Debit Note Format In Tally

You can download the Debit Note Format in Tally for your customers. Also, use the Vyapar App to do billing, inventory, and accounting easily and grow your business faster. Available 7 days Free Trial!

Highlights of Tally Debit Note Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal & grand total amount

Consistently formatted

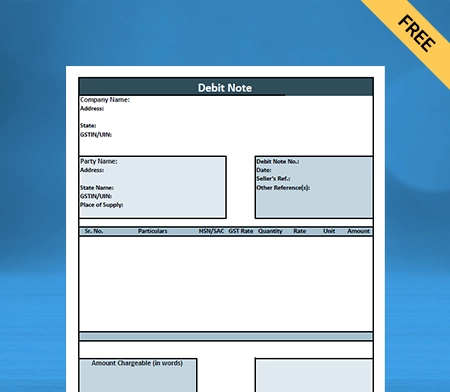

Download Tally Debit Note Format For Free

Download professional free material reconciliation templates, and make customization according to your requirements at zero cost.

Customize Invoice

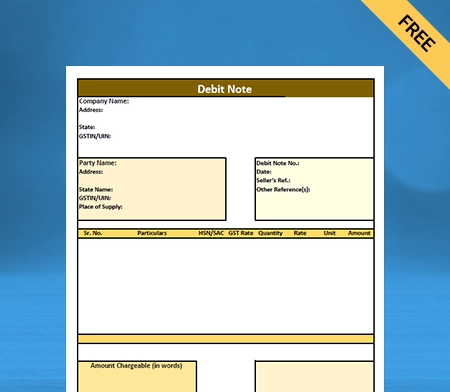

Type – 1

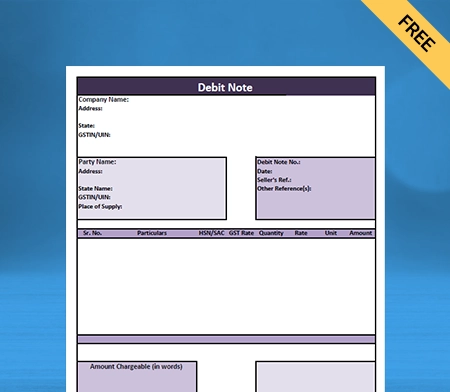

Type – 2

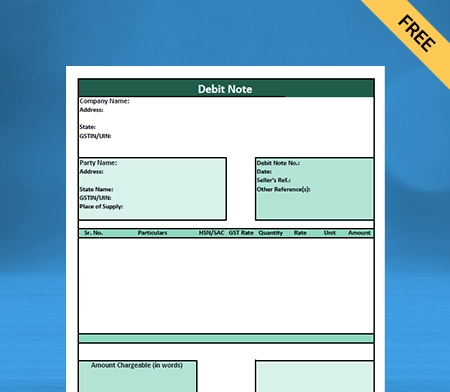

Type – 3

Type – 4

What is a Debit Note in Tally?

A debit note in Tally is a legal document issued to a seller by the buyer. It is used to remind a buyer of existing debt to the seller. A debit note is a document a buyer creates that signifies that the goods and services rendered have been returned to the seller.

A Debit note is also known as a debit memo. It is a document often used as a mode of payment in businesses. A debit note format in Tally is commonly used in case of purchase returns, price escalation, de-escalation, etc.

What are the Differences Between a Debit Note and a Credit Note?

The key differences between a debit note in Tally and a credit note are mentioned below.

A debit note is a document that shows a debit to the seller’s account. On the contrary, credit notes are documents issued to a party by the seller stating that his account has been credited while debiting their account.

A debit note is a document that a buyer issues. On the contrary, a credit note is a document a seller presents.

A debit note is issued when a credit purchase has been made. On the other hand, credit notes are issued when a credit sale has been made.

An example of a debit note would be;

In case of purchase returns by the buyer to the seller; debit notes are issued.

An example of a credit note would be;

When the supplier gets the goods returned by the buyer, they present a credit note.

- A debit note is in the form of a different kind of purchase return. On the other hand, credit notes are in the form of a different kind of sales return.

- A debit note shows a positive amount in the books of account, while a credit note format shows a negative amount.

- A debit note is a document updated in the ‘Purchase Return Book.’ A credit note is a document updated in the ‘Sales Return Book.’

- A credit note is known for reducing the buyer’s payables account. On the other hand, a debit note is known to reduce the sellers’ account receivables.

- Updating the purchase return book is mandatory in exchange for a debit note. On the other hand, it is necessary to update the sales return book in exchange for a credit note.

- A credit note is a document presented when a sales return occurs. A credit note is known to reduce payables. On the contrary, a debit note is a document issued when a purchase return takes place. It is known for reducing receivables.

What are the Key Components of a Debit Note Format in Tally?

A debit note format in Tally consists of certain important components. Ensuring that the GST guidelines are followed while issuing a debit note is necessary.

There is no prescribed debit note format under any law. However, a debit note format in Tally should consist of the following details:

Header: It should be stated that the document is a ‘Debit Note.’

Date: When a debit note format in Tally is issued, it should be mentioned. It is also known as the issuance date of the debit note.

Unique Serial Number: A different and unique serial number for each debit note should be provided. It should also be noted that the serial number is only 16 characters and not more. The unique serial number can consist of numbers, alphabets, and special characters like a hyphen, dash, underscore, etc.

Buyer Details: The name, address, GST number, and contact details of the buyer should be mentioned.

Invoice Details: The invoice number, details, and the issue date should be mentioned for reference.

Supplier Details: The name, address, GST number, and contact details of the supplier should be stated.

Description of Goods: The description of the goods or services rendered being credited should be mentioned on the debit note.

Total Amount: The taxable value of goods or services and the tax rate should be stated. The total amount of the tax debited or credited to the recipient should also be mentioned in the debit note.

Verification: The supplier’s signature or authorized representative should be on a debit note.

Are you a Business Owner?

Take your business to the next level with Vyapar!

Try our Android App (FREE for lifetime)

What are the Reasons For Issuing a Debit Note Format in Tally?

A debit note format in Tally is issued mainly by a buyer. It is issued when a buyer returns the goods purchased from the seller for any valid reason.

- A buyer issues a debit note format in Tally in cases wherein,

- The supplier of the goods delivered damaged or defective goods

- The shape, quantity, or size of the goods delivered is incorrect

- There is a calculation error in the debit note format in Tally

- A debit note is used when some amount of money is spent on behalf of the party

- When the supplier has charged higher tax on the goods and services rendered

- The goods or services are not delivered on time by the supplier, and

- In cases wherein, the buyer does not want to purchase the goods or services

The seller can also issue a debit note format in Tally in cases wherein,

- The buyer increases the total amount of order quantity to be purchased

- When the seller needs to make certain adjustments to the debit credit note

- In cases where there is a change in the total billing amount in the debit note, and

- When the seller finds it important to remind the buyer of their current debt.

What are the Reasons For Issuing a Debit Note Format in Tally?

A debit note format in Tally is issued mainly by a buyer. It is issued when a buyer returns the goods purchased from the seller for any valid reason.

- A buyer issues a debit note format in Tally in cases wherein,

- The supplier of the goods delivered damaged or defective goods

- The shape, quantity, or size of the goods delivered is incorrect

- There is a calculation error in the debit note format in Tally

- A debit note is used when some amount of money is spent on behalf of the party

- When the supplier has charged higher tax on the goods and services rendered

- The goods or services are not delivered on time by the supplier, and

- In cases wherein, the buyer does not want to purchase the goods or services

The seller can also issue a debit note format in Tally in cases wherein,

- The buyer increases the total amount of order quantity to be purchased

- When the seller needs to make certain adjustments to the debit credit note

- In cases where there is a change in the total billing amount in the debit note, and

- When the seller finds it important to remind the buyer of their current debt.

How to Create a Debit Note Format Using the Vyapar App?

To create a customizable debit note format using the Vyapar app, you have two ways you can follow.

- Click on add more (+) option:

- After going to the software, click on the ‘purchase return option’.

- To open the debit note format, you can also use the shortcut key (Alt+L).

- Enter the customer’s necessary details like name, address, date of issue, and invoice number.

- Once you follow the above step, your return will be adjusted against that particular invoice.

- Following the above step, you will be required to give all the details of the products you return to the seller.

- The product details include a description, name, and the total amount of goods.

- After you are done, now save the debit note.

Issuing a debit note often takes a lot of time for users. So, the Vyapar software offers users another way of adjusting a debit note to its specific invoice.

- Go to the left menu option:

- Click on the purchase option in the purchase section on the dashboard.

- The users will get to see the list of all the invoices made by them.

- Find the invoice whose product you want to return to the seller in the search bar.

- The search can be done by invoice number-wise, party name-wise, date-wise, invoice balance, or amount-wise.

- After searching, the invoice will appear on the user’s screen.

- Next, click on the three dots and click on the ‘convert to return’ option.

- Users will see that the debit note is ready with all the necessary details.

- You get to customize the goods list as per your requirements.

- Now, save the debit note after making all the required changes.

These two ways of creating a debit note format in the Vyapar app. You can use either of them at your convenience.

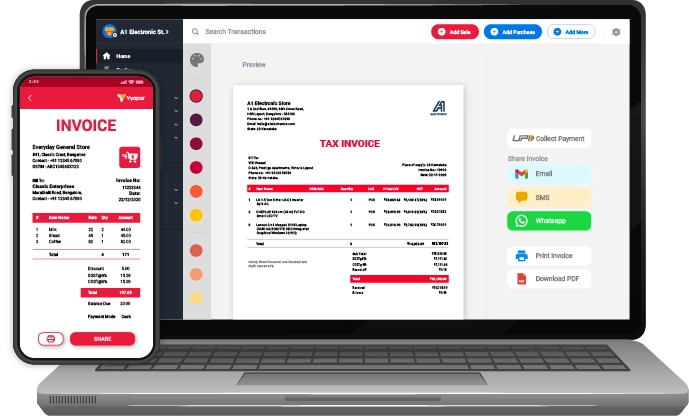

Why Should You Choose the Vyapar Software For Debit Note Format in Tally?

Vyapar accounting software is the best software for debit note format in Tally available in the market. Here is why you should use Vyapar for the best debit note format for your business:

1. Send Payment Reminders to Recover Dues:

Vyapar accounting and billing software ensures that small and medium-sized businesses get timely client payments. The Vyapar software has features that ensure you keep track of all due payments in the business dashboard.

Using the Vyapar app feature, you can send payment reminders to recover your dues from your customers. By email and WhatsApp, you can remind your customers about the total outstanding amount and the due date. Choosing the Vyapar software for debit note format in Tally allows you to avoid unnecessary delays.

The Vyapar billing and accounting software is user-friendly, which attracts users to use it for making debit note format in Tally. Many small businesses rely on the Vyapar app for creating debit credit notes.

Vyapar software is considered the best billing and inventory management software with GST. The features on the app ensure that the dues do not impact the cash flow of your business. Thus, it is a very important advantage for using the Vyapar app to create a debit note format in Tally.

2. Receivables and Payables:

Vyapar is a free billing and accounting software that allows users to keep track of receivables and payables. The free GST billing software allows you to track all the parties stating receivables and payables.

The business dashboard in the Vyapar app allows users to track their money. It includes both the money you have to receive and the money you need to pay in the Vyapar app.

Users easily get the track and observe who did not pay them back. Payment reminders are set by users so that they can timely collect dues from their customers.

Vyapar software allows you to send free payment reminders to any party. This is done through WhatsApp, email, and SMS. Vyapar provides its users with several payment options.

All types of online and offline payment solutions are in the software that allows you to collect dues seamlessly. Vyapar also has a bulk payment reminder feature, saving users a lot of their time. It is done as Vyapar allows sending payment reminders to all the customers in bulk at once.

3. Keeps Data Secure By Automatic Data Backup:

Losing important business data can hurt your business and sales. Hence, you need to create data backups to ensure that all your business data is safe and secure.

Vyapar billing and accounting software for creating a debit note format in Tally allow users to configure an automatic data backup. It thereby ensures the security and safety of the app-stored data of your business.

The features of the Vyapar software for a debit note format in Tally ensure that you can create a debit note whenever necessary without worrying about the data being lost.

Users can also create a local backup for added data safety and security. This helps users secure their data in a personal space such as a hard disc. Using the Vyapar app, you can secure your business by configuring automatic data backups.

4. Record Expenses Seamlessly:

Vyapar’s free accounting and billing app is an efficient option for seamlessly recording business expenses. Keeping a record of your expenses helps you create an efficient gst debit note format in Tally.

The free GST billing and accounting software helps you record GST and non-GST expenses. Keeping track and recording all your expenses in the business is important when you issue a debit note.

Vyapar small business accounting software provides solutions for debit note format in Tally. As you get to track and record your expenses, users get various benefits over its competitors.

Recording expenses helps you reduce costs and maximize sales. Vyapar accounting and billing software is a secure option for instantly recording outstanding expenses. Thus, choosing the Vyapar app for debit note format in Tally is an efficient option.

Features that Make Vyapar the Best All-in-One App for Your Business

Provides Several Payment Options

Vyapar accounting software for a debit note format in Tally allows your customers to pay online and offline payment modes. When you give them various options for your payment, there are very small chances they will default on the payment.

Vyapar app provides various online payment modes such as IMPS, Net Banking, UPI, e-wallet, NEFT, credit card, and debit cards to pay for goods and services. Vyapar billing software for creating a debit note is highly secure and safe.

The biggest comfort a customer can be provided with is the convenience of how they choose to pay you. Vyapar allows customers to make payments using their convenience, like a bank transfer. A bank transfer includes IMPS, NEFT, and RTGS.

Providing customers with various payment methods helps ensure that your customers can pay you without delay. So, issuing a debit note is very convenient using the Vyapar app.

Builds a Positive Brand Image:

Vyapar GST billing and accounting software help build a professional and positive brand image. The Vyapar software for debit note format in Tally allows you to establish a professional image of your brand.

A professionally built customized debit note will tend to stand out among competitors. You can customize your company’s logo, name, font, and style on your debit note.

Doing all these things will help you to present your brand’s identity and professional image in the best possible manner. An exquisitely crafted and customized debit note demonstrates your expertise. It ensures that the seller is convenient to clear all their payment dues.

A customized debit note in accordance with the format looks trustworthy to the sellers. It includes all the necessary information you need to get your dues. The data in the debit note consists of product/service descriptions, taxes, unique serial numbers, etc.

Online/Offline Billing Software:

Using the free accounting software, you can issue a debit note as soon as you want the goods returned. The Vyapar app has online and offline features. This feature on the app is very helpful in rural areas, where network connectivity problems are common.

You need not halt your business operations when there is poor network connectivity. You can use the offline features of the Vyapar app for issuing a debit note format in Tally.

This Vyapar app feature allows you to accept payment dues using e-wallets without needing an active internet connection. The Vyapar app helps you issue a debit note without requiring you to stay online.

Users can solely rely on the business accounting and free billing software to validate the issued debit note and update the database accordingly after regaining internet connectivity.

Manage Your Inventory:

Vyapar software for issuing a debit note format in Tally helps you to detect when your inventory goes low. This happens mainly when the goods are returned to the seller by the buyer.

Periodic checks on the inventory space help in detecting inventory discrepancies. Inventory management is important for businesses with a wide variety of goods.

Using the best invoicing software for issuing a debit note format in Tally helps you track the remaining goods. It is very convenient when you use the Vyapar software for a debit note format in Tally. It is because the given data can be used to generate various sales reports.

Frequently Asked Questions (FAQs’)

Material reconciliation format is an essential aspect of the manufacturing process. It allows the manufacturers to ensure that the operating project is based on goals and results determined by the business.

Reconciliation raises the production capacity and outputs. It allows the manufacturers to compare the standard data to actual data based on the variances and inefficiencies in production.

Material reconciliation should be performed at least twice by businesses. Preparing material reconciliation at the beginning and end of the production process is advised.

Material reconciliation allows businesses to conduct proper checks and verify the data collection of the resource. It assists the companies in finding the difference between the physical inventory records and the material data record.

Businesses may use this data to make the necessary adjustments and changes in the production process. It allows the industry to make the numbers align with each other in the process. It helps to improve the inventory management process of the company.

The critical components of a material reconciliation format include checking the inventory count of materials and comparing the records of it. It also includes documenting the material reconciliation at the end of the production process. This includes checking any differences and finding the leading cause of the issue to optimise the production process.

Material reconciliation is an essential aspect of the manufacturing process. It is important because it can easily detect errors, reduce time, and save money. It also helps to verify the production flow, keep it in check, prevent fraud, and manually alter data. These are the reasons why material reconciliation is essential for the manufacturing process.

Material reconciliation confirms that the main components obtained at the end of the manufacturing process match the input amount of material entered and used. It is a great way to determine the actual yield of integrins, as you can determine the actual output with the expected output.