GST Reconciliation Format in Excel

Vyapar is India’s best and easiest solution for accounting. Get yourself the premium plan, and you are all set to access this gst reconciliation format in excel and take care of your company’s accounting effortlessly. Start your 7-day free trial today!

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download GST Reconciliation Format in Excel

What is a GST Reconciliation Format In Excel?

Goods and services tax is a form of indirect tax that authorities levy on goods and services. GST reconciliation, on the other hand, is a process of comparing GST returns with total sales and purchases. Compare to ensure that you file the right amount of GST returns.

In India, there are specific rules for GST, and breaking them will lead to penalties for the person paying GST. There are several methods to obtain the GST reconciliation format, one of which is via Excel.

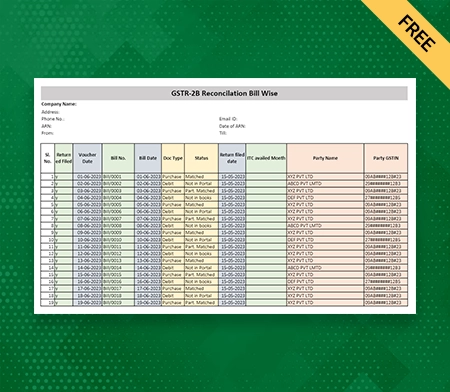

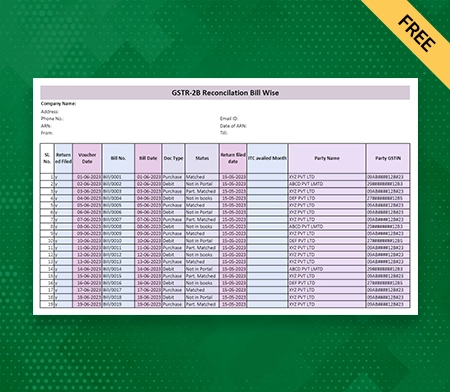

A GST reconciliation Excel sheet compares GST details with your company’s sales/purchase details for accuracy and consistency. Some of the key elements of a typical GST reconciliation format in Excel contains:

- Columns for taxable amount, invoice amount, invoice number and date.

- A dedicated section to record all the purchases and sales of a company.

- A section to enter the decided GST return forms, such as GSTR-1 and GSTR-3B. By including GSTR-1 and GSTR-3B in the reconciliation excel format, you can easily compare reported data with actual financial transactions.

- Specific formulas for comparing the financial transactions and GSTRs with the GST details.

- A summary section contains the GST reconciliation conclusion and the GST credit breakdown.

A GST reconciliation format in Excel is a spreadsheet that helps simplify the GST filing process. This format guarantees that a business adheres to all the necessary GST regulations established by the government.

Furthermore, it aids in making your GST filing process precise and time-saving. Instead of creating a GST reconciliation format in Excel, you can get it easily through the Vyapar app. To get the professionally crafted GST reconciliation format in Excel, download the Vyapar app today!

Importance Of Using A GST Reconciliation Format In Excel

For a business to avoid GST penalties, filing GST on time and having a proper GST record is important. GST reconciliation format in Excel is an important financial tool to help you streamline accounting in compliance with GST. Here’s why it’s an important tool for you:

1: Streamlining GST Reconciliation

GST reconciliation is a process of matching a company’s accounts with the GST return filed. The major objective of the comparison is to ensure that the data sent to tax authorities through the GST file is right. However, the process of reconciling your accounts with the GST file is pretty effort-consuming.

This is the reason why companies utilize financial tools such as a professional GST reconciliation template. A GST reconciliation template in Excel enables you to enhance the precision of the GST filing procedure. Companies can use a high-quality GST reconciliation template to organize financial data like sales and purchase logs efficiently.

Improved data organization leads to easy identification. With this template, pinpointing any particular transaction, regardless of its age, becomes a breeze. In general, this enhanced data organization and accessibility contribute to the simplification of your overall GST reconciliation process.

2: Ensuring Accuracy In Tax Filings

Every company aims at better credibility and yet avoids breaking any GST laws. Submitting an accurate GST file is an important factor that helps you maintain your market credibility. In addition, filing the wrong GST can have certain bizarre consequences, which every business aims to avoid.

The GST reconciliation Excel template enables businesses to attain precision and accuracy in their tax filings. This template facilitates automatic computations and smooth data migration. By removing the need for manual work in the GST computation process, it also minimizes the likelihood of human-induced mistakes.

Additionally, the Vyapar app’s automated data transfer feature helps prevent errors that can occur when transferring data manually. Besides, since Excel is known for promoting Data organisation, identifying inaccuracies also becomes easy. Their mistakes are identified easily, and implementing the solution becomes no big deal.

3: Identifying Inconsistencies and Mistakes

A minor error in your GST submission could potentially lead to unexpected legal repercussions. Fortunately, these can be prevented by utilizing a GST reconciliation template in Excel. This is a superb instrument that allows you to not only detect but also locate the exact source of the mistake.

As mentioned above, we compare multiple data in GST reconciliation to identify accuracy in GST filing. The good thing is that when you perform reconciliation using a GST reconciliation format in Excel, the comparison becomes easier than before. You can conveniently perform a line-by-line comparison between your company’s sales/purchase record and GST.

The improved Data organisation in Excel helps with easy GST reconciliation. With accurate GST conciliation, you can further identify dispensaries even more easily. It’s like a chain of tasks that this format brings convenience into.

4: Ensuring Adherence to GST Regulations

Adherence to GST regulations is another crucial aspect to guarantee that your business avoids any legal issues. Any legal problems arising from non-compliance can directly impact your business activities. The GST reconciliation format in Excel is an excellent financial instrument that can assist in maintaining GST compliance.

First, this format gives you an in-depth overview of all the details and Data relevant to your GST filing. With such an overview, it becomes effortless for the accountants to review and validate your GST information. Since Excel promotes data organisation, accountants will face no inconvenience in cross-checking the transactions relevant to GST.

Further, the GST reconciliation format in Excel allows you to include or update financial details in real time. Therefore, even if you discover any potential mistake in the financial data, you don’t have to worry about how you will audit your data. Making changes in this format is a really simple and effortless task.

5: Effective Management of Extensive Data Sets

The process of GST reconciliation can become a daunting task if your business involves a high number of transactions on a daily basis. Luckily, the availability of a GST reconciliation format in Excel can be of immense assistance. This format enables you to manage extensive data sets effectively and saves time.

The GST reconciliation format in Excel provides the capability to import data from various sources smoothly. You can then merge all the data into a single spreadsheet, removing the necessity to handle multiple files. Moreover, the format includes features like searching, filtering, and sorting.

These features promote efficiency in the GST reconciliation process. With these features, you can easily locate any transaction, no matter how old. Overall, efficiently handling large data sets promotes convenience, efficiency and accuracy in the GST reconciliation process.

6: Minimising Tax Penalties And Auditing Risks

Submitting inaccurate or erroneous GST returns can lead to severe repercussions, including tax fines. In extreme cases, these consequences could even extend to imprisonment. By utilizing a GST reconciliation template in Excel, businesses can mitigate these risks by adhering to GST regulations.

The GST reconciliation template in Excel aids in avoiding tax fines by ensuring precision in tax reporting. As mentioned earlier, this template provides a structured layout and embedded validation rules for managing financial data. Both these aspects assist in minimizing the likelihood of mistakes in computations and data input.

Fewer errors mean more accuracy in the financial data, and therefore, the chances of your business overpaying for underpaying taxes get reduced. Both these things are the major causes of GST penalties, and this format helps reduce their chances of happening. Thus, if you want to reduce auditing risk and minimise text penalties, get yourself this format now.

Advantages Of Working With A GST Reconciliation Format In Excel

Make the GST filing process more efficient using the GST reconciliation format in Excel. This format provides a range of functionalities, minimizing unnecessary complications during the filing procedure. Here are some of the primary advantages of using this format:

Easy Data Organization And Management

Should you wish to manage your GST-related financial information effortlessly, a GST reconciliation template in Excel is your solution. Excel is renowned for its superior ability to segregate data into distinct rows and columns. This enhances data structuring, thereby making it easy for businesses to enter financial data in a well-organised way.

Moreover, another excellent feature of Excel is its data filtering and sorting capabilities. They allow businesses to arrange their data according to certain sorting criteria. Both these features make it easy for businesses to manage data and further analyse it in the easiest manner. The hassle of gathering and managing data for GST calculation is removed.

Further, when an accountant is performing GST reconciliation, they need financial data to be easily accessible. With GST reconciliation format in Excel, data accessibility is top-notch and convenient. You will have everything you would need for the reconciliation process in just one place. Therefore, you don’t have to shuffle through multiple files and accounts.

Quick Identification Of Discrepancies

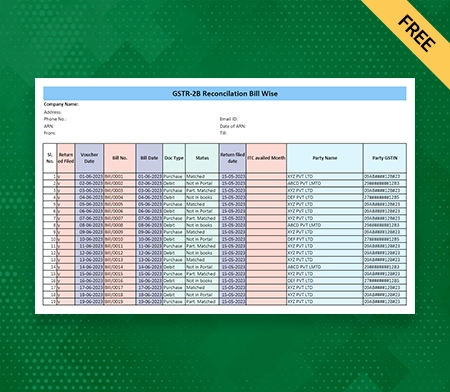

The GST reconciliation format in Excel helps businesses improve the speed of identifying dispensaries. During the reconciliation process, the major objective is to figure out the accuracy of the GST filed by comparing it with the company’s financial record. Since Excel is known for its advanced data comparison capabilities, error identification becomes easy.

Furthermore, it’s super easy to import the GST data into this Excel format. The company’s financial data, as well as the GST return data, are placed side-by-side so that the comparison can be done in the least effort-consuming manner. Since all the required data is present in one place and that too side by side, any dispensary can be spotted instantly.

Furthermore, Excel provides a function known as conditional formatting, which aids in automatically emphasizing possible mistakes. Companies can use this function to sort through data and see transactions for tax purposes. In the end, this format ensures that the accounts possess all they require to carry out GST reconciliation without any hassle.

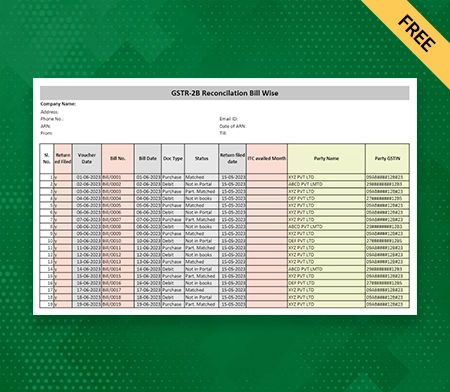

Seamless Integration With Accounting Software

The GST reconciliation format in Excel easily integrates with various accounting programs. The straightforward integration facilitates data movement and reconciliation, simplifying the procedure. Additionally, you can utilize a variety of accounting applications to export your data into this format without any hassle.

This format allows businesses to seamlessly import GST-related data into their preferred accounting software, thereby removing the requirement for manual data entry. As both the import and export between the GST reconciliation format in Excel and accounting applications are automated, the likelihood of data inaccuracies is virtually eliminated.

Furthermore, automatic data transfer aids in saving time and human labor. In addition to this, the smooth integration of the accounting application into this format eliminates a lot of the difficulties that accountants face during data movement from one source to another. Therefore, this format is ideal if you’re seeking a tool that significantly reduces time and effort during GST reconciliation.

Enhanced Precision in GST Submissions

Utilizing the GST reconciliation template in Excel, companies can enhance the precision of their GST submissions and associated data. Excel provides superior built-in functionalities and formulas that can be leveraged for exact tax computations. Furthermore, these features also assist in precise data input, a significant challenge for accountants.

Besides, this Excel format also allows you to create your own formulas. For example, you can create automation formulas for input credits or tax calculations based on sales and purchase transactions. Automatic calculation is a huge advantage for your business as it helps you achieve accuracy in tax calculation.

In addition, it also helps prevent calculation mistakes that could lead to an inaccurate GST calculation. Inaccurate GST calculation can end up you facing serious legal complications. Luckily, you have this format to help you with accurate GST calculations, eliminating any potential risk of legal penalties caused due to inaccuracy in GST filing.

Efficient Reconciliation Procedure

One significant benefit of utilizing a GST reconciliation template in Excel is the time-saving aspect it introduces to the GST reconciliation procedure. Excel provides data handling capabilities that assist in managing your financial information effortlessly. This ease of use and data management enhances the overall health of the reconciliation procedure.

Moreover, locating any specific transaction or data element in this format is very easy. It’s a feature that comes in handy during times when you are handling high volumes of transactions. You can also automate repetitive calculations by applying formulas into multiple cells in this Excel format. It’s another fantastic technique that will save you some time.

Time is a crucial resource for any enterprise, particularly in the realm of accounting. By utilizing our expert GST reconciliation template, the time and effort saved can be redirected towards other vital business operations. So, why delay? Acquire this template and expedite your GST reconciliation process.

Enhanced Clarity In Tax Submissions

Clarity in tax submissions is essential for businesses to uphold the required compliance with GST regulations. This can be achieved through a GST reconciliation template in Excel. The information gathered using this expert template assists you in filing the accurate GST amount.

Furthermore, an often overlooked benefit of employing a GST reconciliation template in Excel is its assistance in data analysis. Tax auditors and accountants can methodically examine the GST data as it’s all contained within a single spreadsheet. Additionally, tracing any particular transaction detail can be effortlessly accomplished using the Vyapar app.

In addition, using the Vyapar accounting app for the GST reconciliation format in Excel can achieve an extra advantage. The app offers the facility to create detailed reconciliation reports on various aspects of accounting, including GST reports. For example, if you don’t have any organised record of something, you can simply import the data into the app, and the statement will be ready.

Why Use Vyapar App For GST Reconciliation Format in Excel?

User-Friendly Interface:

Vyapar accounting software is recognized for its intuitive interface. This characteristic makes it an excellent option for utilizing the GST reconciliation format. The software provides a ready-made GST reconciliation in Excel at no cost. Furthermore, this format, when paired with the software’s integrated accounting feature, makes GST management a challenging but manageable task.

When you open the app, the first thing that you will be greeted by is an organised and clean dashboard. The dashboard will present you with a variety of options or features, all designed to make accounting easier and simpler. Since the Vyapar app is visually appealing and offers an uncluttered layout, users can remain more focused on the task.

The last thing they will feel is overwhelming, as everything is easily accessible. Moreover, instead of using an Excel format to perform reconciliation, you can use this tool. Well, it’s not like you cannot use Excel; you, of course, can. But Vyapar is a more time-saving and less effort-consuming alternative to performing GST reconciliation.

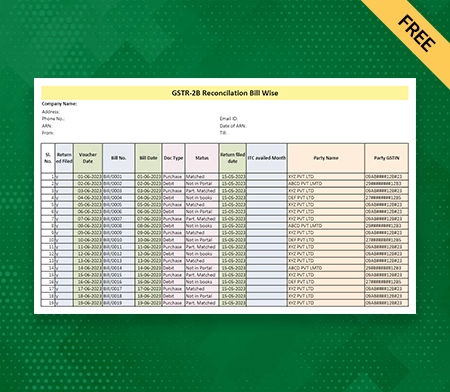

Pre-Designed GST Reconciliation Format:

An excellent feature that Vyapar offers is a ready-to-use GST reconciliation format. Now you can always create this format from scratch using Excel, but why waste so much effort? Simply create an account on the Vyapar app and access this format for free. The best part is that the format is expertly designed, so it’s the best among the ones in the market.

Moreover, Vyapar provides outstanding customization options. In contrast to other models that are difficult to modify, the GST reconciliation format provided by Vyapar can be effortlessly tailored to your needs. The format is extremely adaptable, allowing you to add or delete any elements in just a few seconds. This ease of customization enhances the convenience of GST reconciliation.

An underrated feature of the GST reconciliation in Excel that Vyapar offers is that it’s versatile. It means that the format works well for any business, doesn’t matter which industry it serves or deals in. So you can simply use this format to perform reconciliation without worrying about non-compliance with any GST law.

Seamless Import And Export Of Data:

Vyapar is a favored option for companies due to its proficient ability to import and export information. The simplicity of transferring financial data enhances the overall work process. Additionally, the app allows for the integration of the GST reconciliation format in Excel, enabling smooth data transfer.

This software eradicates the requirement for manual data entry when moving data from one location to another. Furthermore, once the data is imported, Vyapar autonomously organizes it into the appropriate sections of the reconciliation format. This smart data organization minimizes the likelihood of data discrepancies.

Vyapar not only facilitates data transfer but also enhances the efficiency of record creation and upkeep. This solution allows you to generate a GST reconciliation record that can be utilized for future audits and references. Finally, this tool also provides real-time data synchronization. Hence, as the software’s data gets updated, your format’s data is updated concurrently.

Real-Time Data Synchronisation:

As mentioned above, Vyapar offers real-time data synchronisation. It is this feature that sets it apart from other tools that deal with manual GST reconciliation techniques. When you integrate this software with your accounts, Vyapar automatically will create a seamless connection. The connection is what will help with data synchronisation in the least effort-consuming way.

Data synchronisation plays a crucial role in the GST reconciliation process, primarily due to its automatic updates. Essentially, any changes made to a data element in the app will be automatically reflected in your GST format. This eliminates the need for manual updates. the changes in the other data source, saving you a lot of time.

Another advantage of data synchronisation is that it gives a real-time view of the GST details. You will not have to worry about the data’s authenticity as it keeps updating in real-time. Since the data remains accurate all the time, you can make accurate calculations about GST filing. When the GST calculation is accurate, the risk of legal penalties gets reduced.

Frequently Asked Questions (FAQs’)

A GST reconciliation format in Excel is basically a format that helps businesses reconcile their GST accounts with sales and purchase records. It’s a format that helps organise the GST-relevant data systematically.

Yes, the GST reconciliation format in Excel is free to access. However, only a few software offer it for free. One such excellent accounting software is Vyapar, which you can use to access this format for free.

A GST reconciliation is important for a business as it helps determine whether or not the right amount of GST is paid.

Yes. You can use the Vyapar app to access the customisable GST reconciliation format in Excel. You should use Vyapar because the format it offers is free and highly customisable.

Related Posts: