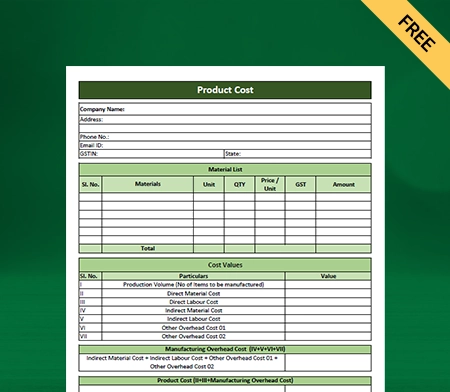

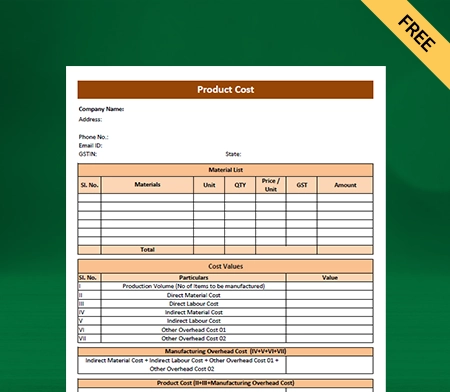

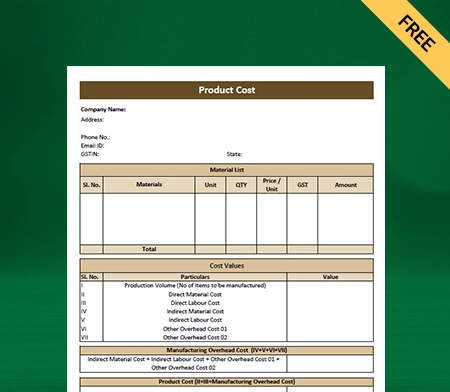

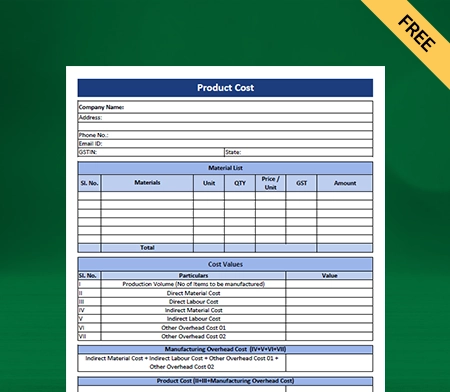

Product Costing Format

Use product costing formats by Vyapar to record your business manufacturing cost. It makes the entire process seamless and helps you manage your tasks easily. Claim your complimentary 7-day trial today!

Download Product Costing Format in Excel, Word, and PDF

What is the Product Costing Format?

The Product Costing Format calculates the overall cost of manufacturing to deliver the product to customers. This format usually includes a breakdown of all production costs, such as direct materials, direct labour, and overhead costs.

The given format can differ significantly depending on how it is made, product type and how the company keeps its books. Product costing aims to figure out exactly how much it costs to create a product to be priced right to make a profit and stay competitive in the market.

Various Popular Product Costing Methods

There are five product costing methods used in accounting. Some of the most common ways to figure out how much a product costs are:

Job Costing: It is a type of accounting that keeps track of costs and income by “job” and makes it possible to report on profit growth by a job in a standard way. For a bookkeeping system to work with job costing, it must let you assign job numbers to each expense and revenue item.

Process Costing: This method is used when the product is made in large quantities continuously. The most common way to figure out the actual unit cost is to divide the total cost of production by the number of units manufactured.

Activity-Based Costing (Abc): With this method, you figure out the activities that go into making a product or providing a service, and then you assign the costs of each activity to the product or service in proportion to how much it uses that activity.

Standard Costing: In this method, costs for direct materials, direct labour, and overhead are set ahead of time, and then actual costs are compared to those set ahead of time to find differences.

Backflush Costing: This method is often used in a just-in-time (JIT) manufacturing environment. It involves waiting until the end of the production process to assign costs to the products made.

Some industries or businesses may use other ways to determine the number of products produced.

What Information is Typically Included in a Product Costing Format?

A Product Costing Format typically includes the following information:

Direct Material Cost: This is the total product cost of all the materials used to make the product.

Direct Labour Cost: This is the cost of all the work needed to make the product.

Manufacturing Overhead Costs: These are all the indirect costs of making something, like rent, utilities, repairs, and depreciation.

Total Manufacturing Cost: The sum of the direct material, labour, and manufacturing overhead costs.

Cost Of Goods Sold: calculates the amount it costs to make the product and get it to the customer.

Gross Profit: it is considered as the difference between how much the product is sold for and what is its actual cost.

Selling and Administrative Expenses: This includes all costs related to selling and marketing the product and general administrative expenses incurred.

Net Profit; depends on the difference between the gross profit and the cost of running the business or selling.

A Product Costing Format is a tool that helps companies figure out how much it costs to make a product and make smart decisions about pricing, production, and making money.

Benefits Of Using the Product Costing Format

Here are the following benefits of using the Product Costing Format:

1. Better Cost Control:

By accurately figuring out how much it costs to make a product, businesses can learn more about the factors affecting the total cost and find places to cut costs. It makes the cash flow in your business more inclusive and gives your business better control over the financial statement.

By using suitable methods to determine how much a product costs, businesses can gain a competitive edge by making themselves more profitable and efficient and better managing their resources and investments.

2. Provides Accurate Pricing:

Businesses need to know the exact cost of production to set fair prices. Using the Product Costing Format can assist the business. By adding the costs of materials, labour, administration, and other fees, businesses can determine the minimum price to cover their costs and profit using the Product Costing Format.

Underpricing can lead to losses, while overpricing can turn off customers and lower sales. Accurate pricing helps businesses make money, stay competitive, and keep customers returning.

3. Helps With Effective Budgeting:

Product Costing Format is a necessary procedure that assists Businesses in determining the total cost of creating a product. By identifying and assessing the costs associated with the production process, such as raw materials, manufacturing dm labour, and overhead expenses, firms can produce an accurate budget that reflects the cost of items sold.

It enables businesses to make informed judgments on pricing strategies, production levels, and resource allocation. Product costing helps firms achieve higher efficiency, profitability, and competitiveness by comprehensively understanding product costs.

4. Improved Decision-Making:

Product costing helps businesses make intelligent decisions about their operations by giving them accurate cost information. It helps find the most cost-effective ways to make things and spots places where costs can be cut. Businesses can also use this information to set fair prices for their products, considering all the costs of making them.

Product cost format also helps determine different product lines’ profitability and where improvements are required. With accurate cost information, businesses can improve their operations and become more competitive in the market.

5. Increased Profitability:

Businesses need to know the costs of production to maximize their profits. Companies can make more money without sacrificing quality by looking at their costs and finding places where they can be cut.

You can do it in several ways, such as by improving production processes, negotiating for lower prices on raw materials, cutting down on waste and inefficiency, and using technologies that save money. By managing production costs well, businesses can be more competitive, invest in growth, and improve their financial performance.

6. Provides Competitive Advantage:

Businesses can be more competitive in their industry if they carefully look at their costs and find places to improve. They can offer high-quality products and services at competitive prices by streamlining operations and minimising waste.

It can attract customers concerned with both price and quality, giving the company an advantage over competitors who may need assistance balancing the two. In addition, efficient operations can result in more customer support and trust inside your business platform. It can significantly enhance your business reputation.

7. Enhanced Financial Reporting:

Product costing is a technique for calculating the cost of producing a particular good or service. With this format, a corporation can track and allocate expenditures to distinct interests, which can benefit improved financial reporting.

This data can be used to assess the profitability of each product and make innovative pricing and production decisions. Budgeting, forecasting, and financial analysis can also benefit from accurate product costing. Using the Product costing model can provide a more thorough insight into a company’s financial performance and enhance its ability to secure financing.

8. Helps With Better Communication:

A standardized product costing structure facilitates successful communication inside a company. It helps employees at all levels to appreciate the costs associated with each product or service and to make decisions in line with the enterprise’s overall objectives.

It increases openness, enables the identification of cost-saving options, and contributes to the organisation’s development of a cost-conscious culture. Overall, a uniform structure for product costing helps improve communication, cooperation, and decision-making across all corporate divisions and functions.

How is Product Costing Calculated?

When it comes to calculating product costs, there are numerous methods, but the following are the most common:

Direct Material Cost: The cost of all materials get used directly to produce the product. It considers the prices of raw materials, packaging, and other products directly used in production.

Direct Labour Cost: The labour cost is directly involved in producing the product. Wages, salaries, benefits, and other charges linked with employees directly involved in the manufacturing process are included.

Manufacturing Overhead Cost: It comprises all extra expenditures associated with the manufacturing process that are not directly related to the product. You can include rent, utilities, equipment upkeep, and other indirect expenditures.

After calculating these costs, we can add them together to determine the total cost of creating the product. Then, we can establish the product cost per unit using the targeted profit margin of the firm and use this cost to set the selling price of the product.

Why Choose Vyapar App to Create Your Product Costing Formats?

Here are some major reasons why you should use Vyapar to create your Product Costing Format:

1. Create Your Bill in All Three Formats:

Vyapar is a robust business accounting software that offers a variety of features to help small and medium-sized businesses properly manage their money. Vyapar’s capacity to create product costing in three formats- PDF, Excel, and Word- is an essential advantage.

By utilising Vyapar, small businesses can generate product costing reports in these formats, making it simpler to distribute them to stakeholders. PDF is suitable for sending reports to clients or investors, whereas Excel is ideal for additional data analysis and manipulation. The Word format is ideal for creating documents and presentations with a professional appearance.

With Vyapar, organisations can generate product costing reports in any required format, effectively and efficiently communicating their financial information. It is just one of the many tools Vyapar provides to assist businesses in streamlining their accounting operations and enhancing their financial performance.

2. Manage Your Cash Flow Seamlessly:

Vyapar Inventory Management app for Product Costing Format enables firms to record transactions. It helps to monitor payments. Almost one crore small and medium businesses have evaluated our free product costing generating software capabilities. Cash Flow management is frequently used for billing, accounting, and other corporate needs.

Vyapar’s software to create a Professional Product Costing Format helps automate management. It is done to prevent accounting errors. Investing in this software lets you conveniently control your firm’s cash flow. The Vyapar software enables the management of cash transactions, including capabilities such as tracking bank withdrawals and deposits.

Our free Vyapar software for Product Costing Format is more helpful in establishing a cash book in real-time. It can help maintain the cash flow of a business. It compiles data on expenses incurred, payments, and purchases. With this GST accounting software, cash management becomes comparatively simple.

3. Create Business Reports:

Using Vyapar’s free billing software, businesses can make decisions based on facts if they want to keep growing at the same rate. Use our free software to generate 40+ business reports for all your business needs.

Balance sheets made by professionals are part of the Vyapar software for Product Costing Format. The operational efficiency of your business goes up when you use Vyapar a lot because you can easily export the reports in PDF or Excel.

- Accounting and management

- Charges and online payments

- Reports Report and taxation

With our Vyapar software for Product Costing Format, users can easily see and analyse the data immediately. Using the app, you can make graphical reports to keep track of sales prices and costs. This free software analyses accurate business details, accounts, and more. It is also a quick way to determine how much the business makes. Several reports, like:

- GSTR 1 Format

- GSTR 3B

- Reports about GST

- Profit and loss

- balance sheet

4. GST Filing Made Simpler And Faster:

Filing GST is complex and time-consuming for business owners; it takes a long time if done by hand. Using Vyapar software, you can create GST reports and make the GST filing process more manageable.

Every month, a lot of business owners spend their time and work. So they can make sure they follow the tax laws. After all, they must keep track of their monthly invoices, expenses, and accounting details. Also, you have to type them in by hand to file GST returns.

Use the information you saved when you made a Product Costing Format for your clients and put in expenses incurred. Every business owner can save time by making GST reports with a professional Product Costing Format. With this, they can be sure that all accounting tasks will be done correctly by automation.

5. Plan Your Inventory Space:

With our Vyapar easy-to-use inventory management software for Product Costing Format, you can keep track of the items in your store that are still available. It can help you set up low-stock alerts to place orders ahead of time and find signs of possible theft.

Inventory management is vital for businesses that sell many different products, and our free Vyapar software can help. With our software to create a Product Costing Format, you can track what’s in your store.

Vyapar software has features that help determine if someone is stealing from your store. As items get sold, the number of items in stock goes down. Using the inventory management system, you can regularly check to determine if your inventory doesn’t match up. You can check your security cameras when you notice something is missing.

6. GST Billing And Invoicing:

Our product costing software that does everything is an excellent addition to your business because it helps you automate your costing needs. It works well to help small and medium-sized companies save more time on accounting.

The “auto-backup” feature of Vyapar GST software in India makes it easy to back up your files. A backup is automatically made daily when this mode is turned on in the Vyapar software. Vyapar’s free invoicing software keeps your business data as the topmost priority, and it ensures every possible way to keep your data secure.

Most businesses in India have used this software to keep track of their finances and send out product costing because it makes the job go faster and keeps data more secure. The Vyapar accounting app has encryption technology that only allows the owner to see the data. It makes security even better.

7. Record And Track Expenses:

Monitoring and tracking expenses incurred is essential for business accounting and tax filing. Using the Vyapar billing software, tracking expenditures and generating an accurate report is simpler.

Our free application to create a professional-looking Product Costing Format is an easy way to track spending. Companies may optimise their expenditures to save more money with relative ease. You may record both GST and non-GST charges using our free GST software.

In addition, Vyapar Solutions offers numerous advantages over rivals. It allows you to minimise expenses incurred and increase sales. The free software to create product costing is an effective method for swiftly capturing overdue expenses. It helps to track them in the future as well.

8. Online/Offline Software:

Using features of our product costing software, you may continue operating your business even when internet connectivity is poor. The offline product costing software allows your retail store to accept cash and provides wages and benefits, including using eWallet payments that do not require an active internet connection.

With our GST software, you can instantly generate a Product Costing Format for your customers. In remote places where connectivity and network troubles frequently occur, the online and offline capabilities of the Vyapar free accounting app are beneficial.

The app’s capabilities are useful for customers because they do not have to wait in line for their Product Costing Format. In addition, it streamlines their invoicing process by allowing them to record transactions as they occur without further work.

Frequently Asked Questions (FAQs’)

A Product Costing Format is a way to divide up how much it costs to make a product. It involves collecting a fee for every aspect of the production cost, such as basic materials, labour, and overhead. This information can help determine the overall cost of the product and the selling price.

Firms need accurate product costs to set a fair price for their products. The company’s capacity to charge competitive prices, produce at a good volume and retain its profit margins all depend on its health and longevity, which can be positively impacted by accurate cost calculations.

Product costing is figuring out how much a product will cost, including direct costs (like materials and labour) and indirect costs (such as overhead and depreciation). This information sets the product’s price so the business can make money.

Spreadsheets, cost sheets, and bill of materials (BOM) documents are standard forms for documentation of product pricing. Typically, spreadsheets provide itemized cost breakdowns for each product component, whereas cost sheets summarise the entire expenses for a product or project. BOM records include a list of all materials and their associated costs required to manufacture a product. Cost estimates, manufacturing schedules, and profit-and-loss statements are examples of additional formats.

You should regularly update the product costing documents to ensure accurate and up-to-date information. The frequency of updates may depend on factors such as changes in material costs, labour costs, and overhead expenses. In general, we recommend reviewing and updating product costing documents at least once a year or as changes occur.