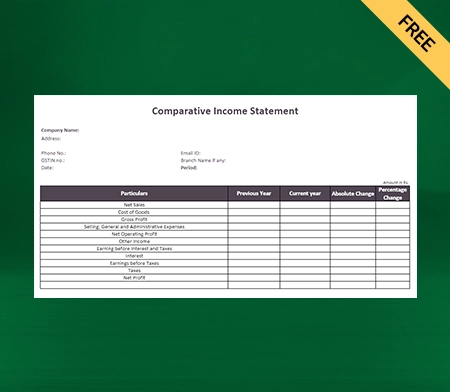

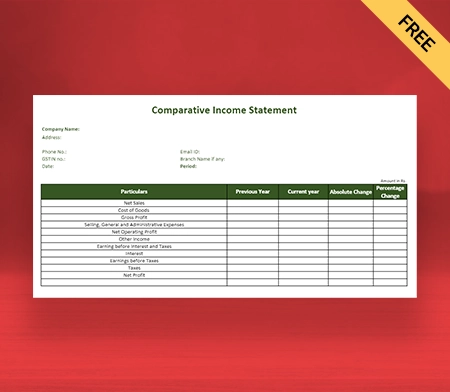

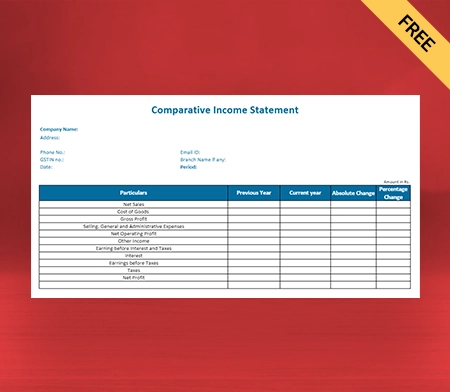

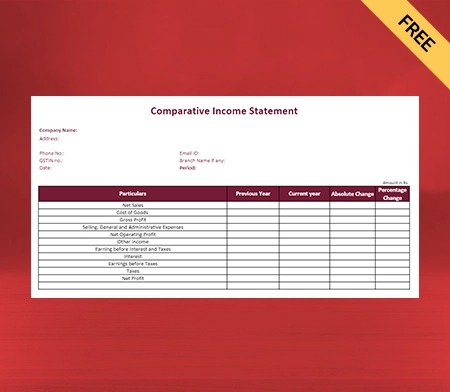

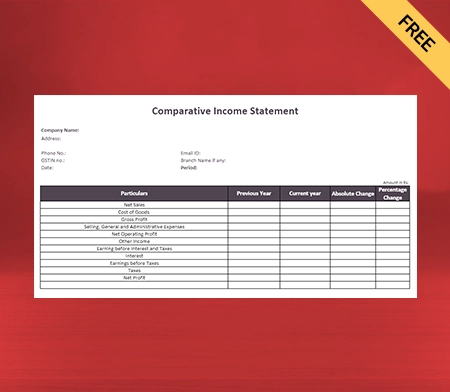

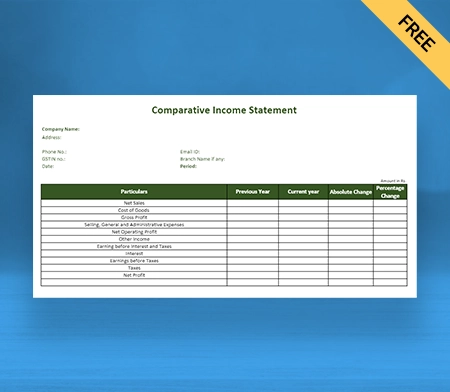

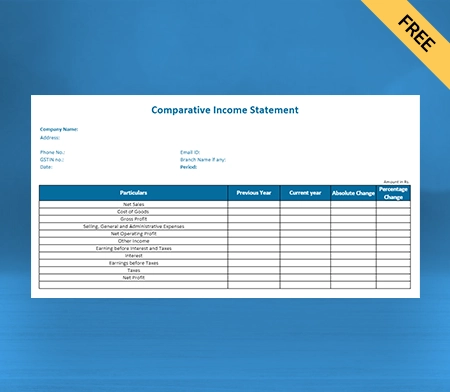

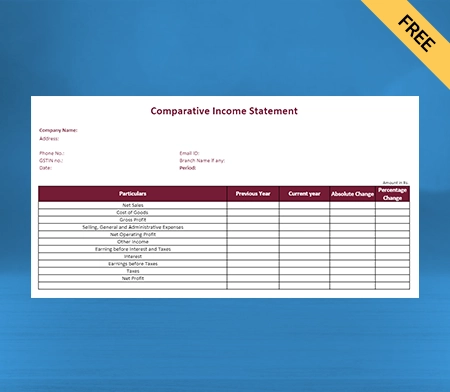

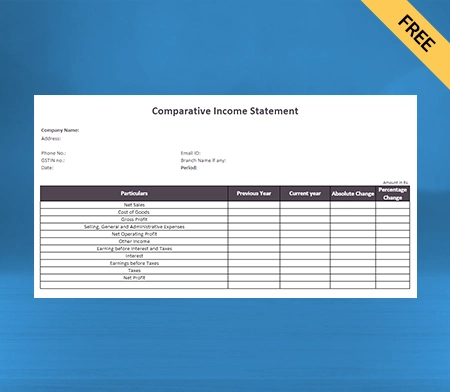

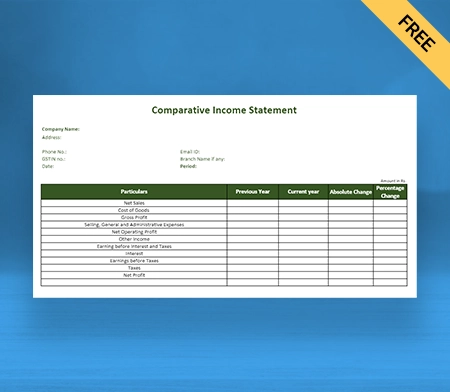

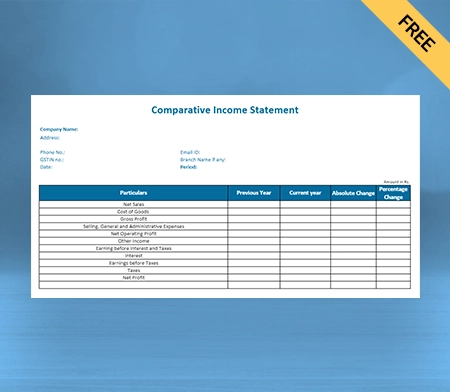

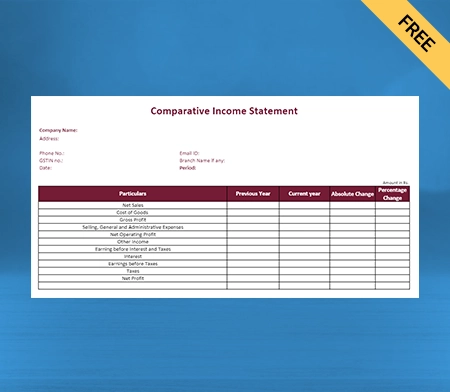

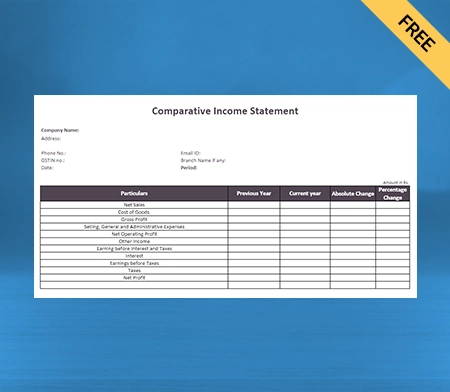

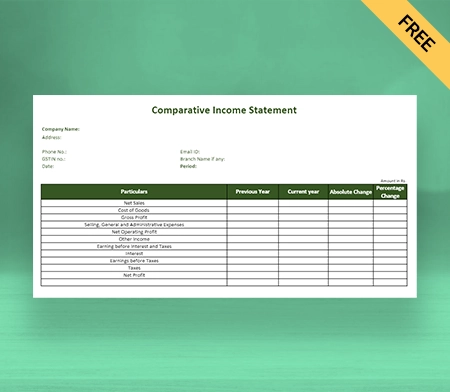

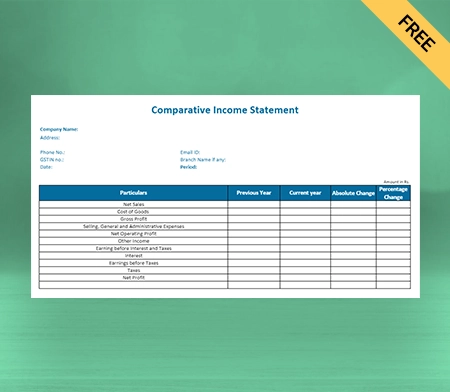

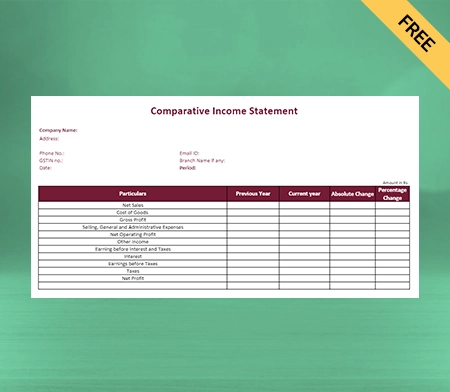

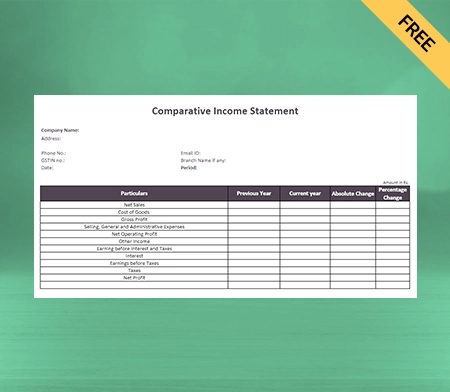

Comparative Income Statement Format

Compare your brand’s income against expenses through a comparative income statement. Vyapar allows you to prepare a comparative income statement in the least complex manner. To use billing software Vyapar’s Comparative Income Statement Format, download the free now!

Download Comparative Income Statement Format in Excel

Download Comparative Income Statement Format in PDF

Download Comparative Income Statement Format in Word

Download Comparative Income Statement Format in Google Docs

Download Comparative Income Statement Format in Google Sheets

What is a Comparative Income Statement Format?

A comparative income statement is a financial instrument that presents a company’s financial performance. The financial performance listed in this statement is for two or more consecutive years. A side-by-side comparison of your income allows you to analyse the economic foundation of a company.

The term income statement is a popular financial term, also referred to as a statement of operations or profit and loss statement. It’s a company’s fundamental financial statement, summarising the losses, gains, expenses, and revenues over a certain period. The income statement format determines a company’s ability to generate profits through its operations.

Creating a comparative income statement is a challenging task. Small Business Accounting Software Vyapar has noticed this concern and devised a solution, i.e., a comparative income statement format. With a pre-designed format, creating a comparative income statement is easy and time-saving. All you need to do is add data, and you will get a statement in minutes.

Besides, it’s an easier option for creating a comparative income statement. There’s a less easy way also, which is to create one from scratch. It depends upon the preference of the company, whichever method of creating this statement suits them. However, if you choose the second option, ensure you know about the essential content of the comparative income statement format.

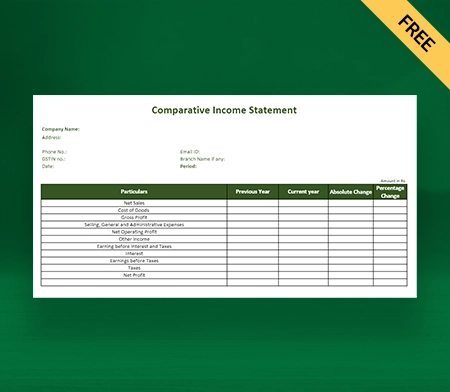

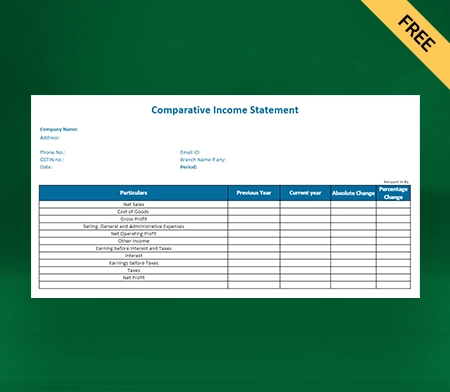

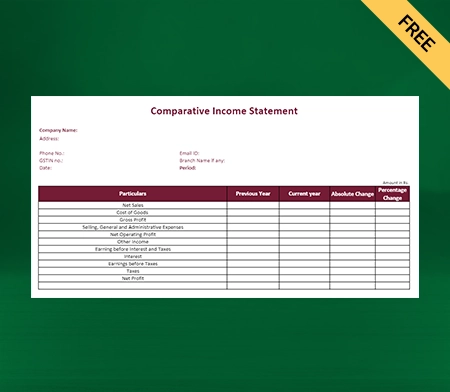

What Should A Comparative Income Statement Format Include?

Since we are discussing a statement that helps you understand your financial condition, it’s crucial to get everything right. The comparative income statement format consists of various critical financial elements to keep in check. Some of the key elements are presented below:

Company Name And Period Of Comparison

The first essential thing you must include in a comparative income statement is your brand name. It helps avoid any confusion that may emerge later. Further, having the company name is helpful if you share the statement with accountants or lawyers.

In addition to the company name, the comparison period must include. The comparison period helps specify the time frame covered by the income statement. It could be a month, quarter, or year. A comparative income statement is usually based on two or more years.

Total Revenue

The second important element of a comparative income statement is “total revenue”. Total revenue refers to the total income your business earns through its core business operations. It includes the income earned from sales of services or goods alone. In addition to income earned from general sources, you must include other income figures.

For example, your business might earn income through other activities. You have to include that income as well. Simply put, all the activities you do regularly and earn your income must be included under the “total revenue”. Having these headings helps you understand your income potential in the easiest way possible.

Cost Of Goods Sold (COGS)

Cost of goods sold or COGS refers to the money spent on making the final product. Here we are talking about the final product, i.e., the goods or services sold to customers. The figure of COGS includes all the direct expenses linked with acquiring or producing the final goods or services the business sells.

The expenses could be the cost of raw materials, labour costs, manufacturing expenses, transit costs, overheads, etc. The cost of goods sold is subtracted from the amount of total revenue to calculate gross profit. Gross profit is used as the figure to get insights into a company’s profitability in terms of sales.

Operating Expenses

When discussing the comparative income statement format, it’s hard to ignore the expenses. If we are comparing incomes, the costs that are incurred in the process of earning them have to be considered. So when it comes to operating expenses, it includes all the amount that is used to support your day-to-day business operations.

An interesting fact about operating expenses is that they are not directly tied to manufacturing activities. Instead, these indirect expenses are used against those needs essential for running a business smoothly. For example, salaries, marketing expenses, property rents, administrative costs, etc.

Income Tax Expense

Every business that runs on profits, excluding non-profit organisations, must pay income tax. Your comparative income statement also includes the income tax you have paid. Corporate income tax is a permanent expense for a company that must be paid anyhow.

If you have filed income tax returns, you already have the figures for the required year frame. Simply include the tax amount in the dedicated tax column. However, if you haven’t filed the tax or don’t have the tax figure, we recommend you file the taxes as soon as possible. Without the tax figure, the comparative income statement format is incomplete.

Non-Operating Income (Or Loss)

There are two types of income that we talk about when it comes to comparative income statements. The first is operating income, which we have already covered, and the second is non-operating income or loss. The non-operating income or loss refers to the losses or revenues derived from activities outside a business’s core operations.

It includes income earned from interest, investment gains, foreign exchange gains, etc. Non-operating losses, on the other hand, include investment losses, capital losses, etc. Non-operating income and losses are generally presented separately in a comparative income statement to have a clear view of the company’s profitability.

Gross Profit

It is a critical metric included in a comparative income statement. Gross profit is calculated by subtracting the total cost of goods sold from the total revenue earned. If you are creating a comparative statement from scratch, you can not ignore the column for gross profit. Without it, your income statement is incomplete.

Analysing the changes in gross profit helps identify the effectiveness of the company’s pricing strategy. When you have an idea of pricing strategy and insights from your comparative income statement, making the right decision becomes easy. Your chances of making unfavourable financial decisions are lowered, helping you strengthen your treasury.

Why Should Companies Use A Comparative Income Statement Format?

A comparative income statement is an excellent tool for evaluating and analyzing your financial performance. Every successful brand with a strong financial foundation has used this statement to better understand its income and expenses. Here are some significant reasons why you should, too, use a comparative income statement:

Identify Changes In Financial Performance

A financially strong company accomplishes business goals faster than one with fluctuating finance. Since we are talking about a business, identifying pitfalls in financial records isn’t easy. You would need a financial tool such as a comparative income statement to help you analyse your finances better.

A comparative income statement allows you to identify changes in your company’s financial performance within a given time period. The statement gives you a detailed comparison of income earned in a time frame and expenses against it. Having income and expenses side-by-side helps you achieve a clear view of your finances and, thus, better analyses.

Provide Context For Financial Results

A comparative income statement helps you get a clear context for your financial results. By presenting the finances from multiple periods in one place, you can get a clearer idea of changes, patterns and trends in your brand’s financial performance. This context is vital to identify whether the financial results have improved or are stable.

Moreover, a comparative income statement also allows businesses to assess the impact of external and internal factors on their financial outcomes. For example, changes in market conditions, business strategies and economic trends. You can make better financial decisions by examining financial data from multiple years.

Assess The Effectiveness Of Financial Strategies

Companies widely use comparative income statements to evaluate the effectiveness of their financial plans and strategies. By comparing finances across different periods, you can determine the area of improvement in your strategy. Identifying areas of improvement is the most challenging part. When you know them, progress can be made fast for better financial performance.

Let’s have a look at an example. Suppose a company implements cost-cutting measures. Now using a comparative income statement, it can determine whether this measure has resulted in improved profitability or reduced expenses. It makes the whole financial management process more effective and better result-oriented.

Track Financial Goals

Tracking financial goals is another good reason why brands across the globe use comparative income statements. By comparing financial results with predefined objectives, brands can monitor their progress more quickly. The comparative income statement format lets you determine if you are on the right track with your financial goals.

For example, you aim to increase your revenue by 10% each quarter. A comparative income statement will act as a medium for you to see what you did right and wrong. In simple words, you will have a blueprint of your track record. Nevertheless, regular tracking of financial goals with this statement will help you stay focused on your targets.

Help Investors Make Informed Decisions

Another great reason to use a comparative income statement is that it helps investors make informed decisions. The statement provides investors with all the information they need to assess the company’s financial performance. By using the insights from that information, investors can evaluate a company’s stability, profitability, and growth potential.

To be more precise, a comparative income statement gives insights into a firm’s ability to generate revenue consistently. Moreover, it also offers insights into cost control and whether the company can manage its operations well. Both data allow investors to make comprehensive decisions with a low risk of financial failure.

Support Financial Planning And Forecasting

Comparative income statements are also an excellent tool to help with financial planning and forecasting. The statement contains the financial data of a company for a certain year frame. By reviewing this data, companies identify financial relationships, patterns and trends that help make accurate and realistic financial projects.

Moreover, a comparative income statement is a reference point for calculating revenue estimates and expense levels. In addition, you can also assess the financial outcomes of certain strategies and make informed decisions towards business expansion, investments and resource allocations.

Comply With Regulatory Requirements

Comparative income statement format is by businesses to comply with their regulatory requirements. Financial reporting frameworks and accounting standards such as GAAP, IFRA etc., often require businesses to present financial data in a comparative format. This is to ensure that financial reporting offers comparability, consistency and transparency features.

A comparative income statement allows stakeholders to assess the financial performance of a company. In addition, it promotes convenience in identifying trends and making meaningful comparisons between multiple periods. By using comparative income statements, companies demonstrate their compliance with regulatory requirements.

Importance Of Comparative Income Statement Format In A Company

A comparative income statement is an essential financial tool that you cannot miss out on. If you ask why it’s important, there is no one answer. In fact, there are many answers to the importance of this statement. Some of them are as follows:

Identify Areas For Improvement

The comparative income statement format is an essential tool for a business to identify areas of improvement and make required changes to boost overall financial performance.

When we compare incomes of various time periods, it becomes easier for us to pinpoint specific revenue sources that are underperforming or declining. It can help you use your inventory in the best possible way to maximise sales and profits.

Working on underperforming sources will therefore help you accomplish your financial goals efficiently. In simple words, a comparative income statement format allows you to focus on the right area of business. Those areas that have a direct impact on the financial outcomes of your business.

Analyse Market Or Economic Effects

A comparative income statement format allows businesses to analyse the impact of economic factors on their financial performance. By comparing the income of various years, you can identify changes in revenue that have affected your finances.

Analysing all these factors and trends will help you understand the market dynamics. You can use the data to generate business reports that help you understand which products sell better than the others.

A comparative income statement format is an excellent financial tool that can help you gain insights into the market in an effortless manner. All the data from market analysis, economic effects and market dynamics will help you make informed decisions based on facts.

Assess Financial Health And Stability

The best way to predict the future of a company is by looking at its financial health. The stronger the financial health of a company, the better it will grow in the long run. You have to apply the same approach in your business as well.

Using a comparative income statement format, you can assess the financial health of your business in a timely manner. Moreover, you can also use this statement to identify the stability of your finances for a specific period.

This assessment of your financial health and stability will give you insights that you can use to make future predictions. Nevertheless, when you have an idea of your future finances, you can make the required changes in the present to ensure good future financial health.

Determine The Impact Of Changes

With a comparative income statement, you can determine the impact of changes in your strategies, external factors and operations on your company’s financial performance. When we compare incomes of various years, it becomes easy for us to analyse the cause-and-effect relationship between economic outcomes and specific business changes.

For example, your company introduced a new line of products or made specific changes in your marketing strategies. With the help of a comparative income statement, you can determine the overall impact of those changes on your company’s profitability, expenses and revenues.

Determining the impact of new business changes on your financial health is otherwise a tough job, which is made more accessible by a comparative income statement format.

Monitor Fluctuations In Profitability

Fluctuation and probability can impact the financial performance of your business significantly. Therefore, it becomes vital for you to use a comparative income statement format in this context.

A comparative income statement format offers a comprehensive view of profitability, allowing you to get a better look at the fluctuations. You can analyse comparative balance sheets and business reports to ensure profitability in your business.

Having a clear look at the fluctuations will allow you to identify negative or positive changes in net profitability. This, and in return, will give you enough time to take appropriate actions to control those fluctuations and manage financial performance in a sustainable way.

Provide Insights Into Cash Flow

In comparative income statement format, you can get exclusive insights into the cash flow of your company. This statement format primarily focuses on revenue and expenses. But despite that fact, it indirectly offers data about the cash flow. The data can be used to make informed strategies and decisions toward financial performance.

You can also use a comparative income statement to determine the sustainability and consistency of your cash flow generation. This way, it becomes easier for you to identify positive and negative trends in net income.

Lastly, you can use the insights derived from these trends to make strategies that improve cash management and better utilisation of working capital. Keeping cash flow in check helps maximise operating profit for any business.

Evaluate Return On Investment

Return on investment, as the name says, is the returns you get from the investment you make in a company. If you have multiple investors in your business, chances are, you would have to send a report to them from time to time.

Calculating return on investment is all about comparing incomes of various periods and concluding a percentage of positive or negative growth. Luckily, the easiest way to do so is through a comparative income statement format. You can track your business performance with comparative balance sheets created using the data.

A comparative income statement format allows businesses to evaluate ROI in the easiest way possible. This statement contains almost everything you would need to evaluate return on investment, saving you a lot of effort and time.

Frequently Asked Questions (FAQs’)

A comparative income statement format is a statement that offers data about financial performance for multiple periods. This statement makes it easier for businesses to compare the results and earnings. It helps analyse their finances effectively.

A comparative income statement is beneficial for both investors and stakeholders as it allows an easy understanding of financial data. Investors can use the statement to evaluate the returns on their investments made in the company.

Some of the critical components of a comparative income statement format are company name, period of comparison and total revenue. In addition, the cost of goods sold, operating expenses, income tax expense and gross profit is also key component. For details about them, scroll up!

In a comparative income statement format, we have financial data for more than one year. Single period income statement, on the other hand, contains financial data for just one year. The “number of years” is the primary differentiating factor between the comparative income statement and the single-period income statement.

A comparative income statement gives a detailed view of the financial health of your business and its earnings. You can use the statement to determine the financial fluctuations and take appropriate actions to cure them. Doing so will automatically boost your financial performance.

A comparative income statement is highly important for a business, as it gives an opportunity to understand the finances better. Moreover, if you want to get into the details about the importance of this statement, scroll up now.

A comparative income statement is the easiest way of analysing your financial history. When you have a detailed overview of your past earnings and expenses against it, identifying areas of improvement becomes much easier. This, at the end of the day, boosts your ability to make better financial plans.

The easiest way to access comparative income statements is through the Vyapar accounting app. With Vyapar, you can use this format in the easiest possible way, thanks to the app’s convenient UI. So without any delay, download the Vyapar app now!

With a comparative income statement format, you can observe changes and trends in your expenses, revenue and profitability. This helps you with a better and more convenient analysis of the impacts of economic factors and market dynamics on your financial performance.

There are platforms where you will have to spend some funds in order to acquire a comparative income statement. But with Billing Software Vyapar, that’s not the case. Vyapar is India’s #1 accounting software and a great tool for you as it gives free access to this statement. Download the app now to enjoy income statement format for free!

Related Posts: