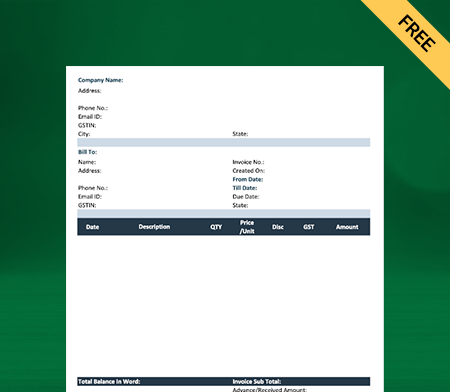

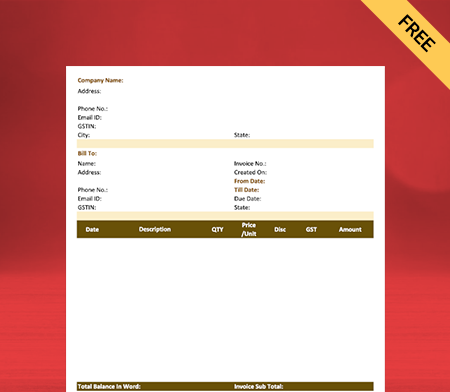

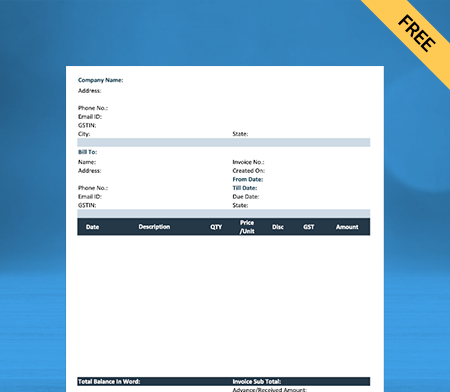

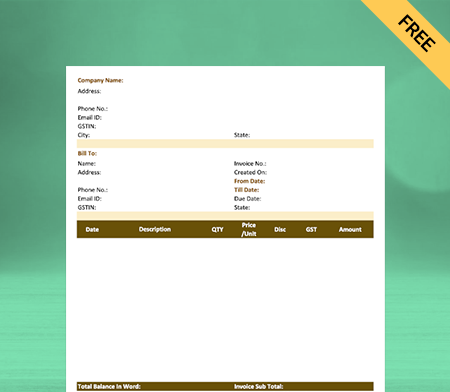

Cumulative Bill Format

You can download the software to create the Cumulative Bill Format for your business. Or use the Vyapar App for all your business requirements, like billing, accounting, and inventory management. Avail of your 7-day free trial now!

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Highlights of Cumulative Bill Format

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is the Cumulative Bill Format?

The cumulative Bill Format is used to create a billing statement or invoice showing all the charges and payments made over a certain period. “Cumulative” means that all transactions and balances get included in the bill up to date.

What Should Be Included in a Cumulative Bill Format?

The Cumulative Bill Format should include the following details:

Invoice Number: A unique identification number for the invoice is the invoice number.

Date: The invoice date when it gets sent.

Billing Period: The period at which the invoice gets sent to clients, such as every month, every three months, or every year.

The client’s information: Should include the customer’s name, address, and active phone number.

List of the Goods Or Services: it should accommodate the delivered goods or services, including the amount, cost per unit, and overall cost.

Taxes & Fees: The invoice should properly calculate the applicable taxes, fees, or discounts.

Total Due: it should also accommodate fees and taxes in the account payable.

Payment Conditions: The payment conditions include the due date, late fines, and incentives for paying early, which are all essential to paying terms.

Payment Instructions: Instructions about the mode of payment, as it accommodates the accepted payment methods, and whom to contact in case of any unforeseen condition.

Company Information: it should include your company’s name, address, and phone number.

The Invoice Template will be more understandable for the consumer and the business if these facts are included in a Cumulative Bill Format.

What are the Benefits of Using a Cumulative Bill Format?

Here are some of the benefits that businesses can derive from using Cumulative Billing:

1. Reduces Administrative Costs:

Using Cumulative Billing enables businesses to bill their customers efficiently, allowing them to put all their sales or services details provided over a specific period. This billing method offers multiple benefits, such as saving money, lowering administrative costs, and making billing easier.

Businesses can make the billing process easier and faster by using Cumulative billing. It allows them to assemble all customer transactions on a single invoice at the end of the billing period. Manual billing requires considerable time and effort to process each transaction, but using digital cumulative billing allows businesses to give employees more time to work on critical tasks.

It allows businesses to improve their business planning, build customer trust in their business, and reduce errors in their bill. Using a Cumulative bill gives your business more customer satisfaction and confidence by making the billing process clear, concise, and uncomplicated.

2. Improves Cash Flow:

Your business receives several benefits if clients get billed at the end of each billing cycle. It helps your business with assured cash flow by maintaining a constant source of earnings, enabling your businesses to manage charges and investments properly.

By using Cumulative billing, it is commonly seen that at the end of each billing cycle, it significantly reduces the administrative cost by reducing the number of invoices issued to your clients, processed and less complicated. It allows your business to indulge in important tasks by automating them.

In addition, by charging at the cycle’s conclusion, firms may offer customers a thorough account of all services and products rendered, thereby reducing customer confusion and complaints. Overall, billing at the end of the cycle is a practical and efficient method that provides various benefits to organizations.

3. Enhances Customer Experience:

Cumulative billing is an elegant way for your business to bill your clients, combining multiple transactions into a single bill. Using the cumulative bill can make it much easier for your business customers to pay their bills quickly and efficiently. Customers feel a burden to see several bills on their table, but using cumulative bills makes it more accessible.

By using cumulative bills, your business platform becomes simplified and less complicated, enabling your clients now to pay you for many services in a single billing. It makes the billing process easier and less confusing for customers. Also, Cumulative Billing can reduce misunderstandings between your business and potential clients because they are provided with a complete summary of all their transactions.

By using Cumulative billing, your retail business can significantly reduce operation costs. It is known to enhance the customer experience and assists businesses in handling their operation efficiently.

4. Facilitates Tracking and Reporting:

Your business can easily manage the cash flow into your business using Cumulative billing. You don’t need to track several transactions simultaneously by using a Cumulative bill. It makes balancing accounts and creating accurate financial statements much simpler and easier.

Using a Cumulative Billing process saves businesses time and keeps them from making mistakes that can happen when they handle many separate invoices. By putting all transactions in one place, businesses can easily track how their clients pay and quickly find any problems or missing payments.

Further, Cumulative Billing helps businesses maintain their cash flow and make intelligent financial decisions. Overall, Cumulative Billing makes managing money more accessible so businesses can focus on other vital parts of their business.

Are you a Business Owner?

Take your business to the next level with Vyapar! Try free for 7 days

Try our Android App (FREE for lifetime)

How to Choose the Best Software to Create Your Cumulative Bill Format?

Here are the following steps to choose the best possible software to create the Cumulative Bill for your business:

1. Software With Better Compatibility:

Compatibility is essential to consider while choosing software to create a Cumulative Bill. First, ensure the software works with your existing systems, like your accounting software and payment gateway.

The software you seek should be competent enough to handle numerous transactions single-handedly. Using less complicated and simplified billing software makes it possible for everyone on your team to figure out how easy it is. Otherwise, you have to spend time and money training them.

Consider how the software will work long-term with your business goals and growth plans. By thinking about these things, you can choose software that fits your needs and lets you make and manage Cumulative Bills quickly.

2. Software With Better Customisation:

While businesses consider using software to create a Cumulative Bill, there are multiple things to Customise your bill professionally. First, you should look for less complicated software to integrate easily with your present billing system and any other pertinent software you are looking to integrate.

Look for software that enables you to add or remove data fields as needed to meet your needs. It would assist you in managing how to change the software’s layout, design, and data fields. Additionally, you should go for the software that allows you to create cumulative bills that add up over time and have features like discounts, taxes, and multiple payment methods.

Lastly, look for software that allows your business platform full reporting and analysis tools and assists you in keeping track of how well billing is going and finding places where it could be better.

3. Software With Better Customer Support:

There are a few key things to consider when looking for software with good customer support to make a Cumulative Bill. In case you go for the software that offers customer service to your clients through numerous methods or online platforms like phone, e-mail, and chat.

It will give you the freedom to ask them in any unwanted situation. Also, consider reading reviews and ratings from other customers to learn how they felt about customer service. Look for software providers known for being quick to respond and helpful when customers have problems.

Lastly, check whether or not there are training materials or documentation in the software, as it can help you learn how to use the software well. By thinking about these things, you can select the best possible Cumulative billing software provider with good customer service that will make it easy to create bills.

4. Software With Better Integrated Features:

Choosing the right integrated features for creating a Cumulative Bill Format for a business depends on several things, such as the size and complexity of the business, the software systems already in use, and the specific needs for the bill format.

The best choice is to use small business accounting software like Vyapar, which integrates various billing, invoicing, and accounting features into one app. The software comes with free Invoice Formats that can be customized and help automate billing processes.

Ultimately, the type of integrated features in the app depends on your business needs. Before finally committing to software, it is important to consider the features, prices, and compatibility of different software options. Getting advice from someone who works in IT or accounting is also helpful.

Why Choose Vyapar to Create a Cumulative Bill Format?

Here are the following reasons why you should use the Vyapar software to create the Cumulative Bill for your business:

1. Create Your Bill in Various Formats:

The Vyapar app is a powerful business tool that makes it easy and quick to create invoices and bills. One of the most exciting things about this software for Cumulative Bill Format is that it can make bills in PDF, Word, and Excel formats. Business appreciates Vyapar as it allows them to choose the format that best fits their needs and business preferences.

Creating bill/invoices in PDF format enables you to send clients documents that look professional, while bills in Word format can be edited and changed to meet specific needs. Excel format is excellent for businesses needing to bill customers in more detail and analyze data.

Using our all-in-one software allows your business to create a Cumulative Bill format for your business quickly. Using Vyapar, your business can easily send bills to clients and streamline the billing process simultaneously. With the ability to make bills in different formats, you can improve the efficiency of your billing process and the business.

2. Seamless Billing and Invoicing:

Using Vyapar’s free invoicing software to create a GST Cumulative Bill for your clients quickly and easily. Most Cumulative Bills should be in the GST invoice format, and you can make them with our GST billing software for Cumulative Bill Format.

You can speed up the billing process with a barcode scanner, and shortcut keys can help you do repetitive tasks faster. One of the most critical parts of the Vyapar software for Cumulative Bill Format is “bill-by-bill payment,” which makes it easy to link payments to sales invoices.

The free GST mobile app lets you easily set up multiple parties to manage your clients. This feature makes it easier to track all the invoices’ due dates and find old invoices at any time. The Vyapar app lets businesses quickly determine if payments are overdue using the business dashboard.

3. Manage Your Cash Flow:

Businesses can keep track of their transactions with GST billing software. It allows you to keep track of money. More than a million businesses have used our free billing software. Many businesses use cash flow management for billing, accounting, etc.

Vyapar’s billing software helps to make management more effortless. It is done to keep accounting simple to reduce possible errors. If you buy this billing software, it will be easy to keep track of your business’s cash flow. This software has everything you need to handle cash transactions, including features like tracking bank withdrawals and deposits.

Our free GST software for Cumulative Bill Format is better for making a real-time cash book. Vyapar software enables the business to run its cash flow cycle efficiently by adding information about incurred operations costs, payments, purchases, and other things. With this GST software, it’s easy to keep track of cash.

4. Record Expenses:

Keeping track of expenses is easy with our free software for Cumulative Bill Format. Businesses can easily use our free software to create Cumulative Bills for their business and save tons of money. With our free GST billing software, you can efficiently track both GST and non-GST costs incurred on your business platform.

Using Vyapar’s billing solutions gives your business platform several benefits over those of competitors. Vyapar software significantly reduces operating costs and allows your business to make as much money as possible. The free billing software is an excellent way to run your cash flow cycle efficiently.

Our free mobile app is suitable for businesses that are growing. It helps them keep their money in order. Using GST software to track expenses, the company can find the best way to spend money. It’s a way to save money. Keeping track of costs will also help you make better plans. The business will make more money as a result.

Features that Make Vyapar Best in a Row

1. Online/Offline Compatibility Software:

With the Vyapar app, you can send Cumulative Bills to your customers without requiring an active internet connection. Connecting our business accounting software to the internet will help secure your transactions by updating your database.

With the software’s features for Cumulative billing, you don’t have to stop running your business when the internet connection is slow. You can use offline accounting software in your retail business to accept payments like cash and e-Wallets that don’t need an active internet connection. The Vyapar app is the best choice for businesses in India’s remote areas.

With our GST accounting software, you can send customers bills as soon as the billing cycle ends by creating a Cumulative Bill using a free invoice template. The Vyapar app is helpful in rural areas where connectivity and network problems are common because it can be used online and offline.

2. Keep Your Data Safe:

Using our free GST software to create your Cumulative Bill in different formats in India, you can set up an automatic data backup to protect the information the app stores. You can also make a local backup of your data for extra safety.

Data is an essential part of any retail business, and losing it can adversely impact your business platform. Creating professional reports and looking at sales information gives you much-needed insights into your business’s possible growth shortly.

But losing this information could hurt your business and sales, so you must make backups to ensure everything is safe. So, our free GST software in India lets you set up an automatic data backup, which helps keep the app’s data secure.

3. Allows You to Change the Theme:

You can improve your brand identity if you keep a professional Cumulative Bill Format and send them to your clients. The GST Billing App has two thermal printer themes that can be used for bills. It also has 12+ Invoice Templates for regular printers.

With this GST Vyapar software, it’s easy to make your Cumulative Bill look better. It’s easy to use the available customization options. You can make the Cumulative Bill for your client look nice. Making business bills can make a client more impressed.

The best thing to do for your accounting inventory is to use the Billing App for GST. It is straightforward to use. Choose the best Cumulative Bill Format for your business needs from the list below. Most businesses use Vyapar billing software because it helps them look more professional. It is a great way to build a good name for your brand.

4. Regular/Thermal Printer:

Vyapar billing software is ideal if you need a Cumulative Bill in the proper format instead of bill format or Excel format. Vyapar is compatible with thermal and standard (laser) printers and can help you acquire the printing you need in minutes.

Vyapar’s billing software/app provides a quick and easy way to print invoices and bills. You now have a superior choice for swiftly generating prints in all appropriate sizes, including conventional paper sizes A4 and A5, thermal paper sizes 2″ and 3″, and additional custom paper size possibilities.

Pair our app with your regular/thermal Printer through Bluetooth or plug-in to print Cumulative Bills. Create and send the professional Cumulative Bill to your customers using the Vyapar app. You can use digital techniques like e-mail, SMS, or WhatsApp instead of printing.

5. Free Lifetime Usage:

Using our free software for cumulative GST billing, you can create a Cumulative Bill quickly. You can also manage all your business dashboards and keep track of items in your stock. You can use many useful and helpful features with free access.

All of the essential parts of our business accounting tool are still free to use. Vyapar aims to bring millions of small business owners into the digital economy by giving them free access. Our invoicing tool to create a Cumulative Bill is best for SMEs because it lets them use mobile devices for free for life.

Vyapar is dedicated to providing the best services possible. You can get the Vyapar software from the Play Store, sign up to use it, and use its numerous features without paying a single coin from your pocket. But a business can subscribe to access the premium features and desktop application.

Frequently Asked Questions (FAQs’)

The Cumulative Bill Format is used to serve as a billing statement or invoice, and it lists all the charges incurred and funds received over a certain amount of time.

When a bill is presented in a cumulative format, the total amount is arrived at by adding up all of the individual charges that have been racked up for a predetermined amount of time.

Suppose there is a disagreement about charges on a Cumulative Bill. In that case, the parties can ask for a detailed breakdown and try to resolve any differences if the controversy cannot be solved bilaterally. Then you may need a mediator, or you can take the help of legal authorities.