E-Way Bill Format In Excel

Generate Free E-Way Bill Format in Excel. The fully customizable format makes E-Way Bill generation simple for businesses. You can use free templates to create your E-Way Bill and send digital copies to your clients.

Download a Free Excel E-Way Bill Formats

Access and customize professional Excel e-way bill formats in PDF, Excel and Word for free to meet your specific requirements.

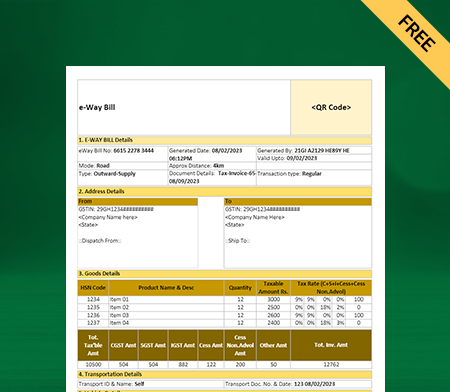

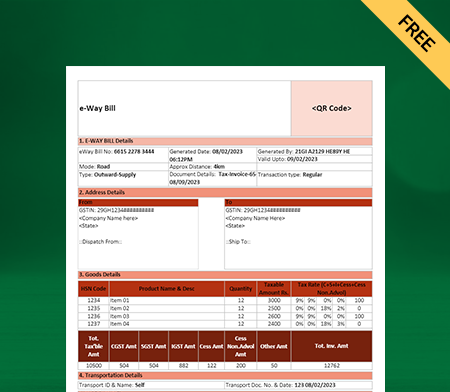

Template – 1

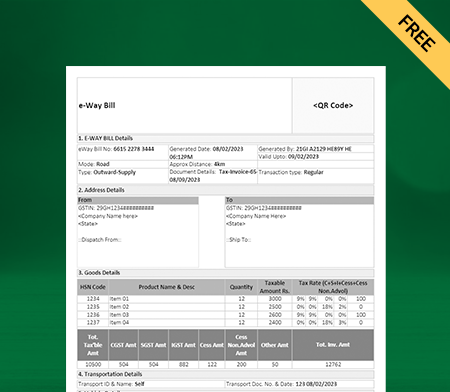

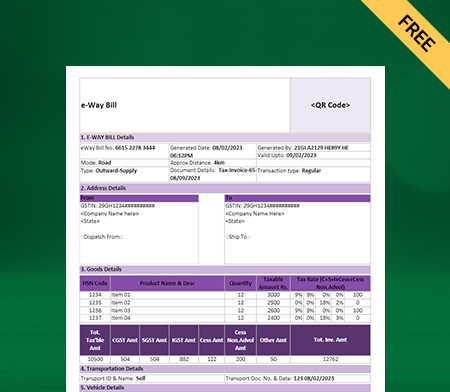

Template – 2

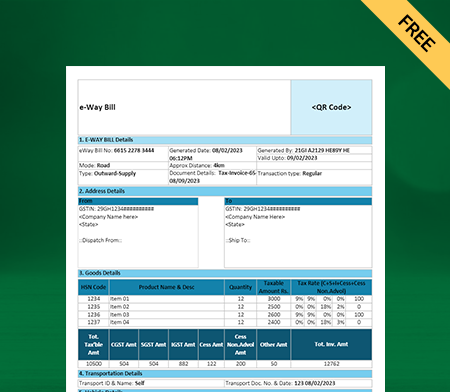

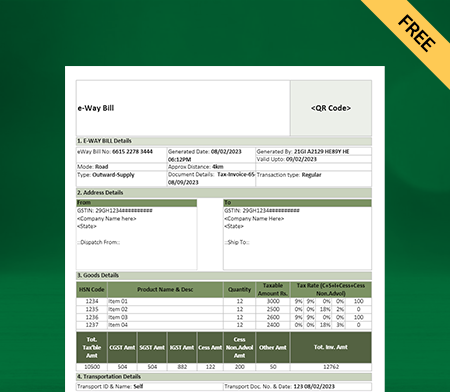

Template – 3

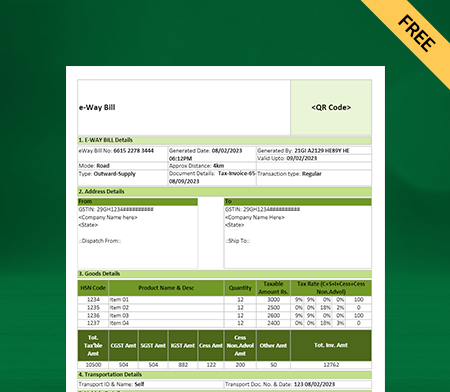

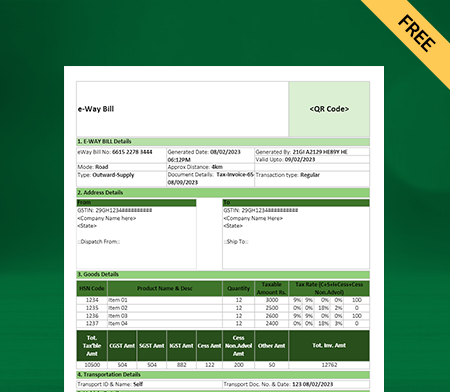

Template – 4

Template – 5

Template – 6

Template – 7

Template – 8

Highlights of Excel E-Way Bill Templates

We’ve put in a lot of effort to make sure you get the best e-way bill excel template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

Contents of Excel E-Way Bill Format

There are two parts to the E-Way Bill Format: Part A and Part B. Part A must be completed at the time the E-Way Bill is generated by the supplier, the recipient (if the supplier is not registered), the e-commerce operator, or the transporter.

If the items are carried in a vehicle that the supplier owns or rents, then Part B must be completed by the supplier. If the provider opts to use a transporter, he can submit the information from Part A to the transporter, who will then complete Part B to create an E-Way Bill.

Part-B information is optional when the commodities are transported within a State or Union territory between the consignor and consignee locations over fewer than fifty kilometers.

Part A:

Consignment data is gathered in Part-A of the form, often invoice information like:

- GSTIN: The recipient’s GSTIN must be included while completing an E-Way Bill form.

- Location Of Dispatch: In this field, you must enter the pin code of the address where the products will be delivered.

- Indicate the invoice or EWB number against which the items were supplied.

- Value Of Goods: Explain the consignment value of the products.

- Hsn Code Of Goods: Type in the HSN code for the shipped items. If your yearly sales are less than or equal to INR 5 crores, you must submit the first two digits of your HSN code. The HSN code must be four digits if the sum exceeds INR 5 crores.

- Reason For Transportation: Several choices are provided. The option that best meets your demands must be chosen.

Part B:

Part B includes details about the transportation of goods, such as departure hours and vehicle identification numbers.

- Transport Document Number: This number can be found on a Bill of lading, a goods receipt, a railway receipt, or an airway Bill. Section B of Form EWB01 requires the vehicle number to be specified for goods transportation.

Features of the Vyapar App that Help Manage Businesses Smoothly

Manage the Cash Flow of Your Business Seamlessly

Businesses can keep track of E-Way Bills using the Billing and accounting software by Vyapar. It aids in seamless payment tracking and management. Using Vyapar, you can monitor your current payables and receivables.

Your business’s cash flow ensures you have enough money to keep things running. The dashboard can show how easily you can cover ongoing costs without missing EMI installments.

With the help of cash flow data, you can make decisions quickly. It will guarantee a smooth workflow, additionally assisting in preventing debt. Managing cash flows is essential for many corporate processes, like Billing and accounting.

This free Billing software allows you to monitor your company’s cash flow efficiently. You can manage cash transactions with this all-in-one software.

Create and Send Online GST Invoices

The effective GST Billing solutions in the Vyapar Billing software help you establish a credible business brand. The Billing and accounting program Vyapar can be used to generate professional invoices.

Use our straightforward invoicing application to abide by GST rules. Vyapar provides various helpful Billing solutions, including E-Way Bill Format In Excel. You may create invoices for your customers in a few easy steps. Also, you can print, email or WhatsApp and share them with your clients.

Both offline and internet usage of the Vyapar app is possible. So, adopting the app will make it easier for an SME to follow the finest accounting practices. For businesses, it simplifies the bookkeeping process.

You can rapidly create invoices with Vyapar. The best aspect is that it doesn’t require lengthy, taxing training. You may choose from more than ten GST invoice Formats and Bill templates in the program to create professional and distinctive Bills.

Obtain Useful Reports

Businesses must make wise decisions if they want to continue on a growth track. Use our free Billing software to create up to 40+ different business reports that you may use. The Vyapar small business accounting software comes with expert balance sheets.

Using data collected from Bills created using E-Way Bill Format In Excel The operational efficiency of your business is enhanced by how simple it is to export reports from Vyapar.

Users can view and analyze the data immediately with our free Accounting & Invoicing Software. You can create graphical reports using the software to monitor sales and expenses.

This free program analyses exact financial data, commercial facts, etc. It is also a quick and efficient approach to assessing profitability. You can create reports in the GSTR 1 format, GSTR 3B, and GST-related reports.

Provide Estimates For Your Goods

Using the Vyapar app, you can easily produce quotations, estimates, and accurate GST invoices. With our all-in-one accounting software, you may give clients quotes and estimates whenever possible.

With instant estimates and quotes, the Billing software from Vyapar provides a professional image. The Vyapar app allows for the automation of the majority of tasks. It removes mistakes from estimates and quotations.

Also, you always have the option to convert your bids and estimates into sales invoices. Thanks to Vyapar’s free Billing software, the company can save more time and get immediate estimates. You can run your business more effectively.

Our Billing software helps in the simplification of bids and estimates. The Billing app’s professionalism will impress your customers and draw them back. You can immediately print or send such quotes through email, SMS, or WhatsApp.

Provide Multiple Payment Options

If you offer a variety of convenient payment methods to your clients, payment default is less likely to occur. You may produce E-Way Bills and invoices with several payment options using the Vyapar invoicing tool.

Options including UPI, QR, NEFT, IMPS, e-wallets, and credit/debit cards are available. You can decide which payment methods your consumers prefer, or you may provide them with all your options.

You can include a QR code inside the invoice as one of the payment alternatives to make it easier for your customers to transfer a payment to the connected UPI ID. Furthermore, the app allows you to state the specifics of your bank account.

Offering multiple payment options to customers is highly beneficial. By doing so, you can ensure that your customers can pay you promptly, which helps to build trust and preference for your brand. In short, providing a variety of payment methods is a great way to improve customer satisfaction and distinguish yourself from competitors who do not offer such flexibility.

Track Expenses

For accounting and tax preparation, it is crucial to keep track of and document all expenses made during the delivery of the items. Vyapar facilitates precise report generation and tracking of expenditures.

You receive several advantages from Vyapar’s Billing solutions as well. It enables cost-cutting and revenue growth. You may easily keep track of outstanding obligations using the free programme. Also, it helps in future tracking of them.

Our free app is a valuable tool for budgeting. Companies that must issue E-Way Bills can quickly optimize their expenses to result in significant savings. You can track GST and non-GST spending using our free GST Billing software.

Vyapar provides a free Android invoicing app for small and medium-sized business owners. It helps them manage all business finances in one place. Also, tracking your expenditures will make it easier to develop solutions that work. This will boost business profitability.

Advantages of Using Vyapar’s E-Way Bill Format in Excel

Save Time While Keeping Consistency

When done manually, it takes a while and is time-consuming and error-prone. You can avoid this problem by utilizing the Vyapar app’s formats. You can edit the professional E-Way Bill Format and save the details.

Easily Produce E-Way Bills that suit your company’s requirements using our free E-Way Bill Formats in Excel. The customized format can be stored and utilized as needed to save time.

Using this technique, you can avoid starting over each time you need a Bill. You may maintain consistency by giving your clients matching E-Way Bills in Excel format. You become more productive with more time to do other essential chores.

It is Simple to Use

You may quickly create Export Quotation Formats based on your company’s requirements. Manually carrying it out takes a long time. All information must be recorded manually. This is different from our online quotation tool.

Modifying your company’s information is all required to prepare your format for use with Vyapar’s Export Quotation Format. The customized Export Quotation Format can be saved in different forms for later use.

Doing it this way can avoid having to start from scratch each time you need a quotation. By providing matching quotations to your clients, you can maintain consistency. Because you have more time to do other critical chores, you become more effective.

Entirely Free to Use

Free Excel invoice templates are available to download for free. You can save money by choosing these free invoice formats as they won’t cost your company any money.

The E-Way Bill Format in Excel is fully customizable. So business owners can edit it to meet their needs. The entire procedure is cost-free. The customization gives you a professional appearance and raises the value of your brand.

They can download it for later use. To enter data manually, you can print the finalized format as well. The excel formats of E-Way Bills are compatible with regular and thermal printers in any standard Bill size.

You Can Print It Or Digitally Store It

Your E-Way Bills can be sent electronically instead of physically if you like. You can manually fill in the details of your transaction and buyer after printing a digital copy, which only takes a few minutes. Or, you can enter them before printing.

The seller can modify the E-Way Bill Format In Excel to suit their requirements and download it for later usage. Everything about the process is free. You appear more professional thanks to the customization, which increases your brand’s worth.

Whatever your preferred method for managing your accounts is, you can customize the E-Way Bill Format In Excel to suit your needs. You can also print the custom format and manually enter the data. The Formats work with standard and thermal printers and any typical Bill size.

Significantly Minimise Human Error

Manually entering every single detail in E-Way Bills raises the possibility of error. It is advisable to select an E-Way Bill Format that can lessen repeated data entering and assist you in avoiding mistakes.

Automation improves process efficiency and helps do away with human error. By adhering to a formal framework, you may concentrate on the essential issues that require your attention.

The E-Way Bill Formats offered by Vyapar are simple to use. It lessens the need to hire staff to create an E-Way Bill Template for your company.

Seamless Brand Management

Companies use specific colour patterns and designs on their websites, social media profiles, and create logos a recognizable corporate identity. It’s pretty simple to alter previously posted content and change details in an E-Way Bill Format to meet your needs.

The brand’s reputation is improved by using professional E-Way Bill Format In Excel throughout transactions. You may be completely honest about the transaction because all the information is in the E-Way Bill Format, which promotes even more confidence.

You can use our company’s logo, style, font, and brand colours in your invoice to accurately convey your business’s identity. Consumers will grow more familiar with your brand and are more likely to make another purchase from you.

How to Generate a Bulk E-Way Bill Format in Excel?

To generate a bulk E-Way Bill, the user must select the “Generate Bulk” sub-option under the “E-Way Bill” option. To create a bulk E-Way Bill, the user needs the EWB bulk converter or an Excel file that helps them combine multiple Excel files for E-Way Bills into a single JSON file.

- Log into the website ewayBill.nic.in. Select the “How To Use” tab and click “Tools.”

- The user must choose the “Generate Bulk” sub-option under the “E-Way Bill” option to create a Bulk E-Way Bill. Click on “E-Way Bill JSON Preparation” on the bulk Bill generation tools page.

- Download the E-Way Bill Format In Excel with the extension “.xlsx.” You can download “E-Way Bill JSON Format.xlsx” or “Consolidated E-Way Bill JSON Format.xlsx”.

- Update the Excel format with all the required information.

- You must download the “E-Way Bill converter tool.xlsm” or “Consolidated E-Way Bill converter tool.xlsm.” The tool assists in merging several electronic way Bills (EWBs) from an Excel file into a single JSON file.

- The Excel file can be transformed into JSON using the .xlsm converter tool. The final JSON file is ready for upload.

- Next, click on “Choose File” on the Bill portal and browse for the JSON file. To upload the file containing the details, click Upload & Generate.”

- The Bill portal will then handle the request after that. The “Error Description” field will display any errors if there are any. If everything is in order, one can generate the bulk, E-Way Bill.

The E-Way Bill can be canceled and a new one issued if it was generated with incorrect information. There is a provision for the individual who generated the E-Way Bill to cancel it within 24 hours. Within 72 hours of Bill generation, the receiver may reject the electronic waybill.

Benefits of E-Way Bill Format in Excel

- The E-Way Bill serves as a document that validates the delivery of goods from one place to another. This Excel tool lets you input data from numerous invoices to create an E-Way Bill.

- Rather than carrying several E-Way Bills for each consignment when transporting multiple consignments from different consignors and consignees in a single vehicle, the transporter can now generate and have just one consolidated E-Way Bill.

- The vehicle owner no longer needs to carry paper copies of the E-Way Bill because the RGIC device already in the car can map and verify them. It made carrying and storing physical papers easier by eliminating those inconveniences.

- It enables the tax authorities to monitor the movement of products and ensure they are being transported with the correct documentation.

- The seamless transfer of goods from one state or union territory to another is made possible by the E-Way Bill, which functions as a single document for the journey.

- E-Way Bills eliminate the need for several documents at numerous checkpoints, which cuts down on the time and effort required for transportation.

- The Bill portal and E-Way Bill system are pretty straightforward and user-friendly. Sellers can generate E-Way invoices using technology, which is very easy.

- The E-Way Bill helps efficiently manage logistical operations by offering real-time data on the flow of goods. It facilitates supply chain optimization and reduces both the cost and time of transportation.

What is the Validity Period of an E-Way Bill Format in Excel After Bill Generation?

The distance travelled by the goods determines the validity of the E-Way Bills. E-Way Bills are valid for 24 hours, i.e., one day from the moment they are generated.

E-Way Bills are valid for one day after the relevant date for travel distances under 100 kilometers. A day will be added to the validity of the E-Way Bill for every 100 kilometers after that.

When Can an E-Way Bill Be Cancelled?

The goods for which the E-Way Bill was generated are not transported, the entity that generated the E-Way Bill can cancel the E-Way Bill within the next 24 hours.

If there are any errors in the E-Way Bill, such as an incorrect vehicle or EWB number or goods details, the E-Way Bill can be cancelled (within 24 hours).

The issuer of the E-Way Bill is able to cancel it if there is a modification in the means of transportation for goods subsequent to its generation. The entity can then generate a new E-Way Bill with the correct details.

In case the goods being transported are not consistent with the details mentioned in the E-Way Bill, the recipient has the option to decline them. Further, they can initiate the cancellation of the E-Way Bill.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

According to Rule 138 of the CGST Rules 2017, every registered person must electronically submit Part A of the GST EWB-01 to provide information about any movement of goods with a consignment value greater than Rs. 50000.

An E-Way Bill Format In Excel is a template or a spreadsheet in Microsoft Excel format that businesses can use to prepare and upload E-Way Bills in bulk to the GST portal.

Businesses need to generate multiple E-Way Bills in certain situations. If the supplier creates E-Way Bills individually, Bill generation will take time. The E-Way Bill portal allows users to generate E-Way Bills faster.

An E-Way Bill has two sections in its format. The invoice Bill of supply and receiver information is included in Part A. Transporter specifics, including departure information and vehicle numbers, are included in Part B.

The purpose of an E-Way Bill In Excel Format is to allow users to generate E-Way Bills in bulk for multiple transactions. It lets businesses create and upload multiple E-Way Bills to the GST portal simultaneously, saving time and reducing errors.

Yes. You can generate an E-Way Bill In Excel Format with the generation tool. You can download the E-Way Bill Format In Excel, fill in the details, and generate a JSON file.

On the ‘E-WayBill’ menu, choose ‘Generate Bulk.’ The system will ask you to select the JSON file and upload the EWB Excel file when you click the “Select file” button.

You can not change the E-Way Bill In Excel Format once you have uploaded it to the portal. They are final and cannot be edited. However, you can cancel it on the Bill portal and generate a new one with the correct details.