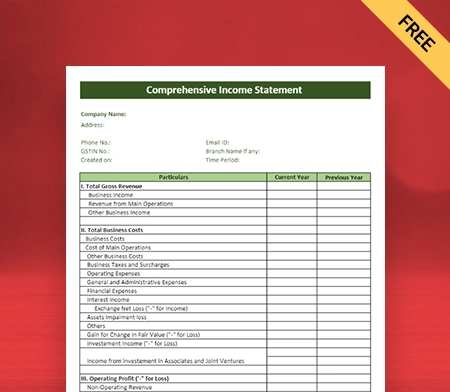

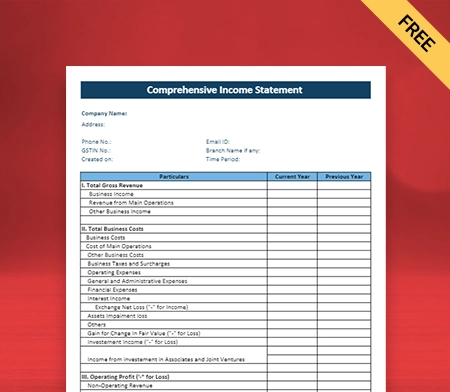

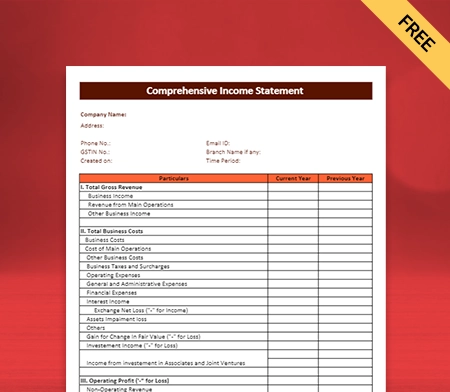

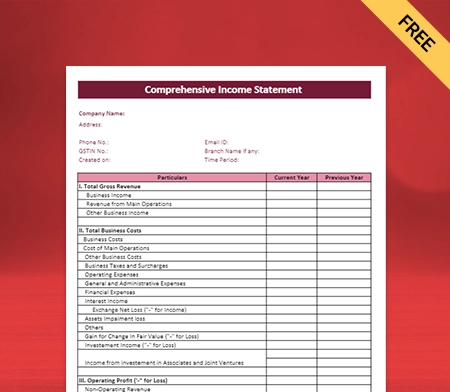

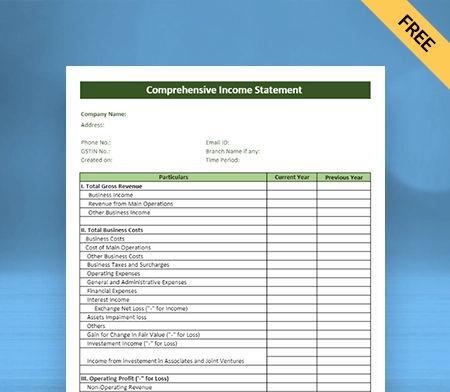

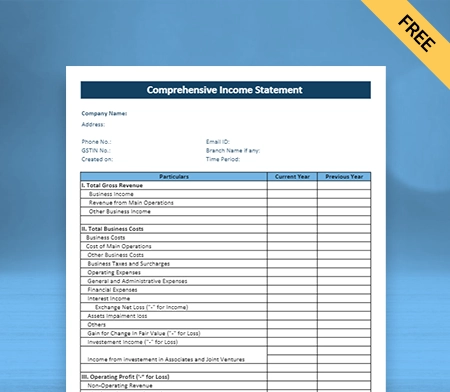

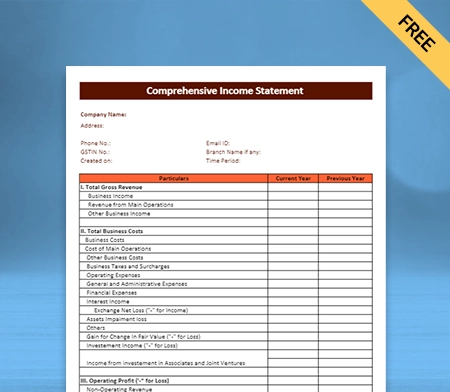

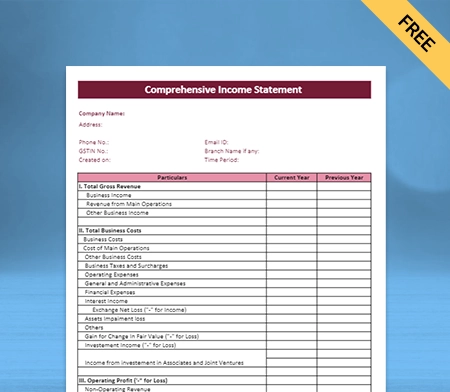

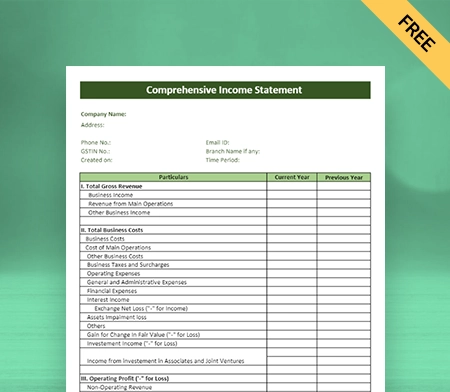

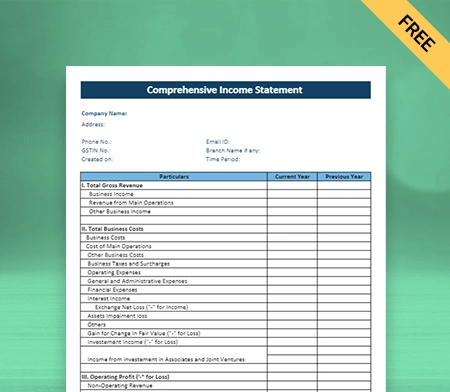

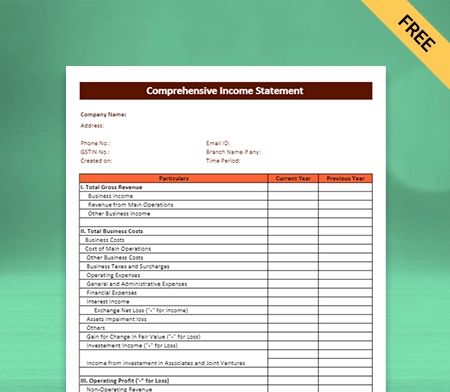

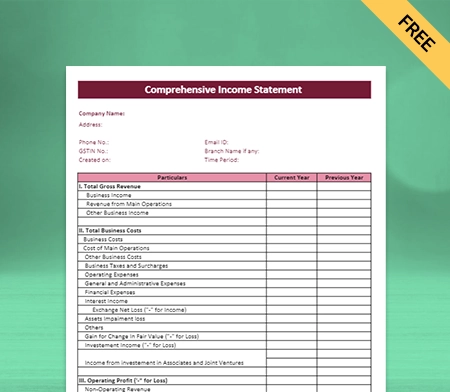

Statement Of Comprehensive Income Format

Prepare income statements with our free statement of comprehensive income format. Vyapar allows you to easily create a format with the least complexity, download it now for free!

Table of contents

- Download Statement Of Comprehensive Income Format in Excel

- Download Statement Of Comprehensive Income Format in PDF

- Download Statement Of Comprehensive Income Format in Word

- Download Statement Of Comprehensive Income Format in Google Docs

- Download Statement Of Comprehensive Income Format in Google Sheets

- What is A Comprehensive Income Statement?

- What is Included In A Comprehensive Income Statement Format?

- Difference Between The Income Statement And The Comprehensive Income Statement

- Advantages Of Preparing The Statement Of Comprehensive Income

- Benefits Of Using The Statement Of Comprehensive Income Format By Vyapar

- Features Of Vyapar Accounting Software For Small Businesses

- Frequently Asked Questions (FAQs’)

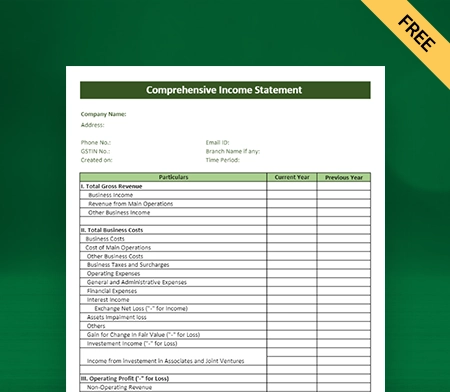

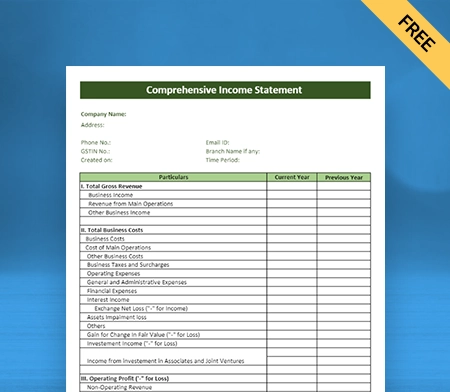

Download Statement Of Comprehensive Income Format in Excel

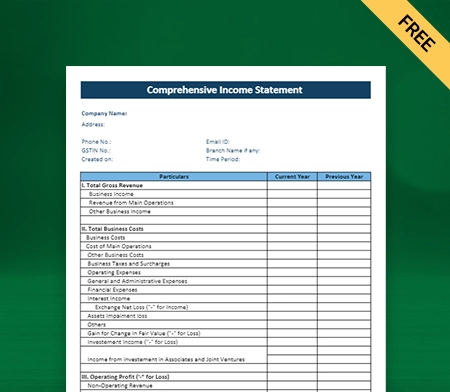

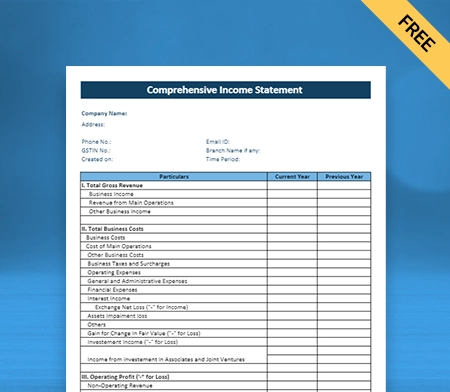

Download Statement Of Comprehensive Income Format in PDF

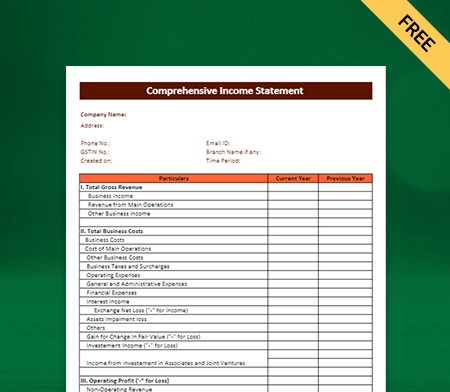

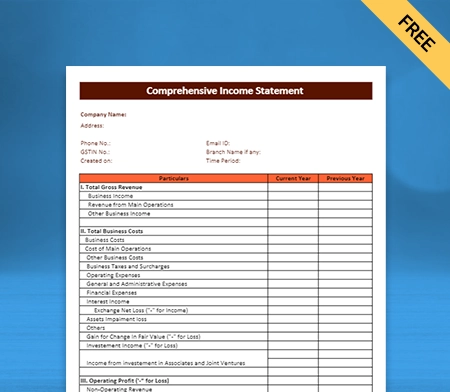

Download Statement Of Comprehensive Income Format in Word

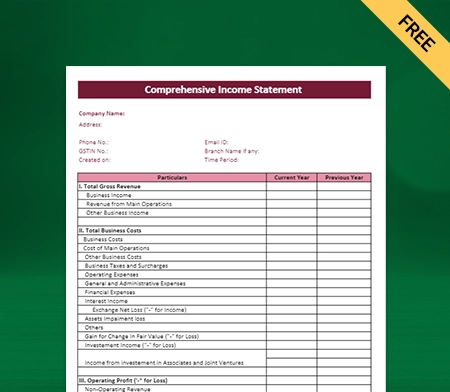

Download Statement Of Comprehensive Income Format in Google Docs

Download Statement Of Comprehensive Income Format in Google Sheets

What is A Comprehensive Income Statement?

Comprehensive income includes both net income and other comprehensive income (OCI). Companies use it to measure the change in a company’s equity during a specific period from transactions and assets that are not reflected in net income.

Net income represents the company’s profit or loss from its regular operations. It is calculated by deducting expenses from revenues. It includes items such as sales revenue, cost of goods sold, operating expenses, interest income, and taxes.

Other comprehensive income (OCI) comprises gains and losses that are not recognized in the net income but directly affect shareholders’ equity. OCI includes unrealized gains or losses on available-for-sale debt securities, foreign currency translation adjustments, certain pension plan adjustments, and unrealized gains and losses on derivative instruments.

A comprehensive income statement, also known as a statement of comprehensive income, provides a detailed breakdown of a company’s financial performance over a specific period. Owner-caused changes in equity are excluded from the income statement.

What is Included In A Comprehensive Income Statement Format?

Revenue:

This section lists the company’s total sales or revenue generated from its primary operations. It includes the sales of goods or services, net of any discounts, returns, or allowances.

Cost Of Goods Sold (COGS):

COGS represents the direct costs associated with producing or delivering the goods or services sold. It includes expenses such as raw materials, labour, and manufacturing overhead.

Gross Profit:

Gross profit is calculated by subtracting the COGS from the revenue. It reflects the profitability of the company’s core operations before considering other expenses.

Operating Expenses:

This section includes various expenses incurred in running the business, such as selling expenses (e.g., sales commissions, marketing costs), general and administrative expenses (e.g., salaries, rent, utilities), research and development expenses, and other operating costs.

Operating Income:

Operating income is derived by subtracting the total operating expenses from the gross profit. It represents the profitability of the company’s operations after considering all operating expenses.

Non-Operating Income Or Expense:

This category includes income or expenses that are not directly related to the core operations of the business. It typically includes items such as interest income, interest expense, gains or losses from the sale of assets, and other non-operating activities.

Income Before Taxes:

Income before taxes is calculated by adding or subtracting the non-operating income or expense from the operating income.

Income Tax Expense:

This section reflects the income taxes owed by the company based on its taxable income, considering applicable tax rates and any tax credits or deductions.

Net Income:

Net income is the final figure obtained by subtracting the income tax expense from the income before taxes. It represents the company’s profit or loss after all expenses, and comprehensive income including taxes, have been accounted for.

Other Comprehensive Income:

This category includes certain gains and losses that are not included in the calculation of company net income. It encompasses items such as foreign currency translation adjustments, gains and losses on available-for-sale securities, changes in pension plans, and accumulated other comprehensive income-related items.

Comprehensive Income:

Comprehensive income is the total net income and other comprehensive income. It provides a more comprehensive view of the company’s overall financial performance.

Difference Between The Income Statement And The Comprehensive Income Statement

- The income statement primarily focuses on the company’s revenue, expenses, gains, and losses related to its core operations. It reports the net income or loss for a specific period. In contrast, the comprehensive income statement includes additional items. It contains comprehensive income, which encompasses gains and losses that are not part of the net income calculation.

- The income statement follows a traditional format. It starts with revenue, deducts expenses and taxes, and ends with net income. On the other hand, the comprehensive income statement provides a more detailed breakdown of the components contributing to comprehensive income. It often presents comprehensive income as a separate section or statement after the net income section.

- The income statement includes items directly related to the company’s operations, such as sales revenue, cost of goods sold, operating expenses, and taxes. In contrast, the comprehensive income statement includes other comprehensive income items, such as foreign currency translation adjustments, unrealized gains and losses on investments, and actuarial gains or losses on pension plans.

- The income statement provides a summary of the company’s profitability by reporting net income or loss. It helps stakeholders assess the company’s operational efficiency and its ability to generate profits. On the other hand, the comprehensive income statement offers a more comprehensive view of the company’s financial performance by including other comprehensive income items.

- The income statement does not directly impact the equity section of the balance sheet. Net income or loss is transferred to the retained earnings account, affecting the equity indirectly. In contrast, the comprehensive income statement directly impacts the equity section of the balance sheet.

- The income statement focuses on reporting net income, which is the difference between total revenues and total expenses. In contrast, the comprehensive income statement provides a broader measure of income by including other comprehensive income items that are not part of the net income calculation.

Advantages Of Preparing The Statement Of Comprehensive Income

The statement of comprehensive income provides a more comprehensive and transparent view of a company’s financial performance. It allows stakeholders to understand the impact of non-operational factors on the company’s overall financial position.

The comprehensive income statement provides additional information beyond net income. It enables stakeholders to make more informed decisions. By considering items such as foreign currency translation adjustments or unrealized gains/losses on investments, stakeholders can assess the effects of these factors on the company’s financial health and future prospects.

Many accounting standards and regulatory bodies require the preparation and disclosure of a comprehensive income statement. By complying with these standards, businesses can ensure transparency and consistency in financial reporting, which enhances credibility and trust among stakeholders.

The statement of comprehensive income enables businesses to communicate a broader picture of their financial performance to investors and other stakeholders. It provides insights into the various components affecting the company’s profitability and financial position. It demonstrates the company’s commitment to transparent reporting.

The comprehensive income statement allows for a more holistic evaluation of a company’s overall performance. It considers not only the operational income but also the impact of other comprehensive income items. The broader assessment helps stakeholders gauge the company’s ability to generate sustainable long-term value.

By preparing the statement of comprehensive income consistently over time, businesses can analyse trends and changes in various income components. This analysis facilitates benchmarking, performance evaluation, and identification of areas where the company is experiencing significant gains or losses, thereby supporting strategic decision-making.

Benefits Of Using The Statement Of Comprehensive Income Format By Vyapar

Financial Performance Evaluation

The statement of comprehensive income format allows you to assess the company’s revenue streams and their sources. It provides details about sales, service income, and other sources of revenue.

By analysing revenue trends over time, you can identify growth or decline patterns and evaluate the effectiveness of the company’s sales and marketing efforts. The statement of comprehensive income helps calculate the gross profit or loss and operating income of the company.

The statement of comprehensive income format enables you to compare the financial performance of the company with competitors. You can identify areas where the company excels or lags behind and make informed decisions to improve performance.

Helps In Decision Making

The statement of comprehensive income format provides a breakdown of the company’s revenues by different sources. Resource allocation, product/service expansion, pricing tactics, and market targeting decisions can all be made by businesses with knowledge.

Detailed information regarding various expenses is included in the statement of comprehensive revenue. Businesses can pinpoint regions with high costs and look into cost-cutting options. Decisions about cost management, budgeting, and increasing operational effectiveness are aided by this study.

By computing metrics, firms can use the income statement to assess their profitability. The statement can be used by businesses to assess their capacity to raise capital for new initiatives, grow their business, buy assets, or seize strategic opportunities.

Mobile Accessibility

Users who have mobile and internet access can instantly add or edit the Vyapar format from their mobile devices and receive real-time updates. Users don’t need to wait till they are back at their computers to enter data, change numbers, or make new modifications.

The Vyapar statement of comprehensive income format can be easily shared and collaborated on with team members, stakeholders, or clients thanks to mobile accessibility. Mobile devices make it simple for users to distribute the format.

Working with the Vyapar format is more convenient and flexible because of mobile accessibility. Users are not limited to a particular location or device and can access and evaluate the format whenever it suits their schedules.

Time Saving And Efficiency

Vyapar formats offer predefined templates for various business documents. By using these standardised formats, businesses can ensure consistency in their documents and streamline the creation process. Users can quickly fill in the required information.

You don’t have to spend time designing or formatting business documents manually. The pre-designed templates are ready to use. This saves considerable time and effort compared to creating documents from scratch.

By using standardised Vyapar formats, businesses can maintain a consistent and organised approach to their documentation. It makes it easier to locate and retrieve information when needed. This contributes to overall efficiency by reducing the time spent searching for relevant details.

Automated Calculations

Vyapar statement of comprehensive income format enables users to create professional statements quickly and easily. It allows for automatic calculations of taxes and discounts and supports multiple currencies.

Vyapar financial accounting software simplifies financial accounting tasks by automating calculations of income, expenses, profits, and losses. It allows users to generate financial statements such as balance sheets, profit or loss statements, and cash flow statements.

Vyapar software is designed with a user-friendly interface. It makes it accessible even for individuals with limited accounting knowledge. Its intuitive layout and navigation features ensure that users can quickly adapt to the software and perform tasks efficiently.

Professional Appearance

The format provides a standardised structure for presenting a comprehensive income statement. It enhances the overall appearance and readability of the financial statements. This consistency gives a professional impression and facilitates easy comparison and analysis.

The format of Vyapar’s statement of comprehensive income ensures that the financial information is presented in a clear and organised manner. It includes headings, subtotals, and totals that allow readers to quickly understand it.

Vyapar allows customisation and branding options. Organisations can incorporate their logo, corporate colours, and other design elements to reflect their brand identity. This customisation adds a professional touch and creates a consistent visual identity across financial statements and other business documents.

Features Of Vyapar Accounting Software For Small Businesses

Integration With Bank Accounts

The integration with bank accounts feature allows users to seamlessly connect their business bank accounts with Vyapar. By linking your bank account to Vyapar, you can automatically import all your financial transactions.

Vyapar captures the relevant details from your bank transactions, such as payee information, date, and amount, and categorises them accordingly. It simplifies expense management and provides a clear overview of your business expenditures.

Reconciling your bank accounts becomes a breeze with Vyapar. The software automatically matches the imported bank transactions with the corresponding entries in your books, allowing you to quickly identify any discrepancies and ensure that you accurately balance your accounts.

The integration feature provides valuable insights into your cash flow by consolidating your bank account data with other financial information in Vyapar. You can monitor your inflows and outflows, track due payments, and effectively manage your working capital.

Seamless Reporting

Vyapar’s comprehensive income statement report presents a clear breakdown of your business’s revenues and expenses. You can easily view your total sales, cost of goods sold, operating expenses, and other income or expenses incurred during the reporting period.

The statement of comprehensive income generated by Vyapar automatically calculates the gross profit and net profit figures for your business. Gross profit represents the difference between total sales and the cost of goods sold. Net profit reflects the residual income after accounting for all expenses.

These figures provide valuable insights into your business’s profitability and help in assessing its financial viability. You can easily generate financial reports for multiple periods and analyse the changes in revenue, expenses, and profit over time.

Vyapar offers flexibility in customizing your income statement reports. You can select the reporting period, choose specific accounts or categories to include or exclude, and even add additional notes or comments to provide further context.

Income Tracking

Vyapar’s income tracking feature allows you to easily record and categorize your income sources. You can capture details such as sales revenue, service fees, and interest income. This streamlined income recording process ensures accurate and organized financial data.

The income tracking feature provides a detailed breakdown of your income sources. Vyapar generates a comprehensive report that outlines the individual revenue streams contributing to your total income. It helps you understand the composition of your income.

Vyapar’s income tracking feature enables you to compare income data across different periods. You can generate financial reports for multiple periods and analyse the changes in revenue streams over time.

The Vyapar Statement of Comprehensive Income format income tracking feature empowers you to effectively monitor your income sources. You can gain valuable insights into your business’s revenue generation.

Expense Management

Vyapar makes expense recording a breeze. You can easily input your business expenses, such as purchases, utilities, rent, salaries, and other expenditures, directly into the software. This streamlined process ensures that we accurately record and organize all expenses for analysis.

You can categorise and classify your expenses according to predefined categories or create custom categories that align with your business needs. The classification enables you to gain insights into different expense types.

Vyapar inventory management software automatically tracks and calculates your expenses based on the data entered. The software aggregates expenses across various categories and generates comprehensive expense reports. It allows you to monitor your spending patterns.

The expense management feature of Vyapar’s Statement of Comprehensive Income format empowers you to take control of your business expenses. By effectively tracking and analyzing your expenses, you can identify areas of inefficiency, optimize spending, and maximize profitability.

User Friendly

Vyapar boasts a clean and intuitive interface that guides users through the process of generating and analyzing the Statement of Comprehensive Income. The software presents a clear layout with easily identifiable sections.

The logical flow of data entry fields helps users accurately record financial information without confusion or guesswork. It ensures that users can quickly locate and access the relevant features and information they need.

Vyapar simplifies the process of entering data for the Statement of Comprehensive Income. The invoicing software provides user-friendly forms and fields where users can input their revenue and expense data.

Vyapar offers predefined categories for income and expense classification, reducing the effort required to set up the statement. Users can simply select the appropriate categories from the provided list or customise them to align with their specific business needs.

Data Safety

Vyapar employs robust data storage measures to safeguard your financial information. All your income, expense, and related data are securely stored within the software. It ensures that your sensitive financial data is protected from unauthorised access or data breaches.

Vyapar uses industry-standard encryption protocols to secure your data during transmission and storage. The encryption technology ensures that your financial information remains confidential and protected from potential security threats.

Vyapar’s Statement of Comprehensive Income format includes automatic data backup functionality. We regularly back up your financial data. It minimises the risk of data loss due to system failures, hardware malfunctions, or other unforeseen circumstances.

Vyapar allows you to set up access controls and user permissions within the software. You can define who can view, edit, or access your financial data. It ensures that only authorised individuals can work with sensitive financial information.

Frequently Asked Questions (FAQs’)

Comprehensive income combines net income and OCI to provide a more comprehensive view of a company’s financial performance and its overall change in equity. It helps stakeholders understand the impact of various non-operating items on the company’s financial position and value.

The statement of comprehensive income format refers to a specific format or template used to present the statement of comprehensive income for a business.

The statement of comprehensive income is an important financial statement that provides an overview of a company’s revenues, expenses, gains, and losses over a specific period. It helps in evaluating the profitability and financial performance of a business.

A statement of comprehensive income is usually prepared quarterly, semi-annually, or annually. The frequency of preparation depends on the reporting requirements of the company and the needs of its stakeholders.

The statement of comprehensive income format typically includes the following components:

Revenue or Sales

Cost of Goods Sold (COGS)

Gross Profit

Operating Expenses

Operating Income or Operating Profit

Other Income or Expenses

Net Income Before Tax

Tax Expense

Net Income

Other Comprehensive Income

Total Comprehensive Income

Yes, comprehensive income can be negative if the net income for the period is negative, and the other comprehensive income items also result in losses. A negative comprehensive income indicates a reduction in a company’s equity due to losses incurred during the reporting period.

Related Posts: