Free GST Bill Format & Tax Invoice Templates

Create GST-compliant, professional invoices in minutes with our free, ready-to-use templates.

- ⚡️ Ensure 100% GST Compliance with a professional Tax Invoice Format

- ⚡ Download the perfect GST Invoice Format for Word, Excel, or PDF

- ⚡️ Automate calculations and look professional with a Simple GST Bill Format

What is a GST Invoice (or Tax Invoice)?

A GST Invoice (also known as a Tax Invoice under GST) is a mandatory legal document that a seller issues to a buyer. Its meaning is to formally list the goods or services sold, the quantities, and the total amount due. The GST bill is the common term for this document.

A GST tax invoice is the official document that formally records the sale and the applicable taxes (CGST, SGST, IGST). This is crucial, as a valid GST Invoice Format is necessary for the buyer to claim Input Tax Credit (ITC).

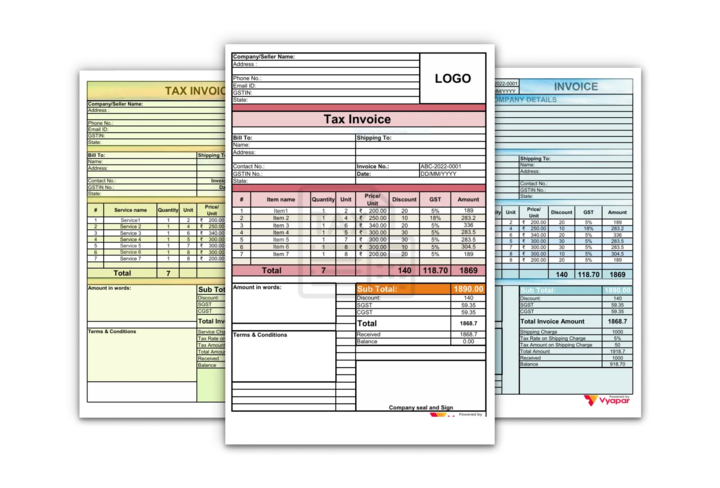

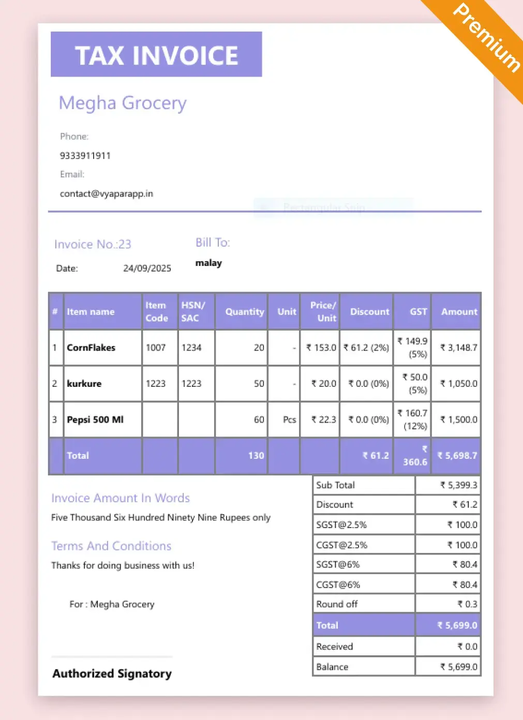

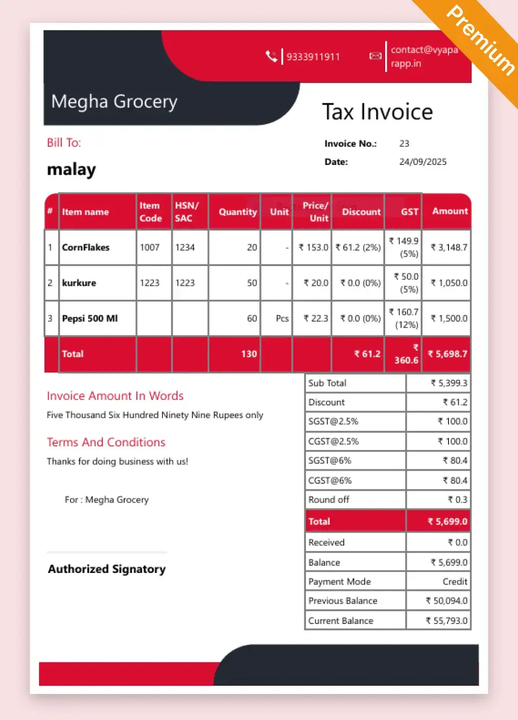

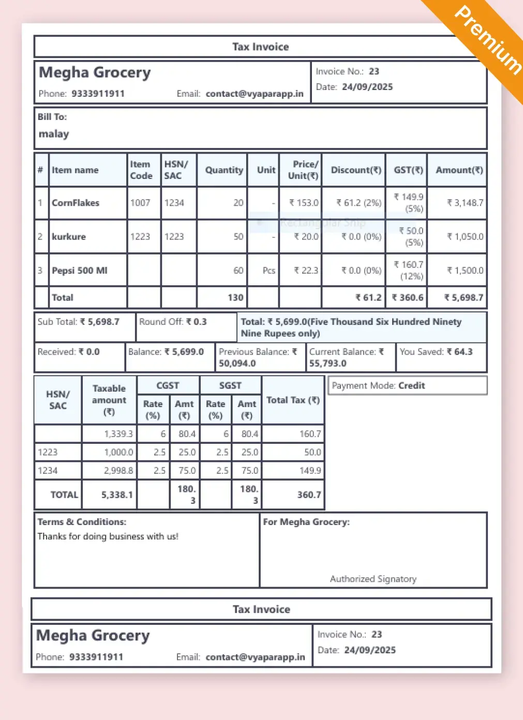

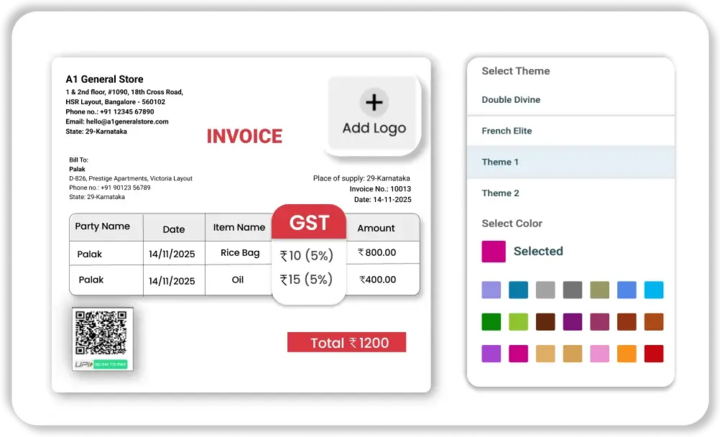

Want More GST Compliant Themes? Upgrade to Our Premium Themes

Our free templates are a great start, but our premium, GST-compliant themes are exclusive to the Vyapar App. Downloading the app not only gives you access to these stunning designs but also unlocks powerful features such as one-click GSTR-1 reports, e-invoicing, and automated payment reminders.

French Elite

Double Divine

Landscape

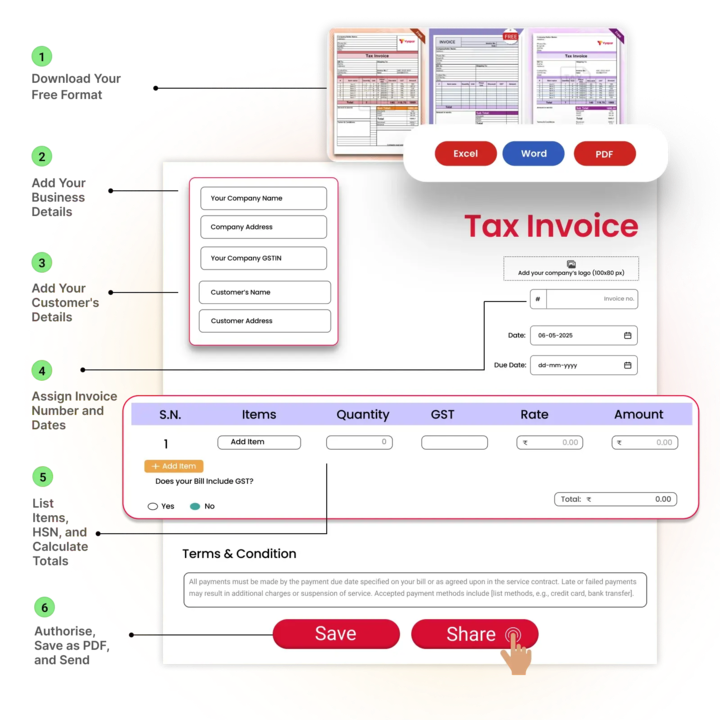

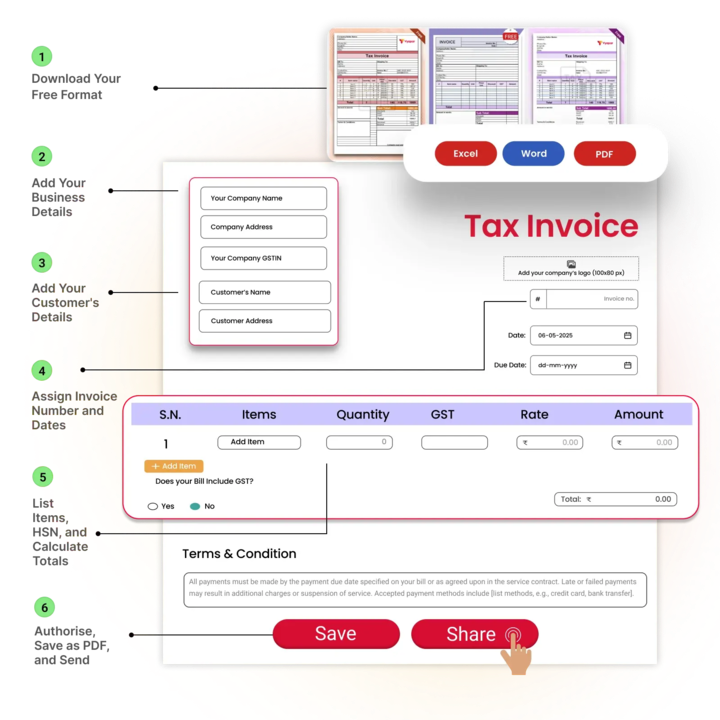

How to Make a GST Bill

Here’s how to make a GST bill using our free templates. This process also answers how to make a tax invoice.

✅ Step 1: Download Your Free Format: Download our Simple GST Bill Format in Excel, PDF or Word from this page.

✅ Step 2: Add Your Business Details: Open the file and enter your company name, logo, registered address, contact information, and your GSTIN.

✅ Step 3: Add Your Customer’s Details: Fill in the client’s name, billing address, shipping address, and their GSTIN (This is mandatory for them to claim ITC).

✅ Step 4: Assign Invoice Number and Dates: Add a unique, sequential Invoice Number (e.g., 001, 002) and the Date of Issue.

✅ Step 5: List Items, HSN, and Calculate Totals: Add a detailed list of goods/services, including the HSN/SAC Code, Quantity, and Rate. Manually (in Word) or automatically (in Excel) calculate the Subtotal, CGST, SGST/IGST, and the final Grand Total.

✅ Step 6: Authorise, Save as PDF, and Send: Add your authorised signature. Save the file as a PDF (it’s more professional) and send it to your customer.

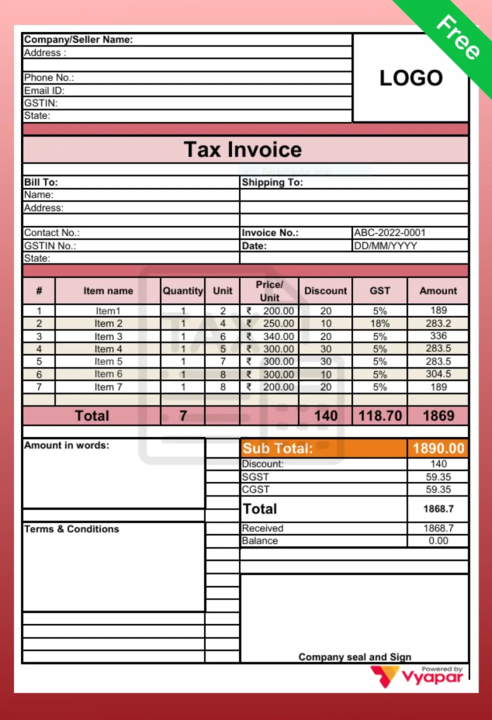

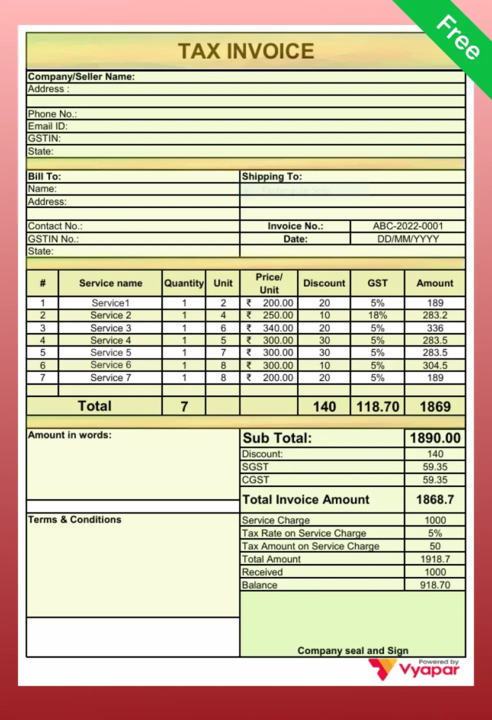

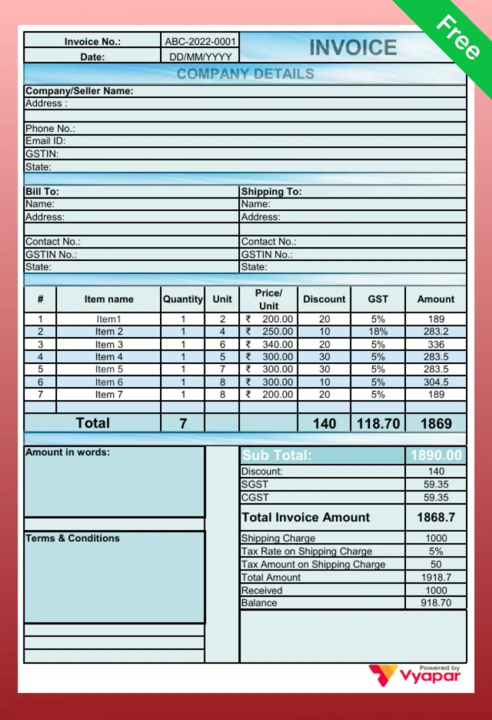

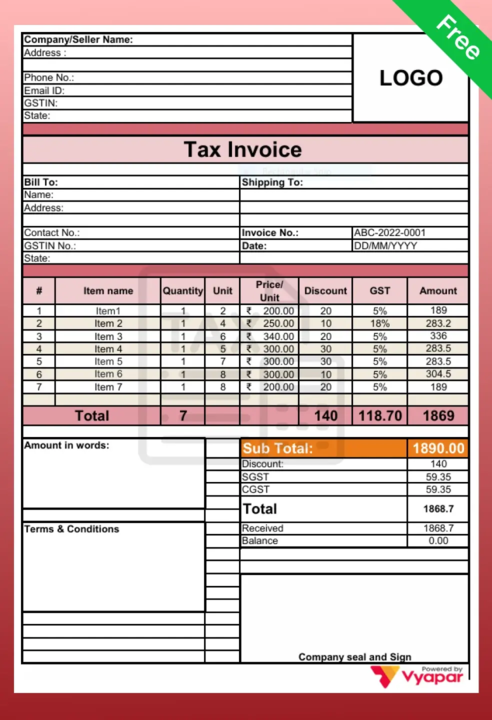

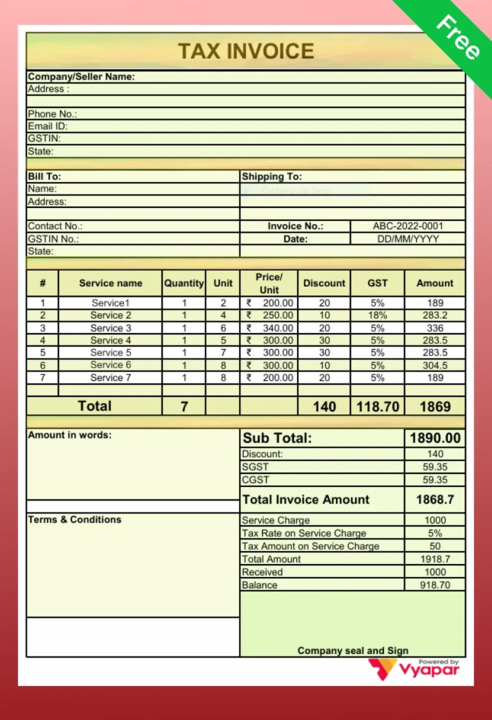

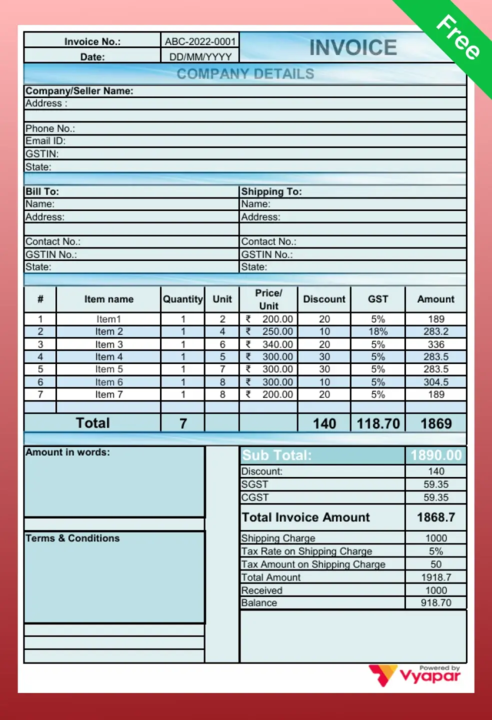

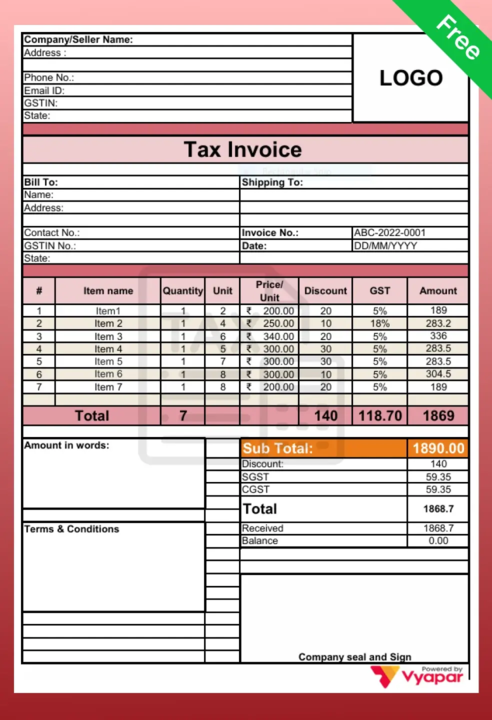

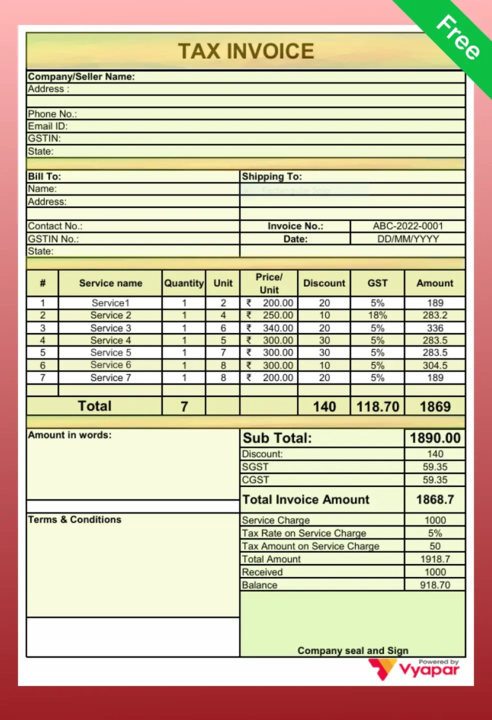

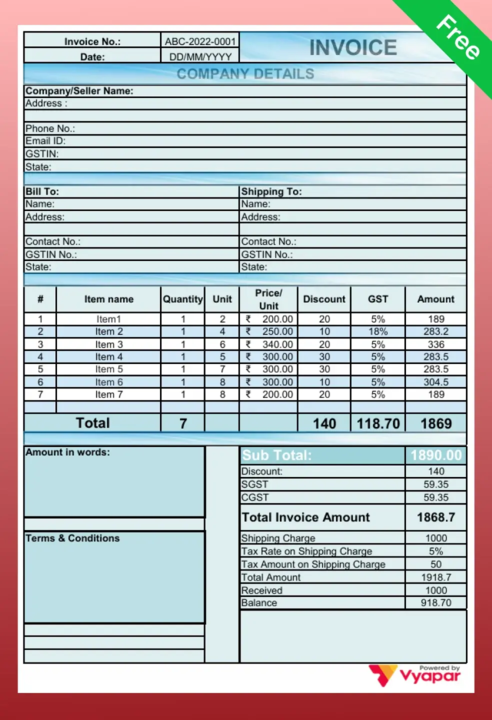

Must Have Components of a GST Invoice Format

A legally compliant GST Tax invoice Format must be clear and include these six essential elements:

1. Your Business Details

Your business’s legal name, registered address, GSTIN, and contact information, such as your phone number or email, must be clearly displayed.

2. Invoice Number & Dates

A unique serial number (for the financial year), the Date of Issue, and the Payment Due Date.

3. Customer Details

The recipient’s name, billing/shipping address, and their GSTIN (if they are a registered business).

4. Itemised List

A detailed table listing the HSN/SAC Code, Description, Quantity, Rate, and Taxable Value.

5. Summary of Charges

A clear, separate breakdown of the Subtotal, any Discounts, CGST, SGST, or IGST amounts, and the final Grand Total payable.

6. Terms & Conditions

Includes your bank details for payment, standard terms & conditions, and a space for your authorised signature (digital or physical) to validate the document.

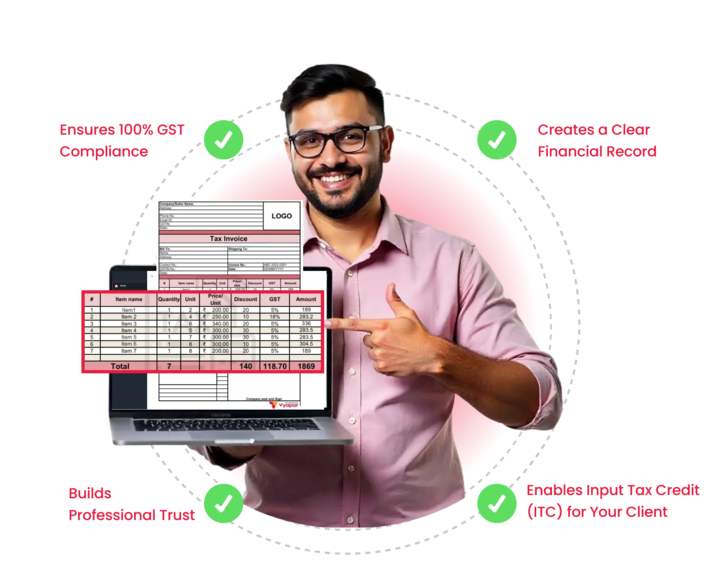

Advantages of Using a Professional GST Invoice Format

Using a dedicated Tax Invoice Format is not just professional, it’s a legal requirement.

- Ensures 100% GST Compliance: A proper format ensures you include all mandatory fields required by GST law, protecting you from penalties.

- Enables Input Tax Credit (ITC) for Your Client: This is the most important benefit. Without a valid GST Invoice Format, your B2B customers cannot claim ITC, and they may refuse to do business with you.

- Builds Professional Trust: A Simple GST Bill Format that is clean, accurate, and professional shows clients that you are a legitimate and trustworthy business.

- Creates a Clear Financial Record: It acts as a legal proof of sale, essential for your own accounting, tax filing, and in case of any disputes.

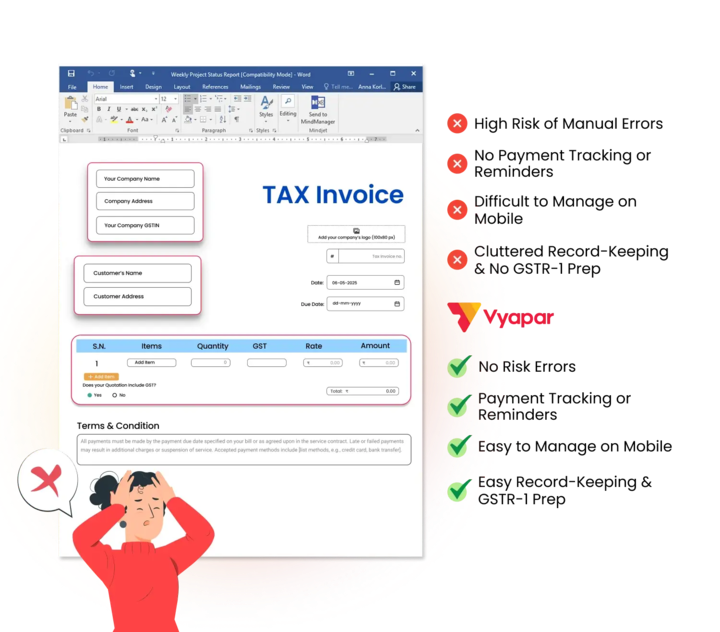

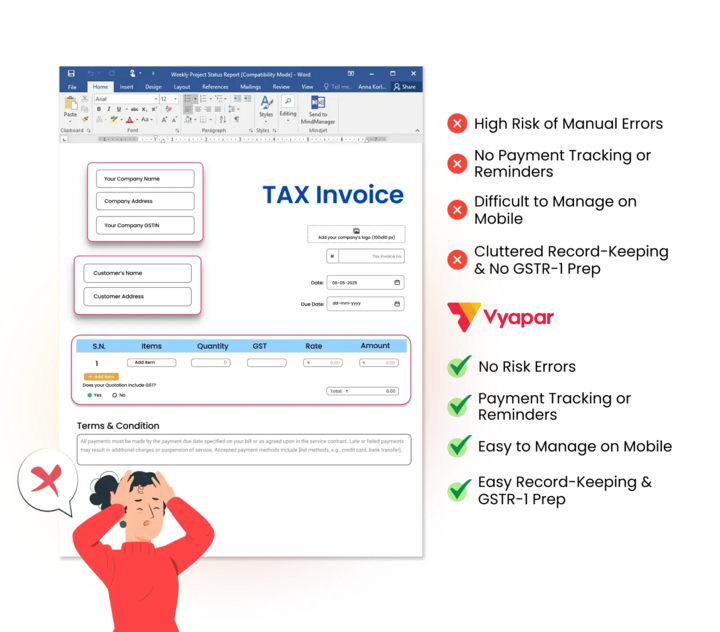

Limitations & Challenges of Static Invoice Templates

While a GST bill format in Word or Excel is a good start, static files have major drawbacks that create more work.

- High Risk of Manual Errors: Manually calculating CGST, SGST, and totals in a Tax invoice Format in Word is slow and can lead to costly math errors, which can cause compliance issues.

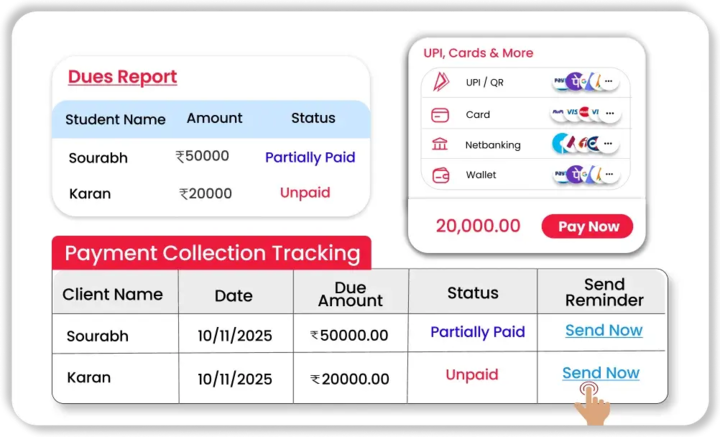

- No Payment Tracking or Reminders: A static file can’t tell you if the client has seen the invoice, and it can’t automatically send payment reminders for overdue bills.

- Difficult to Manage on Mobile: You can’t easily create or send a GST bill format PDF from your phone when you’re on-site or away from your computer.

- Cluttered Record-Keeping & No GSTR-1 Prep: Your invoices are just separate files. You can’t automatically generate GSTR-1 or other sales reports, making tax filing a manual, time-consuming process.

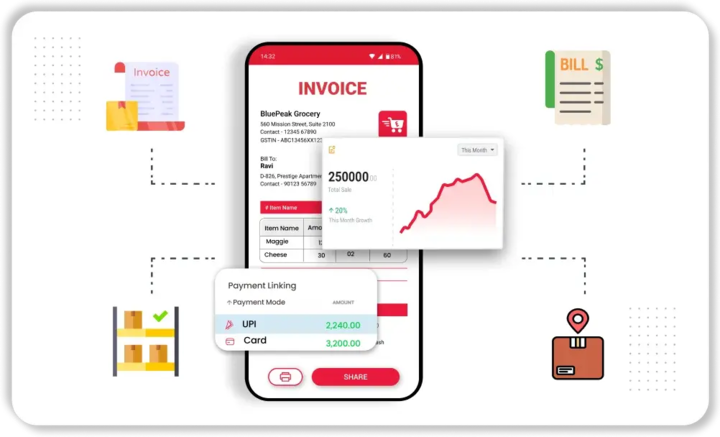

Top 5 Benefits of Switching to Vyapar for GST Invoicing

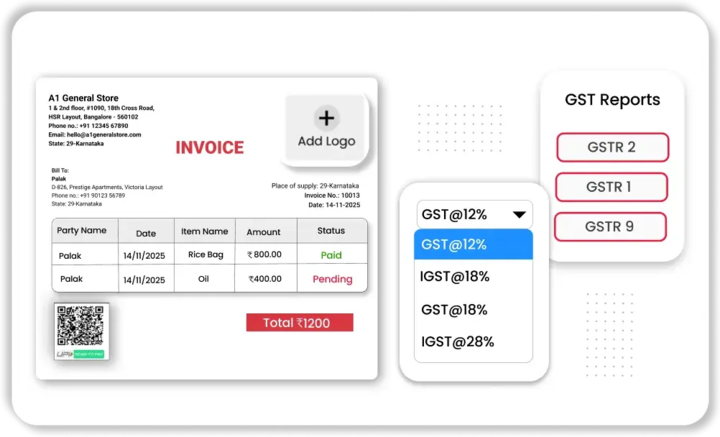

100% Error-Free GST Invoicing

Automatically calculates CGST, SGST, and IGST with 100% accuracy, every time.

Generate GSTR Reports Instantly

Stop manual data entry. Generate GST reports like GSTR-1 and GSTR-3B directly from your invoices in one click.

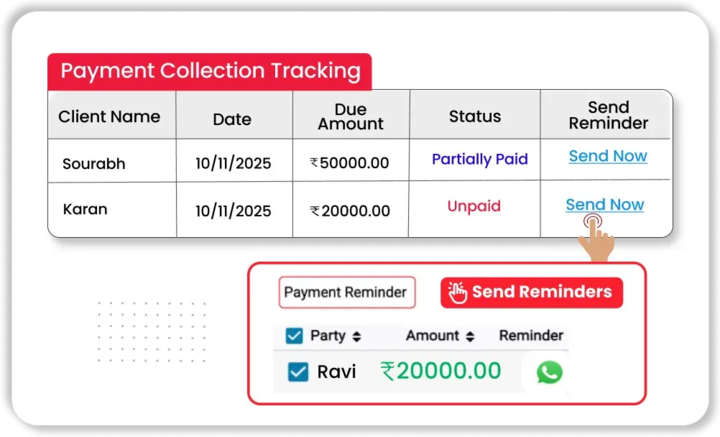

Get Paid Faster with Payment Reminders

Automatically send payment reminders via WhatsApp, SMS, or email for all invoices as soon as they pass their due date.

Accept Online Payments

Add a QR code directly to your invoices so customers can pay you instantly via UPI or other online methods.

Manage Everything in One App

Your invoices, inventory, payments, expenses, and bank accounts are all synced in one place, on your phone and desktop.

Explore Our More Format and GST Calculator Pages

Download free GST-compliant quotation templates in PDF, Word & Excel, ideal for Indian businesses needing tax-ready formats.

Access GST bill book formats in PDF, Word & Excel, and streamline billing for registered entities under GST.

Get GST credit note templates in PDF, Word & Excel, useful for issuer adjustments, returns or refunds under GST.

Download GST debit note templates in PDF, Word & Excel, suitable for upward corrections or additional charges.

Free GST reconciliation formats in Excel, PDF & Word help you align books with GST returns effortlessly.

Use Vyapar’s free online GST calculator, compute CGST, SGST/IGST, taxes and totals for Indian transactions in seconds.

Did not find what you were looking for?

Frequently Asked Questions (FAQs)

A GST invoice is issued for taxable goods/services and must show the GST amount. A Bill of Supply is issued for GST-exempt goods/services (or by a Composition Scheme dealer) and does not show any tax.

For goods, you must issue the invoice on or before the date of dispatch/delivery. For services, you have 30 days from the date the service was provided.

A GST invoice is mandatory for all B2B sales. For B2C sales, you must issue an invoice if the value is over ₹200. If it is less than ₹200, it is not mandatory unless the customer demands one.

Yes, slightly. For a B2B invoice, you must include the customer’s GSTIN so they can claim Input Tax Credit (ITC). For B2C invoices (to a regular customer), the customer’s GSTIN is not required.

The customer (or end consumer) pays the GST amount to you (the seller). You then collect this tax from your customer and remit it to the government on their behalf.

A Simple GST Bill Format is a clean, easy-to-read template that contains all the mandatory GST fields (like GSTIN, HSN code, tax breakup) without extra clutter. It’s perfect for small businesses.

This page provides several tax invoice formats in Excel, free download options. These “GST bill format in Excel” templates are ideal for using formulas to automatically calculate tax and totals.

Yes. We also offer a GST invoice format in Word (or “Tax invoice Format in Word”). This format is useful if you need to add long descriptions, but you must calculate all totals manually.

A Tax Invoice is a final, legal bill demanding payment for goods/services already delivered. A Proforma Invoice is a preliminary, or “draft” bill, sent to a client before the goods are sent, often to request an advance payment.

Yes. Vyapar is a fully GST-compliant billing software that includes an e-invoicing feature, allowing you to generate and manage IRN-backed e-invoices directly from the app.

Yes. The Vyapar app works across all your devices. It is available for iOS (iPhone/iPad), Android, Windows (desktops/laptops), and macOS.

Yes. The basic mobile version of the Vyapar app for Android has a lifetime free plan that includes creating GST invoices. For more advanced features, like syncing across all your devices, we offer affordable premium plans with a free trial.