Composition Dealer Invoice Format

Download Composition Dealer Invoice Format for your business. Or use Vyapar App to do billing, inventory, and accounting easily and grow your business faster! Avail 7 days Free Trial Now!

- ⚡️ Create professional invoices with Vyapar in 30 seconds

- ⚡ Share Invoices automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Free Professional Composition Dealer Invoice Templates

Download professional free Composition Dealer invoice templates, and make customization according to your requirements at zero cost.

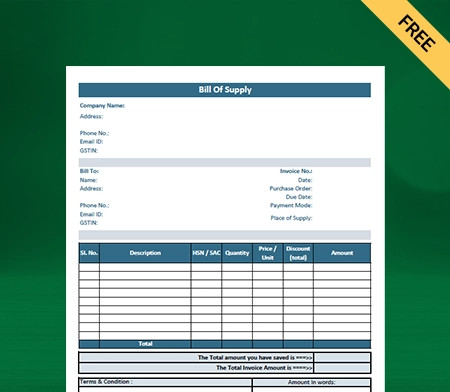

Composition Dealer Invoice Format 01

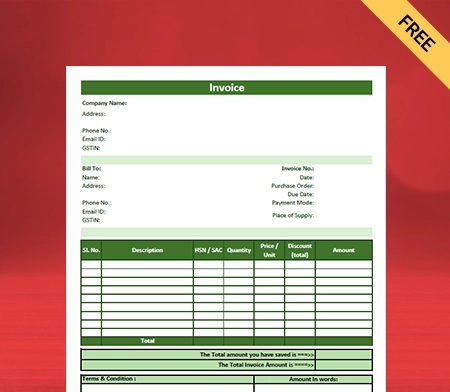

Composition Dealer Invoice Format 02

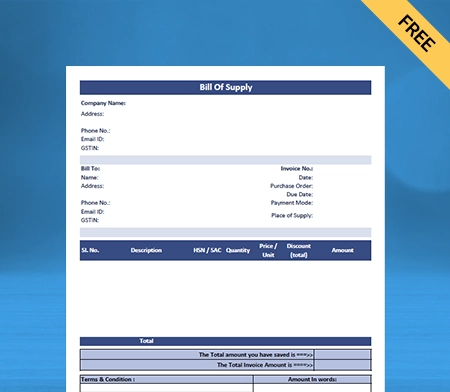

Composition Dealer Invoice Format 03

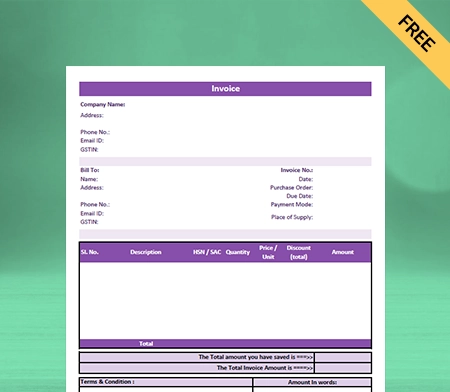

Composition Dealer Invoice Format 04

Generate Invoice Online

Highlights of Composition Dealer Invoice Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

What is the Composition Invoice Dealer Format?

A Composition Dealer Invoice Format is used to create invoices by Composition Dealers in India in compliance with the Goods and Services Tax (GST) system. These invoices are generated by small taxpayers who chose the composition system. They pay a predetermined percentage of their turnover as tax and file more straightforward returns.

What Details Should a Composition Dealer Invoice Contain?

The Composition Dealer Invoice Format may vary depending on local tax laws and regulations, but generally, it should include the following information:

- Name, address, and GSTIN of the supplier

- A unique invoice number and date of issue

- Name, address, and GSTIN of the recipient, if registered

- Description of goods or services being supplied

- The total amount of the invoice

- Tax rate and amount, if applicable

- Any discounts or other adjustments to the total amount

- A signature or digital signature of the supplier

It’s important to check local tax laws and regulations while issuing a bill and including all required information.

Benefits of Using the Composition Dealer Invoice

Over 1 crore customers are using Vyapar’s comprehensive e-invoicing solution that offers seamless business operations and improves the invoicing process. Here are the key features of the E-invoicing software:

Lower Tax Liability:

The Invoice registration portal creates a unique invoice reference number for electronically posted invoices under the new e-invoicing system (IRP). A hash algorithm is also used to compute IRN.

IRN ensures that the provider will not upload the same e-invoice more than once. You can verify the authenticity of the e-invoice using IRN or barcode.

Reduced Compliance Burden:

Companies typically automate only one invoicing method (sending or receiving invoices). Consider this factor when looking for e-invoicing software and prioritising solutions that enable you to automate all processes.

Automating both the receipt and transmission of invoices results in a shorter pay period and allows your business to save money, increase scalability, stay on top of payouts, and get the best ROI possible.

Simplified Record-keeping:

Maintaining a smooth data flow throughout your organisation is difficult if the e-invoice solution does not merge well with other work-specific enterprise applications. Many e-invoicing alternatives are not built to work with complex organisational networks.

If your company requires invoicing solutions to serve data into existing systems, ensure that the vendor can supply you with safe and seamless software integration.

Increased Competitiveness:

Businesses handle massive amounts of sensitive data daily, which must be safeguarded at all costs. Take the time to carefully evaluate and analyse vendors who fully recognise data’s importance and have made data security one of their business objectives.

It is going digital to increase productive capacity by elevating routine things, saving physical time and resources, and providing immediate access to invoices anytime. The solution for you is software that eliminates your daily hassle.

Create your first GST quotation with our free Quotation Generator

How to Choose the Best App For Creating Composition Dealer Invoices?

Choosing the best invoicing software to create your Composition Dealer Invoice is difficult when you are clueless. Here are the following ways to go for the best possible software for your business:

1. Software With Better Customer Support:

Customer support in software that generates invoices for Composition Dealers should assist users who run into problems or have queries regarding the capabilities and functionalities of the product.

This may involve responding to questions on generating reports, computing and applying taxes, generating invoices, and troubleshooting mistakes or other problems. The assistance could be offered through various mediums, including the telephone, electronic mail, live chat, or a dedicated online support hub.

Customer support exists to assist end users in getting the most out of the product they are using and ensuring they are happy with their overall experience. You should check thoroughly before finally committing to accounting software for your small business.

2. Software With Better Compliance:

Compliance is one of the most valuable aspects of choosing the best billing software to make Composition Dealer Invoices. For your business to stay on the right side of the law, the software must follow the GST rules in India.

This includes making correct and valid invoices and meeting the format and content rules set by the authorities. The software should also be able to calculate taxes correctly and include all the tax codes and rates that are needed.

The software must be able to make compliance reports, like annual returns, and keep an accurate audit trail of all transactions. By choosing compliant software, you can make sure that your business meets all the requirements and avoids any fines or legal problems that could come up.

3. Software that Offers Seamless Integration With Your Business:

Integration for Composition Dealers means ensuring seamless connectivity with your business. It helps share information within your organization seamlessly, usually through accounting and inventory management software.

The software that makes invoices can quickly transfer information and automate tasks. So, using the professional business accounting app, you can reduce manual work and make the invoicing process more efficient.

This integration makes it easier for businesses to send out invoices, reduces mistakes, and makes the process more accurate. It can also give you more information about how your business is running, which can help you make better decisions and improve your bottom line.

4. Software that Enables Ease-of-Use:

Before committing to the subscription for the software that creates invoices for Composition Dealers, check whether it is easy to use according to your business, as it varies significantly in different software, and the user’s experience may vary.

But many of these free invoicing software options are made easy to use and understand, with drag-and-drop interfaces, customizable invoice templates, and automatic data entry that make it easier to make and send invoices.

Go to the app website and check its features and tools. You should read reviews from other users and try out demos or free trials of the software you are considering to find out which is the easiest to use for your needs.

5. Software that Brings Better Security:

Security is one of the most important things to consider when choosing billing software to make invoices for a Composition Dealer. The software should have the right security measures to protect sensitive financial information and stop people from getting in without permission.

It includes encryption to protect data transmission, ensuring software is regularly updated with the latest security patches, using multi-factor authentication to stop unauthorized access, and having good backup and disaster recovery plans.

The software should have the correct access controls to ensure that only authorized users can access the data. Auditing and monitoring tools should be in place to catch any possible security breaches. Choosing a software vendor who takes security seriously and is committed to keeping their product safe is essential.

6. Software With Better Customisation Features:

Making customizations in invoice format means making changes to fit the business needs. It can mean making changes to the user interface of the format, adding or removing fields, changing the invoice’s layout or design, or adding new features.

Customization can be done in several ways, such as by changing the software’s settings or configuration options or making changes to the source code. Looking for software that brings better Customisation features is essential as it makes the format more useful and fits their specific needs perfectly.

Various customization features can help speed up the billing process and reduce mistakes that can be detrimental to your business reputation. It can help increase the trustworthiness of your business and improve the user’s overall experience with the software.

Why Choose Vyapar to Create Your Composition Dealer Invoice Format?

Vyapar is high-performing software recommended by millions of Composition Dealers for your business. Here is why you choose Vyapar to create your invoices:

1. Create GST Bills and Invoices:

With the Vyapar app, accounting is error-free. It helps make sure that your business’s data is safe. Composition Dealer Invoice Formats in the Vyapar app make it easy to make GST invoice formats in just a few easy steps.

The Vyapar app can be used in both online and offline modes. So, an SME can easily create invoices by following the CGST Act 2017 by using the app. It makes it easy for businesses to keep their books.

Vyapar is different from most accounting software because it lets you make Composition Dealer Invoices in just a few minutes. The best part is that you won’t have to train for hours because the process is easy. You can choose from 10 or more GST Composition Dealer Invoice Formats in the app to make bills that look professional and are your own.

Vyapar is the best software to create invoices for composition schemes under GST. It has several valuable features for billing and accounting. SMEs can run their businesses using the app without having to work hard. Your business can stand out from the rest with a fully customized Composition Dealer GST Invoice Format that follows GST rules.

2. Provides Free 7 days Trial:

Vyapar software is used by millions of small business owners to create their bills and invoices and to perform their day-to-day operations. As we all know, SMEs have small cash to go for professional software to create a compelling Composition Dealer Invoice Format.

Vyapar offers a 7-day trial to businesses before they commit to subscribing to the software. You can ensure by going through its features, customer support, integration, Ease-of-use, and customization, for which Vyapar is very popular in the market.

Vyapar software to create Composition Dealer Invoice Format also allows you to perform most of your essential operations free of cost. You can create your business platform more productive and profitable.

3. Secures Your Data:

If you retain your business information, it could help your business and sales and have a significant negative impact on your business, so you need to make sure you have backups of everything. So, our free GST software to create your Composition Dealer Invoice Format in India lets you set up an automatic backup of your data, which helps keep the app’s data safe.

For extra safety, you can make a local backup once in a while. It would help keep your business data safe in a personal space like a flash drive or hard disc. Using the free Composition Dealer Invoice app, you can ensure your business is safe by setting up automatic backups or making secure backups at the right times.

The accounting features of the Vyapar software will also ensure that you can look at your sales data whenever you need to and make a business plan based on the business reports that the Vyapar app makes. Vyapar is highly known for its professional formats.

4. Send Payment Reminder to Recover Your Dues:

Vyapar software helps small and medium-sized businesses get paid on time and steady their cash flow. Vyapar does it for you by helping you keep track of all payments due in the business dashboard. You can also seamlessly create your Composition Dealer Invoice by using Vyapar software.

With the Vyapar software reminder feature, you can let your customers know when they need to pay you back. It will help remind them via WhatsApp and email of how much is still owed and when it’s due. By sending reminders, you can ensure the customer remembers to pay. With this, you can keep money in your business, so you don’t have to wait around for it.

With the payment reminder feature of the Vyapar software, many small and medium-sized business owners could get paid faster. The app has high-performance features that work together to ensure that the dues don’t affect the business’s cash flow. You can make reports to change your business plans based on how much cash is coming in.

5. Speed and Accuracy:

Vyapar is a popular software used to make invoices for Composition Dealers. It is known for being fast and accurate, making it a good choice for small and large businesses. You can create multiple invoices in consecutive serial numbers as a invoice format composition scheme under GST.

With Vyapar, users can easily make a Composition Dealer Invoice Format that looks professional and follows GST rules. The software is meant to make billing and invoicing easier by automating tasks like figuring out taxes, making invoices, and keeping track of inventory. It saves time and lowers the chance of making mistakes, ensuring that the billing process is quick and accurate.

Vyapar also has several tools to help users manage their finances, such as ways to track their income and expenses, link their bank accounts, and make reports. The software is easy to use and can be accessed from anywhere because it can be used on both desktop and mobile devices. Vyapar is a reliable and easy-to-use invoicing software that can help businesses manage their finances.

6. Manage Your Cash Flows Seamlessly:

Vyapar software to create your Composition Dealer Invoice Format lets Composition Dealers record transactions. Over one crore organizations have evaluated our free billing software capabilities. Cash Flow management is frequently utilized for billing, accounting, and other corporate needs.

Vyapar’s software for Composition Dealer Gst Invoice Format helps automate management. It is done to prevent accounting errors. Investing in this software allows you to conveniently control your firm’s cash flow. This software enables the management of cash transactions by including capabilities such as tracking bank withdrawals and deposits.

Our free GST invoice software is more helpful in establishing a cash book in real time. It can help maintain the cash flow of a business. It compiles data on expenses, payments, and purchases, among others. This GST accounting software makes cash management pretty simple and enables you to create a compelling Composition Dealer Invoice Format.

7. GST Filing Made Simple and Fast:

Many business owners spend a lot of hours calculating and filing a GST every month. But by using the Vyapar app, you can ensure all invoices follow the tax laws. After all, you must keep track of their monthly invoices, expenses, and accounting details.

Vyapar changes everything by making it easier to make GSTR reports and saves time by automating the process. It can help you create reports like GSTR1, GSTR2, GSTR3, GSTR4, and GSTR9 from the app itself. Accounting software Vyapar provides reports for sales and expenses in a financial year to file your GST returns without errors.

Every business owner can save time by making GST reports with professional software to create a Composition Dealer Invoice Format. With this, they can be sure that all accounting tasks will be done correctly by automation.

8. Build a Positive Brand Image:

Vyapar allows you to make your business process more competent and effective simultaneously. Providing a professional Composition Dealer Invoice Format enhances the business image significantly. In addition, you can develop confidence by giving full disclosure about the transaction.

The Vyapar GST invoicing software lets you establish a professional brand. An expertly crafted, personalized Composition Dealer Invoice Format can set you apart from the competition and demonstrate your expertise as a seller.

You may integrate our company’s logo, style, font, and brand colors on your invoices since doing so will assist you in presenting your brand’s identity in the best possible light. A buyer is more likely to purchase from a vendor who uses specialized quotation forms rather than plain text.

Frequently Asked Questions (FAQs’)

A Composition Dealer Invoice Format is used as a document issued by a Composition Dealer in India as part of the Goods and Services Tax (GST) system. Small taxpayers that have chosen the composition system, which allows them to pay a predetermined percentage of their turnover as tax and file more straightforward returns, issue this invoice.

No, under India’s Goods and Services Tax (GST) system, a dealer who sells only parts cannot give a tax invoice. This is because a Composition Dealer is a small taxpayer who has chosen a simplified tax scheme and is not allowed to charge or collect GST from their customers.

Instead, they must send a “bill of supply” or a “Composition Dealer Invoice,” neither of which include GST, for the services they provide.

You can use Vyapar software to create your professional Composition Dealer Invoice Format. It comes with formats that contain all the essential information required in your Composition Dealer Invoice. Vyapar also allows you to customize and add information to your invoice per your business requirements.

Yes, under India’s Goods and Services Tax (GST) system, Composition Dealers must put the Harmonized System of Nomenclature (HSN) code on the invoice for all taxable sales they make.