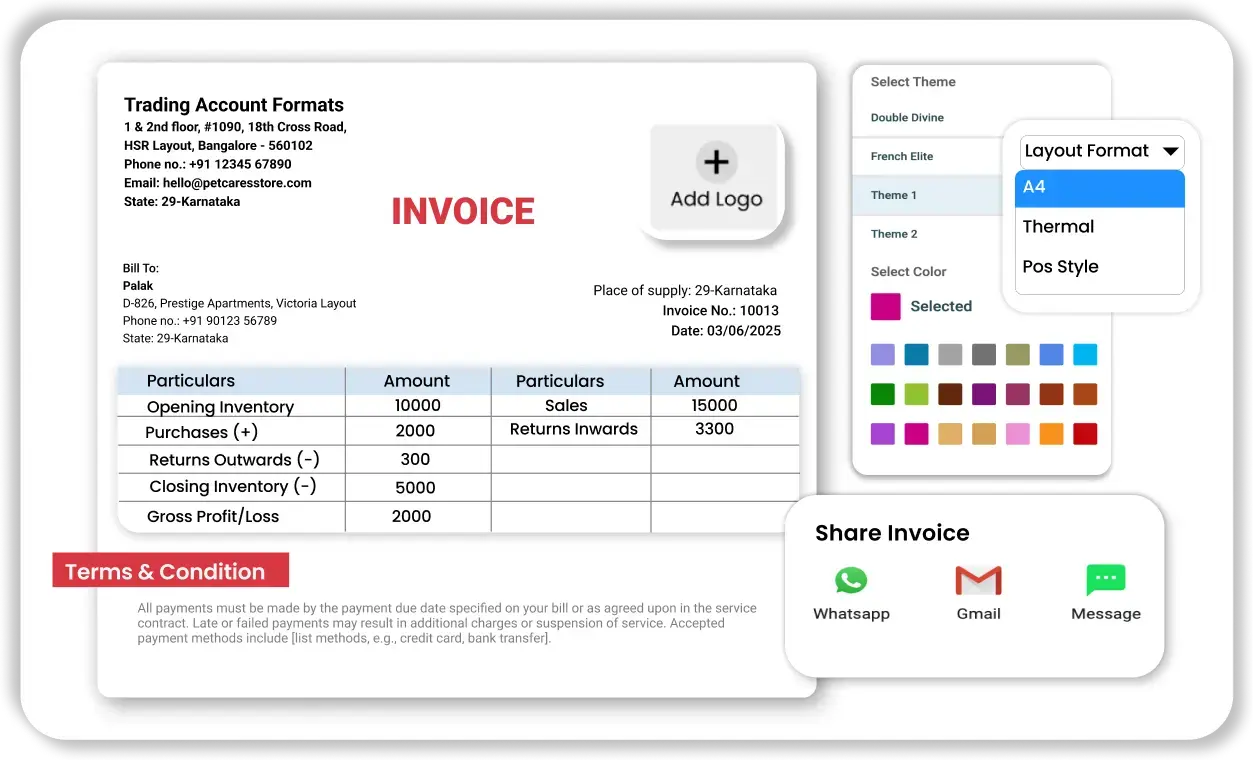

Advanced Invoicing and Billing

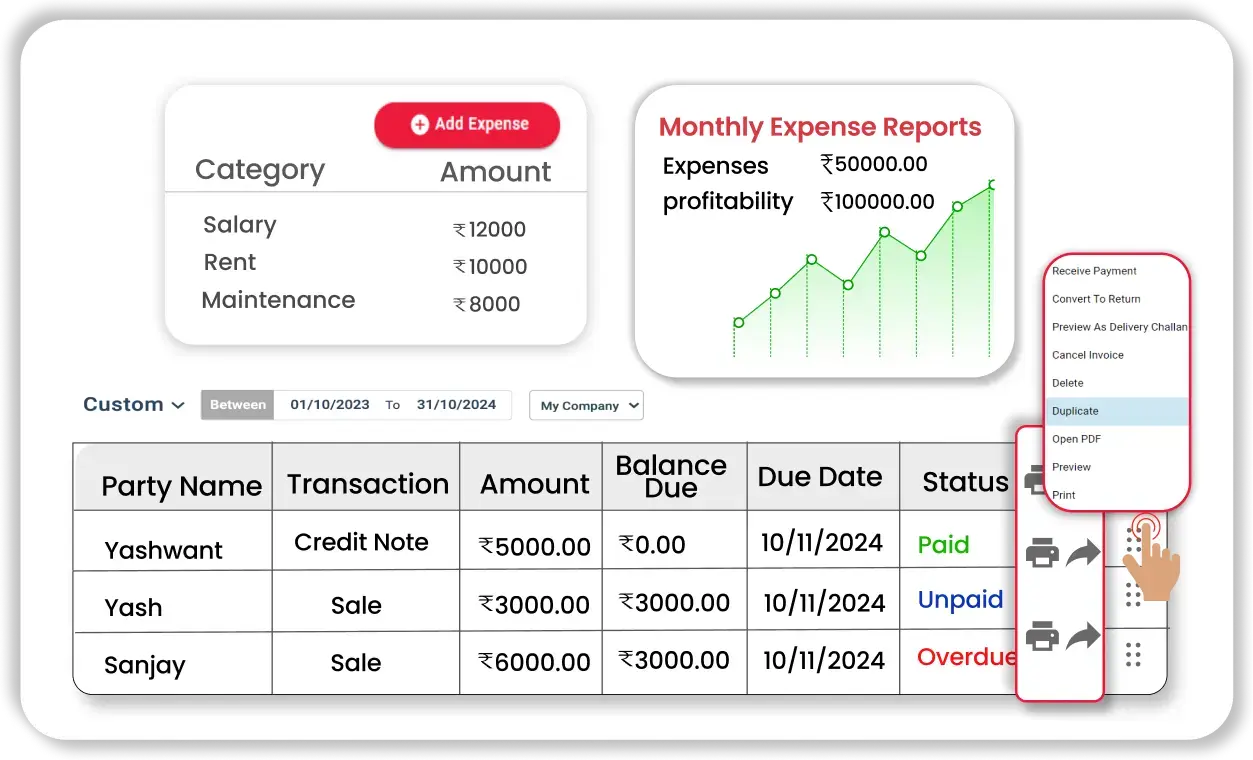

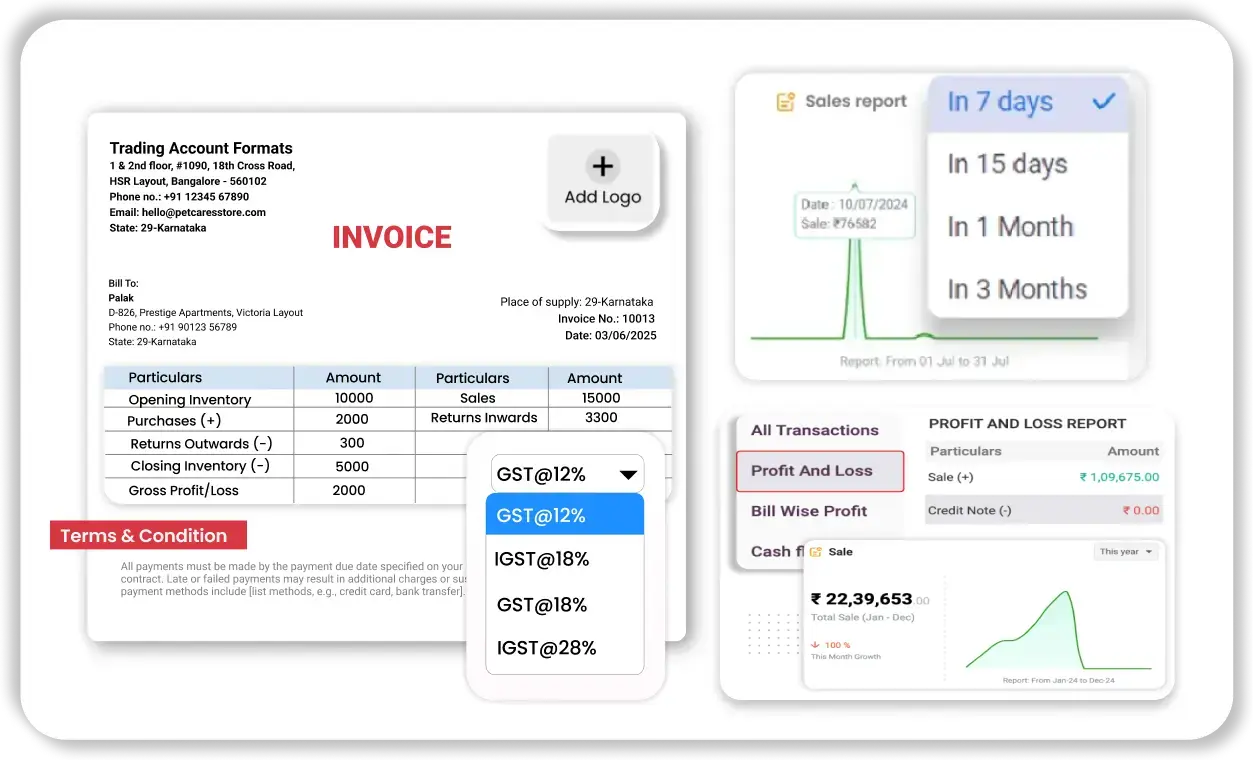

Along with trading account templates, Vyapar comes with powerful invoicing features. Create, send, and manage professional GST-compliant invoices in minutes. It simplifies billing and reduces the time you spend on paperwork.

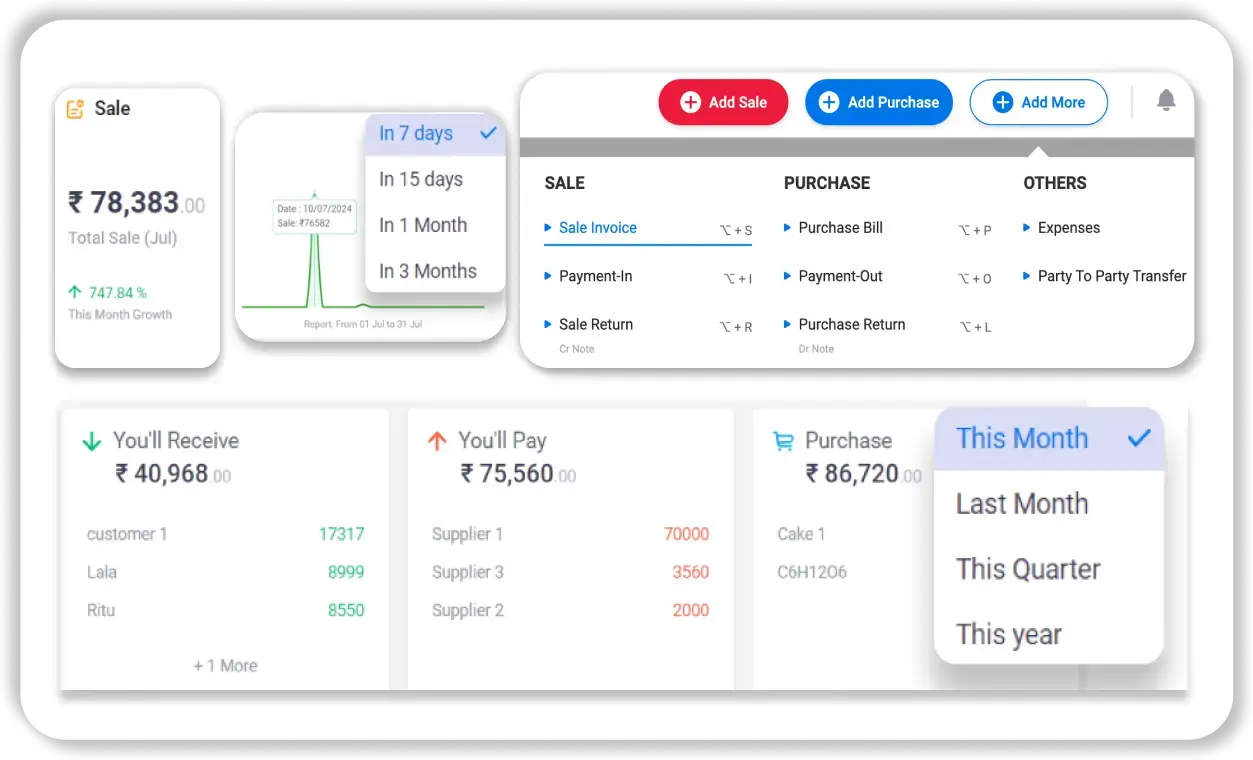

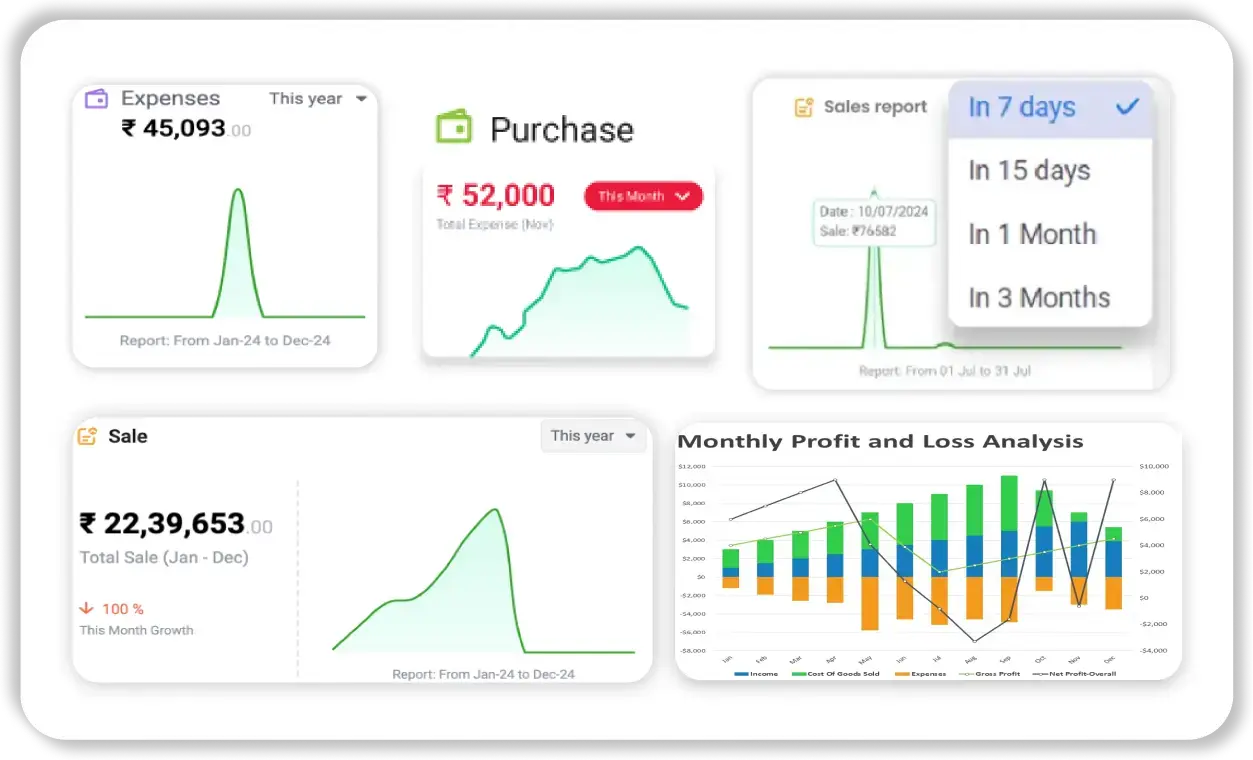

Real-Time Financial Tracking

No more juggling multiple tools. With Vyapar, you can monitor cash flow, sales, and expenses in real-time — all from one dashboard. This helps you stay on top of your business and make faster, smarter financial decisions.

Expense Tracking and Reporting

Track daily, monthly, and yearly expenses with ease. The app provides a detailed breakdown of your spending and lets you generate insightful reports. It’s especially helpful during tax filing or when you’re planning budgets.

Customisable Trading Account Templates

Vyapar gives you ready-made professional templates — but with full flexibility. Choose from different designs, colors, and fields to match your business needs and preferences. It’s your format, your way.

Automatic Profit, Loss, and Tax Calculation

Forget manual calculations. Vyapar automates the process of calculating profits, losses, and taxes — reducing errors and saving time. You get accurate results instantly, which improves financial reporting and compliance.

Frequently Asked Questions (FAQs’)

What is a Trading Account Format?

How is a Trading Account Format different from a Profit and Loss Account?

Where can I find a Trading Account Format?

Is it free to use Vyapar’s Trading Account Format?

What are the key components of a Trading Account Format?