Reconciliation of Cost And Financial Account Format

Use accounting software to create your processional-looking reconciliation of cost and financial account format. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all formats for free.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Table of contents

- Reconciliation of Cost And Financial Account Format

- Download Reconciliation Of Cost And Financial Account Format in Excel

- Download Reconciliation Of Cost And Financial Account Format in PDF

- Download Reconciliation Of Cost And Financial Account Format in Word

- Download Reconciliation Of Cost And Financial Account Format in Google Docs

- Download Reconciliation Of Cost And Financial Account Format in Google Sheets

- What is the Reconciliation Of Cost And Financial Account Format?

- Steps To Prepare A Reconciliation Of Cost And Financial Account Format

- Benefits Of Using The Reconciliation Of Cost And Financial Account Format

- Features Of Vyapar That Make It Best For Reconciliation Process

- Frequently Asked Questions (FAQs’)

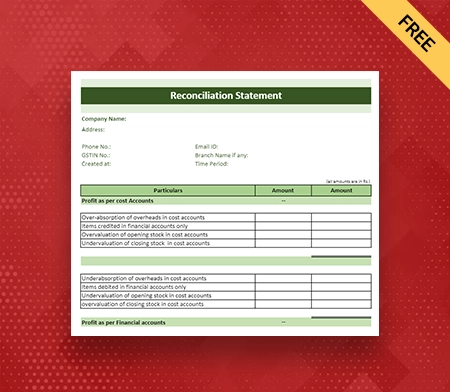

Download Reconciliation Of Cost And Financial Account Format in Excel

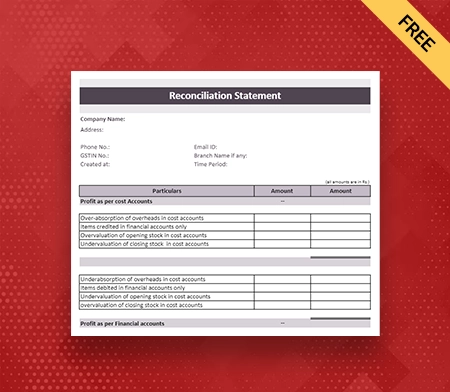

Download Reconciliation Of Cost And Financial Account Format in PDF

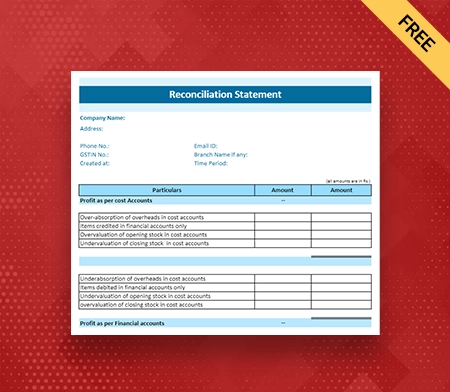

Download Reconciliation Of Cost And Financial Account Format in Word

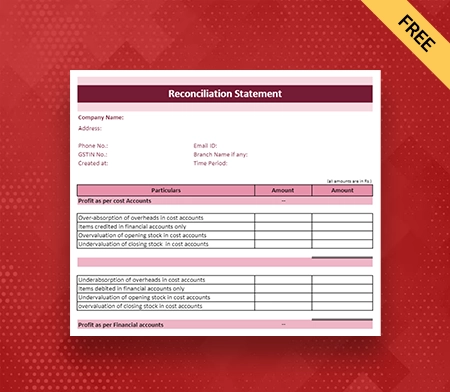

Download Reconciliation Of Cost And Financial Account Format in Google Docs

Download Reconciliation Of Cost And Financial Account Format in Google Sheets

What is the Reconciliation Of Cost And Financial Account Format?

The reconciliation of cost and financial account format harmonizes the information presented in a company’s cost and financial accounts. It assures consistency between the cost details recorded in the cost accounts and the financial information presented in the financial statements.

This reconciliation identifies discrepancies or errors between the two sets of accounts, allowing for accurate financial reporting and decision-making based on dependable cost data.

Steps To Prepare A Reconciliation Of Cost And Financial Account Format

Here are the following steps to prepare the reconciliation of cost and financial account format:

1: Identify The Scope

The correct accounting scope requires the period when accounts will be part of the reconciliation process. It includes choosing the cost and financial account details that must be matched and compared. The scope may change based on the wants and goals of the organization.

Also, it requires a time period that needs to be adjusted carefully in monthly, quarterly and annually. Clearly defining the topic helps set limits for the reconciliation process and ensures the work is focused and done well.

2: Collect Cost and Financial Account Data

Collect the essential data from financial accounts with precision and completeness, and the following actions might be followed. First, identify the precise data that must be collected, such as expenses, revenues, profit and loss accounts, assets, liabilities, and equity. Then, collect the necessary financial statements, such as income statements, balance sheets, financial books and cash flow statements.

Extraction of cost-related data from cost accounting records, such as production costs, overhead charges, and cost allocation details, is also recommended. Cross-reference and reconcile information from numerous sources to ensure consistency in data accuracy. Finally, ensure that all essential data is gathered to show the company’s financial and cost performance clearly.

3: Compare Account Structures

Analysing the structure and classification of accounts in both the cost and financial accounts is essential for identifying discrepancies or variances. Examining the account nomenclature conventions and categorisation methods can be used for both sets of accounts when it is required.

Inconsistencies and discrepancies can get identified by comparing the terminology and classification systems. For instance, a cost account may classify particular expenses differently than financial statements. This analysis ensures the accounts are aligned properly and facilitates accurate mapping and comparison during the reconciliation process.

4: Align Account Codes

To ensure the mapping and comparison are done properly, it is important to check that the account codes which are used in the cost accounts should match with those used in the financial accounts. It is done by looking at the account codes for both sets of accounts and seeing if there are any differences or mistakes.

By matching the account codes, cost and financial data can be perfectly aligned, and costs can be correctly mapped to the right financial groups. This step makes it easier to reconcile, reduces mistakes, and ensures that the costs are shown correctly in the financial records.

5: Adjust Cost or Financial Accounts

During the reconciliation process, if mistakes or differences between the cost and financial accounts are found, it is important to make the appropriate changes to bring them into line. It means fixing mistakes, eliminating inconsistencies, and ensuring the cost and financial data are correct.

Adjustments can include reclassifying spending, redistributing costs, or updating entries in either cost or financial accounts. By making these changes, the reconciliation process ensures that both sets of accounts are in sync. It makes reporting on finances easier and making decisions based on true cost data.

6: Document Reconciliation Adjustments

For transparency, accountability, and a clear audit record in memorandum reconciliation accounts, it is important to keep track of all changes made during the reconciliation process. Each change should be written down, explaining why it was made and proof, like an invoice, a receipt, or an internal note.

Proper documentation ensures that the reasons for the changes are well-documented so that auditors, stakeholders, and future reconcilers can easily understand and review them. This paperwork helps show that the reconciliation process is accurate and honest and gives a good point of reference for future analyses or audits.

7: Update Financial Statements

To ensure accuracy and integrity in financial statements, including the reconciled cost data after the reconciliation procedure is essential. It entails incorporating the adjusted cost information into the financial statements balance sheet, income statement, profit and loss statement and cash flow statement.

By doing this, the financial statements will completely reflect the organisation’s financial status and reflect the reconciled data. The financial statements are reliable and can be utilised for decision-making, financial analysis, and compliance with accounting rules and regulations when the reconciled cost data is included.

8: Review and Validate

It is essential to thoroughly review the reconciled accounts to validate their accuracy and completeness following the reconciliation procedure. It entails a comprehensive examination of the reconciled data, a comparison with the supporting documentation, and various analytical procedures to ensure consistency and accuracy.

The review procedure includes acquiring approvals and signatures from stakeholders such as management and finance personnel and increases the reliability of cost accounts. By conducting a thorough evaluation, organisations can ensure the dependability and integrity of the reconciled accounts, assuring that the reconciliation process has been executed effectively.

Benefits Of Using The Reconciliation Of Cost And Financial Account Format

Here are the following benefits of using the reconciliation of cost and financial account format:

1: Compliance with Accounting Standards

Reconciliation of cost and financial account format is essential for assuring compliance with accounting standards and regulations because it aligns costs and financial accounts. This procedure enables organisations to demonstrate financial reporting transparency and accuracy.

Companies can satisfy regulatory requirements by reconciling costs by providing a clear and exhaustive overview of their financial performance. In addition, it builds customer, investor, and stakeholder trust in your business.

2: Provided Enhanced Accuracy

Reconciliation of cost and financial account format is essential to ensure the accuracy of financial statements. This process minimises errors and discrepancies by comparing and reconciling the costs incurred with the financial accounts, resulting in more reliable financial information. It ensures that costs are recorded and allocated accurately and that any inconsistencies or discrepancies are identified and corrected.

Consequently, stakeholders can have more faith in the cost accounts and financial statements, which makes them more credible and reliable. Accurate financial information facilitates decision-making, financial planning, and performance evaluation.

3: Improved Decision-Making

Reconciliation of cost and financial account format clarifies a business’s financial health, allowing for more informed decision-making. Business managers require access to accurate and current information on the reconciliation of cost and financial account format for better decision-making in future.

It includes evaluating profit as per financial statements, identifying inefficient areas, and determining the financial viability of various projects or initiatives. By thoroughly comprehending the company’s financial books and other sets of books, managers can make strategic decisions that optimise resources, increase profitability, and foster sustainable growth.

4: Effective Cost Control

Reconciliation cost and financial account format enable businesses to monitor and control costs more effectively. The administration obtains valuable insight into the organisation’s cost drivers by comparing and aligning costs with financial accounts. It allows them to identify excessive expenditure, inefficiency, and waste areas.

With this information, management can implement targeted cost-saving measures and make informed decisions to enhance cost management overall. Companies can increase profitability, streamline operations, and improve financial performance by actively managing costs.

5: Facilitates Budgeting And Forecasting

Reconciliation cost and financial account format provide a firm foundation for developing accurate budgets and projections with better reliability of cost planning. Companies can obtain insight into historical spending patterns and trends by aligning costs with financial data. This data facilitates effective financial planning by providing a premise for estimating future expenses and revenues.

Managers can make informed judgments regarding strategies for resource allocation, revenue generation, and cost control. With more precise budgets and projections, organisations can improve their financial stability, make more accurate projections, and adapt their strategies to achieve their financial objectives.

6: Streamlined Auditing Process

Reconciliation of cost and financial account format facilitates auditing by giving auditors a clear and organised view of the financial data. Auditors can quickly confirm the accuracy of financial statements by comparing reconciled costs to the corresponding financial accounts.

Discrepancies and irregularities are easily identified, allowing auditors to investigate and resolve them expeditiously. This streamlined procedure enhances audits’ effectiveness and financial reporting’s dependability. The reconciliation provides an exhaustive and accurate picture of the company’s financial position and performance, instilling stakeholders with confidence.

7: Better Cost Allocation

Reconciliation of cost and financial account format is essential for accurately allocating costs to cost centres or initiatives within an organisation. Businesses can ensure that expenses are correctly allocated by reconciling costs, facilitating accurate performance evaluation, profitability analysis, and pricing decisions.

It enables a thorough comprehension of the costs associated with particular activities or projects, thereby facilitating the identification of areas of inefficiency or profitability. Accurate cost allocation facilitates informed decision-making, aids in determining the profitability of various operations, and facilitates the establishment of appropriate prices for goods or services, resulting in Enhanced performance.

8: Improved Performance Measurement

Companies can measure and judge their success more accurately when reconciling their cost and financial accounts. By matching costs to financial data, organisations can figure out key financial ratios and metrics that inform them about their operational efficiency, profitability, and financial health.

The reconciliation process allows management to make choices based on data, implement effective management strategies, and improve overall financial performance.

Features Of Vyapar That Make It Best For Reconciliation Process

1: Manage Your Business Cash Flow Seamlessly

Businesses can effortlessly prepare reconciliation statements by keeping track of their transactions with accounting tools. It helps keep track of money and reduces the operation cost. More than one crore businesses have used our free billing tools. Many companies use Cash Flow management for various purposes such as billing, budgeting, profit and loss shown in statements etc.

Vyapar’s free billing software makes your reconciliation process easier. It is done to keep sets of accounting from going wrong. If you buy this accounting program, keeping track of your business’s cash flow will be easy. This software has everything you need to handle cash transfers, as it has benefits like tracking bank withdrawals and deposits.

Our free accounting software is better for making a cash book in real time. It can help a business keep making money through efficient tools and adding all the information about costs, payments, purchases, and other things. With this GST accounting program, it’s easy to keep track of cash. You can also track trading profit and loss statements on the Vyapar business dashboard.

2: Filing GST Become Faster And Easier

Filing GST is hard for small business owners; if done manually, it takes a long time and resources. Using the Vyapar accounting tools, you can make GST reports and file GST easier and simpler. So they can make sure they follow the tax rules and create and keep the GST report for future decision-making.

After all, you must keep track of their monthly invoices, expenses, and memorandum accounting information. You have to type them in by hand to make GST returns. Vyapar changes everything by making it easier to make GSTR returns and saves time by automating the process. You can use the app to make different GSTR business reports, such as GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9.

Suppose you are using the information you saved when you prepare a reconciliation statement for your business and put in costs. Business owners can save time by making GST reports with professional accounting software. With this, they can be sure that all accounting jobs will be done correctly by automation.

3: Create Your Reconciliation Account In Various Formats

Vyapar accounting software includes various tools that can aid your business in preparing and reconciling cost and financial accounts in various formats, including DOC, PDF, Word, and Excel. Users of Vyapar can generate comprehensive reports that accurately capture cost and financial data.

These reports can then be exported and saved in many forms, making them easy to share, distribute, and integrate with other papers or analysis tools. Vyapar has the functionality to satisfy your needs, whether you need to provide the reconciliation information in a professional paper (DOC or Word), a universally accessible format (PDF), or a flexible and configurable spreadsheet (Excel).

This feature improves the versatility and readability of reconciliation data, allowing businesses to efficiently communicate financial information and make informed decisions based on cost and financial account analysis. Small business owners who perform their accounting operations from their Android phones don’t have to pay subscription fees.

4: Cash And Bank Management

Vyapar is an all-in-one tool for managing cash and bank accounts efficiently. With Vyapar, it’s easy to handle cash-to-bank and bank-to-cash transfers. It lets you move money quickly between your cash register and bank accounts. The app also makes it easier to move money between accounts by enabling people to transfer money from one bank to another.

Vyapar enables you to change your cash and bank amounts and recover overhead costs, making it easier to keep track of your finances and ensure everything is in order. Vyapar makes it easier to record and track cheque transactions, which makes cheque handling easier. Within the system, you can easily handle deposits and withdrawals and check the clearing status.

Vyapar allows you to manage loan accounts by giving you tools to record loan details, keep track of payments, and make loan statements for better financial tracking. Vyapar gives businesses strong cash and bank management tools, an easy-to-use interface, and several features that make financial processes run more smoothly.

5: Create Various Reports

Inventory management software Vyapar provides extensive reporting capabilities to help businesses monitor and manage their finances effectively. The transaction report provides users with detailed summaries of sales, purchases, payments, and other income and expenditures, allowing them to analyse their financial activities.

The balance sheet report provides an overview of the company’s assets, liabilities, and equity, revealing its financial standing. The profit and loss statement details the company’s income, expenses, and profitability over a specified time frame. The low stock summary report identifies low inventory levels, facilitating inventory management and replenishing stock of finished goods as soon as possible.

The party outstanding report displays overdue payments from customers, whereas the party report by group categorises parties based on specific criteria, facilitating improved customer management. The software Vyapar ensures that businesses have access to valuable financial data for making informed decisions.

6: Tax And Discounts

Using the Vyapar advanced features, you can track the status of each bill’s payment. Vyapar aids in establishing invoice due dates, ensuring your business maintains a healthy and steady cash flow while automating tasks to save money. It provides different tax and discount options depending on the item or transaction.

The agreement can get stored in our sophisticated accounting software. The Vyapar software allows for modifying or adding tax categories and rates. Our accounting software allows you to manage discounts effectively. It will enable you to accept/make partial and full payments based on your business’s needs. Our Vyapar accounting software allows for the management of loans and payments.

Vyapar has an intuitive user interface and automates your organisation’s repetitive business processes. Vyapar offers more than 40+ reports to its customers. Our accounting software enables you to perform multiple duties at no additional cost. You can easily keep track of your business expenses and disclose profits to your stakeholders, board members, or partners when required.

7: Track Your Business Expenses Easily

Keeping track and recording all business expenses is essential for reconciliation and tax filing. Using the Vyapar expense management software, tracking expenditures and generating an accurate report is simpler. Small businesses can optimize their expenditures to save more money with relative ease.

Using our free software, you can record both GST and non-GST expenses effortlessly. Vyapar Solutions offer numerous advantages over rivals not focusing on these strategic business areas. It allows you to reduce costs and increase sales. The software is an effective method for swiftly documenting overdue expenses.

It serves to track them in the future as well. Our free accounting app is ideal for expanding small enterprises. It helps them maintain financial stability. By recording expenses using GST software, the business can optimise expenditures. It reduces expenses. Keeping track of expenditures will also aid in the development of superior strategies. It will result in increased business profitability.

8: Helps in Building Processional Brand Image

During negotiations, offering professional reconciliation of cost and financial account format enhances the brand’s reputation. To further foster confidence, you can give full disclosure regarding the deal. Vyapar aids in your professional brand development.

A reconciliation of cost and financial account format that has been expertly created can help you stand out from the crowd and project a professional seller image. To convey your brand’s identity flawlessly, you can use our company’s logo, style, font, and brand colours in your reconciliation format.

A buyer is more likely to purchase from a seller who uses expert-tailored quotation formats instead of plain text. Buyers perceive the custom-built estimates and quote as reliable as it includes all the details required to close the deal. The information in the quotes can include details about goods and services, price breaks, taxes, etc.

Frequently Asked Questions (FAQs’)

Reconciliation of cost and financial account format is comparing and making changes to the cost accounts and their matching financial accounts to ensure that financial reporting is accurate and consistent. It means matching the cost of goods sold, inventory, and other costs with the financial statements.

Reconciliation of cost and financial account format is essential because it helps ensure the accuracy of financial statements. It facilitates the identification of any discrepancies or errors between cost and financial accounts, allowing for implementing the necessary corrections. This reconciliation is essential for generating dependable financial reports that can be used for compliance and decision-making.

Some common differences between cost and financial accounts are Variations in inventory valuation techniques, scheduling mismatches in recognising income and expenses, handling of overhead costs, and differences in cost allocation. These discrepancies may result in variations in profit numbers and a company’s overall financial status.

Most of the time, the reconciliation of cost and financial account format is done by comparing the balances and transactions recorded in the cost accounts (like the cost of goods sold, work in progress, and finished goods) with the corresponding items in the financial statements (like sales revenue, inventory, and cost of sales). Any differences or differences are looked into, and changes are made.

Use Vyapar software to create a professional and detailed reconciliation of cost and financial account format for your business. You can take a 7-day free trial and test its tool and features before making a final decision on it. Vyapar app is easily accessible on Android devices, Windows PCs, and MacBooks.

A cost reconciliation statement compares actual costs with budgeted costs to identify discrepancies and manage expenses effectively. It includes details like budgeted and actual costs, variations, reasons for discrepancies, and corrective actions.

Related Posts: