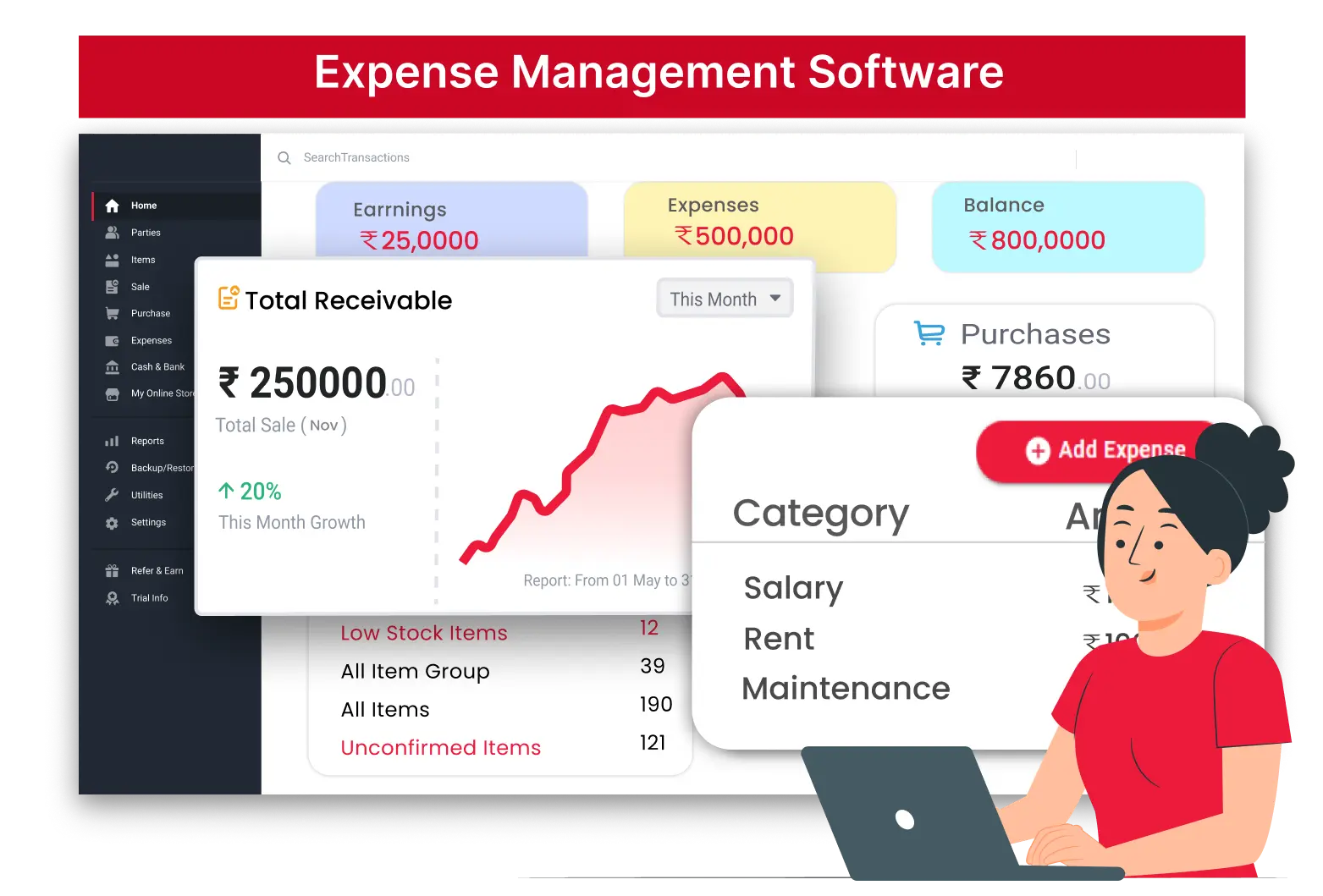

Expense Management Software for Small Business

Vyapar’s expense management software is your one-stop solution! Get started for FREE and take control of your finances.

- Effortlessly track every business expense ✅

- No need for paperwork and say goodbye to lost receipts ✅

- Manage tasks and boost revenue ✅

1 Cr+

Happy Customers

FREE

Android Mobile App

Rated 4.7 / 5

On Google Play Store

Multi-Device

Use together on Mobile/Desktop

Multi-User

User Management

Feature

What is Expenses Management Software?

Expenses Management Software helps businesses track and control their daily spending with ease. It automates expense reporting, travel management, and approvals to ensure every claim is handled in real time. With Vyapar, you can monitor company expenses, speed up reimbursements, and make smarter financial decisions effortlessly.

Best Tailored Features of Expense Management Software

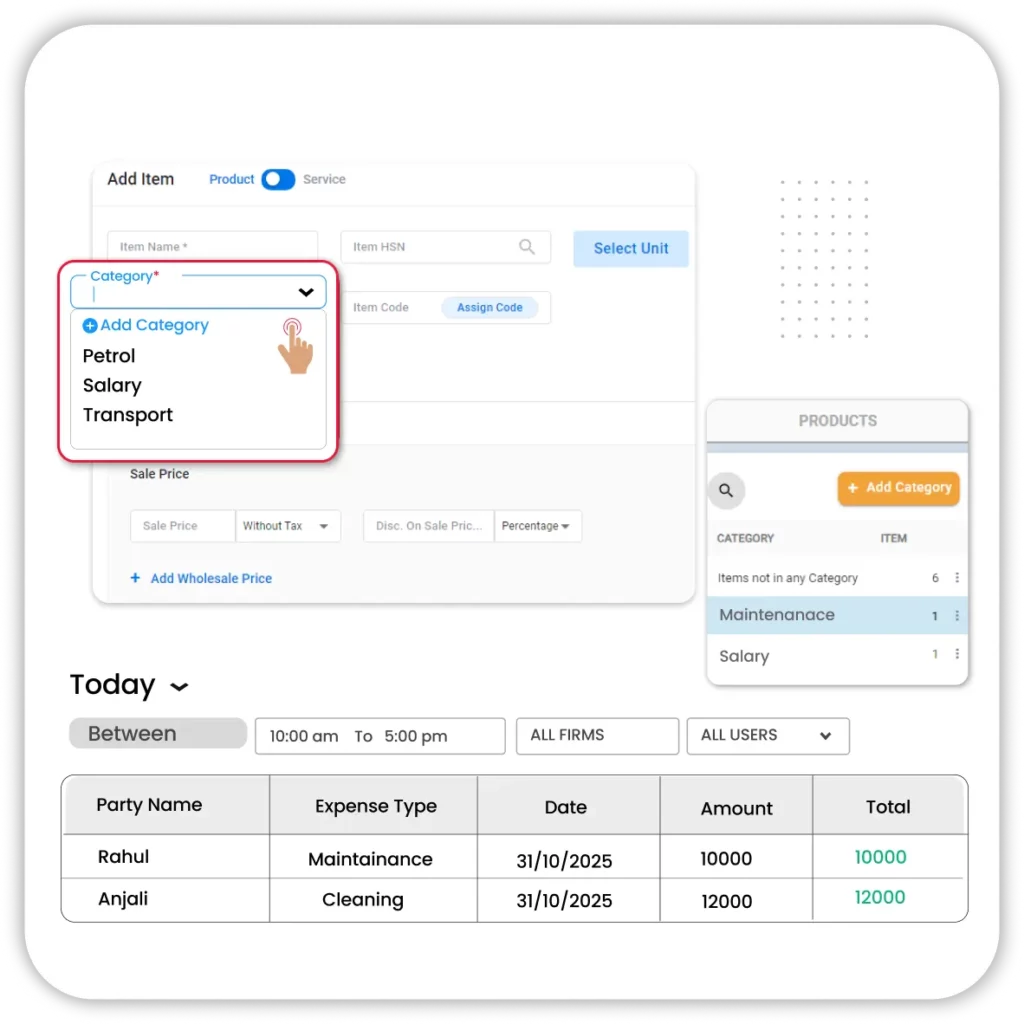

Real-Time Expense Tracking & Categorisation

Keep your business expenses organised and up-to-date with Vyapar. The app lets you record every expense instantly — whether it’s rent, salaries, electricity, or travel — right from your mobile or desktop.

- Instant Recording: Add expenses the moment they occur to avoid missing entries.

- Smart Categorisation: Group expenses under clear categories (GST / non-GST, vendor, or department).

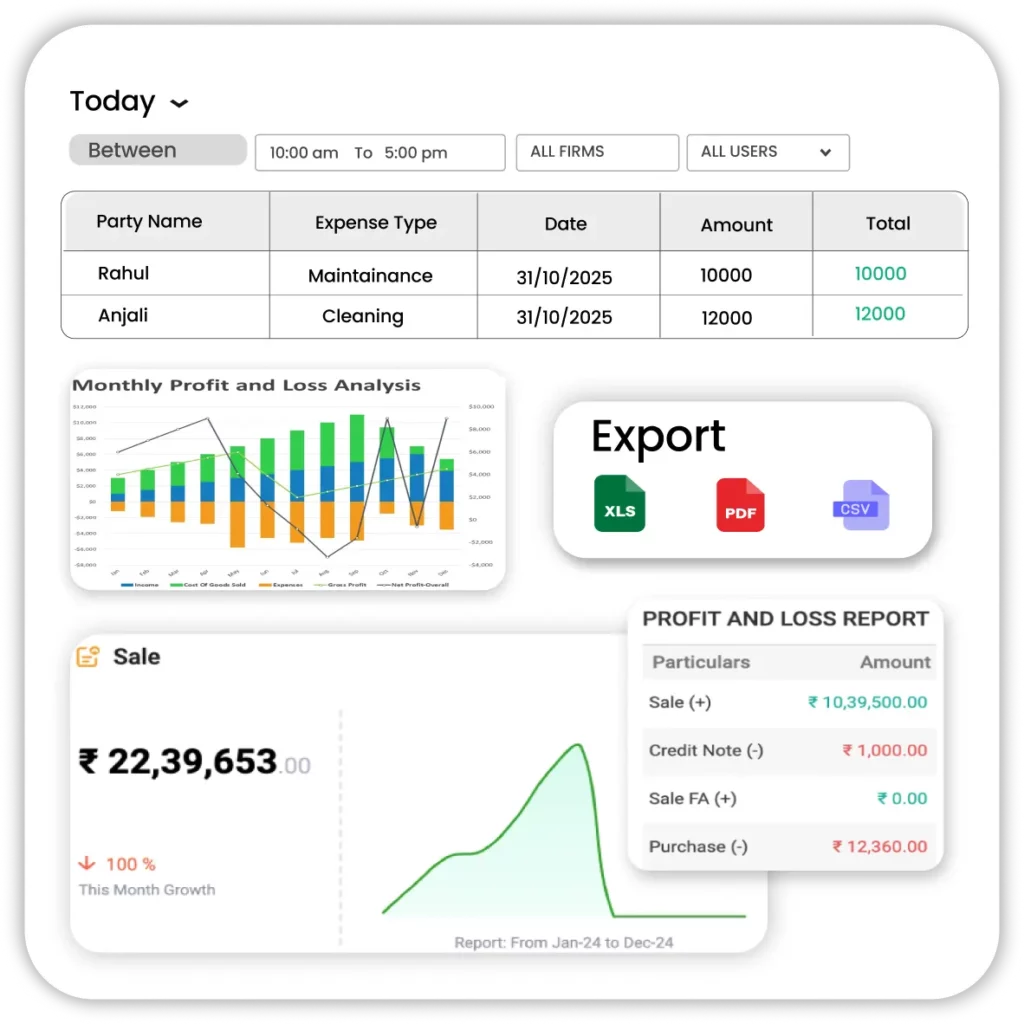

Detailed Expense Reports & Insights

Get complete visibility into your business spending with easy-to-understand reports. Vyapar automatically organises your data into detailed summaries and visual charts, helping you spot trends and control costs.

- Custom Reports: View expenses by date, category, or party.

- Visual Insights: Analyse where your money goes using graphs and summaries.

- Easy Export: Download reports in PDF or Excel to share with your accountant or team.

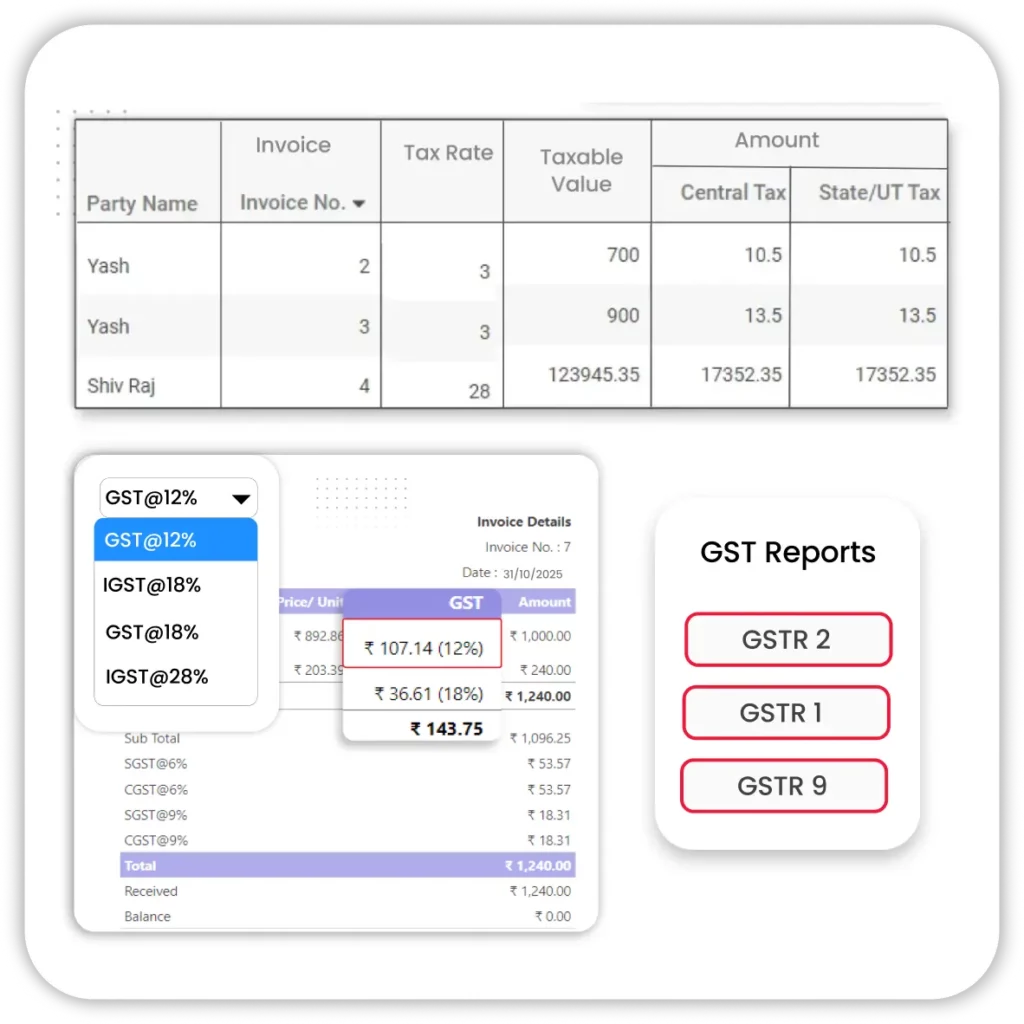

Tax-Compliant Expense Management

Ensure your expense records are always audit-ready. Vyapar helps you maintain GST-compliant expense entries and calculates taxes automatically, making tax filing simple and error-free.

- Auto Tax Calculation: Detect and apply GST on eligible expenses.

- Audit-Ready Records: Generate clean, compliant reports for quick tax filing.

- Error-Free Entries: Reduce manual effort and prevent calculation mistakes.

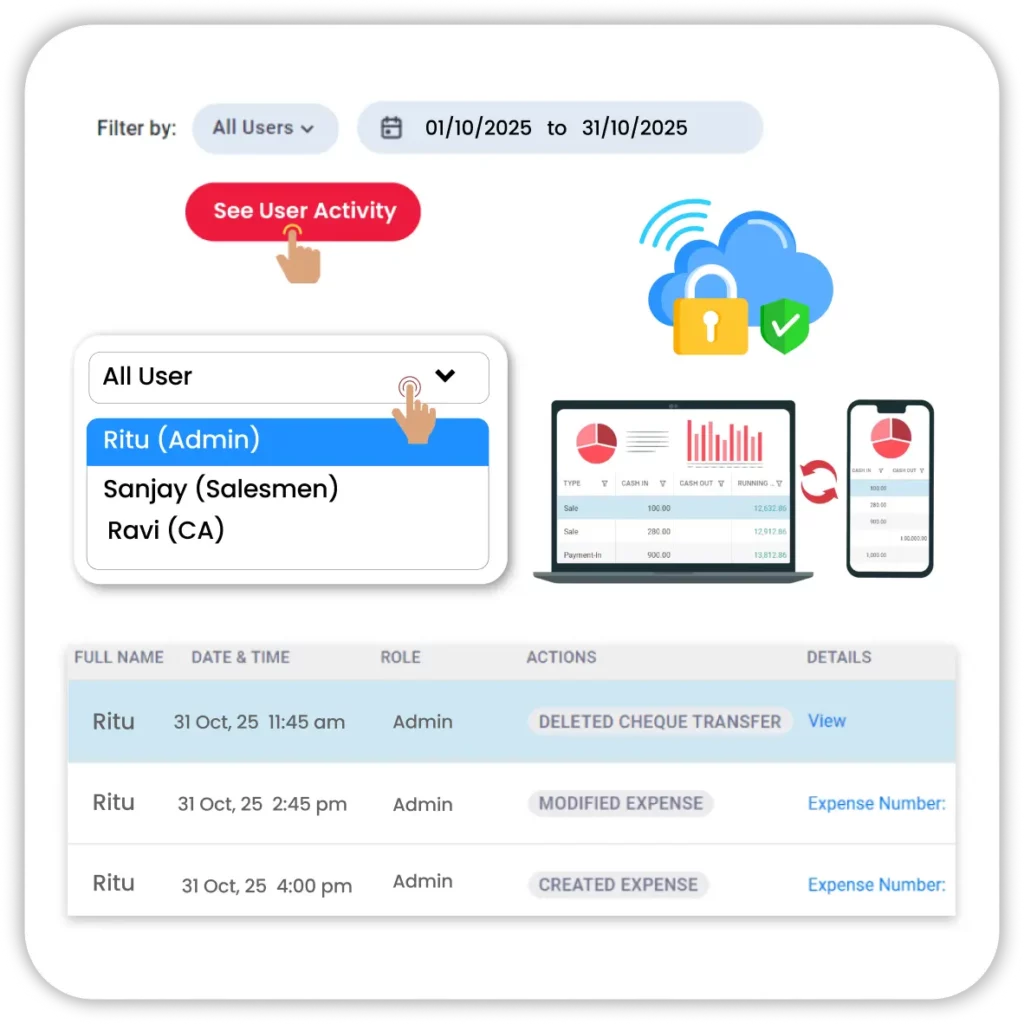

Data Backup & Multi-Device Access

Your financial data stays safe and accessible at all times. Vyapar securely backs up your expense records in the cloud, letting you and your team manage business finances from any device.

- Cloud Backup: Automatically syncs and saves expense data securely.

- Multi-Device Login: Access your expense records from both mobile and desktop.

- Data Security: Keep your business information safe with encrypted storage.

Boost Your Small Business Finance with Expense Management and Tracker Tool

Auto Data Backup

With Vyapar’s automatic backup feature, your data is consistently uploaded on Google Drive, avoiding loss of data from accidental deletions, hardware malfunctions, or other unexpected disasters.

Your vital business information remains secure, enabling swift recovery in the event of data loss. Easily configure automatic updates to suit your schedule and seamlessly restore data within minutes whenever needed.

Manage Inventory Expenses

Expense management software allows businesses to track expenses related to inventory management in real-time. This includes purchases of raw materials, transportation costs, warehouse expenses, and any other expenses incurred in the process.

Vyapar inventory management feature generates detailed reports on inventory expenses, offering insights into where money is being spent. These reports can include breakdowns of expenses by category, vendor, or time period, facilitating better cost analysis and decision-making.

Multi-Device Support

Unlock the potential of multi-device accessibility with Vyapar licenses, enabling data access across single or multiple devices at your convenience.

Additionally, Vyapar business accounting software empowers you to establish and manage multiple companies, with the flexibility to create up to 5 firms within each entity. This capability enhances multi-location management efficiency, providing a comprehensive solution for your business needs.

Multi User Access

With Vyapar’s multi-user access feature, you have the flexibility to assign various permission levels to your team members, facilitating smooth communication and coordination within your organisation.

Vyapar’s business expense management software tailored for small businesses extends its functionality to multiple devices, ensuring accessibility wherever you go. Whether managing a single store or a network of outlets, Vyapar streamlines operations seamlessly.

Cash Flow Tracking

Focus on your business’s net current cash flow effortlessly with Vyapar’s expense management app dashboard. With Vyapar, gain real-time insights into your business’s financial health, track the inflow and outflow of payments, and have the power to send payment reminders to customers, ensuring timely settlements.

With this proactive approach, you can navigate your organisation’s financial landscape with confidence and foresight.

Business Transaction Reports

Vyapar expense management software accelerates the creation of business transaction reports by automating data collection from various sources, including sales records, purchase invoices, and bank statements. The app provides customizable templates, offers real-time reporting, integrates with financial systems, and enables analysis and insights.

With access to comprehensive transaction details, business owners can make informed decisions on forecasting and budgeting to drive business growth effectively.

From Receipts to Reports in Seconds. Experience Vyapar’s Magic. Download Now!

Benefits of Using Vyapar Expense Management Software

Vyapar Expense Management Software helps you automate expense tracking, reduce manual work, and improve business efficiency.

1. Real-Time Visibility in Expenses and Spending

Get real-time insight into company expenditures with clear dashboards and graphs. The system tracks every fund movement automatically from approval to payment.

2. Less Manual Errors

Automation eliminates duplicate or missing entries, ensuring accurate, tamper-proof records integrated with your accounting system.

3. Enhanced Fraud Protection

Track every transaction securely with restricted access and password protection to prevent data tampering or unauthorized edits.

4. Improves Policy Compliance

Automatically apply company-specific spending rules and update new policies instantly across the system for full compliance.

5. Increased Operational Efficiency

Connects with ERP to simplify submissions, approvals, and tracking—boosting cash-flow visibility and team productivity.

6. Eliminates Paper Trail

Go paper-free with digital records safely stored, categorized, and backed up—eco-friendly and easy to access anytime.

7. Streamlined Reimbursement Process

Employees can scan and upload receipts; managers review and approve digitally—speeding up reimbursements and reducing errors.

8. Faster and Simpler Operations

Submit and approve claims in just a few clicks. The automated workflow shortens processing time and keeps operations hassle-free.

Recommended by Leading Industry Experts

5.0/5.0

4.4/5.0

4.6/5.0

Other Vyapar Business Management Solutions

Vendor Management Software

Manage and track vendor orders, payments, and inventory. Keep your supply chain efficient with Vyapar’s vendor management features.

Franchise Management Software

Manage your franchisee operations seamlessly. From inventory to performance tracking, Vyapar simplifies the entire process.

Salesman Tracking Software

Track your field sales team in real-time, monitor visits, sales performance, and optimize sales processes.

Outlet Management Software

Manage multiple stores with ease. Track sales, stock, and employees all under one unified system.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Expense Management Software FAQ

What Is Expense Management Software?

Expense Management Software allows businesses to automate registering, monitoring, approving, and paying employees’ reimbursable expenses. In accordance with the company’s expenditure management policy, it ensures that the business pays appropriately on approved (or unapproved) expenses.

What Are The Benefits Of Using Expense Management Software For Small Businesses?

Expense management software offers several benefits:

1. Streamlined Expense Tracking

2. Improved Accuracy and Compliance

3. Real-Time Expense Visibility

4. Efficient Expense Reimbursement

5. Integration with Accounting Systems

6. Analytics and Reporting

7. Mobile Accessibility

8. Enhanced Policy Enforcement

How Can Expense Management Software Help Streamline The Expense Reporting Process?

Expense management software automates several aspects of the expense reporting process, including receipt capture, expense report submission, and reimbursement approval. This automation saves time and reduces the likelihood of mistakes and fraud.

Is Expense Management Software Compatible With Other Financial Systems Or Accounting Software?

Yes. You can use Vyapar software to manage your business expenses. Vyapar is fully compatible with other financial systems and includes all the accounting features you need for daily operations. You don’t have to spend extra money to use our professional expense management features.

Can Expense Management Software Generate Reports And Insights Into Spending Patterns And Trends?

Yes. Using Vyapar expense management software, you can generate 37+ detailed reports that provide insights into your spending and earning patterns. These reports help you analyze financial trends and make informed business decisions.

Who Uses Expense Management Software?

Expense management software is used by businesses of all sizes — from startups to large enterprises — across multiple industries. It’s especially helpful for finance departments, accountants, managers, and employees involved in expense tracking and reimbursements. Even freelancers and independent contractors use it to record business-related expenses for tax purposes.