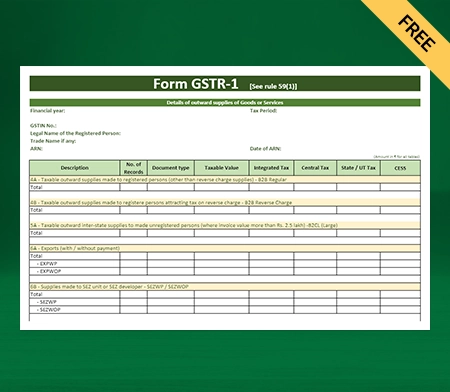

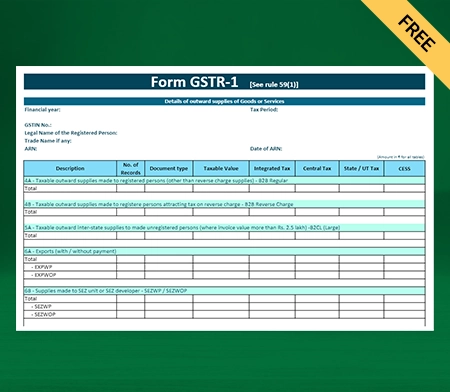

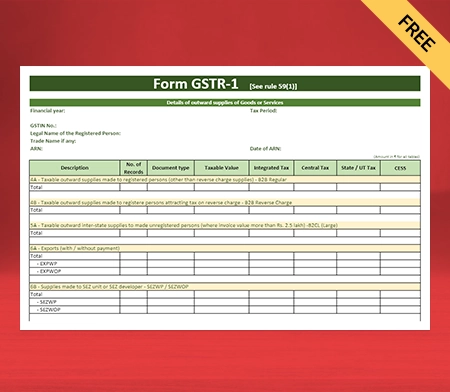

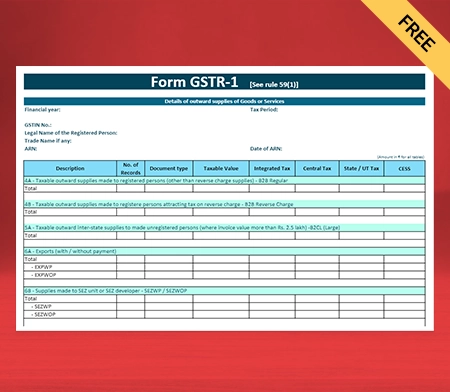

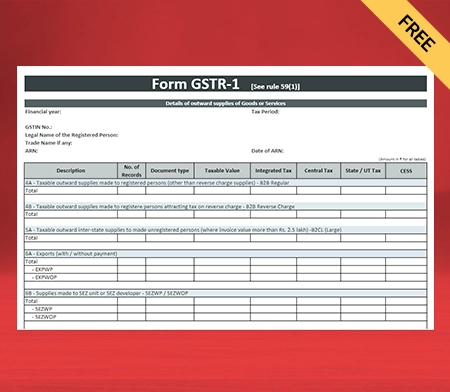

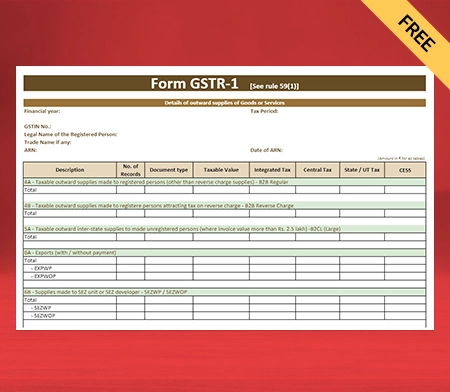

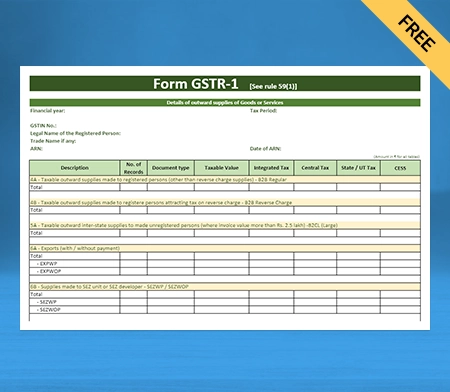

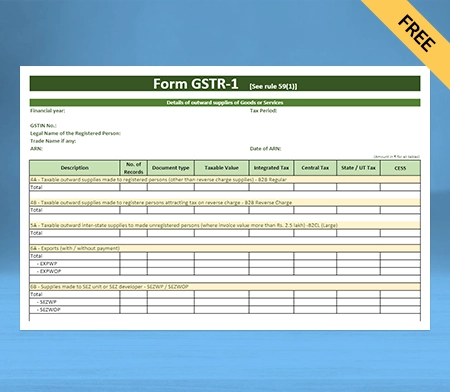

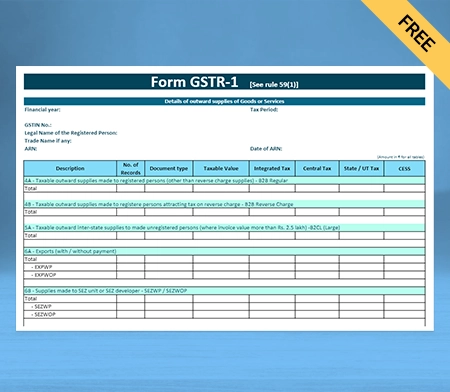

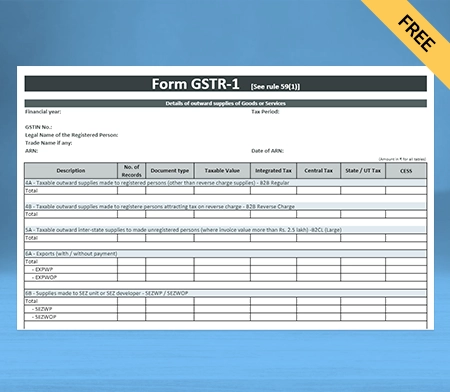

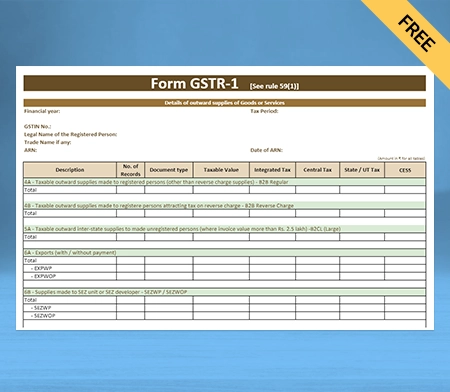

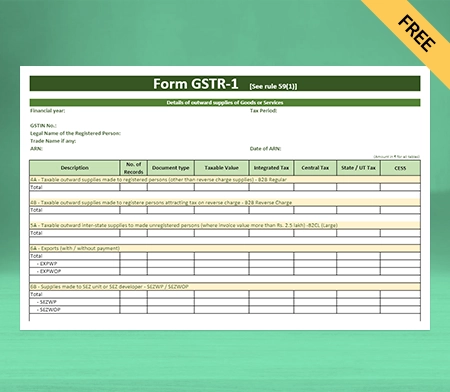

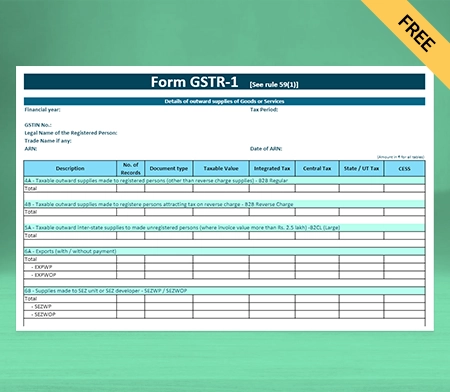

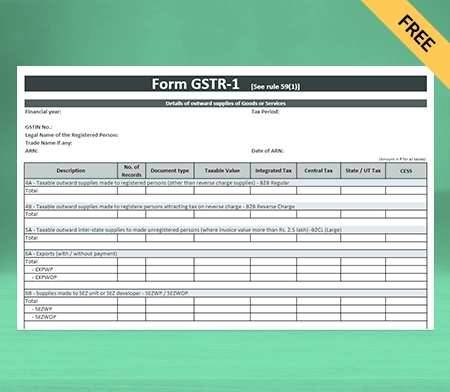

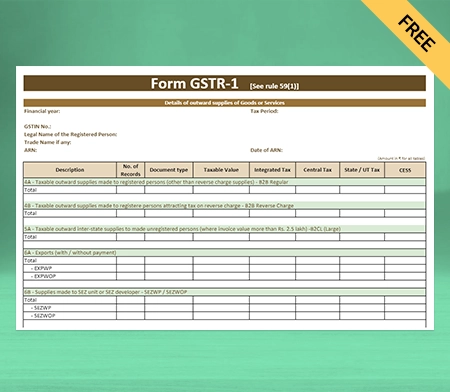

GSTR-1 Format

Use the standardized GSTR-1 format by Vyapar to file your return. Avail of additional features of the Vyapar free accounting app and make your accounting and billing process seamless. A free trial period is available, try it now!

- ⚡️ Create professional return filing with Vyapar in 30 seconds

- ⚡ Share GSTR-reports automatically on WhatsApp and SMS

- ⚡️ Connect with your parties through reminders, greetings, business cards and more

Download GSTR-1 Format in Excel

Download GSTR-1 Format in PDF

Download GSTR-1 Format in Word

Download GSTR-1 Format in Google Docs

Download GSTR-1 Format in Google Sheets

What is GSTR-1?

GSTR-1 is a return that every GST-registered person or business making outward supplies must furnish. It includes the details of the outward supply of both goods and services. It must be filed monthly or quarterly.

Outward supply means the supply of goods or services or both, whether made or agreed to by sale, transfer, barter, exchange, license, rental, lease or disposal, or any other mode during the furtherance of business.

Details Required in the GSTR-1 Format

The GSTR-1 format requires various details related to the outward supplies made by a business during a tax period. Here are the details required in the GSTR-1 format:

GSTIN of the Taxpayer:

The GSTIN (Goods and Services Tax Identification Number) is a 15-digit unique number that every registered person gets after registration under GST.

The Legal Name of the Taxpayer:

The name of the registered taxpayer filing the return is an essential requirement for filing the GSTR-1.

Details of Outward Supplies Made During the Tax Period:

This includes the following details of all outward supplies or sales made by the registered taxpayer during the tax period:

- Invoice number

- Invoice date

- Value of supply

- The taxable value of the supply

- Place of supply (state or union territory)

- HSN (Harmonized System of Nomenclature) is a code of goods or services supplied

- GSTIN of the recipient, if the recipient is registered under GST

- Export invoices

Amendments to Details Of Outward Supplies Made in Earlier Tax Periods:

If any changes or corrections are to be made to the details of outward supplies made in the earlier tax periods, they must be reported in this section.

Details Of Credit Or Debit Notes Issued During the Tax Period:

If the registered taxpayer has issued any credit or debit notes during the tax period, the details of a net of debit notes, credit notes refund vouchers must be reported in this section.

Amendments to Details Of Credit Or Debit Notes Issued in Earlier Tax Periods:

If any changes or corrections are to be made to the details of credit or debit notes issued in earlier tax periods, they must be reported in this section.

Details Of Advances Received Against the Supply Of Goods Or Services:

If the registered taxpayer has received any advances against the supply of goods or services, the details must be reported in this section.

Adjustment Of Advances Received Earlier:

Any advances received and adjusted in the earlier tax periods must be reported in this section.

Hsn Summary Of Outward Supplies:

This includes the HSN code of all the goods and services supplied by the registered taxpayer during the tax period.

Documents Issued During the Tax Period:

This includes the details of all invoices, credit notes, debit notes, and revised invoices issued by the registered taxpayer during the tax period. If the registered taxpayer issues any documents during the tax period that were not included in the financial statements, the details must be reported in the GSTR-1.

Tax Paid And Payable:

The amount paid and payable during the tax period must be reported in this section.

Verification:

The registered taxpayer must declare that the information in the GSTR-1 report is true and correct to the best of their knowledge and belief.

Who Should File the GSTR-1 Return?

All the registered taxpayers are required to file the GSTR-1 return except:

- Input Service Distributors

- Non-resident taxable person

- Composite dealers

- OIDAR suppliers

- Taxpayers liable to deduct TDS

- Taxpayers liable to collect TCS

Due Dates For Filing GSTR-1

The due date for monthly returns is the 11th of the following month; quarterly returns are due on the 13th of the month following the quarter.

Businesses whose aggregate turnover is less than or up to Rs 5 crores can file quarterly returns. However, A company with an aggregate turnover of over Rs 5 crores must file monthly returns.

What Are the Prerequisites For Filing A GSTR-1 Return?

- You must be a registered taxpayer and have an active PAN-based GSTIN.

- You must have a valid user ID and password to access the GST portal.

- The taxpayer should have issued invoices for the outward supply of goods or services during the tax period covered by the return.

- The taxpayer should have paid the tax due for the tax period covered by the return.

- The GSTR-1 return should be filed on or before the due date, the 11th day of the following month for monthly filers, and the 13th day of the following month for quarterly filers.

- You must have access to the registered mobile number to receive the OTP for verification in case you want to use EVC (electronic verification code).

- You must maintain detailed invoices with specific serial numbers for all your transactions, including intrastate and outward interstate supplies, business-to-business, and retail sales.

- It also covers stock transfers between your company’s locations in other states and transactions involving nil-rated exempt and non-GST outward supplies.

The information in the GSTR-1 return should be accurate and complete, including details of the goods or services supplied, invoice-wise details, tax rates, and amounts.

Importance Of Filing GSTR-1 Report

GSTR-1 is a mandatory document that taxpayers are required to file to comply with the GST law. Failure to file GSTR-1 on time can lead to penalties, interest, and other legal repercussions.

The GST system’s input tax credit enables taxpayers to receive a credit for the taxes they paid on their purchases. However, taxpayers must ensure that the details of their purchases are accurately reported in GSTR-2A/2B, based on the specifics provided in the GSTR-1 by the suppliers, to claim the input tax credit.

GSTR-1 ensures the accuracy of data and information related to outward supplies made by taxpayers. By filing GSTR-1, taxpayers can verify the details of their outward supplies, including the amount of tax paid, and ensure they are correct and accurate.

GSTR-1 is also essential for assessment and audit purposes. Tax authorities may use the data to cross-verify the details provided by taxpayers and assess the correctness of their tax liability.

Filing GSTR-1 on time helps easily reconcile data between the supplier and the recipient. The details of outward supplies furnished in GSTR-1 can be used to reconcile with the details of inward supplies furnished in GSTR-2A/2 B of the recipients.

Late Fees And Penalties For GSTR-1

The government levies the late fee as compensation for late submission of a GST return. When a taxpayer forgets to submit their GST return, the government imposes a late fee for each day that passes.

The government charges a minimum amount of Rs 50 for every day of delay. The maximum late fees can range from Rs 2000 to Rs 10,000 based on the company’s annual aggregate turnover in the previous financial year.

- If a company’s aggregate turnover is upto Rs 1.5 crore, the maximum late fees can be Rs 2000.

- If a company’s aggregate turnover ranges from Rs 1.5 crore to Rs 5 crore, the ultimate late fees levied can be Rs 5000.

- If a company’s aggregate turnover exceeds Rs 5 crore, the maximum late fees can be Rs 10,000.

The Procedure For Filing GSTR-1 Through the GST Portal

Here is the step-by-step process to file the GSTR-1 Return via the GST portal:

Step 1: Log in to the GST portal with your id and password.

Step 2: Click on the “Returns Dashboard. “

Step 3: Select the financial year and month you want to file the return.

Step 4: Next, click on the option of GSTR-1 (Outward supplies made by the taxpayer) to prepare it online.

Step 5: Enter the details required. You must mention all the mandatory information.

Step 6: Now, click on the “summary” option to generate the summary. Wait for the process to end.

Step 7: After obtaining a summary, recheck the data and click the “Submit” button.

Step 8: Once you have submitted the data, click on “File Return.”

Step 9: Select the name of the authorized person who can file the return.

Step 10: Now, you’ll see an option “File with EVC.” Click on that option once you receive an OTP on your registered number for verification.

Step 11: On the next screen, enter the OTP you received and click on verify.

Once you click on verify, your return is filed.

How to File the Return Using the Vyapar GSTR-1 Format?

Here’s how you can file GSTR-1 Return through Vyapar:

- Open Vyapar on your desktop.

- On the top-left corner, scroll down to the reports section under ‘My Company’.

- You will see a section for GST reports.

- Click on the “GST” option from the left sidebar and select “GSTR-1.”

- Click on the “Generate GSTR-1” button.

- Select the applicable tax period for which you want to file the return.

- Based on your sales data, the software will automatically populate the details of outward supplies.

- Review the details of the supplies and make any necessary corrections.

- Preview the GSTR-1 report to ensure all details are accurate.

- Click on the “.xls” button to create an Excel file.

- Prepare a JSON file using tools available at the GST portal.

- Log in to the GST portal and upload the generated file.

- Review and submit the GSTR-1 return on the GST portal.

Benefits Of Using The GSTR-1 Format By Vyapar

Vyapar’s GSTR 1 format is a simplified and efficient way to file GST returns. Here are some benefits of using Vyapar’s GSTR 1 format:

1. Accuracy In Filing The Return:

The GSTR-1 format requires businesses to enter certain mandatory fields, such as the recipient’s GSTIN (Goods and Services Tax Identification Number), invoice number, and taxable value.

Using Vyapar’s GSTR-1 format ensures that all the necessary information is included in the return, which helps to ensure accuracy and minimize errors. The platform provides real-time updates on the status of your return so that you can stay informed about the progress of your filing.

The inventory management software includes validation checks that ensure the accuracy of the data being entered. The software highlights any errors or discrepancies in the data, which can be corrected before submitting the return. It reduces the chances of errors being carried forward to the final return.

2. Helps In Efficient Filing:

The GSTR-1 format by Vyapar makes it easier to organize and file information, which can save time. A clear and organized format can help taxpayers understand the information required for each return section, making it easier to complete.

Vyapar’s GSTR-1 format automates data entry by importing data from invoices and other transactions that have been recorded in the software. This eliminates the need for manual data entry, which saves time and reduces the chances of errors.

Vyapar’s GSTR-1 format is integrated with the GSTN, which allows businesses to file their returns from the software directly. It eliminates the need for separate login credentials and reduces the time and effort required to file the returns.

3. Maintains Consistency:

Vyapar’s GSTR-1 format provides a standardized template for reporting monthly or quarterly returns for outward supplies of goods and services in India. It specifies the fields that need to be filled and the format in which the data needs to be presented.

The format helps to ensure that all businesses are consistently reporting their data. A consistent format helps ensure that all returns are filed similarly, making it easier for the tax authorities to review and verify the information.

The GSTR-1 format by Vyapar provides a consistent way for reporting sales and supplies, which helps to eliminate variations in reporting formats across businesses. This reduces the chances of inconsistencies.

4. Saves Time And Reduces Errors:

Vyapar’s GSTR-1 format automates data entry by importing data from invoices and other transactions that have been recorded in the software. It eliminates the need for manual data entry, which can be time-consuming and error-prone.

Vyapar’s GSTR 1 format saves time by automating data entry and calculation. The software includes validation checks that ensure the accuracy of the data being entered.

This reduces the time required for manual error checking and correction. The format can be saved and reused for subsequent returns, saving time and effort in future filings.

5. User-Friendly Interface:

The GSTR-1 format in Vyapar is designed to be user-friendly and intuitive. It guides businesses through filing their returns step-by-step, making it easy for even non-experts to use.

The format is easy to use, even for those with little or no experience filing GST returns. It can reduce the time and effort required to learn the software, which can be particularly helpful for businesses with limited resources or time constraints.

Vyapar’s GSTR-1 format can increase the efficiency of the filing process, as businesses can navigate through the software quickly and easily. It can help to reduce the time and effort required to file returns.

6. Enhances work efficiency:

The software follows a standard format for GST returns, making it easier for businesses to prepare and file their returns. The form ensures that all the necessary information is included and that the return has no errors or omissions.

The software provides tools for managing and organizing data related to GST returns, such as customer details, invoice data, and tax rates.

Vyapar GSTR-1 automates many processes in preparing and filing GST returns, such as data entry, tax calculation, and report generation. This automation saves time and reduces the chances of errors.

Valuable Features Of The Vyapar App For All Business Owners

1. Generate GST Bills Online:

By providing efficient GST billing options, Vyapar billing software helps develop a trustworthy business identity. You can follow the Indian Goods and Services Tax rules.

The Vyapar software can be used both online and offline. With the assistance of the software, an SME can more easily adhere to the best accounting procedures. It simplifies the accounting process for businesses.

To comply with GST regulations, use our easy invoicing software. GST invoices for clients can be created in a few easy steps. You can distribute them to your customers via paper, email, or WhatsApp.

You can rapidly generate invoices/bills with Vyapar. It is a simple process that will not necessitate extensive, rigorous training. You can select from more than ten GST invoicing and GST invoices templates in the application to produce professional and distinct bills.

2. Generate Reports:

Companies that want to expand must make sound choices. Vyapar allows you to create up to 37 distinct business reports. Vyapar accounting software for bookkeeping includes expert balance sheets.

By exporting reports from Vyapar, you can improve your company’s operational efficiency by using information collected from invoices created with the E-Way Bill Format in Excel.

The free GST Reconciliation tool assists in analyzing precise financial information, company data, etc. It is also a quick and efficient way of determining profitability. GSTR 1 records, GSTR 3B reports, and GST-related reports can all be generated.

Users can instantly examine and analyze data using our free GST Invoicing & Accounting Software. You can create graphical reports to monitor sales and expenditures with the software.

3. Order Tracking And Management:

The ability to track orders makes it much simpler to fulfill orders quickly. Setting a due date simplifies order management and guarantees that inventory items are accessible.

Vyapar makes it easier to create orders for sales or transactions. Use our GST invoicing software to save money and effort. Users can save time by automating the conversion of orders into sale/purchase receipts.

Tracking assists in avoiding unnecessary losses. Complete other routine chores with the time you would have spent tracking. Using the app, you can track when payments are due and add a tax invoice level to your purchase.

Using our free billing software, you can keep track of open, closed, and late purchases. Using our GST Reconciliation billing system, you can enhance the order types for your purchases and sales.

4. Data Security For Your Business:

The platform is secure and reliable, ensuring the safety and confidentiality of your financial data. All the important GST data can be saved regularly in Vyapar-created local or web Google Drive backups.

You also have constant access to financial details about your business via various devices. Data from your company will not be accessible to other team members or third parties, guaranteeing its long-term security.

The bill generation app’s “auto-backup” feature lets you pick up where you left off. Vyapar’s accounting and billing features make company management easier. The app’s comprehensive dashboard lets you analyze your company’s daily activities immediately.

As an added layer of security, the programme employs encryption technology to limit data access to the owner alone. Vyapar will not save or share user login details for future use.

5. Bank Account Management:

Payments for online and offline businesses can be added, managed, and monitored quickly. Whether your revenue originates from banks or e-wallets, you can quickly enter data into the free billing software.

You can control your cash flow by sending and receiving money through bank accounts and conducting bank-to-bank transfers. With all cash-ins and cash-outs handled by the Vyapar invoicing program, it is ideal for businesses.

Vyapar small business accounting software must be linked to a business bank account to use the bank account function. Using the Vyapar app, managing credit cards, O.D., and loan accounts is simple. It can be used to transfer or withdraw funds from bank accounts.

You can manage cheque payments and change the amount using Vyapar’s free accounting software. The Vyapar App supports open checks, enabling users to deposit or withdraw funds and immediately close them.

6. Keep Expenses Recorded:

Keeping track of and recording all expenditures spent during commodity delivery is critical for accurate accounting and tax preparation. Vyapar simplifies the generation of precise reports and the tracking of expenses.

Keeping track of your expenses allows you to increase income while lowering costs. You can use the free software to keep track of outstanding funds. It also helps them monitor their materials in the future.

Budgeting is a piece of cake with our complimentary programme. Companies can reduce costs fast and save a substantial amount of money. You can monitor your GST and non-GST spending with our free billing software.

Vyapar is free for small and medium-sized companies. Registered taxpayers will be able to manage their finances better. Keeping track of your expenses can also assist you in developing appropriate alternatives. Profits for corporations will rise as a consequence.

Frequently Asked Questions (FAQs’)

The GSTR-1 report format is a standard template that businesses registered under the Goods and Services Tax (GST) system in India use to file their monthly or quarterly returns. The GSTR-1 report contains details of all outward supplies or sales made by a business to other registered taxpayers, as well as details of any exports made during the period.

The GSTR-1 format includes the following details:

1. Basic information about the taxpayer

2. Details of all invoices issued during the tax period

3. Details of advances received for goods or services that are yet to be supplied

4. Details of export and deemed export supplies

5. Details of credit and debit notes issued during the tax period

6. Details of any amendments made to the invoices issued in the previous tax period

7. Details of any tax collected at source (TCS)

You can use Vyapar’s GSTR-1 format to file your return. You just need to open the format and fill out the necessary details. It is very simple to use.

GSTR-1 can be filed monthly or quarterly. If the taxpayer has an annual turnover of up to Rs. 5 crores and has opted for the QRMP scheme, they can file a GSTR-1 quarterly return.

Yes, GSTR-1 filing is mandatory for all registered taxpayers except Input service distributors, taxpayers under the composition scheme, non-resident taxpayers, and OIDAR.

If you fail to file a GSTR-1 Return, you will have to pay late fees for every day of default. Also, if any tax is due, you must pay an interest rate of 18% per annum on the tax liability.

To file GSTR-1:

* Log in to the GST portal.

* Select GSTR-1 from the Returns section.

* Enter details like outward supplies, invoices, exports, etc.

* Verify and submit the data.

Related Posts:

1. Quotation Format For Manpower Supply