E-Way Bill Format in PDF

Customers can easily generate E-Way Bills thanks to the free E-Way Bill Format PDF by Vyapar. You may generate your free E-Way Bill templates and digitally deliver copies to your clients. With our all-inclusive automated solution, you may produce customized bills. A free 7-day trial is offered right now, so sign up today!

Download E-Way Bill Format PDF

What is an E-Way Bill Format PDF?

An E-Way Bill Format PDF is a document that contains the electronic way bill format prescribed by the government for the movement of goods in India. An E-Way Bill is an electronic document required to move goods worth more than Rs. 50,000 within the country.

The E-Way Bill contains details such as the name of the supplier, recipient, and transporter, the GSTIN of the supplier recipient, the HSN code of the goods, the quantity and value of the goods, the place of origin and destination, and the mode of transportation, among others.

Why is it Necessary to Generate an E-Way Bill?

The E-Way Bill is a crucial document that promotes hassle-free transportation, permits effective logistics management, and helps ensure compliance with tax regulations.

Under India’s Goods and Services Tax (GST) regime, the E-Way Bill is required to transfer items costing more than Rs. 50,000. It guarantees adherence to tax regulations and aids in suppressing tax evasion.

The E-Way Bill acts as a document that certifies the transportation of products from one location to another. It makes it possible for the tax authorities to monitor the flow of goods and ensure they are transported with the appropriate documents.

The E-Way Bill, which serves as a single document for the full journey, permits the smooth transfer of products from one state or union area to another.

E-Way Bills reduce the time and effort needed for transportation by doing away with the necessity for several documents at various checkpoints.

By providing real-time data on the flow of goods, the E-Way Bill helps effectively administrate logistical operations. It facilitates supply chain optimization and cuts down on transportation expenses and time.

Modes to Generate E-Way Bills:

There are several ways to generate E-Way Bills. The following methods for producing E-Way invoices have been made available by GSTN:

Via Web: Anyone with a valid user or sub-user login can use the E-Way Bill site. Next, select the “Create new” option found in the “E-Way Bill” main menu that appears on the dashboard’s left side.

Via SMS: A practical on-the-go method for creating E-Way Bills is through SMS. Select the option “For SMS.” You must enter your mail ID and registered mobile number and verify the OTP. Once you press ‘Submit,’ you can generate an E-Way Bill via SMS.

Bulk Generation: The user must choose the “Create Bulk” sub-option under the “E-Way Bill” option to generate a bulk, E-Way Bill. The user needs the EWB bulk converter or the Excel file, which assists the user in converting the several E-Way Bills Excel files into a single JSON file to generate a bulk E-Way Bill.

What is the Validity Period of an E-Way Bill After Its Generation?

E-Way Bills have a validity period measured from the moment they are generated, with each day equalling 24 hours. The distance travelled by the goods determines the validity of the E-Way Bills.

For travel distances under 100 kilometers, the E-Way Bill is valid for one day after the pertinent date. Every 100 kilometers after that, the validity of the E-Way Bills will be extended by one day from the applicable date.

It is not possible to extend the validity of the E-Way Bills. However, the Commissioner may only prolong the validity term by issuing a notification for certain products.

Note: If extraordinary circumstances prevent the items from being delivered within the E-Way Bill’s validity period, the transporter may generate another E-Way Bill by changing the information in Part B of FORM GST EWB-01.

Who Should Generate an E-Way Bill Format PDF?

Generating an E-Way Bill is a must if the value of the goods is more than Rs 50,000:

- Every registered person must generate an E-Way Bill if the goods are transported through their own or hired means.

- The recipient must generate an E-Way Bill if the supplier is not registered.

- A transporter should generate an E-Way Bill if both the consignor and consignee fail to do so while providing the goods for road transportation.

An E-Way Bill must be generated even if the value is less than 50000 in the following cases:

- When an interstate transaction (from one state to another) involves a principal providing the commodities to an employee

- When a seller exempted from GST registration transfers handcrafted goods inter-state.

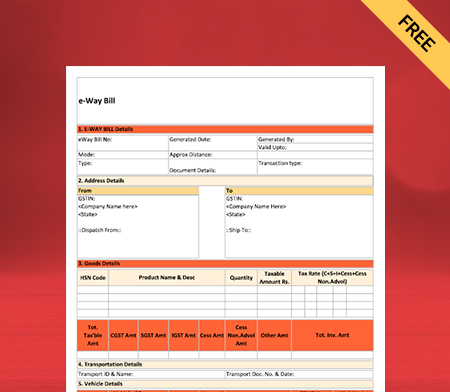

GST E-Way Bill Format PDF:

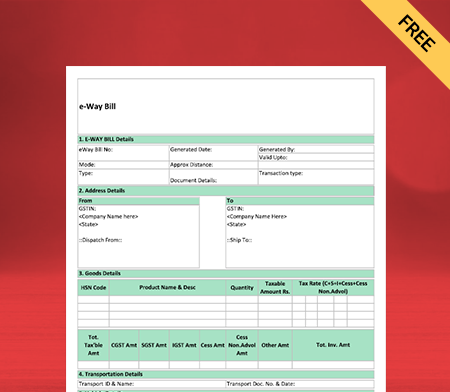

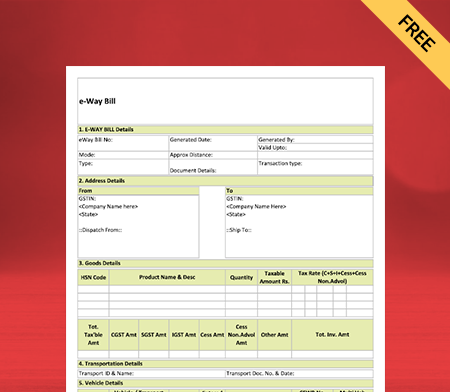

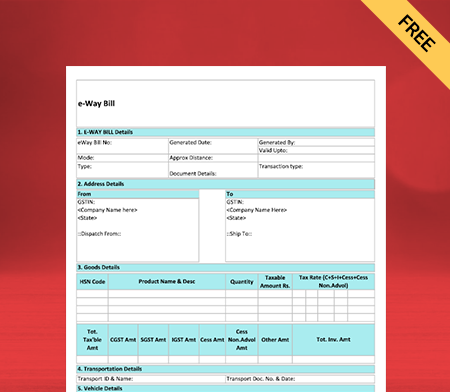

The E-Way Bill Format PDF consists of Part A and Part B. The supplier, the recipient (if the supplier is unregistered), the e-commerce operator, or the transporter must fill out Part A at the time of generation of the E-Way Bill.

The supplier must fill Part B if the goods are transported in his own or hired conveyance. However, if the supplier uses transporter services, he can send the details of Part A to the transporter, and the transporter will fill in Part B to generate an E-Way Bill.

However, Part-B information is optional when the goods are transported within a State or Union territory over fewer than fifty kilometers between the consignor-consignee location.

Part A

Part-A of Form EWB 01 collects consignment information, usually invoice details, such as:

- GSTIN: It is essential to mention the GSTIN of the recipient in an E-Way Bill form.

- Place Of Dispatch: Here, you need to enter the pin code of the location where the goods are being delivered.

- Invoice Number: Specify the invoice or challan number against which the goods were supplied.

- Value Of Goods: Describe the consignment value of goods.

- Hsn Code Of Goods: Enter the HSN code for the shipped items. You must include the first two digits of your HSN code if your annual revenue is less than or up to INR 5 crores. Four digits of the HSN code are necessary if the amount exceeds INR 5 crores.

- Reason For Transportation: There are several options listed. You must choose the one that best fits your needs.

Part B

Part B contains information relevant to transporting goods, such as departure times and vehicle numbers.

- Transport Document Number: It denotes either the Bill of Lading Number, the Goods Receipt Number, the Railway Receipt Number, or the Airway Bill Number. The vehicle number for transporting goods must be specified in Part B of Form EWB01.

Documents Necessary to Create an E-Way Bill:

- The invoice, bill of supply, or delivery challan

- Whether transferring products by train, air, or ship, the transporter must have their transporter ID, the transport document number, and the transportation date.

- Either the E-Way Bill’s number or a copy of it (EBN)

- The transporter may carry the EBN on paper or be mapped to a radio frequency identification device (RFID).

How to Generate E-Way Bills in PDF Format?

The E-Way Bill can be generated online through the GST Common Portal or SMS. The E-Way Bill Format PDF can be downloaded from the GST Common Portal, and it contains the format for both Part A and Part B of the E-Way Bill.

Part A contains details about the goods, the supplier, and the recipient, while Part B contains details about the transporter and the vehicle carrying the goods.

Be prepared with the invoice/bill/challan details and the Transporter ID and vehicle number of the transporter moving the goods before creating the E-Way Bill.

Login to the E-Way Bill portal using your username, password, and captcha. The main menu of the E-Way Bill site will pop up after the credentials have been successfully authenticated, offering several options for E-Way Bill generation and maintenance.

On the left side of the E-Way Bill portal’s main menu, click “E-Way Bill”, and within that click, the sub-option “Generate New.”

The E-Way Bill filing form, with its many fields, will open. While most fields are optional, those required will be noted, either with a red or green dot.

For the E-Way Bill, the fields highlighted with a red dot will be required, whereas those marked with a green dot will be required for Form GSTR-1. All required fields are indicated with an asterisk symbol (*)

The user must first choose the type of transaction (outward or inward) in the EWB Input Form. According to the outward transaction, the user provides the goods; in the inward transaction, the user gets the goods.

The system will display the sub-type of transactions based on the selected transaction type. The user must choose the sub-type appropriately.

The system will only present the appropriate document types in the “Document Type” selection corresponding to the selected subtype once the user has chosen the transaction type and subtype in the “Transaction Details” section.

The fields in this section will all be as follows:

- GSTIN

- Name

- Shipping Address

- Place Pincode

- Item description

- Transporter details

After entering all the details, click ‘Generate E-Way Bill’. Once the E-Way Bill is generated, click on the ‘print’ button to download the E-Way bill in PDF format. You can print the E-Way Bill and provide it to the tax authorities when required.

Benefits of Using E-Way Bill Format PDF:

Using the E-Way Bill Format PDF offered by the Vyapar app has numerous advantages. Below is a list of some of them:

1. Effortless Brand Management:

Businesses use specific colour palettes in their logos, social media profiles, and websites to establish a consistent, identifiable brand identity. An E-Way Bill Format PDF makes it very easy to edit what has previously been put up and lets you change details to suit your demands.

The brand’s reputation is enhanced by providing professional E-Way Bill Format PDF throughout transactions. As all the information is in the E-Way Bill Format, you can be entirely honest about the transaction, which fosters even greater confidence.

To accurately express your brand’s identity, you can include our company’s logo, style, font, and brand colours in your invoice. Customers will become more accustomed to your brand and will likely shop from you again.

2. Print It or Save It in PDF Form Digitally:

You can choose whether to send digital copies of your E-Way Bills instead of physical ones. It only takes a few minutes to print a digital copy, and you can then manually fill in the information about your transaction and buyer or enter it before printing.

The E-Way Bill Format PDF is fully customizable by the seller to meet their needs, and they can download it for later use. The entire procedure is cost-free. The customization gives you a professional appearance and raises the value of your brand.

E-Way Bill Format PDF can be modified to meet your needs regardless of how you like to handle your accounts. To enter data manually, you can print the custom format as well. Any common bill size can use the Formats with ordinary and thermal printers.

3. Seamless Usage:

Use blank E-Way Bill Format PDF templates for your business needs. You can format, add, or remove information as you see fit. Choose the template that best meets your company’s needs and fill it in with the necessary data.

An E-Way Bill and your company logo can be made in many colours with different themes and fonts. Updating your company’s information on the E-Way Bill Format is simple.

With our free E-Way Bill Formats in excel, pdf, word you may tailor a professional invoice to your business needs. You can save the format, view the E-Way Bill after creating it, and download it for further use.

4. Professional Designs:

You can quickly produce high-quality E-Way Bills within minutes. A professional-looking E-Way Bill Format PDF may be easily created for your business, thanks to customizable designs of PDF formats offered by the Vyapar app for free.

Building an E-Way Bill template from scratch for your business or brand takes time and effort. You’ll need to use formulas and functions to set up and run any required calculations and consider your colour scheme, font size, and type.

When all of this is considered, it becomes clear that it would be wise to merely alter the specifics of a document with all the necessary components. You can use any E-Way Bill Format PDF to create a professional and unique format design for your business.

5. Time Saver:

Your business will save time using a customized blank E-Way Bill Format PDF. Once a template is created, it must be filled in with data rather than completely rebuilt for each billing run.

When done manually, it takes a while and is time-consuming and error-prone. You can avoid this problem by utilizing the Vyapar app’s formats. Using this technique, you can avoid starting over each time you need a bill.

To save the details about your business, you can edit the E-Way Bill Format PDF. The customized format can be stored and utilized as needed to save time.

6. Significantly Minimise Human Error

Manually entering every single detail in E-Way Bills raises the possibility of error. It is advisable to select an E-Way Bill Format that can lessen repeated data entering and assist you in avoiding errors.

Automation improves process efficiency and helps do away with human error. By adhering to a formal framework, you may concentrate on the important issues that require your attention.

The E-Way Bill Formats offered by Vyapar are simple to use. It lessens the need to hire staff to create an E-Way Bill Template for your company.

Valuable Features of the Vyapar Billing Software that Can Help You in Your Business:

Here are some app features that will simplify your daily accounting and management tasks:

Make GST E-Way Invoices Online:

Vyapar billing software helps establish a credible brand name by providing effective GST billing options. It allows you to follow Indian Goods and Service Tax rules.

You can rapidly create bills with Vyapar. It’s a simple process that won’t require lengthy, stressful training. To produce expert and unique bills, you may select from more than 10+ GST invoice formats and bill templates in the application.

The Vyapar app can be used both online and offline. With the software, an SME can thus adhere to the finest accounting practices more readily. It simplifies the bookkeeping process for businesses.

To comply with GST rules, use our straightforward invoicing app. You can create client invoices in just a few easy steps. You may also print, email, or WhatsApp them to your clients.

Track and Manage Orders:

It is quite beneficial to have tracking functions to fulfil orders promptly. Setting up a due date makes it easier to handle orders efficiently, ensuring the availability of inventory products.

Tracking helps prevent losses. With tracking, you may save time and use it towards other regular activities. The app lets you track when payment is due and attach a tax invoice to your order.

Using our free billing software, you can keep track of open, closed, and late orders. Businesses can easily track everything by utilizing these features. Using our GST billing tool, you can enhance your purchase/sale order types.

Vyapar simplifies order creation for purchases or sales. You can reduce labour costs and time by using our invoicing software. By automating the conversion of orders into sale/purchase invoices, time can be saved.

Data Security For Your Business:

You can frequently create local or online Google Drive backups with Vyapar to store all data, including Bills created using E-Way Bill Format PDF. Also, you always have access to your company’s financial data through various devices.

Vyapar billing and accounting app streamline business management. The app’s comprehensive dashboard lets you analyse your company’s daily operations in real-time.

The software uses encryption technology to limit access to the data to the owner only as an additional degree of security. Vyapar won’t store or distribute user login information for subsequent use.

Other team members and parties won’t have access to your company’s data, ensuring its long-term security. You can pick up where you left off using the bill generation app’s “auto-backup” function.

Seamless GST Filing:

Filing GST can be difficult and time-consuming for business owners if done manually. You may prepare GST reports and streamline the filing procedure using Vyapar billing software.

Every month, many business owners invest their time and energy. It is done to make sure they abide by the tax regulations. They must, after all, keep track of their monthly bills, outlays, and accounting information. To file GST returns, manually enter them as well.

With the use of automation, Vyapar changes everything by assisting in the creation of specific GSTR reports. You can use Vyapar’s app to create reports like GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9.

The software automatically determines the tax applicable to the goods when you create annual GST bills. Recording every transaction assists in adhering to tax regulations. It also guarantees that the right GST tax rate is entered.

Create an Online Store:

Set up your online store with Vyapar. Using our mobile billing software, you may provide a catalogue of all the goods you sell online to your consumers. Having an online store will increase your sales.

The online shop capabilities that Vyapar provides to assist you in expanding your business online are free to use. Your consumers can use the link you offer them to place online orders with you and pick up their purchases from your physical store.

You can pack the package for your clients before they arrive at the store. Thus, reduce wait times at the checkout counter by using the online shop feature.

Expanding your business online through the Vyapar online store can attract more local clients. It contributes to more sales and, consequently, the company’s expansion.

Send Estimates of Your Products:

You can quickly create quotes, estimates, and correct GST invoices with the Vyapar app. With the built-in features in the GST billing software, you may send clients quotations and estimates whenever you want.

The billing software from Vyapar offers a professional appearance with immediate estimates and quotes. Most operations can be automated with the Vyapar app. It eliminates errors from quotations and estimations.

Also, you can change your quotes and estimates into sales invoices at any moment. The business has a choice for fast saving more time and obtaining instant estimates thanks to Vyapar’s free billing software. You can operate your company more productively.

Estimates and quotes are made simpler with the help of our billing software. Your loyal consumers will be impressed by the professionalism the billing app offers, luring them back. These can be sent immediately via email, SMS, WhatsApp, or printing.

Frequently Asked Questions (FAQs’)

Yes, you can generate an E-Way Bill In PDF Format. You must have a PDF printer on your computer to make a PDF file of the E-Way Bill.

You must install a PDF printer on your computer to download the E-Way Bill In PDF Format. After that, you can instantly generate an E-Way Bill PDF from the portal.

The PDF format of an E-Way Bill must include all the relevant information related to the movement of goods, such as:

1. E-Way Bill number

2, GSTIN

3. Date and time of generation

4. Place of dispatch

5. Goods description

6. HSN code

7. Value of goods

8. Transporter detailsur specific requirements.

The validity of the E-Way Bills in PDF format depends on the distance the goods are transported. For distances up to 100 km, the E-Way Bill is valid for one day from the generation date. For every additional 100 km or part thereof, an additional day is added to the validity of the E-Way Bills.

Yes, you can print the E-Way Bill In PDF Format for physical verification by tax authorities. When you generate an E-Way Bill on the GST portal, you can download and save the E-Way Bill In PDF Format. You can print the E-Way Bill and provide it to the tax authorities for physical verification.

Yes, the PDF format of the E-Way Bill is considered a legal document and can be used as evidence in a court of law. The E-Way Bill is generated on the GST portal, a government-mandated platform for generating E-Way Bills.