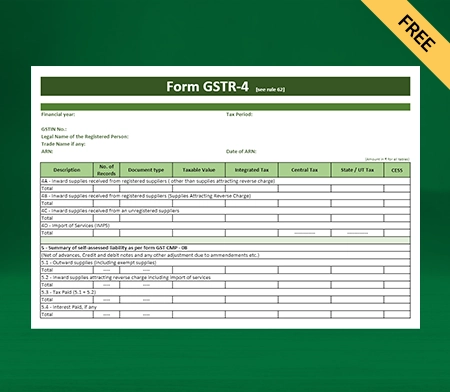

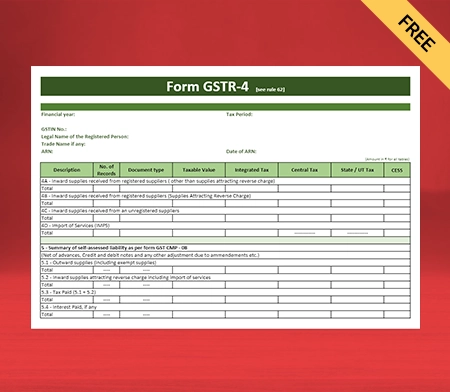

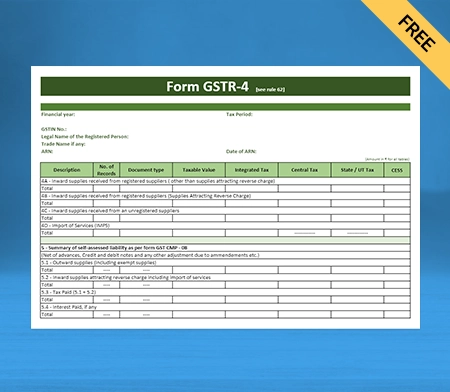

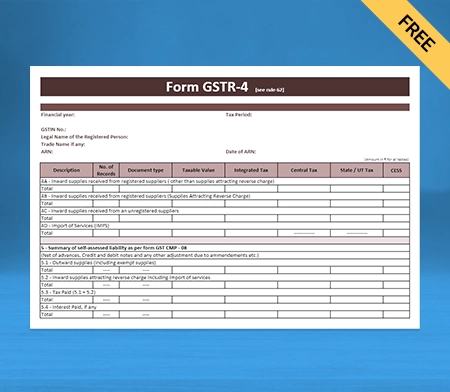

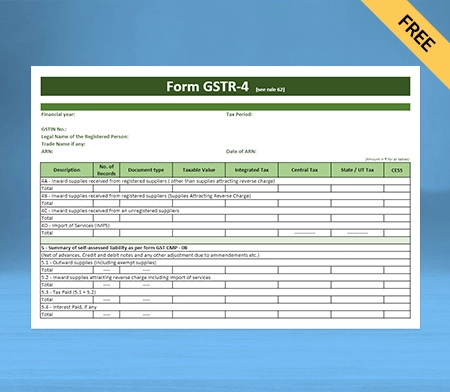

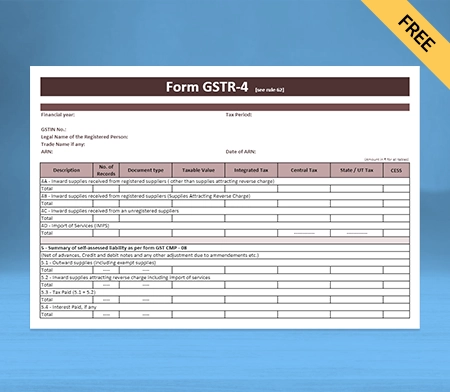

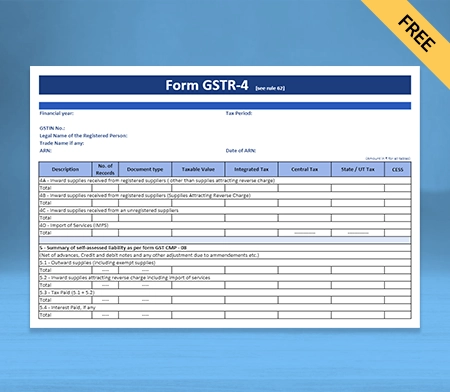

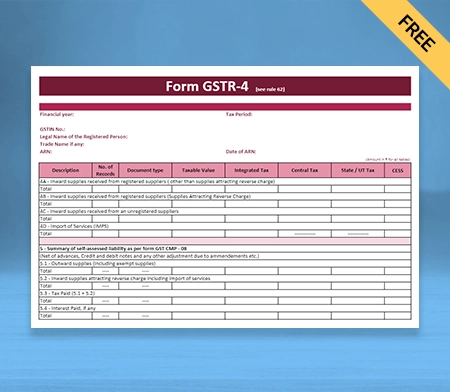

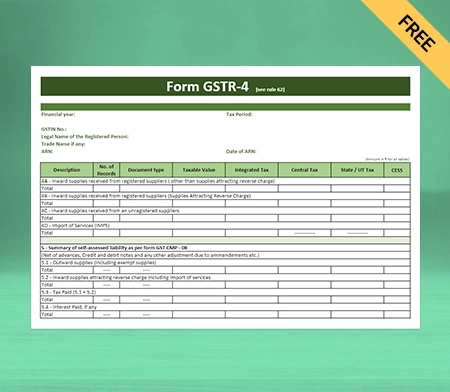

GSTR-4 Format

Use GSTR-4 Format by Vyapar to file your return. Avail additional features of the Vyapar app and make your accounting and billing process seamless. A free trial period is available, so try it now!

- ⚡️ Create professional GSTR-4 format with Vyapar in 30 seconds

- ⚡ Share GSTR-4 format automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download GSTR-4 Format in Excel

Download GSTR-4 Format in PDF

Download GSTR-4 Format in Word

Download GSTR-4 Format in Google Docs

Download GSTR-4 Format in Google Sheets

What is GSTR-4?

GSTR-4 is an annual return that a taxpayer must file for each financial year. Every taxpayer opting for the composition scheme during the financial year or any period for the said financial year must file GSTR-4. The last day for submitting GSTR-4 is the 30th of April, following the financial year in question.

Who Can Opt For the Composition Scheme?

The eligibility criteria for the composition scheme are as follows:

- Only manufacturers, traders, and restaurant businesses can choose the composition scheme. Service providers are not eligible for this scheme.

- The taxpayer’s annual turnover in the previous financial year should not exceed Rs. 1.5 crore. However, for special category states (such as Arunachal Pradesh, Assam, Himachal Pradesh, etc.), the limit is Rs. 75 lakhs.

- The taxpayer cannot collect tax from their customers under the composition scheme. Therefore, they cannot claim any input tax credit.

- The taxpayer cannot supply goods or services through an e-commerce operator who must collect tax at source under Section 52.

- Once a taxpayer opts for the composition scheme, they cannot opt-out until the end of the financial year.

- Taxpayers engaged in supplying exempted goods or services or making inter-state supplies are not eligible for the composition scheme.

Conditions Required to be Fulfilled Before Opting For the Composition Scheme:

The composition scheme is a simplified scheme for small taxpayers, under which they can pay tax at a fixed rate without the need to maintain detailed records or comply with regular tax procedures. However, not all taxpayers are eligible for the composition scheme.

Below are the conditions that must be fulfilled to opt for the composition scheme:

Turnover Limit: The taxpayer’s annual turnover should be less than or equal to Rs. 1.5 crores (Rs. 75 lakhs for Special Category States) to be eligible for the composition scheme.

Nature of Business: The composition scheme is available only for certain businesses. It is available for manufacturers, traders, and restaurants (not serving alcohol) and not available for service providers.

Inter-State Supplies: If a taxpayer makes any inter-state supplies, they are not eligible for the composition scheme.

Registration: A taxpayer must be registered under GST to qualify for the composition scheme.

Tax Rates: Taxpayers who will be opting for the composition scheme will have to pay tax at a fixed rate depending on the nature of their business. For instance, manufacturers have to pay a 1% tax rate, and traders and restaurant owners (not serving alcohol) must pay a 0.5% tax rate.

It is essential to note that taxpayers who opt for the composition scheme cannot collect tax from their customers. They also cannot claim input tax credits for any taxes paid on their purchases. Additionally, a composition scheme taxpayer must mention the words “Composition taxable person” on every invoice they issue.

Benefits of Filing the GSTR-4 Return:

- Filing a GSTR-4 return is mandatory for taxpayers who have opted for the Composition Scheme. By filing the return, the taxpayer stays compliant with the GST law.

- Filing the GSTR-4 return on time can help taxpayers avoid penalties and interest charges for late filing or non-filing.

- The GSTR-4 return filing process is relatively simple. The taxpayer can file the return online through the GST portal.

- The Composition Scheme is designed to reduce the compliance burden on small taxpayers. The taxpayer can further reduce their compliance cost by opting for this scheme and filing the GSTR-4 return.

- Filing GSTR-4 returns on time can improve the credibility of the taxpayer’s business, especially when dealing with suppliers, customers, and financial institutions.

- Filing a GSTR-4 return is essential for taxpayers who have opted for the Composition Scheme. By doing so, the taxpayer can stay compliant with the GST law, avoid penalties, reduce compliance costs, claim the input tax credit, and improve business credibility.

Contents of GSTR-4 Return:

There are several sections in GSTR-4. They contain information such as:

GSTIN:

The GST Identification Number of the taxpayer. This field is auto-populated.

Legal Name:

The legal name of the Composition Scheme taxpayer is registered under GST.

Aggregate Turnover:

The turnover of the taxpayer in the preceding previous financial year will get auto-populated at the time of filing the return.

Details of Registered Supplier Attracting Reverse Charge:

This section contains details of all inward supplies, including reverse charges made by the taxpayer. It includes the following subsections:

a. Supplies received from registered persons: It includes details of all supplies received from registered persons attracting reverse charges, such as the name of the supplier, their GSTIN, and the value of supplies.

b. Supplies received from unregistered persons: It includes details of all supplies received from unregistered persons attracting reverse charge, such as the name of the supplier, their address, and the value of supplies.

c. Imported services from overseas vendors for which you must pay the applicable IGST linked with the services received.

Amendments to the Details of Inward Supplies Provided in Returns For Earlier Tax Periods, Including Debit Notes/Credit Notes and Later Amendments:

It will include amendment details from returns for earlier tax periods and the initial amended debit or credit note received, rate-wise. The place of supply must be specified if it differs from the recipient’s location.

The invoice details must be provided in the first three columns of the Table when giving the information of the original debit/credit note. In contrast, the revision of the details of the original debit/credit note must be provided in the first three columns of the Table.

Consolidated Statement of Advances Paid and Advances Adjusted on Account of Receipt of Supply:

a. Part I details intrastate and interstate purchases for which reverse charge tax is levied, and you made an advance during the current tax term. Include information about purchase transactions for which you paid an advance during a previous tax period but only received the complete invoice.

b. Part II is used to correct incorrect data and to update the Table of prior GSTR-4 returns.

TDS Credit Received:

Any tax deducted at the source by the customer will be immediately updated here. It contains the customer’s GSTIN, the invoice’s gross value, and the amount of tax deducted.

Tax Paid:

It section contains details of the tax paid by the taxpayer, including the following subsections:

a. Tax paid on outward supplies: It includes details of the supplies on which tax was paid by the supplier.

b. Tax paid on reverse charge supplies: It includes details of the tax paid on all inward supplies, including the reverse charge made by the taxpayer.

Advances Received and Adjustments Made:

This section contains details of any advances received and adjustments made to them during the year.

Taxpayers registered under the GST composition scheme and filing GSTR-4 can claim a refund of any excess amount paid through the electronic cash ledger by filing Form GST CMP-08. The refund claimed from the electronic cash ledger will be credited to the electronic cash ledger of the taxpayer and can be used for future tax payments.

How to File the GSTR-4?

Step 1: Log in to the GST Portal

Go to the GST portal and log in with your valid id and password.

Step 2: Go to the Returns Dashboard

On the GST dashboard, click the “Services” tab and then “Returns Dashboard.”

Step 3: Enter Year and Filing Period Details

The file return page will appear. Select the “Financial Year” and the “Return Filing Period.” Click on “Search,” and separate tiles of all GST returns that can be filed will be displayed.

Step 4: Select the GST Return Type You Want to File

You can prepare a GST return online by clicking “Prepare Online” or opt for an offline method by clicking on “Prepare Offline.”

Step 5: Enter the Details

You need to enter all the details required in the GSTR-4 form. Once done, save the details and submit it. After submitting all the relevant information, you can pay through challan.

Now that the form has been filed successfully, the “Filling Successful” message will appear on the screen with the ARN (Acknowledgment Reference Number).

Tax Interest Penalty Fee:

According to the most recent update, a late fee of Rs.50 per day, up to a limit of Rs.2,000, is charged when the liability is nil. The highest late fee is Rs.500.

Previously, if the GSTR-4 was not submitted by the due date, a late fee of Rs. 200 per day was levied. The highest late fee that could be charged was Rs. 5,000.

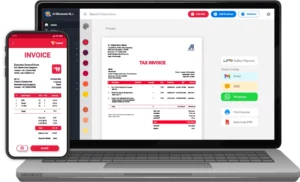

How to File GSTR-4 Using the Vyapar App?

To file GSTR-4 using Vyapar, you can follow these steps:

- Login to your Vyapar account and go to the “GST” section.

- Click the “GSTR-4” option and select the relevant financial year and quarter.

- Enter the details of your outward supplies, including the GSTIN of the recipient, invoice details, and taxable value.

- Enter the details of any amendments or corrections to your previous GSTR-4 filings, if applicable.

- Verify the entered details and click the “Generate JSON file” option.

- Once the JSON file is generated, login to the GST portal and upload the file.

- Review the details and click the “Submit” button to file your GSTR-4 return.

Benefits of Using GSTR-4 Format By Vyapar:

The GSTR-4 format is a return filing form used by taxpayers registered for the GST Composition Scheme. Here are some benefits of using the GSTR-4 format by Vyapar:

1. Ease of Filing:

Vyapar’s GSTR-4 format is designed with a user-friendly interface that makes it easy for businesses to navigate through the various sections of the return and input the required information hassle-free.

The GSTR-4 form auto-populates data from the previous return, making it convenient for businesses to update and reconcile their tax details. It helps to reduce errors and save time in manual data entry.

Vyapar’s GSTR-4 format provides predefined templates for different types of transactions, such as sales, purchases, and expenses, making it easy for businesses to categorize their transactions correctly and report them in the appropriate return sections.

2. Accurate Reporting:

The GSTR-4 format requires taxpayers to report their sales and purchases for the relevant period. Using Vyapar’s format, taxpayers can ensure their reporting is accurate and complete.

Vyapar’s GSTR-4 format provides a user-friendly interface that makes it easy for small businesses to enter their sales and purchase data. It automates calculations and validates data to ensure accuracy while minimizing errors.

Our GSTR-4 format helps with the automatic calculation of the tax liability based on the sales and purchase data entered by the taxpayer. It helps ensure the tax liability is accurately reported, avoiding under-reporting or excess taxes.

3. Increased Efficiency:

Using Vyapar’s GSTR-4 format, taxpayers can increase their efficiency in managing their GST compliance. It helps them to focus on their core business activities and improve their productivity.

It automates calculations and validations, reducing the time and effort required to enter data manually. It streamlines the data entry process and minimizes the chances of errors, increasing efficiency.

Vyapar’s GSTR-4 format automatically calculates the tax liability based on the sales and purchase data entered by the taxpayer. It eliminates the need for manual calculations and reduces the chances of errors in tax calculations. It saves time and effort, increasing efficiency in the process.

4. Mobile Accessibility:

The Vyapar GSTR-4 format works on Android and iOS platforms, allowing users to access their business data anytime. The format also works offline, ensuring users can continue working without an internet connection.

Mobile Accessibility can help users save time by eliminating the need to switch between different devices or log in to their desktop computers whenever they need to access the GSTR-4 format.

Users can access the GSTR-4 format on the go, anytime, and anywhere. It can be particularly useful for businesses needing to file their GST returns while moving or away from their desktop computers.

5. Saves Time:

Vyapar’s GSTR-4 format automatically populates relevant data from previous tax periods, reducing the need for manual data entry and saving time in the process.

Vyapar’s GSTR-4 format includes built-in compliance checks to ensure that the entered data is accurate and meets the requirements of the GSTR-4 form.

Vyapar’s GSTR-4 format allows for the one-click filing of the GSTR-4 form directly from the software, reducing the need for manual submission and saving time.

6. Helps Reduce Errors

Vyapar’s GSTR-4 format automatically calculates the GST liability based on the data entered, reducing the chances of manual errors during calculations.

Vyapar’s GSTR-4 format allows easy and simplified data entry of relevant information, such as sales, purchases, and expenses, required to file GSTR-4.

The software automatically populates relevant fields, reducing the chances of errors that can occur during manual data entry. This reduces the chances of errors that can occur during manual data entry.

Helpful Features of the Vyapar App

Vyapar is a business accounting software app for small and medium-sized businesses in India. Here are the key features of the Vyapar app:

Invoicing:

With Vyapar, users can create professional-looking invoices and send them directly to their customers. The app supports multiple payment modes and allows users to track payments and overdue invoices.

With Vyapar, users can customize their invoices with their company logo, add products and services with their respective prices and taxes, and set payment terms.

The invoicing software also allows for different payment methods, such as credit cards, debit cards, and online payment gateways. Users can also set reminders for due payments and track the payment status for each invoice.

The invoicing feature also includes creating recurring invoices for regular customers and creating quotes and estimates for potential customers. Vyapar also offers options for creating proforma invoices, delivery notes, and purchase orders.

Inventory Management:

The app allows users to manage inventory, track stock levels, and set reorder alerts. Users can also create purchase orders and receive goods against them.

Vyapar allows you to manage your stock levels efficiently. You can track your stock levels in real-time and receive alerts when running low on a particular item. The inventory management software also provides insights into your top-selling products and slow-moving items.

With Vyapar, you can create purchase orders for your suppliers, track the status of your orders, and receive notifications when your orders are received.

The software enables you to create sales orders, track the status of your orders, and generate invoices once the orders are fulfilled.

GST Compliance:

With Vyapar, businesses can easily generate GST-compliant invoices that include all the necessary details, such as GSTIN, HSN/SAC codes, and tax rates. It can help ensure that businesses charge the correct amount of GST on their sales.

Vyapar allows businesses to record all their GST payments and receipts, which can help them keep track of their GST liabilities and claim input tax credits. It can also help businesses avoid penalties for late or incorrect GST payments.

Vyapar makes it easy for businesses to file their GST returns directly from the software. The software automatically generates GSTR-1, GSTR-2A, and GSTR-3B returns based on the invoices and payments recorded in the system. It can save businesses time and effort in preparing and filing their GST returns.

Vyapar also provides various reports related to GST, such as IGST, CGST, SGST reports, GST summaries, turnover, and liability reports. These reports can help businesses analyze their GST transactions and ensure they comply with GST regulations.

Expense Tracking:

The accounting app allows users to track and record their business expenses for tax purposes. Users can also categorize expenses and generate expense reports. It can help businesses better understand their spending and identify areas where they can cut costs.

Users can manually enter expenses or import them from bank or credit card statements. Vyapar allows users to set expense budgets for different categories. It can help businesses stay on track with spending and avoid overspending in certain areas.

Businesses with multiple projects or clients can track expenses by project or client in Vyapar. It can help businesses track expenses associated with each project or client and ensure that they are billing their clients accurately.

Vyapar provides various expense reports, such as expense summaries, expense details, and expense category reports. These reports can help businesses analyze their expenses and make informed decisions about their spending.

Business Reports:

Vyapar provides users with detailed business reports, including profit and loss statements, balance sheets, and cash flow statements. These reports help users to track the financial health of their business.

Vyapar’s profit and loss statement gives users a summary of their revenue, expenses, and net profit or loss over a specified period. It can help businesses understand their financial performance and make informed decisions about their future investments.

Vyapar allows users to generate inventory reports that provide an overview of their current inventory levels, stock movements, and reorder levels. It can help businesses manage their inventory effectively and avoid stockouts.

Vyapar provides various reports related to GST, such as GST summary, GST turnover, and GST liability reports. These reports can help businesses analyze their GST transactions and ensure they comply with GST regulations.

Data Safety:

Vyapar app priorṣitises data security and offers a variety of features to safeguard user data. The app automatically backs up user data to the cloud, ensuring that data is always available even if the device is lost or damaged.

The Vyapar app protects user data with encryption, ensuring that data is safe and cannot be accessed by unauthorized users. Users can establish access controls in the app, limiting access to sensitive data and ensuring that only authorized users can view or modify data.

The Vyapar app requires users to create a strong password and includes additional security features such as biometric authentication to safeguard user data from unauthorized access.

The app employs secure data transfer methods to ensure user data is not intercepted or compromised while in transit. It offers regular updates to keep the app secure and up to date with the newest security features and protocols.

Frequently Asked Questions (FAQs’)

The GSTR-4 includes the entire value of the sales and supplies made, the tax paid at the compounding rate, and invoice-level details of purchases made from other registered taxpayers by the composition vendor during the tax period.

Yes, the annual return GSTR-4 is mandatory for every composite scheme dealer.

GSTR-4 is mandatory for all composition dealers.

Any taxpayer whose aggregate annual turnover is less than Rs 1.5 crore can opt for a composition scheme and file the form GSTR-4.

If a taxpayer fails to file the form GSTR-4, he must pay late fees and interest. The late fees can be charged upto Rs 500 per day when the tax liability is nil.

When completing Form GSTR-4 for any fiscal year, the composition taxpayer may fail to complete Table 6 of the GSTR-4 return. In that case, the sum paid by the taxpayer via Form CMP-08 is credited to the negative liability statement.

Vyapar simplifies GSTR-3B filing by offering updated templates and features that align with the revised format. Its user-friendly interface and automated calculations save time and ensure accuracy in GST compliance.

The components of GSTR-4 include:

* Business details: Name, GSTIN, legal name, and trade name (if applicable).

* Aggregate turnover: Total turnover for the financial year.

* Taxable turnover: Turnover subject to tax under the composition scheme.

* Tax payable: Tax amount payable under the composition scheme.

* Invoice details: Details of outward supplies, including B2B and B2C supplies.

* Tax adjustments: Adjustments for advances received, reverse charge, etc.

* Late fees and penalties: If applicable.

* Payment details: Payment of tax and any other liabilities.

Yes, GSTR-4 is filed quarterly by taxpayers registered under the Composition Scheme under the Goods and Services Tax (GST) regime in India. It is a simplified return that businesses opting for the Composition Scheme use to report their tax liabilities and pay taxes on a quarterly basis.

Businesses registered under the Composition Scheme of the Goods and Services Tax (GST) in India file GSTR-4. This scheme is designed for small businesses with a turnover up to a specified limit, allowing them to pay tax at a fixed rate based on their turnover without the need for detailed invoicing and input tax credit calculations.

Penalties in GSTR-4 may apply for late filing, incorrect details, or non-payment of tax. The specific penalty amounts and conditions are defined in GST laws and regulations, emphasizing the importance of timely and accurate filing to avoid penalties.

GSTR-4 is a quarterly return for Composition Scheme taxpayers, summarizing turnover and tax liability. GSTR-4A is an auto-generated summary of their purchase transactions from registered suppliers.

Related Posts:

1. Composition Dealer Invoice Format

2. Quotation Format For Manpower Supply