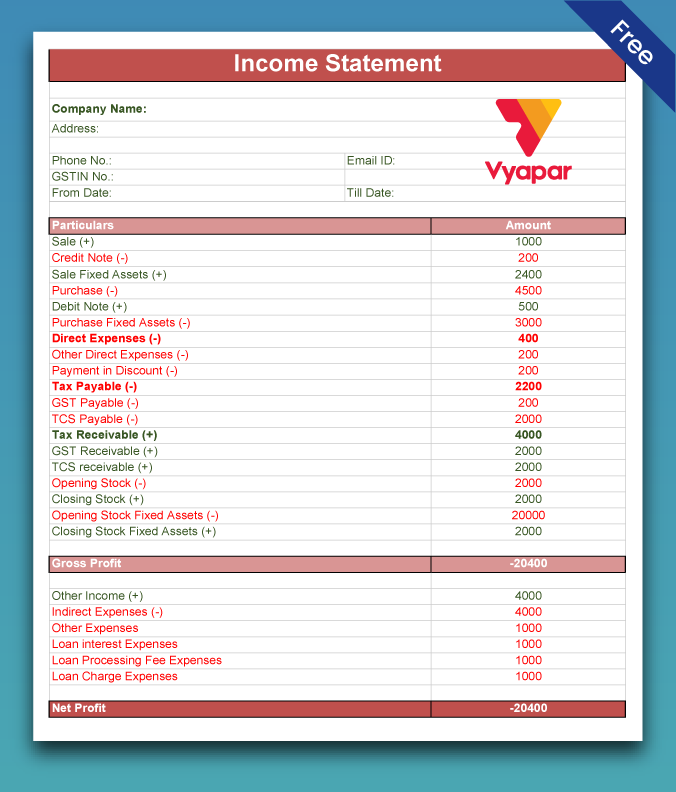

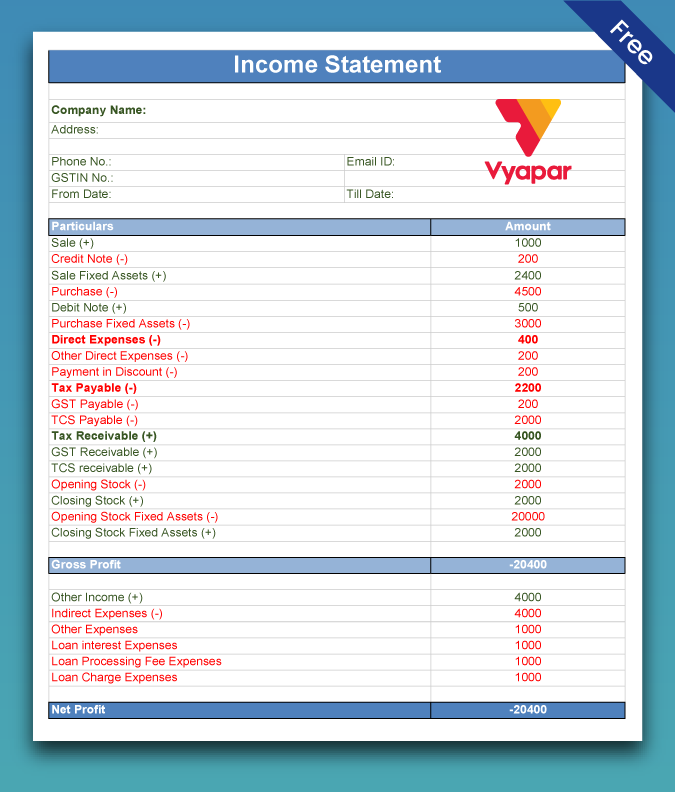

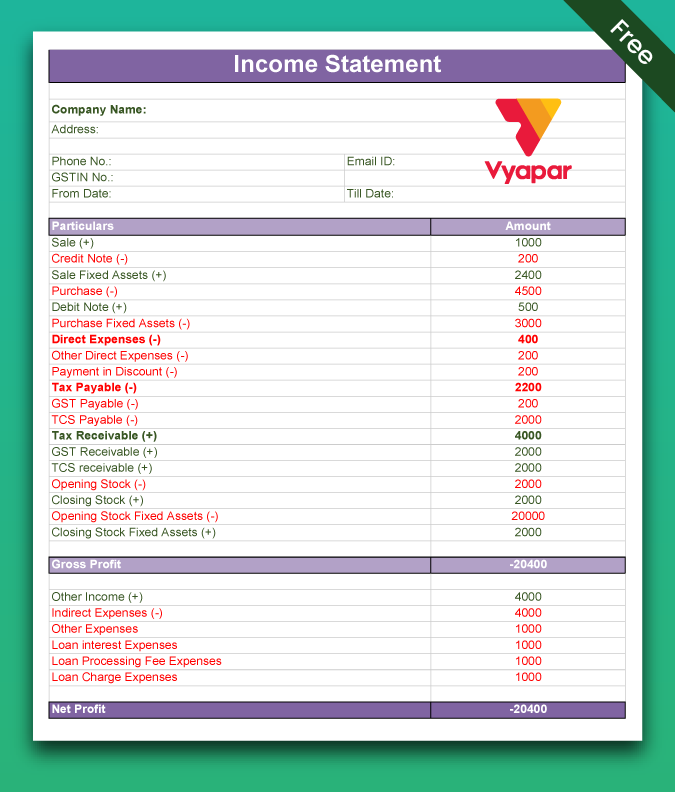

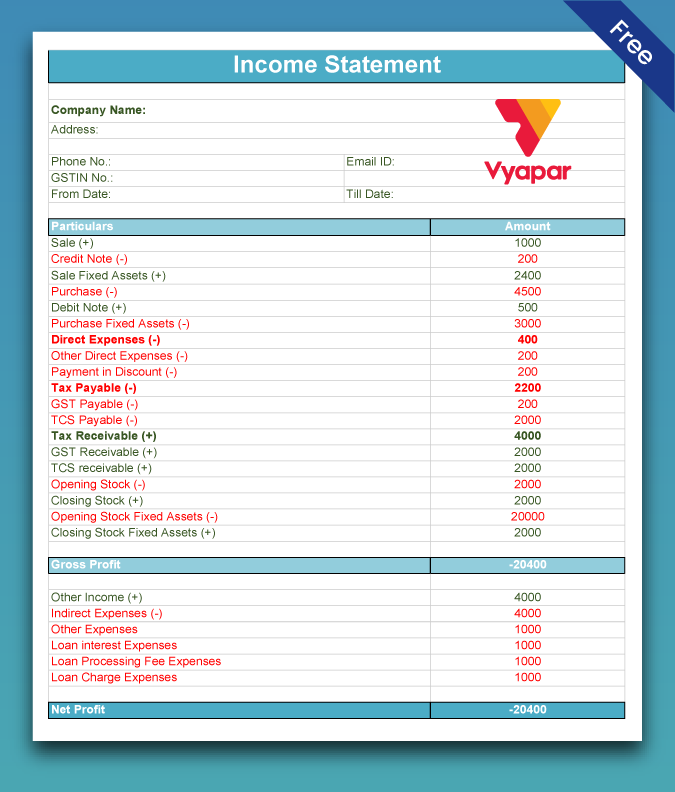

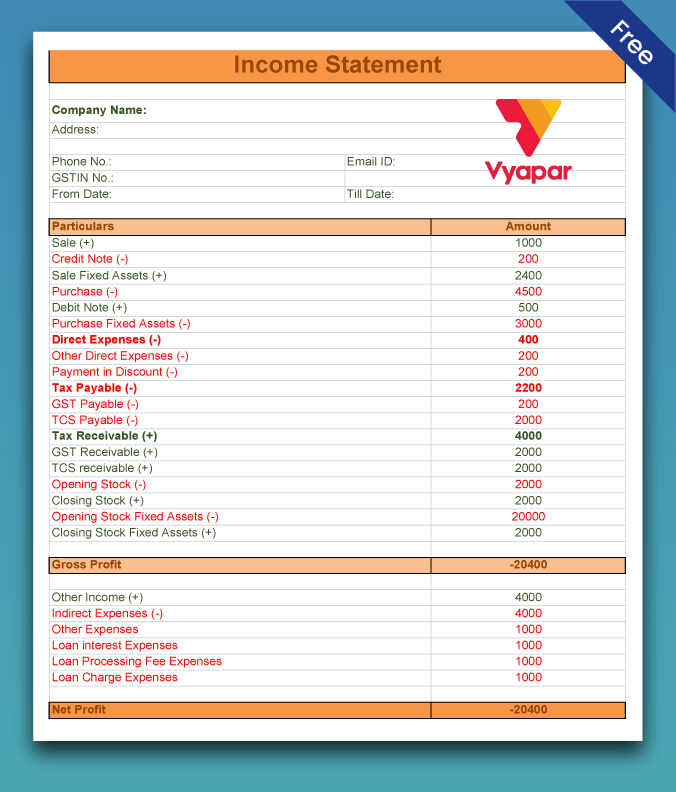

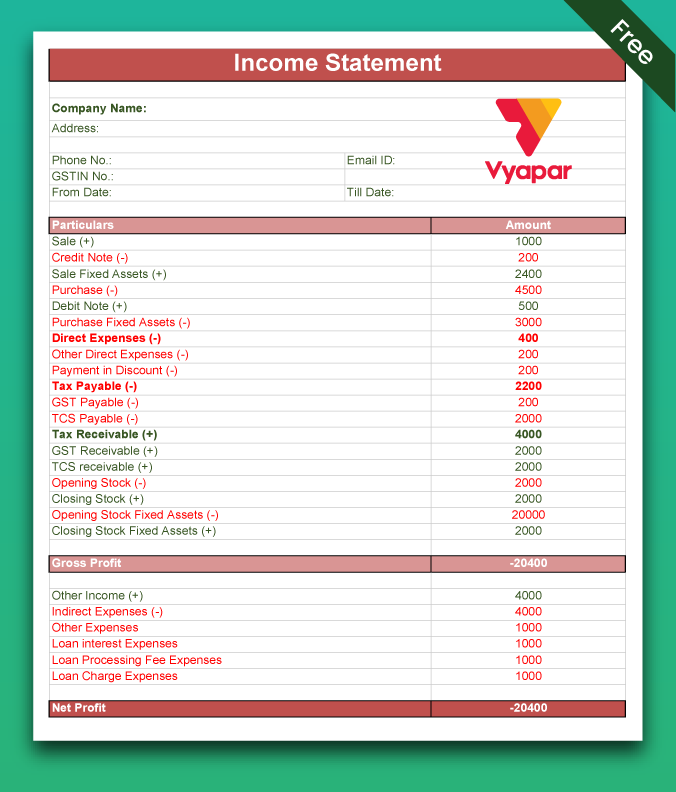

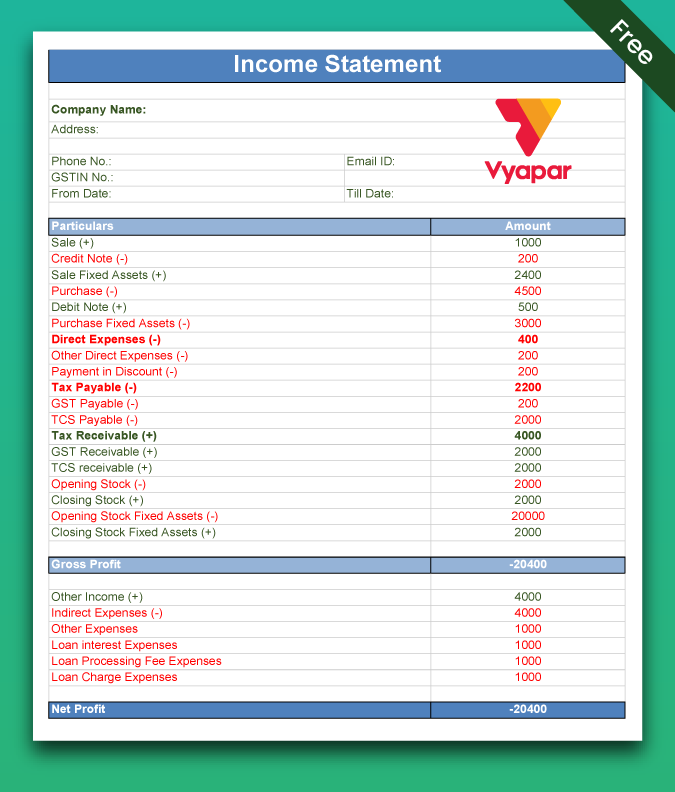

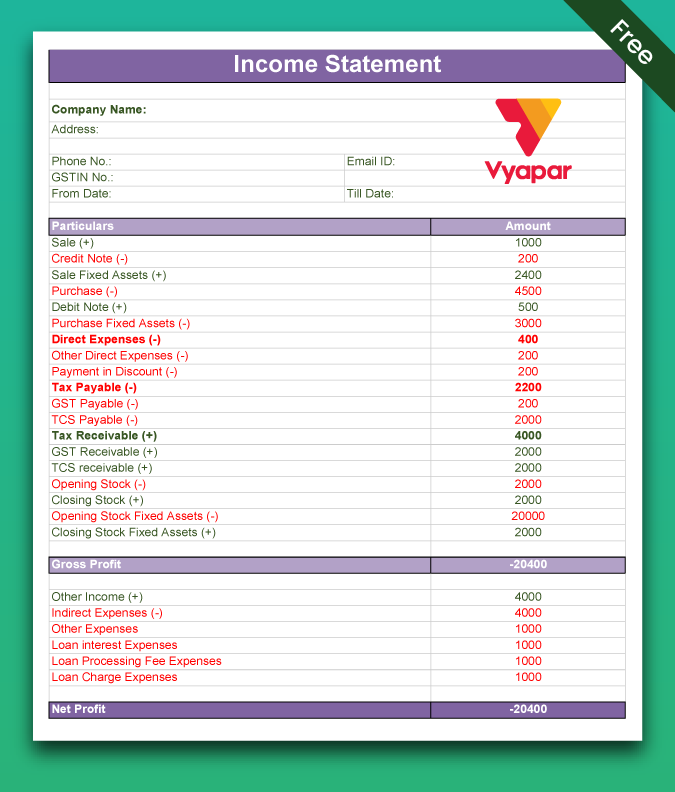

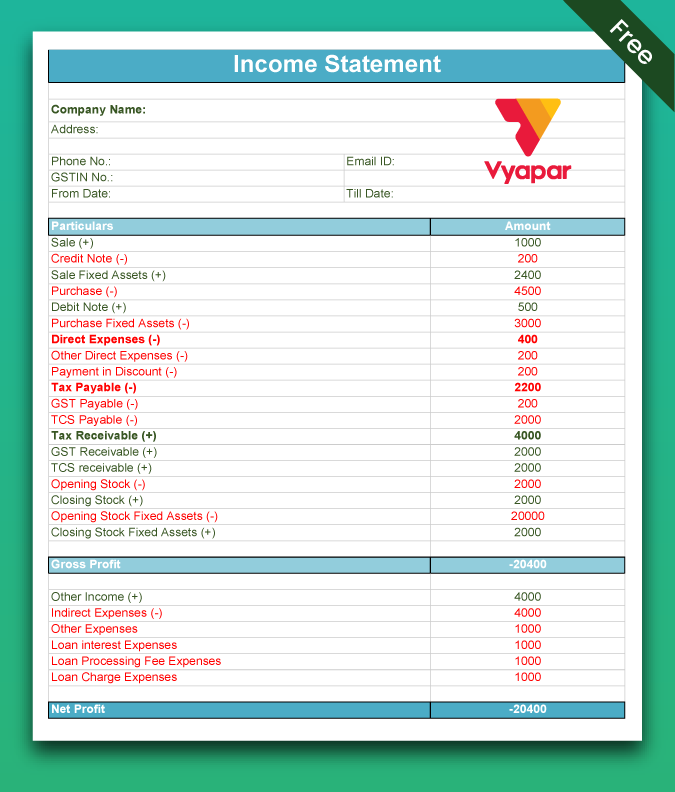

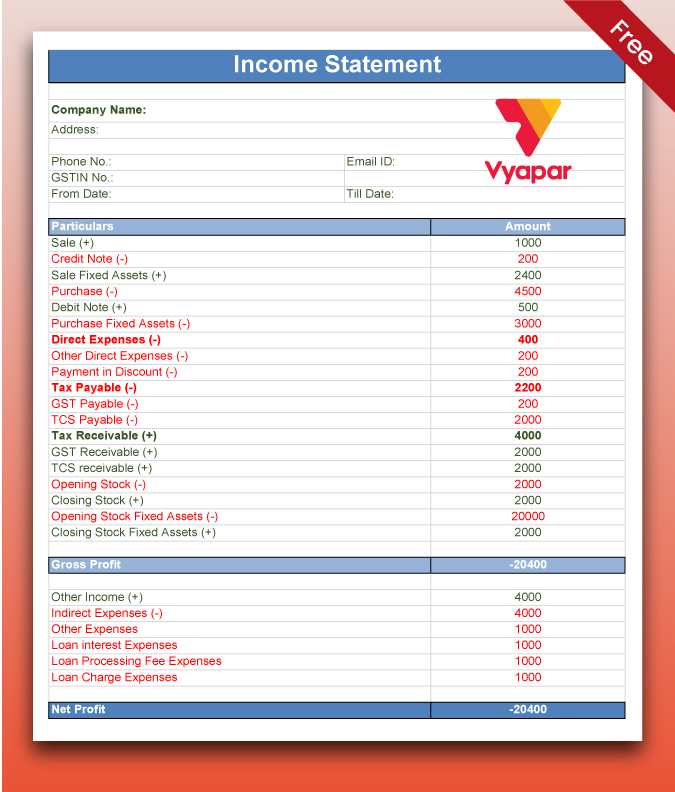

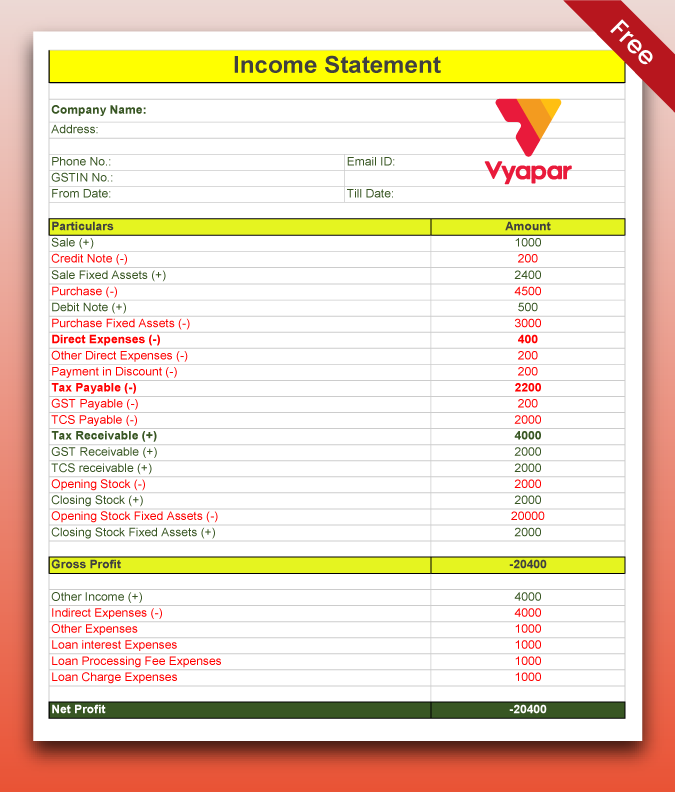

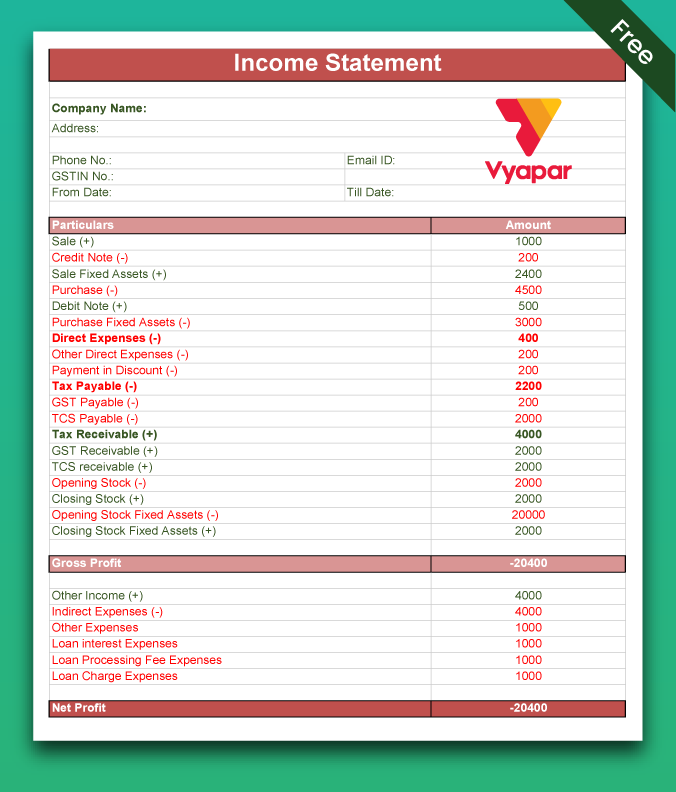

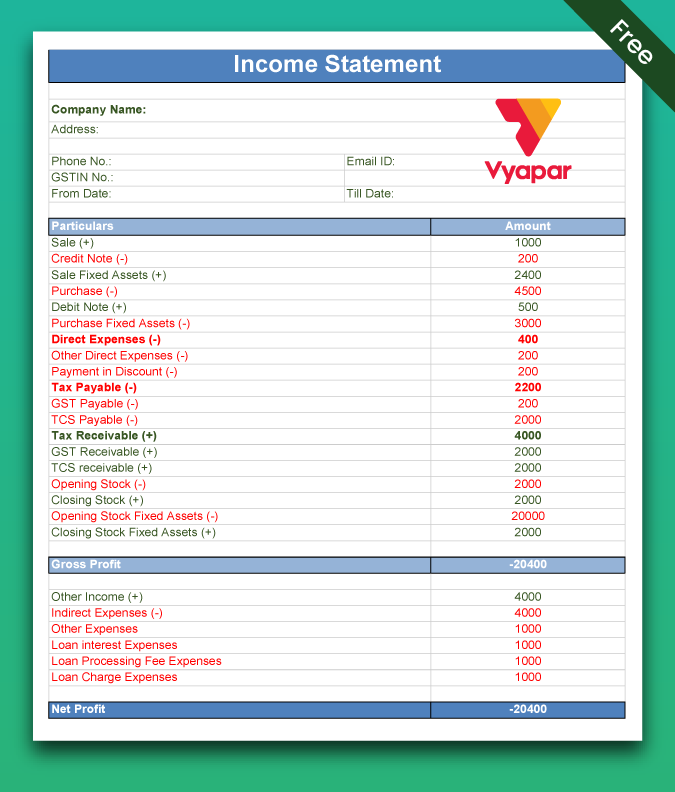

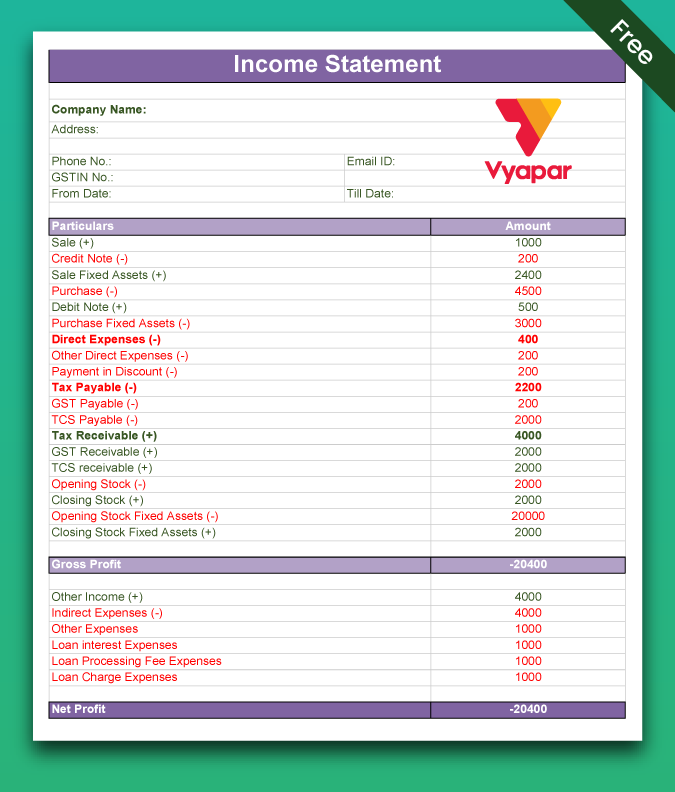

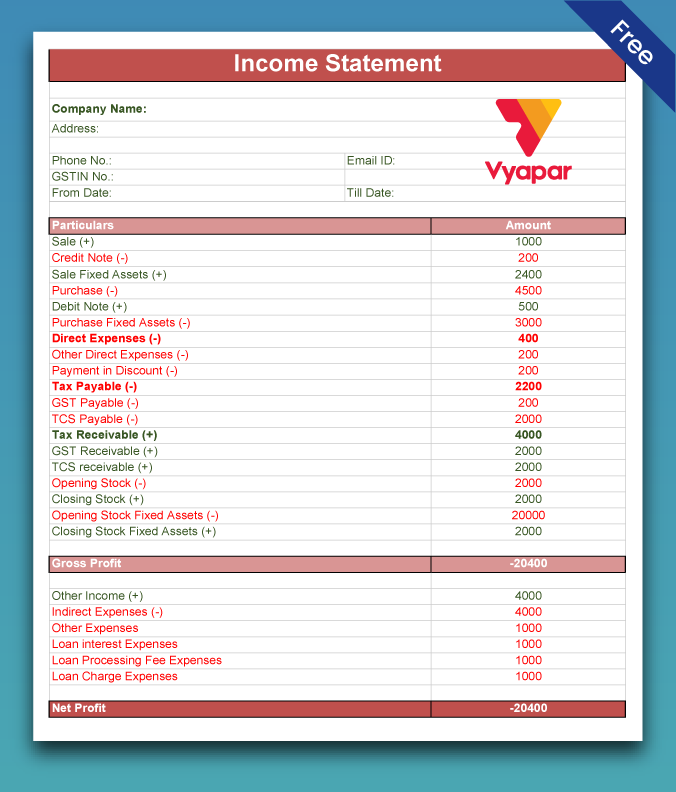

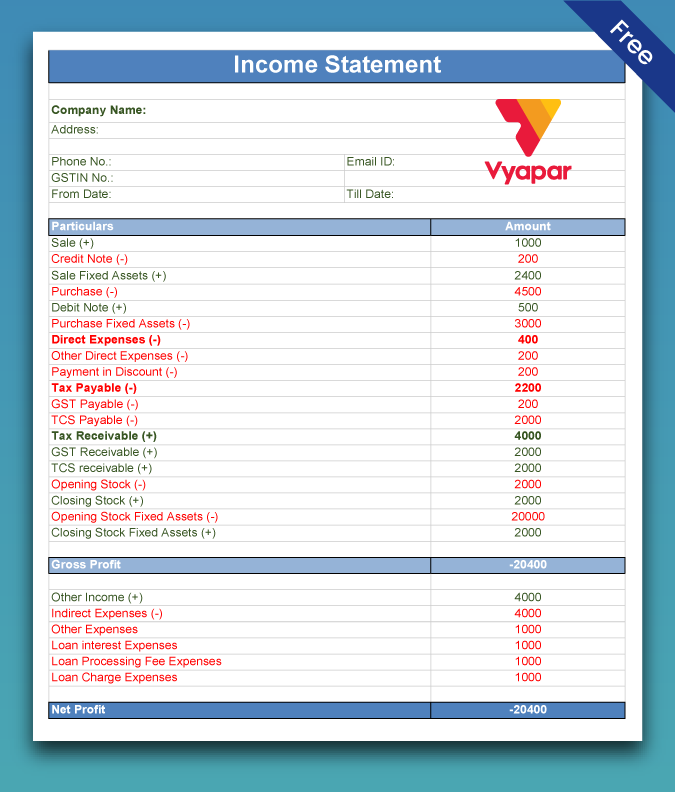

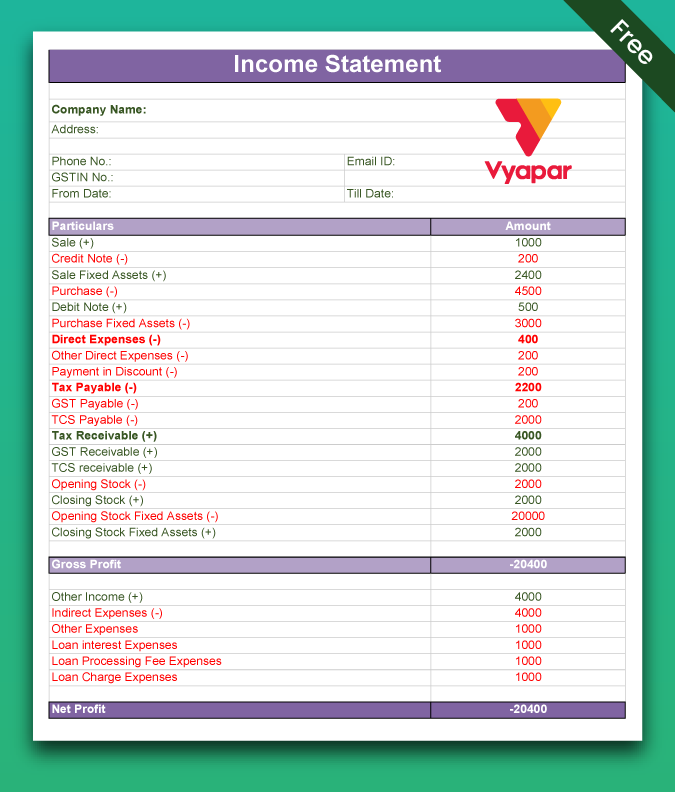

Income Statement Format

Use the income statement format to compile and calculate your business’s net income, revenue, expenses, gross profit, interest and taxes. Download Vyapar to make the entire process seamless, manage your tasks easily, and access all formats for free.

Download Free Income Statement in Word, Excel, PDF

Explore income statement templates, and make customization according to your requirements at zero cost.

Income Statement in Word Format

Income Statement in Excel Format

Income Statement in PDF Format

Income Statement in Google Sheets

Income Statement in Google Docs

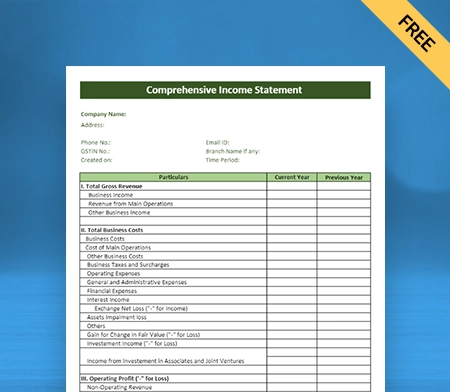

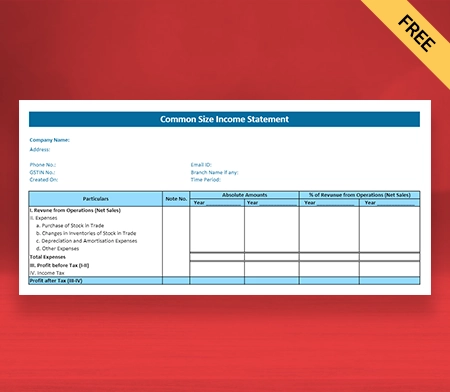

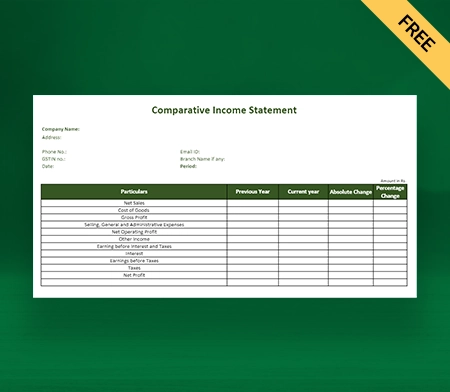

Other Income Statement Formats

Create your first Income Statement with Vyapar App

Objectives of Income Statement Format

Revenue Insights

One of the chief benefits of using the income statement for companies is that it offers information directly related to the organization’s revenues. It provides a comprehensive report that details all sources that generate revenue and expenditures incurred during the evaluation period.

It also includes taxes, expenses, interest payments, and operations. There is no better document to investigate the company’s comprehensive revenue information.

Budgeting and Forecasting

The income statement predicts what will happen in the next accounting period. Based on what is being looked at, these plans are used to make budgets for the company that may last for 12 months, five years, or even ten years.

It also assists companies in tackling future financial problems efficiently. The consolidated statement of Income format in PDF enables the company to devise a plan for how to handle the possible problems that the income statement shows.

Tax Reporting

The income statement is very helpful when you declare your business and personal income taxes. It provides the details you need to complete the tax line items.

You have a report that already provides this information; you can leave some lines of income or spending. Complete the blanks and, if advised, submit your filing with the earning statement attached.

What is the Income Statement Format?

The income statement format is used as a document to compile a company’s financial results over a certain time period. The company’s revenue is added first, then other income is also added to it, and finally, information about the company’s expenses, all of which are subtracted from the revenue and other income to determine the net profit or loss.

Essential Components of the Income Statement Format

Here is a list of essential components in an income statement format:

1: Revenue

Revenues are the money earned from the normal business sale of goods and services. Net revenue is all proceeds from selling products and services minus returns.

2: Expenses

Expenses are sums paid to create revenue and include the cost of providing services, such as operating expenses, interest payments, rent, salaries and wages, taxes, etc.

To make revenue by offering services, the corporation would spend numerous expenses such as promotional charges (advertisement expenses), sales manager salaries, depreciation on fixed asset usage, and other administrative expenses. Because they are incurred in response to such revenues, all these expenses are included in the income statement.

3: Net Income

The net income reveals whether or not a company is profitable. A net loss on an earning statement indicates that expenses exceed income for the period or year under review. This is also known as net income or net profit after taxes.

4: Cost of Goods Sold

The cost of goods sold (COGS) is any direct expense associated with the manufacturing of sold items or the cost of inventories purchased to sell to consumers. It excludes overhead expenses connected to normal business activities, such as rent. A company’s earning statement includes the cost of goods sold.

5: Operating Expenses

Operating expenses are those incurred by an organization as per their regular business operation.

It includes money for marketing, rent, inventory, tools, payroll, step costs, insurance, and research and development.

The main operating costs are selling, general, and management costs, asset depreciation, and asset amortization.

6: Operating Profit

Operating profit shows how much money a business makes by doing what it does every day.

This is the profit before any non-operating income or costs are taken into account.

Operating profit is commonly referred to as the difference between gross profit and daily expenses of a company (Operating cost).

7: Profit Before Tax

This item is a measure of how profitable a business is. It is also called “pre-tax income,” analysts look at it when they look at a company’s financial statements.

Analysts prefer this item instead of “profit after tax” because a company’s profit tax is not always based on a straight line.

Many companies use different ways to avoid paying taxes, which makes it harder to judge how well a company is doing by its profit after taxes.

8: Income Tax

The income tax shown on a Consolidated Statement of Income is an estimate only paid upon agreement with the tax authorities.

While it has to be provided by the companies as soon as they arrive at the profit after tax and interest, what gets paid in the outcome as tax can be higher or lower than the earlier amount provided.

9: Earning Per Share

You can expect supplemental entries following earnings after taxes that may indicate (EPS) earnings per share or diluted earnings per share, as applicable.

EPS is calculated by dividing earnings after tax and dividends on preference shares by the number of outstanding shares.

Before arriving at the earnings attributable to each share, diluted EPS is calculated by adding convertible securities to the shares outstanding.

10: Comprehensive Income

A standard part of an earning statement is how it shows the total income. This line shows how entries like unrealized losses or gains on investments and pension debt changes affect the net income. It also shows any possible wins or losses from converting money from one currency to another.

The main point of the items listed here is to give an idea of how volatile markets might affect a company’s financial results if and when they happen.

How to Prepare an Income Statement Format?

1: Choose Your Reporting Period

The reporting period of your business is the time window that the Consolidated Statement of Income discusses. Reporting times are usually monthly, quarterly, or once a year. Your goals will tell you which reporting time is best for you.

For example, a monthly report covers a shorter period, making it easier to make practical changes that affect how business is done the next month.

On the other hand, a quarterly or annual report gives research from a higher level, which can help find long-term trends.

2: Calculate Your Revenue

Once you know how long the filing period is, go ahead with the previous year’s earning statement to determine how much your company made revenue last year.

When you make an income statement for your whole business, you should include cash from all your business lines. While preparing the Consolidated Statement of Income for your company’s particular segment or line, it becomes crucial to include revenue from goods and services underneath it.

3: Calculate the Cost Of Good Sold

Next, determine the total cost of goods sold for each product or service that contributed to your company’s revenue during the period analyzed in the report.

This includes both the direct and indirect expenses of manufacturing and selling goods or services, and it specifically includes the following items:

- Direct labour expenses

- Material expenditures

- Parts or component expenses

- Expenses related to distribution

- Any cost that is immediately associated with the manufacturing of your product or provision of your service

4: Calculate Gross Profit

The following stage is to determine the period’s gross profit. Subtract the cost of products sold from revenue to arrive at this figure.

5: Calculate Operating Expenses:

After you know your gross profit, you can determine your Operating Expenses (OPEX).

Operating costs are the secondary costs of running a business. These differ from the cost of goods sold because they have nothing to do with making or selling items or services. Some costs that fall into the category of OPEX are:

- Rent

- Utilities

- Overhead

- Legal fees

- Office Supplies

6: Calculate Income

To figure out total income, take gross profit and subtract running costs. This number is the amount of money your business made before taxes during your reporting period. This is also called EBIT, which stands for profits before interest and taxes.

7: Calculate Interest and Taxes

After figuring out the period’s income, determine interest and tax expenses.

Interest refers to any fees your business must pay on its outstanding debt. To calculate interest charges, you must be aware of outstanding debt and interest. Typically, good accounting software calculates interest charges for the reporting period automatically.

Calculate your total tax burden for the period covered by the report. This includes all local, state, federal, and payroll taxes.

8: Calculate Net Income

The last step is determining how much money was made during the reporting time. To do this, consider the difference between your EBIT and interest and taxes. The amount left shows how much money is still available for your business.

The company can put the money into its contingency fund to meet unforeseen circumstances or in the shareholder’s account for research and development.

Why Choose Vyapar App to Create Income Statement Formats?

Vyapar is an excellent billing software to create your professional-looking income statement. Here are the following reasons why you should choose Vyapar to prepare your income statement:

Manage Your Cash Flow Seamlessly:

Vyapar’s inventory management software for income statements allows you to handle your business Cash Flow easily. It is done to keep accounts from going wrong. If you buy this accounting programme, keeping track of your business’s cash flow statement will be easy. This software has everything you need to handle cash transfers, as it has benefits like tracking bank withdrawals and deposits.

Our business accounting software is better for making a cash book in real-time. It can help a business keep making money and adding up all of the information about costs, payments, purchases, and other things. With this GST accounting programme, it’s easy to keep track of cash.

The daybook with a solution to create an income statement is a bonus for businesses. With this free accounting programme, you don’t have to manually enter data. It gives a better way to keep track of the money numbers. We can make choices at the right time with the cash flow data. It will make sure that work goes smoothly. Also, avoid getting stuck in a debt trap because of bad money management.

Gst Filing Made Simpler and Easier

Every month, many business owners spend their time and work filing GST. So they can make sure they follow the tax rules. After all, many Business owners have to keep track of their monthly income statement, expenses, and accounting information. Also, you have to type them in by hand to make GST returns.

Vyapar software for income statement format in Excel, Word and PDF changes everything by making it easier to make GSTR returns and saves time by automating the process. You can create Various types of reports for your business by using Vyapar such as GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9.

Use the information you saved when you made income statements for your business and put in costs. Every business owner can save time by making GST reports with professional Vyapar accounting software. With this, they can be sure that all accounting jobs will be done correctly by automation.

Business/Accounting Management

Vyapar software allows you to manage a single store and a chain of stores simultaneously. It doesn’t matter whether your business store is registered or unregistered to operate your business operations. Using Vyapar, you can access your data on single and multiple devices simultaneously.

Vyapar is an excellent software for creating your professional-looking financial statement, and it comes with all the essential details required to create a well-detailed income statement sheet. It also Allows you to create up to 5 firms within a company.

You can also do the GST and non-GST transactions using the Vyapar. Using this accounting software, you can easily create and perform various operations like billing, invoicing, reports, etc. It also provides you with a business dashboard for a better business overview.

Create Your Income Statement In Various Formats.

By using Vyapar software, you can create your income statement in all three formats, PDF, Word, and Excel, according to your business requirements. All three formats have pre-made essential details required to create a well-detailed earning statement format.

Using Vyapar’s free invoicing software to create your earning statement allows for better financial statement analysis, and you can access it as per your requirements. It is easily Customisable. You can easily create your earning statement format in Excel with proper details.

You can also create in PDF as it provides better security, as it is encrypted and password protected and can only be accessible as you requested. It can be easily achieved and accessed as per your requirements.

Record Your Expenses

Our cost-free accounting app is a useful tool for keeping track of your business expenditures. Using our tool, businesses may quickly optimize their spending to generate significant savings. GST and non-GST expenses are recorded using our free billing software for income statements.

Additionally, Vyapar Solutions has several advantages over other companies. It aids in cost-cutting and increases sales of your business. The free Business accounting software is useful for swiftly logging unpaid bills. It aids in future tracking of them as well.

Growing businesses can use our free mobile accounting app. It assists in managing their finances. The business can reduce spending on unnecessary things by employing GST software to record the expenses. It aids in cost reduction. Additionally, keeping track of expenses will aid in developing better tactics. Better business profitability will arise from it.

Keep Your Data Intact With Back-Up

Creating your Consolidated Statement of Income using Vyapar ensures your essential information, like revenue, expenses, net income, etc., remains intact, and your business data should not be compromised. It creates Auto-backup and manual back-up to Google Drive.

Vyapar software allows the transaction-level passcode for edit and deleting. So, our free accounting software in India lets you set up a regular backup of your data, which helps keep the app’s data safe. It comes with a passcode for software technology.

For extra safety, you can make a local backup occasionally. This would help keep your data safe in a personal place like a flash drive or hard disk. You can use the free billing app to ensure your business is safe by setting up automatic or private backups at the right times.

How Many Types of Income Statements Are There?

There are two types of income statement formats. Here are the following:

1: Single-Step Income Statement

A single-step income statement is used as the simpler version of the Consolidated Statement of Income by small and medium size companies.

Total Revenue – Total Expenses = Net Profit

When prepared, The single-step income statement presents the company’s costs and revenues without additional sub-categorization. To compute the net income on the single-step income statement, subtract the entire revenue from the total costs.

Small enterprises or sole proprietorships most typically utilise the single-step revenue statement.

Compared to a multi-step income statement, the single-step income statement is simpler and easier to compile and understand.

2: Multi-Step Income Statement

The multi-step income statement is the standard format used by large enterprises and all publicly traded firms.

Using the multi-step income statement, three equations have been used to calculate net income. Companies using the multi-step method for earning statement preparation often divide their revenues and costs into running and non-operating business activities.

The three accounting equations used to calculate net income are as follows:

Gross Profit= Net Sales – Cost Of Goods Sold

Operating Income = Gross Profit – Operating Expense

Net Income = Operating Income + Non-Operating Items

Net income is figured out by adding operating income along with the non-operating items.

It gives a more comprehensive and in-depth review of a company’s performance of its important financial statement, which is extremely valuable to potential investors and external readers.

Benefits of Using the Income Statement Format?

Here are the benefits of using the income statement format in Excel / PDF for a business:

1: Gives A Better Overview to Financers:

The income statement template in Excel will give your potential financiers a better overview of your financial situation if you need outside funding for a project. They will also want to analyze the company’s financial trends to create a risk profile.

You’re more likely to be given a loan with a reduced interest rate if you demonstrate regular net sales growth and rising profits. If not, you’ll either pay excessive interest rates or get flat-out turned down for financing.

2: Assists With Better Success Or Failure Rate Of Specific Budget Areas:

The revenue statement is a good way to figure out how healthy a company is as a whole. Using the information in this financial paper, you can look at how well different budget lines are doing.

That information enables you to devise a plan for handling certain situations or keep going when you’re making more money during an evaluation time.

3: Allows You to Identify Competitive Advantage

Most businesses will generate an income statement, which you can find online. This information is normally required to be released by publicly traded companies. Private firms and non-profits often make this information available to interested parties or stakeholders.

When you compare one income statement to another from a competitor, you can uncover potential competitive advantages where future revenues could be earned. You can also identify areas where your competitors outperform your organization, allowing you to reallocate resources to become more competitive or explore new profitable methods in other areas.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

Frequently Asked Questions (FAQs’)

The income statement format is used as a document detailing the financial results of a company’s business activities over a specified time period. It informs the business about the earned revenue over a particular period, and the cost associated with it while generating revenue.

The consolidated statement of income format should include the following details:

1. Revenue

2. Cost of Goods Sold (Sg&a)

3. Gross Profit

4. Operational Expenses

5. Operating Income

6. Interest Income/Expense

7. Taxes

8. Net Income

The income statement gives an overview of the company’s financial health over a specific period. The income statement presents the overall revenue generated by a firm, as well as the expenses and costs involved with its operations, revealing whether the company made a profit or a loss.

The organization often prepares the income statement monthly, quarterly or annually, depending on their requirements. Factors including company size, industry, and the financial reporting obligations of regulatory organizations may also affect how often preparation is needed.

In India, accounting standards that govern the preparation of income statement formats are done by the Institute of Chartered Accountants of India (ICAI). The Indian Accounting Standards (Ind AS), created by the ICAI, have converged with IFRS and control the creation of financial statements such as income statements.

You can use Vyapar software to create your professional-looking income statement. The best part is you don’t have to pay a single penny from your pocket for Vyapar’s professional tools and features. Vyapar has tested software and is used by millions of small business owners to perform their day-to-day operations.