Consolidated Balance Sheet Format in Pdf, Excel

Vyapar automates consolidated balance sheets with ease. Track subsidiaries, analyze data & make informed decisions.

⚡️ Eliminate errors with pre-defined formulas

⚡ Simplify calculations and save time

⚡️ Generate accurate balance sheets in minutes

Download Free Consolidated Balance Sheet Format

Download free Consolidated Balance Sheet Format in excel, pdf, word and make customization according to your requirements at zero cost.

Customize Invoices

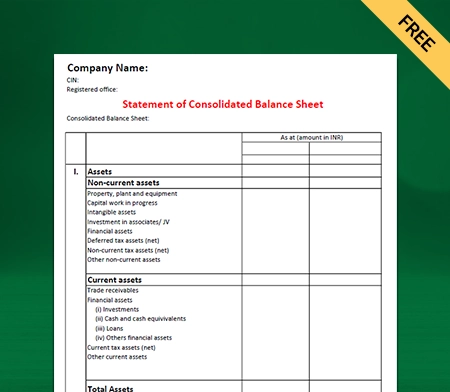

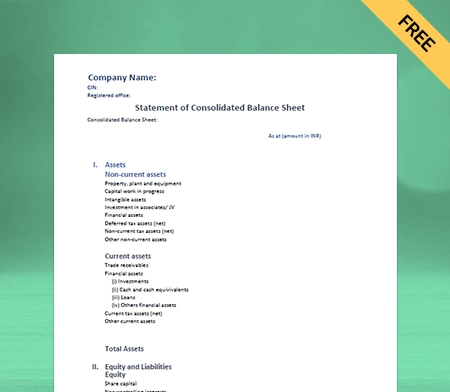

Consolidated Balance Sheet Format Type I

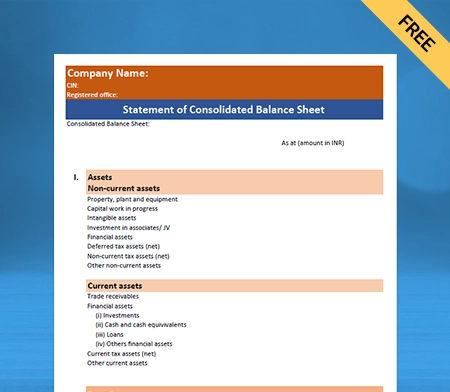

Consolidated Balance Sheet Format Type II

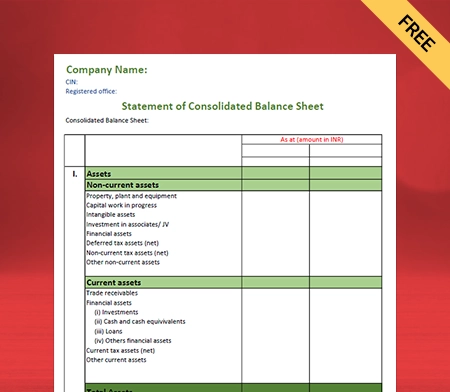

Consolidated Balance Sheet Format Type III

Consolidated Balance Sheet Format Type IV

Generate Invoice Online

Highlights of Consolidated Balance Sheet Simple Templates

We’ve put in a lot of effort to make sure you get the best template possible

All versions are print friendly

Built From scratch

Include essential invoice elements

Automatically calculate subtotal and grand total amounts

Consistently formatted

What is Consolidated Balance Sheet?

An organization’s consolidated financial statements present its parent and subsidiaries’ assets, liabilities, equity, income, expenses, and cash flow as if it is a single economic entity. While making a consolidated financial statement, the parent company’s financial statements and subsidiaries must be combined line by line by totalling similar assets, liabilities, income, and expenses.

Benefits of Using Consolidated Balance Sheet Format by Vyapar

Saves Time:

The consolidated statements can save time and resources by eliminating the need for subsidiary companies to prepare separate financial statements. The app helps you prepare balance sheets and export data to the tally with just a few clicks, so you can easily prepare the format of consolidated balance sheet.

Inform Interested Parties:

A consolidated balance sheet format allows interested parties to make informed financial decisions by giving them an idea of the company’s financial position. The free accounting software allows any interested party to quickly glance over your parent and subsidiary’s economic situation, showing all assets and liabilities and helping stakeholders and potential investors make decisions.

Potential Future:

Based on non-current assets and current assets, Vyapar’s consolidated balance sheet format can help you determine how sustainable your business is. Suppose your company and subsidiary own the equipment, utilities, office space, etc. If their overall value is higher than that of current assets, your business is capable of persisting future functions.

Promotes Transparency:

The Vyapar helps the financial statements of parent and subsidiary companies promote transparency. It enables anyone interested in examining the financial health of the parent company’s subsidiaries and the organization. Accounting reports should be translucent so that investors can easily understand a company’s financial details.

How To Prepare a Consolidated Balance Sheet?

Some things that you need to keep in mind while preparing Consolidated Financial Statements are:

- You need to ensure that the rules and methods used to collect the information regarding the parent company and its subsidiaries are consistent before creating the consolidated balance sheet.

- While making the balance sheets for consolidation, you need to detect and eliminate the parent company’s investments in the subsidiary as well as its ownership stake should be eliminated.

- Any additional cost other than investment in equity shares incurred by the parent company concerning the subsidiary must be shown as goodwill.

- After ensuring the relevance of data, you can start by creating a worksheet. Initially, you are required to keep the financial information of the parent company and its subsidiaries separately.

- Whenever the parent company’s investment in the subsidiary is less than its equity share, the investment date should be noted as the capital reserve.

- A portion of minority interests in the net income of the consolidated subsidiary must be recognised and adjusted against the group’s revenue for arriving at the net income, which is attributable to the owners of such parent company.

- Minority interests in net assets include the amount of equity attributable to the minorities at the date on which such investment in the subsidiary is made; minorities’ share of the movements in equity from the date the parent-subsidiary relationship came into force.

- After gathering all the information, you may proceed to make a consolidated balance sheet. You should add the date and the company’s name at the top and add sections for assets, liabilities, and equity.

Create your first invoice with our free Invoice Generator

Situations Where Consolidated Financial Statements Are Not Prepared

The parent company isn’t required to submit consolidated financial statements if its stock or debt isn’t listed on any public market like the stock exchange or over-the-counter market.

The presentation of consolidated statements is unnecessary if the parent firm is a wholly or partly owned subsidiary. However, this is dependent on the owners not questioning the parent firm for failing to represent the consolidated statements.

If any parent produces the consolidated statements under the International Financial Reporting Standards (IFRS) mandate, no consolidated statements for public use are required.

Suppose the parent business is about to file its financial statements with a security commission to issue any public market instrument. In that case, the parent company will not be obliged to produce a consolidated balance sheet.

Consolidated Balance Sheet vs Balance Sheet

There’s a slight difference between the balance sheet and the consolidated balance sheet in the way both are prepared. Vyapar app helps you create them both with professional balance sheet formats. You can refer to the points below to know more about the differences between the two:

A Balance Sheet is a company’s financial statement showing its assets and liabilities. At the same time, a consolidated balance sheet is an extension of the balance sheet, which also includes the items of the subsidiary companies and the parent company.

The prime objective of a balance sheet is to showcase an accurate financial position to external stakeholders. On the contrary, a consolidated balance sheet format

reflects a company and its subsidiary’s accurate financial picture.

Every company prepares the balance sheet since it is one significant financial statement. All companies don’t prepare a consolidated balance sheet; instead, companies with shares in other companies (subsidiaries) prepare a consolidated balance sheet.

The standalone balance sheet includes the company’s assets, liabilities, and shareholders’ equity, but you need to include other items like minority interest in the consolidated balance sheet.

The traditional balance sheet equation is Assets = Liabilities + Shareholders’ Equity. The equation of the consolidated balance sheet is Assets of (Parent + Subsidiary) = Liabilities ((Parent + Subsidiary) + Shareholders’ Equity + Minority Interest.

Features of Vyapar Consolidated Balance Sheet Maker App

Accounting Management:

If you keep track of your parent and subsidiary’s financial records, you can identify any issues ahead and avoid future problems. It also helps your entity to stay flexible and adopt change with time. A consistent balance sheet ensures that your business is not suffering from a lack of cash flow. Using our free consolidated balance sheet maker app, you can perform all accounting transactions like creating professional bills, recording sales, purchases & expenses, keeping track of inventory, etc.

Bill and Invoicing:

You can make professional GST & non-GST bills & invoices using this best business accounting software, customise it according to your needs & share them with your customers in just a few clicks. It will help you keep track of account receivables & maintain cash flow for your business.

Faster Payments:

The Vyapar app allows you to send invoices with payment links to your customers. The customer can click on the link to pay the amount through RTGS, IMPS, NEFT, UPI, or other digital modes. You will instantly receive the message, and the account also gets settled automatically after the payment. You can also make contra entries for your parent or subsidiary company.

Determines Risk:

By monitoring your parent and subsidiary company’s assets through the Vyapar app, you grasp your ability to generate cash flow and sustain business operations. You can keep liabilities in check and grow more assets. It helps prioritize your most urgent financial obligations. It would be better for your business if your assets exceed your liabilities.

Record Assets and Liabilities:

Your consolidated balance sheet effectively shows your ability to collect payments and repay debts if updated from time to time. It offers business loan lenders a track record of managing assets and liabilities responsibly. With the help of a professional consolidated balance sheet maker app, the user can know a precise financial position by analyzing and scrutinizing the assets and liabilities at a particular date.

Online / Offline Software:

Vyapar consolidated balance sheet generator helps you create invoices for your customers without requiring you to stay online. Our business accounting software validates your transactions and updates your database when connecting it to the internet. You don’t need to stop your business operations when there is weak internet connectivity. You can use the offline tool in your retail business to receive payments through cash and eWallets that do not require an active internet connection.

Frequently Asked Questions (FAQs’)

No, the Vyapar app for iOS devices is not available yet. However, you can use it on android devices or desktops. Also, you can download consolidated balance sheet format in excel, pdf, word anywhere.

As per Section 137 of the Act, 2013, the financial statements, including consolidated financial statements, shall be filed within 30 days of the Annual General Meeting with the Registrar in AOC 4.

Consolidated financial statements are necessary when the parent company holds a majority stake by controlling more than 50% of the subsidiary business. Parent companies with more than 20% can use consolidated accounting, but if a parent company owns less than a 20% stake, it must use equity method accounting.

Yes. Our team at Vyapar provides you with multiple options in consolidated balance sheet format in excel, pdf, word for free. You can use the form that best serves your business requirements and even customize them to meet your unique business requirements.

Vyapar provides access to Consolidated balance sheet format pdf, excel, word for free. You can use the premium features of the Vyapar app using a monthly subscription plan. The app is affordable, and you can choose the package that suits your requirements the best.

A consolidated balance sheet format combines the financial information of a parent company and its subsidiaries into one comprehensive statement, providing a holistic view of the group’s financial health and performance. For streamlined and efficient consolidation processes, businesses often use accounting software like Vyapar.

Creating a consolidated balance sheet in Excel involves gathering individual balance sheets of the parent company and subsidiaries, setting up a consolidation template, linking data with formulas, adjusting for eliminations, calculating totals, and reviewing the consolidated balance sheet for analysis. Using accounting software like Vyapar can streamline this process with built-in tools for consolidation and reporting.

The consolidation method of a balance sheet combines the financial statements of a parent company and its subsidiaries, eliminating intercompany transactions to present a consolidated view of the group’s financial position.

A balance sheet typically represents the financial position of a single entity, such as a company, showing its assets, liabilities, and equity. On the other hand, a consolidated balance sheet combines the financial information of a parent company and its subsidiaries, providing a comprehensive view of the entire group’s financial health and performance.

A consolidated balance sheet is used to provide a holistic view of the financial health and performance of a group of companies, including the parent company and its subsidiaries. It helps stakeholders, investors, and management understand the overall financial position, identify intercompany transactions, eliminate double-counting, and make informed decisions regarding the group’s operations, investments, and strategic direction.

The consolidated balance sheet includes key details like assets, liabilities, equity, non-controlling interests, intercompany eliminations, and explanatory notes for transparency. For streamlined consolidation processes, consider using Vyapar, which offers efficient tools for financial management and reporting.

The consolidated balance sheet is typically prepared by the accounting or finance department of a company, under the supervision of financial managers or controllers.

The income statement tracks a company’s performance over time, detailing revenues, expenses, and net income, while the consolidated balance sheet provides a snapshot of its financial position, including assets, liabilities, and equity, at a specific point in time.