Saas Invoicing Software

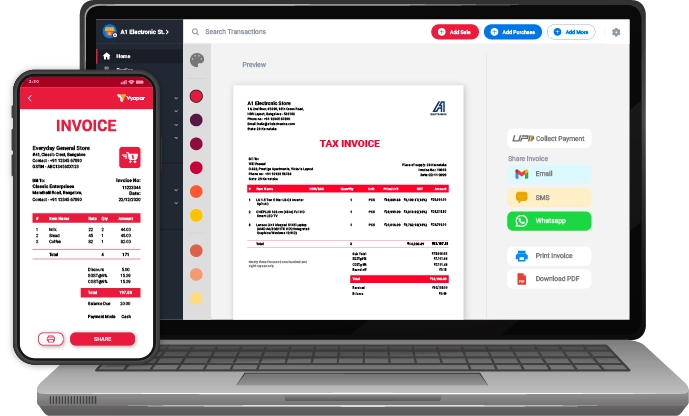

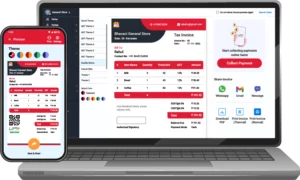

Send invoices online via numerous means with Vyapar SaaS invoicing software. Invoices can be sent immediately from the software by email or WhatsApp. Try the 7-day free trial now.

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

Key Features Of Vyapar Saas Invoicing Software

Invoicing And Billing

Vyapar’s SaaS invoicing solution allows b2b SaaS companies to generate professional invoices, manage recurring payments, and keep accurate financial records. Users can upload their company logo, select invoice templates, and edit areas to contain payment information.

Businesses can automate the invoice generation process. Users can create recurring billing for loyal clients. It saves time and works in manually preparing invoices each time. This is especially beneficial for firms that use subscription-based or recurring revenue models.

Vyapar makes tax calculations and management easier. It supports numerous tax rates, including India’s GST (Goods and Services Tax). It computes taxes automatically based on the rules you choose. You can avoid manual efforts and cut down on errors.

Our SaaS invoicing software is compatible with accounting applications like Tally. It facilitates the synchronisation of invoicing and financial data. The software also allows for data export in a variety of formats like PDF, Excel, and so on.

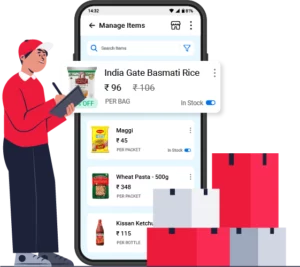

Inventory Management

Vyapar enables firms to efficiently track their inventories. It enables users to build a centralised inventory database for managing goods, stock levels, and variants. You can correctly monitor your inventory levels, ensuring efficient stock management.

Our SaaS invoicing solution makes it easier to handle purchases and sales by giving tools for recording and tracking purchases and sales orders. Users can easily generate purchase orders, record supplier information, track order status, and manage sales orders.

Vyapar’s stock alert and reorder management tools assist organisations in avoiding stockouts and overstocking. Users can specify custom reorder points for products, and the software will notify them if stock levels fall below a certain threshold.

Vyapar provides accurate inventory valuation, helping businesses assess the value of their stock at any given time. It supports various valuation methods. It allows businesses to choose the most suitable approach for their inventory management needs.

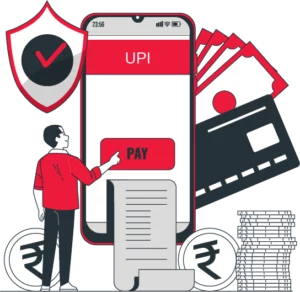

Multiple Payment Getaways

Our SaaS invoicing system allows businesses to take recurring payments via a variety of payment methods. This tool enables enterprises to reach a broader customer lifecycle. It has the potential to improve your invoicing and payment procedures.

Vyapar integrates with PayPal, Stripe, Razorpay, Paytm, and others. Businesses can provide their clients with various payment alternatives, such as credit/debit cards, net banking, digital wallets, and UPI (Unified Payments Interface).

Vyapar’s invoice system gives customers the option to choose their preferred payment method. Different clients may have different payment preferences or may feel better at ease with a particular payment provider.

Companies can speed up the payment collection process. Customers can pay immediately through the invoice using their preferred payment gateway. It eliminates the need for manual operations and various payment sites.

Reports And Analytics

Vyapar’s billing system offers a variety of financial reports that provide firms with a detailed picture of their financial status. Profit and loss statements, balance sheets, cash flow statements, and other reports can be generated by users.

Businesses can receive detailed insights into their sales performance using Vyapar’s sales reports. Users can study sales patterns. They can track income earned, identify top-selling items, and evaluate teams’ performance.

Vyapar’s reporting and analytics section provides data visualisation tools. Our SaaS invoicing software uses charts and graphs to show payment information in a visually appealing and easy-to-understand way. The visual representations help firms quickly evaluate data, spot patterns, and draw actionable insights.

Businesses can make data-driven decisions by using Vyapar’s reports and analytics capability. These insights assist firms in identifying their strengths, weaknesses, opportunities, and dangers.

Bank Management

Vyapar SaaS invoice application allows businesses to immediately integrate their bank accounts into the programme. Users can use the interface to securely connect their bank accounts and import transaction data straight from their financial institutions.

Businesses can record and track various types of financial transactions using Vyapar’s bank management tool. Payments received, payments made, expenses, and other items can all be included. This makes it easier to estimate and manage cash flow.

Vyapar makes bank reconciliation easier. It is the process of matching and reconciling the software transactions with the bank statement. Users can compare imported bank transactions to those recorded in Vyapar. It assures accuracy and detects any discrepancies.

Vyapar allows businesses to keep track of their bank balances in real time. Account balances can be viewed immediately within the app by users. It does away with the necessity for manual computations or logging into multiple financial portals.

Benefits Of Using Vyapar Saas Invoicing Software

Easy-To-Use Interface

Vyapar has a clean and intuitive design that allows users to locate the necessary features and functions quickly. The layout is well-organised. It ensures that important tools and options are easily accessible.

The software has a quick and straightforward setup process. Users can easily create their accounts, set up their company profile, and start generating invoices within minutes.

Vyapar simplifies the process of creating and managing invoices. You can create invoices with a professional appearance, brand them with your company’s logo, and distribute them to clients with ease.

Cash Management

Vyapar allows you to accurately track your cash flow by recording all income and expenses. You can easily enter your daily sales, recurring payments received, and expenses incurred. It helps you maintain an up-to-date view of your financial transactions.

The SaaS billing solution enables you to record and categorise your expenses. It makes it easier to track revenue recognition and where your money is being spent. This feature helps you analyse your expenses, identify areas for cost optimisation, and make informed financial decisions.

Vyapar provides a range of cash reports that give you valuable insights into your business’s financial health. You can generate reports such as cash flow statements, profit and loss statements, and balance sheets.

Personalised Invoices

Vyapar offers a variety of professionally designed invoice templates that you can personalise to match your brand identity. You may add your corporate logo, select a colour scheme, and customise the layout to produce bespoke invoices that reflect your brand’s style.

Vyapar SaaS invoicing solution enables you to include specific components in your invoices based on your company’s needs. You can include line items for the products or services offered, as well as specific pricing, quantities, and discounts. You can also include extra fields.

You may add thorough descriptions for each item on your invoices using Vyapar. This function lets you express the specifics of the products or services provided to your clients, assuring clarity. Detailed descriptions can aid in the avoidance of misunderstandings or disputes.

Track Recurring Payments

Vyapar invoicing software allows you to record all incoming payments, including cash, cheques, bank transfers, and digital payments. You can easily enter the details of each payment received. It ensures that you have an accurate record of all the recurring payments your business has received.

You can link payments to specific invoices. It makes it easy to track which invoices have been paid and which are still outstanding. You can set reminders for clients who have pending invoices. It makes sure that you follow up promptly and receive payments on time.

With the Vyapar SaaS invoice application, you can track the status of each payment. It provides you with a real time overview of your receivables and helps you identify any outstanding recurring payments that require attention. You can easily monitor the payment status of individual clients or generate reports to view the overall payment trends.

Data Security

Vyapar stores your data in a secure cloud infrastructure. This infrastructure is built with strong security measures in mind. Data encryption, firewalls, and access controls are all part of it. Vyapar provides a dependable and secure environment for storing and accessing your company’s data.

Vyapar protects your data with industry-standard encryption technologies. This ensures that your data is secure both in transit and when stored in the cloud. Encryption offers an additional degree of security by encoding your data and rendering it unreadable to unauthorised users.

Our SaaS invoicing software performs regular data backups to prevent data loss and assure business continuity. These backups are kept in separate secure places from the core data storage. It reduces the chance of data loss due to hardware failure, natural calamities, or human error.

24/7 Access

Our SaaS invoice solution operates on a cloud-based subscription management platform. You can access your Vyapar account and data from any device with an internet connection. Whether working from your office, home, or on the go, you can securely log in to Vyapar and access all your business management tools and data.

Our SaaS invoicing software is compatible with a wide range of devices. You can use it on desktop computers, laptops, tablets, and smartphones. The versatility ensures that you can access and use Vyapar on the device of your choice.

Vyapar employs real time data syncing. So any changes you make to your account or data are instantly updated across all devices. This ensures you have access to the updated payment information, regardless of your device.

How To Choose The Best SaaS Invoicing Software?

You must carefully analyse a number of variables before selecting the best SaaS (Software as a Service) invoicing software for your company. You can use the following actions to aid in the choosing process:

Identify Your Invoicing Requirements:

Start by understanding your business’s specific invoicing needs. It would be best if you considered certain factors. Analyse the number of invoices you produce, the difficulty of your billing procedure, the need for a system interface with other systems (like accounting software), and any unique features.

Research And Evaluate Options:

To find trustworthy SaaS invoicing software:

- Do extensive research.

- Look for software that complies with the needs you have defined.

- Take into account elements like user reviews, ratings, and reputation in the business.

- Choose software with dependability, security, and client happiness history.

Assess Ease Of Use And User Interface:

The software you choose must be user-friendly and have an intuitive interface. Look for software that offers easy navigation. Consider whether the software provides customisable templates, automation options, and a precise process for creating and managing invoices.

Check Integration Capabilities:

See if the invoicing software integrates seamlessly with other systems you use. Is it compatible with business accounting software, CRM subscription management platforms, or payment gateways? Integration can streamline your workflow. You can reduce manual data entry and ensure data consistency across systems. Make sure that the software offers the necessary integration options or APIs to connect with your existing tools.

Consider Scalability And Flexibility:

Check if the invoicing programme can scale with your business as it grows. Look for billing software that can handle an increase in the volume of invoices. Multiple users must be supported, and it must support additional features or customising options. Flexibility is essential since it enables you to customise the software to meet your unique business and invoicing needs.

Assess Security And Data Protection:

Since invoicing software deals with private financial information, data security is crucial. Evaluate the security measures in the software. Check if it has data encryption, access controls, and regular backups. Verify that the provider complies with applicable data protection laws.

Review Customer Support And Service:

Evaluate the software provider’s level of customer service.

- Look for customer lifecycle support channels, including phone, email, and live chat, that are simple to use and have timely responses.

- Consider whether there are any resources like user forums, knowledge bases, or manuals that can help you solve problems.

Evaluate Pricing And Value:

Examine the pricing structure to see if it fits your spending plan and the expected volume of invoices. To estimate the value you will receive for your money, compare the features offered at various pricing points. You must try the software’s operation and determine its suitability with free trials or demo versions.

Seek Recommendations And Reviews:

You must check the reviews for the software.

- Consult peers or business experts who know about SaaS invoicing programmes.

- Ask for advice and their opinions on the advantages and disadvantages of different software options.

- Check internet reviews and testimonials for better insights.

Advantages Of Using SaaS Invoicing Software

Using SaaS (Software as a Service) invoicing software offers several advantages for businesses.

- Businesses no longer need to spend money on expensive hardware, infrastructure, and software development. They can purchase a subscription service instead to have access to the software online.

- SaaS software may readily adapt to handle increasing consumption or more features as firms expand or their needs change. Flexibility and adaptability are ensured.

- Any device with an internet connection can use SaaS invoicing software. Users can access and manage invoices from any place, which is very useful for mobile workers, remote teams, and b2b SaaS companies with many locations.

- SaaS invoicing software often offers integrations with other business tools. They usually integrate with CRM programmes, payment gateways, or accounting applications. It streamlines data interchange, lessens the need for human data entry, and increases workflow effectiveness.

- SaaS invoicing software prioritises data security and establishes strict safeguards to safeguard customer data. They frequently have specialised security teams and use encryption techniques to protect data. Additionally, regular data backups are carried out to lower the chance of data loss.

- Software as a service (SaaS) invoicing includes built-in analytics and reporting functions. These enable b2b SaaS companies to analyse important KPIs, keep an eye on payment statuses, and thoroughly understand their financial health by drawing insights from their invoicing data.

Recommended by Leading Industry Experts

5.0/5.0

4.4/5.0

4.6/5.0

Frequently Asked Questions (FAQs’)

SaaS invoicing is the process of generating and managing invoices using Software-as-a-Service (SaaS) platforms. It is also known as Subscription-based billing. SaaS billing models help save time and costs. It reduces manual efforts by automating invoices. Your company can collect revenue via a recurring billing system with SaaS billing software.

Invoice Generation

Automation and Integration

Payment Processing

Invoice Tracking and Management

Customisation and Branding

Our SaaS invoicing system offers customisation options. Your invoices can be made unique by including your company logo, choosing colours, and changing the layout. You can also customise the invoice details to reflect your brand identity by adding custom fields.

Recurring billing is supported by Vyapar SaaS invoicing software. You can create recurring profiles for clients who pay regularly, such as monthly or quarterly invoices. The software will generate and send these recurring invoices automatically, depending on the chosen intervals.

Here are the benefits of using Vyapar SaaS invoicing software:

It automates invoice creation and management.

It reduces manual effort and saves time.

SaaS invoicing software minimises errors by automating calculations.

It allows businesses to send invoices quickly and receive payments faster through online payment gateways.

All invoice-related information is stored in one place.

Yes. Vyapar SaaS invoicing software includes tools for tracking payments and monitoring past-due invoices. You can quickly view each invoice’s payment status, set up automated reminders for late payments, and generate reports to assess payment trends and outstanding balances.

Businesses can adopt several types of Software as a Service (SaaS) invoicing subscription models. Here are some common types of SaaS invoicing subscription models:

1. Flat-Rate Pricing: Customers pay a fixed monthly subscription or annual fee for using the SaaS invoicing software.

2. Tiered Pricing: Businesses use to provide clients with various products or services at various price points and customers can choose the package that best suits their needs.

3. Usage-Based Pricing: In this model, customers are billed accordingly by the number of invoices generated, transactions processed, or other SaaS metrics.

4. Per-User Pricing: In this model, customers are charged based on the number of users accessing the SaaS invoicing software.

5. Value-Based Pricing: The cost of the SaaS invoicing software is determined based on the value it delivers to the customer’s business.

6. Freemium Model: Initially a basic version of the software for free will be provided later on it will be charged for additional features, higher usage limits, or premium support.

7. Custom Pricing: SaaS invoicing providers offer custom pricing models tailored to the specific needs of large enterprises or businesses with unique requirements.