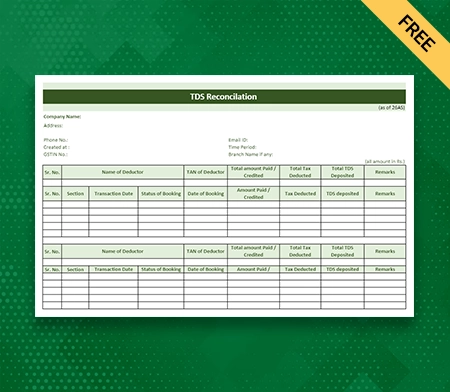

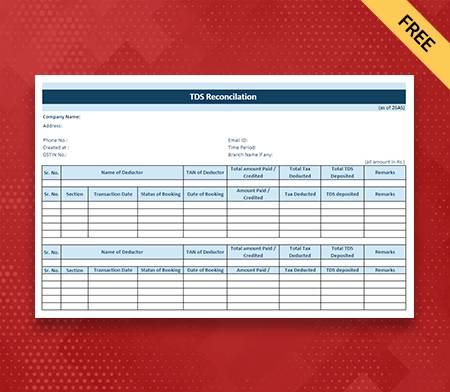

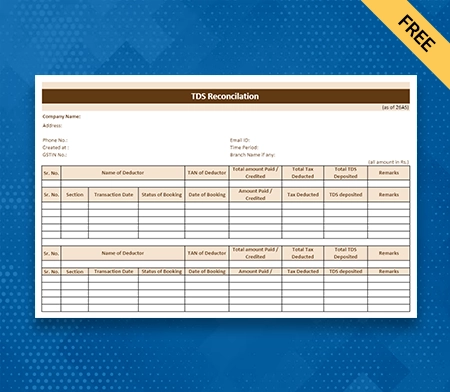

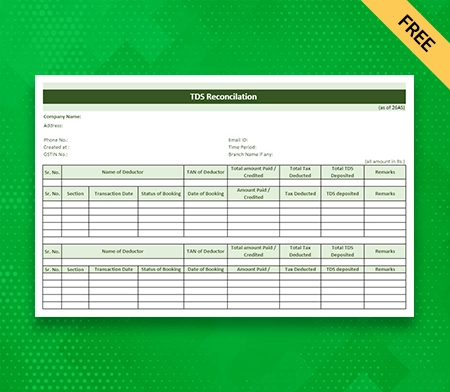

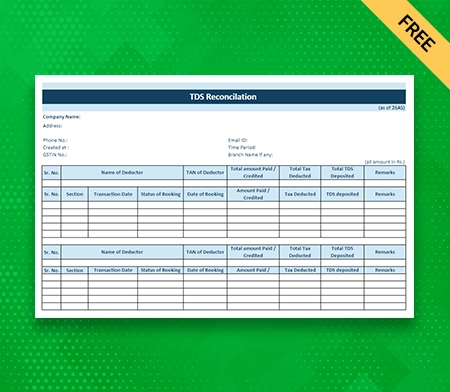

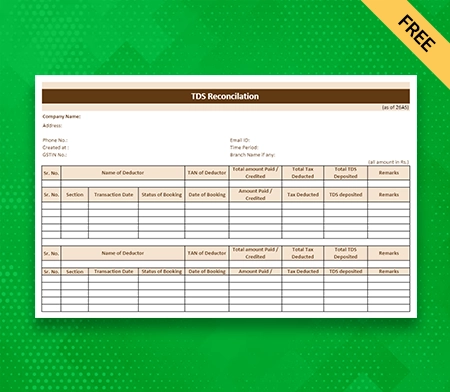

TDS Reconciliation Format

Use accounting software to create your processional-looking TDS reconciliation format. Using Vyapar makes the entire process seamless and helps you manage your work with one app. You can download Vyapar now and access all reconciliation formats for free.

- ⚡️ Create professional reconciliation with Vyapar in 30 seconds

- ⚡ Share reconciliation automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download TDS Reconciliation Format

What is TDS Reconciliation Format?

The TDS reconciliation format accommodates details of a taxpayer’s tax deductions that are reported and matched with the information the tax officials already have. The TDS reconciliation format ensures that the TDS taken out by the deductor matches the TDS reported by the deductee. This makes it easier to figure out and pay taxes correctly.

TDS Reconciliation Process

Here is the step-by-step guide for creating a well-detailed TDS reconciliation format:

1: Collect TDS Reconciliation Details

The first step for TDS reconciliation is collecting TDS deduction information from different sources, such as TDS certificates like Form 16 and Form 16A, TDS challans, and other related documents. Review the TDS certificates carefully to find out information like the deductee’s PAN (Permanent Account Number), the TDS area, the payment type, and the amount taken out.

Also, collect TDS challans and other papers showing the TDS deductions were made. For the next steps of TDS reconciliation, you need accurate and full information from these sources. It helps make sure that the process goes smoothly and without mistakes.

2: Compile TDS Data

The next stage of the TDS reconciliation format, following the collection of TDS deduction details, is to consolidate them into a single document for easier management and reconciliation. It can be accomplished with an Excel spreadsheet or specialized TDS software. Create columns for deductee PAN (Permanent Account Number), TDS section, nature of payment, and deductee-specific breakdown of the data.

Enter the correct information in each column, ensuring the data corresponds to the appropriate TDS deductions. By consolidating the TDS details into a single document and categorizing them, you can expedite the reconciliation process and gain a clear understanding of the deductions made for each deductee.

3: Download Form 26AS

Accessing the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website or the income tax department’s e-filing portal will give you a full list of all the TDS deductions made on your account by different deductors in India. From there, you can download Form 26AS, which shows all TDS charges in one place.

Form 26AS gives information like TDS numbers, deductor information, the type of payment, and the TDS challan. It is an essential record for reconciling TDS because it lets you compare your deductions with the information you got from other sources.

4: Verify TDS Deduction Data

Once you have collected the TDS information, it is essential to check it against the information on Form 26AS. Carefully compare the TDS amounts, information about the deductor, and payment type on Form 26AS to what you have written down. Make sure everything is correct and items are present.

If you find mistakes or differences, fix them right away. It could mean contacting each deductor to make changes, making new TDS returns, or sending correction statements. Fixing any mistakes will help make sure the TDS balance is correct and keep you from having problems with the income tax department.

5: Identify Discrepancies

During the TDS reconciliation process, carefully review the TDS data to find any mistakes. Check to see if the deductee’s PAN, the TDS amounts, or any records need to be corrected or added. Precautionary steps should be immediately taken if there are any differences or discrepancies. It could mean getting proper TDS certificates from deductors or contacting them to make changes.

Communicate with them about the problems and give them the proof they need to fix them. By resolving the differences, the TDS data will correctly show the deductions made and match the information the deductors gave.

6: Carefully Rectify The Errors

Correct any errors or anomalies in the TDS data according to the processes established by the income tax department. This usually entails submitting amended TDS returns or corrective statements. Ensure you follow the criteria and supply the required information and supporting documentation.

By doing so, you can rectify the errors and discrepancies in the TDS reconciliation format and guarantee that the amended TDS data accurately reflects the correct TDS facts following the income tax department’s standards.

7: Prepare TDS Reconciliation Statement

The TDS reconciliation statement must be drafted after verifying and correcting the TDS data. This statement should summarise the total TDS deductions made, ensuring they correspond to the information on Form 26AS. It should comprehensively summarise the reconciled TDS data, including a breakdown by deductee, payment type, TDS section, and accurate TDS amounts.

The TDS reconciliation format functions as a consolidated report, allowing you to present a comprehensive picture of TDS deductions and their conformity with Form 26AS data. You can create your TDS reconciliation in a different format and add the other necessary details you want to add as per your requirement.

8: Submit Reconciliation Statement

Finally, send the TDS reconciliation format to the income tax department at the specified deadline. It is typically done electronically through the income tax department’s e-filing system. Along with the statement, ensure to include any required documents and attachments.

Before submitting, double-check that the information provided is correct and comprehensive. Following the given timetable and submitting all essential papers will ensure a seamless and compliant TDS reconciliation statement filing process with the income tax department.

Best Practices For TDS Reconciliation Format

Here are the following best practices to follow for an efficient TDS reconciliation format:

1: Maintain Accurate Records

The TDS reconciliation format requires meticulous documentation of all TDS deductions, TDS certificates, challans, and other pertinent documents. These records are a reliable point of reference for cross-checking and identifying discrepancies. TDS reconciliation format helps businesses with long-term planning and decision-making.

A complete record-keeping system facilitates the identification and resolution of discrepancies during the reconciliation process. Additionally, accurate records facilitate efficient communication with deductees and tax authorities, ensuring compliance and minimizing the risk of errors or penalties.

2: Regularly Update TDS Returns

TDS returns must be filed on time and accurately for the TDS reconciliation procedure to work. Following the dates helps to prevent penalties and guarantees compliance. It is critical to regularly update and revise the returns to reflect any changes in TDS deductions, such as corrections or revisions.

This procedure guarantees that TDS returns correspond to total deductions, reducing discrepancies during reconciliation. It also makes the reconciliation process go more smoothly and ensures the correctness of TDS reporting to the tax authorities.

3: Validate Pan And Other Details

Before deducting TDS, it is essential to verify the PAN (Permanent Account Number) and other information of the deductees. Only correct or valid information can lead to difficulties and delays in reconciliation. Verifying the details of the deductees ensures accurate TDS reporting and prevents complications during the reconciliation procedure.

By validating the PAN and other pertinent information, such as the deductee’s name and address, errors can be identified and corrected in advance, reducing the likelihood of mismatched records and facilitating a more efficient TDS reconciliation format. This practice promotes conformance and minimizes potential complications resulting from incorrect deductee information.

4: Timely Issuance Of TDS Certificates

For the TDS reconciliation process, TDS receipts must be sent to deductees within the time limit. Deductees use these papers to ensure that their TDS deductions match how much tax they owe. When certificates are sent out on time, deductees can correctly report their income and TDS credits on their tax returns.

It encourages transparency, helps deductees avoid mistakes in their tax calculations, and makes it easy for deductors and deductees to get back on the same page. By ensuring that TDS certificates are sent out quickly, deductees can meet their tax responsibilities and stay in line with tax rules.

5: Reconcile TDS Deductions With TDS Certificates

A crucial phase in the TDS reconciliation format process is cross-verifying the TDS deductions performed with the TDS certificates obtained from deductees. It is vital to check that the deductions match the amounts listed on the certificates. This verification will enable any inconsistencies or mistakes to be quickly identified.

Maintaining accuracy in TDS reporting and facilitating smooth reconciliation are made possible by matching the TDS deductions with the certificates. It increases transparency in the TDS reconciliation process and guarantees that deductors and deductees agree on the TDS deductions made.

6: Regular Communication

Effective TDS reconciliation format requires establishing and sustaining open communication channels with deductees and tax authorities. Responding quickly to any questions or concerns raised by deductees or tax authorities is crucial. A collaborative approach is fostered by timely communication, allowing for promptly resolving any discrepancies, clarifications, or other issues that may arise during the reconciliation process.

Open communication channels also facilitate the exchange of information, guaranteeing the accuracy of TDS reporting and compliance. By proactively addressing questions and concerns, reconciliation can be accomplished without hiccups or instances of noncompliance.

7: Conduct Internal Audits

Regular internal audits are necessary for assuring the accuracy of TDS deductions, filing, and reconciliation. Any errors or discrepancies can be uncovered in advance by performing periodic audits. It entails examining the TDS deduction procedure, confirming the accuracy of TDS submission, and cross-checking reconciliation records.

Internal audits also enhance TDS processes by identifying areas for improvement and assuring the accuracy of TDS reporting. By maintaining a proactive approach to auditing, accuracy and compliance can be maintained consistently.

8: Stay Updated With Regulatory Changes

For a smooth TDS reconciliation process, staying current on changes to TDS regulations, rates, and reporting requirements is essential. It is crucial to keep abreast of any changes or updates through official notifications and instructions issued by the tax authorities. It includes any updates to TDS rates, forms, filing deadlines, and other pertinent information.

By keeping apprised of these changes, deductor organisations can ensure compliance, prevent errors, and make the necessary adjustments to their TDS processes, resulting in accurate reporting and seamless reconciliation with the most current regulatory requirements.

Feature Of Vyapar That Makes It Best To Manage Your Taxes

Tax And Discount Management:

Using the advanced features of the Vyapar free billing software, you can track the status of each payment. Vyapar aids in establishing tax due dates, ensuring that your business maintains a healthy and steady cash flow by removing the repetitive task by automating it. Depending on the item or transaction, this provides different tax and discount options to your firm.

The Vyapar software allows businesses to modify or add tax categories and rates. Our accounting software allows you to manage discounts effectively. It will enable you to accept/make partial and full payments based on your business’s needs. Our accounting software allows easy management of loans and payments.

It features an intuitive user interface and automates your organisation’s repetitive business processes. Vyapar offers 40+ reports to its customers. Our small business accounting software enables you to perform multiple duties at no additional cost.

GST Filing Made Faster And Easier:

Filing GST manually is challenging for businesses, can lead to human errors, and can be time-consuming. Using our accounting software, you can generate GST reports and streamline the filing process effortlessly. Many business proprietors spend time and effort filing the GST each month. Vyapar accounting software assists businesses with compliance and tax laws.

Once you have created your GST reports, you can file GST returns easily. Vyapar accounting software revolutionises the process by automating the creation of specialised GSTR reports, which saves your valuable time and can be devoted to productive business areas. Vyapar can help you generate multiple GSTR reports directly within the app, such as the GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9 reports.

Vyapar accounting software easily stores your data once you’re done with your bills, invoices, reports etc. Every business owner who uses professional accounting software to generate GST reports saves their resources and time. With Vyapar, they can rely on automation to accurately complete all accounting duties.

Generate Various Reports:

The Vyapar accounting software offers various transaction reports that help you to manage your cash flow effortlessly. The Day Book keeps track of everything that happens during a particular financial period. The sales ageing report documents sales bills that have yet to be paid, making it easier to track when customers pay.

The Balance Sheet is essential for a financial report that shows a company’s assets, liabilities, and equity over a certain financial year. The Profit and Loss statement lists income, costs already paid, and the net gain or loss. The Expenses report sorts expenses into groups to make cost research easier.

Lastly, the Tax Report makes it easier to pay taxes by giving a summary of taxable activities. With Vyapar, businesses can quickly get these reports and use them to make smart choices and keep their finances clear. You can also create your reports and TDS reconciliation in different formats, such as TDS reconciliation format in excel, docs, PDFs, and Word.

Track Your Business Expenses Effortlessly:

Tracking and recording all business expenses for TDS reconciliation and tax filing. Using premium accounting software makes tracking expenditures and generating accurate reports easier and simpler. Our application is an efficient way to track expenses incurred by your firm. Businesses can optimise their expenditures to save more money with relative ease.

Using our expense management software, you can easily record GST and non-GST expenses within a few minutes. In addition, Vyapar accounting software offers numerous advantages over your business rivals who must focus on these evolving aspects. It enables you to reduce expenses and increase sales in your business. Accounting software is an effective method for swiftly documenting expenses. It serves to track them in the future as well.

Our free Android application is ideal for expanding enterprises, and it is easy-to-use which hardly requires any additional training for your staff. It helps them maintain financial stability. By recording expenses using GST software, the business can optimise expenditures.

Track Your Business Status Using Dashboard:

Using the Vyapar business dashboard, which streamlines the administration process to have an eye on real-time operation in your business. You can easily track the Cash flow, inventory status, open orders, and payment status in one location. It is free of cost for businesses that are performing their business with Android phones.

With free accounting software and reporting tools, windows, PCs, Macbooks, and tablets, business management is possible. Using this free inventory management software, accounting in your business streamlines easily, no matter where you are. As TDS reconciliation, data is stored automatically in Vyapar and can be accessed when needed.

Using the business dashboard, you can rapidly obtain comprehensive updates of the real-time status of your company from anywhere. In our application, dashboard access is complimentary. Moreover, our Vyapar software includes other essential features: Cash Flow, Bank Status, Inventory/Stock Status, and Open Orders.

Keep Your Data Safe With Multiple Backup:

Vyapar accounting software is known for being 100% secure, and it is simple to store TDS reconciliation data safely and precisely. Our free accounting app allows you to safeguard your valuable TDS reconciliation data by creating local, remote, and online Google Drive backups.

Vyapar Accounting Software makes it simple to recover data rapidly without losing it. The data is encrypted with advanced security, and the Vyapar app is the most advanced free accounting software available. The app’s encryption system restricts data access to the owner, enhancing safety.

The “auto-backup” function of the Vyapar in India makes data backups effortless and makes it a popular choice for multiple business owners. After activating this mode in the Vyapar app, a daily backup is created automatically, making it simpler to back up all your data so you do not lose anything.

Frequently Asked Questions (FAQs’)

The TDS reconciliation format is used to match the required details of Tax Deducted At Source (TDS) taken out by the deductor with the TDS reported by the deductee. It usually includes things like the details of the TDS challan, the deductor and the deductee, and the details of the TDS certificate.

TAN (Tax Deduction or Collection Account Number) of the deductor, PAN (Permanent Account Number) of the deductee, details of TDS challan, details of TDS certificate, details of TDS deductions and payments, and any other relevant information needed for accurate reconciliation of TDS data are usually the most important parts of the TDS reconciliation format.

You can usually find the TDS reconciliation format on the website of your country’s or region’s tax authority or income tax department. It could be downloadable in the form of a template or format that can be tailored to TDS reconciliation. The format can also be obtained with the help of tax advisers or experts.

You can use Vyapar software to create and customise your TDS reconciliation format for free. Android users don’t have to pay fees for using our premium tools to perform their day-to-day operations seamlessly. Vyapar software for TDS reconciliation is the best choice for millions of businesses across India to create and manage their TDS reconciliation.

Related Posts: