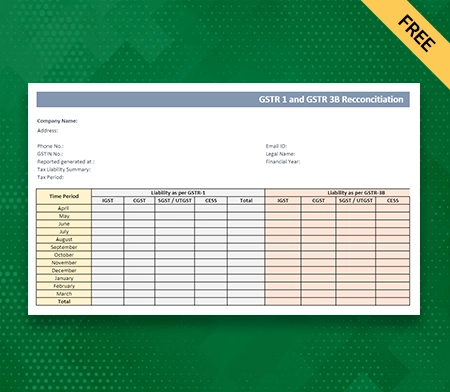

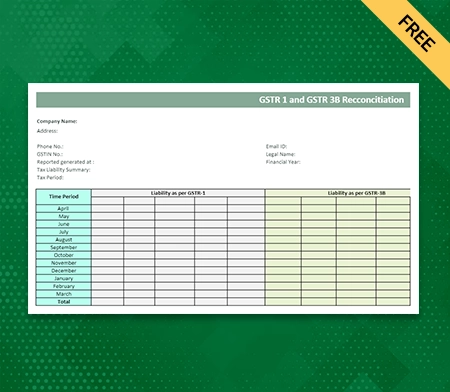

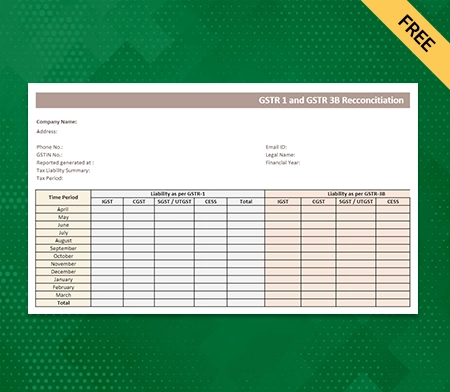

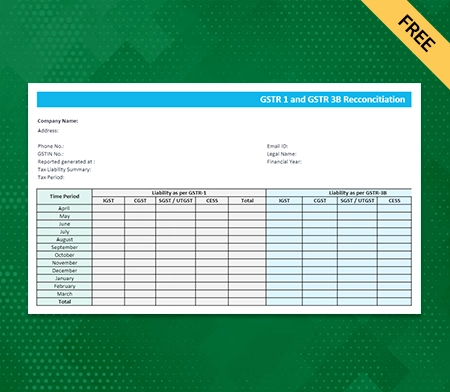

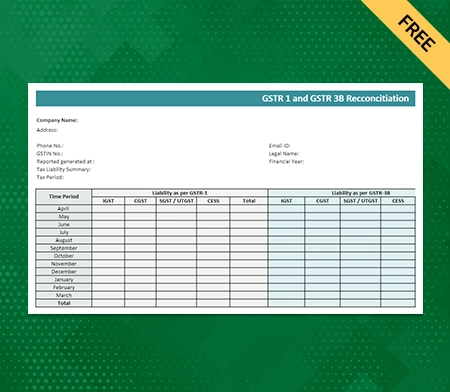

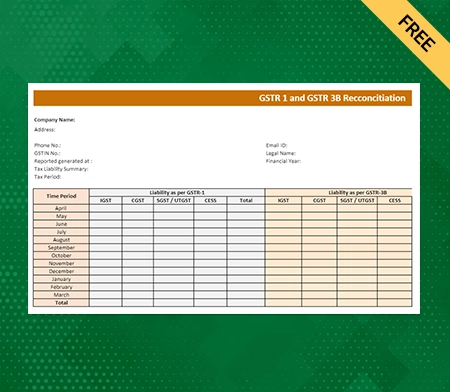

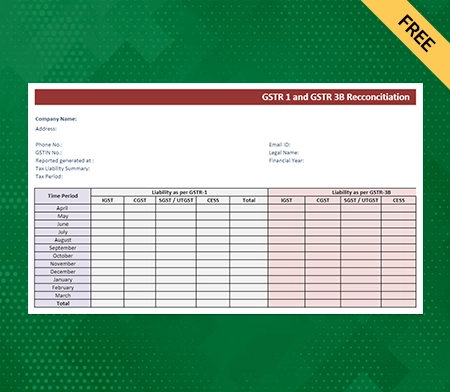

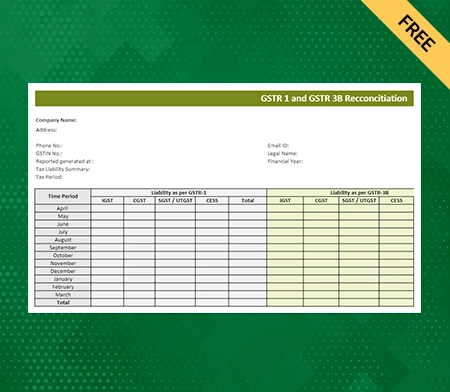

GSTR-3B And GSTR-1 Reconciliation in Excel Format

Download GSTR-3B and GSTR-1 Reconciliation in Excel Format by Vyapar to rectify the mismatches in your GST returns. All the formats are entirely free and simple to use. Try them now!

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Table of contents

- GSTR-3B And GSTR-1 Reconciliation in Excel Format

- Download GSTR-3B And GSTR-1 Reconciliation Format in Excel

- What Are GSTR-3B And GSTR-1?

- What Do You Mean By GSTR-1 And GSTR-3B Reconciliation In Excel Formats?

- What Are The Reasons For Mismatches In GSTR-3B And GSTR-1?

- Why is It Necessary To Reconcile GSTR-3B And GSTR-1?

- How To Reconcile GSTR-3B And GSTR-1 In Excel Format?

- Benefits Of Using Vyapar GSTR-1 And GSTR-3B Reconciliation Format In Excel

- Valuable Features Of The Vyapar App:

- Frequently Asked Questions (FAQs’)

Download GSTR-3B And GSTR-1 Reconciliation Format in Excel

What Are GSTR-3B And GSTR-1?

GSTR-3B is a monthly self-declaration return filed by registered taxpayers under the Goods and Services Tax (GST) system in India. It is a simplified summary return that provides a summary of outward supplies, inward supplies, and the tax liability of the taxpayer for a particular tax period.

GSTR-1 is a monthly or quarterly return that needs to be filed by registered taxpayers under the GST system in India. The GSTR-1 contains details of outward supplies or sales made by the taxpayer during a particular tax period.

What Do You Mean By GSTR-1 And GSTR-3B Reconciliation In Excel Formats?

Reconciliation between GSTR-1 and GSTR-3B involves comparing the information provided in both returns. The purpose of reconciliation is to identify any discrepancies or differences between the two returns, which could include:

Differences In Outward Supplies:

Reconciliation helps identify any gaps between the sales reported in GSTR-1 and the corresponding taxable value reported in GSTR-3B. It ensures that all sales transactions are accounted for correctly.

Input Tax Credit (ITC) Reconciliation:

GSTR-3B allows taxpayers to claim the input tax credit on purchases made for business purposes. Reconciliation involves cross-verifying the ITC claimed in GSTR-3B with the details of the corresponding inward supplies reported in GSTR-1.

What Are The Reasons For Mismatches In GSTR-3B And GSTR-1?

Here are some common reasons for mismatches in GSTR-1 and GSTR-3B:

Timing Differences:

GSTR-3B is a monthly summary return that taxpayers file to report their summary tax liability and make the corresponding tax payments. On the other hand, GSTR-1 is a monthly or quarterly return that provides details of outward supplies made by the taxpayer. Due to the difference in the reporting periods and the timing of supply invoices, mismatches can arise.

Incorrect Reporting:

Mismatches can occur if there are errors or discrepancies in the reporting of details in GSTR-3B and GSTR-1. This can include errors in the invoice number, tax amount, or any other details related to supplies made or received.

Non-Filing Or Delayed Filing:

If a taxpayer fails to file either GSTR-3B or GSTR-1 within the due dates specified by the tax authorities, it can result in mismatches between the two forms. Late filing or non-filing of returns may lead to penalties and could disrupt the reconciliation process.

Reversal Or Modification Of Transactions:

Sometimes, a taxpayer may modify or reverse a transaction after filing GSTR-1. If the modification or reversal is not appropriately reflected in GSTR-3B, a mismatch can occur.

Input Tax Credit (Itc) Discrepancies:

Mismatches can arise when there are discrepancies in the ITC claimed by the taxpayer. If the ITC claimed in GSTR-3B does not match the corresponding outward supplies reported in GSTR-1 by the supplier, it can lead to mismatches.

Technical Issues:

Technical glitches or errors in the GST portal or software used for filing returns can also result in mismatches between GSTR-1 and GSTR-3B.

Why is It Necessary To Reconcile GSTR-3B And GSTR-1?

1. Compliance:

Reconciliation ensures that the information reported in GSTR-3B (summary return) aligns with the details provided in GSTR-1 (outward supplies return). It helps ensure compliance with the GST law and regulations.

2. Accuracy Of Tax Liability:

Reconciliation helps verify the accuracy of the tax liability reported in GSTR-3B. By comparing it with the details of outward supplies in GSTR-1, any discrepancies or errors can be identified and rectified.

3. Input Tax Credit (Itc) Reconciliation:

Reconciliation allows for the matching of input tax credits claimed in GSTR-3B with the eligible outward supplies reported in GSTR-1. It helps ensure that the ITC claim is correctly calculated and supports the claim with proper documentation.

4. Error Identification:

Reconciliation helps identify any errors or discrepancies in the reporting of outward supplies, such as incorrect invoice numbers, taxable values, or tax amounts. This allows for timely corrections and prevents any potential issues during audits or assessments.

5. Compliance With GST Law:

Reconciliation is important for complying with the GST law, which requires accurate reporting of outward supplies and tax liabilities. Non-compliance or discrepancies may lead to penalties, interest, or other legal consequences.

6. Smooth GST Return Filing:

Reconciliation helps streamline the process of filing GST returns. By ensuring the accuracy and consistency of data between GSTR-3B and GSTR-1, it reduces the likelihood of errors or rejections during return filing.

Reconciling GSTR-3B and GSTR-1 helps maintain the integrity and accuracy of GST reporting, promotes compliance, and minimises the risk of penalties or audit issues.

How To Reconcile GSTR-3B And GSTR-1 In Excel Format?

Reconciling GSTR-3B and GSTR-1 in Excel format involves comparing the data from both returns to identify any discrepancies. Here’s a step-by-step guide to reconciling GSTR-3B and GSTR-1 in Excel:

- Download GSTR-3B and GSTR-1 data from the GST portal or your accounting software in Excel format.

- Open a new Excel workbook and create two worksheets, one for GSTR-3B data and another for GSTR-1 data.

- Copy and paste the relevant data from GSTR-3B into the GSTR-3B worksheet. Include columns such as Invoice Number, Invoice Date, Taxable Value, CGST Amount, SGST/UTGST Amount, IGST Amount, and Total Tax Amount.

- Copy and paste the relevant data from GSTR-1 into the GSTR-1 worksheet. Include the same columns as in GSTR-3B.

- In a new worksheet, create a reconciliation template with columns. Copy the relevant data from the GSTR-3B and GSTR-1 worksheets into their respective columns in the reconciliation template.

- Use Excel formulas to calculate the differences or discrepancies between the GSTR-3B and GSTR-1 amounts. For example, in the Discrepancy column for Taxable Value, use the formula “=GSTR-3B Taxable Value – GSTR-1 Taxable Value” to calculate the difference.

- Apply conditional formatting to highlight any discrepancies or differences in the Discrepancy column for easy identification.

- Analyse the discrepancies and investigate the reasons behind them. Check for errors in data entry, mismatched invoice numbers, or any other factors causing discrepancies.

- Once you have identified the discrepancies, take the necessary steps to rectify them. This may involve making corrections in GSTR-3B and GSTR-1 reconciliation in Excel format, issuing credit notes or debit notes, or seeking assistance from a tax professional.

- Update the reconciliation template accordingly with any corrections or remarks.

Benefits Of Using Vyapar GSTR-1 And GSTR-3B Reconciliation Format In Excel

Streamlined Reconciliation Format

Small firms can easily use the GSTR-3B and GSTR-1 reconciliation in Excel format because it does not require advanced accounting processes. GST Reconciliation forms can be created by downloading a free copy of the format in Excel mode.

Choose the appropriate template for your company’s needs and fill it out with the essential information. It is simple to reconcile your company’s details in the GST Reconciliation Format or download GST Reconciliation format in excel, word or pdf

With the assistance of our free GSTR-3B and GSTR-1 reconciliation in Excel format, you can simply develop a unique, expert form to match the needs of your organisation. After the GST Reconciliation is prepared, you can view, download, and save its format.

Accuracy And Compliance

The GSTR-3B and GSTR-1 reconciliation in Excel format comes with built-in formulas and auto-population features. These functionalities automatically calculate totals, subtotals, tax amounts, and other relevant figures based on the imported data.

By eliminating manual calculations, the chances of human errors are reduced. It ensures accurate and error-free reconciliation. You can also keep track of the changes made, annotations, and comments, providing a transparent record of the reconciliation process.

Once the reconciliation is complete, you can easily transfer the reconciled data from Excel to the GSTR-1 and GSTR-3B filing portals or the respective GST software you are using. This simplifies the process of filing returns as you can directly copy and paste the reconciled data. It minimises the chances of errors during data entry.

Saves Time And Effort

Vyapar allows you to export GST data in an Excel format. This feature automates the process of generating GST reconciliation reports. It eliminates the need to extract and compile data from multiple sources manually.

The automation saves time and reduces the chances of errors that can occur during manual data entry. With GSTR-3B and GSTR-1 reconciliation in Excel format, you can tailor the reconciliation format to your specific requirements.

By using Excel for GST reconciliation, you can keep a record of modifications, formulas applied, and any other adjustments made during the process. This audit trail helps maintain data integrity. It ensures accuracy and simplifies the process of identifying and rectifying errors.

Quick Error Identification

The GSTR-3B and GSTR-1 reconciliation in Excel format ensures that the data entered or imported meets certain criteria and validity checks. It verifies the accuracy and completeness of the information entered. It prevents common errors such as incorrect GSTIN, incorrect tax rates, or missing mandatory fields.

Vyapar allows you to cross-verify your GST data by providing access to reports, invoices, and other relevant documents. This cross-verification helps in identifying errors by comparing the data entered in the billing software with the source documents.

Vyapar’s user-friendly interface makes it easier to navigate through the software and locate potential errors. The intuitive design and organisation of data fields enable quick identification of missing or incorrect information.

Data Integrity And Security

Vyapar’s GSTR-3B and GSTR-1 reconciliation in Excel format allows you to encrypt the file and set a password for accessing the data. Encryption ensures that the data is stored securely and can only get accessed by authorised individuals with the password.

You can create backup copies of the reconciliation file to protect against accidental deletions or system failures. In the event of data loss, restore using the backup files, ensuring data integrity and minimising the risk of data loss.

Vyapar’s reconciliation format in Excel allows you to control access to the data by setting user permissions. You can assign different system access to users. It ensures that only authorised individuals can view or modify the data.

Reporting And Documentation

GSTR-3B and GSTR-1 reconciliation in Excel format allows you to generate comprehensive reports summarising the reconciliation process. These reports provide a clear overview of the reconciled data. You can easily get the status of the reconciliation and track the progress made.

Vyapar’s reconciliation format in Excel allows you to create customised templates and checklists specific to your business requirements. These templates can include predefined fields, formulas, and formatting. It makes the reconciliation process more standardised and efficient.

Vyapar’s reconciliation format in Excel allows you to export the reconciled data to different file formats, such as PDF or Excel. This is useful for record-keeping or sharing the reconciliation details with auditors, stakeholders, or regulatory authorities.

Valuable Features Of The Vyapar App:

Make Online GST Invoices

Vyapar is designed to meet the requirements of GST regulations. It supports various GST tax slabs and allows businesses to generate invoices with the necessary GST details. It ensures that the invoices generated through Vyapar are compliant with the GST laws.

With Vyapar, tax calculations become automated. You can input the product or service details, along with the applicable tax rate, and the software will automatically calculate the GST amount for each line item. This saves time and reduces the chances of manual errors.

Vyapar provides a variety of pre-designed invoice templates that you can choose from. You can select a template that aligns with your business style and preferences and then simply fill in the necessary details to generate your GST invoice.

Vyapar allows you to integrate payment gateways with your GST invoices. This means that you can include payment links or QR codes on the invoices. It enables your customers to make online payments conveniently.

Bank Reconciliation

Vyapar provides an intuitive interface to match the transactions in your accounting records with those in your bank statements. The software displays a side-by-side comparison of the transactions. It ensures that your records are synchronized with the bank statement.

Vyapar employs intelligent algorithms to match transactions based on specific criteria automatically. It reduces the time and effort required for manual reconciliation. It allows you to verify and reconcile transactions quickly.

Vyapar enables you to reconcile transactions manually. You can review and match the transactions individually. It ensures that each entry is accurately accounted for. This flexibility allows you to address any unique or complex transactions specific to your business.

With Vyapar’s bank reconciliation feature, you can keep track of your bank account balances in real time. By reconciling your transactions regularly, you can monitor your cash flow accurately. It helps identify any discrepancies or errors and reconcile any outstanding items promptly.

Purchase And Expense Tracking

Vyapar allows businesses to create and manage purchase orders seamlessly. You can generate purchase orders for the products or services you need to procure. It helps streamline the purchasing process. It ensures that all procurement activities are properly documented.

Vyapar enables businesses to record various expenses. You can record office supplies, travel costs, utilities, rent, and more. You can categorise expenses based on different cost centres or expense types. It facilitates accurate expense tracking and analysis.

Vyapar allows you to categorise expenses based on different expense heads or custom categories specific to your business. The categorisation helps you organise and analyse expenses effectively. It provides insights into the areas where your business is spending the most.

Vyapar allows businesses to maintain a database of vendors and suppliers. You can store essential vendor information, such as contact details, payment terms, and past purchase history. It facilitates efficient communication and collaboration with suppliers.

Order Management

Vyapar allows businesses to create and manage sales orders efficiently. You can generate sales orders for products or services requested by customers. It helps streamline the order creation process and ensures accurate documentation of customer requests.

When a sales order is created, the software automatically adjusts the inventory levels. It helps you track the availability of products in real time. It ensures that you have accurate information about stock levels so you can fulfil orders efficiently without overselling or running out of stock.

Vyapar enables businesses to track the status of orders from creation to fulfilment. You can monitor the progress of each order, including order processing, packaging, shipping, and delivery. It helps you manage customer expectations and address any potential delays or issues proactively.

Vyapar allows you to generate invoices directly from sales orders. Once an order is fulfilled, you can convert it into an invoice with a few clicks. This integration between order management and invoicing helps streamline the billing process. It ensures accurate and timely invoicing for customers.

Mobile Accessibility

The Vyapar mobile app allows users to manage their finances and accounting tasks while on the move. It ensures that you stay connected and make informed financial decisions anytime, anywhere.

Users can access real-time updates of their financial data. You can view the latest sales figures, check inventory levels, monitor payment statuses, and track expenses, all in real-time. This empowers businesses to have a clear understanding of their financial position and make timely decisions.

The Android mobile app helps users create and send invoices to customers directly using their smartphones or tablets. You can generate professional invoices, customise them with your branding, and instantly send them to recipients.

Vyapar’s mobile app enables businesses to access customer and vendor information on the go. You can view contact details, payment terms, purchase history, and other relevant information about your customers and vendors. This helps in maintaining strong relationships.

Payment Reminders

Vyapar automates the process of sending payment reminders to customers for overdue invoices. You can set up customised reminder templates with polite and professional messaging to be sent at specific intervals.

Vyapar provides flexibility in setting reminder intervals. You can choose to send reminders at predefined intervals, such as one week before the due date, on the due date, and after a specific number of days past the due date.

Vyapar’s payment reminders feature enables businesses to include clear payment instructions in the reminders. You can specify the preferred payment methods, provide bank account details, and include payment links or QR codes for online payments.

By automating the payment reminders process, Vyapar helps businesses improve cash flow. Timely reminders prompt customers to settle their outstanding invoices. It reduces the average payment cycle and ensures that payments are received on time.

Frequently Asked Questions (FAQs’)

It is a standardised format used to reconcile the data reported in GSTR-3B (summary of monthly sales and purchases) and GSTR-1 (details of outward supplies) for a given period.

Reconciliation helps identify any discrepancies or errors between the two returns, ensuring accurate reporting of GST liabilities, availing input tax credits, and maintaining compliance with GST regulations.

You can use GSTR-3B and GSTR-1 in Excel format by Vyapar. It streamlines the reconciliation process.

1. Generate the GSTR-1 and GSTR-3B reports from your accounting or GST software.

2. Compare the sales data, tax values, and other relevant details between the two returns.

3. Identify any discrepancies or variances, such as mismatches in sales values or unclaimed input tax credits.

4. Rectify the errors, if any, in either return by filing appropriate amendments or corrections.

5. Ensure that the reconciled figures in GSTR-3B and GSTR-1 match before filing the returns.

While there are no specific guidelines, it is advisable to maintain clear documentation. Follow a systematic approach, validate data accuracy, and seek professional assistance if required to ensure accurate and error-free reconciliation.

Related Posts: